0 Annual Financial Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

DXE Liquidity Provider Registered Firms

DXE Liquidity Provider Program Registered Securities European Equities TheCboe following Europe Limited list of symbols specifies which firms are registered to supply liquidity for each symbol in 2021-09-28: 1COVd - Covestro AG Citadel Securities GCS (Ireland) Limited (Program Three) DRW Europe B.V. (Program Three) HRTEU Limited (Program Two) Jane Street Financial Limited (Program Three) Jump Trading Europe B.V. (Program Three) Qube Master Fund Limited (Program One) Societe Generale SA (Program Three) 1U1d - 1&1 AG Citadel Securities GCS (Ireland) Limited (Program Three) HRTEU Limited (Program Two) Jane Street Financial Limited (Program Three) 2GBd - 2G Energy AG Citadel Securities GCS (Ireland) Limited (Program Three) Jane Street Financial Limited (Program Three) 3BALm - WisdomTree EURO STOXX Banks 3x Daily Leveraged HRTEU Limited (Program One) 3DELm - WisdomTree DAX 30 3x Daily Leveraged HRTEU Limited (Program One) 3ITLm - WisdomTree FTSE MIB 3x Daily Leveraged HRTEU Limited (Program One) 3ITSm - WisdomTree FTSE MIB 3x Daily Short HRTEU Limited (Program One) 8TRAd - Traton SE Jane Street Financial Limited (Program Three) 8TRAs - Traton SE Jane Street Financial Limited (Program Three) Cboe Europe Limited is a Recognised Investment Exchange regulated by the Financial Conduct Authority. Cboe Europe Limited is an indirect wholly-owned subsidiary of Cboe Global Markets, Inc. and is a company registered in England and Wales with Company Number 6547680 and registered office at 11 Monument Street, London EC3R 8AF. This document has been established for information purposes only. The data contained herein is believed to be reliable but is not guaranteed. None of the information concerning the services or products described in this document constitutes advice or a recommendation of any product or service. -

Liste Des Actions Concernées Par L'interdiction De Positions Courtes Nettes

Liste des actions concernées par l'interdiction de positions courtes nettes L’interdiction s’applique aux actions listées sur une plate-forme française et relevant de la compétence de l’AMF au titre du règlement 236/2012 (information disponible dans les registres ESMA). Cette liste est fournie à titre informatif. L'AMF n'est pas en mesure de garantir que le contenu disponible est complet, exact ou à jour. Compte tenu des diverses sources de données sous- jacentes, des modifications pourraient être apportées régulièrement. Isin Nom FR0010285965 1000MERCIS FR0013341781 2CRSI FR0010050773 A TOUTE VITESSE FR0000076887 A.S.T. GROUPE FR0010557264 AB SCIENCE FR0004040608 ABC ARBITRAGE FR0013185857 ABEO FR0012616852 ABIONYX PHARMA FR0012333284 ABIVAX FR0000064602 ACANTHE DEV. FR0000120404 ACCOR FR0010493510 ACHETER-LOUER.FR FR0000076861 ACTEOS FR0000076655 ACTIA GROUP FR0011038348 ACTIPLAY (GROUPE) FR0010979377 ACTIVIUM GROUP FR0000053076 ADA BE0974269012 ADC SIIC FR0013284627 ADEUNIS FR0000062978 ADL PARTNER FR0011184241 ADOCIA FR0013247244 ADOMOS FR0010340141 ADP FR0010457531 ADTHINK FR0012821890 ADUX FR0004152874 ADVENIS FR0013296746 ADVICENNE FR0000053043 ADVINI US00774B2088 AERKOMM INC FR0011908045 AG3I ES0105422002 AGARTHA REAL EST FR0013452281 AGRIPOWER FR0010641449 AGROGENERATION CH0008853209 AGTA RECORD FR0000031122 AIR FRANCE -KLM FR0000120073 AIR LIQUIDE FR0013285103 AIR MARINE NL0000235190 AIRBUS FR0004180537 AKKA TECHNOLOGIES FR0000053027 AKWEL FR0000060402 ALBIOMA FR0013258662 ALD FR0000054652 ALES GROUPE FR0000053324 ALPES (COMPAGNIE) -

