Operating Income of ¥24.1 Billion – Decline in Both Revenue and Earnings

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Notes for Chapter Re-Drafts

Making Markets for Japanese Cinema: A Study of Distribution Practices for Japanese Films on DVD in the UK from 2008 to 2010 Jonathan Wroot PhD Thesis Submitted to the University of East Anglia For the qualification of PhD in Film Studies 2013 1 Making Markets for Japanese Cinema: A Study of Distribution Practices for Japanese Films on DVD in the UK from 2008 to 2010 2 Acknowledgements Thanks needed to be expressed to a number of people over the last three years – and I apologise if I forget anyone here. First of all, thank you to Rayna Denison and Keith Johnston for agreeing to oversee this research – which required reining in my enthusiasm as much as attempting to tease it out of me and turn it into coherent writing. Thanks to Mark Jancovich, who helped me get started with the PhD at UEA. A big thank you also to Andrew Kirkham and Adam Torel for doing what they do at 4Digital Asia, Third Window, and their other ventures – if they did not do it, this thesis would not exist. Also, a big thank you to my numerous other friends and family – whose support was invaluable, despite the distance between most of them and Norwich. And finally, the biggest thank you of all goes to Christina, for constantly being there with her support and encouragement. 3 Abstract The thesis will examine how DVD distribution can affect Japanese film dissemination in the UK. The media discourse concerning 4Digital Asia and Third Window proposes that this is the principal factor influencing their films’ presence in the UK from 2008 to 2010. -

Movie Museum JANUARY 2012 COMING ATTRACTIONS

Movie Museum JANUARY 2012 COMING ATTRACTIONS THURSDAY FRIDAY SATURDAY SUNDAY MONDAY 2 Hawaii Premieres! WATERBOYS PENGUINS IN THE SKY– CRADLE SONG 2 Hawaii Premieres! LATE BLOOMERS (2001-Japan) ASAHIYAMA ZOO aka Canción de cuna NOT WITHOUT YOU (2006-Switzerland) in Japanese with English (2008-Japan) (1994-Spain) aka Bu Neng Mei You Ni in Swiss German with English subtitles & in widescreen in Japanese with English in Spanish with English (2009-Taiwan) subtitles & in widescreen with Satoshi Tsumabuki, subtitles & in widescreen subtitles & in widescreen in Hakka/Mandarin w/English with Stephanie Glaser. Hiroshi Tamaki, Akifumi with Toshiyuki Nishida, 12:00 & 7:30pm only subtitles & in widescreen 12:00, 3:15 & 6:30pm only Miura, Naoto Takenaka, Yasuhi Nakamura, Ai Maeda, ---------------------------------- 12:00, 3:15 & 6:30pm only ---------------------------------- Koen Kondo, Kaori Manabe. Keiko Horiuchi, Zen Kajihara. I KNOW WHERE I'M ---------------------------------- NOT WITHOUT YOU GOING! (1945-British) LATE BLOOMERS aka Bu Neng Mei You Ni Directed and Co-written by Directed by with Wendy Hiller, Roger (2006-Switzerland) (2009-Taiwan) Shinobu Yaguchi. Masahiko Tsugawa. Livesey, Finlay Currie. in Swiss German with English in Hakka/Mandarin w/English Directed by Michael Powell subtitles & in widescreen subtitles & in widescreen 12:00, 1:45, 3:30, 5:15, 12:30, 2:30, 4:30, 6:30 and Emeric Pressburger. with Stephanie Glaser. 1:30, 4:45 & 8:00pm only 2:00, 3:45 & 5:30pm only 5 7:00 & 8:45pm 6 & 8:30pm 7 8 1:45, 5:00 & 8:15pm only 9 2 Hawaii Premieres! Martin Luther King Jr. Day Hawaii Premiere! Hawaii Premiere! MONEYBALL DISPATCH MONSIEUR BATIGNOLE THE LAST LIONS 2 Hawaii Premieres! (2011) THE FIRST GRADER (2011) (2002-France) in widescreen (2011-US/Botswana) in widescreen in French/German w/English in widescreen (2010-UK/US/Kenya) with Michael Bershad. -

