Annual Financial Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Securities and Exchange Commission on June 27, 2013 SECURITIES and EXCHANGE COMMISSION Washington, D.C

As filed with the Securities and Exchange Commission on June 27, 2013 SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 20-F ‘ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR È ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended March 31, 2013 OR ‘ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 ‘ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report………. For the transition period from to Commission file number: 1-15236 KABUSHIKI KAISHA ADVANTEST (Exact name of registrant as specified in its charter) ADVANTEST CORPORATION (Translation of registrant’s name into English) Japan (Jurisdiction of incorporation or organization) Shin-Marunouchi Center Building 1-6-2, Marunouchi Chiyoda-ku Tokyo 100-0005 Japan (Address of principal executive offices) Hiroshi Nakamura, (81-3) 3214-7500, (81-3) 3214-7711, Shin-Marunouchi Center Building 1-6-2, Marunouchi Chiyoda-ku Tokyo 100-0005 Japan (Name, telephone, facsimile number and address of company contact person) Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of each class: Name of each exchange on which registered: American Depositary Shares* The New York Stock Exchange Common Stock** * American Depositary Receipts evidence American Depositary Shares, each American Depositary Share representing one share of the registrant’s Common Stock. ** No par value. Not for trading, but only in connection with the registration of American Depositary Shares, pursuant to the requirements of the Securities and Exchange Commission. -

Convocation Notice of the 76Th Ordinary General Meeting of Shareholders of Advantest Corporation (The “Company”)

(The following is an unofficial English translation of the Convocation Notice of the 76th Ordinary General Meeting of Shareholders of Advantest Corporation (the “Company”). The Company provides this translation for your reference and convenience only and without any warranty as to its accuracy or otherwise.) (Stock Code Number: 6857) CONVOCATION NOTICE OF THE 76th ORDINARY GENERAL MEETING OF SHAREHOLDERS Date and time: June 27, 2018 (Wednesday) at 10:00 a.m. (The reception desk will open at 9:10 a.m.) Place: Narimasu ACT Hall 3-11-3-405, Narimasu, Itabashi-ku, Tokyo Message to Shareholders To Our Shareholders We are pleased to send you this Convocation Notice for the 76th Ordinary General Meeting of Shareholders. In semiconductor-related markets, there was generally a slump in capex for semiconductors used in smartphones due to prolonged Chinese smartphone inventory adjustments. However, there was solid growth in demand for automotive semiconductors and sensors amid the development of advances in automotive electronics. Moreover, vigorous growth in demand for data center-related semiconductors continued, especially for 3D NAND flash memory and DRAM, causing memory semiconductor manufacturers to actively invest in expanding production capacity. In this business environment, the Company worked to capture demand for test equipment for memory semiconductors and automotive semiconductors, both of which have shown remarkable growth, as well as to boost sales of peripheral devices for semiconductor testing. The Company also took steps to increase production capacity in order to keep up with the steep increase in demand. As a result, orders received were ¥247.8 billion and net sales were ¥207.2 billion. -

VLSI PP Master 1/7/2015

wins five stars from customers VLSIresearch Customer Satisfaction Survey 2017 VLSIresearch …Customer intelligence Satisfaction to make Survey better 2017decisions faster Copyright © 2017 VLSI Research Inc. All rights reserved. Distribution rights contained in T&Cs. Advantest Earns 29th Consecutive Ranking as a Top IC Test Equipment Supplier • Advantest wins 5 VLSI Stars, continuing its LARGE SUPPLIERS OF VLSI Stars legacy in an elite group of companies CHIP MAKING EQUIPMENT – awarded as a 10 BEST supplier since the survey’s inception 29 years ago Teradyne • A leading producer of automatic test ASML equipment (ATE), Advantest’s concentration ASM Pacific Technology on Hitachi Kokusai Electric – groundbreaking measurement technologies Applied Materials Lam Research – best-in-class operations Tokyo Electron – an emphasis on ongoing R&D and Hitachi High-Technologies – standards of excellence for more than six decades Copyright © 2017 VLSIresearch. All rights reserved. – has enabled them to deliver world-class customer satisfaction 2 VLSIresearch Customer Satisfaction Survey 2017 Copyright © 2017 VLSI Research Inc. All rights reserved. Distribution rights contained in T&Cs. Advantest’s Approach to Customer Satisfaction • Continually expand and refine core measurement technology – Focus engineering on the customer – Develop extraordinary global engineering capability – Drive product and application engineering as well as customer service • Advantest is a trusted supplier of measurement solutions – Diverse customers in SOC, MPU, and memory markets – Extraordinary capabilities to partner with different customers in the Fabless, IDM, and OSAT spaces – Integrates varying customer demands into its platforms • Customer satisfaction leadership is created with excellent products and operations 3 VLSIresearch Customer Satisfaction Survey 2017 Copyright © 2017 VLSI Research Inc. All rights reserved. -

