For Immediate Release

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

NIKE, Inc. Sells Bauer Hockey Subsidiary to Kohlberg & Company

NIKE, Inc. Sells Bauer Hockey Subsidiary To Kohlberg & Company and W. Graeme Roustan for $200 Million BEAVERTON, Ore. (21 February, 2008) – NIKE, Inc. (NYSE:NKE) today announced that it has reached a definitive agreement to sell its Bauer Hockey subsidiary to an investor group led by Kohlberg & Company and Canadian businessman W. Graeme Roustan for $200 million in cash. Nike expects the transaction to be completed before the end of its current fiscal year. “We’re pleased to have reached an agreement for Bauer with strategic buyers who have a passion for hockey and are committed to continue to invest in Bauer’s long-term growth and brand leadership” said Nike, Inc. President and CEO Mark Parker. “Nike Bauer Hockey has been part of the Nike family for 12 years, and its team has done an incredible job. Selling this great hockey company was a tough decision but one that was in the best interests of Nike and Bauer as we each look to maximize our respective growth opportunities.” Bauer, hockey’s leading manufacturer, has delivered innovative products for over 80 years. Founded in 1927, Bauer developed the first skate with the blade attached to the boot, forever changing the game of hockey. Since then, Bauer has continued to develop the most sought after products in the industry, including the widely successful Supreme and Vapor lines of equipment. Bauer is set to once again raise the bar in innovation when it introduces the Supreme One95 skate and 9500 helmet this spring. “Throughout the entire sale process, we were committed to find the right partner to continue moving our business forward and we have definitely found that partner,” said Mark Duggan, CEO, Nike Bauer Hockey. -

Guía Profesional 2017 • 12€ Guía Profesional 2017 Profesional Guía

GUÍA PROFESIONAL 2017 • 12€ GUÍA PROFESIONAL 2017 PROFESIONAL GUÍA MAMADEDE F RFOM R OM RE RECYCCYCLELED D MAMADEDE F RFOM R OM RE RECYCCYCLELED D BEBEMAACHACHDE PLASTICF PLASTIC R OM RECYC LED BEBEACHACH PLASTIC PLASTIC BEACH PLASTIC O NEIO NEILL.COLL.COM/BM/BLUELUE O NEIO NEILL.COLL.COM/BM/BLUELUE O NEILL.CO M/BLUE GUÍA PROFesiOnal www.diffusionsport.com EDITA Peldaño 5 | 6 Direcciones de interés 5 Cadenas comerciales DIRECTOR DEL ÁREA 6 Grupos de compra DE DEPORTE Jordi Vilagut 7 Empresas [email protected] 69 Marcas colABORADOR José Mª Collazos índice de publicidad PUBLICIDAD Atmósfera Sport ........................................................................... 39 Pablo Prieto [email protected] Chiruca .............................................................................................. 43 Dare 2b ............................................................................................. 47 IMAGEN Y DISEÑO DS Multicanalidad ......................................................................... 63 Eneko Rojas DS Newsletter ............................................................................... 51 DS Suscripción ............................................................................... MAQUETACIÓN 68 Miguel Fariñas DS Web .............................................................................................. 59 Débora Martín FBO ...................................................................................................... 31 Verónica Gil Cristina Corchuelo Happy Dance ................................................................................. -

