Pricing and Hedging Spread Options in a Log-Normal Model

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Options Strategy Guide for Metals Products As the World’S Largest and Most Diverse Derivatives Marketplace, CME Group Is Where the World Comes to Manage Risk

metals products Options Strategy Guide for Metals Products As the world’s largest and most diverse derivatives marketplace, CME Group is where the world comes to manage risk. CME Group exchanges – CME, CBOT, NYMEX and COMEX – offer the widest range of global benchmark products across all major asset classes, including futures and options based on interest rates, equity indexes, foreign exchange, energy, agricultural commodities, metals, weather and real estate. CME Group brings buyers and sellers together through its CME Globex electronic trading platform and its trading facilities in New York and Chicago. CME Group also operates CME Clearing, one of the largest central counterparty clearing services in the world, which provides clearing and settlement services for exchange-traded contracts, as well as for over-the-counter derivatives transactions through CME ClearPort. These products and services ensure that businesses everywhere can substantially mitigate counterparty credit risk in both listed and over-the-counter derivatives markets. Options Strategy Guide for Metals Products The Metals Risk Management Marketplace Because metals markets are highly responsive to overarching global economic The hypothetical trades that follow look at market position, market objective, and geopolitical influences, they present a unique risk management tool profit/loss potential, deltas and other information associated with the 12 for commercial and institutional firms as well as a unique, exciting and strategies. The trading examples use our Gold, Silver -

What Drives Index Options Exposures?* Timothy Johnson1, Mo Liang2, and Yun Liu1

Review of Finance, 2016, 1–33 doi: 10.1093/rof/rfw061 What Drives Index Options Exposures?* Timothy Johnson1, Mo Liang2, and Yun Liu1 1University of Illinois at Urbana-Champaign and 2School of Finance, Renmin University of China Abstract 5 This paper documents the history of aggregate positions in US index options and in- vestigates the driving factors behind use of this class of derivatives. We construct several measures of the magnitude of the market and characterize their level, trend, and covariates. Measured in terms of volatility exposure, the market is economically small, but it embeds a significant latent exposure to large price changes. Out-of-the- 10 money puts are the dominant component of open positions. Variation in options use is well described by a stochastic trend driven by equity market activity and a sig- nificant negative response to increases in risk. Using a rich collection of uncertainty proxies, we distinguish distinct responses to exogenous macroeconomic risk, risk aversion, differences of opinion, and disaster risk. The results are consistent with 15 the view that the primary function of index options is the transfer of unspanned crash risk. JEL classification: G12, N22 Keywords: Index options, Quantities, Derivatives risk 20 1. Introduction Options on the market portfolio play a key role in capturing investor perception of sys- tematic risk. As such, these instruments are the object of extensive study by both aca- demics and practitioners. An enormous literature is concerned with modeling the prices and returns of these options and analyzing their implications for aggregate risk, prefer- 25 ences, and beliefs. Yet, perhaps surprisingly, almost no literature has investigated basic facts about quantities in this market. -

Options Application (PDF)

Questions? Go to Fidelity.com/options. Options Application Use this application to apply to add options trading to your new or existing Fidelity account. If you already have options trading on your account, use this application to add or update account owner or authorized agent information. Please complete in CAPITAL letters using black ink. If you need more room for information or signatures, make a copy of the relevant page. Helpful to Know Requirements – Margin can involve significant cost and risk and is not • Entire form must be completed in order to be considered appropriate for all investors. Account owners must for Options. If you are unsure if a particular section pertains determine whether margin is consistent with their investment to you, please call a Fidelity investment professional at objectives, income, assets, experience, and risk tolerance. 800-343-3548. No investment or use of margin is guaranteed to achieve any • All account owners must complete the account owner sections particular objective. and sign Section 5. – Margin will not be granted if we determine that you reside • Any authorized agent must complete Section 6 and sign outside of the United States. Section 7. – Important documents related to your margin account include • Trust accounts must provide trustee information where the “Margin Agreement” found in the Important Information information on account owners is required. about Margins Trading and Its Risks section of the Fidelity Options Agreement. Eligibility of Trading Strategies Instructions for Corporations and Entities Nonretirement accounts: • Unless options trading is specifically permitted in the corporate • Business accounts: Eligible for any Option Level. -

