Seenews TOP 100 2014

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Possibilities of Applying Markowitz Portfolio Theory on the Croatian Capital Market

POSSIBILITIES OF APPLYING MARKOWITZ PORTFOLIO THEORY ON THE CROATIAN CAPITAL MARKET Dubravka Pekanov Starčević, Ph.D. J. J. Strossmayer University of Osijek, Faculty of Economics in Osijek E-mail: [email protected] Ana ZRNIć, Ph.D. Student, J. J. Strossmayer University of Osijek, Faculty of Economics in Osijek E-mail: [email protected] Tamara Jakšić, BEcon, student J. J. Strossmayer University of Osijek, Faculty of Economics in Osijek E-mail: [email protected] POSSIBILITIES OF APPLYING MARKOWITZ PORTFOLIO THEORY ON THE CROATIAN CAPITAL... MARKOWITZ PORTFOLIO THEORY ON THE CROATIAN POSSIBILITIES OF APPLYING Abstract In order to achieve the maximum possible profit by taking the lowest possible risk, investors build a stock portfolio consisting of a specific number of stocks which, according to the principle of diversification, significantly reduce the risk of loss. To build a portfolio, in developed capital markets investors have used the Markowitz portfolio optimization model for many years that enables us to find an optimal risk-return trade-off by selecting certain stock combinations. Despite the development of the Zagreb Stock Exchange, i.e., the central trading venue in the Republic of Croatia, the Croatian capital market is still under- developed. It is characterized by numerous shortcomings such as low liquidity, lack of transparency, high stock price volatility and insufficient traffic. Accord- ingly, the aim of this paper is to provide an insight into the functioning of the Dubravka Pekanov Starčević • Ana Zrnić • Tamara Jakšić: Dubravka Pekanov Starčević • Ana Zrnić Tamara 520 Croatian capital market and to examine the possibility of building an optimal stock portfolio by using the Markowitz model. -

The Port of Rijeka J. S. C. Supervisory Board Meeting Hasn't Been Held

Supervisory Board meeting hasn't been held, due to current situation with COVID-19 pandemic, therefore, set of financial reports for Zagreb Stock Exchange couldn’t be verified by members of the Supervisory Board. The investment public will be informed in time about Supervisory Board meeting and verification of reports. The Port of Rijeka j. s. c. LUKA RIJEKA d.d. Annual Report for the year ended 31 December 2020 This version of the Annual Report is a translation from the original, which was prepared in Croatian language. All possible care has been taken to ensure that the translation is an accurate representation of the original. However, in all matters of interpretation of information, views or opinions, the original language version of the Annual Report takes precedence over this translation. CONTENTS Page Management report for the year ended 31 December 2020 1 Statement of implementation of the corporate governance code 18 Statement of Management's responsibilities 21 Independent Auditors’ Report to the Shareholders of Luka Rijeka d.d. 22 Statement of comprehensive income 27 Statement of financial position 28 Statement of changes in equity 29 Statement of cash flows 31 Notes to the financial statements 32 - 83 Management report for the year ended 31 December 2020 LUKA RIJEKA GROUP MANAGEMENT REPORT FOR THE YEAR ENDED 31 DECEMBER 2020 LUKA RIJEKA D.D. Riva 1, HR-51 000 RIJEKA OIB: 92590920313 Rijeka, April 2021. 1 Management report for the year ended 31 December 2020 STRUCTURE OF LUKA RIJEKA GROUP The Group is comprised of the following companies: LUKA RIJEKA d.d. -

Svoj Ugled Izgradili Smo Na Projektiranju, Izgradnji I Održavanju

Svoj ugled izgradili smo na projektiranju, izgradnji i održavanju sustava tehničke zaštite i sigurnosti, parkirališnih rješenja i sustava, razvoju programskih aplikacija, sustava automatizacije i energetske učinkovitosti te njihovoj implementaciji u raznovrsne profesionalne programske aplikacije. Svoj uspjeh temeljimo na timu od stotinjak djelatnika od kojih je više od polovice diplomiranih inženjera. Naš tim sastoji se od mladih, kompetentnih i profesionalnih ljudi koji su predanim radom stekli značajna iskustva u razvoju, projektiranju i izvođenju kompleksnih projekata u Hrvatskoj i zemljama jugoistočne Europe što nas čini pouzdanim partnerom za širok raspon djelatnosti. MISIJA VIZIJA Unaprijediti poslovanje u segmentima zaštite i Postati vodeći sistem integrator na projektima sigurnosti, razvoja parkirališnih i programskih tehničke zaštite i sigurnosti, parkirališnih rješenja te automatizacije i energetske rješenja, programskih aplikacija te energetike i učinkovitosti upravljanja resursima u industriji i automatizacije u jugoistočnoj Europi i šire. zgradarstvu provođenjem tehnološki naprednih projekata temeljenih na integraciji različitih sustava u cjelovita i efikasna rješenja. TEHNIČKA ZAŠTITA I PARKING • Integracija sustava tehničke zaštite • Kontrola pristupa • Dojava požara • Plinodetekcija • Protuprovala • Videonadzor • Ozvučenje i multimedija • Integrirani sustavi nadzora i upravljanja • Upravljanje parkiralištima • Mehanička zaštita (rampe, sigurnosna vrata i sl.) • Sustavi uzbunjivanja stanovništva ENERGETIKA • Nadzor potrošnje -

