Trading Activity and Bid∓Ask Spreads of Individual Equity Options

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SABAF Spa Via Dei Carpini 1 – Ospitaletto (BS)

SABAF SpA Via dei Carpini 1 – Ospitaletto (BS) - Italy Share capital: EUR 11,533,450 fully paid in Brescia Companies Register and Tax Code no. 03244470179 -*-*-*-*- BOARD OF STATUTORY AUDITORS’ REPORT ON FINANCIAL STATEMENTS FOR THE YEAR ENDING ON DECEMBER 31st 2006 To the Shareholders Sabaf SpA is a company listed on the Italian Bourse. Consequently, by virtue of Italian Legislative Decree no. 58 of February 24th 1998 and of the current Articles of Association, all controls concerning accounting and financial reporting are attributed to the independent auditor. The Board of Statutory Auditors’ report has therefore been prepared reflecting the requirements indicated above as well as those of CONSOB (Italian securities & exchange commission) communications relating to listed companies. We have also overseen the overall approach applied to year-end financial statements and their general legal compliance as regards formation and structure, giving our consent to recognition among intangible assets of research and development costs of € 444,000 gross. The financial statements relating to the financial year (FY) ending on December 31st 2006 show a net profit of € 14,241,149 after expensing current, deferred and advance income tax totalling € 9,977.569. 1 Having specified this, we inform you of what follows: We recall the fact that Sabaf SpA has accepted the Italian Corporate Governance Code drawn up by the Italian Corporate Governance Committee for Listed Companies. The Code expresses and regulates some important aspects of operation of the Board of Directors and of its members. [Sabaf has accordingly] appointed an Internal Control & Audit Committee and also a Compensation Committee. -

Options Strategy Guide for Metals Products As the World’S Largest and Most Diverse Derivatives Marketplace, CME Group Is Where the World Comes to Manage Risk

metals products Options Strategy Guide for Metals Products As the world’s largest and most diverse derivatives marketplace, CME Group is where the world comes to manage risk. CME Group exchanges – CME, CBOT, NYMEX and COMEX – offer the widest range of global benchmark products across all major asset classes, including futures and options based on interest rates, equity indexes, foreign exchange, energy, agricultural commodities, metals, weather and real estate. CME Group brings buyers and sellers together through its CME Globex electronic trading platform and its trading facilities in New York and Chicago. CME Group also operates CME Clearing, one of the largest central counterparty clearing services in the world, which provides clearing and settlement services for exchange-traded contracts, as well as for over-the-counter derivatives transactions through CME ClearPort. These products and services ensure that businesses everywhere can substantially mitigate counterparty credit risk in both listed and over-the-counter derivatives markets. Options Strategy Guide for Metals Products The Metals Risk Management Marketplace Because metals markets are highly responsive to overarching global economic The hypothetical trades that follow look at market position, market objective, and geopolitical influences, they present a unique risk management tool profit/loss potential, deltas and other information associated with the 12 for commercial and institutional firms as well as a unique, exciting and strategies. The trading examples use our Gold, Silver -

What Drives Index Options Exposures?* Timothy Johnson1, Mo Liang2, and Yun Liu1

Review of Finance, 2016, 1–33 doi: 10.1093/rof/rfw061 What Drives Index Options Exposures?* Timothy Johnson1, Mo Liang2, and Yun Liu1 1University of Illinois at Urbana-Champaign and 2School of Finance, Renmin University of China Abstract 5 This paper documents the history of aggregate positions in US index options and in- vestigates the driving factors behind use of this class of derivatives. We construct several measures of the magnitude of the market and characterize their level, trend, and covariates. Measured in terms of volatility exposure, the market is economically small, but it embeds a significant latent exposure to large price changes. Out-of-the- 10 money puts are the dominant component of open positions. Variation in options use is well described by a stochastic trend driven by equity market activity and a sig- nificant negative response to increases in risk. Using a rich collection of uncertainty proxies, we distinguish distinct responses to exogenous macroeconomic risk, risk aversion, differences of opinion, and disaster risk. The results are consistent with 15 the view that the primary function of index options is the transfer of unspanned crash risk. JEL classification: G12, N22 Keywords: Index options, Quantities, Derivatives risk 20 1. Introduction Options on the market portfolio play a key role in capturing investor perception of sys- tematic risk. As such, these instruments are the object of extensive study by both aca- demics and practitioners. An enormous literature is concerned with modeling the prices and returns of these options and analyzing their implications for aggregate risk, prefer- 25 ences, and beliefs. Yet, perhaps surprisingly, almost no literature has investigated basic facts about quantities in this market. -

