Forecasting Implied Volatility Smile Surface Via Deep Learning and Attention Mechanism①

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

MERTON JUMP-DIFFUSION MODEL VERSUS the BLACK and SCHOLES APPROACH for the LOG-RETURNS and VOLATILITY SMILE FITTING Nicola Gugole

International Journal of Pure and Applied Mathematics Volume 109 No. 3 2016, 719-736 ISSN: 1311-8080 (printed version); ISSN: 1314-3395 (on-line version) url: http://www.ijpam.eu AP doi: 10.12732/ijpam.v109i3.19 ijpam.eu MERTON JUMP-DIFFUSION MODEL VERSUS THE BLACK AND SCHOLES APPROACH FOR THE LOG-RETURNS AND VOLATILITY SMILE FITTING Nicola Gugole Department of Computer Science University of Verona Strada le Grazie, 15-37134, Verona, ITALY Abstract: In the present paper we perform a comparison between the standard Black and Scholes model and the Merton jump-diffusion one, from the point of view of the study of the leptokurtic feature of log-returns and also concerning the volatility smile fitting. Provided results are obtained by calibrating on market data and by mean of numerical simulations which clearly show how the jump-diffusion model outperforms the classical geometric Brownian motion approach. AMS Subject Classification: 60H15, 60H35, 91B60, 91G20, 91G60 Key Words: Black and Scholes model, Merton model, stochastic differential equations, log-returns, volatility smile 1. Introduction In the early 1970’s the world of option pricing experienced a great contribu- tion given by the work of Fischer Black and Myron Scholes. They developed a new mathematical model to treat certain financial quantities publishing re- lated results in the article The Pricing of Options and Corporate Liabilities, see [1]. The latter work became soon a reference point in the financial scenario. Received: August 3, 2016 c 2016 Academic Publications, Ltd. Revised: September 16, 2016 url: www.acadpubl.eu Published: September 30, 2016 720 N. Gugole Nowadays, many traders still use the Black and Scholes (BS) model to price as well as to hedge various types of contingent claims. -

The Equity Option Volatility Smile: an Implicit Finite-Difference Approach 5

The equity option volatility smile: an implicit finite-difference approach 5 The equity option volatility smile: an implicit ®nite-dierence approach Leif B. G. Andersen and Rupert Brotherton-Ratcliffe This paper illustrates how to construct an unconditionally stable finite-difference lattice consistent with the equity option volatility smile. In particular, the paper shows how to extend the method of forward induction on Arrow±Debreu securities to generate local instantaneous volatilities in implicit and semi-implicit (Crank±Nicholson) lattices. The technique developed in the paper provides a highly accurate fit to the entire volatility smile and offers excellent convergence properties and high flexibility of asset- and time-space partitioning. Contrary to standard algorithms based on binomial trees, our approach is well suited to price options with discontinuous payouts (e.g. knock-out and barrier options) and does not suffer from problems arising from negative branch- ing probabilities. 1. INTRODUCTION The Black±Scholes option pricing formula (Black and Scholes 1973, Merton 1973) expresses the value of a European call option on a stock in terms of seven parameters: current time t, current stock price St, option maturity T, strike K, interest rate r, dividend rate , and volatility1 . As the Black±Scholes formula is based on an assumption of stock prices following geometric Brownian motion with constant process parameters, the parameters r, , and are all considered constants independent of the particular terms of the option contract. Of the seven parameters in the Black±Scholes formula, all but the volatility are, in principle, directly observable in the ®nancial market. The volatility can be estimated from historical data or, as is more common, by numerically inverting the Black±Scholes formula to back out the level of Ðthe implied volatilityÐthat is consistent with observed market prices of European options. -

