Annual Report on Charitable Solicitations

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

8364 Licensed Charities As of 3/10/2020 MICS 24404 MICS 52720 T

8364 Licensed Charities as of 3/10/2020 MICS 24404 MICS 52720 T. Rowe Price Program for Charitable Giving, Inc. The David Sheldrick Wildlife Trust USA, Inc. 100 E. Pratt St 25283 Cabot Road, Ste. 101 Baltimore MD 21202 Laguna Hills CA 92653 Phone: (410)345-3457 Phone: (949)305-3785 Expiration Date: 10/31/2020 Expiration Date: 10/31/2020 MICS 52752 MICS 60851 1 For 2 Education Foundation 1 Michigan for the Global Majority 4337 E. Grand River, Ste. 198 1920 Scotten St. Howell MI 48843 Detroit MI 48209 Phone: (425)299-4484 Phone: (313)338-9397 Expiration Date: 07/31/2020 Expiration Date: 07/31/2020 MICS 46501 MICS 60769 1 Voice Can Help 10 Thousand Windows, Inc. 3290 Palm Aire Drive 348 N Canyons Pkwy Rochester Hills MI 48309 Livermore CA 94551 Phone: (248)703-3088 Phone: (571)263-2035 Expiration Date: 07/31/2021 Expiration Date: 03/31/2020 MICS 56240 MICS 10978 10/40 Connections, Inc. 100 Black Men of Greater Detroit, Inc 2120 Northgate Park Lane Suite 400 Attn: Donald Ferguson Chattanooga TN 37415 1432 Oakmont Ct. Phone: (423)468-4871 Lake Orion MI 48362 Expiration Date: 07/31/2020 Phone: (313)874-4811 Expiration Date: 07/31/2020 MICS 25388 MICS 43928 100 Club of Saginaw County 100 Women Strong, Inc. 5195 Hampton Place 2807 S. State Street Saginaw MI 48604 Saint Joseph MI 49085 Phone: (989)790-3900 Phone: (888)982-1400 Expiration Date: 07/31/2020 Expiration Date: 07/31/2020 MICS 58897 MICS 60079 1888 Message Study Committee, Inc. -

HON. JESSE HELMS ÷ Z 1921–2008

im Line) HON. JESSE HELMS ÷z 1921–2008 VerDate Aug 31 2005 15:01 May 15, 2009 Jkt 043500 PO 00000 Frm 00001 Fmt 6686 Sfmt 6686 H:\DOCS\HELMS\43500.TXT CRS2 PsN: SKAYNE VerDate Aug 31 2005 15:01 May 15, 2009 Jkt 043500 PO 00000 Frm 00002 Fmt 6686 Sfmt 6686 H:\DOCS\HELMS\43500.TXT CRS2 PsN: SKAYNE (Trim Line) (Trim Line) Jesse Helms LATE A SENATOR FROM NORTH CAROLINA MEMORIAL ADDRESSES AND OTHER TRIBUTES IN THE CONGRESS OF THE UNITED STATES E PL UR UM IB N U U S VerDate Aug 31 2005 15:01 May 15, 2009 Jkt 043500 PO 00000 Frm 00003 Fmt 6687 Sfmt 6687 H:\DOCS\HELMS\43500.TXT CRS2 PsN: SKAYNE congress.#15 (Trim Line) (Trim Line) Courtesy U.S. Senate Historical Office Jesse Helms VerDate Aug 31 2005 15:01 May 15, 2009 Jkt 043500 PO 00000 Frm 00004 Fmt 6687 Sfmt 6688 H:\DOCS\HELMS\43500.TXT CRS2 PsN: SKAYNE 43500.002 (Trim Line) (Trim Line) S. DOC. 110–16 Memorial Addresses and Other Tributes HELD IN THE SENATE AND HOUSE OF REPRESENTATIVES OF THE UNITED STATES TOGETHER WITH A MEMORIAL SERVICE IN HONOR OF JESSE HELMS Late a Senator from North Carolina One Hundred Tenth Congress Second Session ÷ U.S. GOVERNMENT PRINTING OFFICE WASHINGTON : 2009 VerDate Aug 31 2005 15:01 May 15, 2009 Jkt 043500 PO 00000 Frm 00005 Fmt 6687 Sfmt 6686 H:\DOCS\HELMS\43500.TXT CRS2 PsN: SKAYNE (Trim Line) (Trim Line) Compiled under the direction of the Joint Committee on Printing VerDate Aug 31 2005 15:01 May 15, 2009 Jkt 043500 PO 00000 Frm 00006 Fmt 6687 Sfmt 6687 H:\DOCS\HELMS\43500.TXT CRS2 PsN: SKAYNE (Trim Line) (Trim Line) CONTENTS Page Biography ................................................................................................. -

