Wrap-Up for the 86 Legislature

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Bibles, Badges and Business for Immigration Reform News Clips January – August 2015

Bibles, Badges and Business for Immigration Reform News Clips January – August 2015 JANUARY ....................................................................................................................................................... 4 CHRISTIAN POST: Top 10 Politics Stories of 2014 ......................................................................................... 4 CHRISTIANITY TODAY (Galli Column): Amnesty is Not a Dirty Word ............................................................ 5 THE DENVER POST (Torres Letter): Ken Buck is right on immigration .......................................................... 6 SIOUX CITY JOURNAL: Church News ............................................................................................................. 6 CBS-WSBT (Indiana): South Bend police chief helps launch immigration task force ................................... 7 FOX NEWS LATINO (Rodriguez Op-Ed): Pro Life, Pro Immigrant .................................................................. 7 TERRA: Funcionarios de seguridad crean fuerza de tarea migratoria en EUA ............................................. 9 UNIVISION (WFDC News): Noticias DC – Edición 6 P.M. ............................................................................... 9 THE POTPOURRI (Texas; Tomball Edition): Harris County Sheriff Adrian Garcia helps launch national immigration task force .................................................................................................................................. 9 CBS-WSBT (Indiana): South -

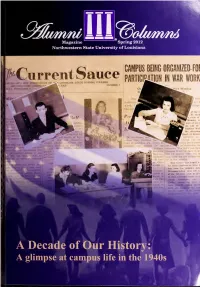

Alumni Columns Oflicial Publication of Northwolcm State University Dr

Magazine Spring 2012 Northwestern State University of Louisiana CAMPUS BEING ORGANIZEDJOi ^^^Current Sauce COLLEGE PARTICMION IN WAR WORK oA'noN op I "3 LOUISIANA STATE NORMAL l'S XXX- NUMBEJR trOAY. NOVEi\mER 6. 3: t Monday fired room of Mdmlay a iiiU of all r^ >n> uill be Mudfiit \\\-l the diiMlton Xlunt^ at dinner operation on several war en iident parlioipatio as authorities fee nei-cssai.v. The Red Cross Surs Oressing Room has been in op tion for several weeks but m local coeds are not yet pai-ttcl; ing in this aetlvlty. MijiS C'lMdey has LssBed i (ur loral stiulriiUi lo titlic t JrtH; time lor national defi Reeonunendine: th;»t lOK h of tlie 16«-liour week b<' dev ADeca r History: A glimpse at ca II ; life in the 1940s 1 Alumni Columns Oflicial Publication of Northwolcm State University Dr. Randall J. Webb, 1965, 1966 Natchitoches. Louisiana President, Northwestern State University Organi/cd in I SK4 •A member ol'C ASE Volume XXII Number I Spring 2012 The Alumni Columns (USPS 015480) is published Dear alumni, by Northwestern Stale Uni\ersity. Natchitoches. Louisiana. 7I4974KX)2 While serving as president of Northwestern Periodicals Postage Paid at Natchitoches. La . and at additional mailing offices. State University, I have many opportunities to POSTMASTRR: Send address changc-s to the be humbled by the generosity of people who are Alumni Columns. Northwestern State University. NatchiliK-hes. La. 714y7-(HXl2. associated with this special institution. It means so much to me and Alumni Office Phone: .1 18-357-4414 and 888-799-6486 those who work here to know that people value what we do so highly I AX: 318-357-4225 • E-mail: owensd unsula.cdu that they are willing to make donations to support Northwestern State. -

33 Publishers Affidavit

PUBLISHERS AFFIDAVIT \-LrPlf TI IE STATE OFTEXAS § .■9 COUNTY OF FORT BEND § Before me, the undersigned authority, on this day personally appeared Clyde C. King, Jr. who being by me duly sworn, deposes and says that he is the Publisher of The HeraldlCoaster and that said newspaper meets the requirements of Section 2051.044 of the Texas Government Code, to wit: PUBLIC NOTICE 1. it devotes not less than twenty-five percent (25%) of its The Commissioners Court of Fort Bend County, Texas will consider an Order Adopting an Amendment total column lineage to general interest items; to the Fort Bend County Regula tions of Subdivisions in Fort Bend County, revising the following sec tions: 2. it is published at least once each week; Paragraph 5.2.B.1., to read: The minimum width of the right-of- way to be dedicated for any desig nated major thoroughfare shall not 3. it is entered as second-class postal matter in the county be less than 100 feet, nor more than 120 feet." where it is published; and Paragraph 6.2.B.2., to read: "Where the subdivision is located adjacent to an existing designated major thoroughfare have a right-of- way width of less than 100 feet, suf 4. it has been published regularly and continuously since ficient additional right-of-way must be dedicated, within the subdivision 1892. boundaries, to provide for the de velopment of the major thorough fare to a total right-of-way width of not less than 100 feet nor more 5. it is generally circulated within Fort Bend County. -

