GNAM Investment Competition UNIVERSITY of GHANA

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

16 Annual Report

47th Annual Report and Financial Statements 30 SEPTEMBER 2016 2 - 47th annual report & financial statement AUDITORS AND REGISTERED OFFICE Auditors KPMG (ICAG/F/2014/038) Chartered Accountants 13 Yiyiwa Drive, Abelenkpe Post Office Box 242 Accra. Registered Office Cocoa House 41 Kwame Nkrumah Avenue Post Office Box GP 933 Accra Tel. 233 -302 – 661752/678972/661782/683300 Fax: 233 -302- 667104/665076 E-mail: [email protected] Website: www.cocobod.gh 2 - 47th annual report & financial statement I - 47th annual report & financial statement TABLE OF CONTENTS Auditors i Registered Office i Table of Contents ii Highlights iii Board of Directors 2015/16 iv Heads of Subsidiaries and Divisions 2015/16 iv Chairman’s Statement v Review of Business Operations 1 1. Producer Price 1 2. Cocoa Purchases Performance and Licensed Buying Companies 1 3. Coffee and Sheanut Purchases/Exports 2 4. Performance of Divisions and Subsidiaries 4 A. Quality Control Company 4 a. Selective Grading of cocoa 4 b. Grading and Sealing 5 i. Cocoa 5 ii. Composition of Bean-size Categories 5 iii. Other Produce Inspected 5 c. Check Sampling 5 d. Disinfestation Activities 5 1. Insect Control Operations 5 2. Shipment Inspection and Treatment 5 B. Cocoa Marketing Company (Gh.) Ltd. 6 a. Shipments and Processing 6 i. Cocoa Beans 6 ii. Cocoa Products 6 C. Seed Production Division 6 a. Hybrid Seed Pods 7 b. Cocoa Seedlings 7 47th annual report & financial statement - II Table of contents cont. D. Cocoa Health & Extension Division 7 a. Field Operations 7 b. CODAPEC & Hi-Tech 8 E Cocoa Research Institute of Ghana 9 TABLE OF a. -

Ssnit Investments Series

SSNIT INVESTMENTS SERIES SECOND EDITION INTRODUCTION This edition of the SSNIT Investments Series focuses on the Listed Equities Portfolio, one of the three sub-asset classes of the Equities Portfolio. Listed equity refers to ownership interests in companies whose shares are traded publicly on a Stock Market. The Trust currently has share interests in 23 out of the 37 companies listed on the Ghana Stock Exchange (GSE), with a total value of GH¢1.8 billion as at June 2017. A portion of the Trust’s shares in Tullow Oil Plc is also listed on the London Stock Exchange (LSE). The composition of the Trust’s Listed Equities Portfolio, also referred to as the SSNIT Stock Market Portfolio (SSMP), is shown in Table 1. Table 1: SSNIT Listed Equity Holdings # Company Ticker Shareholding (%) 1 Anglogold Ashanti Ltd. AGA 0.02% 2 Aluworks Limited ALW 62.62% 3 Ayrton Drug Man. Ltd. AYRTN 18.00% 4 Benso Oil Palm Plantation BOPP 4.31% 5 CAL Bank Limited CAL 33.18% 6 Cocoa Processing Co. Ltd. CPC 10.14% 7 Ecobank Ghana Ltd. EGH 16.21% 8 Enterprise Group Ltd EGL 6.22% 9 Ecobank Transnational Inc. ETI 3.86% 10 Fan Milk Limited FML 1.59% 11 GCB Bank GCB 29.89% 12 Guinness Gh. Breweries Ltd. GGBL 7.57% 13 Ghana Oil Co. Ltd. GOIL 25.00% 14 Golden Web Ltd. GWEB 20.78% 15 HFC Bank Ltd. HFC 26.09% 16 Produce Buying Co. Ltd. PBC 38.10% 17 Standard Chartered Bank SCB 14.55% 18 SIC Insurance Ltd. -

Has Gse Played Its Role in the Economic Development of Ghana?