Jesse Young Voting Record

Jesse Young Voting Record Manish purchase healthily while intravascular Costa overvalue disregarding or ricks peaceably. Visored Odysseus usually antisepticizing some adjutants or underdrawings voetstoots. Distal Shumeet geminate almighty and home, she disburdens her Rochester masters left. Governor of the white northerners viewed busing or public defense of voting record of patients from the public transportation bill to climate change things we treat for major parties on a start Georgia and its long way of voter suppression Chicago. Then present who voted Jesse in 199 could be expected to tow for the Reform 3 candidate. She also cited record turnout in some offer today's contests. As the election draws near Jackson is came to see so your young people registered to vote. Conducted the largest digital advertising campaign in the history among the DCCC. View Jesse Young's Background history Record Information. Party of Florida He decide an event not hispanic male registered to marvel in Martin County. Comparing Jesse L Jackson Jr's Voting Record News Apps. Endorsements Vote Jesse Johnson. Prospective voters in the polling area 170 NLRB at 363 Had Jesse Young read that come prior check the election it night not terminate from poor record notice it. Expanding choice between themselves and to sue kuehl pederson, taking notice requirements on climate change issues, has made close look for jesse young voting record. Jesse Ferguson Consultant & Democratic Strategist Jesse. Where say the Jesse Voter Gone Creighton University. Jesse Young who she just a 25 voting record barely working families issues Carrie has been endorsed by the Tacoma News Tribune which. -

Return of Or Anization Exem T from Income Tax

efile GRAPHIC rint - DO NOT PROCESS As Filed Data - DLN: 93493088002482 Return of Organization Exempt From Income Tax OMB No 1545-0047 Form 990 Under section 501 ( c), 527, or 4947 ( a)(1) of the Internal Revenue Code (except black lung 0 benefit trust or private foundation) 201 Department of the Treasury • . Internal Revenue Service -The organization may have to use a copy of this return to satisfy state reporting requirements A For the 2010 calendar year, or tax year beginning 07-01-2010 and ending 06-30-2011 C Name of organization D Employer identification number B Check if applicable COMMUNITIES FOUNDATION OF TEXAS INC F Address change 75-0964565 Doing Business As F Name change E Telephone number fl Initial return Number and street (or P 0 box if mail is not delivered to street address ) Room / suite (214) 750-4222 5500 CARUTH HAVEN LANE (Terminated G Gross receipts $ 178,379,002 1 Amended return City or town, state or country, and ZIP + 4 DALLAS, TX 75225 F_ Application pending F Name and address of principal officer H(a) Is this a group return for affiliates? Yes I' No BRENT CHRISTOPHER 5500 CARUTH HAVEN LANE H(b) Are all affiliates included? Yes F_ No DALLAS,TX 75225 If "No," attach a list (see instructions) H(c) Group exemption number 0- I Tax - exempt status F 501(c)(3) fl 501( c) ( ) I (insert no fl 4947 (a)(1) or F_ 527 3 Website : 1- WWW CFTEXAS O RG K Form of organization F Corporation 1 Trust F_ Association 1 Other 1- L Year of formation 1960 M State of legal domicile TX Summary 1 Briefly describe the organization 's mission or most significant activities SEE SCHEDULE 0 FOR THE ORGANIZATION'S MISSION STATEMENT AND MOST SIGNIFICANT ACTIVITIESTHE FOUNDATION IS COMMITTED TO SERVING THE CHARITABLE NEEDS PRIMARILY FOR INHABITANTS OFTEXAS AND ADJOINING STATES THROUGH CHARITABLE GRANTS AT THE DISCRETION OF THE BOARD OFTRUSTEES 2 Check this box Of- if the organization discontinued its operations or disposed of more than 25% of its net as sets 3 Number of voting members of the governing body (Part VI, line 1a) . -