201 ,QWHUQDWLRQDO 9Aluation Handbook ,QGXVWU\ Cost of Capital

201,QWHUQDWLRQDO9aluation Handbook ,QGXVWU\ Cost of Capital Market Results Through0DUFK 2015 Duff & Phelps &RPSDQ\/LVW 1RWH 7KLV GRFXPHQW SURYLGHV D OLVW RI WKH FRPSDQLHV XVHG WR SHUIRUP WKH DQDO\VHV SXEOLVKHG LQ WKH ,QWHUQDWLRQDO 9DOXDWLRQ +DQGERRN ̰ ,QGXVWU\ &RVW RI &DSLWDO GDWD WKURXJK 0DUFK 7KHLQIRUPDWLRQ KHUHLQ LV VSHFLILF WR WKH KDUGFRYHU ,QWHUQDWLRQDO 9DOXDWLRQ +DQGERRN ̰,QGXVWU\ &RVW RI &DSLWDO GDWD WKURXJK 0DUFK DQG LV QRW DSSOLFDEOH WR DQ\ RWKHU ERRN XSGDWH RU GRFXPHQW Cover image: Duff & Phelps Cover design: Tim Harms Copyright © 2016 by John Wiley & Sons, Inc. All rights reserved. Published by John Wiley & Sons, Inc., Hoboken, New Jersey. Published simultaneously in Canada. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, (978) 750-8400, fax (978) 646-8600, or on the Web at www.copyright.com. Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, (201) 748-6011, fax (201) 748-6008, or online at http://www.wiley.com/go/permissions. The foregoing does not preclude End-users from using the 2015 International Valuation Handbook ࣓ Industry Cost of Capital and data published therein in connection with their internal business operations. -

Domestic Vs International Risk Diversification Possibilities in Southeastern Europe Stock Markets

Sinisa Bogdan, Suzana Baresa, and Zoran Ivanovic. 2016. Domestic vs International Risk Diversification Possibilities in Southeastern Europe Stock Markets. UTMS Journal of Economics 7 (2): 197–208. Preliminary communication (accepted August 27, 2016) DOMESTIC VS INTERNATIONAL RISK DIVERSIFICATION POSSIBILITIES IN SOUTHEASTERN EUROPEAN STOCK MARKETS Sinisa Bogdan Suzana Baresa Zoran Ivanovic1 Abstract Modern portfolio theory is one of the most important investment decision tools in finances. In 1952 Harry Markowitz set the foundations of the Modern portfolio theory, since than this theory was a backbone of many studies that dealt with investment decisions. This research applies mean-variance portfolio optimization on the international Southeastern Europe and domestic Croatian stock market exchange. Aim of this research is to compare risk diversification possibilities on the Southeastern European capital markets and on the Croatian Capital market. By analyzing nine stock market indices in the Southeastern Europe and twenty stocks from Zagreb Stock Exchange in the period of 36 months, results clearly show that internationally diversified portfolios offer better portfolio risk reduction than domestically diversified portfolios. Lowest achieved risk in international portfolio outperformed lowest achieved risk in domestic portfolio. Since risk is lower, returns are also much lower compared to domestic stock portfolios. Results of this research also report that domestic stock portfolios outperformed international portfolios at the risk level equal or higher than 0,97%, for the same risk, domestic portfolios offer greater returns. Keywords: Modern portfolio theory, portfolio optimization, stock portfolio, stock market indices, Zagreb stock exchange. Jel Classification: G11; C61 INTRODUCTION One of the investment theory assumptions is that investors should diversify their portfolios. -