JAPAN CUTS: Festival of New Japanese Film Announces Full Slate of NY Premieres

Media Contacts: Emma Myers, [email protected], 917-499-3339 Shannon Jowett, [email protected], 212-715-1205 Asako Sugiyama, [email protected], 212-715-1249 JAPAN CUTS: Festival of New Japanese Film Announces Full Slate of NY Premieres Dynamic 10th Edition Bursting with Nearly 30 Features, Over 20 Shorts, Special Sections, Industry Panel and Unprecedented Number of Special Guests July 14-24, 2016, at Japan Society "No other film showcase on Earth can compete with its culture-specific authority—or the quality of its titles." –Time Out New York “[A] cinematic cornucopia.” "Interest clearly lies with the idiosyncratic, the eccentric, the experimental and the weird, a taste that Japan rewards as richly as any country, even the United States." –The New York Times “JAPAN CUTS stands apart from film festivals that pander to contemporary trends, encouraging attendees to revisit the past through an eclectic slate of both new and repertory titles.” –The Village Voice New York, NY — JAPAN CUTS, North America’s largest festival of new Japanese film, returns for its 10th anniversary edition July 14-24, offering eleven days of impossible-to- see-anywhere-else screenings of the best new movies made in and around Japan, with special guest filmmakers and stars, post-screening Q&As, parties, giveaways and much more. This year’s expansive and eclectic slate of never before seen in NYC titles boasts 29 features (1 World Premiere, 1 International, 14 North American, 2 U.S., 6 New York, 1 NYC, and 1 Special Sneak Preview), 21 shorts (4 International Premieres, 9 North American, 1 U.S., 1 East Coast, 6 New York, plus a World Premiere of approximately 12 works produced in our Animation Film Workshop), and over 20 special guests—the most in the festival’s history. -

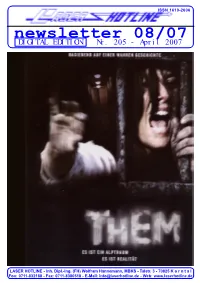

Newsletter 08/07 DIGITAL EDITION Nr

ISSN 1610-2606 ISSN 1610-2606 newsletter 08/07 DIGITAL EDITION Nr. 205 - April 2007 Michael J. Fox Christopher Lloyd LASER HOTLINE - Inh. Dipl.-Ing. (FH) Wolfram Hannemann, MBKS - Talstr. 3 - 70825 K o r n t a l Fon: 0711-832188 - Fax: 0711-8380518 - E-Mail: [email protected] - Web: www.laserhotline.de Newsletter 08/07 (Nr. 205) April 2007 editorial Gefühlvoll, aber nie kitschig: Susanne Biers Hallo Laserdisc- und DVD-Fans, da wieder ganz schön viel zusammen- Familiendrama über Lügen und Geheimnisse, liebe Filmfreunde! gekommen. An Nachschub für Ihr schmerzhafte Enthüllungen und tiefgreifenden Kaum ist Ostern vorbei, überraschen Entscheidungen ist ein Meisterwerk an Heimkino fehlt es also ganz bestimmt Inszenierung und Darstellung. wir Sie mit einer weiteren Ausgabe nicht. Unsere ganz persönlichen Favo- unseres Newsletters. Eigentlich woll- riten bei den deutschen Veröffentli- Schon lange hat sich der dänische Film von ten wir unseren Bradford-Bericht in chungen: THEM (offensichtlich jetzt Übervater Lars von Trier und „Dogma“ genau dieser Ausgabe präsentieren, emanzipiert, seine Nachfolger probieren andere doch im korrekten 1:2.35-Bildformat) Wege, ohne das Gelernte über Bord zu werfen. doch das Bilderbuchwetter zu Ostern und BUBBA HO-TEP. Zwei Titel, die Geblieben ist vor allem die Stärke des hat uns einen Strich durch die Rech- in keiner Sammlung fehlen sollten und Geschichtenerzählens, der Blick hinter die nung gemacht. Und wir haben es ge- bestimmt ein interessantes Double- Fassade, die Lust an der Brüchigkeit von nossen! Gerne haben wir die Tastatur Beziehungen. Denn nichts scheint den Dänen Feature für Ihren nächsten Heimkino- verdächtiger als Harmonie und Glück oder eine gegen Rucksack und Wanderschuhe abend abgeben würden. -

