Vanguard FTSE Social Index Fund

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

FTSE Factsheet

FTSE Russell Factsheet FTSE LATIBEX Index Series Data as at: 29 December 2017 bmkTitle1 FTSE Group and Bolsas y Mercados Españoles (BME) have joined forces to create three indices, FEATURES the FTSE LATIBEX All-Share Index, FTSE LATIBEX TOP Index and the FTSE LATIBEX Brazil Index. These provide investors with real-time access, in one single point, to the performance of Coverage Latin American stocks listed on LATIBEX and denominated in Euros. The indexes measure the performance of Latin American stocks listed on LATIBEX The benchmark FTSE LATIBEX All-Share Index has been designed to represent the performance of the LATIBEX market in real-time. The index comprises all securities that are listed on the Objective market, covering eight countries: Argentina, Brazil, Mexico and Peru. LATIBEX offers international investors a gateway to Latin American equity markets. The FTSE LATIBEX TOP Index is a tradable index for derivatives, designed to represent the LATIBEX is a market segment for Latin performance of the largest and most liquid securities trading on LATIBEX. The index comprises American securities based in Madrid (Spain). the fifteen largest listed securities, who have specialist liquidity providers. The free-float weight Investment products such as warrants and is capped at 10% to ensure that it meets fund regulatory requirements worldwide to avoid over- certificates are already issued on FTSE concentration in any one stock. LATIBEX TOP and listed on the Spanish The FTSE LATIBEX BRAZIL Index is a Euro-denominated tradable index covering Brazilian Exchange, Deutsche Börse, Euronext and stocks, and ranks the most liquid listed on LATIBEX by free float adjusted market cap. -

FTSE Factsheet

FTSE FACTSHEET FTSE Canada Index Data as at: 31 August 2015 bmkTitle1 The FTSE Canada Index is part of a range of indices designed to help North American investors FEATURES benchmark their investments. The FTSE Canada index is a market-capitalisation weighted index representing the performance of Canadian large and mid cap stocks. The index is derived from Coverage the FTSE Global Equity Index Series (GEIS), which covers 98% of the world’s investable market Derived from the FTSE Global Equity Index capitalization. Series (GEIS), which covers 98% of the 5-Year Performance - Total Return world’s investable market capitalisation. (CAD) Objective 300 The index is designed for use in the creation 250 of index tracking funds, derivatives and as a 200 performance benchmark. 150 Investability 100 Stocks are selected and weighted to ensure 50 that the index is investable. Aug-2010 Aug-2011 Aug-2012 Aug-2013 Aug-2014 Aug-2015 Liquidity Data as at month end Stocks are screened to ensure that the index FTSE Canada FTSE North America FTSE Developed FTSE Developed ex North America is tradable. Transparency Performance and Volatility - Total Return The index uses a transparent, rules-based Index (CAD) Return % Return pa %* Volatility %** construction process. Index Rules are freely 3M 6M YTD 12M 3YR 5YR 3YR 5YR 1YR 3YR 5YR available on the FTSE website. FTSE Canada -6.5 -7.4 -3.1 -7.1 29.8 33.3 9.1 5.9 13.3 11.9 9.6 Availability FTSE North America -0.2 0.4 10.9 21.0 96.4 149.1 25.2 20.0 14.9 11.6 8.4 The index is calculated based on price and FTSE Developed -1.0 0.3 12.5 17.8 86.2 114.6 23.0 16.5 12.4 11.0 9.1 total return methodologies, both real time FTSE Developed ex North America -2.3 0.1 14.9 13.5 72.8 78.1 20.0 12.2 12.3 12.3 11.4 and end-of-day. -

