Municipality Credit Iceland

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

MS-Blaðið, 2. Tbl. 2020

2. tbl. 2020 - 37. árg. MSMS blaðið MS-félag Íslands Efnisyfirlit Þjónusta MS-félagsins Frá formanni . 3 Styrkir til félagsins og þakkir . 6 Nánari upplýsingar um alla þjónustu eru á vefsíðunni Af alþjóðasamstarfi . 7 www.msfelag.is/Félagið/Þjónusta Starfsemi félagsins á tímum kórónuveiru og COVID-19 . 8 Skrifstofa félagsins er opin virka daga milli kl. 10 og 15. Á skrifstofu má Leikið og sungið á samfélagsmiðlum . 9 nálgast ýmis konar fræðsluefni, upplýsingar, aðstoð og söluvöru og tæki Félagsleg virkni og samvera. 1 0 færis kort. Þar er einnig hægt að bóka viðtöl við félagsráðgjafa, sálfræðing Lífið er einstakt – njóttu þess! . 1 2 og stuðningsaðila sem og námskeið, fyrirlestra og viðburði. Starfsmenn Ég er ekki MS-sjúkdómurinn! . 1 6 félagsins eru Ingdís Lindal og Berglind Ólafsdóttir. Skellur á netinu . 2 0 Frá fræðsluteyminu . 2 1 Minningarkort er hægt að panta í s. 568 8620, á msfelag.is eða Fundur með göngudeild [email protected] taugalækninga á LSH . 2 2 Félagsráðgjafi, María Rúnarsdóttir, er með viðtalstíma á miðvikudögum. MS Setrið á tímum Covid-19 . 2 4 Hægt er að panta viðtalstíma eða símaviðtal á vefsíðunni msfelag.is eða í síma 568 8620. Sálfræðingur, Berglind J. Jensdóttir, er með viðtalstíma á fimmtudögum. Hægt er að panta stuðningsviðtal á msfelag.is eða í síma 568 8620. Auglýst verður á miðlum félagsins þegar fjarþjónustulausnin Kara Conn- ect verður tekin í notkun en þá verður öllum félagsmönnum okkar gert MS-blaðið kleift að njóta þjónustu félagsráðgjafa og sálfræðings, óháð búsetu. 2. tbl. 2020, 37. árg. ISSN 1670-2700 Formaður, Björg Ásta Þórðardóttir, er með viðtalstíma eftir samkomulagi. -

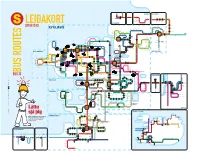

Strætó.Is Bus.Is

HÓLMAVÍK AKUREYRI REYKHOLT Melahverfi Akranes - Akratorg STYKKISHÓLMUR Akranes - Kirkjubraut Akranes - Þjóðbraut Borgarnes - N1 Akranes - Bæjarskrifstofur Kjalarnes - Kjalarnes - Kjalarnes - Akranes - Garðabraut Esjuskáli Esjugrund Klébergsskóli Akranes - Jaðarsbakki Akranes - Bresaflöt Esjurætur Skeljatangi Arnartangi STRÆTÓ.IS Þverholt Skei›holt Kelduskóli/Korpa Korpúlfssta›ir Bollatangi Brekkutangi Esjumelar Brúnasta›ir Bakkasta›ir Klapparhlí› FMOS Varmárskóli Leirvogstunga Skálatún Tröllaborgir Vættaborgir Jötnaborgir Strætóvegur Bar›asta›ir HÁHOLT v/Vættaborgir Mosavegur Goðaborgir Hulduborgir Borgarholtsskóli Kelduskóli/Vík Dofraborgir Go›aborgir Ásland Tjaldanes Mosfell Lundur Skólavegur Laufengi Egilshöll Borgavegur Dvergaborgir SPÖNG Jónsteigur Skarfagar›ar Kænugar›ar Borgavegur Borgavegur Úlfarsbraut SkyggnistorgSkyggnisbraut Úlfarsá Sundagar›ar Hé›insgata Hrafnista Hjallavegur Sægar›ar Víkurvegur Völuteigur Dalbraut Gullengi Mosarimi Lyngrimi Lambhagav./Mímisbrunnur Úlfarsbraut Fiskisló› Laugarnestangi Mi›gar›ur Keldnaholt Reykjalundur Lambhagav./Reynisvatnsvegur Fellsvegur Dælustö›varvegur Kirkjusandur Kirkjusandur Flétturimi Grunnsló› Höf›atorg Nóatún Hótel Cabin Borgartún Sund Holtagar›ar Hallsvegur Húsasmi›jan Reynisvatn Reykjabyggð LaugardalslaugLaugarásvegur Hrafnista Dragavegur Rimaflöt Gufunesbær Þúsöld Biskupsgata Hólsvegur Hólsvegur Dalhús Vallarhús BrekkuhúsVölundarhús Grandagar›ur Tún Teigar Gagnvegur Fíladelfía Hátún Laugardalshöll Lei›hamrar Vegghamrar Grandi LÆKJARTORG Harpa HLEMMUR MaríubaugurIngunnarskóliPrestastígur -

