Results In-Line with Expectations; Investing for Growth

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

To Arrive at the Total Scores, Each Company Is Marked out of 10 Across

BRITAIN’S MOST ADMIRED COMPANIES THE RESULTS 17th last year as it continues to do well in the growing LNG business, especially in Australia and Brazil. Veteran chief executive Frank Chapman is due to step down in the new year, and in October a row about overstated reserves hit the share price. Some pundits To arrive at the total scores, each company is reckon BG could become a take over target as a result. The biggest climber in the top 10 this year is marked out of 10 across nine criteria, such as quality Petrofac, up to fifth from 68th last year. The oilfield of management, value as a long-term investment, services group may not be as well known as some, but it is doing great business all the same. Its boss, Syrian- financial soundness and capacity to innovate. Here born Ayman Asfari, is one of the growing band of are the top 10 firms by these individual measures wealthy foreign entrepreneurs who choose to make London their operating base and home, to the benefit of both the Exchequer and the employment figures. In fourth place is Rolls-Royce, one of BMAC’s most Financial value as a long-term community and environmental soundness investment responsibility consistent high performers. Hardly a year goes past that it does not feature in the upper reaches of our table, 1= Rightmove 9.00 1 Diageo 8.61 1 Co-operative Bank 8.00 and it has topped its sector – aero and defence engi- 1= Rotork 9.00 2 Berkeley Group 8.40 2 BASF (UK & Ireland) 7.61 neering – for a decade. -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

Firstgroup Plc Annual Report and Accounts 2015 Contents

FirstGroup plc Annual Report and Accounts 2015 Contents Strategic report Summary of the year and financial highlights 02 Chairman’s statement 04 Group overview 06 Chief Executive’s strategic review 08 The world we live in 10 Business model 12 Strategic objectives 14 Key performance indicators 16 Business review 20 Corporate responsibility 40 Principal risks and uncertainties 44 Operating and financial review 50 Governance Board of Directors 56 Corporate governance report 58 Directors’ remuneration report 76 Other statutory information 101 Financial statements Consolidated income statement 106 Consolidated statement of comprehensive income 107 Consolidated balance sheet 108 Consolidated statement of changes in equity 109 Consolidated cash flow statement 110 Notes to the consolidated financial statements 111 Independent auditor’s report 160 Group financial summary 164 Company balance sheet 165 Notes to the Company financial statements 166 Shareholder information 174 Financial calendar 175 Glossary 176 FirstGroup plc is the leading transport operator in the UK and North America. With approximately £6 billion in revenues and around 110,000 employees, we transported around 2.4 billion passengers last year. In this Annual Report for the year to 31 March 2015 we review our performance and plans in line with our strategic objectives, focusing on the progress we have made with our multi-year transformation programme, which will deliver sustainable improvements in shareholder value. FirstGroup Annual Report and Accounts 2015 01 Summary of the year and -

31 March 2021 PDF 657KB

Report of all payments made by TfL for value equal to or greater than £250.00 Excl. VAT Reporting Period: 13 Start Date: 7 March 2021 End Date: 3 April 2021 Financial Year: 2020/21 Entity Vendor Name Expenditure Account Document Number Clearing Date Amount (£) Merchant Category RAIL FOR LONDON LIMITED MTR CROSSRAIL Franchise/Concession Fixed Fee 1020\5109911661 31 Mar 2021 18,390,375.92 LONDON BUS SERVICES LTD METROLINE TRAVEL LTD Bus Contract Payments 1006\1900045537 19 Mar 2021 15,246,793.16 RAIL FOR LONDON LIMITED ARRIVA RAIL LONDON Franchise/Concession Fixed Fee 1020\5109909419 25 Mar 2021 14,132,391.89 LONDON BUS SERVICES LTD ARRIVA LONDON NORTH LTD Bus Contract Payments 1006\1900045526 19 Mar 2021 13,487,304.69 TRANSPORT TRADING LTD RAIL SETTLEMENT PLAN Rail Settlement Plan - PAYG Creditor 1004\1901675844 19 Mar 2021 12,737,855.33 LONDON BUS SERVICES LTD LONDON GENERAL TRANSPORT SERVICES Bus Contract Payments 1006\1900045533 19 Mar 2021 12,053,265.68 LONDON BUS SERVICES LTD LONDON CENTRAL BUS COMPANY LTD Bus Contract Payments 1006\1900045532 19 Mar 2021 10,738,958.62 LONDON BUS SERVICES LTD LONDON UNITED BUSWAYS Bus Contract Payments 1006\1900045535 19 Mar 2021 9,453,883.96 LONDON BUS SERVICES LTD EAST LONDON BUS & COACH COMPANY LTDBus Contract Payments 1006\1900045530 19 Mar 2021 9,248,625.79 DOCKLANDS LIGHT RAILWAY KEOLIS AMEY DOCKLANDS LIMITED Franchise/Concession Fixed Fee 1012\5109909456 25 Mar 2021 6,890,678.24 LONDON BUS SERVICES LTD ARRIVA LONDON SOUTH LTD Bus Contract Payments 1006\1900045527 19 Mar 2021 6,774,192.60 LONDON -