An Economic Reform Agenda for Croatia

70 ifo Forschungsberichte 15,6 An Economic Reform Agenda for Croatia Editors: Oliver Falck Siegfried Schönherr Institute Leibniz Institute for Economic Research at the University of Munich An Economic Reform Agenda for Croatia A comprehensive economic reform package prepared for the Croatian Statehood Foundation (Zaklada Hrvatskog Državnog Zavjeta) Editors: Prof. Dr. Oliver Falck (Ifo Institute & LMU Munich) Prof. Dr. Siegfried Schönherr (Ifo Institute) January 2016 Institute Leibniz Institute for Economic Research at the University of Munich Bibliografische Information der Deutschen Nationalbibliothek Die Deutsche Nationalbibliothek verzeichnet diese Publikation in der Deutschen Nationalbibliografie; detaillierte bibliografische Daten sind im Internet über http://dnb.d-nb.de abrufbar ISBN 978-3-95942-005-1 Alle Rechte, insbesondere das der Übersetzung in fremde Sprachen, vorbehalten. Ohne ausdrückliche Genehmigung des Verlags ist es auch nicht gestattet, dieses Buch oder Teile daraus auf photomechanischem Wege (Photokopie, Mikrokopie) oder auf andere Art zu vervielfältigen. © ifo Institut, München 2016 Druck: ifo Institut, München ifo Institut im Internet: http://www.cesifo-group.de Foreword 1 Foreword When the Ifo Institute received a request from the Croatian Statehood Foundation for developing a reform programme for Croatia, it made it clear from the outset that it would keep the study strictly neutral, based upon sound economic principles and in no way aligned to any existing political party programmes. The Ifo Institute is an independent research establishment devoid of any party or political affiliation whatsoever. The only principle we clearly adhere to, as a result of proven theoretical underpinnings and the empirical evidence available, is the conviction that the social market economy (with a strong emphasis on “social”) is the most successful system for achieving and combining economic growth and social welfare. -

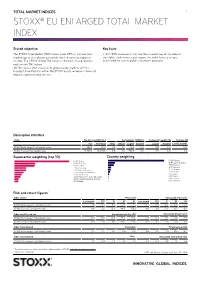

Stoxx® Eu Enlarged Total Market Index

TOTAL MARKET INDICES 1 STOXX® EU ENLARGED TOTAL MARKET INDEX Stated objective Key facts The STOXX Total Market (TMI) Indices cover 95% of the free-float » With 95% coverage of the free-float market cap of the relevant market cap of the relevant investable stock universe by region or investable stock universe per region, the index forms a unique country. The STOXX Global TMI serves as the basis for all regional benchmark for a truly global investment approach and country TMI indices. All TMI indices offer exposure to global equity markets with the broadest diversification within the STOXX equity universe in terms of regions, currencies and sectors. Descriptive statistics Index Market cap (USD bn.) Components (USD bn.) Component weight (%) Turnover (%) Full Free-float Mean Median Largest Smallest Largest Smallest Last 12 months STOXX EU Enlarged Total Market Index 266.7 121.0 0.6 0.1 10.3 0.0 8.5 0.0 N/A STOXX Europe Total Market Index 12,763.5 10,020.5 9.5 2.6 250.9 0.0 2.5 0.0 3.0 Supersector weighting (top 10) Country weighting Risk and return figures1 Index returns Return (%) Annualized return (%) Last month YTD 1Y 3Y 5Y Last month YTD 1Y 3Y 5Y STOXX EU Enlarged Total Market Index 1.2 -3.4 6.4 0.1 1.7 14.7 -4.9 6.3 0.0 0.3 STOXX Europe Total Market Index 0.4 2.0 18.3 44.5 55.2 4.8 2.9 17.9 12.7 8.9 Index volatility and risk Annualized volatility (%) Annualized Sharpe ratio2 STOXX EU Enlarged Total Market Index 15.1 15.0 16.3 23.2 25.3 -0.1 -0.4 0.4 0.0 -0.0 STOXX Europe Total Market Index 11.0 11.1 11.5 20.0 21.6 -0.9 0.3 1.3 0.6 0.4 Index to benchmark Correlation Tracking error (%) STOXX EU Enlarged Total Market Index 0.7 0.7 0.7 0.8 0.9 10.3 10.7 11.9 12.3 12.7 Index to benchmark Beta Annualized information ratio STOXX EU Enlarged Total Market Index 1.0 0.9 1.0 1.0 1.0 0.8 -0.8 -0.8 -1.0 -0.6 1 For information on data calculation, please refer to STOXX calculation reference guide. -

