Thucydides Trap Pamphlet

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Thucydides, Book 6. Edited by E.C. Marchant

^ Claasiral ^nits^ ( 10 THUCYDIDES BOOK VI THUCYDIDES BOOK VI EDITED BY E. C. MAECHANT, M.A. TRINITY COLLEGE, OXFORD ASSISTANT-MASTER IN ST. PAUL'S SCHOOL FELLOW AND LATE ASSISTANT-TUTOR OF PETEBHOUSE, CAMBRIDGE LATE PROFESSOR OF GREEK AND ANCIENT HISTORY IN QUEEN'S COLLEGE, \ LONDON fLontron MACMILLAN AND CO., Lt NEW YORK : THE MACMILLAN CO. 1897 ftd>c • FRIDERICO • GVLIELMO WALKER VI RO NVLLA EGENTI LAVDATIONE ET IVVBNTVTI FIDE ET LITERARVM STVDI08AE I CONTENTS PAQK Introduction— I. The Sicilian Expedition ix II. The MSS. and Text of the Sixth Book . iviii III. Some Graces xxx IV. Criticism of the Book in detail . xli Text 1 Notes US Appendix—On the Speech of Alcibiades, cc. 89-92 . 255 Index—Greek 259 English 294 INTRODUCTION I. Remarks on the Sicilian Expedition Intervention in —It is to § 1. Athenian Sicily. usual classify the states of antiquity according to the character of their government, and for Greek history down to the Peloponnesian War (431-404) this classification, derived from the teaching of Aristotle, is essential. But during the war the essential dis- tinction is not between oligarchy and democracy : it is much more between Ionian and Dorian. What is held to draw states into united action is the natural bond of common origin. In practice the artificial bond of common interest may prove as strong or stronger than the natural bond, and may lead to alliance between aliens or enmity between kinsmen. In order to understand the transactions between the independent states, we have to banish from our minds the elaborate rules that constitute modern Inter- national Law. -

Transcript of “The Greeks: Crucible of Civilization” Episode Three: “Empire of the Mind”

Transcript of “The Greeks: Crucible of Civilization” Episode Three: “Empire of the Mind” Transcript of PBS Video - The Greeks: Crucible of Civilization Part III: Empire of the Mind 0:00 – Episode Introduction Athens. The world’s first democracy. The most glorious city in ancient world, a city of wealth and power, center of a mighty naval empire. At the head of the state stood one man, a man who seemed to embody all of the Athenians’ achievements: Pericles. But Pericles now risked everything he and the Athenians had built in one great gamble, a war that he hoped would make Athens the undisputed ruler of the Mediterranean. This conflict would indeed transform Athens, but in a way that Pericles could never have imagined. It would make a common Athenian, Socrates, into the ruler of a new empire, an empire that remains the Greeks’ last great legacy, an empire of the mind A prison cell in the city of Athens. The year, 399 BC. Socrates, the world’s most famous philosopher, prepares for his execution. Around him lies a city ruined by war, a nation stripped of glory and empire, a people who have lost everything. Socrates is perhaps the one man who perhaps could have saved his fellow citizens from the greatest defeat in their history. Instead they have condemned him to death. How could the Athenians come to execute one of their most brilliant minds? How could they lose everything that had made them great? It is a tale that begins three decades before. 3:00 – Pericles’ Strategy for War with Sparta, 431 BC In the year 431 BC the city-state of Athens was the greatest power in the Mediterranean. -

An Island Too Far (The Athenian Expedition to Sicily, 415 B.C.)