John Wood Group PLC Annual Report and Accounts 2015 Contents

John Wood Group PLC Annual Report and Accounts 2015 Contents Strategic report Our operations, strategy and business model and how we have performed during 2015 “Against a backdrop of significantly reduced customer activity, the Group delivered EBITA of $470m in line with expectations and 14.5% lower than 2014. Our continued actions to reduce costs, improve efficiency and broaden our service offering through organic initiatives and strategic acquisitions, position us as a strong and balanced business in both the current environment and for when market conditions recover” Robin Watson, Chief Executive Strategic report Governance Financial statements Highlights Financial Summary Total Total Revenue from Profit before tax Adjusted Total Revenue 1 EBITA 1 continuing and exceptional diluted Dividend operations items EPS cents $5,852m $470m $5,001m $320m 84.0cents 30.3 per share 23.2% 14.5% 23.9% 22.8% 15.7% 10.2% (2014: $7,616m) (2014: $550m) (2014: $6,574m) (2014: $414.5m) (2014: 99.6c) (2014: 27.5 cents) Operational Highlights X Relatively resilient performance. EBITA of $470m in line with expectations; 14.5% lower than 2014 X Management focus on operational utilisation X Delivered overhead cost savings of over $148m which will sustain into 2016 X Underlying headcount reduced by over 8,000 people (c. 20%) X Continued progress on strategic acquisitions including expansion into the US brownfield petrochemical market. Total cash expenditure on new acquisitions of $234m X Strong balance sheet and cash generation. Net debt of $290m (0.5x 2015 EBITDA) and cash conversion of 119% X Dividend up 10%. Dividend cover of 2.8 times. -

Aggreko Plc Annual Report 2014

AGGREKO PLC ANNUAL REPORT 2014 WorldReginfo - 6862ca4a-e7bb-4f01-b3ee-8db39d1a7e72 INSIDE OUR Performance highlights 2 2014 REPORT 1 Strategic report A solid performance – with Ken Hanna 4 A fresh perspective – with Chris Weston 6 What we do 10 Where we operate 11 Our markets 12 How we create value 16 Our strategy 22 How we performed – our KPIs 26 Risk factors that could affect business performance 28 Our investment case 34 Performance review 35 – Americas 38 – APAC 42 – EMEA 46 Financial performance 50 Building a sustainable business 55 2 Governance Corporate Governance 68 – Our Board 72 Audit Committee report 84 Ethics Committee report 88 Nomination Committee report 90 Remuneration Committee report 92 Statutory disclosures 119 Statement of Directors’ responsibilities 124 3 Accounts Independent auditors’ report 126 Group income statement 132 Group statement of comprehensive income 132 Group balance sheet 133 Group cash flow statement 134 Reconciliation of net cash flow to movement in net debt 134 Group statement of changes in equity 135 Notes to the Group accounts 137 Company balance sheet 172 Company statement of total recognised gains and losses 173 Notes to the Company accounts 174 4 Additional information Shareholder information 184 Definition and calculation of non GAAP measures 186 Financial summary 188 POWERING COMMUNITIES IN IVORY COAST Glossary Inside back cover The cover image shows our 200 MW gas-fired Power Project in Ivory Coast. With a booming economy and GDP growth of around 9%, demand for energy has been increasing steadily in recent years. The Aggreko plant injects vital capacity into the local grid, helping keep essential infrastructure and services running, while also ensuring power supplies are maintained to both business and domestic users. -