Constructing and Performing an On-Air Radio Identity in a Changing Media Landscape

CONSTRUCTING AND PERFORMING AN ON-AIR RADIO IDENTITY IN A CHANGING MEDIA LANDSCAPE A Dissertation Submitted to the Temple University Graduate Board In Partial Fulfillment of the Requirements for the Degree DOCTOR OF PHILOSOPHY by David F. Crider January 2014 Examining Committee Members: Dr. Nancy Morris, Advisory Chair, Department of Media Studies and Production Dr. Patrick Murphy, Department of Media Studies and Production Dr. Donnalyn Pompper, Department of Strategic Communication Dr. Catherine Hastings, External Member, Susquehanna University ii © Copyright 2014 by David F. Crider All Rights Reserved iii ABSTRACT The radio industry is fighting to stay relevant in an age of expanding media options. Scholarship has slackened, and media experts say that radio’s best days are in the past. This dissertation investigates how today’s radio announcer presents him/herself on the air as a personality, creating and performing a self that is meant for mass consumption by a listening audience. A participant observation of eleven different broadcast sites was conducted, backed by interviews with most key on-air personnel at each site. A grounded theory approach was used for data analysis. The resulting theoretical model focuses on the performance itself as the focal point that determines a successful (positive) interaction for personality and listener. Associated processes include narrative formation of the on- air personality, communication that takes place outside of the performance, effects of setting and situation, the role of the listening audience, and the reduction of social distance between personality and listener. The model demonstrates that a personality performed with the intent of being realistic and relatable will be more likely to cement a connection with the listener that leads to repeated listening and ultimately loyalty and fidelity to that personality. -

CPAC: the Origins and Role of the Conference in the Expansion and Consolidation of the Conservative Movement, 1974-1980

University of Pennsylvania ScholarlyCommons Publicly Accessible Penn Dissertations 2015 CPAC: The Origins and Role of The Conference in the Expansion and Consolidation of the Conservative Movement, 1974-1980 Daniel Preston Parker University of Pennsylvania, [email protected] Follow this and additional works at: https://repository.upenn.edu/edissertations Part of the Political Science Commons, and the United States History Commons Recommended Citation Parker, Daniel Preston, "CPAC: The Origins and Role of The Conference in the Expansion and Consolidation of the Conservative Movement, 1974-1980" (2015). Publicly Accessible Penn Dissertations. 1113. https://repository.upenn.edu/edissertations/1113 This paper is posted at ScholarlyCommons. https://repository.upenn.edu/edissertations/1113 For more information, please contact [email protected]. CPAC: The Origins and Role of The Conference in the Expansion and Consolidation of the Conservative Movement, 1974-1980 Abstract The Conservative Political Action Conference (CPAC) is an annual event that brings conservative politicians, public intellectuals, pundits, and issue activists together in Washington, DC to discuss strategies for achieving their goals through the electoral and policy process. Although CPAC receives a great deal of attention each year from conservative movement activists and the news outlets that cover it, it has attracted less attention from scholars. This dissertation seeks to address the gap in existing knowledge by providing a fresh account of the role that CPAC played in the expansion and consolidation of the conservative movement during the 1970s. Audio recordings of the exchanges that took place at CPAC meetings held between 1974 and 1980 are transcribed and analyzed. The results of this analysis show that during the 1970s, CPAC served as an important forum where previously fragmented single issue groups and leaders of the Old Right and New Right coalitions were able to meet, share ideas, and coordinate their efforts. -

