Karachi Transportation Improvement Project Final Report Page 4-18

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

23Rd January, 2020 at 02:00 P.M

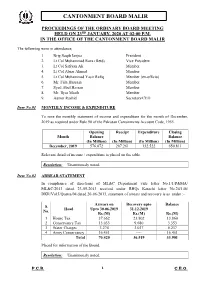

CANTONMENT BOARD MALIR PROCEEDINGS OF THE ORDINARY BOARD MEETING HELD ON 23RD JANUARY, 2020 AT 02:00 P.M. IN THE OFFICE OF THE CANTONMENT BOARD MALIR The following were in attendance; 1 Brig Saqib Janjua President 2. Lt Col Muhammad Raza (Retd) Vice President 3. Lt Col Safiyan Ali Member 4. Lt Col Abrar Ahmed Member 5. Lt Col Muhammad Yasir Rafiq Member (ex-officio) 6. Mr. Fida Hussain Member 7. Syed Abul Hassan Member 8. Mr. Ilyas Masih Member 9. Aamer Rashid Secretary/CEO Item No.01 MONTHLY INCOME & EXPENDITURE To note the monthly statement of income and expenditure for the month of December, 2019 as required under Rule 90 of the Pakistan Cantonments Account Code, 1955. Opening Receipt Expenditure Closing Month Balance Balance (In Million) (In Million) (In Million) (In Million) December, 2019 576.072 207.261 132.522 650.811 Relevant detail of income / expenditure is placed on the table. Resolution: Unanimously noted. Item No.02 ARREAR STATEMENT In compliance of directions of ML&C Department vide letter No.1/1/P&MA/ ML&C/2013 dated 23-05-2013 received under RHQs Karachi letter No.24/146/ DKR/Vol:I/Quetta/04 dated 20-06-2013, statement of arrears and recovery is as under :- Arrears on Recovery upto Balance S. Head Upto 30.06.2019 31.12.2019 No. Rs.(M) Rs.(M) Rs.(M) 1 House Tax 37.662 23.802 13.860 2 Conservancy Tax 13.033 9.680 3.353 3 Water Charges 3.274 3.037 0.237 4 Army Conservancy 16.451 ---- 16.451 Total 70.420 36.519 33.901 Placed for information of the Board. -

Annual Report Final

Empowering Women Ra’ana Liaquat Craftsmen’s Colony Bi-Annual Results Report Strengthening Communities 2016 - 18 Report written by Laleh Habib Table of CONTENTS Message from our Chairperson 01 Highlights at a Glance 03 About RLCC 04 Our Values & Approach 06 Sustainability 08 Education 10 Healthcare 11 Economic Empowerment 12 Awareness and Outreach 14 Strategic Partnerships 15 Message from our We embarked on a new three year strategy Chairperson with clearly defined targets and goals, designed to help prioritize our work streams, and to allow us to operate with maximum efficiency, impact and professionalization. We are proud to have launched a Day Care Persistent inequality remains one of the greatest Centre and Chai Khana. These facilities problems in Pakistan. It is estimated that 35% of the allow women to become more active within population live below the poverty line and are unable the community and economy. to access adequate education, healthcare and economic opportunities. This poverty trap is becoming increasingly intergenerational: today, children born in low-income families are less likely to break out of the cycle of poverty than 20 years ago. In 2017/18, 10 students became the first In addition to the massive human cost of this Matric cohort to be enrolled at The Ra’ana phenomenon, persistent inequality hinders economic School. growth, prevents social mobility, and can lead to extremism, crime and political and social instability. Women are often amongst the most marginalized and disadvantaged sectors of the population and frequently face discrimination, violence, and RLCC has forged a partnership with inequitable access to education, healthcare, and The Recovery House, aimed at providing economic opportunities. -

