BOK Financial Corporation 2021 Proxy Statement

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

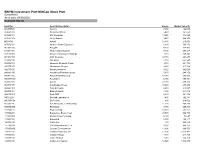

March 31, 2021

Units Cost Market Value US Equity Index Fund US Equities 95.82% Domestic Common Stocks 10X GENOMICS INC 126 10,868 24,673 1LIFE HEALTHCARE INC 145 6,151 4,794 2U INC 101 5,298 4,209 3D SYSTEMS CORP 230 5,461 9,193 3M CO 1,076 182,991 213,726 8X8 INC 156 2,204 4,331 A O SMITH CORP 401 17,703 28,896 A10 NETWORKS INC 58 350 653 AAON INC 82 3,107 5,132 AARON'S CO INC/THE 43 636 1,376 ABBOTT LABORATORIES 3,285 156,764 380,830 ABBVIE INC 3,463 250,453 390,072 ABERCROMBIE & FITCH CO 88 2,520 4,086 ABIOMED INC 81 6,829 25,281 ABM INDUSTRIES INC 90 2,579 3,992 ACACIA RESEARCH CORP 105 1,779 710 ACADIA HEALTHCARE CO INC 158 8,583 9,915 ACADIA PHARMACEUTICALS INC 194 6,132 4,732 ACADIA REALTY TRUST 47 1,418 1,032 ACCELERATE DIAGNOSTICS INC 80 1,788 645 ACCELERON PHARMA INC 70 2,571 8,784 ACCO BRANDS CORP 187 1,685 1,614 ACCURAY INC 64 483 289 ACI WORLDWIDE INC 166 3,338 6,165 ACTIVISION BLIZZARD INC 1,394 52,457 133,043 ACUITY BRANDS INC 77 13,124 14,401 ACUSHNET HOLDINGS CORP 130 2,487 6,422 ADAPTHEALTH CORP 394 14,628 10,800 ADAPTIVE BIOTECHNOLOGIES CORP 245 11,342 10,011 ADOBE INC 891 82,407 521,805 ADT INC 117 716 1,262 ADTALEM GLOBAL EDUCATION INC 99 4,475 3,528 ADTRAN INC 102 2,202 2,106 ADVANCE AUTO PARTS INC 36 6,442 7,385 ADVANCED DRAINAGE SYSTEMS INC 116 3,153 13,522 ADVANCED ENERGY INDUSTRIES INC 64 1,704 7,213 ADVANCED MICRO DEVICES INC 2,228 43,435 209,276 ADVERUM BIOTECHNOLOGIES INC 439 8,321 1,537 AECOM 283 12,113 17,920 AERIE PHARMACEUTICALS INC 78 2,709 1,249 AERSALE CORP 2,551 30,599 31,785 AES CORP/THE 1,294 17,534 33,735 AFFILIATED -

