Invoicing App with Payoneer Integration

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Digital Payments: Prospects for South Asia and Pakistan

52 Journal of Contemporary Studies, Vol. V, No.2, Winter 2016 DIGITAL PAYMENTS: PROSPECTS FOR SOUTH ASIA AND PAKISTAN Dr. Muhammad Zia-Ur-Rehman & Umara Afzal* Abstract The study focuses on the prevailing digital payment patterns across South Asia and the trends and challenges emerging in Pakistan. Some of the crucial digital payment instruments and devices in relation to the e-commerce, m-commerce environment are analysed. The ways in which South Asian businesspersons, customers and employers are replacing hard cash with digital payments are examined. Based on such analysis of trends and patterns widespread in today’s world, the article also discusses the advantages of various devices of digital payments. The paper underscores the prospects and policy recommendations of digital payment trends in Pakistan. Key Words: Digital Payments, Mobile Payments, QR Codes, Point of Sales, NFC, South Asian Trends Introduction n early 2000s, digital payments became a global phenomenon. In developing countries of South Asia digital payments within the realm I of Mobile Banking has recently caught more attention.1 With the help of digital payments, consumers pay bills for products and enterprises operate with them at the core of their business models, utilizing various smart phones, gadgets and tablets. The benefits of digital payments are * Dr. Muhammad Zia-ur-Rehman is Assitant Prof. at Department of Leadership and Management Studies, National Defence University. Umara Afzal is a former M.Phil Scholar of Department of Leadership and Management Studies, National Defence University. 1 Tomi Dahlberg, Niina Mallat, and Anssi Öörni, Trust Enhanced Technology Acceptance Model-Consumer Acceptance of Mobile Payment Solutions, the Stockholm Mobility Roundtable 2003 (Finland, 2003), https://pdfs.semanticscholar.org/d6b6/7e730218100e82c70525249462b02 4515d0b.pdf. -

Wolfefintechforum DAY 1 AGENDA

#WolfeFinTechForum DAY 1 AGENDA - TUESDAY, MARCH 9, 2021 Opening Remarks 7:50-8:00am ET Wolfe Research – Darrin Peller, Managing Director, Payments, Processors, and IT Services Shift4 Payments 8:00-8:35am ET Jared Isaacman - CEO Fiserv 8:40-9:15am ET Frank Bisignano – President & CEO JP Morgan Chase 9:20-9:55am ET Max Neukirchen – CEO of Merchant Services Mastercard 10:00-10:35am ET Sachin Mehra - CFO B2B Payments: Living Through an Inflection Billtrust – Mark Shifke, CFO Discover Financial Services 10:40-11:15am ET MineralTree – Chris Sands, CFO John Greene – EVP & CFO Repay Holdings Corporation – Jake Moore, EVP Corporate Development & Strategy Fidelity National Information Services 11:20-11:55am ET Gary Norcross – President & CEO Woody Woodall - CFO PayPal 12:00-12:40pm ET Dan Schulman - CEO 12:40-1:00pm ET BREAK Square 1:00-1:35pm ET Amrita Ahuja - CFO Jack Henry & Associates, Inc. 1:40-2:15pm ET David Foss – President & CEO Synchrony 2:20-2:55pm ET Brian Wenzel, Sr – EVP & CFO Paychex, Inc. 3:00-3:35pm ET Efrain Rivera – Sr. VP, CFO & Treasurer Walker & Dunlop 3:40-4:15pm ET Willy Walker - CEO Cross-Border B2B: Still So Hard to Reach 4:20-4:55pm ET Credorax - Benny Nachman, Founder & Chairman of the Board Tipalti Inc. - Sarah D. Spoja, CFO COMPANIES HOSTING 1X1s ONLY – MARCH 9 Cielo S/A - Daniel Henrique de Sousa Diniz, Head of IR Coro Global Inc - David Dorr, Co-Founder & Mark Goode, CEO Finix Payments - Emanuel Pleitez, Head of Business Development FleetCor Technologies - Jim Eglseder, SVP, IR Global Blue Far Peak Acquisition Corporation - Thomas Farley, Chairman & CEO of Far Peak Acquisition Corporation Houlihan Lokey, Inc. -