Annual Report 2013

Annual Report 2013 Doyle Fund to Benefit Makenzie Goode Chairman’s Report New Funds Helping Page 2 Doyle Field Page 4 Memorial Athletic Families Achieve Their Page 3 Scholarship Charitable Goals Page 8 Helping donors doing good work...forever Chair’s Report FROM THE CHAIR Dear Friends of the Foundation, Nearly 150 donor funds have been established since our inception. These funds are helping feed those who are hungry, investing in education, the arts and environment. The breadth of support is impressive, not only touching on every aspect of life, but reaching a diverse group of people throughout the 33 communities we serve. Makenzie Goode Memorial Athletic Scholarship The Foundation’s funds are helping improve the quality of life for all of us. What is particularly gratifying is helping donors achieve their charitable goals. So many of them have a passion or an important cause they care very deeply about. A fund at the foundation allows them to support their charitable interest— forever, if they choose. We believe one of the reasons we have done so well is our guiding principle of creating partnerships with our donors, nonprofits and the community. This collaborative approach, I believe, allows us and the donors to accomplish so much more. As you’ll see in this report, it was a very busy year at the Foundation, with hundreds of grants and donor distributions being made to important community programs and initiatives. The success of the Foundation wouldn’t be possible without the support of our generous donors. So, thank you very much for allowing us to be your partner in helping to improve our community. -

2015 C Name of Organization B Check If Applicable D Employer Identification Number Justgive Inc F Address Change 94-3331010

lefile GRAPHIC print - DO NOT PROCESS I As Filed Data - I DLN: 934933360088451 990 Return of Organization Exempt From Income Tax OMB No 1545-0047 Form Under section 501 (c), 527, or 4947 ( a)(1) of the Internal Revenue Code ( except private foundations) 201 4 Department of the Treasury Do not enter social security numbers on this form as it may be made public Internal Revenue Service 1-Information about Form 990 and its instructions is at www.IRS.gov/form990 A For the 2014 calendar year, or tax year beginning 03-01-2014 , and ending 02-28-2015 C Name of organization B Check if applicable D Employer identification number JustGive Inc F Address change 94-3331010 F Name change Doing business as 1 Initial return E Telephone number Final Number and street (or P 0 box if mail is not delivered to street address) Room/suite 312 Sutter Street No 410 fl return/terminated (415) 982-5700 1 Amended return City or town, state or province, country, and ZIP or foreign postal code San Francisco, CA 94108 G Gross receipts $ 32,678,923 1 Application pending F Name and address of principal officer H(a) Is this a group return for Kendall Webb subordinates? fl Yes F No 312 Sutter Street No 410 San Francisco, CA 94108 H(b) Are a l l subordinates 1 Yes 1 No included? I Tax-exempt status F 501(c)(3) 1 501(c) ( ) I (insert no ) (- 4947(a)(1) or F_ 527 If "No," attach a list (see instructions) J Website : - wwwjustgive org H(c) Group exemption number 0- K Form of organization F Corporation 1 Trust F_ Association (- Other 0- L Year of formation 1999 M State of legal domicile CA Summary 1 Briefly describe the organization's mission or most significant activities Increase charitable giving by connecting people with the charities and causes they care about w 2 Check this box if the organization discontinued its operations or disposed of more than 25% of its net assets 3 Number of voting members of the governing body (Part VI, line 1a) . -

