Cm-Am Small & Midcap Euro

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2001 13.02.2002 2.75 MB

Umschl_GeBe_e.qxd 25.04.2002 18:38 Uhr Seite 2 Building the Future Annual Report 2001 Umschl_GeBe_e.qxd 25.04.2002 18:39 Uhr Seite 3 Nemetschek Group at a Glance 2001 2000 Change in million DM in million DM % Sales revenue 243.4 247.7 – 1.7 % Operating income 247.9 253.1 – 2.1 % Gross profit 217.6 210.7 3.3 % as % of sales revenue 89.4 % 85.1 % EBITDA 12.2 16.4 – 25.6 % as % of sales revenue 5.0 % 6.6 % EBIT – 86.8 –8.3 945.8 % as % of sales revenue – 35.7 % – 3.4 % Net income/DVFA/SG profit after goodwill amortisation – 90.9 –10.7 749.5 % per share in DM – 9.44 – 1.11 DVFA/SG result before goodwill amortisation and equity-results –2.2 8.2 – 126.8 % per share in DM – 0.23 0.85 Umschl_GeBe_e.qxd 25.04.2002 18:39 Uhr Seite 5 Nemetschek. Present Worldwide 160,000 customers world-wide. Represented in 142 countries. 14 international subsidiaries. 400 sales partners. More than 1,000 employees world-wide. Three European development centers. Nemetschek Country Representation (without Sales Partners) Image_GeBe_e_Einzelseiten.qxd 25.04.2002 18:41 Uhr Seite 3 DESIGN BUILD MANAGE POTENTIALS Foreword 4 Building the Future 6 Design 10 Build 14 Manage 18 Potentials 20 Consolidated Financial Statements of Nemetschek AG 25 Management Report 26 Report of the Supervisory Board 31 Balance Sheet 32 Profit and Loss Statement 34 Statement of Changes in Equity 35 Cashflow Statement 36 Notes to the Accounts 37 Development of Fixed Assets 58 Report of Independent Auditors 60 The Management 62 Masthead 65 3 Image_GeBe_e_Einzelseiten.qxd 25.04.2002 18:41 Uhr Seite 4 Gerhardt Merkel Chief Executive Officer Image_GeBe_e_Einzelseiten.qxd 25.04.2002 18:41 Uhr Seite 5 FOREWORD Setting the course for the future. -

DXE Liquidity Provider Registered Firms

DXE Liquidity Provider Program Registered Securities European Equities TheCboe following Europe Limited list of symbols specifies which firms are registered to supply liquidity for each symbol in 2021-09-28: 1COVd - Covestro AG Citadel Securities GCS (Ireland) Limited (Program Three) DRW Europe B.V. (Program Three) HRTEU Limited (Program Two) Jane Street Financial Limited (Program Three) Jump Trading Europe B.V. (Program Three) Qube Master Fund Limited (Program One) Societe Generale SA (Program Three) 1U1d - 1&1 AG Citadel Securities GCS (Ireland) Limited (Program Three) HRTEU Limited (Program Two) Jane Street Financial Limited (Program Three) 2GBd - 2G Energy AG Citadel Securities GCS (Ireland) Limited (Program Three) Jane Street Financial Limited (Program Three) 3BALm - WisdomTree EURO STOXX Banks 3x Daily Leveraged HRTEU Limited (Program One) 3DELm - WisdomTree DAX 30 3x Daily Leveraged HRTEU Limited (Program One) 3ITLm - WisdomTree FTSE MIB 3x Daily Leveraged HRTEU Limited (Program One) 3ITSm - WisdomTree FTSE MIB 3x Daily Short HRTEU Limited (Program One) 8TRAd - Traton SE Jane Street Financial Limited (Program Three) 8TRAs - Traton SE Jane Street Financial Limited (Program Three) Cboe Europe Limited is a Recognised Investment Exchange regulated by the Financial Conduct Authority. Cboe Europe Limited is an indirect wholly-owned subsidiary of Cboe Global Markets, Inc. and is a company registered in England and Wales with Company Number 6547680 and registered office at 11 Monument Street, London EC3R 8AF. This document has been established for information purposes only. The data contained herein is believed to be reliable but is not guaranteed. None of the information concerning the services or products described in this document constitutes advice or a recommendation of any product or service. -