Bú Með Greiðslumark Í Sauðfé 1.1.2019 Búsnúmer Heiti Bús

Bú með greiðslumark í sauðfé 1.1.2019 Greiðslumark Búsnúmer Heiti bús Sveitarfélag ærgildi 1257127Krókur 0Reykjavík 76,7 1257461 Saurbær 0 Reykjavík 20,7 1169571 Vatnsendi 1000 Kópavogur 15,4 1179031 Garðav. Vestri Dysjar 1300Garðabær 15,2 1178971 Garðavegur Miðengi 1300 Garðabær 28,1 1178981Garðavegur Nýibær 1300Garðabær 18,1 1178992Garðavegur Pálshús 1300Garðabær 25,3 1232281Gesthús 1603Álftanes 6,3 1232411Sviðholt 1603Álftanes 24 1236361Helgadalur 1604Mosfellsbær 54,4 1236751Hraðastaðir 3 1604Mosfellsbær 61,9 1236771Hrísbrú 1604Mosfellsbær 9,5 1259871 Eyjar 2 1606 Kjósarhreppur 101,4 1260371Fell 1606Kjósarhreppur 252,1 1260381 Flekkudalur 1606 Kjósarhreppur 49,7 1260472Fremri Háls 1606Kjósarhreppur 33,8 1260521Grímsstaðir 1606Kjósarhreppur 129,4 1261071 Hvammur 1606 Kjósarhreppur 6,5 1261301Hækingsdalur 1606Kjósarhreppur 485,3 1261341Ingunnarstaðir 1606Kjósarhreppur 154,3 1261361Írafell 1606Kjósarhreppur 85,5 1261381 Káranes 1606 Kjósarhreppur 0,2 1261431Kiðafell 1606Kjósarhreppur 396,4 1261651Meðalfell 1606Kjósarhreppur 70,2 1263711 Miðdalur 1606 Kjósarhreppur 2,1 1264891þorláksstaðir 1606Kjósarhreppur 6,5 1291671 Bjarmaland 2300 Grindavík 5,5 1291681 Buðlunga 2300 Grindavík 42 1291751Hof 2300Grindavík 7,6 1291791Hraun 2300Grindavík 22,4 1291931 Járngerðarstaðir 2300 Grindavík 25,5 1291611Vík 2300Grindavík 30,9 1308341Efri Brunnastaðir 1 2506Vogar 17,7 1300101Hólkot 2510Suðurnesjabær 8,8 1300131Hólshús 2510Suðurnesjabær 10,9 1340421Grund 3506Skorradalshreppur 128,6 1340521Hálsar 3506Skorradalshreppur 10 1340871Mófellsstaðakot 3506Skorradalshreppur -