LUKA RIJEKA D.D. Annual Report for the Year Ended 31 December 2016

LUKA RIJEKA d.d. Annual Report for the year ended 31 December 2016 This version of our report is a translation from the original, which was prepared in Croatian language. All possible care has been taken to ensure that the translation is an accurate representation of the original. However, in all matters of interpretation of information, views or opinions, the original language version of our report takes precedence over this translation. CONTENTS Page Management report for the year ended 31 December 2016 1 Statement of implementation of the corporate governance code 20 Statement of Management's responsibilities 23 Independent Auditors’ Report to the Shareholders of Luka Rijeka d.d. 24 Statement of comprehensive income 29 Statement of financial position 30 Statement of changes in equity 31 - 32 Statement of cash flows 33 Notes to the financial statements 34 - 78 Management report for the year ended 31 December 2016 LUKA RIJEKA GROUP MANAGEMENT REPORT FOR THE YEAR ENDED 31 DECEMBER 2016 LUKA RIJEKA D.D. Riva 1, HR‐51 000 RIJEKA OIB: 92590920313 Rijeka, April 2017 1 Management report for the year ended 31 December 2016 STRUCTURE OF LUKA RIJEKA GROUP The Group is comprised of the following companies: LUKA RIJEKA d.d. Rijeka (the Company) The Parent is the largest concessionaire for shipping and reload of dry cargo in the Rijeka port basin. The principle activities of the Company comprise provision of maritime transport services, port services, storage of goods and freight forwarding. The Company is headquartered at Riva 1, Rijeka. LUKA ‐ PRIJEVOZ d.o.o. Kukuljanovo, 100% owned by Luke Rijeka d.d., whose principal activity is providing transport services. -

Annual Report on the Operation of the Strategic Companies And

2014. – ANNUAL REPORT ON THE OPERATIONS OF THE STRATEGIC COMPANIES AND COMPANIES OF SPECIAL INTEREST FOR THE REPUBLIC OF CROATIA 2014. - ANNUAL REPORT ON THE OPERATIONS 1 TABLE OF CONTENTS Page FOREWORD OF THE HEAD OF THE STATE ADMINISTRATIVE OFFICE FOR STATE PROPERTY MANAGEMENT ..................................................................................................................... 5 I. INTRODUCTION - DIVISION OF THE STATE PORTFOLIO - ACCORDING TO THE DECISION OF THE CROATIAN GOVERNMENT ON LAYING DOWN A LIST OF COMPANIES AND OTHER LEGAL ENTITIES OF STRATEGIC AND SPECIAL INTERESTS FOR THE REPUBLIC OF CROATIA ................................................................................ 7 II. PORTFOLIO OVERVIEW - 49 COMPANIES OF STRATEGIC AND SPECIAL INTEREST TO THE REPUBLIC OF CROATIA – ACCORDING TO ACTIVITIES .................................................................................................... 8 III. REVIEW OF OPERATIONS - 49 STRATEGIC AND COMPANIES OF SPECIAL INTEREST TO THE REPUBLIC OF CROATIA FROM 2011 TO 2014 ................................................................................................................. 9 III.I. TOTAL REVENUES, EXPENDITURES AND OPERATING RESULTS - 49 STRATEGIC AND COMPANIES OF SPECIAL INTEREST TO THE REPUBLIC OF CROATIA FROM 2011 TO 2014 .................................................... 11 III.II. NUMBER OF EMPLOYEES - 49 COMPANIES OF STRATEGIC AND SPECIAL INTEREST TO THE REPUBLIC OF CROATIA ON DECEMBER 31, 2014 FROM 2011 TO 2014 ........................................................................... -

Agency Problems and Debt Financing

AGENCY PROBLEMS AND DEBT FINANCING Marina Klačmer Čalopa1 Karolina Kokot2 Ivana Đunđek Kokotec3 DOI: https://doi.org/10.31410/EMAN.2019.325 Abstract: The main objective of this paper is to examine correlation between agency costs meas- ured by identified approximation of variables and debt financing as one of the corporate governance mechanisms for reducing these costs. In a modern corporation where ownership is separated from management, many benefits are viewed primarily through an increasing efficiency. The issue of the separation of ownership and management is related to potential conflict between principals (stakehold- ers) and agents (managers). Theoretically possible solution to the agency problem is defined through the agency theory. The most significant problem are agency costs. Agency costs do not have a directly quantifiable value, therefore the approximation of measures such as asset turnover ratio and operat- ing expense ratio (company’s operating expenses divided by its revenues) will be used in this research paper. According to the previous empirical studies, between asset turnover ratio and debt financing positive correlation was determined, while negative correlation was determent between operating ex- pense ratio and debt financing. This research was conducted on Croatian companies whose shares have been listed on the Zagreb Stock Exchange continuously from January 2009 to December 2017. In the analysis, from a total of 154 companies that shares have been listed on the Zagreb Stock Exchange, 31 most actively traded shares measured by the average monthly trading rank in the observed period were taken. Results obtained in this research indicate that debt financing is significant corporate governance mechanism for reducing agency costs where the direction obtained from the correlation is in line with the theoretical expectation. -