Winter I 1999 Y Name Is Viorel, and I'm from an Eastern European M Country

Winter I 1999 y name is Viorel, and I'm from an Eastern European M country. I am 12 years old, and although I'm a boy I cry easily. Some boys laugh at me, but my mother says I ha,-e a good heart. After all, wouldn't you cry in my place? I am at a boardin a school in Resita, Christmas at Home miles away from my home town of 3 Iasi. This was the onh· school in the country that would accept me where Royal Rangers I could learn a craft. I'm training to National Competition make musical instruments such as 4 violins, mandolins, and flu tes. My best fri end is Florin. He's an Powder Plunge orphan. One day h e told me, "I've never 6 seen inside a house. I ah,·ays wanted A Happy Millennium to see one." "What do you mean?" I as ked. 8 "I have n e,·er once left this Rascal Rangers boarding school. I ha,-e spent almost 13 years within the e aates." 10 "Don't you ha,-e anyone?" I asked. Darby Jones Florin shook his head. I cried a lot for the next 2 days. 12 I would soon be aoina home for How To Get To Hell Christmas vacation. Ho,,- could I leave Florin here? 14 "I will see if I can take you home with me for Christmas," I told Florin. Comedy Corner He looked at me 1\·ith a ray of hope 15 in his eyes. I ,,-ent to the director and asked him, "Sir, can Florin come home with me for Christmas?" "Impossible," said the tall, strong man who had a mustache and metal HIGH ADVENTURE-Volume 29, Number 3 ISSN (0190-3802) published teeth. -

Send2press® Media List 2009, Weekly U.S. Newspapers *Disclaimer: Media Outlets Subject to Change; This Is Not Our Complete Database!

Send2Press® Media Lists 2009 — Page 1 of 125 www.send2press.com/lists/ Send2Press® Media List 2009, Weekly U.S. Newspapers *Disclaimer: media outlets subject to change; this is not our complete database! AK Anchorage Press AK Arctic Sounder AK Dutch Harbor Fisherman AK Tundra Drums AK Cordova Times AK Delta Wind AK Bristol Bay Times AK Alaska Star AK Chilkat Valley News AK Homer News AK Homer Tribune AK Capital City Weekly AK Clarion Dispatch AK Nome Nugget AK Petersburg Pilot AK Seward Phoenix Log AK Skagway News AK The Island News AK Mukluk News AK Valdez Star AK Frontiersman AK The Valley Sun AK Wrangell Sentinel AL Abbeville Herald AL Sand Mountain Reporter AL DadevilleDadeville RecordRecord AL Arab Tribune AL Atmore Advance AL Corner News AL Baldwin Times AL Western Star AAL Alabama MessengerMessenger AL Birmingham Weekly AL Over the Mountain Jrnl. AL Brewton Standard AL Choctaw Advocate AL Wilcox Progressive Era AL Pickens County Herald Content and information is Copr. © 1983‐2009 by NEOTROPE® — All Rights Reserved. Send2Press® Media Lists 2009 — Page 2 of 125 AL Cherokee County Herald AL Cherokee Post AL Centreville Press AL Washington County News AL Call‐News AL Chilton County News AL Clanton Advertiser AL Clayton Record AL Shelby County Reporter AL The Beacon AL Cullman Tribune AL Daphne Bulletin AL The Sun AL Dothan Progress AL Elba Clipper AL Sun Courier AL The Southeast Sun AL Eufaula Tribune AL Greene County Independent AL Evergreen Courant AL Fairhope Courier AL The Times Record AL Tri‐City Ledger AL Florala News AL Courier Journal AL The Onlooker AL De Kalb Advertiser AL The Messenger AL North Jefferson News AL Geneva County Reaper AL Hartford News Herald AL Samson Ledger AL Choctaw Sun AL The Greensboro Watchman AL Butler Countyy News AL Greenville Advocate AL Lowndes Signal AL Clarke County Democrat AL The Islander AL The Advertiser‐Gleam AL Northwest Alabaman AL TheThe JournalJournal‐RecordRecord AL Journal Record AL Trinity News AL Hartselle Enquirer AL The Cleburne News AL The South Alabamian Content and information is Copr. -

