Real Estate Market | April & May 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Lista De 28 De Fevereiro a 06 De Março De 2020

Lista de 28 de Fevereiro a 06 de Março de 2020 Nome Tipo Data de Início Data de Fim Processo Morada Freguesia UIT Novo Programa Ricardo Araújo Pereira Filmagem 01-03-2020 07-06-2020 214/POEP/2020 Avenida Fontes Pereira de Melo Arroios Centro Calçada do Monte, Rua da Senhora do Monte, Rua de São Gens, Amar Demais Filmagem 02-03-2020 06-03-2020 250/POEP/2020 São Vicente Centro Histórico Travessa do Monte, Rua Damasceno Monteiro Misericórdia, Santa Maria Distribuição de Flyers Publicitário 05-02-2020 29-04-2020 46/POEP/2020 Praça de Luís de Camões, Rua Garrett Centro Histórico Maior Praça do Comércio, Rua Gomes Freire, Calçada do Monte, Campo dos Santa Maria Maior, Arroios, O Atentado Filmagem 29-02-2020 29-02-2020 255/POEP/2020 Mártires da Pátria, Rua Júlio de Andrade, Paço da Rainha, Travessa da Centro Histórico, Centro São Vicente, Santo António Cruz do Torel Terramotto Vs Moda Lisboa vs CML - 54ª edição Moda Estrela, Misericórdia, Avenidas Divertimento/Espetáculo 26-02-2020 05-03-2020 150/POEP/2020 Largo Vitorino Damásio, Cais do Sodré, Campo Pequeno Centro Histórico, Centro Lisboa Novas Largo Trindade Coelho, Rua Delfim de Brito Guimarães, Rua de São Misericórdia, Campolide, Lázaro, Terreiro do Trancão, Antigas Oficinas Metropolitano Calvanas, Centro Histórico, Centro, Lançamento Mundial Novo Mini Eléctrico Publicitário 01-02-2020 23-03-2020 57/POEP/2020 Santa Maria Maior, Parque das Avenida da Ribeira das Naus, Rua do Arsenal, Rua do Alecrim, Praça do Oriental, Norte Nações, Lumiar Comércio Praça do Duque de Saldanha, Praça dos Restauradores, -

The Working-Class Houses and Its Insertion in Urban Areas

THE WORKING-CLASS HOUSES AND ITS INSERTION IN URBAN AREAS THE 33 MUNICIPAL CASE STUDIES OF THE CITY OF LISBON _________________________________________________________________________________ José Miguel Moreira Correia ABSTRACT The purpose of this study is to analyze the insertion of 33 municipality working-class houses of in the urban fabric of the city of Lisbon. The methodology adopted was based on the Spatial Syntax theory by using the measurements of choice and integration in a Geographic Information Systems environment. The first step was the analysis of 33 cases studies with normalized angular measures of integration and choice, from the global scale to the local scale with radii of 400 m, 800 m, 1200 m and 2000 m respectively. The second step was a detailed analysis based on the adjacency of the spaces from the public street to the dwellings for a subset of 4 working-class houses, selected due to their type-morphological diversity. From the first analysis (the 33 study cases), it was possible to conclude that the patios and the workers' villages have high insertion values in the neighborhood, highlighting the idea that this type of construction intended to promote the proximity of the dwellings to the factories. At the global level the insertion value is weaker, however with a positive growth trend in the period analyzed (1871 - 2005). For all study cases it was verified that the courtyard acts as an aggregating element of the collective space, although it can be accessed in very different ways, which in translates into a proper identity for each patio/village worker. Keywords: Workforce housing Space Syntax analysis Urban morphology Housing GIS November 2018 INTRODUCTION This work is part of a protocol established between the Instituto Superior Técnico (IST) – CERIS research center and the Municipality of Lisbon to study the 33 municipal working-class houses. -

