Annual results FY 2019/2020

Operating margin rate at 31%, increasing significantly compared with previous fiscal years Continued decrease in overheads : new drop of €14 M compared with 2018/2019 overheads, which were already €7 M lower than the previous fiscal year

Net result of €(95) M, mainly due to non-recurring items linked to the restructuring : exceptional result of €(64) M including €(60) M with no cash impact

Finalization of the financial restructuring with the completion after closing of the share capital

increases reserved for the Vine and Falcon funds for €193 M

Saint-Denis, 29 July 2020 – EuropaCorp, one of the leading independent film studios in Europe, film producer and distributor, reports its annual consolidated income, which ended on 31 March 2020, as approved by the Board of Directors at its meeting on 28 July 2020.

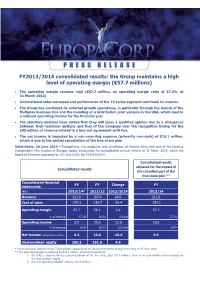

Presentation IFRS 5*

Profit & Loss – € million

- 31 March 2019 31 March 2020

- Var.

- 31 March 2019 31 March 2020

- Var.

- Revenue

- 150,0

- 69,8

-80,2

- 148,7

- 69,8

-78,9

- Cost of sales

- -121,6

- -48,3

73,3 -6,9

- -121,4

- -48,3

73,1 -5,8

- Operating margin

- 28,4

19%

21,4

31%

27,3

18%

21,4

- 31%

- % of revenue

Operating income Net Income

-79,0

-53%

-109,9

-73%

-59,1

-85%

-95,1

-136%

19,9 14,8

-71,2

-48%

-109,9

-74%

-59,1

-85%

-95,1

-136%

12,1 14,8

% of revenue % of revenue

0

* To be compliant with IFRS 5, the activity related to the exploitation of the catalog Roissy Films, sold in March 2019, has been restated within the consolidated FY 2018/19 for a better comparison. The net income for these specific line of business as of 31 March 2019 (-7.7 M€) has been booked directly in the Net Income

1

Consolidated revenues of €69.8 M, decreasing by €80.2 M (-53%) versus 2018/2019, principally constituted of the exploitation of catalogue. The Company has temporized the production of new films due to the financial restructuring.

International sales stand at €14.8 million for the fiscal year, or approximately 21% of total turnover, versus 51.9 million for FY 2018/2019. They comprised mainly of the last deliveries of the films Kursk and Anna as well as the ones for Nous finirons ensemble, as well as significant overages collected on films from the catalogue (in particular Lucy and Taken 3).

Television & SVOD sales in France and the United States stand at €27.3million, or 39% of total turnover, versus

€32.2 million for last fiscal year. This turnover was mainly driven by the French market and corresponds essentially to the opening of broadcasting rights windows for films from the catalogue such as Valerian and the City of a Thousand Planets, Renegades, Lucy and I Feel Better. Revenue for the TV Series activity stands at €6 million for FY 2019/2020, or 9% of total turnover, against €24.4 million for FY 2018/2019, which included international deliveries of the last 6 episodes of the second season of the TV series Taken. This revenue of 6 million corresponds to the international exploitation of this same series (overages). The Video & VOD segment in France and the United States represents around 7% of the annual revenue, coming in at €4.9 million, versus €14.1 million in 2018/2019. This turnover includes video and VOD sales realized in the US, in particular for Renegades and Valerian and the City of a Thousand Planets, and Taxi 5 in France (though less significant than during the previous financial year, when the films Renegades and Taxi 5 first became available in video). Theatrical distribution revenue in France and the United States is €8.7 million for FY 2019/2020, or around 12% of total revenue, against €6.8 million in 2018/2019. This revenue corresponds in 2019/2020 to the sales made in French theaters of the following films: --

Nous finirons ensemble, released in May 2019 : 2.8 million admissions; Anna, released in July 2019 : 750 thousand admissions;

Subsidies generated during FY 2019/2020 stand at €1.1 million (versus €3.1 million over the last financial year). The Other item corresponds mainly to post-production, licenses, partnerships, events and coproduction / line production receipts. It has recorded revenue of €7 million against €17.5 million for the previous financial year which included line production receipts for the film Kursk and those of coproduction for the film Taxi 5. This year, Other revenues mainly correspond to receipts of coproduction for the film Nous finirons ensemble.

