Palm Springs International Airport)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

United States Air Force and Its Antecedents Published and Printed Unit Histories

UNITED STATES AIR FORCE AND ITS ANTECEDENTS PUBLISHED AND PRINTED UNIT HISTORIES A BIBLIOGRAPHY EXPANDED & REVISED EDITION compiled by James T. Controvich January 2001 TABLE OF CONTENTS CHAPTERS User's Guide................................................................................................................................1 I. Named Commands .......................................................................................................................4 II. Numbered Air Forces ................................................................................................................ 20 III. Numbered Commands .............................................................................................................. 41 IV. Air Divisions ............................................................................................................................. 45 V. Wings ........................................................................................................................................ 49 VI. Groups ..................................................................................................................................... 69 VII. Squadrons..............................................................................................................................122 VIII. Aviation Engineers................................................................................................................ 179 IX. Womens Army Corps............................................................................................................ -

Figueroa Tower 660 S

FIGUEROA TOWER 660 S. FIGUEROA STREET LOS ANGELES, CALIFORNIA UNMATCHED DOWNTOWN RETAIL VISIBILITY RETAIL RESTAURANT SPACE FOR LEASE FLAGSHIP RESTAURANT SPACE AVAILABLE For more information, please contact: Gabe Kadosh Vice President Colliers International License No. 01487669 +1 213 861 3386 [email protected] UNMATCHED DOWNTOWN RETAIL VISIBILITY 660 S. FIGUEROA STREET A postmodern mixed-use property bordered by Seventh and Figueroa streets The building consists of 12,000 square feet of ground-floor retail space—below a 283,000 SF Class A Office —including significant frontage feet of coveted frontage on major thoroughfare Figueroa. Figueroa Tower’s beautiful exterior combines the characteristics of traditional French architecture with the sleek verticality of a modern high-rise. These attributes, together with its location at the center of the Figueroa Financial Corridor, offer an aesthetic experience unlike any retail destination in all of Los Angeles. This corridor was solidified abuilding in California, the Wilshire Grand Center, opened directly across the street. This prestigious location boasts a high pedestrian volume and an unparalleled daily traffic count of 30,000. Such volume is thanks in part to being just steps away from retail supercenter FIGat7th, as well as sitting immediately above Seventh Street Metro Center Station, the busiest subway station in Los Angeles by far. Figueroa Tower also benefits from ongoing improvements to Downtown Los Angeles, which is currently undergoing its largest construction boom since the 1920s. In the last decade alone, 42 developments of at least 50,000 square feet have been built and 37 projects are under construction. This renaissance of development has reignited the once-sleepy downtown area into a sprawling metropolis of urban residential lofts and diverse retail destinations. -

Premises, Sites Etc Within 30 Miles of Harrington Museum Used for Military Purposes in the 20Th Century

Premises, Sites etc within 30 miles of Harrington Museum used for Military Purposes in the 20th Century The following listing attempts to identify those premises and sites that were used for military purposes during the 20th Century. The listing is very much a works in progress document so if you are aware of any other sites or premises within 30 miles of Harrington, Northamptonshire, then we would very much appreciate receiving details of them. Similarly if you spot any errors, or have further information on those premises/sites that are listed then we would be pleased to hear from you. Please use the reporting sheets at the end of this document and send or email to the Carpetbagger Aviation Museum, Sunnyvale Farm, Harrington, Northampton, NN6 9PF, [email protected] We hope that you find this document of interest. Village/ Town Name of Location / Address Distance to Period used Use Premises Museum Abthorpe SP 646 464 34.8 km World War 2 ANTI AIRCRAFT SEARCHLIGHT BATTERY Northamptonshire The site of a World War II searchlight battery. The site is known to have had a generator and Nissen huts. It was probably constructed between 1939 and 1945 but the site had been destroyed by the time of the Defence of Britain survey. Ailsworth Manor House Cambridgeshire World War 2 HOME GUARD STORE A Company of the 2nd (Peterborough) Battalion Northamptonshire Home Guard used two rooms and a cellar for a company store at the Manor House at Ailsworth Alconbury RAF Alconbury TL 211 767 44.3 km 1938 - 1995 AIRFIELD Huntingdonshire It was previously named 'RAF Abbots Ripton' from 1938 to 9 September 1942 while under RAF Bomber Command control. -