NIKE Inc. STRATEGIC AUDIT & CORPORATE

NIKE Inc. STRATEGIC AUDIT & CORPORATE A Paper Presented as a Final Requirement in STRAMA-18 -Strategic Management Prepared by: IGAMA, ERICA Q. LAPURGA, BIANCA CAMILLE M. PIMENTEL, YVAN YOULAZ A. Presented to: PROF. MARIO BRILLANTE WESLEY C. CABOTAGE, MBA Subject Professor TABLE OF CONTENTS Page No. I. Executive Summary ……………………………………………………………………...……1 II. Introduction …………………………………………………………………………...………1 III. Company Overview ………………………………………………………………………….2 A. Company Name and Logo, Head Office, Website …………………………...……………2 B. Company Vision, Mission and Values……………………………………………….…….2 C. Objectives …………………………………………………………………………………4 D. Organizational Structure …………………………………………………….…………….4 E. Corporate Governance ……………………………………………………………….……6 1. Board of Directors …………………………………………………………….………6 2. CEO ………………………………………………………………….………….……6 3. Ownership and Control ………………………………………………….……………6 F. Corporate Resources ………………………………………………………………...……9 1. Marketing ……………………………………………………………………….….…9 2. Finance ………………………………………………………………………………10 3. Research and Development ………………………………………………….………11 4. Operations and Logistics ……………………………………………………….……13 5. Human Resources ……………………………………………………...……………14 6. Information Technology ……………………………………………………….……14 IV. Industry Analysis and Competition ...……………………………...………………………15 A. Market Share Analysis ………………………………………………………...…………15 B. Competitors’ Analysis ………………………………………………………...…………16 V. Company Situation.………… ………………………………………………………….……19 A. Financial Performance ………………………………………………………………...…19 B. Comparative Analysis……………………… -

W & H Peacock Catalogue 23 Nov 2019

W & H Peacock Catalogue 23 Nov 2019 *2001 Garmin Vivoactive 3 Music GPS smartwatch *2038 Samsung Galaxy S5 16GB smartphone *2002 Fitbit Charge 2 activity tracker *2039 Song Xperia L3 32GB smartphone in box *2003 Fossil Q Wander DW2b smart watch *2040 Blackview A30 16GB smartphone in box *2004 Emporio Armani AR5866 gents wristwatch in box *2041 Alcatel 1 8GB smartphone in box *2005 Emporio Armani AR5860 gents wristwatch in box *2042 Archos Core 57S Ultra smartphone in box *2006 Police GT5DW8 gents wristwatch *2043 Nokia 5.1 smartphone in box *2007 Casio G-Shock GA-110c wristwatch *2044 Nokia 1 Plus smartphone in box *2008 2x USSR Sekonda stop watches *2045 CAT B25 rugged mobile phone *2009 Quantity of various loose and boxed wristwatches *2046 Nokia Asha 210 mobile phone *2010 2 empty watch boxes *2047 Easyphone 9 mobile phone *2011 iPad Air 2 64GB gold tablet *2048 Zanco Tiny T1 worlds smallest phone *2012 Lenovo 10" TB-X103F tablet in box *2049 Apple iPod Touch (5th Generation - A1421) *2013 Dell Latitude E7250 laptop (no battey, no RAM *2050 iPad Air 2 64GB A1566 tablet and no HDD) *2051 iPad 6th Gen A1893 32GB tablet *2014 Dell Lattitude E6440 laptop i5 processor, 8GB *2052 iPad Mini A1432 16GB tablet RAM, 500GB HDD, Windows 10 laptop with bag and no PSU *2053 Tesco Hudl HTFA4D tablet *2015 Dell Lattitude E4310 laptop, i5 processor, 4GB *2054 Microsoft Surface i5, 4GB RAM, 128GB SSD, RAM, 256GB HDD, Windows 10, No PSU Windows 10 tablet (a/f cracked screen) *2016 HP 250 G4 laptop with i3 processor, 4GB RAM, *2055 Qere QR12 Android tablet -

Indecision Apparent on City Income

HO AG- AND SJONS .BOOK BIDDERS 3 PAPERS 5PRINGPORT, MICH. 49284 Bond issue vitally affects elementary schools Forty members of a 110-member citizens committee used for blacktopping the play areas, providing fencing at all bond issue. School officials pointed out that higher-than- development, leaving little or nothing for 'landscaping and which worked on the 1966 school bond issue drive got a detailed schools and for seeding and landscaping. exppcted costs in the development of sewers (storm and finishing the lawn and play areas. look last week at the progress of the building program—and sanitary), street blacktop and curb and gutter and sidewalk, on The bus storage shelter would cost about $17,500, school why additional money is needed to finish it up. THE BALANCE OFTHE$250,000wouldbeusedfor several Sickles Street and the school sharing in the cost of renovation officials said. It would consist of two facing three-sided and The problem, school administrators pointed out, is that purposes, including site development at the high school, capital of a city sewer on Railroad Street has .already taken about covered shelters in which the school's 36-bus fleet would be building costs have run about $250,000 above what had been ized interest and bonding costs, contingenciesandabus storage $52,000 of the original $60,000. parked when not in use. The shelter buildings would be built anticipated in the original bond issue of $5.4 million; . shelter (which wasn't involved in the original bond issue). where the buses are presently parked.. The school board has scheduled a special election for The high school site development portion of the new bond If more money is notavailable,the $52,000will of necessity THE FURNITURE AND EQUIPMENT FOR the rural Nov. -