AMERICANS for TAX FAIRNESS SELECTED NEWS STORIES and COMMENTARY May 1, 2014 – April 30, 2015

AMERICANS FOR TAX FAIRNESS SELECTED NEWS STORIES AND COMMENTARY May 1, 2014 – April 30, 2015 Media clips included in this report were generated from activities sponsored by ATF, primarily at the national level, as funding for state groups ended in March 2014. A press clip is included that either in whole or in large part was generated by work by ATF and its communications consultants. Included are news stories, op-eds, editorials, opinion columns and blog posts. NATIONAL MEDIA 27 Blog: Opponents: Estate tax repeal would only benefit the wealthy -- FarmWorld.com 27 Column: The Death Tax Deception -- Bloomberg View 27 Column: Fix The Tax Code Friday: Should We Repeal The Federal Estate Tax? -- Forbes 27 How the government taxes rich dead people, explained -- Vox 28 Blog: Congress Might Repeal the Estate Tax, But Here's What They Could Do Instead -- Attn.com 28 In defense of Walmart: Why corporations shouldn't be responsible for preventing poverty -- The Week 29 Column: The Republican Recipe for Widening Inequality -- The New York Times 29 Op-Ed: House GOP Votes to Take Food From the Mouths of Hungry Children to Give Huge Tax Break to Children of Multi-Millionaires -- Really? -- Huffington Post 30 Blog: Walmart Heir Does Not Deserve Assets It Would Take a Worker a Million Years to Earn -- Truth-Out 30 Op-Ed: Ben & Jerry: We don't need this stupid tax cut -- USA TODAY 31 Op-Ed: Undermining the American dream -- The Hill 32 Editorial: Repealing estate tax would reward 0.2%: Our view -- USA TODAY 32 House Votes 240-179 To Repeal Estate Tax -

College of Wooster Miscellaneous Materials: a Finding Tool

College of Wooster Miscellaneous Materials: A Finding Tool Denise Monbarren August 2021 Box 1 #GIVING TUESDAY Correspondence [about] #GIVINGWOODAY X-Refs. Correspondence [about] Flyers, Pamphlets See also Oversized location #J20 Flyers, Pamphlets #METOO X-Refs. #ONEWOO X-Refs #SCHOLARSTRIKE Correspondence [about] #WAYNECOUNTYFAIRFORALL Clippings [about] #WOOGIVING DAY X-Refs. #WOOSTERHOMEFORALL Correspondence [about] #WOOTALKS X-Refs. Flyers, Pamphlets See Oversized location A. H. GOULD COLLECTION OF NAVAJO WEAVINGS X-Refs. A. L. I. C. E. (ALERT LOCKDOWN INFORM COUNTER EVACUATE) X-Refs. Correspondence [about] ABATE, GREG X-Refs. Flyers, Pamphlets See Oversized location ABBEY, PAUL X-Refs. ABDO, JIM X-Refs. ABDUL-JABBAR, KAREEM X-Refs. Clippings [about] Correspondence [about] Flyers, Pamphlets See Oversized location Press Releases ABHIRAMI See KUMAR, DIVYA ABLE/ESOL X-Refs. ABLOVATSKI, ELIZA X-Refs. ABM INDUSTRIES X-Refs. ABOLITIONISTS X-Refs. ABORTION X-Refs. ABRAHAM LINCOLN MEMORIAL SCHOLARSHIP See also: TRUSTEES—Kendall, Paul X-Refs. Photographs (Proof sheets) [of] ABRAHAM, NEAL B. X-Refs. ABRAHAM, SPENCER X-Refs. Clippings [about] Correspondence [about] Flyers, Pamphlets ABRAHAMSON, EDWIN W. X-Refs. ABSMATERIALS X-Refs. Clippings [about] Press Releases Web Pages ABU AWWAD, SHADI X-Refs. Clippings [about] Correspondence [about] ABU-JAMAL, MUMIA X-Refs. Flyers, Pamphlets ABUSROUR, ABDELKATTAH Flyers, Pamphlets ACADEMIC AFFAIRS COMMITTEE X-Refs. ACADEMIC FREEDOM AND TENURE X-Refs. Statements ACADEMIC PROGRAMMING PLANNING COMMITTEE X-Refs. Correspondence [about] ACADEMIC STANDARDS COMMITTEE X-Refs. ACADEMIC STANDING X-Refs. ACADEMY OF AMERICAN POETRY PRIZE X-Refs. ACADEMY SINGERS X-Refs. ACCESS MEMORY Flyers, Pamphlets ACEY, TAALAM X-Refs. Flyers, Pamphlets ACKLEY, MARTY Flyers, Pamphlets ACLU Flyers, Pamphlets Web Pages ACRES, HENRY Clippings [about] ACT NOW TO STOP WAR AND END RACISM X-Refs. -