FICHA GLOBAL PMUS Abril16

PLANO DE AÇÃO MOBILIDADE URBANA SUSTENTÁVEL (FICHA GLOBAL) Identificação da NUT III Área Metropolitana de Lisboa Territórios abrangidos pelas intervenções Concelho de Lisboa JUSTIFICAÇÃO PARA AS INTERVENÇÕES NOS TERRITÓRIOS IDENTIFICADOS Portugal tem definido ao longo dos últimos anos uma série de políticas e instrumentos que apontam à redução da sua elevada dependência energética dos combustíveis fósseis, dos impactos ambientais que a utilização destes incorporam e da sua inerente contribuição para as emissões de gases com efeitos de estufa e para as alterações climáticas. A cidade de Lisboa também está apostada em contribuir para os mesmos objectivos, e tem ela própria levado a cabo uma série de medidas que visam aumentar a eficiência energética do seu sistema urbano, reduzir as poluições atmosférica e sonora, e mitigar as suas responsabilidades em termos de emissões de CO2. Estas preocupações são hoje centrais em todas as estratégias e políticas definidas pela cidade, que tem assumido compromissos e lançado acções que permitam aumentar permanentemente os níveis de sustentabilidade e resiliência da cidade. Documentos como a Carta Estratégica de Lisboa 2010/2014, o PDML, o Pacto dos Autarcas subscrito por Lisboa, o Plano de Acção para a Sustentabilidade Energética de Lisboa ou o Lisboa-Europa 2020 são disso exemplos. No caso do sector dos transportes, a cidade está apostada em promover uma alteração na repartição modal que visa racionalizar a utilização do automóvel e aumentar as deslocações a pé, de bicicleta e de transportes públicos, reduzindo assim decididamente os consumos energéticos e as emissões dentro do seu perímetro territorial, humanizando a cidade e aumentando a qualidade de vida dos que nela vivem, trabalham ou estudam, bem como dos que a visitam. -

URBAN PROJECT | NÓ DO LUMIAR and the Lisbon Northwest Gateway

URBAN PROJECT | NÓ DO LUMIAR and the Lisbon Northwest Gateway Gonçalo Duarte Pita Architecture Dissertation | Instituto Superior Técnico Coordinator: Prof. Carlos Moniz de Almeida Azenha Pereira da Cruz ABSTRACT The following report presents the work carried out for 2010/2012 Final Project course. The conducting element of this report is the impact road infrastructures may have, particularly when inserted in the urban context, whether they are generators of that context or the main cause of its frag- mentation. The mono-functionality of the road layout, which is a consequence of a mono-disciplinary approach to its conception, led to the incapacity of the structural road system to be part of the contem- porary city as an integrated actor of the urban space and therefore becoming an intrusive element. Supported by a reflection on road infrastructures, the goal of this report is to analyze the Lisbon struc- tural route consisting of Calçada de Carriche and Av. Padre Cruz. — the Northwest Gateway —, and the conception of a project on Nó do Lumiar, its main articulation point. Being one of Lisbon’s main gateways for centuries, the Northwest Gateway was responsible for defining the mobility structure of the North Ring when it was still part of the city’s periphery. Today, due to redefinitions of its route and section, it is an element of urban discontinuity along with other high performance roads as Eixo N-S and 2ª Circular. Nó do Lumiar is at this moment a dysfunctional urban centre due to the powerfull impact of its road system. Despite allowing an effective accessibility to automobiles on a broader range of the territory, its impact does not allow for a comfortable use of the space where it’s inserted, a space made up of elements of undeniable historic, patrimonial, cultural and administrative value. -