NASDAQ Stock Market

Nasdaq Stock Market Friday, December 28, 2018 Name Symbol Close 1st Constitution Bancorp FCCY 19.75 1st Source SRCE 40.25 2U TWOU 48.31 21st Century Fox Cl A FOXA 47.97 21st Century Fox Cl B FOX 47.62 21Vianet Group ADR VNET 8.63 51job ADR JOBS 61.7 111 ADR YI 6.05 360 Finance ADR QFIN 15.74 1347 Property Insurance Holdings PIH 4.05 1-800-FLOWERS.COM Cl A FLWS 11.92 AAON AAON 34.85 Abiomed ABMD 318.17 Acacia Communications ACIA 37.69 Acacia Research - Acacia ACTG 3 Technologies Acadia Healthcare ACHC 25.56 ACADIA Pharmaceuticals ACAD 15.65 Acceleron Pharma XLRN 44.13 Access National ANCX 21.31 Accuray ARAY 3.45 AcelRx Pharmaceuticals ACRX 2.34 Aceto ACET 0.82 Achaogen AKAO 1.31 Achillion Pharmaceuticals ACHN 1.48 AC Immune ACIU 9.78 ACI Worldwide ACIW 27.25 Aclaris Therapeutics ACRS 7.31 ACM Research Cl A ACMR 10.47 Acorda Therapeutics ACOR 14.98 Activision Blizzard ATVI 46.8 Adamas Pharmaceuticals ADMS 8.45 Adaptimmune Therapeutics ADR ADAP 5.15 Addus HomeCare ADUS 67.27 ADDvantage Technologies Group AEY 1.43 Adobe ADBE 223.13 Adtran ADTN 10.82 Aduro Biotech ADRO 2.65 Advanced Emissions Solutions ADES 10.07 Advanced Energy Industries AEIS 42.71 Advanced Micro Devices AMD 17.82 Advaxis ADXS 0.19 Adverum Biotechnologies ADVM 3.2 Aegion AEGN 16.24 Aeglea BioTherapeutics AGLE 7.67 Aemetis AMTX 0.57 Aerie Pharmaceuticals AERI 35.52 AeroVironment AVAV 67.57 Aevi Genomic Medicine GNMX 0.67 Affimed AFMD 3.11 Agile Therapeutics AGRX 0.61 Agilysys AGYS 14.59 Agios Pharmaceuticals AGIO 45.3 AGNC Investment AGNC 17.73 AgroFresh Solutions AGFS 3.85 -

Announcement February 22, 2019

Announcement February 22, 2019 Indxx USA Regional Banking Index will be reconstituted after the close of trading hours on February 28, 2019. Listed below are the constituents that will be added to the existing index: S.No ISIN Company Name 1 US5116561003 Lakeland Financial Corporation 2 US42234Q1022 Heartland Financial USA, Inc. 3 US3369011032 1st Source Corporation 4 US89214P1093 TowneBank 5 US4461501045 Huntington Bancshares Incorporated 6 US1637311028 Chemical Financial Corporation 7 US2298991090 Cullen/Frost Bankers, Inc. 8 US1176651099 Bryn Mawr Bank Corporation 9 US72346Q1040 Pinnacle Financial Partners, Inc. 10 US90539J1097 Union Bankshares Corporation 11 US81768T1088 ServisFirst Bancshares Inc 12 US06652K1034 BankUnited, Inc. 13 US6952631033 PacWest Bancorp 14 US9897011071 Zions Bancorporation, N.A. 15 US05945F1030 BancFirst Corporation 16 US15201P1093 CenterState Bank Corporation Listed below are the constituents that will be deleted from the existing index: S.No ISIN Company Name 1 US03076K1088 Ameris Bancorp 2 US05561Q2012 BOK Financial Corporation 3 US1011191053 Boston Private Financial Holdings, Inc. 4 US1547604090 Central Pacific Financial Corp. 5 US1972361026 Columbia Banking System, Inc. 6 US2937121059 Enterprise Financial Services Corp 7 US3198291078 First Commonwealth Financial Corporation 8 US3202091092 First Financial Bancorp. 9 US3205171057 First Horizon National Corporation 10 US52471Y1064 LegacyTexas Financial Group, Inc. 11 US7838591011 S&T Bancorp, Inc. 12 US8404411097 South State Corporation 13 US84470P1093 Southside Bancshares, Inc. 14 US9027881088 UMB Financial Corporation 15 US9197941076 Valley National Bancorp Listed below are the new index constituents that will be effective at the close of trading hours on February 28, 2019. Weights as of S.No ISIN Company Name Feb 21, 2019 1 US1491501045 Cathay General Bancorp 2.00% 2 US8984021027 Trustmark Corporation 2.00% 3 US4590441030 International Bancshares Corporation 2.00% 4 US1266001056 CVB Financial Corp. -