October 3-22, 2020

THE BEST OF CONTEMPORARY JAPANESE CINEMA VIRTUAL EDITION and present OCTOBER 3-22, 2020 HATANAKA FAMILY FOUNDATION JAPANESE CANADIAN CULTURAL CENTRE • 6 GARAMOND COURT • TORONTO • 416.441.2345 ABOUT THE TORONTO JAPANESE FILM FESTIVAL “I think what makes the Toronto Japanese Film Festival so special is the wonderful job it does in capturing the current state of the Japanese film industry. The programming conveys a sense of what is really happening in the world of Japanese cinema. By including popular films we can get a better understanding of the country. These choices ensure Toronto audiences can experience a true sense of contemporary Japan.” Takashi Yamazaki (Director, Always: Sunset on 3rd Street, The Eternal Zero, The Man Called Pirate) “The Toronto Japanese Film Festival is quickly becoming the most important window of Japanese cinema toward the world. The selection is impeccable with the dynamic of a true international film festival. My salute to all Canadians and congratulations! This is some place we, the Japanese film-makers, can look for the future of Japanese cinema.” Masato Harada (Director: Sekigahara, Kakekomi, The Emperor in August, Chronicle of My Mother) Now in its ninth year, the Toronto Japanese Film Festival has grown into one of the largest cinema events of its kind in the world, showcasing the finest Japanese films that have been recognized for excellence by Japanese audiences and critics, international film festival audiences and the Japanese Film Academy. Programming addresses popular genres such as historical (samurai) jidaigeki, contemporary dramas, comedies and action, literary adaptations, children’s, art-house and anime films. All films shown are North American, Canadian, or Toronto premieres. -

7Th Sakura Gala Toronto Japanese Film Festival

第7回桜ガラ 7TH SAKURA GALA トロント日本映画祭 TORONTO JAPANESE FILM FESTIVAL May 2015 2015年5月 Vol.41 Issue 5 1 2014 -15 JCCC Board of Directors In This Issue... President Gary Kawaguchi Past President/Advisor Marty Kobayashi VP, Heritage Jan Nobuto 2 JCCC Events VP, Management Ann Ashley Secretary Sharon Marubashi Treasurer Chris Reid 4 Toronto Japanese Film Festival Directors Ken Fukushima Anzu Hara 日 Chris Hope 7-8 Heritage & Sedai News Warren Kawaguchi Karen Kuwahara 系 Lorene Nagata 9 Gala News Christine Nakamura Cary Rothbart 13 Donations Ross Saito 文 Nao Seko Tak Yoshida 15-16 Moriyama Nikkei Heritage Centre Inscriptions 化 Advisors Mackenzie Clugston (Ambassador of Canada to Japan) 17-20 日本語紙面 Sid Ikeda Miki Kobayashi 会 Mickey Matsubayashi Steve Oikawa Connie Sugiyama 館 JCCC Foundation Chair Shari Hosaki Calendar of Events 役 JCCC Staff James Heron 員 May Executive Director Sat 2 Bazaar [email protected] 416-441-2345 ext.224 Sun 10 Kumihimo Workshop Kathy Tazumi 及 Mon 18 JCCC closed -Victoria Day Accounting/General Administration Manager Thu 21 Movie Night - Kanzaburo [email protected] 416-441-2345 ext.229 Sat 23 Karate Tournament Christine Takasaki び Sat 23 Karaoke Club Community Events Coordinator [email protected] 416-441-2345 ext.221 Mon 25 Manju Workshop Wed 27 Origami Workshop Haruko Ishihara ス Community Rentals Coordinator Sat 30 Sakura Gala [email protected] 416-441-2345 ext.228 Christine Seki タ Corporate Rentals/Programming and Business Development June [email protected] 416-441-2345 ext.231 Thu 11 Toronto JFF opening Sally Kumagawa -

