Inside Africa

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Full Year 2020 Results Presentation to Investors and Analysts

FULL YEAR 2020 RESULTS PRESENTATION TO INVESTORS AND ANALYSTS Disclaimer The information presented herein is based on sources which Access Bank The information should not be interpreted as advice to customers on the Plc. (the “Bank”) regards dependable. This presentation may contain purchase or sale of specific financial instruments. Access Bank Plc. bears no forward looking statements. These statements concern or may affect future responsibility in any instance for loss which may result from reliance on the matters, such as the Bank’s economic results, business plans and information. strategies, and are based upon the current expectations of the directors. Access Bank Plc. holds copyright to the information, unless expressly They are subject to a number of risks and uncertainties that might cause indicated otherwise or this is self-evident from its nature. Written permission actual results and events to differ materially from the expectations from Access Bank Plc. is required to republish the information on Access expressed in or implied by such forward looking statements. Factors that Bank or to distribute or copy such information. This shall apply regardless of could cause or contribute to differences in current expectations include, but the purpose for which it is to be republished, copied or distributed. Access are not limited to, regulatory developments, competitive conditions, Bank Plc.'s customers may, however, retain the information for their private technological developments and general economic conditions. The Bank use. assumes no responsibility to update any of the forward looking statements contained in this presentation. Transactions with financial instruments by their very nature involve high risk. -

Equipment Leasing in Africa Handbook of Regional Statistics 2017 Including an Overview of 10 Years of IFC Leasing Intervention in the Region

AFRICA LEASING FACILITY II Equipment Leasing in Africa Handbook of Regional Statistics 2017 Including an overview of 10 years of IFC leasing intervention in the region © 2017 INTERNATIONAL FINANCE CORPORATION 2121 Pennsylvania Avenue, N.W., Washington, DC 20433 All rights reserved. First printing, March 2018. This document may not be reproduced in whole or in part without the written consent of the International Finance Corporation. This information, while based on sources that IFC considers to be reliable, is not guaranteed as to accuracy and does not purport to be complete. The conclusions and judgments contained in this handbook should not be attributed to, and do not necessarily represent the views of IFC, its partners, or the World Bank Group. IFC and the World Bank do not guarantee the accuracy of the data in this publication and accept no responsibility for any consequence of its use. Rights and Permissions Reference Section III. What is Leasing? and parts of Section IV. Value of Leasing in Emerging Economies are taken from IFC’s “Leasing in Development: Guidelines for Emerging Economies.” 2005, which draws upon: Halladay, Shawn D., and Sudhir P. Amembal. 1998. The Handbook of Equipment Leasing, Vol. I-II, P.R.E.P. Institute of America, Inc., New York, N.Y.: Available from Amembal, Deane & Associates. EQUIPMENT LEASING IN AFRICA: ACKNOWLEDGEMENT Acknowledgement This first edition of Equipment Leasing in Africa: A handbook of regional statistics, including an overview of 10 years of IFC leasing intervention in the region, is a collaborative efort between IFC’s Africa Leasing Facility team and the regional association of leasing practitioners, known as Africalease. -

Registered Attendees

Registered Attendees Company Name Job Title Country/Region 1996 Graduate Trainee (Aquaculturist) Zambia 1Life MI Manager South Africa 27four Executive South Africa Sales & Marketing: Microsoft 28twelve consulting Technologies United States 2degrees ETL Developer New Zealand SaaS (Software as a Service) 2U Adminstrator South Africa 4 POINT ZERO INVEST HOLDINGS PROJECT MANAGER South Africa 4GIS Chief Data Scientist South Africa Lead - Product Development - Data 4Sight Enablement, BI & Analytics South Africa 4Teck IT Software Developer Botswana 4Teck IT (PTY) LTD Information Technology Consultant Botswana 4TeckIT (pty) Ltd Director of Operations Botswana 8110195216089 System and Data South Africa Analyst Customer Value 9Mobile Management & BI Nigeria Analyst, Customer Value 9mobile Management Nigeria 9mobile Nigeria (formerly Etisalat Specialist, Product Research & Nigeria). Marketing. Nigeria Head of marketing and A and A utilities limited communications Nigeria A3 Remote Monitoring Technologies Research Intern India AAA Consult Analyst Nigeria Aaitt Holdings pvt ltd Business Administrator South Africa Aarix (Pty) Ltd Managing Director South Africa AB Microfinance Bank Business Data Analyst Nigeria ABA DBA Egypt Abc Data Analyst Vietnam ABEO International SAP Consultant Vietnam Ab-inbev Senior Data Analyst South Africa Solution Architect & CTO (Data & ABLNY Technologies AI Products) Turkey Senior Development Engineer - Big ABN AMRO Bank N.V. Data South Africa ABna Conseils Data/Analytics Lead Architect Canada ABS Senior SAP Business One -