Closed Merged and Renamed Bank Holding Company of Oklahoma 11

Closed Merged and Renamed Bank Holding Company Of Oklahoma 11-30-2004 Ada First Ada Bancshares Inc. Merged into Vision Bancshares Inc., Ada 02-10-1972 Ada Tommie Maines, C.C. Collier, Closed J. M. Carter 11-06-1999 Ada Oklahoma State Bancorporation Merged into First United Bank and Trust Company, Durant 12-28-1998 Adair Commerce Bancshares Relocated to Catoosa 09-30-1994 Alex First Alex Bancshares, Inc. Merged into First Independence Bancorp, Chickasha 05-01-2003 Allen Allen Bancshares Merged into Farmers State Bank, Allen 06-16-1997 Altus Altus NBC Corp Changed name to NBC Corp of Oklahoma, Oklahoma City 07-31-2009 Altus FSB Bancorporation Closed 03-18-2004 Altus NBC Corp of Oklahoma, OKC Relocated to Oklahoma City. 09-01-1994 Anadarko Anadarko Bancshares, Inc. Merged into Falcon Bancorp. Inc., Anadarko 08-01-2015 Anadarko Falcon Bancorp. Inc. On this day, deregistered as a bank holding company, as a result of the merger of its bank (Anadarko Bank & Trust Co).into Bank of Commerce, Duncan. 01-30-1989 Antlers First Antlers Closed 09-30-1992 Apache First Apache Bancshares, Inc. Merged into First Bank of Apache, Apache. See bank entry to find out what happen to this institution. 06-30-1992 Ardmore Exchange Financial Corporation Merged into Security Corporation, Duncan which on 10-01-1998 merged into BancFirst Corporation, Oklahoma City. 06-30-1992 Ardmore Exchange National Corporation Merged into Security Corporation, Duncan which on 10-01-1998 merged 11/13/2020 Page 1 of 29 Closed Merged and Renamed Bank Holding Company Of Oklahoma into BancFirst Corporation, Oklahoma City. -

Q2 2016 SOCIAL RESPONSIBILITY REPORT What If...? We Hear the Question Again and Again

We see power in possibility. Q2 2016 SOCIAL RESPONSIBILITY REPORT What if...? We hear the question again and again. We’re answering that question by acting. By doing. By getting involved. By engaging our communities to ensure they thrive. That’s the power behind possibility. As we commemorate our 150th Anniversary in 2016, we are reminded that serving our communities is a privilege we never take for granted. Through the generations, Huntington colleagues have formed strong bonds with Imagine. our community partners. From our founder, P.W. Huntington in 1866, to the thousands of Huntington colleagues across the Midwest today, playing an active role in supporting our communities has become part of a legacy that we will continue to foster. AROUND THE MIDWEST WEST VIRGINA 150th Partnership with Habitat for Humanity NW OHIO $250,000 “Huntington’s support and to Habitat for Humanity International generosity will greatly improve housing conditions.” $150,000 – Sue Henderson, vice president, U.S. Operations Habitat for Humanity International to Habitat for Humanity Mid-Ohio MICHIGAN Habitat for Humanity receives $400,000 boost What better way to celebrate 150 years of community E.J. Thomas, president and CEO of Habitat for Humanity- engagement than to support home improvements for 150 MidOhio, says, “We are very pleased to be able to partner families throughout the Midwest? with Huntington on their 150th anniversary. Huntington’s stepping up to champion our efforts helps set the tone for That is exactly what Huntington did when it donated the good work we intend to accomplish through private $250,000 to Habitat for Humanity International and sector collaboration.” $150,000 to Habitat for Humanity-MidOhio this past April. -

