User Friendliness of Safety Features Has Large Impact on Quality and Reliability Ratings of New Vehicles, J.D

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

P 01.Qxd 6/30/2005 2:00 PM Page 1

p 01.qxd 6/30/2005 2:00 PM Page 1 June 27, 2005 © 2005 Crain Communications GmbH. All rights reserved. €14.95; or equivalent 20052005 GlobalGlobal MarketMarket DataData BookBook Global Vehicle Production and Sales Regional Vehicle Production and Sales History and Forecast Regional Vehicle Production and Sales by Model Regional Assembly Plant Maps Top 100 Global Suppliers Contents Global vehicle production and sales...............................................4-8 2005 Western Europe production and sales..........................................10-18 North America production and sales..........................................19-29 Global Japan production and sales .............30-37 India production and sales ..............39-40 Korea production and sales .............39-40 China production and sales..............39-40 Market Australia production and sales..........................................39-40 Argentina production and sales.............45 Brazil production and sales ....................45 Data Book Top 100 global suppliers...................46-50 Mary Raetz Anne Wright Curtis Dorota Kowalski, Debi Domby Senior Statistician Global Market Data Book Editor Researchers [email protected] [email protected] [email protected], [email protected] Paul McVeigh, News Editor e-mail: [email protected] Irina Heiligensetzer, Production/Sales Support Tel: (49) 8153 907503 CZECH REPUBLIC: Lyle Frink, Tel: (49) 8153 907521 Fax: (49) 8153 907425 e-mail: [email protected] Tel: (420) 606-486729 e-mail: [email protected] Georgia Bootiman, Production Editor e-mail: [email protected] USA: 1155 Gratiot Avenue, Detroit, MI 48207 Tel: (49) 8153 907511 SPAIN, PORTUGAL: Paulo Soares de Oliveira, Tony Merpi, Group Advertising Director e-mail: [email protected] Tel: (35) 1919-767-459 Larry Schlagheck, US Advertising Director www.automotivenewseurope.com Douglas A. Bolduc, Reporter e-mail: [email protected] Tel: (1) 313 446-6030 Fax: (1) 313 446-8030 Tel: (49) 8153 907504 Keith E. -

Dolz Applicazione Listino A084 A-084 Tapa A-183 28,20 A112 A

DOLZ APPLICAZIONE LISTINO A084 A-084 TAPA A-183 28,20 A112 A-112 SAVA JO-4 C/LARGO 59,00 A113 A-113 SAVA JO-4 C/CORTO 37,20 A115 A-115 SAVA JO-4 5730 40,60 A116 A-116 SAVA JO-4 1.000 70,60 A117 A-117 SAVA JO-4 1.000M 67,60 A121 A-121 BMC MARINA 1.5D 39,40 A122 A-122 LEYLAND SHERPA 70,60 A123 A-123 AUSTIN MARINA 62,50 A124 A-124 LEYLAND TM15/TM30 70,60 A131 A-131 ALFA 33 1.8 TD 77,20 A131ST A-131ST ALFA33 1.8TD INTER 51,60 A134 A-134 A.R.ALFETTA GT 85,00 A135 A-135 ALFA ROMEO 1750 101,00 A138 A-138 ALFA ROMEO 2.0 129,00 A139 A-139 ALFA ROMEO ALFA SUD 41,30 A140 A-140 ALFA ROMEO 164 2.0 44,60 A141 A-141 ALFA ROMEO 2.5 TD 54,60 A145 A-145 A.R.ALFETTA 1.5-1.8 55,80 A146 A-146 ALFA 75 2.5 - 3.0 91,00 A147 A-147 ALFA 33 1.8 TD 47,80 A148 A-148 ALFA 164 3.0 6V 84,00 A149 A-149 ALFA 155 1.8 - 2.0 60,50 A150 A-150 VW PASSAT 37,50 A151 A-151 VW PASSAT 35,60 A151RS A-151RS VW PASSAT DIESEL 39,50 A152 A-152 AUDI 100 GASOLINA 54,10 A153 A-153 AUDI 100 LS-GL 54,00 A154 A-154 AUDI 100 DIESEL 52,20 A158 A-158 AUDI 80-90 2000- 58,80 A159 A-159 AUDI 50 LS-50 47,60 A160 A-160 AUDI COUPE 1600- 74,30 A161 A-161 AUDI COUPE 1600 70,30 A161RS A-161RS VW PASSAT DIESEL 73,90 A162 A-162 VOLKSWAGEN LT 4X4 57,00 A164 A-164 VOLKSWAGEN POLO 1.3 48,10 A165 A-165 VOLKSW. -

Vehicle Initial Quality in Japan Has Steadily Improved, but Satisfaction Remains Stagnant, J.D

Vehicle Initial Quality in Japan Has Steadily Improved, but Satisfaction Remains Stagnant, J.D. Power Finds Honda Ranks Highest for Initial Quality for First Time TOKYO: 19 Aug. 2020 — While new-vehicle owners report fewer problems overall with their new vehicle this year and initial vehicle quality has further improved, more problems are reported in two areas than in previous years, according to the J.D. Power 2020 Japan Initial Quality StudySM (IQS), released today. “Initial vehicle quality in Japan has clearly improved due to efforts by every automobile manufacturer,” said Koichi Urayama, director of the automotive division at J.D. Power. “Despite those efforts, however, there’s still work to be done because customer satisfaction has not increased since 2014. It is critical that manufacturers find ways to decrease the number of reported problems with safety features and the advanced technology-related functions. Both of these areas represent emerging quality issues, and such improvements will not only increase initial quality satisfaction among current owners but also among those who switch from other brands. Presenting the market with solutions to these challenges will be the first step toward a competitive advantage strategy.” The study, now in its 10th year, examines problems experienced by owners of new 2020 model-year vehicles during the first 90 days of ownership. Initial quality is determined by the number of problems experienced per 100 vehicles (PP100), with a lower score reflecting higher quality. Following are some key findings of the 2020 study: The fewest number of problems are reported since the study’s redesign in 2014: Initial quality in 2020 averages 60 PP100. -