Alvalade Lumiar Olivais Areeiro Avenidas Novas São Domingos De

jes l R l s La u u A a a S a A v id a d - L eira e V ag te u l rr n e ro inh r í a Fe id rt ei Az o s m ldo a ua ib N d rna D R o e e ua A E ua do ix F d R ug R n E l ta r a é rla u i e n O e-S R it d i r rt ta a a o o o n s d ss o N Sa B s e e ix l a f a E t r L o ç ie i a A r a n n i P r l a n n a G u R c d u s D o o h r e -S a r a R p u a i a o te t d L r R e s e o n o b d a N i d n s o a na u x e r o i S R e E F S l T a e o d e i o u i R o a r d n r é e p e fr S l R a s A m f. D o o u a io r a ríc d P a a at i t S P a R A u u c u s la a R o is e i b u R o i ad e r L h V R a a l C á Ru n R o u S L o o M a u c d a t u i s a s c A l a de s í a ra e s e e u do F ar R e l ga v d z ha e n zin Ta R D h A P a u R x r R a a ilv n u r a a u ° S l a E a T o u a a n R s a c o M d a t M c A s o b r u o á á e e r i m L R s r r D d i i C a o o P r e l a r C E b a o e a s M a z ve a r l c h l r o C ís h o s Lu t a a o o - g a r u t l a h L e l y r - L c g i a c m - R e - a u Av S o enid a E R d u t e ai a l nha m Do l n n o a a i Am s e éli x a e a e Olivais a t b M o C m r A a o a C o r o a t v n P r i i e u r L u o n a B e R o t i d M r l a n a M o ó o u l t t d n a r l R - A r - o A Lumiar - A q p a - l a u a u o E e r m a u R reir d i e e s P x R a e st R Co o A a d d u sé o o J C a a Ru a s a e d e J r n r e a o o e t i R d s R s u r a r a P P a ro é L u f. -

Cidades, Sp21 | 2021 Towards a Necessary Regenerative Urban Planning 2

Cidades Comunidades e Territórios Sp21 | 2021 Por um planeamento urbano mais sustentável (parte II) Towards a necessary regenerative urban planning Insights from community-led initiatives for ecocity transformation Duncan Crowley, Teresa Marat-Mendes, Roberto Falanga, Thomas Henfrey and Gil Penha-Lopes Electronic version URL: https://journals.openedition.org/cidades/3384 ISSN: 2182-3030 Publisher DINÂMIA’CET-IUL Electronic reference Duncan Crowley, Teresa Marat-Mendes, Roberto Falanga, Thomas Henfrey and Gil Penha-Lopes, “Towards a necessary regenerative urban planning”, Cidades [Online], Sp21 | 2021, Online since 15 May 2021, connection on 20 May 2021. URL: http://journals.openedition.org/cidades/3384 This text was automatically generated on 20 May 2021. Cidades. Comunidades e Territórios is licensed under a Creative Commons Atribuição-Uso Não- Comercial-Proibição de realização de Obras Derivadas 4.0 International. Towards a necessary regenerative urban planning 1 Towards a necessary regenerative urban planning Insights from community-led initiatives for ecocity transformation Duncan Crowley, Teresa Marat-Mendes, Roberto Falanga, Thomas Henfrey and Gil Penha-Lopes Introduction 1 Global climate emergency declarations in 2019 (1,400 local governments, 28 countries) have highlighted the fact that decades of sustainable development have not adequately tackled what Monbiot (2013) suggest we call climate breakdown (CB). What is finally accepted, despite warnings for over half a century (Bookchin, 1964), is that failure to understand the full -

17 ¬43 ¬28 ¬23 ¬16 ¬21 ¬36 ¬30 ¬44 ¬63 ¬9 ¬53 ¬64 ¬35 ¬14 ¬13 ¬48 ¬27 ¬42 ¬52 ¬38 ¬31 ¬62 ¬29 ¬50 ¬3