Toronto Japanese Film Festival 2016

1 5% discount for JCCC members For Experienced and Professional Real Estate Service... Call Anytime... Absolutely No Obligation DAVID IKEDA Sales Representative bonni maikawa 416-234-2424 www.ikedasells.com Sales Representative 416-538-6428 Sutton Group Old Mill Realty Inc., Brokerage [email protected]/www.bonnimaikawa.com Sutton Group Associates Realty Inc.,Brokerage 416-966-9300 Advertise with us! Contact [email protected] or 416-441-2345 ext. 227 2 2015 -16 JCCC Board of Directors In This Issue... President Gary Kawaguchi Past President/Advisor Marty Kobayashi VP, Heritage Jan Nobuto 4 Upcoming JCCC Events VP, Management Ann Ashley Secretary Sharon Marubashi Finance Chair Chris Hope 6-9 Torono Japanese Film Festival VP, NJCC Miki Rushton VP, Marketing/Strategic Planning Karen Kuwahara 日 Directors Jonathan Carter 10-11 Heritage News Mark Hashimoto Kristin Kobayashi 系 15-17 Donations Christine Nakamura Dereck Oikawa Chris Reid 18-22 日本語紙面 Cary Rothbart 文 Ross Saito Nao Seko Peter Wakayama 化 Bob Yamashita Tak Yoshida Calendar of Events Advisors Mackenzie Clugston 会 (Ambassador of Canada to Japan William Hatanaka Sid Ikeda 館 May Sat 7 JCCC Bazaar Miki Kobayashi (in memory) Mon 9 Movie Screening – I am a Monk Steve Oikawa Sat 14 JCCC Karaoke Club Connie Sugiyama 役 JCCC Foundation Chair Shari Hosaki Mon 16 Manju Workshop Wed 18 Tattoo Exhibit Opens JCCC Staff 員 Thurs 19 Tattoo Exhibit Opening Ceremony James Heron Executive Director Sat 21 JCCC Karaoke Club [email protected] 416-441-2345 ext.224 Mon 23 JCCC closed –Victoria Day 及 Kathy -

Japan Booth : Palais 01 - Booth 23.01 INTRODUCTION Japan Booth Is Organized by JETRO / UNIJAPAN with the Support from Agency for Cultural Affairs (Goverment of Japan)

JA P A N BOOTH 2 O 1 6 i n C A N N E S M a y 1 1 - 2 O, 2 O 1 6 Japan Booth : Palais 01 - Booth 23.01 INTRODUCTION Japan Booth is Organized by JETRO / UNIJAPAN with the support from Agency for Cultural Affairs (Goverment of Japan). JETRO, or the Japan External Trade Organization, is a government-related organization that works to promote mutual trade and investment between Japan and the rest of the world. Originally established in 1958 to promote Japanese exports abroad, JETRO’s core focus in the 21st century has shifted toward promoting foreign direct investment into Japan and helping small to medium-sized Japanese firms maximize their global business potential. UNIJAPAN is a non-profit organization established in 1957 by the Japanese film industry under the auspice of the Government of Japan for the purpose of promoting Japanese cinema abroad. Initially named “Association for the Diffusion of Japanese Film Abroad” (UniJapan Film), in 2005 it joined hands with the organizer of Tokyo International Film Festival (TIFF), to form a combined, new organization. CONTENTS 1 Asmik Ace, Inc. 2 augment5 Inc. 3 CREi Inc. 4 Digital Frontier, Inc. 5 Gold View Co., Ltd 6 Hakuhodo DY music & pictures Inc. (former SHOWGATE Inc.) 7 nondelaico 8 Open Sesame Co., Ltd. 9 POLYGONMAGIC Inc. 10 Production I.G 1 1 SDP, Inc. 12 STUDIO4˚C Co., Ltd. 13 STUDIO WAVE INC. 14 TOHOKUSHINSHA FILM CORPORATION 15 Tokyo New Cinema, Inc. 16 TSUBURAYA PRODUCTIONS CO., LTD. 17 Village INC. CATEGORY …Action …Drama …Comedy …Horror / Suspense …Documentary …Animation …Other SCREENING SCHEDULE Title Day / Starting Time / Length of the Film / Place Asmik Ace, Inc. -