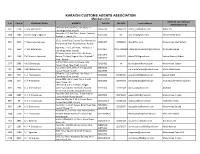

Kcaa Members List.Pdf

KARACHI CUSTOMS AGENTS ASSOCIATION Members List NAME OF AUTHORIZED S. # CHAL # COMPANY NAME ADDRESS TEL NOS FAX NOS Email Address REPRESENTATIVE Office No.614, 6th Floor, Uni Plaza, I. I. 391 2724 3- Star Enterprises 32466518 32466518 [email protected] Akbar Jan Chundrigar Road, Karachi Room No. 411, 4th Floor, Shams Chamber, 1868 2785 3a Sons Cargo Logistics 32423284 NIL [email protected] Sheikh Safdar Alam Shahrah-e-liaquat, Khi 10-11, Ayub Plaza Ground Floor Hamayoon 203 2211 7- Seas Cargo Services 32425407 32419470 [email protected] Muhammad Shahid Rafiq Muhammad Khan Road Keamari, Karachi. Room No. 713-a, Uni Plaza, 7th Floor, I. I. 495 2550 7- Star Enterprises 32412964 0213-7013682 [email protected] Dil Nawaz Ahmed Chundrigar Road, Karachi Al Saihat Centre, Suite 405, 4th Floor, 35653457- 441 1998 786 Business Syndicate Annexe To Hotel Regent Plaza, Shahrah E 35653675 [email protected] Saleem Ahmed Abbasi 35653675 Faisal, Karachi Suit No# 104, Abdullah Square, Altaf 1077 2365 A & S Enterprises 32420422 nil [email protected] Muhammad Saleem Hussain Road, New Challi, Karachi Poonawala View, Office # A-9 Opposite 32313616, 95 2986 A M S Enterprises - [email protected] Malik Allah Nawaz Custom House Karachi 32310680 Office No. 212, 2nd Floor, Uni Plaza, I. I. 983 967 A. A. Ahmad & Co 32420506 32420456 [email protected] Danish Wakil Chundrigar Road, Karachi Room #801, Jilani Tower, M. A. Jinnah 1965 924 A. A. Enterprises 32439802 32477355 [email protected] Aoun Mohammed Choudhary Road, Tower, Khi Office No.b-4 & 5, 1st Floor, Eidgah 889 2301 A. -

Cost of Traumatic Brain Injury (TBI) in Motorcycle Crash Victims at a Public Tertiary Healthcare Facility in Karachi, Pakistan: an Analytical Cross-Sectional Study

Study Participant ID# Questionnaire for patients or caregivers: Study Title: Cost of Traumatic Brain Injury (TBI) in Motorcycle Crash Victims at a Public Tertiary Healthcare Facility in Karachi, Pakistan: An Analytical Cross-sectional Study. Date of Birth of the respondent Date of data collection Respondent Contact Number Data Collector Name with Code# Supervisor’s Name Edited by Entered by Part-a Demographic Variables No. Questions and Filters Coding Categories Skip Answers Q1 What is the Gender of the 1. Male patient? 2. Female Circle one best answer Q2 What is patient’s level of 1. No formal Education education? 2. Less than Primary School Circle one best answer 3. Primary School 4. High School 5. College Diploma 6. Degree 7. Post Graduate and higher. 8. Madrasa education Q3 What is patient’s marital status? 1. Single Circle one best answer 2. Married 3. Widowed 4. Divorced 5. Separated Q4 Is the patient a resident of 1. Yes If No, skip Karachi city? 2. No to Q5 Circle one best answer Q4a Where is the patient living in 1. Baldia Town Karachi? 2. Bin Qasim Town 3. Gadap Town Circle one best answer 4. Gulberg Town 5. Gulshan Town 6. Jamshed Town 7. Kemari Town 8. Korangi Town 9. Landhi Town 10. Liaquatabad Town 11. Lyari Town 12. Malir Town 13. New Karachi Town 14. North Nazimabad Town 15. Orangi Town 16. Saddar Town 17. Shah Faisal Town 18. S.I.T.E. Town Q5 How many members are there in Write exact number of family members in two patient’s family? digits number Q6 What is patient’s role in the 1. -

12086369 01.Pdf

Exchange Rate 1 Pakistan Rupee (Rs.) = 0.871 Japanese Yen (Yen) 1 Yen = 1.148 Rs. 1 US dollar (US$) = 77.82 Yen 1 US$ = 89.34 Rs. Table of Contents Executive Summary Introduction Chapter 1 Review of Policies, Development Plans, and Studies .................................................... 1-1 1.1 Review of Urban Development Policies, Plans, Related Laws and Regulations .............. 1-1 1.1.1 Previous Development Master Plans ................................................................................. 1-1 1.1.2 Karachi Strategic Development Plan 2020 ........................................................................ 1-3 1.1.3 Urban Development Projects ............................................................................................. 1-6 1.1.4 Laws and Regulations on Urban Development ................................................................. 1-7 1.1.5 Laws and Regulations on Environmental Considerations ................................................. 1-8 1.2 Review of Policies and Development Programs in Transport Sector .............................. 1-20 1.2.1 History of Transport Master Plan .................................................................................... 1-20 1.2.2 Karachi Mass Transit Corridors ...................................................................................... 1-22 1.2.3 Policies in Transport Sector ............................................................................................. 1-28 1.2.4 Karachi Mega City Sustainable Development Project (ADB) -