Territórios da EDL - Rede DLBC Lisboa 21 Carta BIP/ZIP da CML (menos BIP/ZIP's 10 e 11) ¬5 ¬21 ¬ 8 ¬ ¬8 ¬8 ¬6 ID BIP / ZIP Freguesia ¬8 1 Casalinho da Ajuda Ajuda ¬66 2 2 de Maio Ajuda ¬8 Quinta do Cabrinha Alcântara, Campo de 7 20 3 Loureiro/ Av Ceuta Ourique e Estrela ¬ 67 ¬ ¬ 4 Portugal Novo Areeiro ¬67 5 Grafanil Santa Clara ¬67 6 Quinta da Torrinha Santa Clara ¬56 ¬67 ¬38 7 Quinta da Mourisca Santa Clara ¬25 67 8 Ameixoeira PER Santa Clara ¬ Ourives/ Estrada de ¬22 9 Chelas Beato ¬24 ¬26 67 12 Murtas Alvalade ¬ 13 Bela Flor Campolide ¬52 22 ¬ ¬40 14 Liberdade Campolide ¬39 ¬16 15 Quinta do Tarujo Campolide ¬18 16 Padre Cruz Carnide ¬18 17 Centro Historico Carnide Carnide ¬19 Az. dos Lameiros/ Az.Torre 18 do Fato Carnide 19 Horta Nova Carnide 20 Sete Céus Santa Clara ¬17 ¬48 21 Galinheiras Santa Clara 22 Alta de Lisboa Sul Lumiar 23 Graça/ Sapadores São Vicente ¬27 24 Quinta do Olival Lumiar ¬58 ¬12 25 Cruz Vermelha Lumiar 26 Pedro Queiróz Pereira Lumiar ¬58 27 Lóios Marvila ¬29 ¬28 28 Amendoeiras Marvila 29 Flamenga Marvila 30 Condado Marvila 31 Armador Marvila ¬61 Quinta das Salgadas/ ¬34 32 Alfinetes Marvila 33 Marquês de Abrantes Marvila ¬30 ¬34 34 PRODAC Marvila 31 ¬35 ¬ 35 Rego Avenidas Novas 36 Pena Arroios 45 ¬ 4 ¬33 37 Alto da Eira Penha de França ¬ 38 Quinta do Morgado Olivais 32 ¬53 ¬ 39 Quinta das Laranjeiras Parque das Nações 40 Casal dos Machados Parque das Nações ¬59 41 Sete Moinhos Campo de Ourique ¬60 ¬9 42 Casal Ventoso Campo de Ourique ¬57 60 ¬ Santa Maria Maior e São ¬14 15 ¬47 ¬60 ¬ ¬46 43 Alfama Vicente 44 Mouraria Santa Maria Maior 45 Furnas São Domingos de Benfica 46 Quinta do Lavrado Penha de França 47 Horizonte Penha de França S. -

Diapositivo 1

Os Governos Urbanos de Proximidade A experiência de Lisboa O processo de reforma político-administrativa e os novos modelos de governação urbana Barcelona, 22 Octobre 2018 João Seixas CICS-NOVA / FCSH Universidade Nova de Lisboa Câmara Municipal de Lisboa / GAMRAL Os governos urbanos de proximidade e a experiência de Lisboa 1. AS RAZÕES 2. A SUBSTÂNCIA 3. O PROCESSO 4. O ACOMPANHAMENTO 5. A CAPACITAÇÃO 6. O FUTURO Área Metropolitana de Lisboa 18 municípios, com c 2.95 milhões habs. (2017) Município Central de Lisboa com c. 600 mil habs. (2017) mas com c. 1.15 milhões territoriantes / dia e 58% PIB regional Lisboa: Grandes Elementos de Re-Gravitas Uma Nova Cidade: O fim do modernismo, a crise e a transição digital. O triplo crash e o capitalismo tecno-financeiro. Novas pressões e novas oportunidades. Sustentabilidade, Coesão/Justiça espacial, Qualidade Vida. Novas políticas e estratégias anti-crise: Carta Estratégica de Lisboa, Reestruturação política e administrativa (dos bairros à metrópole), Novo plano urbanístico, planos de bairros, processos de participação (ALocal 21, Orçamento Participativo, Urbanismo Participativo), economia local e empreendedorismo urbano Uma nova Urbanidade: Novas consciências e exigências cívicas. Crescente reconhecimento sociocultural dos desfasamentos entre cidade, ecologia urbana e política. O Compromisso Político: Pressões e exigências sobre as estruturas de administração da cidade (82% inquiridos). Claro compromisso político desde 2009/10. A crescente complexidade e interconectividade da vida urbana -