List of Municipalities of Iceland

Population Area SNo Name Number Region (1 January 2 Mayor/Manager Party 2013) (km ) Capital Jon Gnarr 1 Reykjavikurborg 0000 119,764 273 Best Party Region Kristinsson Capital Armann Kristinn Independence 2 Kopavogsbaer 1000 31,726 80 Region Olafsson Party Capital Asgerour Independence 3 Seltjarnarneskaupstaour 1100 4,322 2 Region Halldorsdottir Party Capital Independence 4 Garoabaer 1300 13,872 76 Gunnar Einarsson Region Party Capital Guorun Agusta Left-Green 5 Hafnarfjaroarkaupstaour 1400 26,808 143 Region Guomundsdottir Movement Capital Independence 6 Mosfellsbaer 1604 8,978 185 Haraldur Sverrisson Region Party Capital Guomundur H. 7 Kjosarhreppur 1606 205 284 Region Daviosson Southern Independence 8 Reykjanesbaer 2000 14,231 145 Arni Sigfusson Peninsula Party Southern 9 Grindavikurbaer 2300 2,860 425 Robert Ragnarsson independent Peninsula Southern 10 Sandgeroisbaer 2503 1,581 62 Sigrun Arnadottir independent Peninsula Southern 11 Sveitarfelagio Garour 2504 1,429 21 Magnus Stefansson Progressive Party Peninsula Southern 12 Sveitarfelagio Vogar 2506 1,105 165 Asgeir Eiriksson independent Peninsula Western Regina 13 Akraneskaupstaour 3000 6,625 9 independent Region Asvaldsdottir Western 14 Skorradalshreppur 3506 57 216 Davio Petursson Region Western Laufey 15 Hvalfjaroarsveit 3511 610 482 independent Region Johannsdottir Western 16 Borgarbyggo 3609 3,469 4,926 Pall S. Brynjarsson independent Region Western Bjorn Steinar 17 Grundarfjaroarbaer 3709 905 148 independent Region Palmason Western Egill Valberg 18 Helgafellssveit 3710 58 243 -

Pálsson, Grétar Már. 2015

Impact on households and critical infrastructures from electricity failure Two case studies and a survey on public preparedness Grétar Már Pálsson Faculty of Civil and Environmental Engineering University of Iceland 2015 Impact on households and critical infrastructures from electricity failure Two case studies and a survey on public preparedness Grétar Már Pálsson 30 ECTS thesis submitted in partial fulfillment of a Magister Scientiarum degree in Civil Engineering Advisors Dr. Björn Karlsson Böðvar Tómasson Faculty Representative Sveinn Júlíus Björnsson Faculty of Civil and Environmental Engineering School of Engineering and Natural Sciences University of Iceland Reykjavik, May 2015 Impact on households and critical infrastructures - Two case studies and a survey on public preparedness. 30 ECTS thesis submitted in partial fulfillment of a Magister Scientiarum degree in civil engineering Copyright © 2015 Grétar Már Pálsson All rights reserved Faculty of Civil and Environmental Engineering School of Engineering and Natural Sciences University of Iceland VR II, Hjarðarhaga 2-6 107, Reykjavik Iceland Telephone: 525 4600 Bibliographic information: Grétar Már Pálsson, 2015, Impact on households and critical infrastructures - Two case studies and a survey on public preparedness, Master’s thesis, Faculty of Civil and Environmental Engineering, University of Iceland, pp. 76. Printing: Háskólaprent, Fálkagata 2, 107 Reykjavík Reykjavik, Iceland, May 2015 Abstract This thesis studies the impact from electricity failure in Iceland on households and critical infrastructures. Households and critical infrastructures electricity dependence is discussed along with a theoretical identification of impacts towards these two subjects from electricity failure. Risk Assessment Plans for Iceland, Norway and Sweden are compared. The main focus of the comparison relates to how the countries focus on electricity, information and communication technologies and the role of the general public in these plans. -

MCI Interim Financial Statement, June 30Th 2017

okt.22 Municipality Credit Iceland Translation of condensed Interim Financial Statements for the period 1 January through 30 June 2017 This condensed interim financial statements are translated from the original which is in Icelandic. Should there be discrepancies between the two versions, the Icelandic version will take priority over the translated version. Index Page Report of the Board of Directors and the Managing Director .................................................................................... 2 Independent Auditor's Report ................................................................................................................................... 3 Income Statement and Statement of Comprehensive Income .................................................................................. 4 Statement of Financial Position ................................................................................................................................ 5 Statement of Changes in Equity ................................................................................................................................ 6 Statement of Cash Flows .......................................................................................................................................... 7 Notes to the Financial Statements ............................................................................................................................ 8-24 Municipality Credit Iceland Plc. Identity number 580407-1100 Borgartun 30, P.O. Box 8100 -