Karachi Heatwave Management Plan: a Guide to Planning and Response

Karachi Heatwave Management Plan: A Guide to Planning and Response Commissioner Karachi Purpose of the Document This document, Karachi Heatwave Management Plan, outlines what should happen before, during and after periods of extreme heat in Karachi. It sets out strategies that government and non-government agencies will adopt to prevent heat-related illnesses and deaths in Karachi and capacitate the public, particularly the most vulnerable residents, to take protective action. The Plan describes actions of implementation partners to ensure (1) information on weather conditions and heat health is timely and specific, (2) organizations have the capacity to respond according to their roles, and (3) strategies and actions enabling increase in effectiveness over time. In June 2015 Karachi City experienced a severe heatwave that caused over 1,200 deaths and over 50,000 cases of heat illness. The heatwave caught all levels of government and first responders off-guard, highlighting the need for inter-agency coordination, clarity in roles, and a well-publicized trigger to activate a planned response. To address this need and to prevent health impacts from future heatwaves as climate change intensifies, the Commissioner Office Karachi requested support from the Climate and Development Knowledge Network (CDKN) to develop a heatwave management plan. Karachi’s first Heatwave Management Plan is the result of a technical assistance project delivered by national and international experts between October 2016 and May 2017, working closely with the Commissioner Office and other stakeholders. The Plan will be subject to an annual performance review and updated versions will be available to implementation partners accordingly. ii | P a g e Table of Contents List of Figures ...................................................................................................................... -

Pakistan 16-17 October 2017 Rome

European Asylum Support Office EASO COI Meeting Report Pakistan 16-17 October 2017 Rome February 2018 SUPPORT IS OUR MISSION European Asylum Support Office EASO COI Meeting Report Pakistan 16-17 October 2017 Rome Pakistan Practical Cooperation Conference 16-17 October 2017 Rome e Report February 2018 Pakistan © European Asylum Support Office 2018 Reproduction is authorised, provided the source is acknowledged, unless otherwise stated. For third-party materials reproduced in this publication, reference is made to the copyrights statements of the respective third parties. Cover photo: © iStock by Getty images / gaborbasch Lahore, Pakistan - May 5, 2013: Muslim women participating at a public event wearing colorful headscarves, duppattas and hijabs Neither EASO nor any person acting on its behalf may be held responsible for the use which may be made of the information contained herein. EASO COI MEETING REPORT PAKISTAN — 3 Acknowledgements EASO would like to thank the following experts and organisations for their participation at the conference and the presentations they gave: Anna Giustiniani, Project manager, IOM Italy Cyril Almeida, Assistant editor and journalist, Dawn newspaper, Pakistan Luisa Inversini, President of the Territorial Commission for International Protection, Milan Matthew Nelson, Reader in Politics, PhD, School of Oriental and African Studies (SOAS), University of London Muhammad Amir Rana, Director, Pakistan Institute for Peace Studies (PIPS) Nathalie Boschman, COI Expert, Cedoca, Belgium Shehryar Fazli, Senior Analyst -

Creative Solutions R-3, Row-8, Block-C, National Cement Society, Block-10A, Gulshan-E-Iqbal, Karachi-Pakistan