ACCESS BANK PLC DECEMBER 2009 FULL YEAR and FIRST QUARTER 2010 RESULTS PRESENTATION Outline

ACCESS BANK PLC DECEMBER 2009 FULL YEAR AND FIRST QUARTER 2010 RESULTS PRESENTATION Outline About Access Bank Operating Environment 9 Months (December 2009) Performance Review Q1 March 2010 Performance review Ongoing Strategic Initiatives 2 December 31, 2009 2009 FULL YEAR RESULTS PRESENTATION Access Group – Fact Sheet United KingdomUnited Parent Company : Access Bank Plc registered in Nigeria as Kingdom a Universal bank and commenced operations Access Bank Group in May 1989 OmniFinance Bank Access Bank 75% 88% No of Employees : Over 2000 Professional staff Gambia Cote d’Ivoire Access Bank Access Bank 85% 75% Listing : Ordinary Shares & 3 years Convertible Bond Sierra Leone Zambia listed on NSE; Several International GDR The Access Bank Access Bank 100% 100% Holders. Paper traded OTC in London Rwanda UK FinBank 79% 100% Access Bank (RD Auditors : KPMG Professional Services Burundi Congo) Access Homes & 100% 75% Access Bank Credit Rating : A- / B+/ BB/ BBB- Mortgage Ghana (GCR/S&P/Agusto/Fitch) United 100% Access Securities 75% Investments & Securities Partners : Focus Client Segments Institutional (& Public Sector) Awards & Recognitions : 2007 Award of Recognition for “Innovation in Middle Market Trade Structures” 2008 Award of Recognition for “Best Network Distributors & Professionals Banks” Key Industry Segments : Telecoms, Food & Beverages, Cements, Oil & Treasury Gas and Financial Institutions Cash Management Channels : 131 Business Offices Trade Finance 216 ATMs, 204 POS, Call Centre Cards & Payment Services 3 Non-Banking subsidiaries; 9 Banking subsidiaries Asset Mgt. & Custodial Services Capabilities Key Relationship Management Geographical Coverage : Africa and Europe Banking subsidiaries in all monetary zones in Africa December 31, 2009 3 2009 FULL YEAR RESULTS PRESENTATION Board & Management Expertise Our Management Team possesses the requisite skills and experience required to emerge as Winners in a challenging operating environment. -

Summary on Participants

SUMMARY ON PARTICIPANTS CENTRAL BANKS / BANQUES CENTRALES B Observers Final List page 64 SUMMARY ON PARTICIPANTS CENTRAL BANKS-AFRICAN / BANQUES CENTRALES AFRICAINES B1 BANK OF KIGALI MR. ALEX BAHIZI NYIRIDANDI OBSERVER C/O Bank of Kigali Ltd Kigarama Kicukiro HEAD OF LEGAL SERVICES 175 kigali Kigali RWANDA MR. JOHN BUGUNYA OBSERVER C/0 Bank of Kigali Limited, 6112, Avenue CHIEF FINANCE OFFICER de la PaixGasabo, Kiyinya 175 175 Kigali RWANDA MR. NAIBO LAWSON OBSERVER KIGALI -RWANDANYARUGENGE CHIEF OPERATIONS OFFICER KIGALI RWANDA MS. LYS MWIZA OBSERVER Bank of Kigali, 6112 avenue de la PRIVATE BANKER paix175 Kigali RWANDA BANK OF KIGALI MR. ENOCK LUYENZI OBSERVER Avenue de la Paix 6112 Kigali Rwanda175 HEAD OF HR&ADMINISTRATION Kigali RWANDA BANK OF MOZAMBIQUE MRS. ESSELINA MAUSSE OBSERVER Av. 25 de Setembro 1695Maputo FOREIGN COOPERATION OFFICER MOZAMBIQUE Observers Final List page 65 SUMMARY ON PARTICIPANTS BANK OF SIERRA LEONE MR. HILTON OLATUNJI JARRETT OBSERVER Sam Bangura BuildingGloucester Street ASSISTANT DIRECTOR, GOVERNOR'S OFFICE 30 Freetown SIERRA LEONE MR. SHEKU SAMBADEEN SESAY HEAD OF INSTITUTION Sam Bangura BuildingGloucester Street GOVERNOR P O Box 30 Freetown SIERRA LEONE BANK OF TANZANIA MR. LAMECK KAKULU OBSERVER 10 Mirambo StreetDar es Salaam FOREIGN EXCHANGE RESERVE MANAGEMENT TANZANIA MR. DAVID MPONEJA OBSERVER BANK OF TANZANIA 2 MIRAMBO HEAD PORTFOLIO MANAGEMENT STREET ,11884 DAR ES SALAAM2939 NONE DAR ES SALAAM TANZANIA BANK OF ZAMBIA DR. EMMANUEL MULENGA PAMU OBSERVER BANK OF ZAMBIA30080 DIRECTOR FINANCIAL MARKETS LUSAKA ZAMBIA MR. BANDA PETER H OBSERVER BANK OF ZAMBIABANK SQUARE SENIOR DIRECTOR - MONETARY POLICY CAIRO ROAD 30080 10101 LUSAKA ZAMBIA Observers Final List page 66 SUMMARY ON PARTICIPANTS BANQUE CENTRALE DE LA REPUBLIQUE DE GUINEE M. -