Be Active Resource Directory, Please Contact

Riverside County 1 The Network for a Healthy California— Desert Sierra Region Be Active Resource Directory9-2011 • Riverside County • A directory including free & low cost physical activity, nutrition & health assistance resources It is our hope that this resource directory will prove to be a valuable tool for families in discovering activities that are free or reasonably priced; for professionals in promoting affordable referrals for their low-income clients; and the community at large who are dedicated to promoting health and wellness for all adults, children and youth. Most of the community resources are specific to physical activity and nutrition services; however, some provide other health services. The directory may be downloaded for free at http://www.sbcounty.gov/eatwell. For more information, or to inquire how you can have your resource listed in the Be Active Resource Directory, please contact: Pamela Sampson, RD Andrea Morey Physical Activity Coordinator Physical Activity Coordinator San Bernardino County DPH-Nutrition Riverside County DPH-Nutrition Services 909-387-9144 951-358-5977 [email protected] [email protected] This material was produced by the California Department of Public Health, Network for a Healthy California, with funding from the USDA SNAP, known in California as CalFresh (formerly the Food Stamp Program). These institutions are equal opportunity providers and employers. In California, food stamps provide assistance to low-income households, and can help buy nutritious foods for better health. -

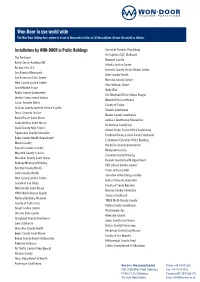

Won-Door in Use World Wide the Won-Door Folding Door System Is in Use in Thousands of Sites of All Descriptions All Over the World As Follows

Won-Door in use world wide The Won-Door folding door system is in use in thousands of sites of all descriptions all over the world as follows: Installations by WON-DOOR in Public Buildings Centre of Forensic Psychology Air Logistics LLC (Galliano) The Pentagon Broward County Aotea Centre Auckland NZ Atlanta Justice Center Air Logistics LLC Hartwell County Senior Citizen Center Los Angeles Municipals Greer County Health San Francisco Civic Centre Nicholas County Center West County Justice Centre Ohio Veterans Home Constellation Place Getty Villa Anoka County Government Fire Marshall Office (Baton Rouge) United States Forest Service Beverly Hills Courthouse Social Security Office County of Tulare Clallam County Juvenile Service Facility Etowah Courthouse Texas Criminal Justice Beaver County Courthouse Baton Rouge Court House Lubbock Courthouse Renovation Santa Monica Court House McClennan County Jail Clark County High School United States Postal Office Courthouse Tippecanoe County Correction Flathead County Justice Center (Galliano) Baker County Health Department Eisenhower Executive Office Building Macon County Hendricks County Government Augusta County Schools Milwaukee County Magoffin County Schools Cameron County Housing Marathon County Court House Russell County Health Department Bethany Municipal Building FDR Library Visitors Center Brantley County Health Plano Justice Center Collin County Health Salvation Army-Orange County West County Justice Centre Dallas Police Headquarters County of San Diego County of Santa Barbara Westchester -