Financial Statements of Nemetschek SE for 2020

Building Lifecycle Intelligence FINANCIAL STATEMENTS (GERMAN COMMERCIAL CODE) NEMETSCHEK SE 2020 Financial Statements Nemetschek SE 2 4 Management Report 56 Balance Sheet Nemetschek SE 58 Profit and Loss Account Nemetschek SE 60 Notes to the Financial Statement ofNemetschek SE 61 Accounting policies 61 Notes to the Balance Sheet 65 Notes to the Profit and Loss Account 66 Other disclosures 68 Supervisory board 69 Executive board 70 Statementoffixedassets Nemetschek SE 72 Declaration of the members of the body authorized to represent the company 72 Inde pendent auditor’s report 78 Publication Details 3 Group Management Report 4 6 About This Report 6 Group Principles 6 Group Business Model 10 Targets and Strategy 12 Corporate Management and Governance 13 Research and Development 14 Non-Financial Declaration 14 Principles 14 Corporate Social Responsibility (CSR) at the N emetschek Group 15 Key Non-Financial Issues 16 ain Risks M Group Management Report Group 16 Key CSR Issues 22 Economic Report 22 Macroeconomic and Industry-Specific Conditions 25 Business Performance in 2020 and Key Events Influencing the Company’s Business Performance 26 Results of Operations, Financial Position and Net Assets of the Nemetschek Group 36 Results of Operations, Financial Position and Net Assets of Nemetschek SE 38 Comparison of Actual and Forecast Business Performance of the Nemetschek Group 39 Opportunity and Risk Report 46 Outlook 2021 50 O ther Disclosures, Remuneration Report 50 Corporate Governance Declaration 50 Explanatory Report of the Executive Board on Disclosures Pursuant to Sections 289a and 315a of the HGB 52 Remuneration Report 5 Combined Management Report for the 2020 Financial Year About This Report The management report of Nemetschek SE and the Group The legal corporate structure is presented in the notes of the con- managementreportforthe2020financialyearhavebeenconso- solidatedfinancialstatementsonpage124. -

Liste Des Actions Concernées Par L'interdiction De Positions Courtes Nettes

Liste des actions concernées par l'interdiction de positions courtes nettes L’interdiction s’applique aux actions listées sur une plate-forme française et relevant de la compétence de l’AMF au titre du règlement 236/2012 (information disponible dans les registres ESMA). Cette liste est fournie à titre informatif. L'AMF n'est pas en mesure de garantir que le contenu disponible est complet, exact ou à jour. Compte tenu des diverses sources de données sous- jacentes, des modifications pourraient être apportées régulièrement. Isin Nom FR0010285965 1000MERCIS FR0013341781 2CRSI FR0010050773 A TOUTE VITESSE FR0000076887 A.S.T. GROUPE FR0010557264 AB SCIENCE FR0004040608 ABC ARBITRAGE FR0013185857 ABEO FR0012616852 ABIONYX PHARMA FR0012333284 ABIVAX FR0000064602 ACANTHE DEV. FR0000120404 ACCOR FR0010493510 ACHETER-LOUER.FR FR0000076861 ACTEOS FR0000076655 ACTIA GROUP FR0011038348 ACTIPLAY (GROUPE) FR0010979377 ACTIVIUM GROUP FR0000053076 ADA BE0974269012 ADC SIIC FR0013284627 ADEUNIS FR0000062978 ADL PARTNER FR0011184241 ADOCIA FR0013247244 ADOMOS FR0010340141 ADP FR0010457531 ADTHINK FR0012821890 ADUX FR0004152874 ADVENIS FR0013296746 ADVICENNE FR0000053043 ADVINI US00774B2088 AERKOMM INC FR0011908045 AG3I ES0105422002 AGARTHA REAL EST FR0013452281 AGRIPOWER FR0010641449 AGROGENERATION CH0008853209 AGTA RECORD FR0000031122 AIR FRANCE -KLM FR0000120073 AIR LIQUIDE FR0013285103 AIR MARINE NL0000235190 AIRBUS FR0004180537 AKKA TECHNOLOGIES FR0000053027 AKWEL FR0000060402 ALBIOMA FR0013258662 ALD FR0000054652 ALES GROUPE FR0000053324 ALPES (COMPAGNIE) -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

MDAX—2019 Supervisory Board Study Key Insights from This Year’S Analysis by Russell Reynolds Associates

