Property-Market-Update-Q1-2020.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Retail Opportunities

RETAIL OPPORTUNITIES DEANSGATE SQUARE 1 AN ICONIC DESTINATION The site is located southwest of the City in Castlefield, an established residential area with a range of converted warehouses, bars, restaurants and leisure offerings. Deansgate Square takes city centre living to a superior level. A ground-breaking development bringing new heights of style, luxury and sophistication to the heart of Manchester. Covering over 2.3 million sq ft, the Deansgate Square development comprises everything you could wish from contemporary city centre living. Boasting a pool, cinema, gym, spa, roof terrace garden and much, much more. 2 3 LOCAL AREA MANCHESTER d oa VICTORIA R am dh GUIDE Ol B la c k fr t ia tree rs Ring Road el S R ap o Ch a d EXCHANGE SQUARE SALFORD CENTRAL NEW A MANCHESTER t 3 ee 4 tr ARNDALE S BAILEY l il NORTHERN QUARTER M New Quay Street ld O These units are perfectly suited for a mixture of uses that Bri dge would cater not only for the residents of West Tower, St ree t 2 but also the densely populated surrounding areas. In 6 6 Home to some 350,000 employers, including 80 FTSE 100 A SPINNINGFIELDS addition to the scheme itself, over 2,750 high quality new L companies, Manchester is the fastest-growing property L t E e e P r t homes are being or have recently been built around this W i S c e R c r market in the UK and is experiencing a new era of capital I o a t d S R CHINA t i e l site making this area a great opportunity for potential E e l t V re Qu y investment due to increasing demand for residential, office I t ay a TOWN S tre g R S et s r e n occupiers. -

Tall Buildings in 2020: COVID-19 Contributes to Dip in Year-On-Year Completions

CTBUH Year in Review: Tall Trends of 2020 Tall Buildings in 2020: COVID-19 Contributes To Dip in Year-On-Year Completions Abstract In 2020, the tall building industry constructed 106 buildings of 200 meters’ height or greater, a 20 percent decline from 2019, when 133 such buildings were completed.* The decline can be partly attributed to work stoppages and other impacts of the COVID-19 pandemic. This report provides analysis and commentary on global and regional trends underway during an eventful year. Research Project Kindly Sponsored by: Note: Please refer to Tall Buildings in Numbers—The Global Tall Building Picture: Impact of 2020 in conjunction with this Schindler paper, pages 48–49. *The study sets a minimum threshold of 200 meters’ height because of the completeness of data available on buildings of that height. Keywords: Construction, COVID-19, Development, Height, Hotel, Megatall, Mixed-Use, Office, Residential, Supertall Introduction This is the second year in a row in which Center (New York City) completed, that the the completion figure declined. In 2019, tallest building of the year was in the For many people, 2020 will be remembered the reasons for this were varied, though United States. as the year that nothing went to plan. The the change in the tall building climate in same can be said for the tall building China, with public policy statements This is also the first year since 2014 in which industry. As a global pandemic took hold in against needless production of there has not been at least one building the first quarter, numerous projects around exceedingly tall buildings, constituted a taller than 500 meters completed. -

(Public Pack)Agenda Document for Planning and Highways Committee, 30/07/2020 14:00

Public Document Pack Planning and Highways Committee Date: Thursday, 30 July 2020 Time: 2.00 pm Venue: Virtual meeting - https://manchester.public- i.tv/core/portal/webcast_interactive/485369 Everyone is welcome to attend this committee meeting. The Local Authorities and Police and Crime Panels (Coronavirus) (Flexibility of Local Authority and Police and Crime Panel Meetings) (England and Wales) Regulations 2020. Under the provisions of these regulations the location where a meeting is held can include reference to more than one place including electronic, digital or virtual locations such as Internet locations, web addresses or conference call telephone numbers. To attend this meeting it can be watched live as a webcast. The recording of the webcast will also be available for viewing after the meeting has ended. Membership of the Planning and Highways Committee Councillors Curley (Chair), Nasrin Ali (Deputy Chair), Shaukat Ali, Andrews, Y Dar, Davies, Flanagan, Hitchen, Kamal, J Lovecy, Lyons, Madeleine Monaghan, Riasat, Watson and White Planning and Highways Committee Agenda 1. Urgent Business To consider any items which the Chair has agreed to have submitted as urgent. 1a. Supplementary Information on Applications Being Considered The report of the Director of Planning, Building Control and Licencing will follow. 2. Appeals To consider any appeals from the public against refusal to allow inspection of background documents and/or the inclusion of items in the confidential part of the agenda. 3. Interests To allow Members an opportunity to [a] declare any personal, prejudicial or disclosable pecuniary interests they might have in any items which appear on this agenda; and [b] record any items from which they are precluded from voting as a result of Council Tax/Council rent arrears; [c] the existence and nature of party whipping arrangements in respect of any item to be considered at this meeting. -