Options Application (PDF)

Questions? Go to Fidelity.com/options. Options Application Use this application to apply to add options trading to your new or existing Fidelity account. If you already have options trading on your account, use this application to add or update account owner or authorized agent information. Please complete in CAPITAL letters using black ink. If you need more room for information or signatures, make a copy of the relevant page. Helpful to Know Requirements – Margin can involve significant cost and risk and is not • Entire form must be completed in order to be considered appropriate for all investors. Account owners must for Options. If you are unsure if a particular section pertains determine whether margin is consistent with their investment to you, please call a Fidelity investment professional at objectives, income, assets, experience, and risk tolerance. 800-343-3548. No investment or use of margin is guaranteed to achieve any • All account owners must complete the account owner sections particular objective. and sign Section 5. – Margin will not be granted if we determine that you reside • Any authorized agent must complete Section 6 and sign outside of the United States. Section 7. – Important documents related to your margin account include • Trust accounts must provide trustee information where the “Margin Agreement” found in the Important Information information on account owners is required. about Margins Trading and Its Risks section of the Fidelity Options Agreement. Eligibility of Trading Strategies Instructions for Corporations and Entities Nonretirement accounts: • Unless options trading is specifically permitted in the corporate • Business accounts: Eligible for any Option Level. -

Global Utilities in Transition

Table of Contents Executive Summary .................................................................................................................................2 Introduction ..............................................................................................................................................4 Engie SA (France) ................................................................................................................................7 Enel SpA.............................................................................................................................................. 10 RWE ..................................................................................................................................................... 13 E.ON SE ............................................................................................................................................... 15 NextEra Energy Inc. ........................................................................................................................... 18 NRG Energy ........................................................................................................................................ 20 Tokyo Electric Power Company Holdings Inc. (TEPCO) ............................................................... 24 AGL Energy (Australia) ..................................................................................................................... 27 China Energy Investment Corp. (China) ...................................................................................... -

Simple Robust Hedging with Nearby Contracts Liuren Wu

Journal of Financial Econometrics, 2017, Vol. 15, No. 1, 1–35 doi: 10.1093/jjfinec/nbw007 Advance Access Publication Date: 24 August 2016 Article Downloaded from https://academic.oup.com/jfec/article-abstract/15/1/1/2548347 by University of Glasgow user on 11 September 2019 Simple Robust Hedging with Nearby Contracts Liuren Wu Zicklin School of Business, Baruch College, City University of New York Jingyi Zhu University of Utah Address correspondence to Liuren Wu, Zicklin School of Business, Baruch College, One Bernard Baruch Way, B10-225, New York, NY 10010, or e-mail: [email protected]. Received April 12, 2014; revised June 26, 2016; accepted July 25, 2016 Abstract This paper proposes a new hedging strategy based on approximate matching of contract characteristics instead of risk sensitivities. The strategy hedges an option with three options at different maturities and strikes by matching the option function expansion along maturity and strike rather than risk factors. Its hedging effective- ness varies with the maturity and strike distance between the target and the hedge options, but is robust to variations in the underlying risk dynamics. Simulation ana- lysis under different risk environments and historical analysis on S&P 500 index op- tions both show that a wide spectrum of strike-maturity combinations can outper- form dynamic delta hedging. Key words: characteristics matching, hedging, jumps, Monte Carlo, payoff matching, risk sensi- tivity matching, strike-maturity triangle, stochastic volatility, S&P 500 index options, Taylor expansion JEL classification: G11, G13, G51 The concept of dynamic hedging has revolutionized the derivatives industry by drastically reducing the risk of derivative positions through frequent rebalancing of a few hedging in- struments. -