Options Strategy Guide for Metals Products As the World’S Largest and Most Diverse Derivatives Marketplace, CME Group Is Where the World Comes to Manage Risk

metals products Options Strategy Guide for Metals Products As the world’s largest and most diverse derivatives marketplace, CME Group is where the world comes to manage risk. CME Group exchanges – CME, CBOT, NYMEX and COMEX – offer the widest range of global benchmark products across all major asset classes, including futures and options based on interest rates, equity indexes, foreign exchange, energy, agricultural commodities, metals, weather and real estate. CME Group brings buyers and sellers together through its CME Globex electronic trading platform and its trading facilities in New York and Chicago. CME Group also operates CME Clearing, one of the largest central counterparty clearing services in the world, which provides clearing and settlement services for exchange-traded contracts, as well as for over-the-counter derivatives transactions through CME ClearPort. These products and services ensure that businesses everywhere can substantially mitigate counterparty credit risk in both listed and over-the-counter derivatives markets. Options Strategy Guide for Metals Products The Metals Risk Management Marketplace Because metals markets are highly responsive to overarching global economic The hypothetical trades that follow look at market position, market objective, and geopolitical influences, they present a unique risk management tool profit/loss potential, deltas and other information associated with the 12 for commercial and institutional firms as well as a unique, exciting and strategies. The trading examples use our Gold, Silver -

What Drives Index Options Exposures?* Timothy Johnson1, Mo Liang2, and Yun Liu1

Review of Finance, 2016, 1–33 doi: 10.1093/rof/rfw061 What Drives Index Options Exposures?* Timothy Johnson1, Mo Liang2, and Yun Liu1 1University of Illinois at Urbana-Champaign and 2School of Finance, Renmin University of China Abstract 5 This paper documents the history of aggregate positions in US index options and in- vestigates the driving factors behind use of this class of derivatives. We construct several measures of the magnitude of the market and characterize their level, trend, and covariates. Measured in terms of volatility exposure, the market is economically small, but it embeds a significant latent exposure to large price changes. Out-of-the- 10 money puts are the dominant component of open positions. Variation in options use is well described by a stochastic trend driven by equity market activity and a sig- nificant negative response to increases in risk. Using a rich collection of uncertainty proxies, we distinguish distinct responses to exogenous macroeconomic risk, risk aversion, differences of opinion, and disaster risk. The results are consistent with 15 the view that the primary function of index options is the transfer of unspanned crash risk. JEL classification: G12, N22 Keywords: Index options, Quantities, Derivatives risk 20 1. Introduction Options on the market portfolio play a key role in capturing investor perception of sys- tematic risk. As such, these instruments are the object of extensive study by both aca- demics and practitioners. An enormous literature is concerned with modeling the prices and returns of these options and analyzing their implications for aggregate risk, prefer- 25 ences, and beliefs. Yet, perhaps surprisingly, almost no literature has investigated basic facts about quantities in this market. -

Options Application (PDF)

Questions? Go to Fidelity.com/options. Options Application Use this application to apply to add options trading to your new or existing Fidelity account. If you already have options trading on your account, use this application to add or update account owner or authorized agent information. Please complete in CAPITAL letters using black ink. If you need more room for information or signatures, make a copy of the relevant page. Helpful to Know Requirements – Margin can involve significant cost and risk and is not • Entire form must be completed in order to be considered appropriate for all investors. Account owners must for Options. If you are unsure if a particular section pertains determine whether margin is consistent with their investment to you, please call a Fidelity investment professional at objectives, income, assets, experience, and risk tolerance. 800-343-3548. No investment or use of margin is guaranteed to achieve any • All account owners must complete the account owner sections particular objective. and sign Section 5. – Margin will not be granted if we determine that you reside • Any authorized agent must complete Section 6 and sign outside of the United States. Section 7. – Important documents related to your margin account include • Trust accounts must provide trustee information where the “Margin Agreement” found in the Important Information information on account owners is required. about Margins Trading and Its Risks section of the Fidelity Options Agreement. Eligibility of Trading Strategies Instructions for Corporations and Entities Nonretirement accounts: • Unless options trading is specifically permitted in the corporate • Business accounts: Eligible for any Option Level. -