Regional Development in the Nordic Countries 2010

Regional Development in the Nordic Countries 2010 Regional Development in the Nordic Countries 2010 Maria Lindqvist, editor Nordregio Report 2010:2 ISSN 1403-2503 ISBN 978-91-89332-76-8 © Nordregio 2010 Nordregio P.O. Box 1658 SE-111 86 Stockholm, Sweden [email protected] www.nordregio.se www.norden.se Analyses & text: Maria Lindqvist, Lisa Hörnström, Petri Kahila, Moa Hedström, Rasmus Ole Rasmussen, Lisa Van Well, Jon Moxnes Steineke, Lisbeth Greve-Harbo, Peter Schmitt, Stefanie Lange, Johanna Roto, José Sterling, Lise Smed Olsen, Katarina Pettersson, Patrick Galera-Lindblom, Asli Tepecik Dis Dtp: Allduplo, Stockholm, Sweden Linguistic editing: Chris Smith Repro and print: Allduplo, Stockholm, Sweden Nordic cooperation Nordic cooperation takes place among the countries of Denmark, Finland, Iceland, Norway and Sweden, as well as the autonomous territories of the Faroe Islands, Greenland and Åland. The Nordic Council is a forum for cooperation between the Nordic parliaments and governments. The Council consists of 87 parliamentarians form the Nordic countries. The Nordic Council takes policy initiatives and monitors Nordic cooperation. Founded in 1952. The Nordic Council of Ministers is a forum of cooperation between the Nordic governments. The Nordic Council of Ministers implements Nordic cooperation. The prime ministers have the overall responsibility. Its activities are co-ordinated by the Nordic ministers for cooperation, the Nordic Committee for cooperation and portfolio ministers. Founded in 1971. Nordregio – Nordic Centre for Spatial Development works in the fi eld of spatial development, which includes physical planning and regional policies, in particular with a Nordic and European comparative perspective. Nordregio is active in research, education and knowledge dissemination and provides policy-relevant data. -

Report to the EFTA Surveillance Authority Regarding the Implementation of Directive 91/271/EU on the Treatment of Wastewater from Agglomerations

Report to the EFTA Surveillance Authority regarding the implementation of Directive 91/271/EU on the treatment of wastewater from agglomerations. Environment Agency of Iceland March 2013 Contents FOREWORD................................................................................................................ 3 1. THE LEGALIZATION OF DIRECTIVE 91/271/EEC (UWWD) ...................... 3 2. CIRCUMSTANCES IN ICELAND AND THE AVAILABILITY OF DATA .. 5 3. AGGLOMERATIONS OF MORE THAN 2,000 P.E. ......................................... 5 3.1 DISCHARGE TO FRESHWATER AND ESTUARIES FROM AGGLOMERATION OF MORE THAN 2,000 P.E. .......................................................................................................... 7 3.2 DISCHARGES TO COASTAL WATER FROM COLLECTIVE SYSTEM FOR AGGLOMERATIONS OF MORE THAN 10,000 P.E. ........................................................... 8 4. PLANS FOR SEWERAGE AND URBAN SITES ................................................ 9 5. DEVELOPMENT IN DRAINAGE AFFAIRS ...................................................... 9 6. SEWERAGE AFFAIRS IN RURAL AREAS ..................................................... 11 7. DEFINITION OF RECEPTORS ......................................................................... 12 7.1 IDENTIFICATION OF SENSITIVE AREAS ................................................................. 12 7.2 LESS SENSITIVE AREAS ........................................................................................ 12 The Capital area ................................................................................................. -

Stjórnarráð Íslands Atvinnuvega- Og Nýsköpunarráðuneytið - Skúlagötu 4 - 101 Reykjavík, Stjornarradid.Is - 545 9700