SCHEDULE of INVESTMENTS MID-CAP 1.5X STRATEGY FUND

SCHEDULE OF INVESTMENTS December 31, 2020 MID-CAP 1.5x STRATEGY FUND SHARES VALUE SHARES VALUE COMMON STOCKS† - 39.5% United Bankshares, Inc. 118 $ 3,823 Kinsale Capital Group, Inc. 19 3,802 FINANCIAL - 9.3% Highwoods Properties, Inc. REIT 95 3,765 Medical Properties Trust, Inc. REIT 489 $ 10,655 RLI Corp. 36 3,749 Brown & Brown, Inc. 215 10,193 Park Hotels & Resorts, Inc. REIT 215 3,687 Camden Property Trust REIT 89 8,893 Selective Insurance Group, Inc. 55 3,684 CyrusOne, Inc. REIT 110 8,047 Rayonier, Inc. REIT 125 3,673 Alleghany Corp. 13 7,848 Healthcare Realty Trust, Inc. REIT 124 3,670 RenaissanceRe Holdings Ltd. 46 7,628 Valley National Bancorp 369 3,598 Omega Healthcare Investors, Inc. REIT 207 7,518 Webster Financial Corp. 82 3,456 STORE Capital Corp. REIT 216 7,340 Bank OZK 110 3,440 Reinsurance Group of Physicians Realty Trust REIT 190 3,382 America, Inc. — Class A 62 7,186 PROG Holdings, Inc. 62 3,340 Eaton Vance Corp. 104 7,065 Hudson Pacific Properties, Inc. REIT 139 3,339 Jones Lang LaSalle, Inc.* 47 6,973 Sabra Health Care REIT, Inc. 189 3,283 Signature Bank 49 6,629 Alliance Data Systems Corp. 44 3,260 Lamar Advertising Co. — Class A REIT 79 6,574 Wintrust Financial Corp. 53 3,238 East West Bancorp, Inc. 129 6,541 CIT Group, Inc. 90 3,231 National Retail Properties, Inc. REIT 159 6,506 JBG SMITH Properties REIT 102 3,190 First Horizon National Corp. 507 6,469 Sterling Bancorp 177 3,183 SEI Investments Co. -

TARP Capital Purchase Program Recipients

TARP Capital Purchase Program Recipients Date Name of Institution City State Investment Type Investment 2/6/2009 Alaska Pacific Bancshares, Inc. Juneau AK Preferred Stock w/Warrants 4,781,000 Alaska Total: 1 12/19/2008 BancTrust Financial Group, Inc. Mobile AL Preferred Stock w/Warrants $50,000,000 11/14/2008 Regions Financial Corp. Birmingham AL Preferred Stock w/Warrants $3,500,000,000 12/5/2008 Superior Bancorp Inc. Birmingham AL Preferred Stock w/Warrants $69,000,000 12/23/2008 United Bancorporation of Alabama, Inc. Atmore AL Preferred Stock w/ Warrants $10,300,000 Alabama Total: 4 12/12/2008 Bank of the Ozarks, Inc. Little Rock AR Preferred Stock w/Warrants $75,000,000 1/16/2009 Home Bancshares, Inc. Conway AR Preferred Stock w/ Warrants 50,000,000 2/ 1/23/2009 Liberty Bancshares, Inc. Jonesboro AR Preferred Stock w/ Exercised Warrants 57,500,000 2/ 1/30/2009 Rogers Bancshares, Inc. Little Rock AR Preferred Stock w/ Exercised Warrants 25,000,000 3/ 1/16/2009 Southern Bancorp, Inc. Arkadelphia AR Preferred Stock 11,000,000 Arkansas Total: 5 2/ 1/30/2009 Goldwater Bank, N.A. Scottsdale AZ Preferred Stock w/ Exercised Warrants 2,568,000 Arizona Total: 1 11/14/2008 Bank of Commerce Holdings Redding CA Preferred Stock w/Warrants $17,000,000 12/5/2008 Bank of Marin Bancorp Novato CA Preferred Stock w/Warrants $28,000,000 2/ 1/30/2009 Beach Business Bank Manhattan Beach CA Preferred Stock w/ Exercised Warrants 6,000,000 12/23/2008 Bridge Capital Holdings San Jose CA Preferred Stock w/ Warrants $23,864,000 11/14/2008 Broadway Financial Corporation -

BNYM Investment Port:Midcap Stock Port (Unaudited) As of Date: 09/30/2020 Common Stocks