Stoxx® Global Total Market Index

TOTAL MARKET INDICES 1 STOXX® GLOBAL TOTAL MARKET INDEX Stated objective Key facts The STOXX Total Market (TMI) Indices cover 95% of the free-float » With 95% coverage of the free-float market cap of the relevant market cap of the relevant investable stock universe by region or investable stock universe per region, the index forms a unique country. The STOXX Global TMI serves as the basis for all regional benchmark for a truly global investment approach and country TMI indices. All TMI indices offer exposure to global equity markets with the broadest diversification within the STOXX equity universe in terms of regions, currencies and sectors. Descriptive statistics Index Market cap (EUR bn.) Components (EUR bn.) Component weight (%) Turnover (%) Full Free-float Mean Median Largest Smallest Largest Smallest Last 12 months STOXX Global Total Market Index 41,428.5 33,610.4 4.6 1.0 469.2 0.0 1.4 0.0 3.4 STOXX Europe Total Market Index 9,689.9 7,607.4 7.2 2.0 190.5 0.0 2.5 0.0 3.0 Supersector weighting (top 10) Country weighting Risk and return figures1 Index returns Return (%) Annualized return (%) Last month YTD 1Y 3Y 5Y Last month YTD 1Y 3Y 5Y STOXX Global Total Market Index 3.9 12.7 21.8 63.3 94.6 57.6 19.2 21.4 17.3 13.9 STOXX Europe Total Market Index 2.0 7.2 19.1 60.8 74.1 26.4 10.8 18.7 16.7 11.4 Index volatility and risk Annualized volatility (%) Annualized Sharpe ratio2 STOXX Global Total Market Index 9.0 8.9 8.4 10.4 15.6 3.0 2.0 2.3 1.5 0.8 STOXX Europe Total Market Index 11.8 10.9 10.6 15.3 16.4 0.7 1.0 1.5 1.1 0.6 Index to benchmark Correlation Tracking error (%) STOXX Global Total Market Index 0.9 0.8 0.8 0.8 0.6 5.9 6.0 6.3 10.2 14.7 Index to benchmark Beta Annualized information ratio STOXX Global Total Market Index 0.7 0.7 0.6 0.5 0.6 3.2 1.2 0.4 -0.1 0.1 1 For information on data calculation, please refer to STOXX calculation reference guide. -

FIMA Daily Insight

FIMA Daily Insight IN FOCUS - ZAGREB STOCK EXCHANGE March 18, 2011 ZSE STOCK MARKET Although most shares closed higher, due to 1.9% decline of oil and gas company w Ina (INARA CZ) domestic indices ended mixed with CROBEX adding 0.08% while CROBEX Last 2.260,7 CROBEX10 slipped 0.17% on regular stock turnover of HRK 25.2 million. % daily 0,08% Diversified producer and distributor Atlantic Group (ATGRRA CZ) was in % YTD 7,10% investors’ focus soaring 3.6% to HRK 805 on HRK 2.2 million in turnover. CROBEX10 last 1252,3 Investors await quarterly results which will also include consolidation of Droga % daily -0,17% Kolinska. On 2010FY results, Atlantic Group also posted pro-forma consolidated % YTD 8,49% results giving investors an insight into what to expect at 1Q2011 results. In pro- forma consolidation, revenues would reach HRK 4,6 billion (99.2% increase), Stock Turnover (HRK m) 25,21 EBITDA HRK 524 million (+159.8%), EBIT HRK 317 million (+116.2%) and Net Total MCAP (HRK bn) 207,12 Income HRK 173.8 million (+78.8%). Source: www.zse.hr Plastic auto-parts producer AD Plastik (ADPLRA CZ) gained 1.9% on turnover of HRK 1.9 million after newspapers reported that Renault’s partner Nissan is CROBEX MOVERS targeting significant portion of Russian car maker AvtoVaz which should, together with 25% currently held by Renault, secure major ownership. Large part of AD Plastik’s products ends in Renaults cars. -10,0% -8,0% -6,0% -4,0% -2,0% 0,0% 2,0% 4,0% 6,0% 8,0% 10,0% INGR-R-A Construction engineering company Ingra (INGRRA CZ) soared 7.4% collecting THNK-R-A HRK 0.9 million in turnover.