Appendix D to Tradition SEF Rulebook Equities Product Listing

Appendix D to Tradition SEF Rulebook Equities Product Listing Broad-Market Equity Index Swap Product Listing Tradition SEF, Inc. I. Discussion of contracts; not readily susceptible to manipulation • Index Selection: Tradition SEF limits the indexes underlying its equity index swap offerings to well-established, publicly available third-party equity index market benchmarks. Tradition SEF believes that the size and liquidity of the cash market that underlies these indexes creates in each case a deliverable supply of underlying securities and volume of trading that would not make them easily susceptible to manipulation. Furthermore, Tradition SEF believes that the large number of participants in each market, and the calculation of each index being based on actual transaction data from major stock markets further limit the susceptibility of manipulation of these indexes. The broad-based equity indexes underlying swaps on Tradition SEF are the timeliest, recognized and reliable benchmarks for equity prices in their respective markets. The index levels are readily available and commercially acceptable as benchmarks for investors, portfolio managers and public policy makers. Tradition SEF believes that such benchmark indexes, which also underlie liquid index futures contracts on major Designated Contract Markets, and equity index exchange traded funds on stock exchanges, due to the large number of index members, ubiquity, and broad-market nature are not readily susceptible to manipulation. Furthermore, the associated index futures contracts and exchange traded funds offer a deep liquidity pool to hedge and risk-manage swaps based on such indexes’ index. Swap Contract Specifications: A discussion of Variance and Volatility Swaps: Equity Index Variance and volatility swaps pay out on the degree of stock price fluctuation, not the absolute level or direction of the underlying index. -

FTSE TWSE Taiwan Technology Index

FTSE Russell Factsheet FTSE TWSE Taiwan Technology Index Data as at: 31 August 2021 bmkTitle1 FTSE Group has partnered with the Taiwan Stock Exchange (TWSE) to calculate the FTSE TWSE FEATURES Taiwan Index Series, combining both local knowledge and international indexing capabilities, to create a family of eight indices for both domestic and international investors. Coverage All information technology stocks in the FTSE The FTSE TWSE Technology Index comprises all the information technology stocks from the TWSE 50 and FTSE TWSE Mid Cap 100 FTSE TWSE Taiwan 50 and FTSE TWSE Taiwan Mid-Cap 100 Indices. The Taiwanese information indices. technology sector is the largest industry sector and represents nearly 30% of the market. Objective 5-Year Performance - Total Return (TWD) The indices are designed for the creation of 350 index tracking funds, derivatives and as a performance benchmark. 300 Investability 250 Stocks are selected and weighted to ensure 200 that the index is investable. 150 Liquidity 100 Stocks are screened to ensure that the index Aug-2016 Aug-2017 Aug-2018 Aug-2019 Aug-2020 Aug-2021 Data as at month end is tradable. Transparency FTSE TWSE Taiwan Technology FTSE Taiwan The index uses a transparent, rules-based bmkTitle3 construction process. Index Rules are freely Note: FTSE Taiwan Index, which is displayed in the time-series chart above and in tables below, available on the FTSE website. is part of the FTSE Global Equity Index Series. See www.ftse.com/geis for more information. Availability Performance and Volatility - Total Return The indices are calculated based on price Index (TWD) Return % Return pa %* Volatility %** and total return methodologies, both real 3M 6M YTD 12M 3YR 5YR 3YR 5YR 1YR 3YR 5YR time and end-of-day. -

Download Investment Profile

Vanguard® Vanguard® FTSE Social Index Fund Product Summary Vanguard Style View : Large Growth Seeks to track the performance of the FTSE4Good US Select Index. Index of large- and mid-capitalization U.S. companies screened for certain social criteria. Market cap weighted index composed of large- and Investment style mid-capitalization stocks. Value Blend Growth Screened for certain environmental, social, and corporate Large governance (ESG) criteria. Specifically excludes stocks of certain companies in the following Mid industries: adult entertainment, alcohol, tobacco, weapons, fossil Small fuels, gambling, and nuclear power.* Market capitalization Excludes stocks of certain companies that do not meet standards Central tendency of U.N. global compact principles and companies that do not meet Expected range of fund holdings certain diversity criteria.* Employs a passively managed, full-replication approach. Quarterly Commentary People and Process The human toll of COVID-19 further mounted during the second Vanguard FTSE Social Index Fund seeks to track the performance quarter of 2021 amid fresh outbreaks of the virus and new of the FTSE4Good US Select Index, a market cap weighted index variants. The global economy nevertheless continued to rebound composed of large- and mid-capitalization stocks that is screened sharply if unevenly. Countries that have better succeeded in for certain environmental, social, and corporate governance (ESG) containing the virus—whether through vaccinations, lockdowns, or criteria by the Index sponsor, which is independent of Vanguard. both—tended to fare the best. With the reopening of economies Specifically, the Index excludes stocks of certain companies in the and pent-up demand boosting corporate profits, global stocks following industries: adult entertainment, alcohol, tobacco, finished the quarter significantly higher. -