Euro Stoxx® Total Market Index

EURO STOXX® TOTAL MARKET INDEX Components1 Company Supersector Country Weight (%) ASML HLDG Technology Netherlands 3.45 LVMH MOET HENNESSY Consumer Products & Services France 2.76 LINDE Chemicals Germany 2.40 SAP Technology Germany 2.38 TOTAL Energy France 1.99 SANOFI Health Care France 1.88 SIEMENS Industrial Goods & Services Germany 1.84 ALLIANZ Insurance Germany 1.74 L'OREAL Consumer Products & Services France 1.55 IBERDROLA Utilities Spain 1.38 SCHNEIDER ELECTRIC Industrial Goods & Services France 1.35 AIR LIQUIDE Chemicals France 1.33 ENEL Utilities Italy 1.32 BASF Chemicals Germany 1.23 ADYEN Industrial Goods & Services Netherlands 1.13 ADIDAS Consumer Products & Services Germany 1.13 AIRBUS Industrial Goods & Services France 1.08 BNP PARIBAS Banks France 1.05 DAIMLER Automobiles & Parts Germany 1.03 ANHEUSER-BUSCH INBEV Food, Beverage & Tobacco Belgium 1.02 DEUTSCHE TELEKOM Telecommunications Germany 1.02 BAYER Health Care Germany 1.00 VINCI Construction & Materials France 0.98 BCO SANTANDER Banks Spain 0.93 Kering Retail France 0.87 AXA Insurance France 0.86 PHILIPS Health Care Netherlands 0.85 SAFRAN Industrial Goods & Services France 0.85 DEUTSCHE POST Industrial Goods & Services Germany 0.84 INFINEON TECHNOLOGIES Technology Germany 0.84 Prosus Technology Netherlands 0.83 ESSILORLUXOTTICA Health Care France 0.80 DANONE Food, Beverage & Tobacco France 0.73 INTESA SANPAOLO Banks Italy 0.73 MUENCHENER RUECK Insurance Germany 0.72 PERNOD RICARD Food, Beverage & Tobacco France 0.66 ING GRP Banks Netherlands 0.64 HERMES INTERNATIONAL -

ESMA Report on Application of AMP 2020

Report To the European Commission on the application of accepted market practices 16 December 2020 | ESMA70-156-3782 ESMA REGULAR USE Table of Contents 1 Executive Summary ....................................................................................................... 2 2 Background .................................................................................................................... 3 3 Information on the legal situation of AMPs established under MAD and AMPs established under MAR ............................................................................................................................ 5 3.1 CNMV ..................................................................................................................... 5 3.2 CMVM ..................................................................................................................... 6 3.3 CONSOB ................................................................................................................ 6 3.4 AMF ........................................................................................................................ 6 4 Application of the established AMPs............................................................................... 7 4.1 AMP established by the CNMV under MAR ............................................................ 7 4.2 AMP established by the CMVM under MAR ............................................................ 8 4.3 AMP established by CONSOB under MAD and MAR ............................................. -

Cm-Am Small & Midcap Euro

CM-AM SMALL & MIDCAP EURO SEMI-ANNUAL INFORMATION DOCUMENT AS AT 30/06/2021 LEGAL FORM OF THE UCI General mutual fund (SICAV) CLASSIFICATION ECB classification Equity funds ALLOCATION OF PROFIT / (LOSS) Profit / (loss) available for accumulation F0526 - CM AM SMALL & MIDCAP EURO: INFORMATION DOCUMENT AS OF 30/06/2021 Page 1 of 13 STATEMENT OF NET ASSETS Amount at the end of Items in the statement of net assets the period * a) The eligible financial securities referred to in 1° of I of Article L. 214-20 of the French Monetary and Financial Code 205,939,659.89 b) Bank assets 11,747,942.98 c) Other assets held by the UCITS 2,880,955.00 d) Total assets held by the UCITS 220,568,557.87 e) Liabilities -1,071,710.80 f) Net asset value 219,496,847.07 * Figures are approved F0526 - CM AM SMALL & MIDCAP EURO: INFORMATION DOCUMENT AS OF 30/06/2021 Page 2 of 13 NUMBER OF UNITS OUTSTANDING AND NET ASSET VALUE PER UNIT OR SHARE Number of units Unit Class Type of unit Net assets Net asset value outstanding C1 CM-AM SM.M.EU.RC3D Available for accumulation 93,571,593.11 2,531,260.754 36.96 C2 CM-AM SM.M.EU.IC3D Available for accumulation 75,481,377.72 1,952,490.836 38.65 C3 CM-AM SM.M.EUR.S3D Available for accumulation 50,443,876.24 1,542,655.243 32.69 F0526 - CM AM SMALL & MIDCAP EURO: INFORMATION DOCUMENT AS OF 30/06/2021 Page 3 of 13 ITEMS IN THE SECURITIES PORTFOLIO Percentage Items in the securities portfolio: Net assets Total assets a) Eligible financial securities and money market instruments admitted to trading on a regulated market within the meaning of Article L. -