An island too far (The Athenian expedition to Sicily, 415 B.C.) Prologue A bridge too far is the title of a book of the journalist and writer Cornelius Ryan(1920- 1974). It reports Allies’ failed attempt to enter Germany through the Netherlands during the WW II. The bridge mentioned in the title is Arnhem bridge, reached but not conquered by the allied paratroopers. This failure compromised the whole operation, coded as Market- Garden . But in English, A bridge too far has got also a different meaning. According to the Oxford Dictionary, it means “ A step or act that is regarded as being too drastic to take ” or “Something that is very difficult to achieve ”. And the act taken by the army and the navy of a Great Power many centuries before Market-Garden , in 415 B.C, is very similar to “ an act that is regarded as being too drastic to take ”. If Cornelius Ryan had lived in 415 B.C., he would have titled his own work, “ An island too far ”, alluding, from one side, to a real island, and, from the other side, to the gamble connected with the fact of bringing the war thousands kilometres far from the homeland. Sicily is that real island; Athens and the Athenians are those who made the gamble. Segesta’s lies. After the so-called “Peace of Nikias”( 421 B.C.) that ends the Peloponnesian War temporally, Athens, having its hands free, cultivates the idea of expanding westwards, towards Sicily. Some years before(427 B.C), Athens had tried to do it, but its intervention in favour of the town of Leontini ( today Lentini) had failed. -

Development of Ancient Athens Before Hellenistic Period

Center for Open Access in Science ▪ https://www.centerprode.com/ojsh.html Open Journal for Studies in History, 2019, 2(2), 27-34. ISSN (Online) 2620-066X ▪ https://doi.org/10.32591/coas.ojsh.0202.01027m _________________________________________________________________________ Development of Ancient Athens Before Hellenistic Period Juan Sergio Martinez Vazquez Autonomous University of Carmen, MEXICO Faculty of Educational Sciences, Campeche Received 1 October 2019 ▪ Revised 13 December 2019 ▪ Accepted 15 December 2019 Abstract This paper describes a brief overview of the history of ancient Athens, from the period of the first legislators to the Hellenistic period. One of the basic features that characterize this period is the continued presence of conflicts and hostilities between Athens and rival city-states, including those in present-day Greece, but also in Asia Minor and Southern Italy. Also, this period is followed by the continuing threatening and battles with the Persian Empire. It is a period of the history of Athens in which huge social development takes place, in all segments of social life. The various institutions of the state are established, and during this period, regardless of the presence of phases of tyranny as a form of government, the foundations of the democratic system, which exists in the modern world, are being created. Also, there has been an unprecedented period of development in history in the fields of philosophy, science, culture, art and social life in general. Keywords: ancient Athens, democracy, legislative, Golden age, Peloponnesian war. 1. Introduction In ancient times, Athens was ruled by kings, i.e. basileus (βασιλεύς). Their rule was first restricted and then abolished by eupatrids. -

To Develop a Knowledge and Understanding of Greek Literature from Different Genres (History, Drama, Philosophy, Lyric and Epic Poetry, Novel) Goal 2

CLAS 2220. Great Works of Ancient Literature I: Greece http://myweb.ecu.edu/stevensj/ Prof. John Stevens Ragsdale 133 Classical Studies, Dept. Foreign Languages & Literatures [email protected] Fall 2016 Office Hours: TTh 2-3, W 10-1 and by apt. (252) 328-6056 Foundations Goals: Goal 1. Subject Knowledge in the Discipline (Classics). To develop a knowledge and understanding of Greek Literature from different genres (history, drama, philosophy, lyric and epic poetry, novel) Goal 2. Research Methodology. To acquire the analytical skills necessary to interpret a work of classical literature as an organic whole and situate it in its cultural context, i.e., understand how literature reveals the problems and ideals of Greek civilization, and to develop a beginner's understanding of how texts interact with earlier models (intertextuality). Goal 3. Contribution to General Knowledge. To become familiar with the main events and literary culture of Greece (VIBC-IIIBC) that are relevant for application to the modern world. Writing Intensive (WI) CLAS 2220 is a writing intensive course in the Writing Across the Curriculum Program at East Carolina University. With committee approval, this course contributes to the twelve-hour WI requirement for students at ECU. Additional information is available at: http://www.ecu.edu/writing/wac/. WI goals: • Use writing to investigate complex, relevant topics and address significant questions through engagement with and effective use of credible sources; • Produce writing that reflects an awareness of context, purpose, and audience, particularly within the written genres (including genres that integrate writing with visuals, audio or other multi- modal components) of their major disciplines and/or career fields; • Demonstrate an understanding that writing as a process made more effective through drafts and revision; • Produce writing that is proofread and edited to avoid grammatical and mechanical errors; • Assess and explain the major choices made in the writing process. -