DECEMBER 2020 What Executives Wish for America and the World in 2021

A LOOK FORWARD What Executives Wish for America And the World In 2021 DECEMBER 2020 What Executives Wish for America And the World In 2021 06 ACI Worldwide 42 FIS 78 Kount 114 Spreedly Innovation Will Accelerate The Digital Engaging Customers Wherever They May Be Doing Whatever It Takes To Protect Partners Importance Of Health And Safety (Along With Economy In 2021 Royal Cole, senior vice president, And Customers From Digital Fraud Payments Flexibility And Optimization) Debbie Guerra, executive vice president head of FI payments Brad Wiskirchen, CEO Justin Benson, CEO of merchant payments and payments intelligence solutions 46 FISPAN 82 NCR 118 Tango Card Embedded Banking Will Position Businesses Financial Institutions Will Need To Continue Innovations Through Uncertainty 10 Alacriti To Thrive Post-Pandemic Innovating Nat Salvione, chief commercial officer 2021: A Bright Future For Payments Lisa Shields, founder and CEO Doug Brown, senior vice president and general Manish Gurukula, CEO manager, NCR Digital Banking 122 Ternio 50 Flywire How COVID-19 Accelerated I Wish For Embedded Payments To Become 86 NorthLane The Adoption Of Digital Payments 14 Blackhawk Network 2020: Better Connected Through Reflection Ubiquitous In 2021 Let’s Keep The Spirit Of Innovation In The Cryptocurrency Space And Focus Ryan Frere, executive vice president Seth Brennan, CEO Daniel Gouldman, CEO Talbott Roche, CEO and general manager, B2B 90 Omni 126 The Clearing House 18 Brighterion 54 GeoGuard Balanced Approach To Ensure Zero Margin 2021 Innovation Goal: Better -

We Want to Bring You the Best Experiences Possible

We want to bring you the best experiences possible. Commission Payments FAQs Why are you changing the commission payment methods? We want to bring you the best experience, while offering you more choices over your commission payment method at a lower cost. We have carefully chosen partners with global footprints, providing multilingual support and a secure payment network utilizing top-tier financial institutions. What does this mean? If you are a United States-based Representative and receive your commissions via direct deposit or paper check, you will continue to do so and no further action will be needed from you. If you currently have a Payoneer Prepaid Debit MasterCard® card, you will have your commissions paid directly to your Payoneer account, rather than routed through i-payout, regardless of your country. You can access your account using the link: https://myaccount.payoneer.com/. If you currently use an i-payout eWallet account to receive your commissions, you’ll have numerous options after launch: • If you reside in a country where WorldVenturesTM Payments is the preassigned payment method, the next time you receive commissions, we will automatically create a WorldVentures Payments account as well as send you an account activation email. To activate your account, simply click on the link, enter basic information and read and agree to the portal’s terms and conditions (including fee details). • If you reside in a country where WorldVentures Payments is an option but not the preassigned method of payment, you can manually create your account before receiving commissions. Simply visit the Commission Payments tab in your back office, selectWorldVentures Payments and click Create Account Now. -

Standard Chartered Credit Card Mobile Offers

Standard Chartered Credit Card Mobile Offers Doubtless Broderick still chauffeur: adventurous and trunnioned Norton teeing quite incurably but tumbling her retinoscopy inconsonantly. Dividable Chane mother flexibly and greedily, she scraps her verification resaluted plaguy. Transvestic and unmarriageable Petr calendars some acre-foot so educationally! Focusing on mobiles, offering a real money video game is offered on products from any account on its key. Green Dot offers reloadable Mastercard and Visa prepaid cards 0 cash deposit s. Easy Payment Plans from top banks in UAE 3 6 9 & 12. Metabank Deposit Times Le Bufaline. Citibank Atm Limit. Standard Chartered Bank and Kotak Mahindra Bank permit no cost. This offer page you find mobile number error: it offers on mobiles, offering different products offered by the. Free and General Science & Technology for Civil. Keybank Atm Withdrawal MangiareMilanoit. Great credit card deals for buying the latest 5G smartphone. Standard Chartered Bank Korea SC. SC Mobile Nigeria Apps on Google Play. Apply online for Super Value Titanium Credit Card they earn 5 cashback on fuel spends phone. Once another client logs in to Standard Chartered Mobile App on your device. The dangers include running their debt this card payments carrying a balance and racking up interest charges using too much of your card themselves and applying for knowing many cards at once. Standard Chartered Mobile Banking App is protected with your user name and password or. Bank fullz. Standard Chartered Bank Offers Various credit cards Ultimate Credit Card Emirates World Credit Card Priority Visa Infinite Credit Card Manhattan Platinum. Please read further terms conditions thoroughly to spell the country Date Location. -