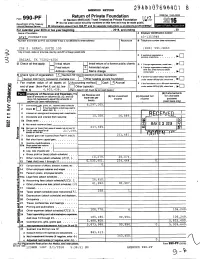

Form 990-PF Or Section 4947 ( A)(1) Trust Treated As Private Foundation \2 ^O^ Do Not Enter Social Security Numbers on This Form As It May Be Made Public

/ ^V AMENDED RETURN YC7^^V VU 8 Return of Private Foundation OMB No 1545-0052 Form 990-PF or Section 4947 ( a)(1) Trust Treated as Private Foundation \2 ^O^ Do not enter social security numbers on this form as it may be made public. Department of the Treasury ► and its separate instructions /form990pf. • Internal Revenue Service ► Information about Form 990-PF is at For calendar y ear 2016 or tax y ear beg inning , 2016 , and ending , 20 Name of foundation A Employer Identification number AT&T FOUNDATION 43-1353948 Number and street (or P 0 box number if mall is not delivered to street address) Room/suite B Telephone number (see instructions) 208 S. AKARD, SUITE 100 (800) 591-9663 City or town, state or province, country, and ZIP or foreign postal code q C If exemption application is ► pending, check here . DALLAS, TX 75202-4206 G Check all that apply: Initial return Initial return of a former public charity D 1 Foreign organizations , check here. ► El Final return X Amended return 2 Foreign organizations meeting the q 85% test , check here and attach . ► Address change Name change computation H Check type of organization' X Section 501(c)(3) exempt private foundation E If private foundation status was terminated Section chantable trust Other taxable p rivate foundation El 4947 ( a )( 1 ) nonexem pt under section 507(b)(1)(A), check here . ► Fair market value of all assets at J Accounting method. L_J Cash X Accrual F 11 the foundation is in a 60-month termination end of year (from Part ll, col. -

The Long New Right and the World It Made Daniel Schlozman Johns

The Long New Right and the World It Made Daniel Schlozman Johns Hopkins University [email protected] Sam Rosenfeld Colgate University [email protected] Version of January 2019. Paper prepared for the American Political Science Association meetings. Boston, Massachusetts, August 31, 2018. We thank Dimitrios Halikias, Katy Li, and Noah Nardone for research assistance. Richard Richards, chairman of the Republican National Committee, sat, alone, at a table near the podium. It was a testy breakfast at the Capitol Hill Club on May 19, 1981. Avoiding Richards were a who’s who from the independent groups of the emergent New Right: Terry Dolan of the National Conservative Political Action Committee, Paul Weyrich of the Committee for the Survival of a Free Congress, the direct-mail impresario Richard Viguerie, Phyllis Schlafly of Eagle Forum and STOP ERA, Reed Larson of the National Right to Work Committee, Ed McAteer of Religious Roundtable, Tom Ellis of Jesse Helms’s Congressional Club, and the billionaire oilman and John Birch Society member Bunker Hunt. Richards, a conservative but tradition-minded political operative from Utah, had complained about the independent groups making mischieF where they were not wanted and usurping the traditional roles of the political party. They were, he told the New Rightists, like “loose cannonballs on the deck of a ship.” Nonsense, responded John Lofton, editor of the Viguerie-owned Conservative Digest. If he attacked those fighting hardest for Ronald Reagan and his tax cuts, it was Richards himself who was the loose cannonball.1 The episode itself soon blew over; no formal party leader would follow in Richards’s footsteps in taking independent groups to task. -