Approximation and Calibration of Short-Term

APPROXIMATION AND CALIBRATION OF SHORT-TERM IMPLIED VOLATILITIES UNDER JUMP-DIFFUSION STOCHASTIC VOLATILITY Alexey MEDVEDEV and Olivier SCAILLETa 1 a HEC Genève and Swiss Finance Institute, Université de Genève, 102 Bd Carl Vogt, CH - 1211 Genève 4, Su- isse. [email protected], [email protected] Revised version: January 2006 Abstract We derive a closed-form asymptotic expansion formula for option implied volatility under a two-factor jump-diffusion stochastic volatility model when time-to-maturity is small. Based on numerical experiments we describe the range of time-to-maturity and moneyness for which the approximation is accurate. We further propose a simple calibration procedure of an arbitrary parametric model to short-term near-the-money implied volatilities. An important advantage of our approximation is that it is free of the unobserved spot volatility. Therefore, the model can be calibrated on option data pooled across different calendar dates in order to extract information from the dynamics of the implied volatility smile. An example of calibration to a sample of S&P500 option prices is provided. We find that jumps are significant. The evidence also supports an affine specification for the jump intensity and Constant-Elasticity-of-Variance for the dynamics of the return volatility. Key words: Option pricing, stochastic volatility, asymptotic approximation, jump-diffusion. JEL Classification: G12. 1 An early version of this paper has circulated under the title "A simple calibration procedure of stochastic volatility models with jumps by short term asymptotics". We would like to thank the Editor and the referee for constructive criticism and comments which have led to a substantial improvement over the previous version. -

Option Implied Volatility Surface

Implied Volatility Surface Liuren Wu Zicklin School of Business, Baruch College Options Markets (Hull chapter: 16) . Liuren Wu Implied Volatility Surface Options Markets 1 / 1 Implied volatility Recall the BSM formula: Ft;T 1 2 − −r(T −t) ln K 2 σ (T t) c(S; t; K; T ) = e [Ft;T N(d1) − KN(d2)] ; d1;2 = p σ T − t The BSM model has only one free parameter, the asset return volatility σ. Call and put option values increase monotonically with increasing σ under BSM. Given the contract specifications (K; T ) and the current market observations (St ; Ft ; r), the mapping between the option price and σ is a unique one-to-one mapping. The σ input into the BSM formula that generates the market observed option price is referred to as the implied volatility (IV). Practitioners often quote/monitor implied volatility for each option contract instead of the option invoice price. Liuren Wu Implied Volatility Surface Options Markets 2 / 1 The relation between option price and σ under BSM 45 50 K=80 K=80 40 K=100 45 K=100 K=120 K=120 35 40 t t 35 30 30 25 25 20 20 15 Put option value, p Call option value, c 15 10 10 5 5 0 0 0 0.2 0.4 0.6 0.8 1 0 0.2 0.4 0.6 0.8 1 Volatility, σ Volatility, σ An option value has two components: I Intrinsic value: the value of the option if the underlying price does not move (or if the future price = the current forward). -

Simple Robust Hedging with Nearby Contracts Liuren Wu

Journal of Financial Econometrics, 2017, Vol. 15, No. 1, 1–35 doi: 10.1093/jjfinec/nbw007 Advance Access Publication Date: 24 August 2016 Article Downloaded from https://academic.oup.com/jfec/article-abstract/15/1/1/2548347 by University of Glasgow user on 11 September 2019 Simple Robust Hedging with Nearby Contracts Liuren Wu Zicklin School of Business, Baruch College, City University of New York Jingyi Zhu University of Utah Address correspondence to Liuren Wu, Zicklin School of Business, Baruch College, One Bernard Baruch Way, B10-225, New York, NY 10010, or e-mail: [email protected]. Received April 12, 2014; revised June 26, 2016; accepted July 25, 2016 Abstract This paper proposes a new hedging strategy based on approximate matching of contract characteristics instead of risk sensitivities. The strategy hedges an option with three options at different maturities and strikes by matching the option function expansion along maturity and strike rather than risk factors. Its hedging effective- ness varies with the maturity and strike distance between the target and the hedge options, but is robust to variations in the underlying risk dynamics. Simulation ana- lysis under different risk environments and historical analysis on S&P 500 index op- tions both show that a wide spectrum of strike-maturity combinations can outper- form dynamic delta hedging. Key words: characteristics matching, hedging, jumps, Monte Carlo, payoff matching, risk sensi- tivity matching, strike-maturity triangle, stochastic volatility, S&P 500 index options, Taylor expansion JEL classification: G11, G13, G51 The concept of dynamic hedging has revolutionized the derivatives industry by drastically reducing the risk of derivative positions through frequent rebalancing of a few hedging in- struments. -