Euro Stoxx® Total Market Small Index

EURO STOXX® TOTAL MARKET SMALL INDEX Components1 Company Supersector Country Weight (%) BE SEMICONDUCTOR Technology Netherlands 1.34 DIALOG SEMICON Technology Germany 1.32 Valmet Industrial Goods & Services Finland 1.19 EVOTEC Health Care Germany 1.18 BANK OF IRELAND GROUP Banks Ireland 1.11 SOITEC Technology France 1.09 BANCO BPM Banks Italy 1.07 TAG IMMOBILIEN AG Real Estate Germany 1.07 WIENERBERGER Construction & Materials Austria 1.03 INTERPUMP GRP Industrial Goods & Services Italy 1.03 COFINIMMO Real Estate Belgium 0.97 AEDIFICA Real Estate Belgium 0.92 SHOP APOTHEKE EUROPE Personal Care, Drug & Grocery Stores Germany 0.85 ALTEN Technology France 0.83 SPIE Construction & Materials France 0.77 BCO SABADELL Banks Spain 0.77 ITALGAS Utilities Italy 0.76 FREENET Telecommunications Germany 0.75 MORPHOSYS Health Care Germany 0.74 ALSTRIA OFFICE REIT Real Estate Germany 0.74 SOLVAC Chemicals Belgium 0.71 ARCADIS Construction & Materials Netherlands 0.70 GERRESHEIMER Health Care Germany 0.69 KONECRANES Industrial Goods & Services Finland 0.69 TIETOEVRY Technology Finland 0.68 GRAND CITY PROPERTIES Real Estate Germany 0.67 SOPRA STERIA GROUP Technology France 0.65 VARTA AG Industrial Goods & Services Germany 0.64 DE LONGHI Consumer Products & Services Italy 0.64 CORBION Food, Beverage & Tobacco Netherlands 0.64 VIDRALA Industrial Goods & Services Spain 0.64 CA IMMOBILIEN ANLAGEN Real Estate Austria 0.63 BUZZI UNICEM Construction & Materials Italy 0.63 VISCOFAN Food, Beverage & Tobacco Spain 0.62 AZIMUT HLDG Financial Services Italy 0.62 -

Registration Document • ENGIE

2015 Registration Document including annual financial report WorldReginfo - 7c177e20-90ff-43ea-b1cd-43456532569f summary PRESENTATION OF THE 4.5 Statutory Auditors’ special report on regulated agreements and GROUP 3 commitments, transactions with 1.1 Profile, organization and strategy of related parties, service contracts 125 the Group 4 4.6 Compensation and benefits paid to 1.2 Key figures 9 members of corporate governance bodies 130 1.3 Description of business lines in 2015 13 1.4 Real estate, plant and equipment 46 1.5 Innovation, research and technologies policy 48 INFORMATION ON THE SHARE CAPITAL AND SHAREHOLDING 153 RISK FACTORS 51 5.1 Information on the share capital and 2.1 Risk management process 53 non-equity instruments 154 2.2 Risks related to the external 5.2 Shareholding 165 environment 54 2.3 Operating risks 58 2.4 Industrial risks 61 FINANCIAL INFORMATION 169 2.5 Financial risks 64 6.1 Management report 170 6.2 Financial statements 187 6.3 Statutory auditor’s report on the SOCIAL AND ENVIRONMENTAL consolidated financial statements 305 INFORMATION, 6.4 Parent company financial statements 307 CORPORATE SOCIAL 6.5 Statutory auditor’s report on the parent company financial statements 354 COMMITMENTS 67 3.1 Ethics and compliance 68 3.2 Social Information 70 ADDITIONAL INFORMATION 357 3.3 Environmental information 83 7.1 Specific statutory provisions and 3.4 Societal information 92 bylaws 358 3.5 Report of one statutory auditor 7.2 Legal and arbitration proceedings – designated as an independent Competition and industry third-party -