FTSE Russell Publications

2 FTSE Russell Publications 19 August 2021 FTSE 250 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Infrastructure 0.43 UNITED Bytes Technology Group 0.23 UNITED Edinburgh Investment Trust 0.25 UNITED KINGDOM KINGDOM KINGDOM 4imprint Group 0.18 UNITED C&C Group 0.23 UNITED Edinburgh Worldwide Inv Tst 0.35 UNITED KINGDOM KINGDOM KINGDOM 888 Holdings 0.25 UNITED Cairn Energy 0.17 UNITED Electrocomponents 1.18 UNITED KINGDOM KINGDOM KINGDOM Aberforth Smaller Companies Tst 0.33 UNITED Caledonia Investments 0.25 UNITED Elementis 0.21 UNITED KINGDOM KINGDOM KINGDOM Aggreko 0.51 UNITED Capita 0.15 UNITED Energean 0.21 UNITED KINGDOM KINGDOM KINGDOM Airtel Africa 0.19 UNITED Capital & Counties Properties 0.29 UNITED Essentra 0.23 UNITED KINGDOM KINGDOM KINGDOM AJ Bell 0.31 UNITED Carnival 0.54 UNITED Euromoney Institutional Investor 0.26 UNITED KINGDOM KINGDOM KINGDOM Alliance Trust 0.77 UNITED Centamin 0.27 UNITED European Opportunities Trust 0.19 UNITED KINGDOM KINGDOM KINGDOM Allianz Technology Trust 0.31 UNITED Centrica 0.74 UNITED F&C Investment Trust 1.1 UNITED KINGDOM KINGDOM KINGDOM AO World 0.18 UNITED Chemring Group 0.2 UNITED FDM Group Holdings 0.21 UNITED KINGDOM KINGDOM KINGDOM Apax Global Alpha 0.17 UNITED Chrysalis Investments 0.33 UNITED Ferrexpo 0.3 UNITED KINGDOM KINGDOM KINGDOM Ascential 0.4 UNITED Cineworld Group 0.19 UNITED Fidelity China Special Situations 0.35 UNITED KINGDOM KINGDOM KINGDOM Ashmore -

Aggreko Annual Report

THE POWER TO make things happen ANNUAL REPORT AND ACCOUNTS 2016 AGGREKO PLC Contents OVERVIEW Introducing Aggreko 01 Our investment case 02 Performance highlights 03 Our business today 04 A personal perspective from our CEO 06 02 BUSINESS STRATEGY OUR INVESTMENT The power to drive major sporting events* 11 CASE Our global markets 12 The power to connect communities* 16 How we create value 18 How we make things happen 22 Our strategic priorities 27 The power to build a new product* 32 PERFORMANCE REVIEW How we performed – our key performance indicators 34 Group and business unit reviews 40 04 Financial review 44 The power to help rocket testing* 50 OUR BUSINESS Risk factors that could affect business performance 52 TODAY Assessment of prospects and viability 61 The power to keep the beat* 62 Making a massive difference 64 GOVERNANCE Chairman’s introduction 70 Audit Committee report 86 Ethics Committee report 90 Nomination Committee report 92 WHAT OUR CUSTOMER NEEDS 18 Remuneration Committee report 94 Statutory disclosures 115 HOW WE Statement of Directors’ responsibilities 121 CREATE VALUE ACCOUNTS & OTHER INFORMATION Independent auditors’ report 122 Group income statement 126 KEY OUTPUTS Group statement of comprehensive income 126 Group balance sheet 127 Group cash flow statement 128 Reconciliation of net cash flow to movement in net debt 129 Group statement of changes in equity 130 Notes to the Group accounts 132 Company balance sheet 169 Company statement of comprehensive income 170 70 Company statement of changes in equity 171 CORPORATE Notes to the Company accounts 172 Shareholder information 176 GOVERNANCE Definition and calculation of non GAAP measures 178 Financial summary 180 Glossary 181 Pages 1-69 comprise the Strategic report * Pages 11, 16, 32, 50 and 62 case studies demonstrate how we make things happen AGGREKO PLC ANNUAL REPORT AND ACCOUNTS 2016 01 Overview Around the world, people, businesses and countries are striving for a better future. -

Aggreko’S Current Hold Valuation As a Moderately Assign I Share, Recommendation Per to Aggreko