MDAX—2019 Supervisory Board Study Key insights from this year’s analysis by Russell Reynolds Associates Summary Over the past year, Germany's MDAX companies have experienced significant change. The number of companies in the index increased by 10, bringing the overall total to 60. Moreover, 11 "old economy" firms, including Jungheinrich, Krones, Leoni, Salzgitter and Schaeffler, were ousted by pharma, med and biotech risers, such as Evotec, Morphosys, Qiagen, Sartorius and Siemens Healthineers, as well as "new economy" powerhouses like Dialog, Nemetschek, Software AG, Telefonica D, and United Internet. This was also an exceptional election year, with 106 shareholder representative positions expiring. All positions were filled. A total of 67 board members were re-elected, while 36 were replaced. The three remaining roles were absorbed by changes to board sizes. Female shareholder representation surpasses 30 percent For the first time, the share of female shareholder representatives surpassed the required quota, reaching 30.6 percent. Including employee representatives, women now make up 32 percent of supervisory board members. A total of three boards are now chaired by women. However, there is still a major gender discrepancy concerning positions of power when comparing chairpersonships and especially executive board positions. Only four companies can boast more than 30 percent of female executives, while 40 MDAX companies do not have a single woman in a leadership role. Accelerated increase in digital directors The number of digital directors on MDAX supervisory boards showed a significant 30 percent year- on-year increase. However, digital expertise is still unevenly spread in the MDAX. Seven companies have three or more digital directors, while 57 percent of boards completely lack digital expertise. -

Media R Elease

Frankfurt/Main, 5 December 2018 Carl Zeiss Meditec AG to be included in MDAX Three changes in SDAX/ Changes to be effective as of 27 December 2018 On Wednesday, Deutsche Börse announced changes to its selection indices, which will become effective on 27 December 2018. The shares of Carl Zeiss Meditec AG will be included in the MDAX index and will replace the shares of CTS Eventim AG & CO. KGaA, which will be included in the SDAX index. The exclusion of CTS Eventim AG & CO. KGaA is based on the fast exit rule; Carl Zeiss Meditec AG is eligible for the index inclusion due to its market capitalisation and order book turnover. MDAX tracks the 60 largest and most liquid companies below DAX. The following changes will apply to SDAX: CTS Eventim AG & CO. KGaA, Knorr- Bremse AG and VARTA AG will be included. The shares of BayWa AG and DMG Mori AG will be deleted from the index, according to the fast exit rule. SDAX tracks the 70 next biggest and most actively traded companies after the MDAX. The constituents of the indices DAX and TecDAX remain unchanged. The next scheduled index review is 5 March 2019. DAX®, MDAX®, SDAX® and TecDAX® are registered trademarks of Deutsche Börse AG. Media Release About Deutsche Börse – Market Data + Services In the area of data, Deutsche Börse Group is one of the world’s leading service providers for the securities industry with products and services for issuers, investors, intermediaries, and data vendors. The Group’s portfolio covers the entire value chain in the financial business. -

Euro Stoxx® Total Market Index

EURO STOXX® TOTAL MARKET INDEX Components1 Company Supersector Country Weight (%) ASML HLDG Technology Netherlands 3.45 LVMH MOET HENNESSY Consumer Products & Services France 2.76 LINDE Chemicals Germany 2.40 SAP Technology Germany 2.38 TOTAL Energy France 1.99 SANOFI Health Care France 1.88 SIEMENS Industrial Goods & Services Germany 1.84 ALLIANZ Insurance Germany 1.74 L'OREAL Consumer Products & Services France 1.55 IBERDROLA Utilities Spain 1.38 SCHNEIDER ELECTRIC Industrial Goods & Services France 1.35 AIR LIQUIDE Chemicals France 1.33 ENEL Utilities Italy 1.32 BASF Chemicals Germany 1.23 ADYEN Industrial Goods & Services Netherlands 1.13 ADIDAS Consumer Products & Services Germany 1.13 AIRBUS Industrial Goods & Services France 1.08 BNP PARIBAS Banks France 1.05 DAIMLER Automobiles & Parts Germany 1.03 ANHEUSER-BUSCH INBEV Food, Beverage & Tobacco Belgium 1.02 DEUTSCHE TELEKOM Telecommunications Germany 1.02 BAYER Health Care Germany 1.00 VINCI Construction & Materials France 0.98 BCO SANTANDER Banks Spain 0.93 Kering Retail France 0.87 AXA Insurance France 0.86 PHILIPS Health Care Netherlands 0.85 SAFRAN Industrial Goods & Services France 0.85 DEUTSCHE POST Industrial Goods & Services Germany 0.84 INFINEON TECHNOLOGIES Technology Germany 0.84 Prosus Technology Netherlands 0.83 ESSILORLUXOTTICA Health Care France 0.80 DANONE Food, Beverage & Tobacco France 0.73 INTESA SANPAOLO Banks Italy 0.73 MUENCHENER RUECK Insurance Germany 0.72 PERNOD RICARD Food, Beverage & Tobacco France 0.66 ING GRP Banks Netherlands 0.64 HERMES INTERNATIONAL -