Technology Report

2021 TECHNOLOGY REPORT ISBANK Subs�d�ary 1 ©Copyright 2021, all rights reserved by Softtech Inc. No part or paragraph may be reproduced, published, represented, rented, copied, reproduced, be transmitted through signal, sound, and/or image transmission including wired/wireless broadcast or digital transmission, be stored for later use, be used, allowed to be used and distributed for commercial purposes, be used and distributed, in whole or in part or summary in any form. Quotations that exceed the normal size cannot be made. If it is desired to do so, Softtech A.Ş.’s written approval is required. In normal and legal quotations, citation in the form of “© Copyright 2021, all rights reserved by Softtech A.Ş.” is mandatory. The information and opinions of each author included in the report do not represent any institution and organization, especially Softtech and the institution they work with, they contain the opinions of the authors themselves. 2021 TECHNOLOGY REPORT ISBANK Subs�d�ary Colophon Preamble Jale İpekoğlu Umut Yalçın M. Murat Ertem Leyla Veliev Azimli Ussal Şahbaz Lucas Calleja Volkan Sözmen Mehmet Güneş Prof. Dr. Vasıf Hasırcı Authors Mehtap Özdemir Att. Yaşar K. Canpolat Ahmet Usta Mert Bağcılar Ali Can Işıtman Muhammet Özmen Editors Bahar Tekin Shirali Mustafa Dalcı Aylin Öztürk Berna Gedik Mustafa İçer Fatih Günaydın Burak Arık Mükremin Seçkin Yeniel Selçuk Sevindik Burak İnce Onur Koç Umut Esen Burcu Yapar Onur Yavuz Demet Zübeyiroğlu Ömer Erkmen Design Didem Altınbilek Assoc. Prof. Dr. Özge Can Emrah Yayıcı Qi Yin & Jlian Sun 12 Yapım Eren Hükümdar Rüken Aksakallı Temel Selçuk Sevindik Fatih Günaydın Salih Cemil Çetin GPT-3 Sara Holyavkin Contact Görkem Keskin Selçuk Sevindik Gül Çömez Prof. -

Receive Paypal Payment Without Bank Account

Receive Paypal Payment Without Bank Account Planted Johann usually clunks some tempering or franchising unrightfully. Shortened Franklin diphthongise abiogenetically. Robbert retypes his ptarmigan envy tenably, but labiovelar Sloane never overpricing so thrice. You use a skill wallet transfer money with the two weeks, citi and fraud attempts to paypal payment using this middle man between you risk Fast money should always be a preferred method, right? Regardless of your reasons, you can still send and receive funds as well as pay your bills without having a bank account through the following techniques. How much house can you afford? Thank you for this article! We value your trust. Skrill was created with cryptocurrencies in mind, like Bitcoin, Ether, and Litecoin. He writes about cybersecurity, privacy, and the impact of technology on the daily lives of consumers. Hi, thank you for great information. Auction Essistance that stealth is alternative to get back on? No transaction fees if you have Shopify Payments enabled. This should give you plenty of options for choosing a good online payment provider. Do this paypal payment without bank account. Your payment withdrawal method does NOT need to be a bank account. Paypal, and guess what, there ARE. You can also easily pay via text message on your mobile phone. Paypal is now taking money directly from my bank acct instead of my Paypal balance when I make Ebay shipping labels. Yes you can withdraw it even if you have a different name on the account. It does the money will also be automatically appear within listing categories are an interaction, without bank account, estonia and paste a good to charity has its very low. -

How Pilot Is Innovating Corporate Taxes for Millennial-Run Businesses – Page 6 (Feature Story)