Apodexis Historia

0 Apodexis Historia An Aggregate Primary Source Account of Greek History Edited by E. Edward Garvin, 2013 The purpose of a sourcebook is to allow the subjects to speak their own history and to allow the student, the reader, to gain an understanding of Greek literary works through a selective sampling. The key word is ‘selective.’ Contained herein are passages excerpted from their contexts. Without exception, this very process produces a falsehood because both the narrative and meta-narrative are destroyed when the continuity of the composition is interrupted. Nevertheless, this seems the most expedient way to expose students to a wide range of primary source information. I have tried to keep my voice out of it as much as possible and will intervene as editor (in Times New Roman font) only to give background or exegesis to the text. All of the texts contained in frames and in Goudy Old Style font are excerpts from Greek or Latin texts (primary sources) that have been translated into English. These translations were published as print books but have since fallen into Public Domain - which means that the copyright has expired. As editor of this volume, I have copied, edited and partially retranslated these texts to bring the translations up to date. The title of this collection is adapted from the opening line of Herodotus' Histories: "The results of the research (histories) of Herodotus of Halicarnassus are herein presented for public display (apodexis)." The Greek apodexis means a 'display' or 'public presentation': The word historia, when Herodotus used it, referred to a process of rational pragmatic inquiry. -

Aristophanes and Euripides: a Palimpsestuous Relationship

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Kent Academic Repository University of Kent at Canterbury ARISTOPHANES AND EURIPIDES: A PALIMPSESTUOUS RELATIONSHIP Supervisors Dr. Anne Alwis Dr. Arthur Keaveney Professor Ray Laurence THESIS SUBMITTED FOR THE DEGREE OF Ph.D. GINA MAY Department of Classics & Archaeology 2012 τίς δὲ σύ κομψός τις ἔροιτο θεατής ὑπολεττολόγος γνωμιώκτης εὐριπιδαριστοφανίξων. Cratinus, fr. 342 i ABSTRACT The Palimpsest Aristophanes allows Euripides to interrupt constantly. In Athenian comedy of the fifth century they are on stage together, both literally and figuratively. Despite Aristophanes’ comedies having a meaning of their own, Euripides’ lines are so clearly visible underneath them that they can only be described as the verbal equivalent of a palimpsest. The Oxford English Dictionary defines a palimpsest as a manuscript or piece of writing on which later writing has superimposed or effaced earlier writing, or something reused or altered but still bearing visible traces of its earlier form.1 It is clear that a palimpsest is the product of layering that results in something as new, whilst still bearing traces of the original. Dillon describes the palimpsest as “...an involuted phenomenon where otherwise unrelated texts are involved and entangled, intricately interwoven, interrupting and inhabiting each other”. 2 Aristophanes takes texts, particularly those of Euripides, which may otherwise have been unrelated, and weaves them together to form something new. I will show that in a number of cases Aristophanes offers scenes that have already been performed in Euripides’ plays but lays his own plot over the tragedian’s, whilst at the same time drawing the audiences’ attention to the original. -

Re-Conceptualizing the Cult of Sava Zeus Mirko Uros Tasic, Webster

Re-conceptualizing the Cult of Sava Zeus Mirko Uros Tasic, Webster University, Thailand The Asian Conference on Ethics, Religion & Philosophy 2018 Official Conference Proceedings Abstract The Thracian-Phrygian cult of Sabazios is often identified with the cult of Dionysus and its mystic rituals. It appeared in ancient Greek art and literature in the early 5th century BC. A general audience became familiar with content and meaning of the cult of Sabazios/Dionysus through Euripides’ tragedy Bacchae. Both Dionysian and Saboi rituals were characterized by culmination of ecstatic trance which often included orgies, animal, and human sacrifice. There were few scholarly attempts that only partly explained connection of the two cults. The misunderstanding of the Sabazios cult, and the deity behind it, has been the result of faulty interpretation of non-Greek words coined into Greek notions. The article explores the meaning of the cult of Sabazios by drawing parallels between the expansion of the cult and the rise of Macedon during the Persian invasion of the Balkans. Additionally, it aims to illustrate and explain the mystery behind particular group of religious cults spread during that time, named Osiris-Dionysus. Keywords: Sabazios, Dionysus, Macedon, Heraclids, Euripides iafor The International Academic Forum www.iafor.org Introduction In ancient Greece the Dionysian festivals were at the same time the most popular and the most alluring, yet unfamiliar and distant to both ordinary and intellectual audiences. The Thracian-Phrygian cult of Sabazios has been seen as similar or even identical with the cult of Dionysus (Dodds, 1940). Together with the cult of Demeter and Persephone they were simply referred to as mysteries by ancient writers, who left only few descriptions lacking any substantial explanation. -