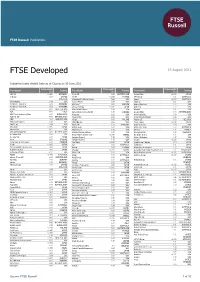

FTSE Developed

2 FTSE Russell Publications 19 August 2021 FTSE Developed Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 1&1 AG <0.005 GERMANY Alcon AG 0.05 SWITZERLAND Aozora Bank <0.005 JAPAN 3i Group 0.03 UNITED Ald SA <0.005 FRANCE APA Group 0.01 AUSTRALIA KINGDOM Alexandria Real Estate Equity 0.04 USA Appen <0.005 AUSTRALIA 3M Company 0.19 USA Alexion Pharm 0.07 USA Apple Inc. 3.61 USA A P Moller - Maersk A 0.02 DENMARK Alfa Laval 0.02 SWEDEN Applied Materials 0.22 USA A P Moller - Maersk B 0.03 DENMARK Alfresa Holdings <0.005 JAPAN Aptiv PLC 0.07 USA a2 Milk 0.01 NEW ZEALAND Align Technology Inc 0.08 USA Aramark 0.01 USA A2A 0.01 ITALY Alimentation Couche-Tard B 0.05 CANADA Arcelor Mittal 0.04 NETHERLANDS AAC Technologies Holdings 0.01 HONG KONG Alleghany 0.02 USA Arch Capital Gp 0.03 USA Aalberts NV 0.01 NETHERLANDS Allegion PLC 0.02 USA Archer Daniels Midland 0.06 USA ABB 0.1 SWITZERLAND Allegro 0.01 POLAND Argenx S.E 0.03 BELGIUM Abbott Laboratories 0.34 USA Alliant Energy 0.02 USA Ariake Japan <0.005 JAPAN AbbVie Inc 0.33 USA Allianz SE 0.17 GERMANY Arista Networks 0.04 USA ABC-Mart <0.005 JAPAN Allstate Corp 0.07 USA Aristocrat Leisure 0.03 AUSTRALIA Abiomed Inc 0.02 USA Ally Financial 0.03 USA Arkema 0.01 FRANCE ABN AMRO Bank NV 0.01 NETHERLANDS Alnylam Pharmaceuticals 0.03 USA Aroundtown SA 0.02 GERMANY Accenture Cl A 0.31 USA Alony Hetz Properties & Inv <0.005 ISRAEL Arrow Electronics 0.01 USA Acciona S.A. -