PAK Condensed Summary Quantitative Finance and Investment Advanced (QFIA) Exam Fall 2015 Edition

PAK Condensed Summary Quantitative Finance and Investment Advanced (QFIA) Exam Fall 2015 Edition CDS Options Hedging Derivatives Embedded Options Interest Rate Models Performance Measurement Volatility Modeling Structured Finance Credit Risk Models Behavioral Finance Liquidity Risk Attribution PCA MBS QFIA Exam 2015 PAK Condensed Summary Ribonato-7 Ribonato-7 Empirical Facts about Smiles Fundamental and Derived Analysis The two potential strands of empirical analysis: 1. Fundamental analysis and 2. Derived Analysis In the fundamental analysis, it is recognized that the value of options and other derivatives contracts are derived from the dynamics of the underlying assets. The fundamental analysis is relevant to the plain vanilla options trader. The derived approach is of great interests to the complex derivatives trader. Not only the underlying assets but also other plain-vanilla options constitute the set of hedging instruments. In the derived approach, implied volatilities (or options prices) and the dynamics of the underlying assets are relevant. But mis-specification of the dynamics of the underlying asset is often considered to be a ‘second-order effect’. The complex trader usually engages in substantial vega and/or gamma hedging of the complex product using plain vanilla options. The delta exposure of the complex trade and of the hedging derivatives usually cancels out. Market Information About Smiles Direct Static Information The smile surface at time t is the function: : 퐼푚푝푙 2 휎푡 푅 → 푅 ( , ) ( , ) 퐼푚푝푙 푡 In principle, a better -

The Empirical Robustness of FX Smile Construction Procedures

Centre for Practiicall Quantiitatiive Fiinance CPQF Working Paper Series No. 20 FX Volatility Smile Construction Dimitri Reiswich and Uwe Wystup April 2010 Authors: Dimitri Reiswich Uwe Wystup PhD Student CPQF Professor of Quantitative Finance Frankfurt School of Finance & Management Frankfurt School of Finance & Management Frankfurt/Main Frankfurt/Main [email protected] [email protected] Publisher: Frankfurt School of Finance & Management Phone: +49 (0) 69 154 008-0 Fax: +49 (0) 69 154 008-728 Sonnemannstr. 9-11 D-60314 Frankfurt/M. Germany FX Volatility Smile Construction Dimitri Reiswich, Uwe Wystup Version 1: September, 8th 2009 Version 2: March, 20th 2010 Abstract The foreign exchange options market is one of the largest and most liquid OTC derivative markets in the world. Surprisingly, very little is known in the aca- demic literature about the construction of the most important object in this market: The implied volatility smile. The smile construction procedure and the volatility quoting mechanisms are FX specific and differ significantly from other markets. We give a detailed overview of these quoting mechanisms and introduce the resulting smile construction problem. Furthermore, we provide a new formula which can be used for an efficient and robust FX smile construction. Keywords: FX Quotations, FX Smile Construction, Risk Reversal, Butterfly, Stran- gle, Delta Conventions, Malz Formula Dimitri Reiswich Frankfurt School of Finance & Management, Centre for Practical Quantitative Finance, e-mail: [email protected] Uwe Wystup Frankfurt School of Finance & Management, Centre for Practical Quantitative Finance, e-mail: [email protected] 1 2 Dimitri Reiswich, Uwe Wystup 1 Delta– and ATM–Conventions in FX-Markets 1.1 Introduction It is common market practice to summarize the information of the vanilla options market in the volatility smile table which includes Black-Scholes implied volatili- ties for different maturities and moneyness levels. -