Creative Solutions R-3, Row-8, Block-C, National Cement Society, Block-10A, Gulshan-e-Iqbal, Karachi-Pakistan. Mob: 0321-8222043 / Fax: 021-34984579 / Email: [email protected] Address : R-3, Row-8, Block-C, National Cement Society, Block-10A, Gulshan-e-Iqbal, Karachi-Pakistan. Mobile : 0321-8222043 Fax : 021-34984579 E-mail : [email protected] URL : www.creativesolutions.net.pk M/s Creative Solutions firm was established in the year 2007 with the object of providing Engineering & Consultancy Services in Electrical installation fields. Over the period of last five years the firm has achieved its goal of providing technical sound and safe Electrical installation services all over Karachi. We have a well equipped team of professional engineers, supervisors and workmen to plan & execute different jobs according to the requirements of our clients to achieve excellent engineering standards. We have undertaken almost all type of electrical jobs such as completion / execution of H.T, L.T Bulk supply sub-station, scheme works of all size of pole mounted Transformers, H.T, L.T panels, H.T, L.T cable laying & fixing work, Cellular Towers Electric connections, Dedicated PMT Schemes and maintenance of cellular towers power supply in Karachi. EXECUTED WORKS OF M/S TELENOR BTS POWER CONNECTIONS WITH DEDICATED PMT, L.T SPANS AND CABLE SCHEME CASES SCHEME CASES OF M/S TELENOR BTS TOWER POWER CONNECTIONS S.No Projects(Address) Description/ Job Executed 15 KVA Transformer with 2 H.T Spans of copper 01. Plot NO.R-211 P.R.E.C.H.S. Gulistan-e-Johar Karachi conductor 3 SWG and 2 H. -

Shah Faisal Town, Karachi, Pakistan: a Temporal Perspective

Karachi University Journal of Science, 2012, 40, 5-11 5 Open Green Spaces - Shah Faisal Town, Karachi, Pakistan: A Temporal Perspective Muhammad Azam1, Farkhunda Burke2,*, Syed Nawaz-ul-Huda1 and Muhammad Miandad2 1Department of Geography, Federal Urdu University of Arts, Sciences and Technology, Karachi, Pakistan and 2Department of Geography, University of Karachi, Pakistan Abstract: Temporal studies of open green spaces are essential in order to realize the conditions of improvement and deterioration, since the latter condition is unacceptable to the law abiding, tax paying urbanites. In the present study area the existing open space provision is unsatisfactory both in quality and quantity. The objective of this study is to evaluate the increasing pressure on open green spaces of Shah Faisal Town, Karachi. With this end in view Quick bird images 2004 and 2009 have been classified for comparative temporal study. Projection of population for 2004 and 2009 based on the 1998 census data has also been made. The paper elucidates how the current ungenerous provision of public open space can be attributed to a number of historical, political and institutional factors including, inefficient division of government responsibilities, and lack of public representation, pro-growth planning ideology, revenue-maximizing land sale policy and privatization and encroachment of urban space. This study concludes that the development of public open green spaces have been prejudiced under the statutory planning system and land allocation process. Planners think that open green spaces are more of a luxury than a need, hence encroachment is rampant. The paper suggests that the shrinking of open green space may cause excessive anomalous development which will aggravate the deteriorating urban, social and political climate in Shah Faisal Town, Karachi. -

Commissioner Inland Revenue Jurisdiction C

Commissioner Inland Revenue Jurisdiction C. No. 57(2)S-DOS/2011-29521-R. Islamabad 1st March, 2011 30th June 2012 All (non-corporate) cases or classes of cases or persons or classes of persons ZONE I, RTO I, KARACHI Karachi Cantt., Clifton Cantt., and Manora Cantt Lyari Town, Keamari Town, Manora Cantt and Karachi Cantt ZONE II, RTO I, KARACHI Saddar Town, Lyari Town, and Kemari Baldia Town, Orangi Town and North Nazimabad Town ZONE III,RTO I, KARACHI ------ Clifton and DHA Phase-I to III of Clifton cantt ZONE IV, RTO I, KARACHI ------ DHA Phase-IV to VIII of Clifton Cantt; and Kehkashan of Saddar Town ZONE I, RTO II, KARACHI Jamshed Town & Baldia Town Saddar Town ZONE II, RTO II, KARACHI Shah Faisal Town & Shah Faisal Cantt. Jasmshed Town ZONE III, RTO II, KARACHI SITE Town, Korangi Town, Korangi Creek and Shah Faisal Town / Shah Faisal Cantt ZONE IV, RTO II, KARACHI Orangi Town, Gulberg Town and Liaquatabad town ZONE V, RTO II, KARACHI Korangi Town and Korangi Creek. Removed ZONE I, RTO III, KARACHI Malir Town and Bin Qasim Town. Gulshan Town ZONE II, RTO III, KARACHI Gulshan Town Landhi Town, Bin Qasim Town, Malir Town & Malir Cantt ZONE III, RTO III, KARACHI Gadap Town and New Karachi Town New Karachi Town and Gadap Town ZONE IV, RTO III, KARACHI Gulberg Town. S.I.T.E Town ZONE V, RTO III, KARACHI Liaqutabad Town. Removed All cases of companies (other than the cases assigned to any other RTOs/LTU) whose names begin with following alphabets otherwise specified. -

