Mergers in Higher Education Institutions

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SYSTRAN Supports Multilingualism and Francophony Alongside Stendhal University, Grenoble

www.systransoft.com SYSTRAN supports Multilingualism and Francophony alongside Stendhal University, Grenoble Paris, France, 13 June 2014 – SYSTRAN, announces its participation as a founding member of the Stendhal Foundation "Multilingualism and Francophony" to contribute to the promotion of the French language and the maintenance of linguistic diversity. SYSTRAN, a leading global player in machine translation technology, offers training programmes that allow students of European universities to become familiar with machine translation tools that are among the most successful and widely used at major companies. By agreeing to become a founding member of the Stendhal Foundation's "Multilingualism and Francophony", SYSTRAN will strengthen its ties to the academic world. Stendhal University, Grenoble III, which provides, among other things, education in language sciences, communication and translation, is at the forefront in the field of linguistic engineering and techno-pedagogical resources for the teaching of languages. The university foundation "Multilingualism and Francophony", which was officially launched on 11 June, aims to support the diversity of languages and cultures, and to contribute to the influence of the French language and culture internationally. The foundation supports projects in three areas: the development of language pedagogy, educational innovation and technology, and promotion of the speaking of French. As a founding member, SYSTRAN plans to invest in the foundation's projects and contribute to its promotion and -

INTERNATIONAL PARTNERSHIPS Afghanistan Armenia Austria

INTERNATIONAL PARTNERSHIPS Faryab University Afghanistan http://faryab.edu.af/en Armenia Vanadzor State University https://vsu.am/en/ University of Innsbruck https://www.uibk.ac.at/ Austria University of Vienna https://www.univie.ac.at/ Johannes Kepler University https://www.jku.at/en/ Belarus Minsk State Linguistic University https://www.mslu.by/en/ University of Mons https://web.umons.ac.be/en/ Belgium Vrije Universiteit Brussel https://www.vub.be/en Panevropski Univerzitet Apeiron https://apeiron-uni.eu/ Bosnia and University of Banja Luka https://unibl.org/en Herzegovina University of Mostar https://www.sum.ba/en Bulgaria Sofia University “St. Kliment Ohridski” https://www.uni-sofia.bg/index.php/eng Sichuan University http://www.scu.edu.cn/ China Sichuan International Studies University http://www.sisu.edu.cn/ Sichuan Normal University http://english.sicnu.edu.cn/EnglishIndex/webindex Dima Foreign Language Katusha Travel http://katusha.cn/ru/about-us/ Shandong Jiaotong University http://english.sdjtu.edu.cn/ Southwest Jiaotong University http://www.swjtu.edu.cn/ Sichuan Education Association for International Exchange General Administration of Confucius Institutes in China Association of Higher Education Institutions of the upper and middle reaches of the Yangtze river China Cyprus College of Tourism and Hotel Management https://www.cothm.ac.cy/ Czech University of Hradec Kralove Republic https://www.uhk.cz/en University of Zadar Croatia https://www.unizd.hr/eng/ Estonia Estonian Entrepreneurship University of Applied Sciences https://www.euas.eu/ -

Innovation in International Student Exchange: Trends and Strategies for the Decade

Innovation in International Student Exchange: Trends and Strategies for the Decade NUPACE 15th Anniversary Symposium & Student Exchange Alumni Reunion October 14-15, 2011, Nagoya University Foreword 2011, the Global 30 (G30) degree programmes. The Nagoya University Program for Academic Exchange (NUPACE) is honoured to convene Nevertheless, despite laudable initiatives, the NUPACE 15th Anniversary Symposium and Japanese universities in general are undeniably Student Exchange Alumni Reunion, an event facing challenges both in attracting and made possible through the generous support of retaining their international student cohort, a the President’s Office and the Nagoya problem arguably compounded by the Great University Alumni Association (NUAL). East Japan Earthquake of March 2011 and, more seriously, in sending their own students Inspired by the Junior Year Abroad in the overseas. United States and ERASMUS in the EU, Japan’s Ministry of Education (MEXT) This Symposium, entitled, “Innovation in established the Short-term Student Exchange International Student Exchange: Trends and Promotion Program in 1995 with the objective Strategies for the Decade” hopes to address of facilitating undergraduate student mobility. current challenges in international student The Nagoya University Program for Academic exchange and, from a variety of angles, to Exchange (NUPACE) was successfully explore innovative policies and strategies launched shortly afterwards in 1996. aimed at nurturing the next generation of globally-oriented leaders. Now, fifteen years after its inauguration, NUPACE hosts approximately 100 students On this, the occasion of the NUPACE 15th annually, the composition of which comprises Anniversary and Alumni Reunion, NUPACE is an enviable regional balance. Significantly, a honoured to invite real time actors in the field large proportion of NUPACE students have of student exchange from Germany and the been, and continue to be financially supported Republic of Korea. -