Adidas, Puma, Nike

The football marketing blog Subscribe to feed Home About Me My Football Lounge out there My blogroll IMAGE OF THE DAY adidas, Puma, Nike: a sport legacy September 15, 2010 in Sponsorship | Tags: Puma, adidas, Nike, Zidane, World Cup, Umbro, Major League Soccer, Usain Bolt, Herbert Hainer, LeBron James, Lance Armstrong, Tiger Woods, Michael Johnson, adidas-Salomon AG, Bill Bowerman, Hurley International, Converse, Ferrari, Phil Knight, Stella Mc Cartney, Reebok, Volvo Ocean race, September 21 day of peace Hi everyone, This sport chronological trilogy has triggered a massive traffic Anelka sent a message to and I thank every single one of you for stopping by. Today, the FFF the last chapter is called “adidas, Puma, Nike: a sport legacy”. These brands are fully established sports brands and have inspired other brands to tap into the sport industry. They left CATEGORIES a legacy or heritage not only to themselves but to other brands that have now models to get inspiration from. From 2010 FIFA World Cup (41) 1996 until today, adidas, Puma and Nike have grown significantly with fantastic 2018-2022 World Cup bid (9) athletes by their sides. Champions League (8) Clubs (12) Here we go: Do you know football? (3) General (9) adidas, Puma, Nike: a sport legacy Players (6) Sponsorship (29) 1996 - adidas outfits 33 nations & 600 participants during the Atlanta Olympic Games. Adidas supplies products for 21 of the 26 sports AND the official Karl Lusbec matchball and equips the referees and linesmen at UEFA European Championships. The German team wins fully outfitted with adidas. - adidas signs an exclusive sponsorship deal with the MLS - Nike signs Tiger Woods soon after he gives up his amateur golf status. -

IGP Park Council Ieyes Demolition of Old Landmark

Home 01 t,"e New, All the News of All the Pointes Every Thursday Morning rosse Pointe' ews Complete News Coverage of All the Pointes Vol. 3o-No. 24 thEnt~red ~sfsecond Class Matler at $5.00Per Year 28 P~ges-Two Sections-Section One, ___________ .:....-=e~..:.os:.:t~.f_I_Ce_.t __ D_ctr_O_It_,_M_lch_lg_all. GROSSE POINTE, MICHIGAN, Thursday, June 12, 1969 lllePerCOpy , j @ -- IIEADLINt:S Products of Teer:"1age Talent Put on Display 'Lead Field of the IGP Park Council Of Four for WEEK School Board As Compiled by the IEyes Demolition Grosse Pointe News Candidates Backed by Citizens for Education Thursday, June 5 Of Old Landmark Victorious as 5,690 A SERIES OF BLASTS sec. Cast Ballots onds apart, rjpped through a Authorizes Solicitation of Bids to Raze McMillan' gunpowder storage area Wed. Residence in Three Mile Drive Park Unless Alfred R. Glancy, Jr. and nesday at E. I. duPont de Ne- William J. Adams led a mours and Company explosives Practical Use is Found field of four candidates to works in Carneys Point, N,J. The Park council on Monday, June 9, authorized win. two four-year terms At least three persons were killed and dozens injured. Four City Manag~rRobert Slone to solicit bids for the pos- on.the Grosse Pointe Board other employes who worked in sible razing of the McMillanmansion, except .the garage of Education in the school the storage area were reported or carriage house, on the seven.acre property, now a district's trusteeship elec- missing and at least 56 persons part of the Three Mile Drive Park. -