Evaluation of Microfinance Services and Potential to Finance Forest Land Restoration (FLR) Investments

Evaluation of Microfinance Services and Potential to Finance Forest Land Restoration (FLR) Investments Final Report Prepared by Azimut Inclusive Finance SPRL November 2016 Azimut Inclusive Finance SPRL TVA : BE 0555.784.066 www.azimut-if.com – [email protected] Evaluation of Microfinance Services and Potential to Finance Forest Land Restoration (FLR) Investments Table of Content EXECUTIVE SUMMARY 3 1 CONTEXT 4 1.1 BACKGROUND 4 1.2 RATIONALE OF THE STUDY 4 1.3 SPECIFIC OBJECTIVES 4 2 FINANCIAL SECTOR AND REGULATORY ENVIRONMENT 5 2.1 BRIEF OVERVIEW OF THE FINANCIAL SECTOR IN RWANDA 5 2.1.1 FINANCIAL SERVICES PROVIDERS 5 2.2 THE MICROFINANCE SERVICE SECTOR 7 2.2.1 THE CONCEPT OF MICROFINANCE 7 2.2.2 THE MICROFINANCE SERVICE PROVIDERS 7 2.2.3 THE INFORMAL SECTOR 8 2.3 FINANCIAL INCLUSION 10 2.4 RELATED POLICIES AND LAWS 12 2.4.1 POLICY ENVIRONMENT 12 2.4.2 MICROFINANCE POLICY, LEGAL FRAMEWORK AND SUPERVISION 13 3 MICROFINANCE PRODUCTS AND SERVICES AND FLR EFFORTS 15 3.1 EXISTING PRODUCTS AND SERVICES 15 3.1.1 COMMERCIAL BANKS 15 3.1.2 MICROFINANCE INSTITUTIONS (MFIS) 19 3.2 ADAPTABILITY OF THE MICROFINANCE PRODUCT AND SERVICES TO SUPPORT FLR INITIATIVES (IN GATSIBO AND GICUMBI) 25 3.2.1 OPPORTUNITIES TO SUPPORT FLR INITIATIVES THROUGH MICROFINANCE INSTITUTIONS 25 3.2.2 CHALLENGES TO SUPPORT FLR INITIATIVES THROUGH MICROFINANCE INSTITUTIONS 28 3.2.2.1 Challenges related to the microfinance sector 28 3.2.2.2 Other challenges relating to the funding of FLR activities 29 4 RECOMMENDATIONS 30 FINANCIAL TERMS AND DEFINITIONS 35 ANNEXES 36 2 Evaluation of Microfinance Services and Potential to Finance Forest Land Restoration (FLR) Investments Executive Summary Rwanda has made international challenges, notably in terms of credit commitments via the Bonn Challenge to management policies, product restore 2 million hectares of degraded development, weak staff capacities and land. -