Italy's Business Leaders Are Clamouring for Constitutional Reform

11/16/2016 Italy’s business leaders are clamouring for constitutional reform | The Economist Seize the day All latest updates Italy’s business leaders are clamouring for constitutional reform But a “yes” vote in the referendum on December 4th will not save corporate Italy Nov 15th 2016 | Europe “THE biggest risk in Europe is the Italian referendum”, said Gianfelice Rocca, head of Assolombarda, Milan’s chamber of commerce, this summer. For corporate Italy, much is at stake in the vote on constitutional reform, which will be held on December 4th. Victory for Matteo Renzi, the businessfriendly prime minister, could mean a big fillip for firms of all sizes, whereas a loss would be “a shock in the system” said Mr Rocca. The national employers’ federation, Confindustria, agrees with him. If those campaigning for a “yes” vote are to be believed, firmer government, easier conditions for investors and generally brighter economic prospects would follow. The two main issues to be decided are reform of the Senate’s powers—whether to let the lower chamber pass future laws, even when opposed by the Senate—and whether decisionmaking powers should be brought back from regional governments to the centre. Francesco Starace, the chief executive of Enel, a giant European electricity company that is one of Italy’s more successful firms, sets out a strong case that the proposed changes would bring important benefits to companies, especially if politicians took it as a signal to push for more reforms that would deregulate the economy and encourage competition. Last year labour laws were eased slightly, and a change this July made it easier and cheaper for startups to register with the authorities. -

Italy's Minister of Communications Maurizio Gasparri Is Keynote

No. 20 NOVEMBER 2002 Italy’s Minister of Communications President Carlo Azeglio Ciampi Denounces Anti- Maurizio Gasparri is Keynote Speaker Semitism as "Insidious Evil" n a message to at “Telecom Israel 2002” I the conference on “Europe without Anti-Semitism” recently held in Rome, inister Gasparri will Telecom Italia then formed President Carlo M lead a delegation of the “Med 1” corporation, Azeglio Ciampi Italian entrepreneurs to with Israeli partners, which denounced anti- underline the country’s has been active in the laying Semitism and discrimination as President Carlo interest in promoting and management of the first “insidious evils.” Azeglio Ciampi partnerships with Israeli undersea fibre optic link While working to enhance the authority, the enterprises in the between Mazara del Vallo effectiveness and the transparency of the European strategically vital (Sicily) and Tel Aviv. The Union, President Ciampi said that respect for telecommunication sector. cable, operative since March human dignity and rights, the core of European 1999 with a transmission identity, must not be overlooked. Referring to the proposed “Charter of Fundamental Rights” of the “Telecom Israel 2002” will capacity of 5 gigabytes per European Union, which has yet to be adopted as present the latest in second, is in fact the part of the European Constitution, President Ciampi technological innovations from principal declared that “anti-Semitism and discrimination the Telecommunications telecommunications artery are insidious evils which should be fought with -

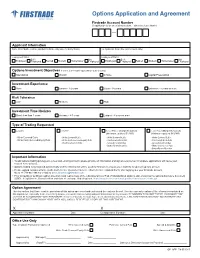

Options Application and Agreement Member FINRA/SIPC Firstrade Account Number (If Application Is for an Existing Account – Otherwise Leave Blank)

Options Application and Agreement Member FINRA/SIPC Firstrade Account Number (if application is for an existing account – otherwise leave blank) Applicant Information Name (First, Middle, Last for individual / indicate entity name for Entity/Trusts) Co-Applicant’s Name (For Joint Accounts Only) Employment Status Employment Status Self- Not Self- Not Employed Employed Retired Student Homemaker Employed Employed Employed Retired Student Homemaker Employed Options Investment Objectives (Level 2, 3 & 4 require “Speculation” to be checked) Speculation Growth Income Capital Preservation Investment Experience None Limited - 1-2 years Good - 3-5 years Extensive - 5 years or more Risk Tolerance Low Medium High Investment Time Horizon Short- less than 3 years Average - 4-7 years Longest - 8 years or more Type of Trading Requested Level 1 Level 2 Level Three (Margin Required) Level Four (Margin Required) (Minimum equity of $2,000) (Minimum equity of $10,000) • Write Covered Calls • Write Covered Calls • Write Covered Calls • Write Covered Calls • Write Cash-Secured Equity Puts • Write Cash-Secured Equity Puts • Purchase Calls & Puts • Purchase Calls & Puts • Purchase Calls & Puts • Spreads & Straddles • Spreads & Straddles • Buttery and Condor • Write Uncovered Puts • Buttery and Condor Important Information To add options trading privileges to a new and existing account, please provide all information and signature(s) below. Incomplete applications will cause your request to be delayed. Options trading is not granted automatically and the information will be used by Firstrade to assess your eligibility to open an options account. Please upload completed form via the Form Center (Customer Service ->Form Center ->Upload Form) after logging into your Firstrade account, fax to +1-718-961-3919 or e-mail to [email protected] Prior to buying or selling an option, investors must read a copy of the Characteristics & Risk of Standardized Options, also known as the options disclosure document (ODD). -

