Wintrust Financial Corporation (WTFC)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Walgreens (Top Performing Location) 3019 W Peterson Avenue Chicago, IL 60659 TABLE of CONTENTS

NET LEASE INVESTMENT OFFERING Walgreens (Top Performing Location) 3019 W Peterson Avenue Chicago, IL 60659 TABLE OF CONTENTS I. Executive Summary II. Location Overview III. Market & Tenant Overview Executive Summary Site Plan Tenant Profile Investment Highlights Aerial Location Overview Property Overview Maps Demographics Photos NET LEASE INVESTMENT OFFERING DISCLAIMER STATEMENT DISCLAIMER The information contained in the following Offering Memorandum is proprietary and strictly confidential. It is intended STATEMENT: to be reviewed only by the party receiving it from The Boulder Group and should not be made available to any other person or entity without the written consent of The Boulder Group. This Offering Memorandum has been prepared to provide summary, unverified information to prospective purchasers, and to establish only a preliminary level of interest in the subject property. The information contained herein is not a substitute for a thorough due diligence investigation. The Boulder Group has not made any investigation, and makes no warranty or representation. The information contained in this Offering Memorandum has been obtained from sources we believe to be reliable; however, The Boulder Group has not verified, and will not verify, any of the information contained herein, nor has The Boulder Group conducted any investigation regarding these matters and makes no warranty or representation whatsoever regarding the accuracy or completeness of the information provided. All potential buyers must take appropriate measures to verify all of the information set forth herein. NET LEASE INVESTMENT OFFERING EXECUTIVE SUMMARY EXECUTIVE The Boulder Group is pleased to exclusively market for sale a single tenant Walgreens property located in the SUMMARY: city of Chicago. -

Steward Small-Mid Cap Enhanced Index Fund Holdings Page 2 of 25

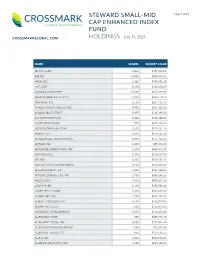

STEWARD SMALL-MID Page 1 of 25 CAP ENHANCED INDEX FUND CROSSMARKGLOBAL.COM HOLDINGS July 31, 2021 NAME SHARES MARKET VALUE 3D SYS. CORP 6,800 $187,272.00 8X8 INC 12,850 $328,446.00 AAON INC 6,268 $389,556.20 AAR CORP 4,150 $148,404.00 AARON'S CO INC/THE 10,815 $312,229.05 ABERCROMBIE & FITCH CO 6,950 $262,779.50 ABM INDS. INC 5,630 $261,738.70 ACADIA HEALTHCARE CO INC 4,990 $307,982.80 ACADIA REALTY TRUST 5,897 $126,195.80 ACI WORLDWIDE INC 6,600 $226,380.00 ACUITY BRANDS INC 1,700 $298,146.00 ADDUS HOMECARE CORP 2,630 $228,257.70 ADIENT PLC 6,040 $254,465.20 ADTALEM GBL. EDUCATION IN 4,890 $177,702.60 ADTRAN INC 2,480 $55,576.80 ADVANCED ENERGY INDS. INC 6,270 $650,512.50 ADVANSIX INC 7,020 $234,819.00 AECOM 8,222 $517,657.12 AEROJET ROCKETDYNE HLDGS. 3,960 $186,832.80 AEROVIRONMENT INC 4,880 $493,368.00 AFFILIATED MGRS. GRP. INC 2,150 $340,646.00 AGCO CORP 3,100 $409,541.00 AGILYSYS INC 6,310 $350,583.60 AGREE REALTY CORP 3,320 $249,498.00 ALAMO GRP. INC 1,790 $262,718.30 ALARM.COM HLDGS. INC 9,590 $798,079.80 ALBANY INTL. CORP 1,580 $136,433.00 ALEXANDER & BALDWIN INC 5,813 $116,376.26 ALLEGHANY CORP 687 $455,549.70 ALLEGHENY TECHS. INC 8,380 $172,041.40 ALLEGIANCE BANCSHARES INC 1,040 $37,928.80 ALLEGIANT TRAVEL CO 656 $124,718.72 ALLETE INC 3,000 $210,960.00 ALLIANCE DATA SYS. -