Access Bank Plc Annual Report and Accounts 2013 Contents

ACCESS BANK PLC ANNUAL REPORT AND ACCOUNTS 2013 CONTENTS Welcome 1 3. GOVERNANCE Speed, Service and Security 2 The Board 68 Directors, Officers and Professional Advisors 74 1. OVERVIEW Management Team 75 Business and Financial Highlights 10 Directors’ Report 78 At a Glance 12 Corporate Governance 83 Locations and Offices 14 Directors’ Responsibilities 92 Chairman’s Statement 14 Customer Complaints Feedback 94 Chief Executive’s Review 16 4. FINANCIAL STATEMENTS 2. BUSINESS REVIEW Statement of Financial Position 96 Corporate Philosophy 22 Statement of Comprehensive Income 97 Reports of the External Consultant 23 Consolidated Statement of Changes in Equity 98 Commercial Banking 24 Consolidated Statement of Cash Flows 102 Business Banking 26 Notes to the Financial Statements 104 Personal Banking 28 Corporate and Investment Banking 30 5. SHAREHOLDER INFORMATION Transaction Services and Settlement Banking 34 Shareholder Engagement 222 Retail Operations Group 35 Notice of AGM 223 IT Services 36 Explanatory Notes to the Proposed Resolutions 224 Our People, Culture and Diversity 37 Capital Formation 226 Sustainability Report 38 e-dividend Mandate Form 227 Risk-Management 41 Shareholder Information Update Form 229 Proxy Form 231 6. CORPORATE INFORMATION Head Office Address 238 Branch Distribution 238 ATM Locations 244 Subscribers’ Addresses 249 WELCOME We are making progress in our journey towards becoming the world’s most respected African bank. The journey has been exciting and has elicited more commitment to delivering our brand promise – to serve our customers with Speed, Service and Security. Accordingly, we are transforming the Bank operationally and culturally, with a view to making banking with Access Bank as convenient as possible for every one of our customers. -

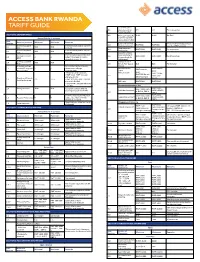

Access Bank Rwanda Tariff Guide

ACCESS BANK RWANDA TARIFF GUIDE FCY cash with - 4.1 drawals against 1% 1% Per transaction funds transfers SECTION 1: DEPOSIT RATES 4.2 FCY cash deposits 0.4% 0.4% Per Day Annual Rate in % per year over the counter above 10000 USD Sub Account product Minimum Maximum Remarks Section Cash withdrawals Amounts that are equal to or 4.3 RWF 500 RWF 500 Current account Interest is not paid on current over the counter less than RWF 300,000 1.1 N/A N/A 3 RWF account Stop payment 4.4 RWF 2950 RWF 2950 Per execution Current account Interest is not paid on current instruction 1.2 N/A N/A FCY account Counter cheque Interest is paid quarterly and (unavailability of Savings account 4.5 RWF 1000 RWF 1000 Per transaction 1.3 4 4 subject to a max of 4 with- cheque book for RWF drawals in a month. withdrawal) Savings account Outward trans- 1.4 N/A N/A FCY 4.6 fers in FCY (Local $15 $15 Per transfer Children savings For children up to 16 years. banks) 1.5 account (Early sav- 6 6 Remarks on savings Account state- RWF 1000 1st RWF 1000 1st ers account) account apply ment page page • Minimum of 3 members Personal use RWF 250 for RWF 250 for ad- • RWF 5000- RWF 100,000 4.7 additional attracts 4% P.A ditional pages. Family and Friends pages. 1.6 4% 7.5% • RWF 101,000- RWF 500,000 Savings Account attracts 6.5% P.A VISA use RWF 5000 RWF 5000 • Above RWF 500,000 attracts 7.5% P.A Account maintenance fee RWF 1000, 1.7 Salary account N/A N/A For salary earners with no RWF 1000, USD Individual account USD 2, EUR 2, monthly maintenance fees 2, EUR 2, GBP 2 4.8 GBP 2 RWF 2000, Interest is paid quarterly and RWF 2000, USD Corporate account USD 3, EUR 3, 1.8 Access Advantage 4 4 subject to a max of 4 with- 3, EUR 3, GBP 3 drawals in a month. -