Corporate Governance Report

Corporate Governance Report Updated on: June 27, 2019 ADVANTEST CORPORATION Yoshiaki Yoshida Representative Director, President and CEO Contact: Atsushi Fujita Director, Managing Executive Officer & Executive Vice President, Corporate Administration Group https://www.advantest.com/ This is an English translation of the Corporate Governance Report of Advantest Corporation updated on June 27, 2019. The corporate governance of Advantest Corporation (“Advantest”) is described below. I. Basic Views on Corporate Governance, Capital Structure, Corporate Profile and Other Basic Information <I - 1. Basic Views> Advantest’s corporate mission is “Enabling the Leading-Edge Technology”. Advantest constantly encourages self-study and carries out cutting-edge technological development to provide technologies, products and services that will satisfy customers around the world. In accordance with the corporate mission of the preceding paragraph, and in response to the mandate from stakeholders, Advantest aims to achieve a sustainable level of business development of the Advantest Group and to enhance corporate value over the mid-to-long term. To that end, Advantest will establish a fair and efficient and transparent governance system. Above is a basic view on Advantest’s corporate governance. Advantest discloses the “Corporate Governance Basic Policy” at the following website. (https://www.advantest.com/investors/management-policy/corporate-governance) [Reasons for Non-compliance with the Principles of the Corporate Governance Code] Principle 1.4: Strategic Shareholdings Advantest may hold shares of other companies for important strategic purposes of the Advantest group (“strategic shares”), including sustainable and long term relationships with business partners, business partnership reinforcement, or research and development efficiency. Advantest holds shares of two listed companies as strategic shares as of June 27, 2019. -

Proposal of a Data Processing Guideline for Realizing Automatic Measurement Process with General Geometrical Tolerances and Contactless Laser Scanning

Proposal of a data processing guideline for realizing automatic measurement process with general geometrical tolerances and contactless laser scanning 2018/4/4 Atsuto Soma Hiromasa Suzuki Toshiaki Takahashi Copyright (c)2014, Japan Electronics and Information Technology Industries Association, All rights reserved. 1 Contents • Introduction of the Project • Problem Statements • Proposed Solution – Proposal of New General Geometric Tolerance (GGT) – Data Processing Guidelines for point cloud • Next Steps Copyright (c)2014, Japan Electronics and Information Technology Industries Association, All rights reserved. 2 Contents • Introduction of the Project • Problem Statements • Proposed Solution – Proposal of New General Geometric Tolerance (GGT) – Data Processing Guidelines for Point Cloud • Next Steps Copyright (c)2014, Japan Electronics and Information Technology Industries Association, All rights reserved. 3 Introduction of JEITA What is JEITA? The objective of the Japan Electronics and Information Technology Industries Association (JEITA) is to promote healthy manufacturing, international trade and consumption of electronics products and components in order to contribute to the overall development of the electronics and information technology (IT) industries, and thereby to promote further Japan's economic development and cultural prosperity. JEITA’s Policy and Strategy Board > Number of full members: 279> Number of associate members: 117(as of May 13, 2014) - Director companies and chair/subchair companies - Policy director companies (alphabetical) Fujitsu Limited (chairman Masami Yamamoto) Asahi Glass Co., Ltd. Nichicon Corporation Sharp Corporation Azbil Corporation IBM Japan, Ltd. Hitachi, Ltd. Advantest Corporation Nippon Chemi-Con Corporation Panasonic Corporation Ikegami Tsushinki Co., Ltd. Japan Aviation Electronics Industry, Ltd. SMK Corporation Mitsubishi Electric Corporation Nihon Kohden Corporation Omron Corporation NEC Corporation JRC Nihon Musen Kyocera Corporation Sony Corporation Hitachi Metals, Ltd KOA Corporation Fuji Xerox Co., Ltd. -