Corporate, Foundation, and Government Gifts

Corporate, Foundation, and Government Gifts Gifts of $100,000 or more. Hackberry Endowment Partners MacLean-Fogg Company Anonymous Macy’s Foundation Merge Healthcare Solutions Inc. Abbott Laboratories Marquette de Bary Co., Inc. Morgan Stanley Bank of America Mayer & Morris Kaplan Motorola Solutions Foundation BP Foundation, Inc. Family Foundation Neal, Gerber & Eisenberg LLP Chicago Community Trust Morgan Stanley Nichols Family Investment Citigroup Polk Bros. Foundation Limited Partnership D & R Fund Prince Charitable Trusts NYSE Euronext Edwardson Family The Rhoades Foundation The Philancon Fund at the Boston Foundation Trust Schwab Charitable Fund Foundation Lillian H. Florsheim Foundation Sirius Fund R2M Holdings-Illinois LLC for Fine Arts Smart Family Foundation David C. & Sarajean Ruttenberg Gilchrist Foundation Sotheby’s Inc. Arts Foundation Goldman Sachs Walgreens Saul and Devorah Sherman Fund Graff Diamonds Chicago, Inc. Schwarz Supply Source Illinois Tool Works Inc. Gifts of $25,000 to $49,999. Scupe Foundation Jewish Federation of Anonymous Seneca Capital Metropolitan Chicago AbelsonTaylor, Inc The Siragusa Foundation Jordan Industries Accenture State Farm JPMorgan Chase & Co. After School Matters Terlato Wine International Lannan Foundation Allstate Corporation The PrivateBank Lazard Freres & Co. LLC Aon Foundation Vanguard Charitable Endowment John D. and Catherine T. The Barker Welfare Foundation Program MacArthur Foundation Baxter International Inc. W. W. Grainger, Inc. Chauncey and Marion Beecken Petty O’Keefe & Co, LLC Wintrust Financial Corporation Deering McCormick Foundation Blue Cross Blue Shield of Illinois Elizabeth Morse Charitable Trust The Boeing Company Gifts of $10,000 to $14,999. The Northern Trust Company Bon Appetit Management Co. Anonymous The Rise Group Bruning Foundation The Astor Foundation Starry Night Fund Elizabeth F. -

Plaintiffs' Appendix

Return Date: No return date scheduled Hearing Date: No hearing scheduled Courtroom Number: No hearing scheduled Location: No hearing scheduled FILED 12/16/2019 4:01 PM DOROTHY BROWN CIRCUIT CLERK COOK COUNTY, IL 2014ch00829 7750447 FILED DATE: 12/16/2019 4:01 PM 2014ch00829 Plaintiffs’ Appendix IN THE CIRCUIT COURT OF COOK COUNTY, ILLINOIS COUNTY DEPARTMENT, CHANCERY DIVISION SHELDON LANGER, RONALD M. ) No. 2014-CH-00829 YERMACK, LANCE R. GOLDBERG, ) ROBERT PROSI and GERALD PETROW, ) individually on behalf of themselves and all ) others similarly situated, ) ) Calendar 6 Plaintiffs, ) ) v. ) ) Hon. Celia G. Gamrath, Presiding CME GROUP, INC., a Delaware Corporation; ) THE BOARD OF TRADE OF THE CITY OF ) FILED DATE: 12/16/2019 4:01 PM 2014ch00829 CHICAGO, INC., a Delaware Corporation, ) ) Defendants. AFFIDAVIT OF NICHOLAS C. CARULLO IN SUPPORT OF PLAINTIFFS’ MOTION FOR CLASS CERTIFICATION, FOR APPOINTMENT OF CLASS REPRESENTATIVES, AND FOR APPOINTMENT OF SUSMAN GODFREY LLP AS CLASS COUNSEL I, Nicholas C. Carullo, having the requisite personal knowledge, certify under the requirements of Section 1-109 of the Illinois Code of Civil Procedure as follows: 1. I submit this Affidavit in support of Plaintiffs’ Motion for Class Certification, for Appointment of Class Representatives, and for Appointment of Susman Godfrey LLP as Class Counsel. 2. I am an attorney at the law firm of Susman Godfrey LLP, counsel to Plaintiffs in the above-captioned action. 3. Attached as Exhibit 1 is an expert declaration of Jonathan I. Arnold, Ph.D., at 1. 4. Attached as Exhibit 2 is a true and correct copy of transcript excerpts of the deposition testimony of Robert Krewer, designated as a corporate representative of Defendant CME Group, Inc. -