Stjórnarráð Íslands Atvinnuvega- og nýsköpunarráðuneytið - Skúlagötu 4 - 101 Reykjavík, stjornarradid.is - 545 9700 Staðfestar greiðslur Skattár Sveitarfél. Landshluti. Tegund BúsnúmerBú Kennitala Fullt Nafn Póstnr.Staður Upphæð 2017 Akrahreppur Norðurland-vestra Beingreiðslur í ull 1462711 Bjarnastaðir 2505793819 Guttormur Hrafn Stefánsson 561 Varmahlíð 356.758 2017 Akrahreppur Norðurland-vestra Beingreiðslur í sauðfé 1462711 Bjarnastaðir 2505793819 Guttormur Hrafn Stefánsson 561 Varmahlíð 41.328 2017 Akrahreppur Norðurland-vestra Gæðastýring í sauðfé 1462711 Bjarnastaðir 2505793819 Guttormur Hrafn Stefánsson 561 Varmahlíð 2.161.530 2017 Akrahreppur Norðurland-vestra Geymslugjald bænda 1462711 Bjarnastaðir 2505793819 Guttormur Hrafn Stefánsson 561 Varmahlíð 587.891 2016 Akrahreppur Norðurland-vestra Geymslugjald bænda 1462711 Bjarnastaðir 2505793819 Guttormur Hrafn Stefánsson 561 Varmahlíð 541.539 2016 Akrahreppur Norðurland-vestra Beingreiðslur í sauðfé 1462711 Bjarnastaðir 2505793819 Guttormur Hrafn Stefánsson 561 Varmahlíð 40.680 2016 Akrahreppur Norðurland-vestra Gæðastýring í sauðfé 1462711 Bjarnastaðir 2505793819 Guttormur Hrafn Stefánsson 561 Varmahlíð 2.027.976 2016 Akrahreppur Norðurland-vestra Beingreiðslur í ull 1462711 Bjarnastaðir 2505793819 Guttormur Hrafn Stefánsson 561 Varmahlíð 253.913 2015 Akrahreppur Norðurland-vestra Beingreiðslur í ull 1462711 Bjarnastaðir 2505793819 Guttormur Hrafn Stefánsson 561 Varmahlíð 356.249 2015 Akrahreppur Norðurland-vestra Beingreiðslur í sauðfé 1462711 Bjarnastaðir 2505793819 Guttormur -

Dýralæknafélag Íslands 9.11.2009

AlÞtngi Erindi nr. Þ komudagur Q.11.2009 Dýralæknafélag íslands 9.11.2009 Sjávarútvegs- og landbúnaðamefhd Alþingis Breytingatillögur um 3 kafla Matvœlafrumvarpsins. Guðbjörg Þorvarðardóttir Formaður Dýralœknafélags Islands III. KAFLI Breytingar á lögum um dýralækna og heilbrigðisþjónustu við dýr, nr. 66/1998, með síðari breytingum. 36. gr. I. mgr. 6. gr. laganna orðast svo: Dýralæknar samkvæmt lögum þessum eru þeir dýralæknar er lokið hafa prófi frá dýralæknaháskóla sem er viðurkenndur af íslenskum stjómvöldum. Jafiiframt teljast þeir dýralæknar sem heimild hafa til að starfa hér á landi imdir starfsheiti heimalands síns í samræmi við reglur Evrópska efiiahagssvæðisins eða stofnsamning Fríverslunarsamtaka Evrópu. Sjávarútvegs- og landbúnaðarráðherra setur nánari reglur um leyfisveitingu, menntunarkröfur og viðurkenndar menntastofiianir. Ef um er að ræða próf frá dýralæknaháskóla sem er utan Evrópska efiiahagssvæðisins og Sviss skal leita umsagnar dýralæknaráðs áður en leyfi er veitt samkvæmt lögunum. 37.gr. II. gr. laganna orðast svo: Matvælastofiiun skal hafa sex umdæmisskrifstofur og við hveija þeirra skal héraðsdýralæknir ráðinn til starfa, en einnig er heimilt að ráða dýralækna og aðra eftirlitsmenn til aðstoðar ef þess er þörf vegna eftirlits og sjúkdómavama. Skrifstofur Matvælastofhunar skulu vera í eftirfarandi umdæmum: 1. Suðvesturumdœmi: Garðabær, Hafiiarfjarðarkaupstaður, Kjósarhreppur, Kópavogsbær, Mosfellsbær, Reykjavíkurborg, Seltjamameskaupstaður, Sveitarfélagið Álftanes, Grindavíkurbær, Reykjanesbær, Sandgerðisbær, Sveitarfélagið -