Euro Stoxx® Multi Premia Index

EURO STOXX® MULTI PREMIA INDEX Components1 Company Supersector Country Weight (%) SARTORIUS STEDIM BIOTECH Health Care France 1.59 IMCD Chemicals Netherlands 1.25 VOPAK Industrial Goods & Services Netherlands 1.15 BIOMERIEUX Health Care France 1.04 REMY COINTREAU Food, Beverage & Tobacco France 1.03 EURONEXT Financial Services France 1.00 HERMES INTERNATIONAL Consumer Products & Services France 0.94 SUEZ ENVIRONNEMENT Utilities France 0.94 BRENNTAG Chemicals Germany 0.93 ENAGAS Energy Spain 0.90 ILIAD Telecommunications France 0.89 DEUTSCHE POST Industrial Goods & Services Germany 0.88 FUCHS PETROLUB PREF Chemicals Germany 0.88 SEB Consumer Products & Services France 0.87 SIGNIFY Construction & Materials Netherlands 0.86 CARL ZEISS MEDITEC Health Care Germany 0.80 SOFINA Financial Services Belgium 0.80 EUROFINS SCIENTIFIC Health Care France 0.80 RATIONAL Industrial Goods & Services Germany 0.80 AALBERTS Industrial Goods & Services Netherlands 0.74 KINGSPAN GRP Construction & Materials Ireland 0.73 GERRESHEIMER Health Care Germany 0.72 GLANBIA Food, Beverage & Tobacco Ireland 0.71 PUBLICIS GRP Media France 0.70 UNITED INTERNET Technology Germany 0.70 L'OREAL Consumer Products & Services France 0.70 KPN Telecommunications Netherlands 0.68 SARTORIUS PREF. Health Care Germany 0.68 BMW Automobiles & Parts Germany 0.68 VISCOFAN Food, Beverage & Tobacco Spain 0.67 SAINT GOBAIN Construction & Materials France 0.67 CORBION Food, Beverage & Tobacco Netherlands 0.66 DAIMLER Automobiles & Parts Germany 0.66 PROSIEBENSAT.1 MEDIA Media Germany 0.65 -

Weekly Screener 17 May – 24 May 2021, Week 20

AlsterResearch Weekly Screener Page 1 of 6 Weekly Screener 17 May – 24 May 2021, Week 20 Rotation Victims Target Find the stocks that have suffered most from sector rotation. Method Identify the beginning of the sector rotation as the yearly high of the Nasdaq in relation to the Dow Jones Industrial: 12th February 2021. Calculate the stock performance since then and select the companies with the biggest decline. Result from AlsterResearch universe: Rotation Victims Name Performance since start of sector rotation GICS Subsector TeamViewer AG -33,2% Application Software Varta AG -26,9% Electrical Components & Equipment CompuGroup Medical -20,2% Health Care Technology Delivery Hero SE -19,0% Internet & Direct Marketing Retail Formycon AG -18,8% Biotechnology MAKING SENSE OF THE NUMBERS: TeamViewer (AlsterResearch view: BUY / PT EUR 39 / closing price EUR 30,66 / upside 28%) The remote access specialist had to suffer twice: an ill-received marketing partnership with Manchester United AND the rotation out of tech both hurt. Attractive again at current levels. Varta (AlsterResearch view: BUY / PT EUR 130,00 / closing price EUR 116,00 / upside 12%) Varta is translating global market leadership in hearing aid and wireless headset batteries into substantial returns. Sector rotation and a sluggish Q1 could provide a good entry point. CompuGroup Medical (AlsterResearch view: BUY / PT EUR 72,00 / closing price EUR 63,55 / upside 13%) CompuGroup is a provider of software for the healthcare sector. The market currently has decided to treat it as “tech” and not as “health care” and rotate out, probably also as a result of weakish Q1 figures. -