Significant improvement in the operating margin rate, at 31% versus 19% in 2018/2019, mainly due to the high proportion of the catalogue in the revenues of the fiscal year. Given the recognition of non-recurring items and a significant negative financial income, a loss of €(95.1) M was incurred, compared to €(109.9) M for last fiscal year.

Operating margin stood at €21.4 M versus €28.4 M last fiscal year, or a €(6.9) M decrease mainly due to the drop in revenues. Operating margin rate increased from 19% to 31% due to the high proportion of the catalogue exploitation in the revenues of the year.

Overheads were at €(16.2) M, or a decrease of €13.6 M compared to N-1 (-46%), confirming the effectiveness of the measures implemented by the Group to reduce general expenses, which had already decreased by a total of €36.7 M over the last three financial years.

Operating income was €(59.1) M, mainly explained by non-recurring items for €(64.3)M, of which €(60.3) M with

no cash impact, in particular the recognition in debt of the Participation Deal (in off-balance sheet commitments before) for an amount of €(41.0) M, recognition criteria for a debt being met on 28 February 2020.

Financial income was €(26.6) M versus €(28.9) M in N-1, including mainly financial interests incurred over the period, notably on the Secondary line of credit (entirely capitalized), as well as unrealized foreign exchange losses and rent expenses following the application of the IFRS 16 standard.

After taking into account taxes for €(8.5) M, net income was €(95.1) M versus €(109.9) M last year.

2

Decrease in net operating cash flows, linked to the drop in revenue

The net operating cash flows came in at €31.3 M versus €101.7 M during last fiscal year, decrease mainly due to :

(i) In N-1, collection of Anna’s main international sales; (ii) Receipts linked to the TV series Taken more important in N-1 because of the delivery of the last 6 episodes of the second season ;

(iii) Receipts linked to the TV sales less important than in N-1 due to the absence of delivery of new films produced.

CAPEX

Due to the restructuring, the Group had to temporize the production of new projects. No investment was made during the fiscal year (€(0.2) M versus €12.8 M during previous fiscal year).

Financial structure

As of March 31, 2020, net debt was €152 M (versus €159 M as of March 31, 2019), decreasing slightly due to the increase in cash (debt freeze linked to the safeguard proceeding) partially offset by the increase in Secondary debt linked to the capitalization of interests incurred over the period.

Outlook

Following the finalization of the financial restructuring (completion of the share capital increases on 28 July 2020, as announced by the press release of the same day), the Group has set as priority objectives to invest again in the production of films with a focus on action and sci-fi, produced with controlled budget, covered by significant pre-financings, with a strong implication of Luc Besson (as writer, director and/or producer). The Group also considers investing in the production of English-language TV series with strong international potential and using the rights it owns to generate revenues issued from the exploitation of TV series.

Financial calendar

....

Annual General Meeting: September 2020 Revenue and consolidated financial statements for the 1st semester: December 2020 Annual revenue: May 2021 Annual consolidated financial statements: June 2021

ABOUT EUROPACORP

Founded in 1999, EuropaCorp has grown to become the leading film and series production studio in Europe. The Group's international activities cover the entire film value chain with expertise in production, theatrical distribution, international sales, TV, video & VOD, and music publishing. EuropaCorp is able to ensure creativity and quality throughout the lifecycle of its films and television projects. The Group has produced or co-produced more than 120 films and has distributed more than 160 of them in French cinemas. Since 1999, it has produced 10 of the 20 biggest French hits internationally and 22 films among the 70 French productions with the most international admissions (source: Le film français – May 17, 2019). The Group has also been active since 2010 in the production of TV series and single titles for platforms worldwide. EuropaCorp was created by the director, screenwriter and producer Luc Besson. More information on www.europacorp.com

Contacts

- Groupe EuropaCorp

- NewCap

Lisa Reynaud | Investor Relations | [email protected] Régis Lefèbvre | Communication | [email protected] Tel: 01 55 99 50 00

Pierre Laurent | NewCap [email protected] | Tel: 01 44 71 94 94

EuropaCorp is listed on the C Compartment of Euronext Paris

ISIN Code: FR0010490920 – MNEMO Code: ECP

3