Table of Contents

vii Table of Contents Keynotes Make it possible, they say Dominique BURGER, Pierre Guillou, Association BrailleNet, France Accessible Technology: New Directions, New Possibilities Debra Ruh, TecAccess, USA Web Accessibility – It’s not Magic, it’s Art Shadi Abou-Zahra, W3C Web Accessibility Initiative, Austria Opening Web-Based Learning to a Larger Student Community Kinshuk, Athabasca University, Canada Sabine Graf, Vienna University of Technology, Austria Topic : Accessibility BrlAPI: Simple, Portable, Concurrent, Application-level Control of Braille Terminals Samuel Thibault, LaBri, Sebastien Hinderer, LORIA, France Talking About People, not Technology: Web Accessibility Natasha Boskic, Kirsten Bole, The University of British Columbia, Canada An Accessible Interface for a Mobile Phone-based Travel Information System Nick Tyler, Marcela Wainstein, University College London, United Kingdom Towards Web-Based automatic interpretation of written text to Sign Language Mohamed Jemni, Oussama Elghoul, Research Unit UTIC, Tunisia Increasing the Robustness of Man-Machine Interfaces Fevzi Belli, Faculty of CSEEM, Germany Graphical Tool to Simplify the Navigation and Web Accessibility Chabane Khentout, Mahieddine Djoudi, Lamri Douidi University of Sétif, Algeria/ University of Poitiers, France Accessibility to Mathematical Documents Afef Kacem, Research unit UTIC, Tunisia AccèsSimple Web site: From innovation to evaluation Sonia Rioux, Jacques Langevin, Université de Montréal, Canada Web Accessibility Education: an European Challenge Roberto Scano, -

EDUCATIONAL VALUES in ROMANS: LE ROUGE ET LE NOIR/THE RED and the BLACK and the CHARTREUSE of PARMA WRITTEN by STENDHAL Sulandr

International Journal of Language Education and Culture Review, Vol.3 (1) June 2017, 35 - 48. Available online at http://journal.unj.ac.id/unj/index.php/ijlecr DOI:doi.org/10.21009/IJLECR.031.05 EDUCATIONAL VALUES IN ROMANS: LE ROUGE ET LE NOIR/THE RED AND THE BLACK AND THE CHARTREUSE OF PARMA WRITTEN BY STENDHAL Sulandri Nuryadin Universitas Negeri Jakarta [email protected] Abstract This scientific work is a qualitative research content analysis with genetic structural approach. The objective of this research to meet the existing educational values in the novels The Red and the Black and The Charterhouse of Parma. This research began in November 2013 in Jakarta. Data for this research were taken of the novels to discuss as well as books about the life of the writer and French history in the nineteenth century. The analysis is based on the genetic and structural approach on historical data. The results of this research show that there are educational values explicitly and implicitly in novels studied related to social events that took place at the time the novels were written. They appear in the learning-teaching, religion, social and political events. These values can play a relevant role that can influence the behavior of readers. They could be people who put worth reading will; the desire to.acquire languages a..language like..Latin..andcuriosity..towards a colosal..event. The results of this research could motivate university students of French to find the pleasure of reading novels in order to enrich them selves intellectually and culturally. Keywords: Educational values, Romans, Genetic Structurale. -