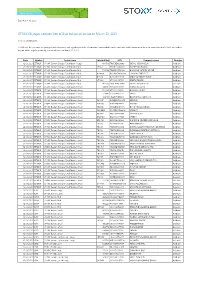

STOXX Changes Composition of Size Indices Effective on March 22, 2021

Zug, March 02, 2021 STOXX Changes composition of Size Indices effective on March 22, 2021 Dear Sir and Madam, STOXX Ltd., the operator of Qontigo’s index business and a global provider of innovative and tradable index concepts, today announced the new composition of STOXX Size Indices as part of the regular quarterly review effective on March 22, 2021 Date Symbol Index name Internal Key ISIN Company name Changes 02.03.2021 EETMLP STOXX Eastern Europe Total Market Large 431519 TRAEREGL91G3 EREGLI DEMIR CELIK Addition 02.03.2021 EETMMP STOXX Eastern Europe Total Market Mid UC001 HRPBZ0RA0004 PRIVREDNA BANKA Addition 02.03.2021 EETMMP STOXX Eastern Europe Total Market Mid 515183 TRABRYAT91Q2 BORUSAN YATIRIM VE PAZ. Addition 02.03.2021 EETMMP STOXX Eastern Europe Total Market Mid RO401K ROSNNEACNOR8 S N NUCLEARELECT Addition 02.03.2021 EETMMP STOXX Eastern Europe Total Market Mid CZ602J CZ0008040318 MONETA MONEY BANK Addition 02.03.2021 EETMMP STOXX Eastern Europe Total Market Mid LT102H LT0000115768 IGNITIS GRUPE Addition 02.03.2021 EETMMP STOXX Eastern Europe Total Market Mid 431519 TRAEREGL91G3 EREGLI DEMIR CELIK Deletion 02.03.2021 EETMSP STOXX Eastern Europe Total Market Small 493461 BE0974271034 VIOHALCO (ATH) Addition 02.03.2021 EETMSP STOXX Eastern Europe Total Market Small 511026 LT0000100372 ROKISKIO SURIS Addition 02.03.2021 EETMSP STOXX Eastern Europe Total Market Small 573885 CY0004690711 LOUIS Addition 02.03.2021 EETMSP STOXX Eastern Europe Total Market Small 412162 TRABTCIM91F5 BATICIM BATI ADCT.SYI. Addition 02.03.2021 EETMSP -

FACTSHEET - AS of 28-Sep-2021 Solactive Mittelstand & Midcap Deutschland Index (TRN)

FACTSHEET - AS OF 28-Sep-2021 Solactive Mittelstand & MidCap Deutschland Index (TRN) DESCRIPTION The Index reflects the net total return performance of 70 medium/smaller capitalisation companies incorporated in Germany. Weights are based on free float market capitalisation and are increased if significant holdings in a company can be attributed to currentmgmtor company founders. HISTORICAL PERFORMANCE 350 300 250 200 150 100 50 Jan-2010 Jan-2012 Jan-2014 Jan-2016 Jan-2018 Jan-2020 Jan-2022 Solactive Mittelstand & MidCap Deutschland Index (TRN) CHARACTERISTICS ISIN / WKN DE000SLA1MN9 / SLA1MN Base Value / Base Date 100 Points / 19.09.2008 Bloomberg / Reuters MTTLSTRN Index / .MTTLSTRN Last Price 342.52 Index Calculator Solactive AG Dividends Included (Performance Index) Index Type Equity Calculation 08:00am to 06:00pm (CET), every 15 seconds Index Currency EUR History Available daily back to 19.09.2008 Index Members 70 FACTSHEET - AS OF 28-Sep-2021 Solactive Mittelstand & MidCap Deutschland Index (TRN) STATISTICS 30D 90D 180D 360D YTD Since Inception Performance -3.69% 3.12% 7.26% 27.72% 12.73% 242.52% Performance (p.a.) - - - - - 9.91% Volatility (p.a.) 13.05% 12.12% 12.48% 13.60% 12.90% 21.43% High 357.49 357.49 357.49 357.49 357.49 357.49 Low 342.52 329.86 315.93 251.01 305.77 52.12 Sharpe Ratio -2.77 1.14 1.27 2.11 1.40 0.49 Max. Drawdown -4.19% -4.19% -4.19% -9.62% -5.56% -47.88% VaR 95 \ 99 -21.5% \ -35.8% -34.5% \ -64.0% CVaR 95 \ 99 -31.5% \ -46.8% -53.5% \ -89.0% COMPOSITION BY CURRENCIES COMPOSITION BY COUNTRIES EUR 100.0% DE