Press Release (PDF 149KB)

PRESS RELEASE LGIM Real Assets Press Release 20th August 2018 LGIM Real Assets One Coleman Street London EC2R 5AA Tel: +44 (0)20 3124 2700 LEGAL & GENERAL REDESIGNS AND ACQUIRES NEW MANCHESTER TOWER FOR GROWING BUILD TO RENT PORTFOLIO Legal & General today announces that it has exchanged contracts on the West Tower in Manchester’s premier development, Deansgate Square, as it continues to scale up its Build To Rent (BTR) portfolio. Working closely with renowned architect SimpsonHaugh, designer of some of Manchester’s major landmarks such as Beetham Tower and Two St Peter’s Square, Legal & General has made a range of significant BTR design improvements to the tower, in order to meet the specific requirements of today’s elective renters. The West Tower will be the tallest BTR scheme in the UK. This latest acquisition brings Legal & General’s development pipeline in Manchester to over 750 units, increasing its exposure to a target city with strong momentum, underpinned by a significant demand for rental accommodation. Whilst Manchester has seen increased investment over recent years, the city’s housing needs remain under-served. According to Experian, the population of Greater Manchester is expected to grow by 14% over the next 20 years with 3,465 rental households forming every year. Despite an estimated 12,000 new homes required each year to meet demand, annual delivery since 2010 has averaged just 650 homes. Deansgate’s West Tower is located in Manchester’s prime residential area of Castlefield, comprising 44 storeys overlooking the River Medlock. It consists of 350 units, 147 car parking spaces and ancillary commercial space. -

Deansgate SQUARE

Deansgate SQUARE A NEW LEVEL A NEW LEVEL A New Level WWW.DEANSGATESQUARE.COM SOUTH TOWER 496 apartments WEST TOWER EAST TOWER 350 apartments 386 apartments NORTH TOWER 276 apartments A NEW LEVEL Contents HEALTH & WELLNESS 05 - 13 LIFESTYLE & SERVICES 04 | 05 14 - 21 APARTMENTS 22 - 27 VIEWS 28 - 31 LOCATION 32 - 37 THE DEVELOPER 39 - 41 WWW.DEANSGATESQUARE.COM A NEW LEVEL Health & Wellness DEANSGATE SQUARE PROVIDES RESIDENTS WITH AN IDYLLIC SPACE TO KEEP ACTIVE AND TO UNWIND. TAKING PRIVATE RESIDENTIAL HEALTH AND WELLNESS FACILITIES TO A NEW LEVEL. WWW.DEANSGATESQUARE.COM 06 | 07 THE CLUB An inspiring space cultivated using the most contemporary materials and equipment. The Club features every aspect of a state-of-the-start leisure facility and more. Boasting a pool, gym, spin studio, yoga studio, beauty spa room, sports hall and more. THE POOL Contained within The Club, a magnificent 20m swimming pool provides both a sumptuous sanctuary and a serious facility for dedicated swimmers. A unique contemporary pool design accompanied by a sauna room, a steam room and a vitality pool, creating a relaxing and indulgent space. 08 | 09 THE GYM The state-of-the-art gym has been perfectly designed to optimise the layout of the two floors and to create workout zones and various programmes. In addition to personal training sessions, residents can join classes, such as hiit, yoga and pilates. THE GYM Technology throughout will enable residents to experience a connected wellness experience that helps them achieve sporting, fitness and health goals in a fast, easy and fun way. The Gym not only boasts outstanding health facilities, but will become a popular, sociable place to unwind. -