BNYM Investment Port:MidCap Stock Port (Unaudited) As of date: 09/30/2020 Common Stocks Identifier Security Description Shares Market Value ($) 002535300 Aaron's 7,450 422,043 00404A109 Acadia Healthcare 5,480 161,550 004498101 ACI Worldwide 13,250 346,223 00508Y102 Acuity Brands 9,470 969,255 BD845X2 Adient 12,480 216,278 00737L103 Adtalem Global Education 6,800 166,872 00766T100 AECOM 4,170 174,473 018581108 Alliance Data Systems 7,130 299,317 01973R101 Allison Transmission Holdings 7,110 249,845 00164V103 AMC Networks 10,710 264,644 023436108 Amedisys 2,760 652,547 025932104 American Financial Group 3,310 221,704 03073E105 AmerisourceBergen 2,220 215,162 042735100 Arrow Electronics 5,620 442,069 04280A100 Arrowhead Pharmaceuticals 5,670 244,150 045487105 Associated Banc-Corp 47,940 605,003 05329W102 Autonation 6,980 369,451 05368V106 Avient 23,030 609,374 053774105 Avis Budget Group 10,600 278,992 05464C101 Axon Enterprise 2,410 218,587 062540109 Bank of Hawaii 4,830 244,012 06417N103 Bank OZK 6,630 141,352 090572207 Bio-Rad Laboratories 1,480 762,881 09073M104 Bio-Techne 880 218,002 05550J101 BJs Wholesale Club Holdings 11,270 468,269 09227Q100 Blackbaud 3,750 209,363 103304101 Boyd Gaming 18,350 563,162 105368203 Brandywine Realty Trust 93,500 966,790 11120U105 Brixmor Property Group 6,300 73,647 117043109 Brunswick 8,150 480,117 12685J105 Cable One 300 565,629 127190304 CACI International, Cl. A 3,980 848,377 12769G100 Caesars Entertainment 11,890 666,553 133131102 Camden Property Trust 11,390 1,013,482 134429109 Campbell Soup 4,440 -

Employee Handbook Subject: Huntington Bancshares Retirement Plan Approved By: Effective Date: Reviewed: Corporate January 1, 1954 January 19, 2016 Employee Benefits

Employee Handbook Subject: Huntington Bancshares Retirement Plan Approved By: Effective Date: Reviewed: Corporate January 1, 1954 January 19, 2016 Employee Benefits The information that follows, along with the information contained in the General Information Section, is the Summary Plan Description for the Huntington Bancshares Retirement Plan. HUNTINGTON BANCSHARES RETIREMENT PLAN Huntington originally established this retirement program as of January 1, 1954. You are eligible to participate in the Huntington Bancshares Retirement Plan (the “Plan”) if you were hired on or before December 31, 2009. Colleagues hired on or after January 1, 2010, are not eligible to participate in the Plan. Benefits under the Plan are “frozen” as of December 31, 2013, meaning that no additional pension benefits will accrue after this date. Any benefit you have accrued up to and including December 31, 2013 will remain in the Plan and be payable as described in this Summary Plan Description. However, you will accrue no new benefits after this date. Quick Reference Guide Feature Description When You Become Eligible If you were hired on or before December 31, 2009, you became a participant on the January 1 or July 1 following the date you completed one year of service from your date of hire or reached age 21, whichever occurred later. If you were hired on or after January 1, 2010, you are not eligible to participate in the Plan. Cost Huntington pays the entire cost of the Plan. You do not contribute. How Your Benefit Your retirement benefit from the Plan is based on a formula that takes Is Determined your pay and service with Huntington into account up through the effective date of the benefit accrual freeze under the Plan on December 31, 2013. -

2014 Annual Report Huntington Bancshares Incorporated Is a $66 Billion Asset Regional Bank Holding Company Headquartered in Columbus, Ohio