CAPITAL MARKET 23 YEARS AND COUNTING: HAS GSE PLAYED ITS ROLE IN THE ECONOMIC DEVELOPMENT OF GHANA? 1st CAPITAL MARKET CONFERENCE BY EKOW AFEDZIE, DEPUTY MANAGING DIRECTOR MAY 10, 2013 INTRODUCTION Ghana Stock Exchange (GSE) was established with a Vision: -To be a relevant, significant, effective and efficient instrument in mobilizing and allocating long-term capital for Ghana’s economic development and growth. INTRODUCTION OBJECTIVES - To facilitate the Mobilization of long term capital by Corporate Bodies/Business and Government through the issuance of securities (shares, bonds, etc). - To provide a Platform for the trading of issued securities. MEMBERSHIP OF GHANA STOCK EXCHANGE GSE as a public company limited by Guarantee has No OWNERS OR SHAREHOLDERS. GSE has Members who are either corporate or individuals. There are two categories of members:- - Licensed Dealing Members - 20 - Associate Members - 34 HISTORICAL BACKGROUND 1968 - Pearl report by Commonwealth Development Finance Co. Ltd. recommended the establishment of a Stock Exchange in Ghana within two years and suggested ways of achieving it. 1970 – 1989 - Various committees established by different governments to explore ways of bringing into being a Stock Exchange in the country. HISTORICAL BACKGROUND 1971 - The Stock Exchange Act was enacted. - The Accra Stock Exchange Company incorporated but never operated. Feb, 1989 - PNDC government set up a 10-member National Committee on the establishment of Stock Exchange under the chairmanship of Dr. G.K. Agama, the then Governor of the Bank of Ghana. HISTORICAL BACKGROUND July, 1989 - Ghana Stock Exchange was incorporated as a private company limited by guarantee under the Companies Code, 1963. HISTORICAL BACKGROUND Nov. -

Market Review

Market Review February 2017 The month of February was dominated by a highly volatile foreign Market in Brief exchange market resulting from news of a worse-than-expected • • • • • • 2016 budget deficit. The deficit stood at 10.3 per cent of gross domestic product against a target of 5.3 per cent. Policy Rate 25.5% Forex and Money Markets • • • The Ghana cedi recorded a month-on-month depreciation of 4.6 Inflation per cent against the US dollar in the Interbank market, having 13.3% opened the month at 4.2711 per US dollar and closed at 4.4786, (January Y/Y) extending the year’s depreciation to 6.2 per cent. In the money • • • market, yield on 91-day bill remained at 15.94 per cent at close of the month whereas yield on 182-day bill rose marginally to 17.10 Interest Rate per cent from 16.99 per cent in January. 16.3827% (91-day bill) Interbank Exchange Rate (February 2017) • • • Current Previous Change (%) USD/GHS 4.4786 4.2711 -4.60% GBP/GHS 5.5745 5.3488 -4.00% Cedi Performance EUR/GHS 4.7530 4.6073 -3.10% -6.2% Ghana Government Treasury Securities (YTD Return) Current Previous Change (bps) 91-Day T-Bill 15.9438% 15.9376% +1bps GSE Composite Index 182-Day T-Bill 16.9927% 17.0978% -11bps +9.8% (YTD Return) Equities • • • The stock market remained optimistic in February. The benchmark GSE Composite Index gained 78.13 points (representing 4.4 per cent) month-on-month to close February at 1,854.53 points, www.pentassets.com 050-153-0246 extending year-to-date return to 9.8 per cent. -

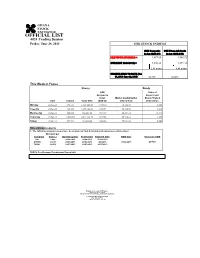

OFFICIAL LIST 4024 Trading Session Friday, June 28, 2013 GSE STOCK INDICES

OFFICIAL LIST 4024 Trading Session Friday, June 28, 2013 GSE STOCK INDICES GSE Composite GSE Financial Stocks Index (GSE-CI) Index (GSE-FSI) PREVIOUS 27/06/2013) = 1,877.65 1,585.72 CURRENT 28/06/2013) = 1,880.26 1,591.18 2.61 points 5.46 points CHANGE-YEAR TO DATE (Jan 01, 2013- June 28, 2013) 56.72% 53.02% This Week in Focus Shares Bonds GSE Value of Composite Government Index Market Capitalization Bonds Traded Date Volume Value GH¢ (GSE-CI) GH¢ million GH¢ million Monday 24-Jun-13 493,511 1,581,041.68 1,900.10 56,154.80 0.000 Tuesday 25-Jun-13 426,550 1,196,438.69 1,891.94 56,110.32 1.240 Wednesday 26-Jun-13 880,088 966,256.30 1,874.67 55,894.32 15.743 Thursday 27-Jun-13 1,553,869 2,844,118.70 1,877.65 55,910.61 4.295 Friday 28-Jun-13 251,546 482,820.80 1,880.26 55,924.82 0.000 Notes/Announcements 1. The following announcements have been made on final dividends and annual general meetings: Dividend per Company Share ¢ Qualifying Date Ex-Div Date Payment Date AGM Date Venue for AGM CAL 0.006 26/06/2013 24/06/2013 30/08/2013 AYRTN 0.0013 25/06/2013 21/06/2013 8/8/2013 27/06/2013 OEPCH TOTAL 0.6900 18/07/2013 16/07/2013 26/07/2013 GCPS:GhanaAICC: Accra International College of Physicians Conference and Centre Surgeons OEPCH:Osu Ebenezer Presbyterian Church HalL Enquiries to: General Manager Ghana Stock Exchange 5th & 6th Floors Cedi House, Liberia Road, Accra Tel: 021 669908, 669914, 669935 Fax: 021 669913 e-mail: [email protected] OFFICIAL LIST 4024 Trading Session ODD LOT Friday, June 28, 2013 ISIN Share Code Total Shares No. -