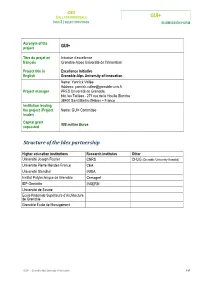

GUI+ Structure of the Idex Partnership

IDEX CALL FOR PROPOSALS GUI+ IDEX 2 | SELECTION PHASE SUBMISSION FORM Acronym of the project GUI+ Titre du projet en Initiative d’excellence français Grenoble-Alpes Université de l’Innovation Project title in Excellence Initiative English Grenoble-Alps University of Innovation Name: Yannick Vallée Address: [email protected] Project manager PRES Université de Grenoble bât. les Taillées - 271 rue de la Houille Blanche 38400 Saint Martin d'Hères – France Institution leading the project (Project Name: GUI+ Committee leader) Capital grant 908 million Euros requested Structure of the Idex partnership Higher education institutions Research institutes Other Université Joseph Fourier CNRS CHUG (Grenoble University Hospital) Université Pierre Mendes-France CEA Université Stendhal INRIA Institut Polytechnique de Grenoble Cemagref IEP Grenoble INSERM Université de Savoie Ecole Nationale Supérieure d’Architecture de Grenoble Grenoble École de Management GUI+ | Grenoble-Alps University of Innovation 1/87 IDEX CALL FOR PROPOSALS GUI+ IDEX 2 | SELECTION PHASE SUBMISSION FORM 1 CONTENTS 2 ADDITIONAL FILE: OPERATIONAL MEASURES ............................................................................ 3 3 EXECUTIVE SUMMARY ........................................................................................................... 12 4 DELTA DOCUMENT ................................................................................................................ 18 4.1 The legal status of the structure carrying the Idex ..................................................................18 -

Application Reference Number

Application Reference Number Application ORGANISATION- Institution Name Name of the organisation in English Organisation City Organisation Country Institutional code Country Name Code 103242-LA-1-2014-1-AT-E4AKA1-ECHE AT KATHOLISCH-THEOLOGISCHE PRIVATUNIVERSITÄT LINZ CATHOLIC THEOLOGICAL PRIVATE UNIVERSITY LINZ Österreich A LINZ11 215141-LA-1-2014-1-AT-E4AKA1-ECHE AT JOSEPH HAYDN KONSERVATORIUM DES LANDES BURGENLAND JOSEPH HAYDN CONSERVATORY OF THE PROVINCEEISENSTADT BURGENLAND Österreich A EISENST05 215901-LA-1-2014-1-AT-E4AKA1-ECHE AT MCI MANAGEMENT CENTER INNSBRUCK MCI MANAGEMENT CENTER INNSBRUCK INNSBRUCK Österreich A INNSBRU08 217232-LA-1-2014-1-AT-E4AKA1-ECHE AT PRIVATE UNIVERSITAET FUER GESUNDHEITSWISSENSCHAFTEN, MEDIZINISCHE INFORMATIK UND TECHNIK (UMIT) UNIVERSITY FOR HEALTH SCIENCES, MEDICAL INFORMATICSHALL I. TIROL AND TECHNOLOGYÖsterreich A INNSBRU20 217372-LA-1-2014-1-AT-E4AKA1-ECHE AT FH CAMPUS WIEN - VEREIN ZUR FÖRDERUNG DES FACHHOCHSCHUL-, ENTWICKLUNGS- UND FORSCHUNGSZENTRUMS IM SÜDEN WIENS FH CAMPUS WIEN, UNIVERSITY OF APPLIED SCIENCESWIEN Österreich A WIEN63 220726-LA-1-2014-1-AT-E4AKA1-ECHE AT MEDIZINISCHE UNIVERSITAET INNSBRUCK MEDICAL UNIVERSITY OF INNSBRUCK INNSBRUCK Österreich A INNSBRU21 220842-LA-1-2014-1-AT-E4AKA1-ECHE AT MEDIZINISCHE UNIVERSITÄT GRAZ MEDICAL UNIVERSITY OF GRAZ GRAZ Österreich A GRAZ23 220934-LA-1-2014-1-AT-E4AKA1-ECHE AT MEDIZINISCHE UNIVERSITAET WIEN MEDICAL UNIVERSITY OF VIENNA VIENNA Österreich A WIEN64 221685-LA-1-2014-1-AT-E4AKA1-ECHE AT CAMPUS 02 FACHHOCHSCHULE DER WIRTSCHAFT GMBH CAMPUS -