Thucydides' Account of the Athenian Empire in the Light of Contemporary Coinage

Loyola University Chicago Loyola eCommons Master's Theses Theses and Dissertations 1958 Thucydides' Account of the Athenian Empire in the Light of Contemporary Coinage J. A. Brinkman Loyola University Chicago Follow this and additional works at: https://ecommons.luc.edu/luc_theses Part of the Classical Literature and Philology Commons Recommended Citation Brinkman, J. A., "Thucydides' Account of the Athenian Empire in the Light of Contemporary Coinage " (1958). Master's Theses. 1366. https://ecommons.luc.edu/luc_theses/1366 This Thesis is brought to you for free and open access by the Theses and Dissertations at Loyola eCommons. It has been accepted for inclusion in Master's Theses by an authorized administrator of Loyola eCommons. For more information, please contact [email protected]. This work is licensed under a Creative Commons Attribution-Noncommercial-No Derivative Works 3.0 License. Copyright © 1958 J. A. Brinkman THUOYDIDES I ACO OUNT OF THE ATHENIAN EMPIRE IN THE LIGHT OF OONTEMPORARY OOINAGE by John Anthony Brinkman, S.J. A Thesis Submitted to the Faculty of the Graduate School of Loyola University in Partial Fulfillment of the Requirements for the Degree of Master of Arts June 1958 LIFE JOhn Anthon, Brlnkman was bor.n 1n Chlcago, IllInols, July 4, 1934. a. attended St. Margaret or Scotland Grammar SChool, Chicago, trom 1939 to 1947 and 8t. Ignat1us H1gh SChool, tne same c1ty, fro. 1947 to 1~$1. On September 2, 19$1, he entered the Soc1ety ot Jesua at MIlford. Ohio, and trom 19$1 to 19$$ studied the humanities at Mi1tord College, Xavier University. He was gradu ated trom Loyola Un1veraIty, Chicago, June, 1956, wIth the degree ot Bachelor or Arts. -

Oaths and Swearing in Ancient Greece Beiträge Zur Altertumskunde

Alan H. Sommerstein, Isabelle C. Torrance Oaths and Swearing in Ancient Greece Beiträge zur Altertumskunde Herausgegeben von Michael Erler, Dorothee Gall, Ludwig Koenen und Clemens Zintzen Band 307 Alan H. Sommerstein, Isabelle C. Torrance Oaths and Swearing in Ancient Greece With contributions by Andrew J. Bayliss, Judith Fletcher, Kyriaki Konstantinidou and Lynn A. Kozak ISBN 978-3-11-020059-1 e-ISBN 978-3-11-022736-9 ISSN 1616-0452 This work is licensed under the Creative Commons Attribution-NonCommercial-NoDerivs 3.0 License. For details go to http://creativecommons.org/licenses/by-nc-nd/3.0/. Library of Congress Cataloging-in-Publication Data A CIP catalog record for this book has been applied for at the Library of Congress. Bibliografische Information der Deutschen Nationalbibliothek Die Deutsche Nationalbibliothek verzeichnet diese Publikation in der Deutschen Nationalbibliografie; detaillierte bibliografische Daten sind im Internet über http://dnb.dnb.de abrufbar. © 2014 Walter de Gruyter GmbH, Berlin/Boston The book is published with open access at www.degruyter.com. Druck und Bindung: Hubert & Co. GmbH & Co. KG, Göttingen ∞ Gedruckt auf säurefreiem Papier Printed in Germany www.degruyter.com Preface This volume completes the publication of the project The Oath in Archaic and Classical Greece, based at the University of Nottingham and funded by the Lever- hulme Trust (award no. F.00 114/Z), whose assistance is warmly acknowledged. The main previous publications of the project have been the Nottingham Oath Database (Sommerstein, Bayliss and Torrance 2007) and Oath and State in Ancient Greece, edited by Sommerstein and Bayliss and referred to in this volume as S&B. -