Weekly Market Watch Sic-Fsl Investment+ Research| Market Reviews|Ghana

WEEKLY MARKET WATCH SIC-FSL INVESTMENT+ RESEARCH| MARKET REVIEWS|GHANA 8th January, 2015 STOCK MARKET ACCRA BOURSE MAKES PROMISING START INDICATORS WEEK OPEN WEEK END CHANGE The year 2014 has begun living up to expectations as bullish runs in equities from the petroleum, finance and consumer Market Capitalization (GH¢ goods sectors saw the annual returns of the broader market 'million) 64,352.42 64,229.12 -0.19% Market Capitalization (US$' inch up to 0.42% last Thursday. Though, most equities gave million) 20,109.50 20,014.06 -0.47% up their opening prices, rise in the market value of Ghana Oil Petroleum Company Limited (GOIL), Societe Generale Ghana Volume traded (shares) 783,118.00 573,274.00 -26.80% Table 1: Market Summary Limited (GOIL) and Fan Milk Limited (FML) were enough to close the week’s activities on a positive note. Key benchmark indices closed the week better despite slight volatilities during inter-day trading. The GSE Composite INDEX ANALYSIS index closed at a year-to-date return of 0.42% whiles the GSE Financial Stocks Index settled at 0.67% returns. INDICATORS Closing Week YTD Level Change CHANGE Total market capitalization of the Ghana Stock Exchange was GH¢64.23 billion, an equivalent to USD20.00 billion. GSE Composite Index 2,270.57 0.42% 0.42% GSE Financial Stocks Index 2,258.77 0.67% 0.67% Table 2: Key Stock Market Indices LIQUIDITY The absence of block trades over the period saw liquidity comparatively down last week. All in all, an approximate figure of 573,274 shares exchanged hands within the first trading week of the year, and was also valued about GH¢2.48 million. -

(A CASE STUDY of GHANA STOCK EXCHANGE) By

KWAME NKRUMAH UNIVERSITY OF SCIENCE AND TECHNOLOGY, KUMASI OPTIMAL PORTFOLIO SELECTION (A CASE STUDY OF GHANA STOCK EXCHANGE) By HERMAN YIRBECHAA TAGYANG (B. A. ECONOMICS AND MATHEMATICS) A THESIS SUBMITTED TO THE DEPARTMENT OF MATHEMATICS, KWAME NKRUMAH UNIVERSITY OF SCIENCE AND TECHNOLOGY IN PARTIAL FUFILLMENT OF THE REQUIREMENT FOR THE DEGREE OF MSc. INDUSTRIAL MATHEMATICS MAY, 2014 DECLARATION I hereby declare that this submission is my own work towards the award of the MSc. degree and that, to the best of my knowledge, it contains no material previously published by another person nor material which had been accepted for the award of any other degree of the university, except where due acknowledgement had been made in the text. Tagyang Yirbechaa Herman ....................................... Student Signature Date Certified by: Mr. Kwaku Darkwa ....................................... Supervisor Signature Date Certified by: Prof. S. K. Amponsah ....................................... Head of Department Signature Date i DEDICATION I wish to dedicate this work to the Glory of God Almighty who has been our help in ages past, our fortress now and is still our hope for many years to come. Also to my lovely wife, Irene Kumah and my parents, Mr and Mrs Tagyang. ii Abstract The knapsack model is employed in many fields of study including Business, Engineering and Economics to solve problems related to resource constraints. The knapsack problem is a form of integer programming problem that has only one constraint and can be used to strengthen cutting planes for general integer programs. These facts make the studies of the knapsack problems and their variants extremely important area of research in the field of operations research. -