Annual Report 2019

Davis Investment Group 875 Perimeter Dr. Moscow, ID Tel (208) 885-6478 www.uidaho.edu/cbe ANNUAL REPORT FY 2019 The Davis Student Investment Management Group presents its annual performance review for the calendar year 2019. The Davis fund achieved a return of 22.59% compared to the 31.49% return of our benchmark, the S&P 500. As the business cycle continues to expand, the defensive‐oriented Davis fund took on a more conservative stance. This report provides a qualitative and quantitative review and discussion of the Davis fund for 2019. We welcome any questions, comments, or suggestions regarding this report, or anything related to the Davis fund and its members. DAVIS GROUP Contents Performance Report 2 Economic Review 3 The Davis Group 4 Portfolio Returns 5 Portfolio Snapshot 6 Portfolio Holdings 7 Energy Analyst: Reilly Dahlquist 8 Industrials Analyst: Konner DeLeon 9 Technology Analyst: Sebastian Houk 10 Consumer Staples Analyst: Gladys Hernandez 11 Healthcare Analyst: Tyler Simonson 12 Utilities Analyst: Ryan Zimmerman 13 Basic Materials Analyst: Joseph Brueher 14 Consumer Discretionary Analyst: McKenzie Kennedy 15 Financials/Real Estate Analyst: Michael Sodeke 16 International Markets Analyst: Shudan He 17 Fixed Income/Other Analyst: Roshawn Walters 18 The 2019 Davis Group Members 19 References 22 Contact Information 23 1 Performance Report A LETTER FROM THE PORTFOLIO MANAGER After a rough end to 2018 that brought market returns down to negative growth, the stock market experienced a significant rebound in 2019, a year that saw stable and consistent growth throughout the majority of the year. Our portfolio’s benchmark, the S&P 500 Total Index Return, experienced returns of 31.49%, while our more conservative portfolio returned 22.59% in 2019. -

WINTRUST CREDIT ACADEMY Develop the Skills You Need to Build a Career in Commercial Banking

WINTRUST CREDIT ACADEMY Develop the skills you need to build a career in commercial banking. wintrust.com Wintrust’s rotational credit analyst training program, Wintrust Credit Academy, offers the opportunity to build a career in commercial banking. During the two- year rotational training program, individuals will gain exposure to a variety of functions in the commercial banking field through classroom training and rotational job assignments. Through in-classroom training, analysts will learn about the organization and our products, services, clients, and business practices. During this portion of the program, individuals will be introduced to the fundamentals of credit analysis, our underwriting framework, and various other subjects, including loan documentation, risk assessment, and concise financial writing. Credit analysts are responsible for conducting financial analysis and risk assessment of potential borrowers, preparing credit memoranda to be presented to senior management, and monitoring credit risk within various loan portfolios. The rotational component of the program includes rotations in areas such as commercial and industrial, commercial real estate, wealth services, asset-based lending, and treasury management. PRIMARY RESPONSIBILITIES After successful completion of the program, highly You will work alongside relationship managers, business development managers, motivated analysts will have the opportunity to move portfolio managers, and others in your office to develop a deep understanding into a professional role in commercial banking or credit of the operating performance and potential borrowing needs of prospective at one of the many Wintrust locations. Wintrust Credit clients. You will also assist relationship managers with ongoing support of Academy provides a solid foundation for developing a existing clients. Your responsibilities may include: successful career as a commercial banker. -