Plans D'investissement Programmé En

PLANS D’INVESTISSEMENT PROGRAMMÉ EN ETF ISIN NOM LU1525418643 AMUNDI BARCLAYS EURO CORP BBB 1-5Y EUR (ACC) LU1437024729 AMUNDI BARCLAYS GLOBAL AGG 500M EUR (ACC) LU1708330318 AMUNDI BARCLAYS GLOBAL AGG 500M EUR (ACC) LU1737654019 AMUNDI BARCLAYS GLOBAL AGG 500M EUR (DIST) LU1778293313 AMUNDI BARCLAYS GLOBAL AGG 500M USD (ACC) LU1525418726 AMUNDI BARCLAYS US CORP BBB 1-5Y USD (ACC) LU1525419294 AMUNDI BARCLAYS US GOV INFLATION-LINKED BONDS USD (ACC) LU1681041387 AMUNDI BBB EURO CORP INV. GRADE EUR (ACC) LU2037750168 AMUNDI BREAKEVEN INFLATION USD 10 YEAR USD (ACC) LU1681046931 AMUNDI CAC 40 EUR (ACC) LU1681047079 AMUNDI CAC 40 EUR (DIST) FR0010655712 AMUNDI DAX EUR (ACC) LU1437025296 AMUNDI ETF FTSE 100 GBP (ACC) LU1681049109 AMUNDI ETF S&P 500 EUR HEDGED (ACC) FR0010757781 AMUNDI ETF SHORT EURO STOXX 50 EUR (ACC) FR0010791194 AMUNDI ETF SHORT MSCI USA EUR (ACC) FR0010790980 AMUNDI ETF STOXX EUROPE 50 EUR (ACC) LU1437018168 AMUNDI EURO AGG CORP SRI EUR (ACC) LU2182388236 AMUNDI EURO AGG SRI EUR (ACC) LU1681040066 AMUNDI EURO CORP FINANCIALS IBOXX EUR (ACC) LU2037748774 AMUNDI EURO CORP SRI 0-3Y EUR (ACC) LU1737653987 AMUNDI EURO CORP SRI EUR (DIST) LU1681039647 AMUNDI EURO CORPS EUR (ACC) LU1681040496 AMUNDI EURO HIGH YIELD LIQUID BOND IBOXX EUR (ACC) FR0010754127 AMUNDI EURO INFLATION EUR (ACC) LU1681047236 AMUNDI EURO STOXX 50 EUR (ACC) LU1681047319 AMUNDI EURO STOXX 50 EUR (DIST) LU1681047400 AMUNDI EURO STOXX 50 USD (ACC) LU1681039563 AMUNDI EUROPE MULTI SMART ALLOCATION EUR (ACC) LU1923163676 AMUNDI FLOATING RATE EURO CORP 1-3 GBP -

JHVIT Quarterly Holdings 6.30.2021

John Hancock Variable Insurance Trust Portfolio of Investments — June 30, 2021 (unaudited) (showing percentage of total net assets) 500 Index Trust 500 Index Trust (continued) Shares or Shares or Principal Principal Amount Value Amount Value COMMON STOCKS – 97.6% COMMON STOCKS (continued) Communication services – 10.9% Hotels, restaurants and leisure (continued) Diversified telecommunication services – 1.2% Marriott International, Inc., Class A (A) 55,166 $ 7,531,262 McDonald’s Corp. 155,101 35,826,780 AT&T, Inc. 1,476,336 $ 42,488,950 MGM Resorts International 86,461 3,687,562 Lumen Technologies, Inc. 208,597 2,834,833 Norwegian Cruise Line Holdings, Ltd. (A) 75,206 2,211,808 Verizon Communications, Inc. 858,032 48,075,533 Penn National Gaming, Inc. (A) 30,865 2,360,864 93,399,316 Royal Caribbean Cruises, Ltd. (A) 45,409 3,872,480 Entertainment – 1.9% Starbucks Corp. 244,224 27,306,685 Activision Blizzard, Inc. 160,872 15,353,624 Wynn Resorts, Ltd. (A) 21,994 2,689,866 Electronic Arts, Inc. 60,072 8,640,156 Yum! Brands, Inc. 62,442 7,182,703 Live Nation Entertainment, Inc. (A) 30,014 2,628,926 151,933,613 Netflix, Inc. (A) 91,957 48,572,607 Household durables – 0.4% Take-Two Interactive Software, Inc. (A) 24,146 4,274,325 D.R. Horton, Inc. 68,073 6,151,757 The Walt Disney Company (A) 376,832 66,235,761 Garmin, Ltd. 31,500 4,556,160 145,705,399 Leggett & Platt, Inc. 27,959 1,448,556 Interactive media and services – 6.3% Lennar Corp., A Shares 55,918 5,555,453 Alphabet, Inc., Class A (A) 62,420 152,416,532 Mohawk Industries, Inc. -

TD Ameritrade French Financial Transactional Tax-Impacted Securities PO Box 2760 Omaha, NE 68103-2760 Fax: 866-468-6268