Jump-Diffusion Models and Implied Volatility

U.U.D.M. Project Report 2015:1 Jump-Diffusion Models and Implied Volatility Simon Wickstrom Examensarbete i matematik, 15 hp Handledare och examinator: Erik Ekström Januari 2015 Department of Mathematics Uppsala University Contents 1 Abstract 2 2 Introduction 3 2.1 Incomplete Markets . .3 2.2 Implied Volatility . .4 2.3 Volatility Smile and Skew . .4 3 Method 5 3.1 Valuing the Option . .6 3.2 Adding a Jump Process . .6 4 Results 7 4.1 Different stock price simulations for different K . 10 4.2 Numerical Problems . 11 4.3 Letting T ! 0 .......................... 11 5 Conclusion 16 6 References 17 7 Appendix 18 7.1 Underlying Function . 18 7.2 Simulation Program . 18 7.3 Simulation Program with different stock prices for different K 20 1 Chapter 1 Abstract The origin of this thesis came from a statement found in the book Financial Modelling With Jump Processes by Rama Cont and Peter Tankov. In the context of option pricing and volatilities, the introduction states: "Models with jumps, by contrast, not only lead to a variety of smile/ skew patterns but also propose a simple explanation in terms of market antici- pations: the presence of a skew is attributed to the fear of large negative jumps by market participants." This statement is written without any reference or proof and the object of this thesis was to examine whether it is true or not. The results from this thesis does confirm the statement. The statement has been tested by using a Monte-Carlo method in a the- oretical pricing model. -

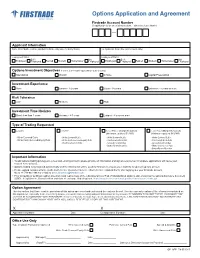

Options Application and Agreement Member FINRA/SIPC Firstrade Account Number (If Application Is for an Existing Account – Otherwise Leave Blank)

Options Application and Agreement Member FINRA/SIPC Firstrade Account Number (if application is for an existing account – otherwise leave blank) Applicant Information Name (First, Middle, Last for individual / indicate entity name for Entity/Trusts) Co-Applicant’s Name (For Joint Accounts Only) Employment Status Employment Status Self- Not Self- Not Employed Employed Retired Student Homemaker Employed Employed Employed Retired Student Homemaker Employed Options Investment Objectives (Level 2, 3 & 4 require “Speculation” to be checked) Speculation Growth Income Capital Preservation Investment Experience None Limited - 1-2 years Good - 3-5 years Extensive - 5 years or more Risk Tolerance Low Medium High Investment Time Horizon Short- less than 3 years Average - 4-7 years Longest - 8 years or more Type of Trading Requested Level 1 Level 2 Level Three (Margin Required) Level Four (Margin Required) (Minimum equity of $2,000) (Minimum equity of $10,000) • Write Covered Calls • Write Covered Calls • Write Covered Calls • Write Covered Calls • Write Cash-Secured Equity Puts • Write Cash-Secured Equity Puts • Purchase Calls & Puts • Purchase Calls & Puts • Purchase Calls & Puts • Spreads & Straddles • Spreads & Straddles • Buttery and Condor • Write Uncovered Puts • Buttery and Condor Important Information To add options trading privileges to a new and existing account, please provide all information and signature(s) below. Incomplete applications will cause your request to be delayed. Options trading is not granted automatically and the information will be used by Firstrade to assess your eligibility to open an options account. Please upload completed form via the Form Center (Customer Service ->Form Center ->Upload Form) after logging into your Firstrade account, fax to +1-718-961-3919 or e-mail to [email protected] Prior to buying or selling an option, investors must read a copy of the Characteristics & Risk of Standardized Options, also known as the options disclosure document (ODD).