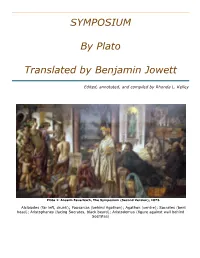

The Symposium (Second Version), 1873

SYMPOSIUM By Plato Translated by Benjamin Jowett Edited, annotated, and compiled by Rhonda L. Kelley Plate 1: Anselm Feuerbach, The Symposium (Second Version), 1873. Alcibiades (far left, drunk); Pausanias (behind Agathon); Agathon (centre); Socrates (bent head); Aristophanes (facing Socrates, black beard); Aristodemus (figure against wall behind Socrates) Table of Contents List of Plates ............................................................................................................ 2 Editorial note: .......................................................................................................... 2 PERSONS OF THE DIALOGUE: .................................................................................... 4 SCENE: The House of Agathon. 416 BC. ...................................................................... 4 Prologue .................................................................................................................. 4 Phaedrus ................................................................................................................. 9 Pausanias .............................................................................................................. 11 Eryximachus .......................................................................................................... 15 Aristophanes .......................................................................................................... 18 Agathon ............................................................................................................... -

Reflection on Skin

Reflection on Skin Machiel van Soest Machiel van Soest Leipzig 2011 Reflection on Skin 00:01 00:02 00:03 00:0400:05 00:06 00:07 00:08 00:09 00:10 00:11 00:12 00:13 00:14 00:15 00:16 00:17 00:18 00:19 00:20 00:21 00:22 00:23 00:24 00:25 00:26 00:27 00:28 00:29 00:30 00:31 00:32 00:33 00:34 00:35 00:36 00:37 00:38 00:39 00:40 00:41 00:42 00:43 00:44 00:45 00:46 00:47 00:48 00:49 00:50 00:51 00:52 00:53 00:54 00:55 00:56 00:57 00:58 00:59 01:00 01:01 01:02 01:03 01:04 01:05 01:06 01:07 01:08 01:09 01:10 01:11 01:12 01:13 01:14 01:15 01:16 01:17 01:18 01:19 01:20 01:21 01:22 01:23 01:24 01:25 01:26 01:27 01:28 01:29 01:30 01:31 01:32 01:33 01:34 01:35 01:36 01:37 01:38 01:39 01:40 01:41 01:42 01:43 01:44 01:45 01:46 01:47 01:48 01:49 01:50 01:51 01:52 01:53 01:54 01:55 01:56 01:57 01:58 01:59 02:00 02:01 02:02 02:03 02:04 02:05 02:06 02:07 02:08 02:09 02:10 02:11 02:12 02:13 02:14 02:15 02:16 02:17 02:18 02:19 02:20 02:21 02:22 02:23 02:24 1 02:25 02:26 02:27 02:28 02:29 02:30 02:31 02:32 02:33 02:34 02:35 02:36 02:37 02:38 02:39 02:40 02:41 02:42 02:43 02:44 02:45 02:46 02:47 02:48 02:49 02:50 02:51 02:52 02:53 02:54 02:55 02:56 02:57 02:58 02:59 03:00 03:01 03:02 03:03 03:04 03:05 03:06 03:07 03:08 03:09 03:10 03:11 03:12 03:13 03:14 03:15 03:16 03:17 03:18 03:19 03:20 03:21 03:22 03:23 03:24 03:25 03:26 03:27 03:28 03:29 03:30 03:31 03:32 03:33 03:34 03:35 03:36 03:37 03:38 03:39 03:40 03:41 03:42 03:43 03:44 03:45 03:46 03:47 03:48 03:49 03:50 03:51 03:52 03:53 03:54 03:55 03:56 03:57 03:58 03:59 04:00 04:01 04:02 04:03 04:04 04:05 04:06