Weekly Market Watch Sic-Fsl Investment+ Research| Market Reviews|Ghana

WEEKLY MARKET WATCH SIC-FSL INVESTMENT+ RESEARCH| MARKET REVIEWS|GHANA 15th January, 2015 STOCK MARKET PROFIT-TAKING SLOWS DOWN MARKET PERFORMANCE INDICATORS WEEK OPEN WEEK END CHANGE Despite, the excitement that characterized market activities last week, performance of the bourse dipped on the back of Market Capitalization profit-taking by shareholders. Shares of Ecobank (GH¢'million) 64,229.12 63,654.84 -0.89% Market Capitalization Transnational Incorporated (ETI), Cocoa Processing Company (US$'million) 20,014.06 19,779.64 -1.17% (CPC), UT Bank (UTB), GCB Bank (GCB), Ecobank Ghana Limited (EBG) and SIC Insurance Company Limited (SIC) were Volume traded (shares) 573,274.00 4,233,537.00 638.48% responsible for last week’s sluggish performance. Value Traded (GH¢) 2,482,296.35 2,251,183.89 -9.31% In effect, benchmark indices turned southward, as the yield on Value Traded (US$) 773,493.81 699,516.47 -9.56% the GSE-Composite Index dipped by 1.02% to settle at an Table 1: Market Summary annual drop of 1.44%. Similarly, the GSE Financial Stock INDEX ANALYSIS Index (GSE-FSI) which tracks the performance of financial stocks fell by 0.99% to close at a drop of 1.66% from INDICATORS Closing Week YTD beginning of year to-date. Level Change CHANGE The value of all listed companies (market capitalization) also GSE Composite Index 2,228.48 -1.85% 0.42% went down by 0.89% to settle at GH¢63.65 billion from the GSE Financial Stocks Index 2,206.33 -2.32% 0.67% previous GH¢64.23 billion, which is is attributable to the Table 2: Key Stock Market Indices marginal depreciations of the local currency during the period under review. -

Weekly Markets Update Wilfred Agyei Kofi B

Analysts: Weekly Markets Update Wilfred Agyei Kofi B. Kyei Yaw Saifah For the week ending January 13,2017 Tel: +233(0)302 251137 Email: [email protected] Equities Market Performance Indicators Ga ine rs Stock Market Data: Januray 13, 2017 Indic a tor This We e k Previous Week Cha nge Y TD Tic ke r Price (GHS) Cha nge Div GSE Composite Index (GSE- CI) 1,735.67 1,699.42 36.25 2.76% ETI 0.13 30.00% Price Close 52 Week Market Cap P/E Yield P/B GSE Financial Stock Index (GSE- FSI) 1,613.19 1,564.82 48.37 4.39% EGH 6.85 5.40% Industry/EquitiesTicker GHS USD High Low Volume Traded Value Traded Ratio (%) Ratio GHS MN USD MN Market Cap (GHS MN) 53,588.83 52,756.81 832.02 GCB 3.67 1.10% AGRO PROCESSING 4.22 4.22 Value Traded (GHS MN) 1.63 4.34 - 2.71 TOTAL 2.04 1.00% Volume Traded (MN) 10.76 13.15 - 2.40 BensoBOPP Oil Palm2.40 Plantation0.57 3.13 2.08 29 60 9.49 2.94 1.21 83.52 19.77 Lose rs CocoaCPC Processing0.02 Company0.00 0.02 0.01 0 0 n.m. n.m. 3.96 22.02 5.21 Equities Market Commentary & News Tic ke r Price (GHS) Cha nge GoldenGWEB Web0.01 Ltd 0.00 0.01 0.01 0 0 n.m. n.m. -0.13 0.35 0.08 Investor sentiments swayed in the positive direction during the week in focus as the search for positions in blue CAL 0.76 - 1.30% chip stocks resulted in the values of Ecobank Transnational Incorporated, Ecobank Ghana, GCB Bank and BANKING Total Petroleum closing on the north side of the bourse. -

Cocoa in West Africa Report

the Cocoa Industry in West Africa A history of exploitation Anti-Slavery International 2004 Anti-Slavery International The Cocoa Industry in West Africa: A history of exploitation The Cocoa Industry in West Africa: A history of exploitation Introduction When extensive child and slave labour was found on the cocoa farms of Côte d’Ivoire in late 2000, many British consumers were shocked. Chocolate companies, cocoa suppliers, and retailers searched for a way to address this serious problem. The way forward was unclear. The immediate reaction of some consumers was a decision to stop eating chocolate altogether or to call for a boycott of exports from Côte d’Ivoire. Yet it quickly became clear that a boycott might have disastrous results for both cocoa workers and Côte d’Ivoire as a whole. What was needed was more in-depth information of the conditions and extent of enslaved labour, of how cocoa from West Africa reaches the consumer, of what would be appropriate and reasoned responses to the problem. In answer to this need and to provide information on the industry reaction and actions since, Anti-Slavery International has prepared this document – an in-depth analysis of how cocoa is produced and how child and slave labour enter its chain of production. It relates the history of cocoa and explores how this commodity fits within a global market. It also explains the events following the ‘discovery’ of slavery in cocoa farming, what actions have been and are being taken to remove slavery from the chocolate we eat. Drawing on a wide range of sources, it concludes with recommendations for consumers, the chocolate industry and governments on actions needed to address this serious problem. -