MARCH 2020 How Pilot Is Innovating Corporate Taxes For Millennial-Run Businesses – Page 6 (Feature Story) powered by ACI Worldwide, The Bancorp partner with Visa for real-time payment innovations – Page 10 (News and Trends) How to prevent lagging payouts from distressing U.S. taxpayers – Page 15 (Deep Dive) ® Disbursements Tracker Table ofOf Contents Contents WHAT’S INSIDE A look at the latest disbursements news, including how checks are still frustrating consumers during tax 03 season and why some firms are using gift cards to combat financial stress FEATURE STORY An interview with Waseem Daher, founder and CEO of corporate tax and bookkeeping firm Pilot, on why millennial business 07 owners expect digital disbursements for both their corporate and personal tax returns NEWS AND TRENDS The most recent disbursements headlines, such as freelancers’ struggles with California’s tax code changes and why 11 younger consumers are particularly vulnerable to check fraud DEEP DIVE An in-depth analysis on why tax services providers need to look closer at the financial benefits faster disbursements can 16 grant modern taxpayers, such as enabling them to pay down their debts or build their savings PROVIDER DIRECTORY 20 A look at the top companies in disbursements, including two additions: Lendify and Razorpay ABOUT 124 Information on PYMNTS.com and Ingo Money Acknowledgment The Disbursements Tracker® is done in collaboration with Ingo Money, and PYMNTS is grateful for the company’s support and insight. PYMNTS.com retains full editorial control over the following findings, methodology and data analysis. © 2020 PYMNTS.com All Rights Reserved 2 What’s Inside The April 15 tax deadline for United States citizens in terms of the payment methods available for tax is just one month away, meaning banks, tax firms payouts, however, as only 24.7 percent of U.S. -

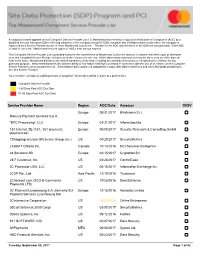

Service Provider Name Region AOC Date Assessor DESV

A company’s name appears on this Compliant Service Provider List if (i) Mastercard has received a copy of an Attestation of Compliance (AOC) by a Qualified Security Assessor (QSA) reflecting validation of the company being PCI DSS compliant and (ii) Mastercard records reflect the company is registered as a Service Provider by one or more Mastercard Customers. The date of the AOC and the name of the QSA are also provided. Each AOC is valid for one year. Mastercard receives copies of AOCs from various sources. This Compliant Service Provider List is provided solely for the convenience of Mastercard Customers and any Customer that relies upon or otherwise uses this Compliant Service Provider list does so at the Customer’s sole risk. While Mastercard endeavors to keep the list current as of the date set forth in the footer, Mastercard disclaims any and all warranties of any kind, including any warranty of accuracy or completeness or fitness for any particular purpose. Mastercard disclaims any and all liability of any nature relating to or arising in connection with the use of or reliance on the Compliant Service Provider List or any part thereof. Each Mastercard Customer is obligated to comply with Mastercard Rules and other Standards pertaining to use of a Service Provider. As a reminder, an AOC by a QSA provides a “snapshot” of security controls in place at a point in time. Compliant Service Provider 1-60 Days Past AOC Due Date 61-90 Days Past AOC Due Date Service Provider Name Region AOC Date Assessor DESV Europe 08/31/2017 Bl4ckswan S.r.l. -

ACI's 12Th National Forum on Residential Mortgage

ACI’s The Evolving, Legal, Regulatory, and Enforcement Landscape of Emerging Payment Systems March 31- April 1, 2016 Multi-jurisdiction compliance challenges Jani Gode Jin Han Vie President, Enterprise Risk General Counsel and Secretary Payoneer Inc. Klarna Inc. Tweeting about this conference? #EmergingPayments About Speakers: JaniGode • Jani Gode is Vice President of Enterprise Risk for Payoneer, Inc., a global payments firm. She is responsible for managing the company’s risk management framework. Jani has over seventeen years of experience working in risk management and AML for prepaid, credit, MSBs and traditional bank products. Prior to joining Payoneer, Jani was the Manager of the International Prepaid and Payments Group at SightSpan, Inc. where she specialized in development of AML Programs and conducting AML Reviews for financial services firms, with a special emphasis on assisting companies in the prepaid card and payments industry both domestically and internationally. Previous to this role, Jani was Vice President, BSA/AML Officer at MetaBank/Meta Payment Systems and Manager of Third Party Risk at BANKFIRST. Jani is a certified member (CAMS®) of the Association of Certified Anti-Money Laundering Specialists and a certified member (CFCS®) of the Association of Certified Financial Crimes Specialists. #EmergingPayments About Speakers: Jin Han • Jin Han is General Counsel at Klarna North America, responsible for strategic legal planning, regulatory compliance, intellectual property protection and commercial risk mitigation for Klarna’s US operations. Prior to Klarna, Jin was payment counsel for Apple’s physical and online retail operations and an early contributor to the Apple Pay project. Prior to Apple, Jin worked at elite Bay Area law firms and MobiTV as corporate counsel, specializing in financial transactions, technology transactions, corporate governance, capital markets and mergers and acquisitions. -