Info Julho Agosto 19 EN

FCGM - Soc. de Med. Imob., S.A. | AMI 5086 Realtors - Med. Imob., Lda. | AMI 5070 ŽůůĞĐƟŽŶŚŝĂĚŽͬ>ƵŵŝĂƌͬĂƉŝƚĂůͬDŝƌĂŇŽƌĞƐͬŽƵŶƚƌLJƐŝĚĞͬDĂƐƚĞƌDŝŶĂƐ'ĞƌĂŝƐ͕ƌĂƐŝů infosiimgroup www . siimgroup . pt JULY/AUGUST2019 RESIDENTIALREPORT infosiimgroup Market in a consolidation period The market is in a period of consolidation, with the foward indicators looking like the PHMS (Portuguese House Market Survey), which measure the opinion of a panel of professionals in the market, confirming a slowdown in the number and value of transactions together with the lowest expectation for the next 12 months since the upturn in the cycle in 2013. Until the end of the year we will still be seeing the publication of very positive figures but which for the most part, in the case of used premises, relate to deals concluded in 2018 and, in the case of new buildings purchased “off-plan”, to deals concluded in some case more than 18 months ago. It is the case of the results published by the INE (National Statistics Institute of Portugal) or the base of Confidencial Imobiliário SIR (Residential Information System) which relate to the information of the Inland Revenue or pre-emption rights of the CML (Lisbon City Hall), when the deed is signed. On the other hand the database of the SIR-RU (Residential-Urban Renewal Information System) relates to sales at the time of closure of the deal and so, if there is an inflection in the market, it will be in this one where it will be felt soonest. Having made this caveat for interpreting the results, we would nevertheless emphasise that the statistics on local prices recently disclosed by the INE (25 July) allow the following conclusions to be drawn: In the period of 12 months ending on 31 March 2019, all Portuguese cities with more than 100,000 inhabitants (those covered in this study) presented positive change in the median for €/m2 compared with the previous period (31.3.2017 to 31.3.2018). -

Research Report

MARVILA/BEATO RESEARCH REPORT João Carlos Martins João Mourato Institute of Social Sciences University of Lisbon Document produced for the Horizon 2020 project ‘ROCK’. Year: 2018. Status: Final. Disseminaon Level: Public. 1 Contents Figures Graphics Tables Introduction 1 Intervention Area 1.1 ROCK integration on Lisbon: 1998-2018. Between planning and the constructed city. Territorial Management, Strategic Plans. From late 1990’s to contemporary practices. Eastern Waterfront of Lisbon 1.2 ROCK Space, Internal borders, urban frontiers and mobilities 1.2.1 Zone 1: Marvila’s Library and Alfinetes Palace. PRODAC, Quinta do Chale, Cooperative Housing and Palace, Alfinetes and Marques de Abrantes Areas 1.2.2 Zone: 2: Island. Marvila and Beato Island Areas 1.2.3 Zone 3: Harbour. Marvila and Beato Harbour Areas 2 Socioeconomic Outline 2.1 Demographic features: people and families 2.2 Old and New Economic profiles 3. Built Space, Green Spaces and Voids 3.1 Housing Stock: Private and Public Funded Initiatives 3.2 Heritage and Culture related Spaces 3.3 Local Agriculture and Lisbon´s Green Belt. Urban Voids, empty spaces and future perspectives 4. Political and Institutional Outline 4.1 Elected governments and other political groups in Marvila and Beato 4.2 Local based groups. Public Funded initiatives and projects References 2 Figures Figure 1 Soil uses of Chelas Masterplan. Font: Gabinete Técnico da Habitação, CML Figure 2 ROCK Zones and Areas Figure 3: Zone 1 Library and Palace Figure 4: Bairro Chines Graffiti Figure 5: Collective Toilet on Bairro do Chines in the 1960’s. Figure 6: Library and Alfinetes Area Figure 7 Bairro Chines on the 1960’s Figure 8: Bairro Chines today. -