Simple Robust Hedging with Nearby Contracts Liuren Wu

Journal of Financial Econometrics, 2017, Vol. 15, No. 1, 1–35 doi: 10.1093/jjfinec/nbw007 Advance Access Publication Date: 24 August 2016 Article Downloaded from https://academic.oup.com/jfec/article-abstract/15/1/1/2548347 by University of Glasgow user on 11 September 2019 Simple Robust Hedging with Nearby Contracts Liuren Wu Zicklin School of Business, Baruch College, City University of New York Jingyi Zhu University of Utah Address correspondence to Liuren Wu, Zicklin School of Business, Baruch College, One Bernard Baruch Way, B10-225, New York, NY 10010, or e-mail: [email protected]. Received April 12, 2014; revised June 26, 2016; accepted July 25, 2016 Abstract This paper proposes a new hedging strategy based on approximate matching of contract characteristics instead of risk sensitivities. The strategy hedges an option with three options at different maturities and strikes by matching the option function expansion along maturity and strike rather than risk factors. Its hedging effective- ness varies with the maturity and strike distance between the target and the hedge options, but is robust to variations in the underlying risk dynamics. Simulation ana- lysis under different risk environments and historical analysis on S&P 500 index op- tions both show that a wide spectrum of strike-maturity combinations can outper- form dynamic delta hedging. Key words: characteristics matching, hedging, jumps, Monte Carlo, payoff matching, risk sensi- tivity matching, strike-maturity triangle, stochastic volatility, S&P 500 index options, Taylor expansion JEL classification: G11, G13, G51 The concept of dynamic hedging has revolutionized the derivatives industry by drastically reducing the risk of derivative positions through frequent rebalancing of a few hedging in- struments. -

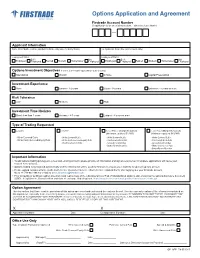

Options Application and Agreement Member FINRA/SIPC Firstrade Account Number (If Application Is for an Existing Account – Otherwise Leave Blank)

Options Application and Agreement Member FINRA/SIPC Firstrade Account Number (if application is for an existing account – otherwise leave blank) Applicant Information Name (First, Middle, Last for individual / indicate entity name for Entity/Trusts) Co-Applicant’s Name (For Joint Accounts Only) Employment Status Employment Status Self- Not Self- Not Employed Employed Retired Student Homemaker Employed Employed Employed Retired Student Homemaker Employed Options Investment Objectives (Level 2, 3 & 4 require “Speculation” to be checked) Speculation Growth Income Capital Preservation Investment Experience None Limited - 1-2 years Good - 3-5 years Extensive - 5 years or more Risk Tolerance Low Medium High Investment Time Horizon Short- less than 3 years Average - 4-7 years Longest - 8 years or more Type of Trading Requested Level 1 Level 2 Level Three (Margin Required) Level Four (Margin Required) (Minimum equity of $2,000) (Minimum equity of $10,000) • Write Covered Calls • Write Covered Calls • Write Covered Calls • Write Covered Calls • Write Cash-Secured Equity Puts • Write Cash-Secured Equity Puts • Purchase Calls & Puts • Purchase Calls & Puts • Purchase Calls & Puts • Spreads & Straddles • Spreads & Straddles • Buttery and Condor • Write Uncovered Puts • Buttery and Condor Important Information To add options trading privileges to a new and existing account, please provide all information and signature(s) below. Incomplete applications will cause your request to be delayed. Options trading is not granted automatically and the information will be used by Firstrade to assess your eligibility to open an options account. Please upload completed form via the Form Center (Customer Service ->Form Center ->Upload Form) after logging into your Firstrade account, fax to +1-718-961-3919 or e-mail to [email protected] Prior to buying or selling an option, investors must read a copy of the Characteristics & Risk of Standardized Options, also known as the options disclosure document (ODD). -

General Black-Scholes Models Accounting for Increased Market

General Black-Scholes mo dels accounting for increased market volatility from hedging strategies y K. Ronnie Sircar George Papanicolaou June 1996, revised April 1997 Abstract Increases in market volatility of asset prices have b een observed and analyzed in recentyears and their cause has generally b een attributed to the p opularity of p ortfolio insurance strategies for derivative securities. The basis of derivative pricing is the Black-Scholes mo del and its use is so extensive that it is likely to in uence the market itself. In particular it has b een suggested that this is a factor in the rise in volatilities. In this work we present a class of pricing mo dels that account for the feedback e ect from the Black-Scholes dynamic hedging strategies on the price of the asset, and from there backonto the price of the derivative. These mo dels do predict increased implied volatilities with minimal assumptions b eyond those of the Black-Scholes theory. They are characterized by a nonlinear partial di erential equation that reduces to the Black-Scholes equation when the feedback is removed. We b egin with a mo del economy consisting of two distinct groups of traders: Reference traders who are the ma jorityinvesting in the asset exp ecting gain, and program traders who trade the asset following a Black-Scholes typ e dynamic hedging strategy, which is not known a priori, in order to insure against the risk of a derivative security. The interaction of these groups leads to a sto chastic pro cess for the price of the asset which dep ends on the hedging strategy of the program traders. -