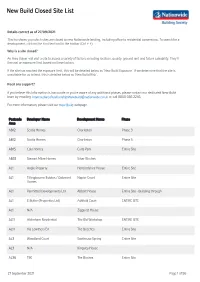

New Build Closed Site List

New Build Closed Site List Details correct as of 27/09/2021 This list shows you which sites are closed to new Nationwide lending, including office to residential conversions. To search for a development, click on the Find text tool in the toolbar (Ctrl + F). Why is a site closed? An Area Valuer will visit a site to assess a variety of factors including location, quality, ground rent and future saleability. They’ll then set an exposure limit based on these factors. If the site has reached the exposure limit, this will be detailed below as ‘New Build Exposure’. If we determine that the site is unsuitable for us to lend, this is detailed below as ‘New Build Risk’. Need any support? If you believe this information is inaccurate or you’re aware of any additional phases, please contact our dedicated New Build team by emailing [email protected] or call 0800 085 2245. For more information, please visit our New Build webpage. Postcode Developer Name Development Name Phase Area AB12 Scotia Homes Charleston Phase 3 AB12 Scotia Homes Charleston Phase 5 AB15 Cala Homes Cults Park Entire Site AB33 Stewart Milne Homes Silver Birches AL1 Angle Property Hertfordshire House Entire Site AL1 Tillingbourne Estates / Oakmont Napier Court Entire Site Homes AL1 Permitted Developments Ltd Abbott House Entire Site - Building through AL1 E Butler (Properties Ltd) Ashfield Court ENTIRE SITE AL1 N/A Ziggurat House AL11 Aldenham Residential The Old Workshop ENTIRE SITE AL11 Via Lowthers EA The Beeches Entire Site AL3 Woodland Court -

Deansgate M3 4Jb 274 Deansgate an Ultra-Rare Opportunity To

274 DEANSGATE M3 4JB 274 DEANSGATE AN ULTRA-RARE OPPORTUNITY TO INVEST IN MANCHESTER CITY CENTRE AMAZING AMENITIES OVERVIEW 274 Deansgate is a striking and attractive The ground floor front & part basement currently MANCHESTER five storey building within touching distance hosts a high-end bike retailer with full wrap DESIRABLE DEVELOPMENT LOCATION POTENTIAL of Manchester’s Metropolis of upmarket around window displays capturing maximum LOCATION bars restaurants and entertainment venues. exposure from South-Deansgate’s high footfall. AMENITIES Located between Spinningfields and the new To the side of the property there is a self- St John’s scheme, the property is flanked by contained entrance leading to the office GALLERY two Metrolink stops, giving gracious access accommodation on rear ground floor and to Piccadilly Station, desirable suburbs and 4 upper floors. In addition, there is storage space VIRTUAL TOUR the UK’s 3rd largest airport. at rear basement level. With endless potential for redevelopment The 3rd/4th floors are currently let with the ACCOMMODATION/ the building could be converted to residential remainder of the office space currently vacant. TENANCY SCHEDULE apartments or even Manchester’s next iconic hotel, giving 274 Deansgate an ever BUILDING HIGHLIGHTS COMPARABLE increasing value. TRANSACTIONS • Part income producing with current This 1950’s building was refurbished in the rental income of £226,265pa and an OPPORTUNITY mid 90’s and the 2nd, 3rd and 4th floors have ERV of £427,230pa recently been refurbished with a modern • Extensive fit out on 1st floor ENQUIRIES contemporary character/industrial look to a • Contemporary Exposed Ceiling high specification. The 4th floor also has an • Floor boxes and cable tray data management outdoor/balcony for the alfresco meeting, • New air conditioning system with a backdrop of city views. -

Land Bound by Silvercroft Street, Crown Street, and the Mancunian Way, Manchester, M15 4AX