Access Bank (Ghana) Plc 2017 Annual Report

INNOVATING FOR A SUSTAINABLE FUTURE Access Bank (Ghana) Plc 2017 Annual Report Contents 01| Overview Welcome 8 Business and Financial Highlights 9 Location and Offices 10 Chairman’s Statement 12 Managing Director’s Review 15 02| Business Review Corporate Philosophy 21 Milestones 22 Our Year in Review 23 Commercial Banking 27 Retail Banking 29 Corporate Banking 33 Public Sector 34 Investment Banking 35 Digital Banking 36 Operations and I.T. 38 Service Quality 39 Our People, Culture and Diversity 42 03| Sustainability and 06| Shareholder Risk Management Information Sustainability 50 Risk Management 54 Shareholder Engagement 142 Notice of Annual General Meeting 143 Proxy Form 145 04| Governance 07| Corporate Information The Board 60 Directors, Officers and Professional Advisors 64 Management Team 65 Branch Network 150 Directors’ Report 66 ATM Network 152 Independent Auditor’s Report 68 International Network 153 Directors’ Responsibilities 72 Authority of the Board 72 Board Effectiveness Review 73 Committees of the Board 74 05| Financials Statement of Comprehensive Income 78 Statement of Financial Position 79 Statements of Changes in Equity 80 Statement of Cash Flows 82 Notes 83 Top 20 Shareholders 133 Other Financial Information 134 Value Added Statement 138 Access Bank (Ghana) Plc 2017 Annual Report 5 01 Overview In this section, is an introduction to the report covering who we are, highlights of the financial results, the Chairman and MD’s reflections on the year and a snapshot of where and how we do business. Welcome 8 Business and Financial -

A Company Stronger Than Ever

MARCH - APRIL 2018 ISSUE 85 www.hope-mag.com TELLING RWANDA’S STORY MAGAZINE First BK Group Financial Report shows a company stronger than ever In this Issue CONTRIBUTORS March-April 2018 Issue 85 HOPE TEAM Iradukunda Anime Rumanzi Abraham PUBLISHED BY HOPE HOLDINGS LTD COPYRIGHT 2013 Allan Migadde Keith Ntagozera Saul Butera ADVERTISING & GENERAL INQUIRIES Reserved by Hope Magazine, a monthly Shema Ignace Magazine published by HOPE HOLDINGS Bob Thuku Kobusingye Bonitah P.O. Box 6176 Kigali-Rwanda Sindayirwanya Isabelle LIMITED. All rights reserved. Erwin Winkler Manzi Joseph +250 788 524189 / 788 404138 Rebero Daniel The opinions expressed in the magazine Himbana Alexandre Mbanda Claude DESIGN & LAYOUT [email protected] are not necessarily those of the editors Ishimwe Yvonne Mucyo Rodrigue Dani K. www.hope-mag.com and publishers of Hope Magazine. ADVERTISERS CONTENTS MTN Rwanda 1 BPR ATlas Mara Group 2 Airtel Tigo Rwanda 3 Bourbon Coffee 4 Mobisol Limited 5 Davis and Shirtliff 8 14 BRALIRWA Limited 9 SERENA HOTEL Serena Hotels & Resorts 15 Airtel Rwanda 16-17 7 BANK OF KIGALI At 50 years young, BK is just entering its golden age UAP Group Rwanda 19 10 BK GROUP Financial Report shows Cogebanque Rwanda 22 21 a company stronger than ever Safintra Limited 23 MTN RWANDA 12 COGEBANQUE and cycling, Akagera Business Group 24-25 a partnership made in heaven Galaxy Hotel 26 14 KIGALI SERENA HOTEL staffs Pay tribute to Genocide victims Vision Fund Rwanda 27 18 UAP RWANDA holds commemoration KCB Bank Rwanda 29 discussions for 24th Kwibuka Engen Rwanda Limited 33 20 MTN RWANDA partners with The Court Boutique Hotel 35 12 32 RwandaOnline to promote Irembo COGEBANQUE ACCESS BANK self-service Sinotruk Rwanda Limited 39 21 MTN RWANDA launches MoMo Pay Herocean Enterprise Ltd. -

FIT for FINANCE – YOUTH TRAINING in RWANDA Module 2 Getting Familiar with the Existing Finance Options