Texas Civil Procedure William Vandercreek

SMU Law Review Volume 22 Article 15 Issue 1 Annual Survey of Texas Law 1968 Texas Civil Procedure William VanDercreek Follow this and additional works at: https://scholar.smu.edu/smulr Recommended Citation William VanDercreek, Texas Civil Procedure, 22 Sw L.J. 174 (1968) https://scholar.smu.edu/smulr/vol22/iss1/15 This Article is brought to you for free and open access by the Law Journals at SMU Scholar. It has been accepted for inclusion in SMU Law Review by an authorized administrator of SMU Scholar. For more information, please visit http://digitalrepository.smu.edu. TEXAS CIVIL PROCEDURE by William VanDercreek* A S WAS done in the Survey article last year,' a limited number of cases have been selected for textual discussion with principal emphasis on supreme court decisions. A few civil appeals rulings on matters which may be of particular interest also have been included. The concluding footnote contains partial selections of the literally hundreds of 1967 cases that involve some facet of procedural law. I. JURISDICTION Jurisdiction over the Person. Although Texas authorized a form of spe- cial appearance under rule 120a in 1962, the last five years have brought relatively few appellate decisions interpreting either this rule or the related long arm statute, article 2031(b).' One of the more significant Texas cases last year was Crothers v. Midland Products Co.,3 decided by the Houston court of civil appeals. Both the issues of burden of proof under rule 120a and doing business under article 2031 (b) were discussed. The court's treatment of the minimal contacts doctrine and article 2031 (b) deserves comment. -

Haverfo)D News Volume 32—Number 9 Haverford (And Ardmore), Pa., Tuesday, November 19, 1940 Z 627� $2.00 a Year

HAVERFO)D NEWS VOLUME 32—NUMBER 9 HAVERFORD (AND ARDMORE), PA., TUESDAY, NOVEMBER 19, 1940 Z 627 $2.00 A YEAR Faculty, Managers Oakley "Living High"I Nickelodeon Show Hotson Entertains Tickets On Sale Turns Hold Annual Up In Turnips Earns Over $1000 For Soph-Senior Just what reasons a professor has for taking a sabbatical leave Dinner Friday are usually unknown to everyone For British Aid Hop November 29 but himself, but last week Profes- sor Cletus O. Oakley, taking the Strawbridge Lauds year oft from Haverford, gave one Old Films, Songs, Bert Kinzell To Play good reason why classes should be "Average Student" given up when he got into a turnip Dance In Gym, At Feature Attraction In Evening Address patch down in Georgia. Entertain Crowd Of Week-end Festivity According to Tom Arnold, fea- Speaking befere the annual ture columnist for the North Geor- Charley Chaplin, Wilt Rogers, Tickets for the Sophomore-Sen- Faculty-Board of Managers joint gia Tribune, of Canton, Profeseor and a host of other silent stare ior Dance, to be held Friday even- dinner in the Common Room Fri- Oakley, who comes "from Penn- came out of the dim past Saturday ing, November 29, were put on day, Mr. Frederic H. Strawbridge sylvania where they don't raise sale Friday, as the sophomore gave a short talk lauding "The anything but spinach," got into night in Roberts Hall to help the committee members completed Average Student," for whom all Lige Ellison's turnip greens patch national drive for British Hospi- plans for their gala post-Thanks- eolleges, in the final analysis, are the other day and "came out with tals, The event, Nickelodeon giving weekend. -

Brenda Theresa Hussey-Gardner Phd, MPH Associate Professor of Pediatrics University of Maryland School of Medicine