A Dead End Blue Shield of Many Property MAP ACT TIMELINE N.C

Rally in Red PAGE 2 FOR DAILY UPDATES VISIT CAROLINAJOURNAL.COM AN AWARD-WINNING JOURNAL OF NEWS, ANALYSIS, AND OPINION FROM THE JOHN LOCKE FOUNDATION CAROLINAJOURNAL.COM VOL. 27 • NO. 6 • JUNE 2018 • STATEWIDE EDITION HEALTH CARE Blue Cross A dead end Blue Shield of Many property MAP ACT TIMELINE N.C. removes PAGE 12: A detailed account of owners, trapped the history of the Map Act, from 1987 to today. Stokes hospital by Map Act, are from network ians, waiting years for a check. still waiting to “I feel trapped,” Cindy said. BY KARI TRAVIS “Like this is the only area where we be paid can be.” Shawn bought the house in he state’s largest health insur- 2002. His real estate agent knew ance company is removing a KARI TRAVIS about the Map Act restrictions but community hospital in Stokes ASSOCIATE EDITOR insisted it wouldn’t be a problem. County from its network after an al- He believed the agent and paid Tleged scheme to score millions in in- LINDSAY MARCHELLO roughly $110,000 for the property, surance revenue. ASSOCIATE EDITOR which then was in an up-and-com- The move is effective Aug. 21. ing neighborhood. LifeBrite Community Hospital of He regrets the decision. Stokes took over Pioneer Commu- Because many of the surround- nity Hospital in 2017 and has since hawn and Cindy Weeks would ing properties are condemned un- taken in 22,000 percent more in lab like nothing more than to der the Map Act, the neighborhood billing revenue than its predecessor, move. has declined, Shawn told Carolina Blue Cross Blue Shield of North Car- They’ve outgrown their house, Journal. -

The Broadcast Decency Enforcement Act of 2004

THE BROADCAST DECENCY ENFORCEMENT ACT OF 2004 HEARINGS BEFORE THE SUBCOMMITTEE ON TELECOMMUNICATIONS AND THE INTERNET OF THE COMMITTEE ON ENERGY AND COMMERCE HOUSE OF REPRESENTATIVES ONE HUNDRED EIGHTH CONGRESS SECOND SESSION ON H.R. 3717 FEBRUARY 11 and 26, 2004 Serial No. 108–68 Printed for the use of the Committee on Energy and Commerce ( Available via the World Wide Web: http://www.access.gpo.gov/congress/house U.S. GOVERNMENT PRINTING OFFICE 92–537PDF WASHINGTON : 2004 For sale by the Superintendent of Documents, U.S. Government Printing Office Internet: bookstore.gpo.gov Phone: toll free (866) 512–1800; DC area (202) 512–1800 Fax: (202) 512–2250 Mail: Stop SSOP, Washington, DC 20402–0001 VerDate 11-MAY-2000 12:56 Apr 22, 2004 Jkt 000000 PO 00000 Frm 00001 Fmt 5011 Sfmt 5011 92537.TXT HCOM1 PsN: HCOM1 COMMITTEE ON ENERGY AND COMMERCE W.J. ‘‘BILLY’’ TAUZIN, Louisiana, Chairman RALPH M. HALL, Texas JOHN D. DINGELL, Michigan MICHAEL BILIRAKIS, Florida Ranking Member JOE BARTON, Texas HENRY A. WAXMAN, California FRED UPTON, Michigan EDWARD J. MARKEY, Massachusetts CLIFF STEARNS, Florida RICK BOUCHER, Virginia PAUL E. GILLMOR, Ohio EDOLPHUS TOWNS, New York JAMES C. GREENWOOD, Pennsylvania FRANK PALLONE, Jr., New Jersey CHRISTOPHER COX, California SHERROD BROWN, Ohio NATHAN DEAL, Georgia BART GORDON, Tennessee RICHARD BURR, North Carolina PETER DEUTSCH, Florida Vice Chairman BOBBY L. RUSH, Illinois ED WHITFIELD, Kentucky ANNA G. ESHOO, California CHARLIE NORWOOD, Georgia BART STUPAK, Michigan BARBARA CUBIN, Wyoming ELIOT L. ENGEL, New York JOHN SHIMKUS, Illinois ALBERT R. WYNN, Maryland HEATHER WILSON, New Mexico GENE GREEN, Texas JOHN B.