(The Following Is an Unofficial English Translation of The

(The following is an unofficial English translation of the Convocation Notice of the 71st Ordinary General Meeting of Shareholders of Advantest Corporation (the “Company”). The Company provides this translation for your reference and convenience only and without any warranty as to its accuracy or otherwise.) (Stock Code Number: 6857, TSE first section) June 3, 2013 To Our Shareholders Haruo Matsuno Representative Director President and CEO ADVANTEST CORPORATION 32-1, Asahi-cho 1-chome, Nerima-ku, Tokyo CONVOCATION NOTICE OF THE 71st ORDINARY GENERAL MEETING OF SHAREHOLDERS Dear Shareholders: Notice is hereby given that the 71st ordinary general meeting of shareholders of ADVANTEST CORPORATION (the “Company”) will be held as set forth below. Your attendance thereat is respectfully requested. If you are not able to attend the meeting, we request that you exercise your voting rights in writing or by way of electro-magnetic method (via the Internet, etc.) by 5:00 p.m. of June 25, 2013 (Tuesday) after carefully reading the reference documents as set forth below. 1. Date and time: June 26, 2013 (Wednesday) at 10:00 a.m. (The reception desk will open at 9:00 a.m.) 2. Place: Main Conference Room of Advantest Corporation 32-1, Asahi-cho 1-chome, Nerima-ku, Tokyo 3. Subject matters of the general meeting of shareholders: Matters to be reported: Item No.1: Matters concerning the business report, consolidated financial statements and financial statements reporting for the 71st Fiscal Year (from April 1, 2012 to March 31, 2013) Item No.2: Matters concerning the results of audit of the Company’s consolidated financial statements by the Independent Auditors and the Board of Corporate Auditors Matters to be resolved: Agenda Item No.1: Partial amendment to the Articles of Incorporation Agenda Item No.2: Election of nine directors 1 4. -

A New Toshiba Takes Shape >>

ANNUAL REPORT 2000 A new Toshiba takes shape >> ANNUAL REPORT >> Year ended March 31, 2000 Printed in Japan BASIC COMMITMENT INVESTOR REFERENCE OF THE TOSHIBA GROUP We, the Toshiba Group companies, based on our total commitment to people and to the future, are determined to help create a higher quality of life for all people, and to do our part to help ensure that progress continues within the world community. COMMITMENT TO PEOPLE Founded Principal Shareholders: We endeavor to serve the needs of all people, especially our customers, July 1875 The Dai-ichi Mutual Life Insurance Company 3.94% shareholders, and employees, by implementing forward-looking The Sakura Bank, Ltd. 3.88% corporate strategies while carrying out responsible and responsive Capital business activities. As good corporate citizens, we actively contribute to The Chase Manhattan Bank NA London 3.85% further the goals of society. ¥274,919 million (US$2,594 million) Nippon Life Insurance Company 3.36% COMMITMENT TO THE FUTURE State Street Bank and Trust Company 2.63% By continually developing innovative technologies centering on Employees Mitsui Mutual Life Insurance Company 2.22% the fields of Electronics and Energy, we strive to create products 190,870 The Sumitomo Trust and Banking Co., Ltd. (Trust Account) 2.01% and services that enhance human life, and which lead to a thriving, Employees Stock Ownership Plan 1.86% healthy society. We constantly seek new approaches that help realize the goals of the world community, including ways to improve the global Common Stock The Nippon Fire & Marine Insurance Co., Ltd. 1.84% environment. -