! Human-Trace Complex Systems Digital Campus

ICCSA 2014 4th International Conference on Complex Systems and Applications (June 23, 2014) ! ! !"#$%&'($)*+ + + ),#-.*/+010'*#0+2343'$.+)$#-"0+"%*0),++ ! (Work un progress/English! presentation being improved) "#$%&'(! ! I. NAME AND RESPONSIBLE OF THE E-LABORATORY$)!! ! $))&*&+,!-+,&.+/&$'! 1. SHORT NAME OF THE E-LABORATORY ! HTCS (Human-Trace Complex Systems ) ! !!012345!67!89:;<! 2. LONG NAME OF THE! E-LABORATORY e-Laboratory on HUMAN-TRACE DIGITAL CAMPUS 3. WEBSITE AND/OR WIKI OF THE E-LABORATORY http://rightunivlehavre.wordpress.com/ichnosanthropos/ (site provisoire) https://en.wikiversity.org/w/index.php?title=Portal:Complex_Systems_Digital_Campus/E- Laboratory_on_human_trace 4. PERSON RESPONSIBLE Pr. Béatrice GALINON-MELENEC, Ph.D. in Education Sciences from Sorbonne University, Paris (1988), Professor of Communication at Normandie University - Le Havre, France. Author or co-author of many books, among them: "L'Homme trace, Perspectives anthropologiques des traces humaines contemporaines" (editor and co-author, CNRS, 2011), "Traces numériques, De la production à l’interprétation" (co- éditor and co-author CNRS, 2013). 1 E-Mail: [email protected], [email protected] 4.WEBSITE: http://rightunivlehavre.wordpress.com/ichnosanthropos/; 5. INSTITUTION: Normandie University - Le Havre. 6. CONTACT FOR THE E-LABORATORY : Pr. Béatrice GALINON-MELENEC E-Mail: [email protected], [email protected] II. CHALLENGE OF THE E-LABORATORY IN THE NEXT TEN YEARS The first part of the twenty-first century has been marked by the exacerbation of issues related to the proliferation of traces associated to human activities (sustainable development, digital traces, health risk, protection of personal data and identity, cybercrime, etc.). This e- laboratory is to bring together researchers who respond to these societal issues. -

Programme Du Symposium: "Websites As Sources: How Should Humanities and Social Sciences Approach, Use and Diffuse Publicly

Programme du symposium: "Websites as sources: how should humanities and social sciences approach, use and diffuse publicly available online sources?" (Luxembourg, 20 et 21 mars 2012) Source: Websites as sources: how should humanities and social sciences approach, use and diffuse publicly available online sources? Copyright: THATCamp is a trademark of the Center for History and New Media URL: http://www.cvce.eu/obj/programme_du_symposium_"websites_as_sources_how_should_humanities_and_social_sciences_approach_use_and_diffuse_publicly_available_online_sou rces_"_luxembourg_20_et_21_mars_2012-fr-70096bec-bf27-401f-a4b1-005f40d8690b.html Date de dernière mise à jour: 04/01/2013 1 / 3 04/01/2013 Symposium The Symposium will be followed by : Websites as sources: How should humanities and social sciences approach, use and diffuse publicly available online sources? 20–21 March 2012 Abbaye de Neumünster, Luxembourg City www.digitalhumanities.lu THATCamp Luxembourg/Trier will launch a tradition of ‘unconferences’ in the Greater Region that assemble humanists, computer scientists, digital media artists — basically anybody who is interested in the fusion of history, culture, heritage and digital media. PROGRAMME 2 / 3 04/01/2013 20 March 2012 21 March 2012 9.00–9.30 — Introduction 9.00–10.30 — 4th panel: Web history (2) Marianne Backes (CVCE) and René Leboutte (University of Luxembourg) Chairman: Stefan Gradmann (Humboldt University) 9.30–11.00 — Keynote – Niels Brügger (Centre for Internet Research, Aarhus University) — Web archiving, Web Peter Haber -