General Black-Scholes Models Accounting for Increased Market

General Black-Scholes mo dels accounting for increased market volatility from hedging strategies y K. Ronnie Sircar George Papanicolaou June 1996, revised April 1997 Abstract Increases in market volatility of asset prices have b een observed and analyzed in recentyears and their cause has generally b een attributed to the p opularity of p ortfolio insurance strategies for derivative securities. The basis of derivative pricing is the Black-Scholes mo del and its use is so extensive that it is likely to in uence the market itself. In particular it has b een suggested that this is a factor in the rise in volatilities. In this work we present a class of pricing mo dels that account for the feedback e ect from the Black-Scholes dynamic hedging strategies on the price of the asset, and from there backonto the price of the derivative. These mo dels do predict increased implied volatilities with minimal assumptions b eyond those of the Black-Scholes theory. They are characterized by a nonlinear partial di erential equation that reduces to the Black-Scholes equation when the feedback is removed. We b egin with a mo del economy consisting of two distinct groups of traders: Reference traders who are the ma jorityinvesting in the asset exp ecting gain, and program traders who trade the asset following a Black-Scholes typ e dynamic hedging strategy, which is not known a priori, in order to insure against the risk of a derivative security. The interaction of these groups leads to a sto chastic pro cess for the price of the asset which dep ends on the hedging strategy of the program traders. -

The Impact of Ownership Concentration and Analyst Coverage on Market Liquidity: Comparative Evidence from an Auction and a Specialist Market

Economic Modelling xxx (2017) 1–12 Contents lists available at ScienceDirect Economic Modelling journal homepage: www.elsevier.com/locate/econmod The impact of ownership concentration and analyst coverage on market liquidity: Comparative evidence from an auction and a specialist market Raffaele Stagliano a, Maurizio La Rocca b,*, Dionigi Gerace c a Montpellier Business School, Montpellier Research in Management, 2300 Avenue des Moulins, 34185 Montpellier Cedex 4, France b Department of Business Administration and Law, University of Calabria, 87036 Arcavacata di Rende, CS, Italy c School of Accounting, Economics and Finance, University of Wollongong, Wollongong, NSW, Australia ARTICLE INFO ABSTRACT Jel classification: This paper examines the relationships among market liquidity, ownership structure and public information G14 production in Italy, where the share market setting might have a considerable effect. Our findings suggest that G32 both the private information held by the largest blockholder and the public information provided by financial G30 analysts have an impact on market liquidity. The percentage of shares owned by the controlling shareholder Keywords: harms market liquidity, whereas analyst coverage improves it. The study demonstrates that the results differ with Market liquidity the stock market setting. We find that the effects of these two key variables are significantly lower in a specialist Ownership concentration market than in a non-specialist market. These results emphasize the importance of distinguishing between auction Analyst coverage and specialist market structures when studying the impact of corporate governance and analyst coverage on Bid-ask spread market liquidity. Notably, the study demonstrates that the sign and the intensity of the effect of analyst coverage on market liquidity changes according to the varying levels of ownership concentration, suggesting that private information and public information may act as complements. -

Introduction to Debit Spreads

© ReadySetTrade !1 Vertical Debit Spreads Overview By Doc Severson" © Copyright 2020 by Doc Severson & ReadySetTrade, LLC" All Rights Reserved" • We Are Not Financial Advisors or a Broker/Dealer: Neither ReadySetTrade® nor any of its o$cers, employees, representatives, agents, or independent contractors are, in such capacities, licensed financial advisors, registered investment advisers, or registered broker-dealers. ReadySetTrade ® does not provide investment or financial advice or make investment recommendations, nor is it in the business of transacting trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation. Nothing contained in this communication constitutes a solicitation, recommendation, promotion, endorsement, or o&er by ReadySetTrade ® of any particular security, transaction, or investment." • Securities Used as Examples: The security used in this example is used for illustrative purposes only. ReadySetTrade ® is not recommending that you buy or sell this security. Past performance shown in examples may not be indicative of future performance." • All information provided are for educational purposes only and does not imply, express, or guarantee future returns. Past performance shown in examples may not be indicative of future performance." • Investing Risk: Trading securities can involve high risk and the loss of any funds invested. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon, or risk tolerance." •Derivatives Trading Risk: Options trading is generally more complex than stock trading and may not be suitable for some investors. Margin strategies can result in the loss of more than the original amount invested.