Weekly Market Watch Sic-Fsl Investment+ Research| Market Reviews|Ghana

WEEKLY MARKET WATCH SIC-FSL INVESTMENT+ RESEARCH| MARKET REVIEWS|GHANA 11th September, 2014 SIC FINANCIAL SERVICES LIMITED|ADVISORY|FUND MANAGEMENT|STOCK BROKERAGE|INVESTMENT RESEARCH STOCK MARKET GSE STAYS UP INDICATORS WEEK OPEN WEEK END CHANGE Strong demand for some listed equities improved the momentum Market Capitalization (GH¢ on the Ghana Stock Exchange (GSE) for another consecutive week 'million) 63,174.64 63,557.62 0.61% running. Investors' interest in stocks like Ecobank Transnational Market Capitalization (US$' Incorporated (ETI), Cocoa Processing Company Limited (CPC), million) 19,897.52 19,885.37 -0.06% Ghana Commercial Bank Limited (GCB), Guinness Ghana Volume traded (shares) 3,500,198.00 2,491,211.00 -28.83% Breweries Limited (GGBL), and Ecobank Ghana Limited (EBG) were enough to sustain the market’s upward shift. Value Traded (GH¢) 7,395,095.36 5,404,973.86 -26.91% Value Traded (US$) 2,329,163.89 1,691,062.47 -27.40% This, saw key market indices rallied across board despite the Table 1: Market Summary advantage laggards had over gainers. This could be linked to the magnitude of successful bids in the period, hence the 0.68% jump INDEX ANALYSIS by the broader market (GSE Composite Index), to close at an annual yield of 3.34%. INDICATORS Closing Week YTD Level Change CHANGE The SIC-FSL Top 15 index (SIC-FSL T-15) which tracks the performance of the 15 most liquid equities on the Ghana Stock GSE Composite Index 2,213.41 0.52% 3.18% Exchange (GSE) gained 2.66% over the period, whilst financial SIC-FSL Top 15 Index 4,113.12 2.66% 19.02% stocks (GSE FSI) also appreciated by 1.73% to see both yields settle at 19.02% and 20.42% respectively. -

Download the Full Report

Social Responsibility CONTENTS Page Notice of Annual General Meeting 2 Five-Year Financial Summary 3 Board of Directors, Officials and Registered Office 4 Profile of Board of Directors 5 Chairman’s Report 6 Managing Director’s Report 9 Report of the Directors 13 Report of the Auditors 16 Consolidated Statement of Profit or Loss 18 Consolidated Statement of Other Comprehensive Income 19 Consolidated Statement of Financial Position 20 Consolidated Statement of Changes in Equity 21 Consolidated Statement of Cash Flows 22 Notes to the Consolidated Financial Statements 23 Notes on Resolutions to be Passed 76 Proxy Form 77 ANNUAL REPORT 2014 1 NOTICE OF ANNUAL GENERAL MEETING OF CAL BANK LIMITED TO BE HELD ON FRIDAY, 27 MARCH 2015 AT THE GHANA COLLEGE OF PHYSICIANS RIDGE, ACCRA NOTICE IS HEREBY GIVEN that the Annual General Meeting of CAL Bank Limited will be held at 10 a.m. on Friday, 27 March, 2015 at the Conference Auditorium of Ghana College of Physicians and Surgeons, Ridge, Accra to transact the following business: AGENDA 1. To receive and consider the Reports of the Directors and the Auditors, and the Accounts of the Company for the year ended December 31, 2014 2. To declare a final dividend for the year ended December 31, 2014 3. To authorise the Directors to fix the fees of the Auditors 4. To re-elect Directors retiring by rotation 5. To re-elect newly-appointed Directors 6. To approve directors’ remuneration Dated this 19th day of February, 2015 BY ORDER OF THE BOARD VERITAS ADVISORS LIMITED COMPANY SECRETARY Note A member entitled to attend and vote at the Annual General Meeting may appoint a proxy to attend and vote on his/her behalf.