Filed by Intercontinentalexchange, Inc. Pursuant to Rule 425 Under The

Filed by IntercontinentalExchange, Inc. Pursuant to Rule 425 under the Securities Act of 1933, as amended, and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934, as amended Subject Company: CBOT Holdings, Inc. (Commission File No. 001- 32650) Legend: Transcript — Callstreet Transcript of Meeting with CBOT Holdings, Inc. Shareholders on May 31, 2007 Johnathan Short, Senior Vice President and General Counsel Good afternoon and welcome. I’m Johnathan Short, Senior Vice President and General Counsel of IntercontinentalExchange, and on behalf of the company, we would like to welcome you here today. Before we get started with the main program, I have a brief legal statement that I need to read about management’s presentation here today, the details of which can be found on pages 2 through 3 in the slide materials that will be available after the program. Please be aware that management’s comments here today may contain forward-looking statements. These statements represent our best judgment and are subject to various risks, assumptions and uncertainties as outlined in the company’s filings with the Securities Exchange Commission. Actual results may differ from those that are expressed in any forward-looking statement. And with that I would like to introduce Jeff Sprecher, the Chairman and Chief Executive Officer of IntercontinentalExchange. Jeffrey Sprecher, Chairman And Chief Executive Officer Well, great. Good afternoon. I would like to thank you all for joining us here to discuss our proposal to merge with the Chicago Board of Trade. We are quite honored to be here and we appreciate your interest in learning more about ICE and our proposal that we submitted to your Board of Directors on March 15th. -

JPMORGAN TRUST II Form NPORT-P Filed 2021

SECURITIES AND EXCHANGE COMMISSION FORM NPORT-P Filing Date: 2021-05-26 | Period of Report: 2021-03-31 SEC Accession No. 0001752724-21-111489 (HTML Version on secdatabase.com) FILER JPMORGAN TRUST II Mailing Address Business Address 277 PARK AVENUE 277 PARK AVENUE CIK:763852| IRS No.: 000000000 | State of Incorp.:DE NEW YORK NY 10172 NEW YORK NY 10172 Type: NPORT-P | Act: 40 | File No.: 811-04236 | Film No.: 21962894 800-480-4111 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document JPMorgan Small Cap Value Fund SCHEDULE OF PORTFOLIO INVESTMENTS AS OF MARCH 31, 2021 (Unaudited) Investments Shares (000) Value ($000) COMMON STOCKS 96.7% Aerospace & Defense 1.1% AAR Corp. * 107 4,473 Astronics Corp. * 208 3,754 Maxar Technologies, Inc. 109 4,111 Moog, Inc., Class A 33 2,711 Triumph Group, Inc. * 45 831 15,880 Air Freight & Logistics 0.5% Echo Global Logistics, Inc. * 223 6,995 Hub Group, Inc., Class A * 6 404 7,399 Airlines 1.1% Allegiant Travel Co. * 19 4,710 Hawaiian Holdings, Inc. * 108 2,891 SkyWest, Inc. * 156 8,499 16,100 Auto Components 1.6% Adient plc * 122 5,392 American Axle & Manufacturing Holdings, Inc. * 48 461 Cooper Tire & Rubber Co. 47 2,653 Dana, Inc. 226 5,495 Gentherm, Inc. * 69 5,084 Goodyear Tire & Rubber Co. (The) * 245 4,306 23,391 Banks 15.6% 1st Source Corp. 59 2,783 American National Bankshares, Inc. 3 109 Atlantic Capital Bancshares, Inc. * 41 998 Atlantic Union Bankshares Corp. -