TD Ameritrade French Financial Transactional Tax-Impacted Securities PO Box 2760 Omaha, NE 68103-2760 Fax: 866-468-6268 Cusip Symbol Description Cusip Symbol Description 00435F309 ACCYY ACCOR ADR SPONSORED 29888Q207 ETCMY EUTELSAT 00786A107 ARRPY AEROPORTS DE PARIS COMMUNICATIONS ADR ADR UNSPONSORED SPONSORED 009119108 AFLYY AIR FRANCE-KLM ADR 36829U106 GZPZY GAZTRANSPORT SPONSORED ET TECHNIGAZ ADR 009126202 AIQUY AIR LIQUIDE (L') ADR UNSPONSORED UNSPONSORED 37428N105 GRPTY GETLINK SE ADR 021244207 ALSMY ALSTOM ADR UNSPONSORED UNSPONSORED 42751Q105 HESAY HERMES INTERNATIONAL 864691209 SZSAY SUEZ ADR ADR UNSPONSORED 041232109 ARKAY ARKEMA ADR SPONSORED 45173Y101 ILIAY ILIAD ADR UNSPONSORED 04962A105 AEXAY ATOS SE ADR 45248D108 IMYSY IMERYS ADR UNSPONSORED UNSPONSORED 054536107 AXAHY AXA ADR SPONSORED 90459E10 URMCY UNIBAIL-RODAMCO- 05565A103 BNP PARIBAS ADR WESTFIELD ADR 05565A202 BNPQY BNP PARIBAS ADR UNSPONSORED SPONSORED 462629205 IPSEY IPSEN ADR SPONSORED 088736103 BICEY BIC ADR UNSPONSORED 47215K107 JCDXY JC DECAUX SA ADR 09074E101 BMXXY BIOMERIEUX ADR UNSPONSORED 102117108 BOUYY BOUYGUES ADR 492089107 PPRUY KERING ADR UNSPONSORED UNSPONSORED 12117P109 BVVBY BUREAU VERITAS ADR 502117203 LRLCY L'OREAL ADR SPONSORED UNSPONSORED 502441306 LVMUY LVMH MOET HENNESSY F2R22T119 GSEFF COVIVIO COM VUITTON SE ADR 12620R105 CNPAY CNP ASSURANCES S.A. UNSPONSORED ADR UNSPONSORED 524671104 LGRDY LEGRAND SA ADR 13961R100 CGEMY CAPGEMINI ADR UNSPONSORED UNSPONSORED 59170V101 MTPVY M6-METROPOLE 144430204 CRRFY CARREFOUR SA ADR TELEVISION ADR SPONSORED -

Universal Registration Document

UNIVERSAL 2019, including REGISTRATION the annual financial report DOCUMENT Sommaire INTRODUCTION 1 5 SUSTAINABLE DEVELOPMENT AND CORPORATE SOCIAL RESPONSIBILITY* 190 Who we are 2 Message from the chairman and chief executive officer 3 5.1 Vision, policies and organization* 192 The group’s performance in 2019 4 5.2 Main risks with regard to corporate social 2019 key events 6 and environmental responsibility* 193 A multi-local leader 8 5.3 Health and safety at the heart of the Group’s preoccupations* 194 A pure player of renewable energies 10 5.4 Dialogue of quality with local communities* 195 Focus on storage 12 5.5 Ethical and responsible practices all along Social and environmental responsibility 14 the value chain* 196 Shareholders 16 5.6 A proactive environmental policy* 197 Governance 18 5.7 Attracting and developing talents* 198 5.8 Report of the independent third-party body* 203 1 PRESENTATION 20 5.9 Vigilance plan* 204 1.1 Overall presentation* 22 1.2 Description of the renewable energy market 28 6 REPORT ON CORPORATE GOVERNANCE* 206 1.3 Neoen’s business 34 1.4 Intellectual property* 53 6.1 State of governance* 208 6.2 Organisation of corporate governance* 215 2 BUSINESS REPORT 54 6.3 Remuneration of corporate officers* 227 6.4 Other information* 248 2.1 Alternative performance indicators and operating data 56 2.2 Analysis of operations and results 58 7 CAPITAL AND SHAREHOLDING STRUCTURE 254 2.3 Financing and investments 71 2.4 Information on trends and objectives 80 7.1 Information on the Company* 256 2.5 Significant change in