Act on the Judiciary No. 15, 25 March 1998

Act on the Judiciary No.15/1998 Translation from Icelandic Act on the Judiciary No. 15, 25 March 1998 Entered into force on 1 July 1998, with the exception of Article 34. Amended by Act No. 47/2006 (entered into force on 1 July 2006), Act No. 88/2008 (entered into force on 1 January 2009, with the exception of transitional provision VII which entered into force on 21 June 2008), Act No. 147/2009 (entered into force on 1 January 2010), Act No. 45/2010 (entered into force on 29 May 2010), Act 162/2010 (entered into force on 1 January 2011) and Act 12/20111(entered into force on 17 February 2011). Chapter I Judicial Organisation Section 1 The Supreme Court of Iceland shall be the highest judicial authority in Iceland. The Court shall be a court of appeals, based in Reykjavík. Section 2 The district courts shall be eight in number. Their names, places and areas of office shall be as follows: 1. The District Court of Reykjavík shall be based in Reykjavík, serving the areas of the following municipalities: Reykjavík, Seltjarnarnes, Mosfellsbær and Kjósarhreppur. 2. The District Court of Western Iceland shall be based at Borgarnes, serving the areas of the following municipalities: Akranes, Hvalfjarðarstrandarhreppur, Skilmannahreppur, Innri-Akraneshreppur, Leirár- og Melahreppur, Andakílshreppur, Skorradalshreppur, Lundarreykjadalshreppur, Reykholtsdalshreppur, Hálsahreppur, Hvítársíðuhreppur, Þverárhlíðarhreppur, Borgarhreppur, Borgarbyggð, Álftaneshreppur, Kolbeinsstaðahreppur, Eyja- og Miklaholtshreppur, Snæfellsbær, Eyrarsveit, Helgafellssveit, Stykkishólmsbær, Dalabyggð and Saurbæjarhreppur. 3. The District Court of the West Fjords shall be based at Ísafjörður, serving the areas of the following municipalities: Reykhólahreppur, Vesturbyggð, Tálknafjarðarhreppur, Bolungarvík, Ísafjörður, Súðavíkurhreppur, Árneshreppur, Kaldrananaeshreppur, Hólmavíkurhreppur, Kirkjubólshreppur, Broddaneshreppur and Bæjarhreppur. -

Atvinnutekjur 2008-2018 Eftir Atvinnugreinum Og Landshlutum

Atvinnutekjur 2008-2018 eftir atvinnugreinum og landshlutum Þróunarsvið Byggðastofnunar nóvember 2019 Texti og gagnavinnsla: Sigurður Árnason Gagnaöflun: Guðmundur Guðmundsson og Sigurður Árnason 1 Fræðslustarfsemi ........................................................................................ 32 Efnisyfirlit Heilbrigðis- og félagsþjónusta .................................................................... 33 Inngangur ......................................................................................................... 4 Menningar-, íþrótta- og tómstundastarfsemi ........................................... 34 Fyrirvarar á niðurstöðum ................................................................................. 6 Annað – bálkar S, T, U og X ........................................................................ 35 Helstu niðurstöður ........................................................................................... 7 Höfuðborgarsvæðið ........................................................................................ 36 Framsetning gagna á myndrænu formi ......................................................... 11 Reykjavík ..................................................................................................... 37 Landið allt – þróun atvinnutekna eftir svæðum ........................................... 12 Kópavogur ................................................................................................... 39 Landið allt - þróun atvinnutekna eftir atvinnugreinum...............................