March 31, 2021

Units Cost Market Value US Equity Index Fund US Equities 95.82% Domestic Common Stocks 10X GENOMICS INC 126 10,868 24,673 1LIFE HEALTHCARE INC 145 6,151 4,794 2U INC 101 5,298 4,209 3D SYSTEMS CORP 230 5,461 9,193 3M CO 1,076 182,991 213,726 8X8 INC 156 2,204 4,331 A O SMITH CORP 401 17,703 28,896 A10 NETWORKS INC 58 350 653 AAON INC 82 3,107 5,132 AARON'S CO INC/THE 43 636 1,376 ABBOTT LABORATORIES 3,285 156,764 380,830 ABBVIE INC 3,463 250,453 390,072 ABERCROMBIE & FITCH CO 88 2,520 4,086 ABIOMED INC 81 6,829 25,281 ABM INDUSTRIES INC 90 2,579 3,992 ACACIA RESEARCH CORP 105 1,779 710 ACADIA HEALTHCARE CO INC 158 8,583 9,915 ACADIA PHARMACEUTICALS INC 194 6,132 4,732 ACADIA REALTY TRUST 47 1,418 1,032 ACCELERATE DIAGNOSTICS INC 80 1,788 645 ACCELERON PHARMA INC 70 2,571 8,784 ACCO BRANDS CORP 187 1,685 1,614 ACCURAY INC 64 483 289 ACI WORLDWIDE INC 166 3,338 6,165 ACTIVISION BLIZZARD INC 1,394 52,457 133,043 ACUITY BRANDS INC 77 13,124 14,401 ACUSHNET HOLDINGS CORP 130 2,487 6,422 ADAPTHEALTH CORP 394 14,628 10,800 ADAPTIVE BIOTECHNOLOGIES CORP 245 11,342 10,011 ADOBE INC 891 82,407 521,805 ADT INC 117 716 1,262 ADTALEM GLOBAL EDUCATION INC 99 4,475 3,528 ADTRAN INC 102 2,202 2,106 ADVANCE AUTO PARTS INC 36 6,442 7,385 ADVANCED DRAINAGE SYSTEMS INC 116 3,153 13,522 ADVANCED ENERGY INDUSTRIES INC 64 1,704 7,213 ADVANCED MICRO DEVICES INC 2,228 43,435 209,276 ADVERUM BIOTECHNOLOGIES INC 439 8,321 1,537 AECOM 283 12,113 17,920 AERIE PHARMACEUTICALS INC 78 2,709 1,249 AERSALE CORP 2,551 30,599 31,785 AES CORP/THE 1,294 17,534 33,735 AFFILIATED -

First Midwest Bancorp, Inc. Announces Change to Virtual 2020 Annual Meeting of Stockholders

FOR IMMEDIATE RELEASE FIRST MIDWEST BANCORP, INC. ANNOUNCES CHANGE TO VIRTUAL 2020 ANNUAL MEETING OF STOCKHOLDERS CHICAGO, IL, May 7, 2020 – First Midwest Bancorp, Inc. (the “Company” or “First Midwest”) today announced that its 2020 Annual Meeting of Stockholders will be held in a virtual meeting format to protect the health, safety and well-being of its stockholders and colleagues during the coronavirus (COVID-19) pandemic, and taking into account related governmental directives and guidance. As such, stockholders will not be able to attend the annual meeting in person. The annual meeting will continue to be held, as previously announced, on Wednesday, May 20, 2020, at 9:00 a.m. Central time. Stockholders of record as of the close of business on March 27, 2020, the record date for the annual meeting, may attend the meeting at www.meetingcenter.io/253702787 (meeting password: FMBI2020) by logging in and entering the control number found on the proxy card previously distributed. Once admitted to the annual meeting, stockholders should follow the instructions on the website. Additional information regarding participation at the annual meeting will be available at www.firstmidwest.com/investorrelations and in the Company’s supplement to its proxy statement filed with the Securities and Exchange Commission. The Company encourages stockholders to vote their shares via the Internet, by telephone or by mail, as described in the proxy statement and on the proxy card sent to stockholders, even if they plan to attend the annual meeting virtually. By voting in advance, shares will be counted as present and voted at the annual meeting even if the stockholder decides later not to attend the meeting. -