1. Persons Interviewed

Karachi Transportation Improvement Project Final Report APPENDIX-1 MEETINGS 1. Persons Interviewed During the Phase 1 study period, which is Karachi Transport Master Plan-2030, JICA Study Team (JST) has been visited different organizations and Departments to collect data and also meet the officials. The list of these officials and their department/organization are given below 1.1 CDGK Administrator/ DCO, City District Government Karachi 1.1.1 KMTC Director General, Karachi Mass Transit Cell, CDGK Director, (Planning & Coordination) Karachi Mass Transit Cell, CDGK. Director (T), KMTC, CDGK 1.1.2 Master Plan Executive District Officer, Master Plan Group of Offices, CDGK District Officer, Master Plan Group of Offices, CDGK 1.1.3 Transport & Communication Executive District Officer, Transport Department , CDGK District Officer (Parking & Terminal Management), Transport & Communication Department (TCD), CDGK District Officer, Policy, Planning & Design, Transport & Communication Dept. CDGK 1.1.4 Education Department Executive District Officer, Education(School) , CDGK 1.1.5 Works & Service Department Executive District Officer, W&S , CDGK 1.2 DRTA Superintendant, District Regional Authority, CDGK 1.3 Town Administration Administrator, Keamari Town Administrator, Baldia Town Administrator, Bin Qasim Town Administrator, Gulberg Town Administrator, Gadap Town Administrator, Gulshan Town Administrator, Jamshed Town Administrator, Korangi Town Administrator, Landhi Town Administrator, Liaquatabad Town Appendix 1 - 1 Karachi -

Office of the Executive &Igineer , (Sewerage ) 'Shah Faisal Town

Office of the Executive &igineer , (sewerage ) 'Shah Faisal Town Kara chi water & sewerage Board NO: •svilF T/ ( Se w )/Te nd er / Kw&SB /2 017 // Dated:/51-0 •A/2 0.17 1/ The Director,( C.B ) , gindh Public Procureme nt Re gula tory Authority is ( PPR 09 Sindh Secretr iate,Barraks-4 rerachi • Bids emulation Re Port of work: - Providing / Laying of 1? ,,Dia R • C -C Rubber Ring sewer PiPes from sabba Palace to TaYYab a !Iasi id in ( tr,-07 ), in Areas of shah Faisal Town • Pe f, :---- gPFRA .5-11 -53/2016 11 lio: Sne lose d Please find herewith, the Bids Trula t ion Port and Bide OPeninic for the above Cited work, is being submitted for early Hoisting /uPloa ding in sPPRA tiutnor ity '5 (t webs ite This is for kind Information, Please • Executive Engineer, (Sew) Oiakt Fa isa l wn ,1 MB !ce ll , No :0300 -R?2464 floPy for Informa tion , Please , 1 • • suPer intend ing tngineer , (Dia t t ;YDrangi ),Kw&sB • 2 • • D • A • Of ficer ( w&s ) shall Faisa l Town 3.• Office CoPy / File CoPy. 1 KARACHI WATER & SEWERAGE BOARD OFFICE OF THE DIRECTOR (DESIGN & ESTIMATE) BID EVALUATION REPORT 1 Name of Procuring Agency: KARACHI WATER & SEWERAGE BOARD 2 Tender Reference No: SPPRA Serial No.31133 I.D No. 3 Tender Description/Name PROVIDING / LAYING OF 12" DIA RCC RUBBER of Work/Item: RING SEWER PIPES FROM SABA PALACE TO TAYYABA MASJID IN (UC-07) AREAS OF SHAH FAISAL TOWN (SEW). 4 Method of Procurement: Single Stage (One Envelop) 5 Tender Published: Through SPPRA Web Site 6 Total Bid Documents Sold: 3 Nos 7 Total Bid Received: 3 Nos 8 Technical Bid Opening N/A Date (if applicable): 9 No.