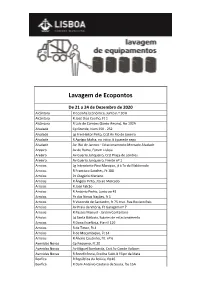

Lavagem De Ecopontos

Lavagem de Ecopontos De 21 a 24 de Dezembro de 2020 Alcântara R Cozinha Económica, Junto n.º 30 K Alcântara R José Dias Coelho, Ft 1 Alcântara R Luís de Camões (Santo Amaro), fte 102A Alvalade Cp Grande, Num 250 - 252 Alvalade Lg Frei Heitor Pinto, Crzt Av Rio de Janeiro Alvalade R Aprígio Mafra, no início Jt à parede cega Alvalade Av. Rio de Janeiro - Estacionamento Mercado Alvalade Areeiro Av de Roma, Forum Lisboa Areeiro Av Guerra Junqueiro, Crzt Praça de Londres Areeiro Av Guerra Junqueiro, Frente nº 1 Arroios Lg Intendente Pina Manique, jt à Tv do Maldonado Arroios R Francisco Sanches, Ft 180 Arroios Pc Olegário Mariano Arroios R Ângela Pinto, Jto ao Mercado Arroios R José Falcão Arroios R António Pedro, Junto ao 41 Arroios Pc das Novas Nações, ft 1 Arroios R Visconde de Santarém, ft 75 cruz. Rua Rovisco Pais Arroios Av Praia da Vitória, Ft Garagem nº 7 Arroios R Passos Manuel - Jardim Contantino Arroios Lg Santa Bárbara, lugares de estacionamento Arroios R Dona Estefânia, Fte nº 129 Arroios R de Timor, Ft 4 Arroios R de Moçambique, Ft 14 Arroios R Álvaro Coutinho, frt. nº 6 Avenidas Novas Cp Pequeno, Ft 20 Avenidas Novas Av Miguel Bombarda, Crzt Av Conde Valbom Avenidas Novas R Beneficência, Ecoliha Subt Jt Filipe da Mata Benfica R República da Bolívia, fte16 Benfica R Dom António Caetano de Sousa, fte 15A Campo de Ourique Av Engenheiro Duarte Pacheco, Ft Amoreiras - Jt CGD Campo de Ourique R Saraiva de Carvalho, Ecoilha sub. Czt R da Arrábida Campo de Ourique R Sampaio Bruno, junto ao nº 14 Campolide R Doutor Júlio Dantas, Ft à escola Carnide Lg Jogo da Bola, Frente Nº13 Carnide R Adelaide Cabete, Jto 3 B Carnide R Maria Brown, estacionamento Jardim Carnide R Públia Hortênsia de Castro, Próximo ao nº 2 Carnide R Adelaide Cabete, Frente nº2 Carnide Rua Padre Américo - Estacionamento Estrela Lg Santos, EcoIlha Subterrânea Estrela R Domingos Sequeira, Fte 74 Estrela R Borges Carneiro, Ft 65 Estrela R das Francesinhas, Ft. -

Relatório Semanal De OTEP De 18 a 25 De Setembro De 2020

Lista de 18 a 15 de Setembro de 2020 Nome Tipo Data de Início Data de Fim Processo Morada Freguesia UIT Festival Queer Cultural 15-09-2020 27-09-2020 617/POEP/2020 Avenida da Liberdade Santo António Centro 90º Feira do Livro Lisboa Cultural 04-08-2020 25-09-2020 540/POEP/2020 Parque Eduardo VII de Inglaterra Avenidas Novas Centro Rastreios Auditivos Gratuitos Publicitário 16-09-2020 18-09-2020 618/POEP/2020 Avenida de Roma Alvalade Centro Multiópticas Publicitário 19-09-2020 20-09-2020 704/POEP/2020 Avenida Elias Garcia Avenidas Novas Centro A Generala Filmagem 19-09-2020 20-09-2020 682/POEP/2020 Rua Gomes Freire Arroios Centro Isto é Gozar com Quem Trabalha Filmagem 20-09-2020 13-12-2020 668/POEP/2020 Rua Andrade Corvo Arroios Centro Exposição 50º Aniversário da CGTP-IN Institucional/Social 23-09-2020 17-10-2020 577/POEP/2020 Praça de Luís de Camões Misericórdia Centro Histórico Calçada dos Barbadinhos, Rua do Museu da Artilharia, Rua do Alviela, Rua da Bica do Sapato, 12.ª Edição Festival Todos 2020 Institucional/Social 17-09-2020 20-09-2020 619/POEP/2020 São Vicente, Santa Maria Maior Centro Histórico Rua de Santa Engrácia Lisbon Under Stars Divertimento/Espetáculo 19-08-2020 05-11-2020 614/POEP/2020 Largo do Carmo Santa Maria Maior Centro Histórico Lisboa Ciclável Desportivo 20-09-2020 20-09-2020 597/POEP/2020 Praça do Comércio Santa Maria Maior Centro Histórico Exposição do Quarteirão do Rossio Institucional/Social 21-09-2020 24-09-2021 709/POEP/2020 Praça D.