Application Number Date of Appln Committee Date Ward 126668/FO/2020 3rd Apr 2020 30th Jul 2020 Deansgate Ward Proposal Full planning permission for the erection of two 52-storey residential buildings (Use Class C3) each incorporating a podium accommodating residential amenity facilities and ground floor and first floor commercial units (Use Classes A1, A2, A3, or D1), private and public basement car parking, landscaping and a public park, servicing and access arrangements, highways improvements, and associated works (Phases A, B, and D as defined on Drawing Reference: 10292Z1SHPG000PL00 B5D802 and 10292Z1SHPG000PLB1B5D801). Outline planning permission (with all matters reserved) for an educational facility (Use Class D1) (Phase C as defined on Drawing References: 10292Z1SHPG000PL00B5D802 and 10292Z1SHPG000PLB1B5D801) Location Land Bound By Silvercroft Street, Crown Street, And The Mancunian Way, Manchester, M15 4AX Applicant , Renaker Build Ltd, C/o Agent Agent Mr John Cooper, Deloitte LLP, P O Box 500, 2 Hardman Street, Manchester, M3 3HF Description This 1.1 ha site is in the Great Jackson Street Strategic Regeneration Framework Area (SRF) close to a key entry point into the city centre. It is bounded by the Mancunian Way, Crown Street Phase 1; the former Bridgewater Canal Offices; a surface level car park; and a slip road off the Mancunian Way linking into Melbourne Street and Crown Street. The site is a cleared site, was formerly a car park and includes Crown Street and Silvercroft Street. The Great Jackson Street area includes cleared sites, light industrial uses and temporary car parking, as well as the Gaddum Centre, which is a three storey red brick office building with a pitched tiled roof on Great Jackson Street. -

Annual Report 2018

2018 ANNUAL REPORT PAGE LEFT INTENTIONALLY BLANK 2 Contents Chair’s Introduction 4 Management structure 6 Attendance & training 9 GMPF Local Pension Board 11 Top 20 equity holdings 13 Investment report 14 Voting activity 36 Financial performance report 37 Statement of accounts 42 Actuarial statement 80 Scheme administration 83 Employer contribution rates 87 The LGPS at a glance 107 Policy Statements 109 - Funding Strategy Statement 111 - Governance Policy 128 - Governance Compliance Statement 132 - Core Belief Statement 138 - Investment Strategy Statement 140 - Communications Policy 152 - Pension Administration Strategy 156 Useful contacts 163 3 Chair’s introduction Welcome to the 2017/18 Annual Report of the Greater Internationally, although much of the major political Manchester Pension Fund (GMPF), my first as Chair of upheaval we saw last year has abated, there still remain GMPF following the tragic death of Cllr Kieran Quinn areas of considerable uncertainty that investors and at the end of 2017. In his seven years as Chair of the pension funds should continue to be aware of; most GMPF Management Panel, his stewardship can only be notably the negotiations of Britain’s exit of the European described as visionary. He was a pioneer in using the Union and, further afield, the economic policies of the financial power of pension funds to invest locally for current US administration, particularly in regards to regeneration and social good. His legacy is plain to see, international trade. and it falls to us to continue and improve upon the work A notable addition to this year’s Annual Report is the that he began. -

34 Great Jackson Street, Manchester M15

Application Number Date of Appln Committee Date Ward 129273/FO/2021 9th Mar 2021 29th Jul 2021 Deansgate Ward Proposal Demolition of existing structures and the construction of two residential buildings of 56 storeys (plus basement and roof plant) (use class C3), with ground floor commercial uses (use class E), car parking, cycle provision, landscaping, access and other associated works Location 34 Great Jackson Street, Manchester, M15 4NG Applicant Great Jackson Street Estates, 66 Waterpark Road, Salford, M7 4JL Agent Hodder + Partners, SGI Studios, 1 Kelso Place, Manchester, M15 4LE EXECUTIVE SUMMARY The proposal is for 1037 residential units in two 56 storey towers. There would be public and private amenity space, 236 parking spaces, 1040 internal cycle spaces and 40 visitor cycle spaces. There have been 12 representations, 11 of which object to the proposal. Key Issues Principle of use and contribution to regeneration: The development is in accordance with national and local planning policies and the scheme would provide much needed housing in a highly sustainable location. Viability & Affordable Housing: A commuted sum of £1,037,000 would be secured via a S106 agreement for off-site affordable housing. Height, Scale, Massing and Design: The heights, scale and massing of the buildings would be in keeping with the scale of development in Great Jackson Street. The buildings would make a positive contribution to the street scene on this gateway route. Residential Amenity: The development would have an impact on the amenities of existing residents particularly in terms of loss daylight. However, the impacts are considered to be acceptable in a City Centre context and not so harmful as to warrant refusal of the application. -