Investors Guide

INVESTORS GUIDE Year Ended of March 31, 2014 Market Data 2014年3月期 1 市場データ Business Segments 2 事業セグメント Consolidated Financial Results, Geographic Sales, Number of Employees 3 連結経営成績、地域別売上高、従業員数 Operating Results by Business Segment 4 事業別セグメントの状況 Profitability, R&D Expenses, Capital Expenditures, Depreciation and Amortization 5 収益性、研究開発費、設備投資額、減価償却費 Financial Position, Cash Flow Condition 6 連結財政状態、連結キャッシュ・フローの状況 Share Information 7 株式情報 © Copyright 2014 ADVANTEST CORPORATION Market Data | 市場データ Semiconductor Market by Category in 2013 Worldwide IC Manufacturing Equipment Sales Top 10 Breakdown of IC Automated Test Equipment Market in 2013 2013年半導体品種別売上高 世界半導体製造装置メーカー売上上位10社 2013年の半導体試験装置市場 (US$ billion 十億米ドル) (US$ million, CY 百万米ドル、暦年) (US$ million 百万米ドル) COMPANY 2013 Discrete Other ディスクリート MOS Memory Applied Materials 6,955 SOC Test Systems その他 メモリ SOCテスタ Optoelectronics 26 ASML 6,729 358 オプトエレクトロニクス 68 29 Tokyo Electron 東京エレクトロン 4,165 Lam Research 3,909 ANALOG Memory IC Test Systems KLA-Tencor 2,805 メモリテスタ アナログ 40 Dainippon Screen Mfg. 大日本スクリーン製造 1,533 442 ASM International 1,265 1,453 Advantest アドバンテスト 1,187 MOS Logic Teradyne 1,023 155 ロジック Hitachi High-Technologies 日立ハイテクノロジーズ 1,007 Source: VLSI Research, April 2014 Source: VLSI Research, April 2014 Source: VLSI Research, April 2014 Trend of Worldwide Semiconductor Market Trend of IC and Related Equipment Market Trend of IC Automated Test Equipment Market 半導体市場の推移 半導体製造装置市場の推移 半導体試験装置市場の推移 (US$ billion 十億米ドル) (billion units 十億個) (US$ million 百万米ドル) (US$ million 百万米ドル) (%) 800 800 60,000 -

CDP Japan Water Security Report 2019

CDP Japan Water Security Report 2019 On behalf of 525 institutional investors with assets of USD 96 trillion CDP Japan Water Security Report 2019 | 2020 March Report writer Contents CDP Foreword 3 Report Writer Foreword 4 Water Security A List 2019 6 Scoring 7 Stories of Change 8 - Kao Corporation - Japan Tobacco Inc. Executive Summary 12 Response to CDP’s Water Security Questionnaire 14 Appendix 22 - CDP Water Security 2019 Japanese companies Please note that the names of companies in the text do not indicate their corporate status. Important Notice The contents of this report may be used by anyone providing acknowledgment is given to CDP. This does not represent a license to repackage or resell any of the data reported to CDP or the contributing authors and presented in this report. If you intend to repackage or resell any of the contents of this report, you need to obtain express permission from CDP before doing so. CDP has prepared the data and analysis in this report based on responses to the CDP 2019 information request. No representation or warranty (express or implied) is given by CDP as to the accuracy or completeness of the information and opinions contained in this report. You should not act upon the information contained in this publication without obtaining specific professional advice. To the extent permitted by law, CDP does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this report or for any decision based on it. -

PCA7439 Instruction Manual

To our customers, Old Company Name in Catalogs and Other Documents On April 1st, 2010, NEC Electronics Corporation merged with Renesas Technology Corporation, and Renesas Electronics Corporation took over all the business of both companies. Therefore, although the old company name remains in this document, it is a valid Renesas Electronics document. We appreciate your understanding. Renesas Electronics website: http://www.renesas.com April 1st, 2010 Renesas Electronics Corporation Issued by: Renesas Electronics Corporation (http://www.renesas.com) Send any inquiries to http://www.renesas.com/inquiry. Notice 1. All information included in this document is current as of the date this document is issued. Such information, however, is subject to change without any prior notice. Before purchasing or using any Renesas Electronics products listed herein, please confirm the latest product information with a Renesas Electronics sales office. Also, please pay regular and careful attention to additional and different information to be disclosed by Renesas Electronics such as that disclosed through our website. 2. Renesas Electronics does not assume any liability for infringement of patents, copyrights, or other intellectual property rights of third parties by or arising from the use of Renesas Electronics products or technical information described in this document. No license, express, implied or otherwise, is granted hereby under any patents, copyrights or other intellectual property rights of Renesas Electronics or others. 3. You should not alter, modify, copy, or otherwise misappropriate any Renesas Electronics product, whether in whole or in part. 4. Descriptions of circuits, software and other related information in this document are provided only to illustrate the operation of semiconductor products and application examples. -