FIT FOR FINANCE – YOUTH TRAINING IN RWANDA Module 2 Getting familiar with the existing finance options Online training - Thursday 20th May with the financial support of Welcome to Training - II Your trainers today: Ross T. Nathan (+250 788381600) [email protected] [email protected] Olawale, Rotimi Opeyemi [email protected] Please contact Rotimi for any technical problems you may encounter during the webinar either in the chat or write into our WhatsApp group. RN House rules Support ! Mute Audio Support: Keep your mobile in silence mode Raise your hand, if you want to speak Seek help if you have issues connecting Use zoom chat to communicate privately Message if you have a question to ask. Message if you need to leave for short break RN Overview of the Learning Webinar Series • Guiding youth to assess and improve on their own financial th Module 1 status. – 13 May’2021 • Getting familiar with the variety of products and services that Module 2 financial institutions offer in Rwanda • Receiving guidance to aid your decision-making abilities when Module 3 choosing the adequate finance solution for themselves. • Business formalization Module 4 RN Module 2: Getting familiar with the existing finance options Go to menti.com or join via the link in the chat to share your views. What is one thing you learned in the previous session? https://www.menti.com/bz7jnvweji RN Module 2: Getting familiar with the existing finance options Recap: 1st session you learnt the following topics Basics of financial Assessing your Financial goals knowledge financial status quo Money management What is needed to & qualify for funding Savings Module 2: Getting familiar with the existing finance options Agri-business contribution to Rwanda GDP Agriculture contributes about 30% of Gross Domestic Product Providing livelihoods for over 70% of the population But the agriculture sector receives only 6% of loan products and services, according to central bank data. -

2020 Organogram

ACCESS BANK PLC (INDICATIVE ORGANISATIONAL STRUCTURE SHOWING ALL DIRECT REPORTS OF EDs, GROUPS, AGMs and ABOVE) BOARD OF DIRECTORS BOARD AUDIT COMMITTEE BOARD RISK MANAGEMENT COMMITTEE GROUP MANAGING DIRECTOR GROUP DEPUTY MANAGING DIRECTOR NON AFRICAN SUBSIDIARIES HEAD, AFRICAN SUBSIDIARIES ED, COMMERCIAL BANKING CORPORATE & INVESTMENT BANKING ED, BUSINESS BANKING ED, RETAIL BANKING ED, IT & OPERATIONS ENTERPRISE RESOURCE GROUPS CRO/ECO ZAMBIA CMD, ACCESS BANK GHANA GH, CBG LAGOS 1 COMPANY SECRETARY CMD ACCESS BANK UK GH, CORPORATE BANKING GH, CORPORATE CHIEF AUDIT EXECUTIVE GH, LAGOS ISLAND GH, EVC CHIEF RISK OFFICER NIGERIA - OPERATIONS COO CHIEF FINANCIAL OFFICER GH, CBG LAGOS 2 SH, OIL & GAS GH, Private Banking GH, RETAIL OPERATIONS GH, LAGOS MAINLAND 1 UH,ANTI FRAUD SOUTH & SUBSIDIARIES EXECUTIVE OFFICER/HEAD DUBAI BRANCH HEAD, FINCON NIGERIA UH, CRM CBD CMD, ACCESS BANK RWANDA SH, EXPLORATION & GH, CBG SOUTH PRODUCING COMPANIES GH, LAGOS MAINLAND 2 BRANCH BANKING HEAD, OPS AFRICA HEAD, ENTERPRISE CRO,CHINA REP OFFICE SH, PUBLIC SECTOR OIL & BUSINESS RESOURCE GAS UH,LARGE EXPOSURES & GH, ABUJA RSD, GH, ABUJA & NORTH CENTRAL GH,RETAIL OPERATIONS PROJECT MONITORING SSZONE HEAD,STRATEGY CMD, ACCESS BANK ZAMBIA NORTH SH, TRANSPORT & LOGISTICS HEAD, GROUP HUMAN CRO,MUMBAI REP OFFICE GH, SOUTH GH, NORTH 1 RSD, GH,CHANNELS & DIGITAL RESOURCES SE ZONE SUPPORT UH,REMEDIAL ASSETS CMD, ACCESS BANK CONGO SH, FOOD & BEVERAGES GH, WEST HEAD, EXECUTIVE OFFICE GH, NORTH 2 RSD, GH,DIGITAL & CENTRALIZED SW ZONE OPERATIONS CRO,LEBANON REP OFFICE HEAD,