Xtrackers FTSE All-World Ex UK UCITS ETF Supplement to The

Xtrackers FTSE All-World ex UK UCITS ETF Supplement to the Prospectus This Supplement contains information in relation to Xtrackers FTSE All-World ex UK UCITS ETF (the “Fund”), a sub-fund of Xtrackers (IE) plc (the “Company”) an umbrella type open-ended investment company with segregated liability between sub-funds and with variable capital governed by the laws of Ireland and authorised by the Central Bank of Ireland (the “Central Bank”). This Supplement forms part of, may not be distributed unless accompanied by (other than to prior recipients of the prospectus of the Company dated 26 February 2021 (the “Prospectus”)), and must be read in conjunction with, the Prospectus. An investment in the Fund should not constitute a substantial proportion of an investment portfolio and may not be appropriate for all investors. Xtrackers (IE) plc Dated 26 February 2021 M-19981595-71 ________________________________________________________________________________________ IMPORTANT INFORMATION The Fund is an ETF. The Shares of this Fund are fully transferable to investors and will be listed for trading on one or more stock exchanges. 2 M-19981595-71 ________________________________________________________________________________________ TERMS OF THE SHARES REPRESENTING INTERESTS IN THE FUND ________________________________________________________________________________________ Investment Objective The investment objective of the Fund is to track the performance before fees and expenses of the Underlying Asset, which is the FTSE All-World ex UK Index (the “Reference Index”). The Reference Index is designed to reflect the performance of shares of companies from developed countries and emerging markets worldwide excluding the UK. Further information on the Reference Index is contained under "General Description of the Underlying Asset". Investment Policy In order to seek to achieve the investment objective, the Fund will adopt a Direct Investment Policy. -

![Evaluation by Outside Stakeholders [PDF:322KB]](https://docslib.b-cdn.net/cover/6360/evaluation-by-outside-stakeholders-pdf-322kb-2246360.webp)

Evaluation by Outside Stakeholders [PDF:322KB]

Businesses Business Corporate 28 Evaluation by Outside Stakeholders Ⅰ and Strategy Segment Data Information The Dow Jones Sustainability Index (DJSI)* recognizes companies that exceed certain Selected for Dow Jones Sustainability standards for sustainability using detailed research to assess their economic, environmental, and social performance. Index for 18th consecutive year * The DJSI is an investment index jointly operated by S&P Dow Jones Indices LLC, a U.S.-based investment research firm, and RobecoSAM AG, a Switzerland-based firm that conducts CSR research and ratings. The FTSE4Good Index* is one of the two leading indexes for investors who are concerned Selected for FTSE4Good Index for about corporate social responsibility. The other major index is the DJSI. the 18th Straight Year * FTSE4Good Index: Launched by the UK-based FTSE Group, which is jointly owned by the Financial Times and the London Stock Exchange. NYK has been included in the MSCI ESG Leaders Indexes, which are internationally Included in the MSCI ESG leading stock indexes for socially responsible investing. Developed by U.S.-based MSCI Leaders Indexes Inc., the MSCI ESG Leaders Indexes recognize companies that are particularly outstanding according to environmental, social, and corporate governance criteria. NYK have been added to the A List by CDP*, an international environmental NPO, putting us in their highest possible tier of rankings for leading global companies in climate change response. Selected for CDP’s A List, the CDP has also selected NYK for their Supplier Engagement Leaderboard. Leaderboard is maximum possible rank, and its the highest rank in their Supplier Engagement Rating, where they select companies Supplier Engagement Leaderboard excelling in actions taken against climate change across the entire supply chain. -

Global Fundamental Indices Do They Outperform Market-Cap Weighted Indices on a Global Basis?