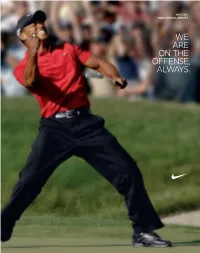

We Are on the Offense Always

NIKE, INC. 2008 ANNUAL REPORT WE ARE ON THE OFFENSE, ALWAYS. .)+%'/,&,/'/ &).!, NIKE BASKETBALL NIKE WOMEN’S TRAINING NIKE SPORTSWEAR NIKE MEN’S TRAINING NIKE FOOTBALL NIKE RUNNING I’m very pleased with how we have enhanced the position, performance, To Our Shareholders, and potential of all the When I stepped into the CEO role 2½ years ago, the leadership team reaffirmed a simple concept that I knew was true from my nearly brands and categories in 30 years of experience here – NIKE is a growth company. That fact shaped the long-term financial goals we outlined more than seven the NIKE, Inc. family. years ago. It also inspired our goal of reaching $23 billion in revenue by the end of fiscal 2011. Fiscal 2008 illustrated the power of that financial model, the strength of our team, and the ability of NIKE to bring innovative products and excitement to the marketplace. Our unique role as the innovator and leader in our industry enables us to drive consistent, long-term profitable growth. In 2008 we added $2.3 billion of incremental revenue to reach $18.6 billion – up 14 percent year over year with growth in every region and every business unit. Gross margins improved more than a percentage point to a record high of 45%, and earnings per share grew 28 percent. We increased our return on invested capital by 250 basis points1, increased dividends by 23%, and bought back $1.2 billion in stock. 2008 was a very good year. As we enter fiscal 2009 we are well-positioned for the future. -

Greenpeace Dirty Laundry Report

Dirty Laundry Unravelling the corporate connections to toxic water pollution in China image Wastewater being discharged from a pipe from the Youngor textiles factory, in Yinzhou district, Ningbo. Youngor is a major apparel and textiles brand in China. Contents Executive Summary 4 For more information contact: [email protected] Section 1 Introduction: Water crisis, toxic pollution 10 Acknowledgements: and the textile industry We would like to thank the following people who contributed to the creation of this report. If we have forgotten anyone, Section 2 Polluters and their customers – the chain of evidence 32 they know that that our gratitude is also extended to them: Case Study 1: Youngor Textile Complex, Yangtze River Delta 36 Jamie Choi, Madeleine Cobbing, Case Study 2: Well Dyeing Factory, Pearl River Delta 46 Tommy Crawford, Steve Erwood, Marietta Harjono, Martin Hojsík, Zhang Kai, Li Yifang, Tony Sadownichick, Section 3 The need for corporate responsibility 54 Melissa Shinn, Daniel Simons, Ilze Smit, Ma Tianjie, Diana Guio Torres, Vivien Yau, Yue Yihua, Zheng Yu, Lai Yun, Lei Yuting Section 4 Championing a toxic-free future: Prospects 72 Designed by: and recommendations Atomo Design Cover photograph: Appendix 1 81 Pipe on the north side of the 1) Main brands that have a business relationship Youngor factory has finished with Youngor Textile Complex dumping wastewater. The black 2) Main brands that have a business relationship with polluted discharge is clearly visible Well Dyeing Factory Limited © Greenpeace / Qiu Bo 3) The global market shares of sportwear companies JN 372 Appendix 2 92 Profiles of other brands linked with Youngor Textile Complex Published by Appendix 3 96 Greenpeace International Background information on the hazardous Ottho Heldringstraat 5 chemicals found in the sampling 1066 AZ Amsterdam The Netherlands References 102 greenpeace.org Note to the reader Throughout this report we refer to the terms ‘Global North’ and ‘Global South’ to describe two distinct groups of countries. -