Arts District 20 Fashion District 22 Little Tokyo 13 23 Chinatown 24 Statistics

DOWNTOWN LA ABOUT THE DCBID Figueroa St. 1st St. Hope St. Grand Ave. 110 Freeway 6th St. Broadway BUNKER 7th St. HILL FINANCIAL DISTRICT J. Wood Blvd. 4th St. Main St. 8th St. 9th St. Flower St. Hope St. Olympic Hill St. Founded in 1998, the Downtown Center Business Improvement District (DCBID) has been a catalyst in Downtown Los Angeles’ transformation into a vibrant 24/7 neighborhood. A coalition of nearly 2,000 property owners in the Central Business District, the DCBID members are united in their commitment to enhance the quality of life in Downtown Los Angeles. Bounded by the Harbor Freeway to the west, First Street to the north, Main and Hill streets to the east, and Olympic Boulevard and 9th Street to the south, the organization helps the 65-block Central Business District achieve its full potential as a great place to live, work, and play. DCBID services include: • 24 Hr. Safety and Maintenance Services – “The Purple Patrol” • Economic Development and Business Recruitment/Retention programs • Strategic Marketing Programs that promote the area to residents, workers and visitors. For more than 20 years, these programs and initiatives have been the driving force behind the Downtown Los Angeles Renaissance that has seen the city become one of the nation’s most dynamic urban centers. 2 Downtown Center Business Improvement District I Retail Report 9 INSIDE 4 RETAIL IN THE CITY OF DTLA 6 MAP OF DTLA 8 FINANCIAL DISTRICT 10 7th STREET CORRIDOR 12 JEWELRY DISTRICT 13 BUNKER HILL 14 SOUTH PARK 16 HISTORIC CORE 18 ARTS DISTRICT 20 FASHION DISTRICT 22 LITTLE TOKYO 13 23 CHINATOWN 24 STATISTICS 22 Retail Report I Downtown Center Business Improvement District 3 RETAIL IN THE CITY OF DTLA owntown LA is becoming a city unto itself. -

Almanac ■ Guide to Air Force Installations Worldwide

USAFAlmanac ■ Guide to Air Force Installations Worldwide Major Installations Note: A major installation is an Air Force Base, Air Andrews AFB, Md. 20762-5000; 10 mi. SE of 4190th Wing, Pisa, Italy; 31st Munitions Support Base, Air Guard Base, or Air Reserve Base that Washington, D. C. Phone (301) 981-1110; DSN Sqdn., Ghedi AB, Italy; 4190th Air Base Sqdn. serves as a self-supporting center for Air Force 858-1110. AMC base. Gateway to the nation’s (Provisional), San Vito dei Normanni, Italy; 496th combat, combat support, or training operations. capital and home of Air Force One. Host wing: 89th Air Base Sqdn., Morón AB, Spain; 731st Munitions Active-duty, Air National Guard (ANG), or Air Force Airlift Wing. Responsible for Presidential support Support Sqdn., Araxos AB, Greece; 603d Air Control Reserve Command (AFRC) units of wing size or and base operations; supports all branches of the Sqdn., Jacotenente, Italy; 48th Intelligence Sqdn., larger operate the installation with all land, facili- armed services, several major commands, and Rimini, Italy. One of the oldest Italian air bases, ties, and support needed to accomplish the unit federal agencies. The wing also hosts Det. 302, dating to 1911. USAF began operations in 1954. mission. There must be real property accountability AFOSI; Hq. Air Force Flight Standards Agency; Area 1,467 acres. Runway 8,596 ft. Altitude 413 through ownership of all real estate and facilities. AFOSI Academy; Air National Guard Readiness ft. Military 3,367; civilians 1,102. Payroll $156.9 Agreements with foreign governments that give Center; 113th Wing (D. C. -