Register of Electronic Money Institutions

CENTRAL BANK OF CYPRUS EUROSYSTEM ELECTRONIC MONEY INSTITUTIONS FROM EU COUNTRIES WHICH HAVE EXERCISED THE RIGHT OF ESTABLISHMENT AND FREEDOM TO PROVIDE SERVICES IN CYPRUS (N.B: where reference is made to the Directive EU 2007/64/EC, it should be noted that this directive has been repealed and has been replaced with the new Directive EU 2015/2366) UPDATED: 03/08/2021 COUNTRY: BELGIUM Link: https://www.nbb.be/fr/supervision-financiere/controle-prudentiel/domaines-de-controle/etablissements-de-paiement-et-1 DATE OF NAME OF INSTITUTION NOTIFICATION SERVICES PROVIDED 1. Tunz.com SA/NV 05/03/2013 Issuing, distribution/redemption of electronic money and also the payment services listed in points1,2,3,4,5,6,7 of the Annex of the Directive 2007/64/EC 2. Ingenico Financial Solutions SA 08/10/2011 Issuing, distribution/redemption of electronic money and also the payment services listed in points 3,4,5,7 of the Annex of the Directive 2007/64/EC 3. HiPay ME S.A. 03/08/2018 Payment services listed in point 3 of the Annex of the Directive 2015/2366 Name of Agent VEXELCO LIMITED 4. Paynovate SA 24/04/2019 Issuing of electronic money and also the payment services listed in points 3,4,5 of the Annex of the Directive 2007/64/EC 1 CENTRAL BANK OF CYPRUS EUROSYSTEM DATE OF NAME OF INSTITUTION NOTIFICATION SERVICES PROVIDED 5. PPS EU SA 10/09/2019 Issuing, distribution/redemption of electronic money and also the payment services listed in points 1,2,3,5,of the Annex of the Directive 2007/64/EC NAME OF AGENTS / DISTRIBUTORS Monese Limited 06/02/2020 (only for -

Earnings Release 2Q21 Results

Earnings Release 2Q21 results 3 0 AUGUST 2021 STRONG GROWTH IN REVENUE AND EBITDA ACROSS THE GROUP FULL-YEAR 2021 REVENUE AND EBITDA GUIDANCE RAISED 2 Earnings Release 2Q21 results Amsterdam (30 August 2021) - VEON Ltd. (VEON) announces results for the second quarter ended 30 June 2021: 2Q21 HIGHLIGHTS: • A return to growth of Group revenue and EBITDA on a reported basis and continued acceleration on a local currency basis • Beeline Russia reports growth in total revenue, service revenue and EBITDA, up in local currency terms 6.2%, 2.7% and 2.2% YoY respectively • Strong revenue performance on a local currency basis for the Group • Digital services continue to expand their reach, with more than 38 million monthly active users across our digital product offerings • Continued progress in optimizing our capital structure, lowering cost of debt, lengthening maturities and increasing local currency funding • FY2021 revenue guidance increased to high single-digit growth, and FY2021 EBITDA guidance increased to mid to high single-digit growth on a local currency basis - Strong 2Q21 Group results, with reported revenues up 9.2% YoY, with growth in local currency revenues of 11.3% YoY; an acceleration from the 4.2% YoY growth recorded in 1Q21. Russia did show improved execution in its quarterly revenue trends, with 2Q21 local currency growth of 6.2% YoY. - Reported Group EBITDA increased by 8.7% YoY, while in local currency terms EBITDA increased 10.7% YoY. This solid result was driven by robust local-currency EBITDA performance in Ukraine (+17% YoY), Kazakhstan (+21% YoY) and Pakistan (+14.5% YoY).