Introduction to Debit Spreads

© ReadySetTrade !1 Vertical Debit Spreads Overview By Doc Severson" © Copyright 2020 by Doc Severson & ReadySetTrade, LLC" All Rights Reserved" • We Are Not Financial Advisors or a Broker/Dealer: Neither ReadySetTrade® nor any of its o$cers, employees, representatives, agents, or independent contractors are, in such capacities, licensed financial advisors, registered investment advisers, or registered broker-dealers. ReadySetTrade ® does not provide investment or financial advice or make investment recommendations, nor is it in the business of transacting trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation. Nothing contained in this communication constitutes a solicitation, recommendation, promotion, endorsement, or o&er by ReadySetTrade ® of any particular security, transaction, or investment." • Securities Used as Examples: The security used in this example is used for illustrative purposes only. ReadySetTrade ® is not recommending that you buy or sell this security. Past performance shown in examples may not be indicative of future performance." • All information provided are for educational purposes only and does not imply, express, or guarantee future returns. Past performance shown in examples may not be indicative of future performance." • Investing Risk: Trading securities can involve high risk and the loss of any funds invested. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon, or risk tolerance." •Derivatives Trading Risk: Options trading is generally more complex than stock trading and may not be suitable for some investors. Margin strategies can result in the loss of more than the original amount invested. -

A Black-Scholes User's Guide to the Bachelier Model

A Black{Scholes user's guide to the Bachelier model Jaehyuk Choia,∗, Minsuk Kwakb, Chyng Wen Teec, Yumeng Wangd aPeking University HSBC Business School, Shenzhen, China bDepartment of Mathematics, Hankuk University of Foreign Studies, Yongin, Republic of Korea cLee Kong Chian School of Business, Singapore Management University, Singapore dBank of Communications, Shanghai, China Abstract To cope with the negative oil futures price caused by the COVID{19 recession, global commodity futures exchanges switched the option model from Black{Scholes to Bachelier in April 2020. This study reviews the literature on Bachelier's pioneering option pricing model and summarizes the practical results on volatility conversion, risk management, stochastic volatility, and barrier options pricing to facilitate the model transition. In particular, using the displaced Black{Scholes model as a model family with the Black{Scholes and Bachelier models as special cases, we not only connect the two models but also present a continuous spectrum of model choices. Keywords: Bachelier model, Black{Scholes model, Displaced diffusion model, Normal model JEL Classification: G10, G13 1. Introduction Louis Bachelier pioneered an option pricing model in his Ph.D. thesis (Bachelier, 1900), marking the birth of mathematical finance. He offered the first analysis of the mathematical properties of Brownian motion (BM) to model the stochastic change in stock prices, and this preceded the work of Einstein (1905) by five years. His analysis also precursors what is now known as the efficient market hypothe- sis (Schachermayer and Teichmann, 2008). See Sullivan and Weithers(1991) for Bachelier's contribution to financial economics and Courtault et al.(2000) for a review of his life and achievements. -

Trading Activity and Bid∓Ask Spreads of Individual Equity Options

Journal of Banking & Finance 34 (2010) 2897–2916 Contents lists available at ScienceDirect Journal of Banking & Finance journal homepage: www.elsevier.com/locate/jbf Trading activity and bid–ask spreads of individual equity options Jason Wei a,*, Jinguo Zheng b a Joseph L. Rotman School of Management, University of Toronto, Toronto, Ontario, Canada b Guanghua School of Management and Institute of Strategic Research, Peking University, Beijing, China article info abstract Article history: We empirically examine the impact of trading activities on the liquidity of individual equity options mea- Received 17 July 2009 sured by the proportional bid–ask spread. There are three main findings. First, the option return volatility, Accepted 13 February 2010 defined as the option price elasticity times the stock return volatility, has a much higher power in Available online 19 March 2010 explaining the spread variations than the commonly considered liquidity determinants such as the stock return volatility and option trading volume. Second, after controlling for all the liquidity determinants, JEL classification: we find a maturity-substitution effect due to expiration cycles. When medium-term options (60–90 days G10 maturity) are not available, traders use short-term options as substitutes whose higher volume leads to a G12 smaller bid–ask spread or better liquidity. Third, we also find a moneyness-substitution effect induced by G14 the stock return volatility. When the stock return volatility goes up, trading shifts from in-the-money Keywords: options to out-of-the-money options, causing the latter’s spread to narrow. Trading activity Ó 2010 Elsevier B.V. All rights reserved. -