2014 Annual Report Huntington Bancshares Incorporated is a $66 billion asset regional bank holding company headquartered in Columbus, Ohio. The Huntington National Bank, founded in 1866, and its affiliates provide full-service commercial, small business, and consumer banking services; mortgage banking services; treasury management and foreign exchange services; equipment leasing; wealth and investment management services; trust services; brokerage services; customized insurance brokerage and service programs; and other financial products and services. The principal markets for these services are Huntington’s six-state retail banking franchise: Ohio, Michigan, Pennsylvania, Indiana, West Virginia, and Kentucky. The primary distribution channels include a banking network of more than 700 traditional branches and convenience branches located in grocery stores and retirement centers, and through an array of alternative distribution channels including internet and mobile banking, telephone banking, and more than 1,500 ATMs. Through automotive dealership relationships within its six-state retail banking franchise area and selected other Midwest and Northeast states, Huntington also provides commercial banking services to the automotive dealers and retail automobile financing for dealer customers. CONSOLIDATED FINANCIAL HIGHLIGHTS Change Change (In millions, except per share amounts) 2014 2013 Amount Percent NET INCOME $ 632.4 $ 641.3 $ (8.9) (1)% PER COMMON SHARE AMOUNTS Net income per common share – diluted .......................................... $ 0.72 $ 0.72 $ — — % Cash dividend declared per common share ........................................ 0.21 0.19 0.02 11 Tangible book value per common share(1) ......................................... 6.62 6.26 0.36 6 PERFORMANCE RATIOS Return on average total assets .................................................. 1.01% 1.14% (0.13)% Return on average tangible common shareholders’ equity(2) .......................... -

COMMERCE BANCSHARES, INC. ANNUAL SHAREHOLDERS MEETING April 18, 2018

COMMERCE BANCSHARES, INC. ANNUAL SHAREHOLDERS MEETING April 18, 2018 David Kemper Chairman and Chief Executive Officer CAUTIONARY STATEMENT A number of statements we will be making in our presentation and in the accompanying slides are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, such as statements of the Corporation’s plans, goals, objectives, expectations, projections, estimates and intentions. These forward-looking statements involve significant risks and uncertainties and are subject to change based on various factors (some of which are beyond the Corporation’s control). Factors that could cause the Corporation’s actual results to differ materially from such forward-looking statements made herein or by management of the Corporation are set forth in the Corporation’s 2017 Report on Form 10-K and the Corporation’s Current Reports on Form 8-K. 2 2 ABOUT COMMERCE $24.8 153 BILLION IN YEARS IN BUSINESS BANCSHARES ASSETS 46TH $20.4 6 LARGEST U.S. BANK BASED ON ASSET SIZE1 BILLION IN TOTAL DEPOSITS 4 9 5 5 1 2 4 1 6 3 2 $14.0 8 7 $6.0 BILLION IN TOTAL LOANS 3 BILLION MARKET CAPITALIZATION 34TH $7.9 LARGEST U.S. BANK BILLION IN COMMERCIAL BASED ON MARKET 1 CARD VOLUME 176 branches and 376 ATMs in our footprint CAPITALIZATION Extended Commercial Market Area Commercial Payments Services offered in 48 states 12.46% Nine key markets RETURN ON AVERAGE St. Louis Central Missouri Tulsa $48.7 ❖ Kansas City Central Illinois Oklahoma City BILLION IN COMMON EQUITY Springfield Wichita Denver TRUST ASSETS TH Commercial offices TH 5 20 Cincinnati Dallas Indianapolis LARGEST AMONG U.S. -

2018 ESG REPORT Table of Contents

Purpose Drives Performance 2018 ESG REPORT Table of Contents Executive Message .............................................................................................................................................................................2 About This Report .............................................................................................................................................................................................8 Our Approach to ESG .......................................................................................................................................................................................9 Awards and Recognitions ......................................................................................................................................................................... 13 2018 ESG Highlights ....................................................................................................................................................................................14 ECONOMIC ............................................................................................................................ 15 Company Overview and Financial Impact .......................................................................................................................................16 CUSTOMER FOCUS AND IMPACT People First, Technology Enabled .......................................................................................................................................................