CSR Report 2013 CSR Report 2013

CSR Report 2013 CSR Report 2013 Editorial Note Contents The Advantest Group has been issuing its Environmental Editorial Note / Contents ....... 1 Report since fiscal 2000, its Social and Environmental Advantest's CSR Report since fiscal 2006, and its CSR Report since fiscal Message from CEO ....... 2 2007. Advantest's CSR ....... 4 We have been releasing such reports in PDF format since Medium-term Management Targets ....... 6 fiscal 2011 in order to help curb use of paper resources. Feature : From integration to full assimilation Moreover, we have been showcasing our activities through Feauture : Research and development ....... 8 the company's online CSR Report since fiscal 2012, with Feature : Production ....... 10 respective sections arranged in accordance with the seven Feature : Maintenance services ....... 13 core subjects of social responsibility defined in the ISO Feature : Human resources management ....... 16 26000 guidelines. Organizational Governance Corporate Governance ....... 20 Risk Management ....... 23 Human Rights Initiatives Related to the Protection and Respect of Human Rights ....... 25 Labor Practices Maintaining and Creating Employment ....... 28 Fair Evaluation and Treatment ....... 29 Human Resources Development ....... 30 Supporting a Better Work-Life Balance ....... 34 Occupational Health and Safety ....... 37 Fair Business Practices Compliance ....... 39 Fair Trade ....... 41 Information Security ....... 42 Intellectual Property Protection ....... 44 Scope of Report and Period Covered Consumer Issues Improving Customer Satisfaction ....... 45 This report covers activities pursued by Advantest and its Quality Management ....... 48 major affiliates in Japan and overseas throughout fiscal 2012 (April 1, 2012 to March 31, 2013). Community Participation and Development Social Contribution Activities ....... 50 * Some activities before and after fiscal 2012 are also featured in the report with the aim of facilitating reader Environment understanding. -

View: Test & Measurement and Industrial Automation

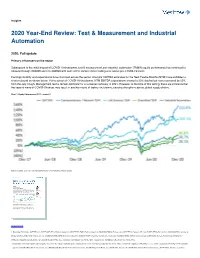

Insights 2020 Year-End Review: Test & Measurement and Industrial Automation 2020: Fall update Primary influencers on the sector Subsequent to the initial impact of COVID-19 shutdowns, test & measurement and industrial automation (TM&IA) equity performance has continued to rebound through 3Q2020 and into 4Q2020 with each of the sector indices trading at or above pre-COVID-19 levels. Earnings visibility and expectations have improved across the sector. Analysts’ EBITDA estimates for the Next Twelve Months (NTM) have exhibited a sharp rebound as shown below. At the outset of COVID-19 shutdowns, NTM EBITDA expectations showed a 25% decline but have recovered by 25% from the July trough. Management teams remain optimistic for a sustained recovery in 2021. However, at the time of this writing, there are concerns that the second wave of COVID-19 cases may result in another round of factory shutdowns, causing disruptions across global supply chains. Chart 1: Equity Performance (2017 – current)1 Source: FactSet, as of 12.11.20. Past performance is not indicative of future results. READ MORE 1. Diversified T&M Index: AMETEK, Inc. (NYSE:AME), ESCO Technologies Inc. (NYSE:ESE), FARO Technologies, Inc. (NASDAQ:FARO), Fortive Corp. (NYSE:FTV), Hexagon AB Class B (STO:HEXA-B), Itron, Inc. (NASDAQ:ITRI), Landis+Gyr Group AG (SIX:LAND), MKS Instruments, Inc. (NASDAQ:MKSI), MTS Systems Corporation (NASDAQ:MTSC), National Instruments Corporation (NASDAQ:NATI), Oxford Instruments plc (LSE:OXIG), Sensata Technologies Holding PLC (NYSE:ST), Spectris plc (LSE:SXS), TE Connectivity Ltd. (NYSE:TEL), Teledyne Technologies Inc. (NYSE:TDY), Teradyne, Inc. (NASDAQ:TER), Xylem Inc.