Equity Research Aggreko Plc Industrials | European Business Services A Case To Continue Holding the Market Leader 08 February 2021 in Temporary Power Solutions Stock Rating Hold Even after the takeover offer re-pricing, I believe Aggreko’s Industry View valuation does not reflect the full extent of growth Positive opportunities in a recovery environment Price Target GBp 964 Under-appreciated positioning amid the energy transition: The acceleration of various themes, such as de-carbonisation, has the potential to magnify dislocations in certain regions and sectors. Providing scope for above-market rates of growth as temporary power providers are engaged to act as a bridging mechanism for Price (as of 08/02/2021) GBp 851 economies and sectors transitioning away from their legacy power infrastructure. Additionally, though unpredictable, I like the added kicker of large one-off events Potential Upside/Downside +13.2% and believe Aggreko’s scale continues to act as an economic moat for these types of Tickers AGK.LN / AGGK.L contracts. Forecasts: Following management’s Nov-20 strategic update, I forecast a recovery in underlying performance to take place in 2021. This is of course predicated on a Enterprise Value (mGBP) 2,679 gradual easing of COVID-19 lockdown restrictions throughout 2021, which is subject Market Cap (mGBP) 2,180 to the effectiveness of global vaccination roll-outs and government lockdown policies. Shares Outstanding (m) 256 My base case estimates a 8.2% growth in underlying revenue, net of pass-through fuel, for 2021 and further acceleration in 2022 as economic conditions continue Free Float (%) 99% normalise, specifically the events business. -

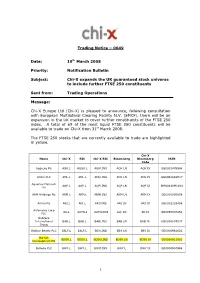

20080319 Trading Notice Functional 0049

Trading Notice – 0049 Date: 19 th March 2008 Priority: Notification Bulletin Subject: Chi-X expands the UK guaranteed stock universe to include further FTSE 250 constituents Sent from: Trading Operations Message: Chi-X Europe Ltd (Chi-X) is pleased to announce, following consultation with European Multilateral Clearing Facility N.V. (EMCF), there will be an expansion in the UK market to cover further constituents of the FTSE 250 index. A total of 69 of the most liquid FTSE 250 constituents will be available to trade on Chi-X from 31 st March 2008. The FTSE 250 stocks that are currently available to trade are highlighted in yellow. Chi-X Name Chi-X RIC Chi-X RIC Bloomberg Bloomberg ISIN Code Aggreko Plc AGK.L AGGK.L AGKl.INS AGK LN AGK IX GB0001478998 Amlin PLC AML.L AML.L AMLl.INS AML LN AML IX GB00B2988H17 Aquarius Platinum AQP.L AQP.L AQPl.INS AQP LN AQP IX BMG0440M1284 Ltd ARM Holdings Plc ARM.L ARM.L ARMl.INS ARM LN ARM IX GB0000595859 Arriva Plc ARI.L ARI.L ARIl.INS ARI LN ARI IX GB0002303468 Autonomy Corp AU.L AUTN.L AUTNl.INS AU/ LN AU IX GB0055007982 PLC Babcock International BAB.L BAB.L BABl.INS BAB LN BAB IX GB0009697037 Group Balfour Beatty PLC BALF.L BALF.L BBYl.INS BBY LN BBY IX GB0000961622 Barratt BDEV.L BDEV.L BDEVl.INS BDEV LN BDEV IX GB0000811801 Development Plc Bellway PLC BWY.L BWY.L BWYl.INS BWY.L BWY IX GB0000904986 1 Biffa PLC BIFF.L BIFF.L BIFFl.INS BIFF LN BIFF IX GB00B129PL77 Bradford & Bingley BB.L BB.L BBl.INS BB/ LN BB IX GB0002228152 PLC Bunzl PLC BNZL.L BNZL.L BNZLl.INS BNZL LN BNZL IX GB00B0744B38 Burberry -