Nomura Securities Co Ltd, Tokyo Global Quantitative Research Global fundamental indices Do they outperform market-cap weighted indices on a global basis? Summary Date In this report, we present the new concept of fundamental indexing developed by Robert 28 October 2005 D. Arnott et al (2005). Fundamental indexing assigns index weightings to stocks based This report is a translation of an article on the use of fundamentals that are not tied to share prices, rather than using the appearing in the Japanese-language commonly accepted method of assigning index weightings based on market Security Analysts Journal October 2005 capitalization. Mr Arnott claims that historical analysis of US stocks shows that Vol. 43 No. 10. fundamental indices have outperformed market-cap weighted indices consistently over Analysts time. In this report, we examine the performance of fundamental indices on a global H. Tamura basis using indices we formulated based on the methods of Mr. Arnott and his +81-3-3274-1079 colleagues. Our analysis shows that fundamental indices have outperformed market-cap [email protected] weighted indices in all the countries included in our study. Y. Shimizu [email protected] Cumulative performances of global indices Financial & Economic Research Center (End-87/12 = 1) Nomura Securities, Tokyo 5.0 FI Global MSCI Wor ld Nomura research sites: 4.0 www.nomura.com/research Bloomberg: NMR 3.0 2.0 FTSE World Cap Global 1.0 Please read the important 0.0 disclosures on the back page of this report. 88/1 89/1 90/1 91/1 92/1 93/1 94/1 95/1 96/1 97/1 98/1 99/1 00/1 01/1 02/1 03/1 04/1 05/1 Note: Cumulative performance of each index is based on a value of one from the starting date of end-December 1987. -

A Rise of Passives, a Rise of Scrutiny

FINANCIAL TIMES MONDAY NOVEMBER 18 2013 15 FTfmIndex investing A rise of passives, a rise of scrutiny Overview Providers staunchly defend their products against both regulators and adherents of active management, writes Chris Flood ndex-based investing is expanding rapidly across glo- Ibal financial markets in a shift that offers big rewards to providers of popular benchmarks. It is also, however, attracting growing scrutiny from regulators. The most visible evidence for the rise of index-based investing comes from growth in the exchange traded funds industry which now commands assets of $2.3tn. Trillions of dollars more are held in index-based portfolios by pension and sovereign wealth funds and other institutional investors. Indices are also widely used for pricing in both structured prod- ucts, where issuance is recover- ing, and also in the derivatives markets, where the outstanding value of contracts contines to rise. The expanding role of indices in financial markets has led regula- tors to re-examine the rules gov- erning financial benchmarks. Both the International Organi- zation of Securities Commissions and the European Securities and Markets Authority have published guidelines intended to strength investor protection through improved standards of transpar- ency and disclosures. Providers of financial indices felt that their own standards and practices already went beyond these guidelines and banded together in 2012 to create an asso- ciation to better respond to regu- lators’ concerns. Nick Lowndes But the industry has found itself under another regulatory spotlight with the European Com- Hartmut Graf, chief executive of adding that retail investors, who will come under more pressure Rob Arnott, chairman of Research mission in September proposing Stoxx, questions whether further typically hold just a small propor- and be replaced by index-based Affiliates. -

FTSE Non-Display Usage

1 January 2021 FTSE Non-Display Usage Customer Declaration Version 1.1 This document is a required declaration for customers to specify their non-display usage of real time FTSE index values (‘Data’). If you are in receipt of FTSE Data, delivered directly or via a vendor, but do not use the Data in respect of the activities detailed within this document, you are still required to sign and complete sections 1, 3 and 5 of this declaration. Please note that the London Stock Exchange Real Time Data team is the appointed agent to administer the non-display usage declarations on behalf of FTSE Group. All completed and scanned declarations should be emailed to: [email protected] If you prefer to mail us a hard copy, then please send to: Market Data Administration Real Time Data Team London Stock Exchange Group plc 10 Paternoster Square London EC4M 7LS If you require further policy clarification in respect of the use of real time data detailed within this document or guidance on how to complete the declaration, then please contact the London Stock Exchange Real Time Data Business Development Team on +44(0) 20 7797 3699, or email: [email protected]. 1 1 January 2021 Section 1: Customer Details Company Name: Contact Name: Position: Telephone: Email: Street Address: Town: County: Post Code: Country: VAT Number: Please list all subsidiaries to be covered by this declaration in Appendix A. Section 2: Invoice Details (if different from customer details above) Company Name: Contact Name: Position: Telephone: Email: Street Address: Town: County: Post Code: Country: VAT Number: 2 1 January 2021 Section 3: Source Of Data (e.g. -