Anti-Plagiarism Charter – Grenoble Alpes University

Anti-plagiarism charter – Grenoble Alpes University Grenoble Institute of Technology (Grenoble INP) Grenoble Institute of Political Sciences – Joseph Fourier University Pierre-Mendès-France University – Stendhal University – Savoie University Art 1: Definition of plagiarism Plagiarism is the act of duplicating a text, a portion of a text, an illustration or the original ideas of an author, without proper attribution through a bibliographic or iconographic referencing (refer to Article 3). Art 2: Purpose of academic work Academic work relates to all documents written by students and teachers, researchers and professors in connection with course and research activities. Academic work should always aim to produce exceptional know-how and provide a critical, new and personal perspective of the topic. Art 3: Bibliographic referencing methodology The methodology of academic work involves clearly identifying borrowed passages (for example copy/paste) and mentioning the name of the author and the source of the extract. Direct quotes, including in a personal translation, must be placed between inverted commas and must be accompanied by a bibliographic reference following the quote or in a foot note. Non-textual borrowed work such as tables, graphs, photographs, scientific formulas and so forth must also be directly followed by a bibliographic reference or one should be placed in a foot note. In addition, references to the cited, borrowed or adapted documents must be included in the bibliography. Art 4: Detecting plagiarism To check for plagiarism, the Grenoble Alpes University possesses a tool that helps to systematically check academic work and detect any similarities with other work. Art 5: Disciplinary sanctions for plagiarism Plagiarists shall be brought before the qualified disciplinary unit and potential sanctions may even include permanent exclusion from any higher learning institution. -

Welcome Guide for Incoming Exchange Students Academic Year 2014-2015

WELCOME GUIDE FOR INCOMING EXCHANGE STUDENTS ACADEMIC YEAR 2014-2015 HOUSING Once you have been accepted for an exchange into our University as an exchange student, the Housing Service of the “International Students and Scholars Office of Grenoble University – ISSO” will help you find accommodation for the duration of your stay in Grenoble (the month of intensive French classes is not included). You will receive an e-mail that informs you of the possibility to fill in the housing application form online (with your personal login and password). To choose your accommodation properly, please read carefully the description of the residences. You can choose between: • traditional residence : 9m2, simple comfort (collective kitchen, washroom facilities are shared and non- gendered and centrally located on each floor), Wi-Fi Internet connection (around 160 Euros/month). • refurbished residence : 12m2, more comfort, private washroom facilities, shared kitchen, Wi-Fi Internet connection (around 300 Euros/month). Please note that refurbished residences are in priority allocated to students coming in Grenoble for two semesters. • private residence : 12m2, even more comfort, private washroom facilities, Wi-Fi Internet connection (around 450 to 600 Euros/month). • accommodation through a private individual : you can have temporary accommodation when you arrive and then find by yourself accommodation in town, alone or with flatmate(s). Then, you must know that owners generally ask for a “guarantor” for the accommodation, i.e. a person who will act as a guarantor in case there is a problem paying the rent. The applications will be processed within two sessions (the deadline are not negotiable): • Before the 10th of July 2014 if you arrive in September / October (1st semester) • Before the 15th of November 2014 if you arrive in January / February (2nd semester) • Apart from these two sessions: the application must be sent at least one month before the beginning of your stay. -

Program Handbook 2019

Fall 08 Sciences Po & Universite Sorbonne Nouvelle – Paris 3 > ART, LITERATURE, & CONTEMPORARY EUROPEAN THOUGHT EUROPEAN UNION STUDIES PUBLIC HEALTH IN EUROPE PROGRAM HANDBOOK 2019 Northwestern in Paris, Fall 2019 Program Handbook CONTENTS PROGRAM INFORMATION ....................................................................................................... 4 PROGRAM TEAM .......................................................................................................................... 4 PROGRAM PARTICIPANTS ............................................................................................................. 7 ART, LITERATURE, AND CONTEMPORARY EUROPEAN THOUGHT ...................................................... 7 EUROPEAN UNION STUDIES .......................................................................................................... 7 PUBLIC HEALTH IN EUROPE ........................................................................................................... 8 TENTATIVE PROGRAM SCHEDULE & ACTIVITIES ............................................................................. 9 SPECIAL NOTE REGARDING PLANNING PERSONAL TRAVEL & VISITORS.......................................... 10 COURSE DESCRIPTIONS .............................................................................................................. 10 ART, LITERATURE, AND CONTEMPORARY EUROPEAN THOUGHT COURSES ..................................... 10 EUROPEAN UNION STUDIES COURSES ........................................................................................