PŘEHLED ASIJSKÉ KINEMATOGRAFIE PRO ROK 2011 My Way

PŘEHLED ASIJSKÉ KINEMATOGRAFIE PRO ROK 2011 My Way Režie: Kang Je-Gyu (Shiri, Taegukgi) Obsazení: Joe Odaigiri, Fan Bingbing, Jang Dong Gun Blind Režie:Ahn Sang-Hoon Obsazení: Kim Ha-Neul ,Yoo Seung-Ho Quick Režie: Jo Beom-Gu Obsazení: Lee Min-Ki Kang Hye-Won Kim In-Kwon War of the Arrows Režie: Kim Han-Min Obsazení: Park Hae-Il Ryoo Seung-Ryong Moon Chae-Won Kim Mu-Yeol Sector 7 Režie: Kim Ji Hun Obsazení: Ha Ji-Won Ahn Sung-Ki Oh Ji-Ho Lee Han-Wi Cha Ye-Ryeon Park Cheol-Min Song Sae-Byeok Park Jung-Hak Spellbound Režie: Hwang In-Ho Obsazení: Son Ye-Jin Lee Min-Ki Link Režie: Woody Han Obsazení: Ryu Deok-Hwan Kwak Ji-Min The Front Line Režie: Jang Hun (Secret Reunion, Rough Cut) Obsazení: Ko Soo Shin Ha-Kyun Kim Ok-Bin Ryoo Seung-Ryong Lee Je-Hoon Ko Chang-Seok Ryu Seung-Soo Lee Da-Wit Always Režie: Song Il-Gon (Spider Forest) Obsazení: So Ji-Sub Han Hyo-Joo Yun Jong-Hwa Kang Shin-Il Park Cheol-Min Jo Sung-Ha Jin Goo The Day He Arrives Režie: Hong Sang-Soo Obsazení: Yu Jun-Sang Song Seon-Mi Kim Bo-Kyung Kim Sang-Jung Baek Jong-Hak That‘s The Way! Režie: Hideaki Sato Obsazení: Horikita Maki Tadano Asanobu Tsuyoshi Abe Tae Kimura Ayumi Ishida Koichi Sato Bokuzo Masana Makoto Awane Hirofumi Arai Takeshi Yamamoto Andalucia: Revenge of the Goddess Režie: Hiroshi Nishitani Obsazení: Yuji Oda Meisa Kuroki Hideaki Ito Erika Toda Masaharu Fukuyama Shosuke Tanihara Takeshi Kaga Isao Natsuyagi Into the White Night Režie: Yoshihiro Fukagawa Obsazení: Maki Horikita Kengo Kora Eichiro Funakoshi Nobuo Kyo Yurie Midori Urara Awata Hara-Kiri: Death of -

Asian Extreme As Cult Cinema: the Transnational Appeal of Excess and Otherness Jessica Anne Hughes BA English and Film Studies

Asian Extreme as Cult Cinema: The Transnational Appeal of Excess and Otherness Jessica Anne Hughes BA English and Film Studies, Wilfrid Laurier University MA Film Studies, University of British Columbia A thesis submitted for the degree of Doctor of Philosophy at The University of Queensland in 2016 School of Communications and Arts Hughes 2 Abstract This thesis investigates the way Western audiences respond to portrayals of excess and otherness in Japanese Extreme cinema. It explores the way a recent (2006-2016) cycle of Japanese Splatter (J-Splatter) films, including The Machine Girl (Noboru Iguchi, 2008) and Tokyo Gore Police (Yoshihiro Nishimura, 2008), have been positioned as cult due to their over-the-top representations of violence and stereotypes of Japanese culture. Phenomenological research and personal interviews interrogate Western encounters with J-Splatter films at niche film festivals and on DVD and various online platforms through independent distributors. I argue that these films are marketed to particular Western cult audiences using vocabulary and images that highlight the exotic nature of globally recognised Japanese cultural symbols such as schoolgirls and geisha. This thesis analyses J-Splatter’s transnational, cosmopolitan appeal using an approach informed by the work of Ernest Mathijs and Jamie Sexton, Matt Hills, Henry Jenkins, and Iain Robert Smith, who read the relationship between Western audiences and international cult cinema as positive and meaningful cultural interactions, demonstrating a desire to engage in more global experiences. The chapters in this thesis use textual analysis of J-Splatter films and case studies of North American and Australian film festivals and distribution companies, which include interviews with festival directors and distributors, to analyse the nature of the appeal of J- Splatter to Western audiences. -