Brenda Theresa Hussey-Gardner PhD, MPH Associate Professor of Pediatrics University of Maryland School of Medicine Date June 1, 2018 Contact Information Business address: University of Maryland Division of Neonatology, 110 South Paca Street, 8th Floor, Baltimore, MD, 21201 Business phone: 410-328-6003 Business FAX: 410-328-1076 Email: [email protected] Education 1981-1985 BS Special Education University of Maryland College Park, Maryland 1985-1987 MA Special Education University of North Carolina Chapel Hill, North Carolina 1985-1987 MPH Maternal & Child Health University of North Carolina Chapel Hill, North Carolina 1991-1995 PhD Early Childhood Special Education University of Maryland College Park, Maryland Certifications 1987 Neonatal Behavioral Assessment Scale 1992 Denver II 1993 Early Childhood Special Educator (State of Maryland) 1995 Newborn Individualized Developmental Care & Assessment Program 2005 NICU Network Neurobehavioral Screen Employment History Academic Appointments 1996-2013 Adjunct Faculty of Special Education, University of Maryland College Park 2000 Adjunct Faculty of Special Education, Johns Hopkins University 2000-2003 Volunteer Clinical Assistant Professor of Pediatrics, University of Maryland School of Medicine 2000-2012 Adjunct Faculty of Psychology, University of Maryland Baltimore County 2003-2012 Assistant Professor of Pediatrics, University of Maryland School of Medicine 2012-present Adjunct Faculty II of Psychology, University of Maryland Baltimore County 2012-present Associate Professor of Pediatrics, -

Tomball City Council Regular Meeting Document

MINUTES OF REGULAR CITY COUNCIL MEETING CITY OF TOMBALL, TEXAS Monday, January 4, 2021 6:00 PM The City Council of the City of Tomball, Texas, conducted the Council meeting scheduled for January 4, 2021, 6:00 PM, at 401 Market Street, Tomball, Texas 77375, via video/telephone conference. A. Call to Order PRESENT Mayor Gretchen Fagan Council 1 John Ford Council 2 Mark Stoll Council 3 Chad Degges Council 4 Derek Townsend, Sr. (Called away for emergency, left before voting began) Council 5 Lori Klein Quinn OTHERS PRESENT: City Manager – Robert Hauck Assistant City Manager – David Esquivel City Secretary – Doris Speer Assistant City Secretary – Tracylynn Garcia City Attorney – Loren Smith Fire Chief – Randy Parr (via video) Fire Marshall – Joe Sykora (via video) Assistant Fire Chief – Taner Drake (via video) Finance Director – Glenn Windsor Director of Community Development – Craig Meyers Administrative Assistant - Johnita Robinson B. Invocation - Led by Pastor Dustin Reitzel - Woodlands Church Northpointe Campus C. Pledges to U.S. and Texas Flags led by TPD Chief Jeff Bert D. No public comments received. E. Reports and Announcements 1. Announcements Minutes Regular City Council Meeting January 04, 2021 Page 2 of 5 I. January 13, 2021 – First day to apply for Place on Ballot for the May 1, 2021 General City Election II. February 12, 2021– Last day to apply for Place on Ballot for the May 1, 2021 General City Election 2. Reports by City staff and members of council about items of community interest on which no action will be taken: F. Approval of Minutes 1. Motion made by Council 2 Stoll, Seconded by Council 5 Klein Quinn to approve the Minutes of the December 21, 2020 Regular Tomball City Council Meeting Voting Yea: Council 1 Ford, Council 2 Stoll, Council 3 Degges, Council 5 Klein Quinn Absent: Council 4 Townsend Sr. -

Harding University Alumni ENGLISH NEWS Summer 2012 Searcy, Arkansas 72149-2248 Volume 27 from the Chair John Williams

hARDING uNIVERSITY ALuMNI ENGLISh NEWS SuMMER 2012 SEARCY, ARKANSAS 72149-2248 VOLuME 27 From the Chair John Williams Pardon the potpourri, but this year’s col- in a new course for English and communi- The Bobbie Coleman Teaching umn features two updates and one retro- cations majors. Tentatively titled “Introduc- Forum and Student Teaching spective, each with its own title: tion to Publishing,” the class will be submit- Award ted for approval this fall and, if approved, John and Pam Go to New York, could start the following summer. It would Bobbie Coleman, who died in 2009, was or, be offered on campus as an English and a Harding English major and alumnus who How the English Department communications elective in intersession or become a legendary teacher at Searcy High Changes Course summer I of alternate years. We have an School. She possessed the combination of agreement in principle with a New York lit- knowledge, pedagogical skill, and loving erary agent to teach the course, with topics I went to New York City last March dur- concern that every parent wants for his or ranging from the history of publishing to the ing spring break in pursuit of a new class her child. Not surprisingly, Searcy High new digital world of the profession. It will for the English department and someone to has honored Bobbie with a scholarship include contributions, via video technology, teach it. My wife Pam went with me be- bearing her name. with other professionals in New York and cause the opportunity for us to visit the Big Now our English department has found Los Angeles, giving our students a practi- City is so rare — as in never, at least as a way to remember her.