Vegan Guide to Leather Alternatives

Vegan Guide to Leather Alternatives From The Vegetarian Resource Group fibers, or recycled rubber when possible? On the other hand it can be argued that by using leather and fur n many occasions, after turning down a hotdog alternatives we can show others a way of wearing or hamburger at a barbecue and explaining that clothes with the look they like that doesn’t require the you’re vegetarian, the next question you might exploitation of animals for it. be asked (if wearing leather-like Birkenstocks) is, O or this update we have been able to add a vegan “Then why are you wearing leather?” You’ll answer that the sandals are made from synthetic materials source for Play Station Portable cases. We also that look like leather, and this usually pacifies the Fdiscovered cd player and disc carrying cases. inquisitors. They do ask a valid question though. If When choosing a non-leather company, one you are choosing a vegetarian diet for ethical reasons, should also consider the company’s reasons for “How can you stop eating animals, but continue to carrying non-leather goods. Although we are pleased wear them?” Like a vegetarian diet, people often choose that more and more companies offer non-leather to “quit leather” at different stages. items, most large manufacturers and retailers who Since cowhide is the most common animal hide carry both leather and non-leather offer the non- used, links to the meat industry are undeniable. Accord- leather goods primarily for economic reasons. It is ing to the Leather Industries of America, the leather cheaper to manufacture non-leather goods, and as a industry’s trade association, very few animals are raised result they often cost less. -

NOTE 18 Operating Segments and Related Information

PART II Note 18 Operating Segments and Related Information counterparty, to post collateral should the fair value of outstanding derivatives of derivative instruments with credit risk related contingent features that are per counterparty be greater than $50 million. Additionally, a certain level of in a net liability position at May 31, 2011 was $160 million. The Company, or decline in credit rating of either the Company or the counterparty could trigger any counterparty, were not required to post any collateral as a result of these collateral requirements. As of May 31, 2011, the Company was in compliance contingent features. As a result of the above considerations, the Company with all such credit risk related contingent features. The aggregate fair value considers the impact of the risk of counterparty default to be immaterial. NOTE 18 Operating Segments and Related Information Operating Segments Effective June 1, 2009, the primary fi nancial measure used by the Company to evaluate performance of individual operating segments is Earnings Before The Company’s operating segments are evidence of the structure of the Interest and Taxes (commonly referred to as “EBIT”) which represents net income Company’s internal organization. The major segments are defi ned by geographic before interest expense (income), net and income taxes in the consolidated regions for operations participating in NIKE Brand sales activity excluding statements of income. Reconciling items for EBIT represent corporate expense NIKE Golf. Each NIKE Brand geographic segment operates predominantly in one items that are not allocated to the operating segments for management industry: the design, development, marketing and selling of athletic footwear, reporting. -

Definiring Van De Sportindustrie

2e Licentiaat Academiejaar 2005-2006 De productieketen van de sportindustrie: Een analyse van de sportgoederenbedrijven Eindverhandeling voorgedragen door Mario Van Dyck tot het behalen van het diploma van licentiaat in de handelswetenschappen o.l.v. Prof. Dr. Trudo Dejonghe Voor Sofie 2e Licentiaat Academiejaar 2005-2006 De productieketen van de sportindustrie: Een analyse van de sportgoederenbedrijven Eindverhandeling voorgedragen door Mario Van Dyck tot het behalen van het diploma van licentiaat in de handelswetenschappen o.l.v. Prof. Dr. Trudo Dejonghe De productieketen van de sportindustrie: Een analyse van de sportgoederenbedrijven Abstract Sinds haar ontstaan staat de sportindustrie gelijk aan big business. De pioniers onder de sportgoederenproducenten pasten reeds aan het einde van de 19e eeuw diverse marketingtechnieken toe om hun producten te verkopen, waaronder het onderschrijven van professionele atleten. De opkomst van de tv, de toegenomen participatie en de opkomst van de consumentencultuur tijdens de tweede helft van de 20e eeuw hebben dit proces alleen maar versterkt. De huidige producenten onder wie Nike en Adidas zijn over het algemeen ‘ondernemers zonder ondernemingen’. Vanuit het globale productieketenconcept kan dit verklaard worden. De kerncompetenties zoals: onderzoek en ontwikkeling, ontwerp, financiën, verkoop en marketing blijven behouden. De productie wordt uitbesteed aan onderaannemers in lagelonenlanden in de periferie en/of semi-periferie binnen het huidige wereldsysteem. Nike was één van de eerste bedrijven binnen de industrie die deze uitbestedingstechniek op grote schaal ging toepassen. De economische ontwikkelingen en de intensifiëring van de internationale handel hebben ertoe geleid dat andere spelers deze strategie eveneens zijn gaan toepassen. Verder heeft de huidige economische context tot een verzadigde westerse sportgoederenmarkt geleid.