A Bayesian Nonparametric Approach to Option Pricing

A Bayesian nonparametric approach to option pricing Zhang Qin† Caio Almeida‡ Abstract Accurately modeling the implied volatility surface is of great importance to option pricing, trading and hedging. In this paper, we investigate the use of a Bayesian nonparametric approach to fit and forecast the implied volatility surface with observed market data. More specifically, we explore Gaussian Processes with different kernel functions characterizing general covariance functions. We also obtain posterior distri- butions of the implied volatility and build confidence intervals for the predictions to assess potential model uncertainty. We apply our approach to market data on the S&P 500 index option market in 2018, analyzing 322,983 options. Our results suggest that the Bayesian approach is a powerful alternative to existing parametric pricing models. Keywords: Machine Learning, Gaussian processes, Bayesian nonparametrics, Options, Kernels. JEL Code: C13, C11. 1. Introduction Implied volatility is a measure of the future expected risk of the underly- ing price. Accurately modeling and forecasting implied volatility is of great importance in both finance theory and practical decision making. In this project, we propose a method to approach the option pricing problem in a Bayesian framework. Implied volatility tends to increase for in-the-money (ITM) and out-of- the-money (OTM) options. This pattern is usually described as the “volatility smile” as the implied volatility plotted against strike or moneyness looks like the shape of a smile. Dupire(1994) extends the Black-Scholes model by allowing the volatility to be a deterministic function of the spot price and time. Heston(1993) develops a mean-reverting stochastic volatility model, with closed-form solution for the implied volatility surface up to solving an inverse Fourier transform. -

Asymptotics for at the Money Local Vol Basket Options

ASYMPTOTICS FOR AT THE MONEY LOCAL VOL BASKET OPTIONS CHRISTIAN BAYER AND PETER LAURENCE To the memory of Peter Laurence, who passed away unexpectedly during the final stage of the preparation of this manuscript. Abstract. We consider a basket or spread option on based on a multi-dimensional local volatility model. Bayer and Laurence [Comm. Pure. Appl. Math., to ap- pear] derived highly accurate analytic formulas for prices and implied volatili- ties of such options when the options are not at the money. We now extend these results to the ATM case. Moreover, we also derive similar formulas for the local volatility of the basket. 1. Introduction For a local volatility type model for a basket of stocks, whose forward prices are given by dFi(t) = σi(Fi(t))dWi(t); i = 1;:::; n; (1.1) D E d Wi ; W j (t) = ρi jdt; i; j = 1;:::; n; (1.2) with a given correlation matrix ρ, we consider basket options with a payoff 0 1+ BXn C B − C P(F) = @B wiFi KAC ; i=1 where we generally denote in bold face a vector of the corresponding italic compo- nents, as in F = (F1;:::; Fn). Since we only assume that at least one of the weights w1;:::; wn is positive, we will refer to options of that type as generalized spread options. The purpose of this paper is to provide an explicit first order accurate short time expansion of the price CB(F0; K; T) of the above option using the heat kernel ex- pansion technique (see, for instance, [11], [10], [18]) when the option is at the money. -

Geodesic Strikes for Composite, Basket, Asian, and Spread Options

Geodesic strikes for composite, basket, Asian, and spread options Peter J¨ackel∗ First version: 28th July 2012 This version: 11th February 2017 Abstract In practice, it is not uncommon for X to be the mar- ket price of a standard investment asset such as an We discuss simple methodologies for the selection of equity share, denominated in its domestic currency most relevant or effective strikes for the assessment DOM, and for Y to be an FX rate that converts the of appropriate implied volatilities used for the valu- final investment asset value to a target currency TAR. ation of composite, basket, Asian, and spread options As a consequence of the natural direction of the FX following the spirit of geodesic strikes [ABOBF02]. rate, i.e., DOMTAR, meaning the value of one DOM currency unit expressed in units of TAR, the valu- Introduction ation of a composite option may also incur a quanto effect since the asset X and the FX rate DOMTAR In the context of vanilla, or near-vanilla, derivatives cannot be martingales in the same measure, and this trading, we often also encounter composite, basket, has to be taken into account. For the purpose of this Asian, and spread options. Whilst their respective article, however, we shall assume that all involved payoff rules do in principle warrant treating them underlyings are martingales in the same measure. In as genuinely exotic options, it is often desirable to practice, this may mean that we have to determine use a simple approximation for the sake of tract- an effective quanto forward for the asset X in the tar- ability.