Expiry Notice

Expiry Notice 17 February 2017 London Stock Exchange Derivatives Expiration prices for UK Single Stock Products Please find below expiration prices for UK Single Stock Products expiring on Friday 17 February 2017: Underlying Code Underlying Name Expiration Price ADN ABERDEEN ASSET MANAGEMENT PLC 264.70 AGK AGGREKO PLC 1012.00 AAL ANGLO AMERICAN PLC 1345.00 ANTO ANTOFAGASTA PLC 837.00 AHT ASHTEAD GROUP PLC 1704.00 ABF ASSOCIATED BRITISH FOODS PLC 2609.00 AZN ASTRA ZENECA PLC 4595.00 AV AVIVA PLC 498.40 BA BAE SYSTEMS PLC 606.50 BARC BARCLAYS PLC 237.00 BLT BHP BILLITON PLC 1394.50 BP BP PLC 446.00 BATS BRITISH AMERICAN TOBACCO PLC 5004.00 BTA BT GROUP PLC 316.10 CPI CAPITA PLC 522.00 CCL CARNIVAL PLC 4303.00 CNA CENTRICA PLC 232.60 CPG COMPASS GROUP PLC 1473.00 DGE DIAGEO PLC 2273.00 EVR EVRAZ PLC 245.00 FRES FRESNILLO PLC 1523.00 GFS G4S PLC 260.20 GSK GLAXOSMITHKLINE PLC 1639.50 GLEN GLENCORE PLC 319.45 HSBA HSBC HOLDINGS PLC 707.50 IMB IMPERIAL BRANDS PLC 3781.00 1 IHG INTERCONTINENTAL HOTELS GROUP PLC 3889.00 IAG INTERNATIONAL CONSOLIDATED AIRLINES 513.00 ITV ITV PLC 205.50 KAZ KAZ MINERALS PLC 559.50 KGF KINGFISHER PLC 327.10 LCL LADBROKES CORAL GROUP 120.60 LAND LAND SECURITIES GROUP PLC 1054.00 LGEN LEGAL & GENERAL GROUP PLC 244.00 LLOY LLOYDS BANKING GROUP PLC 66.86 LMI LONMIN PLC 133.25 EMG MAN GROUP PLC 141.80 MKS MARKS & SPENCER GROUP PLC 325.50 MRW MORRISON (WM) SUPERMARKETS PLC 248.90 NG NATIONAL GRID PLC 961.20 NXT NEXT PLC 3852.00 PSON PEARSON PLC 668.50 PFC PETROFAC PLC 869.50 POLY POLYMETAL INTERNATIONAL PLC 979.00 PRU -

Investments July 2013

Newcastle University Endowment Asset Investments Valuation as at 31/07/2013 Funds managed by Majedie Asset Management Super Sector Issuer Market Value (£) Basic Materials Mondi 503,676 Rio Tinto 121,155 Cash CASH GBP 1,203,694 Consumer Goods Bellway 164,110 General Motors 137,229 GKN 107,551 Nintendo 141,599 Panasonic 25,111 Unilever 222,301 Abercrombie and Fitch 115,131 Carnival 721,602 Daily Mail and General Trust (A Shs) 108,966 Debenhams 390,247 Dixons 255,918 Easyjet 35,300 FirstGroup 421,477 Halfords Group 105,905 Home Retail 165,041 Intl. Consolidated Airlines 884,996 ITV 619,354 Kingfisher 634,513 Marks and Spencer 1,183,782 Mediaset 112,245 Pearson 451,899 Ryanair 326,182 Tesco 595,228 Whitbread 172,676 WM Morrison 317,524 Financials 3I Group 298,354 Amlin 370,197 Aviva 554,973 Bank of America 322,615 Barclays 666,929 British Land Co 54,880 HSBC 1,058,818 Intesa Sanpaolo 646,568 Jardine Lloyd Thompson 99,027 Land Securities Group 57,965 Lloyds Banking Group 677,963 LMS Capital 33,889 Man Group 103,046 RBS 822,279 Standard Life 414,461 Health Care AstraZeneca 219,676 GlaxoSmithKline 1,547,327 Sanofi-Aventis 112,349 Smith and Nephew 173,233 Industrials BAE Systems 1,050,986 Davis Service Group 50,376 Electrocomponents 446,529 Hays 272,747 Marshalls 67,952 Mears Group 193,177 MITIE 235,607 Rentokil Initial 227,290 SThree 82,416 Travis Perkins 428,955 Oil & Gas BP 2,311,073 Royal Dutch Shell 1,975,773 Pooled Funds MASSIF 2,820,750 Technology Check Point Software 70,583 CSR 213,586 Hewlett-Packard 793,682 Invensys 0 Microsoft 269,497