2AD Memorial Library Memorabilia Collection

ABCDEFGHIJK AUDIT OLD NO. of ITEM TYPE GIVEN or OFFICIAL DESCRIPTION of image DATE (s) ARTIST or Maximum CONDITION GENERAL NOTES ITEM REFERENCE ITEMS (PROCESS) TITLE subject AUTHOR DIMENSIONS NOTES (context or back story) NUMBER NUMBERS width x height 1 in millimetres 2AD.1 10 1 Published Armed Blanche Fury Paperback book with red cover 1939 Joseph Shearing 110 x 165 pages yellowed Services Edition showing small picture of and spotted, ink book original book cover design. stains on title Armed Services Edition printed page, staple in white text on blue circle showing rust, bend down middle of front cover 2 2AD.2 13 1 Published Armed Country Editor Paperback book with blue 1940 Henry Beetle Hough 110 x 165 pages yellowed unknown Services Edition cover showing small picture of and spotted, small book original book cover design. tear at top of spine Armed Services Edition printed in black text on yellow circle 3 2AD.3 19 1 Published book With Love and Paperback book with yellow 1943 Compilation - 220 x 155 Tears and staining unknown Kisses: Cartoons, cover, red and black text, various to cover, general Stories, Gags, cartoon illustration wear and tear laughs for the Soldier, Sailor, 4 Marine 2AD.4 22 1 Published magazine Woman's Weekly Weekly magazine showing 3 August 1940 Various contributors 275 x 190 Poor general unknown women modelling fashions of condition, yellowed the period paper, rusted staples, cover detached from inner content 5 2AD.5 24 1 Post war metal Model Aircraft Post war metal model of B-24 Unknown Unknown 170 x 130 x 120 2 Given by donor who was model of B-24 Liberator bomber mounted on with 458th BG at Liberator bomber wooden base with inscription Horsham St Faith on plaque inset and metal aircrew 'wings' also inset into base. -

Historical Brief Installations and Usaaf Combat Units In

HISTORICAL BRIEF INSTALLATIONS AND USAAF COMBAT UNITS IN THE UNITED KINGDOM 1942 - 1945 REVISED AND EXPANDED EDITION OFFICE OF HISTORY HEADQUARTERS THIRD AIR FORCE UNITED STATES AIR FORCES IN EUROPE OCTOBER 1980 REPRINTED: FEBRUARY 1985 FORE~ORD to the 1967 Edition Between June 1942 ~nd Oecemhcr 1945, 165 installations in the United Kingdom were used by combat units of the United States Army Air I"orce~. ;\ tota) of three numbered .,lr forl'es, ninc comllklnds, frJur ;jfr divi'iions, )} w1.l\~H, Illi j(r,IUpl', <lnd 449 squadron!'! were at onE' time or another stationed in ',r'!;rt r.rftaIn. Mnny of tlal~ airrll'lds hnvc been returned to fann land, others havl' houses st.lnding wh~rr:: t'lying Fortr~ss~s and 1.lbcratorR nllce were prepared for their mis.'ilons over the Continent, Only;l few rcm:l.1n ;IS <Jpcr.Jt 11)11., 1 ;'\frfll'ldH. This study has been initl;ltcd by the Third Air Force Historical Division to meet a continuin~ need for accurate information on the location of these bases and the units which they served. During the pas t several years, requests for such information from authors, news media (press and TV), and private individuals has increased. A second study coverin~ t~e bases and units in the United Kingdom from 1948 to the present is programmed. Sources for this compilation included the records on file in the Third Air Force historical archives: Maurer, Maurer, Combat Units of World War II, United States Government Printing Office, 1960 (which also has a brief history of each unit listed); and a British map, "Security Released Airfields 1n the United Kingdom, December 1944" showing the locations of Royal Air Force airfields as of December 1944. -