Deansgate SQUARE

RETAIL AND LEISURE OPPORTUNITIES Deansgate SQUARE A NEW LEVEL RETAIL OPPORTUNITIES | DEANSGATE SQUARE 02 | 03 WWW.DEANSGATESQUARERETAIL.COM re Lo MANCHESTER VICTORIA C dham Road able St Ol Y re et WA Blackfriars PRINT WORKS t TRINITY ee eet W e tr Str it rov S Road h G y m o s R s o ING RO l T h B Chapel EXCHANGE o LOCATION m et SQUARE as re St AD SALFORD CENTRAL re ill St et Deansgate Square is taking Chu et dh re rc MANCHESTER h et e St R ree re St t city centre living to a new A3 ARNDALE h St r et 4 e g r i t ve S level, comprising over H NORTHERN QUARTER e ll L i M d l 2.3million sq ft of residential O apartments, complimented B ridge St by over 50,000 sq ft of reet PICCADILLY GARDENS ground retail & leisure 2 6 Ne 6 A w space. SPINNINGFIELDS Y ork S tr ee The scheme will not t et WELL OPERA HOUSE et P re re ic St only benefit from 3,500 Y c re Mi adilly to A S ge St n + residents living in ALBERT HALL sh W RIVER IR et or MANCHESTER ull re Qua e Y y St G re et ART GALLERY S this ground-breaking St et t r re re INIT et et te t A development and new re e TR Wa C MANCHESTER re 3 mes St h t 4 o a neighbourhood of S r MUSEUM OF SCIENCE m St J Sack lt CITY r o ro St n AND INDUSTRY m Ox o t S Manchester, but also from vi r CHINA TOWN t lle re y e ee r By e r B S t popular surrounding areas tr THE VILLAGE MANCHESTER we St ee n t Li Lo PICCADILLY ve such as Castlefield and the rp o ol Ro atsoMANCHESTER CENTRAL t ad e P e wider city centre. -

Planning and Highways Committee on 8 March 2018 Item 6. St Michaels

Manchester City Council Item 6 Planning and Highways Committee 8 March 2018 Application Number Date of Appln Committee Date Ward 114664/FO/2016 24th Jan 2017 8th Mar 2018 City Centre Ward Proposal Partial demolition of existing buildings. Development up to 171.6m AOD comprising residential (Use Class C3), offices (Use Class B1), hotels (Use Class C1), place of worship (Use Class D1) and leisure/food and drink uses (Classes A1, A3, A4, A5 and D2). Creation of public spaces and new public realm, provision of basement car parking, highway alterations, landscaping and associated works. Location Land Bounded By Jacksons Row, Bootle Street, Southmill Street & 201 Deansgate, Manchester, M2 5GU Applicant , Jacksons Row Developments Limited, C/o Agent Agent Mr Mike Ralph, Zerum Consult Ltd, 4 Jordan Street, Manchester, M15 4PY INTRODUCTION This application proposes a major mixed use development at a large site in the City Centre known as St Michael’s. The proposal has been modified since originally submitted and the revised scheme has been subject to a further full round of notification and consultation. The site has been identified by the City Council as a major regeneration priority that could deliver a range of economic, physical, social and environmental benefits for the city and city region. The Jackson’s Row Strategic Regeneration Framework was endorsed for the site by the Executive in December 2015 and is a material planning consideration. The SRF aims to guide the development of the site in a manner that recognises its physical and locational characteristics. It dentifies ten objectives that future development should aspire to and identifies that the site should be developed for a high-density, mixed use scheme comprising offices, synagogue, residential, hotel and retail within a shared space.