America's Largest Japanese Film Fest Announces 27 NYC Premieres For

Media Contacts: Shannon Jowett, [email protected], 212-715-1205 Kuniko Shiobara, [email protected], 212-715-1249 America’s Largest Japanese Film Fest Announces 27 NYC Premieres for 8th Installment JAPAN CUTS: The New York Festival of Contemporary Japanese Cinema July 10-20, 2014 at Japan Society New York, NY -- North America’s largest showcase of Japanese film and “One of the loopiest… and least predictable of New York’s film festivals” (New York Magazine), JAPAN CUTS: The New York Festival of Contemporary Japanese Cinema returns for its eighth annual installment. Running July 10-20 and screening 27 features with 8 special guests, JAPAN CUTS 2014 encompasses a thrilling cross section of cinephilic genre oddities, sword-swinging period action, profound documentaries, cathartic melodramas, warped comedies and cutting-edge arthouse cinema made in and around Japan. Guests include superstar performers and independent auteurs opening up in rare Q&As and dynamic parties rocking Japan Society’s historic theater and waterfall atrium. As in past years, the festival dovetails with the 13th New York Asian Film Festival (NYAFF), co-presenting 13 titles in the JAPAN CUTS lineup July 10-13. JAPAN CUTS 2014 again earns the distinction as “New York’s premiere Japanese cinema event,” every title never before screened in New York City, “unspooling across a kaleidoscopic range of taste and aesthetics” (The Wall Street Journal). Boasting 1 World Premiere, 3 International Premieres, 7 North American Premieres, 6 U.S. Premieres, 5 East Coast Premieres, and 4 New York Premieres, every day of the festival provides a must-see event for the NYC cinephile, follower of Japanese art and culture, and devoted world cinema aficionado alike. -

Entrevues Belfort 29E Festival Du Film Cinéma Pathé / 22–30 Novembre 2014 Entrevues Pub Truffaut Belford.Indd 1

6€ édition e 29 2014 festival international du film de belfort entrevues Belfort e 29 festival du film CinÉma PatHÉ / 22–30 novemBre 2014 www.festival-entrevues.Com entrevues pub_truffaut_belford.indd 1 François Truffaut lors de la promotion de Baisers volés, 1968, Pierre Zucca © Sylvie Quesemand-Zucca / Graphisme : Roland Lecouteux © Ciné-culture - La Cinémathèque française 27/10/2014 15:05:38 ENTREVUES BELFORT 29e FESTIVAL INTERNATIONAL DU FILM 22-30 NOVEMBRE 2014 3 ÉDITOS 8 JURYS 10 LA COMPÉTITION INTERNATIONALE lES LONGS MÉTRAGES 25 LA COMPÉTITION INTERNATIONALE lES COURTS & MOYENS MÉTRAGES 32 LA FABBRICA : TONY GATLIF 46 UN CERTAIN GENRE : JAPON, ESPRITS FRAPPEURS DOUBLE FEATURE KIYOSHI KUROSAWA 70 UN CERTAIN GENRE : JAPON, ESPRITS FRAPPEURS INTÉGRALE SATOSHI KON 80 LA TRANSVERSALE : lE VOYAGE DANS LE TEMPS 124 PREMIÈRES ÉPREUVES : EXPÉRIENCE SON 150 CINÉMA ET HISTOIRE : 14-18, KALÉIDOSCOPE 160 AVANT-PREMIÈRES 172 ENTREVUES JUNIOR 176 RENCONTRES PROFESSIONNELLES 178 FILMS EN COURS 195 INDEX DES FILMS 1 La force du cinéma est de nous apprendre que le temps n’est pas linéaire, mais bien plutôt subjectif. Au festival Entrevues, dédié au jeune cinéma d’auteur avec des compétitions internationales, mais aussi à l’histoire et au patrimoine cinéma- tographique, on est emporté dans un voyage dans le temps et dans les géographies imaginaires des cinéastes du monde entier. En cette année du Centenaire de la Première Guerre mondiale, le public prendra le temps de la réflexion distanciée sur cette période de l’histoire mondiale, à travers une sélection de films à l’intersection de l’art et de la discipline historique. Cette plongée dans notre passé offrira au public matière à revisiter, par des regards croisés entre la France, l’Italie, l’Allemagne, l’URSS et les Etats-Unis, notre mémoire collective.