The Fighting Five-Tenth: One Fighter-Bomber Squadron's

The Fighting Five-Tenth: One Fighter-Bomber Squadron’s Experience during the Development of World War II Tactical Air Power by Adrianne Lee Hodgin Bruce A dissertation submitted to the Graduate Faculty of Auburn University in partial fulfillment of the requirements for the Degree of Doctor of Philosophy Auburn, Alabama December 14, 2013 Keywords: World War II, fighter squadrons, tactical air power, P-47 Thunderbolt, European Theater of Operations Copyright 2013 by Adrianne Lee Hodgin Bruce Approved by William Trimble, Chair, Alumni Professor of History Alan Meyer, Assistant Professor of History Mark Sheftall, Associate Professor of History Abstract During the years between World War I and World War II, many within the Army Air Corps (AAC) aggressively sought an independent air arm and believed that strategic bombardment represented an opportunity to inflict severe and dramatic damages on the enemy while operating autonomously. In contrast, working in cooperation with ground forces, as tactical forces later did, was viewed as a subordinate role to the army‘s infantry and therefore upheld notions that the AAC was little more than an alternate means of delivering artillery. When President Franklin Delano Roosevelt called for a significantly expanded air arsenal and war plan in 1939, AAC strategists saw an opportunity to make an impression. Eager to exert their sovereignty, and sold on the efficacy of heavy bombers, AAC leaders answered the president‘s call with a strategic air doctrine and war plans built around the use of heavy bombers. The AAC, renamed the Army Air Forces (AAF) in 1941, eventually put the tactical squadrons into play in Europe, and thus tactical leaders spent 1943 and the beginning of 1944 preparing tactical air units for three missions: achieving and maintaining air superiority, isolating the battlefield, and providing air support for ground forces. -

Non-Motorized Transportation Plan Update

FINAL COACHELLA VALLEY ASSOCIATION OF GOVERNMENTS NON-MOTORIZED TRANSPORTATION PLAN UPDATE Prepared by: Ryan Snyder Associates, LLC In Association with Urban Crossroads September 2010 Table of Contents CHAPTER 1 INTRODUCTION ..................................................................................................... 1 PROCESS 2 Public Outreach ....................................................................................................................... 2 Fieldwork ................................................................................................................................. 5 Meetings with Local Jurisdictions ........................................................................................... 5 Other Planning Efforts ............................................................................................................ 5 PLAN ORGANIZATION 7 CHAPTER 2 GOALS AND OBJECTIVES ........................................................................................ 8 GOAL 1: BICYCLE TRANSPORTATION 8 Goal 1 Objectives: ................................................................................................................... 8 GOAL 2: THE PEDESTRIAN REALM 12 Goal 2 Objectives: ................................................................................................................. 12 GOAL 3: HIKING AND EQUESTRIAN RECREATIONAL OPPORTUNITIES 14 Goal 3 Objectives: ................................................................................................................. 14 CHAPTER -

Lieutenant General Stayce Harris

UNITED STATES AIR FORCE LIEUTENANT GENERAL STAYCE D. HARRIS Retired March 01, 2019 Lt. Gen. Stayce D. Harris is the Inspector General of the Air Force, Office of the Secretary of the Air Force, Washington, D.C. In this capacity, she reports to the Secretary and Chief of Staff of the Air Force on matters concerning Air Force effectiveness, efficiency and the military discipline of active duty, Air Force Reserve and Air National Guard forces. She also provides inspection policy and oversees the inspection and evaluation system for all Air Force nuclear and conventional forces; oversees Air Force counterintelligence operations and chairs the Air Force Intelligence Oversight Panel; investigates fraud, waste and abuse; oversees criminal investigations; and provides oversight of complaints resolution programs. General Harris is responsible for two field operating agencies: the Air Force Inspection Agency and the Air Force Office of Special Investigations. General Harris received a commission in the Air Force through the University of Southern California's Air Force ROTC program. She served on active duty until joining the Air Force Reserve in 1991. She has commanded an airlift squadron, an expeditionary operations group, an air refueling wing and a numbered air force. Prior to her current position, Gen Harris served as the Assistant Vice Chief of Staff and Director, Air Staff, Headquarters U.S. Air Force, Washington, D.C. EDUCATION 1981 Bachelor of Science degree in industrial and systems engineering, University of Southern California, Los Angeles 1987 Master of Aviation Management degree, Embry-Riddle Aeronautical University, Daytona Beach, Fla. 1988 Squadron Officer School, Maxwell Air Force Base, Ala.