FTSE Group-Of-Seven (G7) Index | August 31, 2021

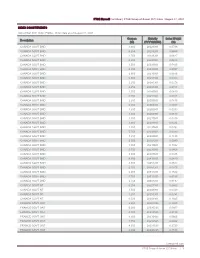

FTSE Russell Factsheet | FTSE Group-of-Seven (G7) Index | August 31, 2021 INDEX CONSTITUENTS September 2021 Index Profile - Index data as of August 31, 2021 Coupon Maturity Index Weight Description (%) (YYYYMMDD) (%) CANADA GOVT BND 1.000 20220901 0.0788 CANADA GOVT BND 0.250 20230201 0.0669 CANADA GOVT BND 1.750 20230301 0.0627 CANADA GOVT BND 0.250 20230501 0.0613 CANADA GOVT BND 1.500 20230601 0.0425 CANADA GOVT BND 0.250 20230801 0.0597 CANADA GOVT BND 2.000 20230901 0.0836 CANADA GOVT BND 0.500 20231101 0.0303 CANADA GOVT BND 2.250 20240301 0.0278 CANADA GOVT BND 0.250 20240401 0.0731 CANADA GOVT BND 2.500 20240601 0.0410 CANADA GOVT BND 0.750 20241001 0.0161 CANADA GOVT BND 2.250 20250601 0.0435 CANADA GOVT BND 0.250 20260301 0.0657 CANADA GOVT BND 1.500 20260601 0.0293 CANADA GOVT BND 1.000 20260901 0.0613 CANADA GOVT BND 1.000 20270601 0.0319 CANADA GOVT BND 2.000 20280601 0.0284 CANADA GOVT BND 2.250 20290601 0.0252 CANADA GOVT BND 5.750 20290601 0.0389 CANADA GOVT BND 1.250 20300601 0.1185 CANADA GOVT BND 0.500 20301201 0.0980 CANADA GOVT BND 1.500 20310601 0.1082 CANADA GOVT BND 5.750 20330601 0.0468 CANADA GOVT BND 5.000 20370601 0.0315 CANADA GOVT BND 4.000 20410601 0.0419 CANADA GOVT BND 3.500 20451201 0.0512 CANADA GOVT BND 2.750 20481201 0.0475 CANADA GOVT BND 2.000 20511201 0.1542 CANADA GOVT BND 1.750 20531201 0.0105 CANADA GOVT BND 2.750 20641201 0.0197 CANADA GOVT NT 0.250 20221101 0.0862 CANADA GOVT NT 1.500 20240901 0.0329 CANADA GOVT NT 1.250 20250301 0.0291 CANADA GOVT NT 0.500 20250901 0.1025 FRANCE GOVT OAT 2.250 -

FTSE Russell. Your Global Index Partner

Guide to products and services FTSE Russell. Your global index partner ftserussell.com Contents 4 6 10 12 About us FTSE Russell Our history Industry difference classification 14 18 62 Custom index Our indexes ETFs and solutions derivatives About us 4 FTSE Russell FTSE Russell is a leading global provider of benchmarks, analytics and data solutions for investors worldwide, giving a precise view of the markets relevant to any investment process. A comprehensive range of reliable and accurate indexes provides investors with the tools they require to measure and analyze markets across asset classes, styles or strategies. FTSE Russell index expertise and products are used FTSE Russell is focused on applying the highest industry extensively by institutional and retail investors globally. standards in index design and governance, employing We bring a combined experience of more than half a century transparent rules-based methodology informed by in index management and are a trusted source of market independent committees of leading market participants. information. Leading asset owners, asset managers, ETF FTSE Russell fully embraces the IOSCO Principles and providers and investment banks have chosen FTSE Russell its Statement of Compliance has received independent indexes to benchmark their investment performance and assurance. Index innovation is driven by client needs and create ETFs, structured products and customer partnerships, allowing FTSE Russell to continually index-based derivatives. enhance the breadth, depth and reach of its offering. Guide to products & services 5 FTSE Russell difference Whether you seek a benchmark or research tool to support an investment strategy, choosing the right index partner has never been more important.