CCB 2021 0322.Pdf

INDEMAND JOBS: Here are the 10 hottest well-paying careers in Illinois. PAGE 12 CONVENTIONS: What Chicago must do to win them back. PAGE 3 CHICAGOBUSINESS.COM | MARCH 22, 2021 | $3.50 MANUFACTURING As the ‘engine Socially conscious investing gains currency as investors seek to improve sustainability of the economy’ and bene t the social good while still making money. PAGE 15 heats up again, tech advances are accelerating ahead of a lagging labor FACTORIES FORWARD force. PAGE 15 FACTORIES FORWARD FIND THE COMPLETE SERIES ONLINE ChicagoBusiness.com/CrainsForum ZAC OSGOOD ZAC How Chicago became Herd immunity: the Silicon Valley of pot Kayvan Khalatbari, a cannabis A moving target Early obstacles helped consultant from Denver who turn local marijuana advised Cresco on its original li- Threshold for stopping COVID is higher in some areas cense application. companies into giants In the six years since Illinois BY STEPHANIE GOLDBERG issued its rst licenses to grow MINDING THE GAP: Why so many health care workers are BY JOHN PLETZ and sell marijuana for medical As COVID-19 inoculations use, GTI, Cresco, Verano and accelerate, a weary public waits still unvaccinated. PAGE 3 Call Chicago the capital of Big privately held PharmaCann have anxiously for vaccines to reach 70 Weed. emerged as industry giants, win- BOEHM R. JOHN percent of the population, a level tration in areas that have been e city is home to three of the ning or acquiring licenses across Cresco CEO Charlie Bachtell widely associated with “herd im- hit harder during the pandemic. ve biggest public companies in the country as legalization took munity.” In other words, vaccinating any the United States that grow and o . -

NASDAQ Stock Market

Nasdaq Stock Market Friday, December 28, 2018 Name Symbol Close 1st Constitution Bancorp FCCY 19.75 1st Source SRCE 40.25 2U TWOU 48.31 21st Century Fox Cl A FOXA 47.97 21st Century Fox Cl B FOX 47.62 21Vianet Group ADR VNET 8.63 51job ADR JOBS 61.7 111 ADR YI 6.05 360 Finance ADR QFIN 15.74 1347 Property Insurance Holdings PIH 4.05 1-800-FLOWERS.COM Cl A FLWS 11.92 AAON AAON 34.85 Abiomed ABMD 318.17 Acacia Communications ACIA 37.69 Acacia Research - Acacia ACTG 3 Technologies Acadia Healthcare ACHC 25.56 ACADIA Pharmaceuticals ACAD 15.65 Acceleron Pharma XLRN 44.13 Access National ANCX 21.31 Accuray ARAY 3.45 AcelRx Pharmaceuticals ACRX 2.34 Aceto ACET 0.82 Achaogen AKAO 1.31 Achillion Pharmaceuticals ACHN 1.48 AC Immune ACIU 9.78 ACI Worldwide ACIW 27.25 Aclaris Therapeutics ACRS 7.31 ACM Research Cl A ACMR 10.47 Acorda Therapeutics ACOR 14.98 Activision Blizzard ATVI 46.8 Adamas Pharmaceuticals ADMS 8.45 Adaptimmune Therapeutics ADR ADAP 5.15 Addus HomeCare ADUS 67.27 ADDvantage Technologies Group AEY 1.43 Adobe ADBE 223.13 Adtran ADTN 10.82 Aduro Biotech ADRO 2.65 Advanced Emissions Solutions ADES 10.07 Advanced Energy Industries AEIS 42.71 Advanced Micro Devices AMD 17.82 Advaxis ADXS 0.19 Adverum Biotechnologies ADVM 3.2 Aegion AEGN 16.24 Aeglea BioTherapeutics AGLE 7.67 Aemetis AMTX 0.57 Aerie Pharmaceuticals AERI 35.52 AeroVironment AVAV 67.57 Aevi Genomic Medicine GNMX 0.67 Affimed AFMD 3.11 Agile Therapeutics AGRX 0.61 Agilysys AGYS 14.59 Agios Pharmaceuticals AGIO 45.3 AGNC Investment AGNC 17.73 AgroFresh Solutions AGFS 3.85