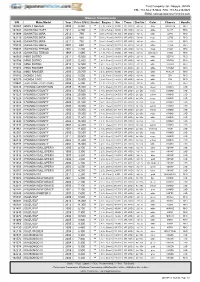

Manual Transmission S/N Make,Model Year Price (US$) Grade Engine Km Trans

Trust Company Ltd., Nagoya, JAPAN TEL: +81-52-219-9024 FAX: +81-52-219-9025 EMAIL:[email protected] Manual Transmission S/N Make,Model Year Price (US$) Grade Engine Km Trans. Drs/Sts Color Chassis Handle 180968 BMW 3 SERIES 2008 6,880 ** 2.0 L Petrol 97,000 MT, 2WD 4d / 5s blue WBAVG76 RHD 182342 DAIHATSU HIJET 2012 4,700 ** 0.66 L Petrol 36,000 MT, 4WD 2d / 2s white S211P RHD 181699 DAIHATSU MIRA 2012 790 ** 0.66 L Petrol 151,000 MT, 2WD 3d / 4s white L275V RHD 182115 DAIHATSU MIRA 2008 890 ** 0.66 L Petrol 138,000 MT, 2WD 5d / 4s beige L275S RHD 182449 DAIHATSU MIRA 2011 790 ** 0.66 L Petrol 179,000 MT, 2WD 3d / 4s silver L275V RHD 179832 DAIHATSU MOVE 2007 650 ** 0.66 L Petrol 183,000 MT, 4WD 5d / 4s white L185S RHD 179697 DAIHATSU TERIOS 2001 2,200 ** 1.3 L Petrol 99,000 MT, 4WD 5d / 5s black J102G RHD 182018 DAIHATSU TERIOS 1998 1,690 ** 1.3 L Petrol 97,000 MT, 4WD 5d / 5s white/silver J100G RHD 180569 HINO DUTRO 2011 15,500 ** 4.0 L Diesel 193,000 MT, 2WD 2d / 3s white XZC710 RHD 180756 HINO DUTRO 2007 12,800 ** 4.0 L Diesel 130,000 MT, 2WD 2d / 3s white XZU554 RHD 181123 HINO DUTRO 2010 12,500 ** 4.0 L Diesel 104,000 MT, 2WD 2d / 3s white XZU508 RHD 178382 HINO RANGER 2006 12,500 ** 6.4 L Diesel 202,000 MT, 2WD 2d / 3s white FD7JKW RHD 180544 HINO RANGER 2006 20,700 ** 6.4 L Diesel 56,000 MT, 2WD 2d / 2s white FC7JJW RHD 178582 HONDA CIVIC 2002 5,500 ** 2.0 L Petrol 100,000 MT, 2WD 3d / 4s white EP3 RHD 180275 HONDA CIVIC 2008 10,900 ** 2.0 L Petrol 102,000 MT, 2WD 4d / 4s white FD2 RHD 179841 HONDA INTEGRA (ACURA INTEGRA) -

Daihatsu Mira E:S Mini Passenger Car Undergoes Minor Model Upgrade Achieves Best Fuel Efficiency for a Gasoline Engine Vehicle*1Of 35.2 Km/L*2

July 9, 2014 (1/3) Daihatsu Mira e:S Mini Passenger Car Undergoes Minor Model Upgrade Achieves best fuel efficiency for a gasoline engine vehicle*1of *2 35.2 km/L Mira e:S G “SA” Daihatsu Motor Co., Ltd. (“Daihatsu”) is pleased to announce a minor upgrade to the Mira e:S mini passenger car, which will be released nationwide on Wednesday, July 9. The Mira e:S has been gaining the support of customers in a wide range of age groups as the “third eco-friendly car” that pursues high fuel efficiency and affordability, which are the essence of a mini passenger car. With the latest refinements, the e:S technology has evolved further, achieving improved fuel efficiency. In terms of power train evolution, combustion efficiency has been improved through a higher compression ratio and the adoption of Atkinson cycle technology*3 and a dual injector. In terms of energy management evolution, regenerative power has been increased through the improvement of Eco Power Generation Control, achieving fuel efficiency of 35.2 km/L, the best for a gasoline engine vehicle in all grades of 2WD vehicles. In addition, the Black Interior Package, an option that comes with a black-based interior, including black seat upholstery, has been added to some grades, creating a high quality, relaxing interior space. Daihatsu considers high fuel efficiency and affordability to be the essential features of all mini passenger cars, and it will continue to proactively pursue these aspects. *1: As of July 9, 2014, among gasoline engine cars, excluding hybrids (based on research undertaken by Daihatsu) *2: 2WD vehicles; JC08 mode fuel efficiency (Ministry of Land, Infrastructure, Transport and Tourism inspection value) *3: Internal combustion that achieves improved combustion efficiency by allowing the expansion ratio to be higher than the compression ratio (2/3) Outline ◆Through the evolution of e:S technology, fuel efficiency of 35.2 km/L has been achieved, the highest for a gasoline engine vehicle. -

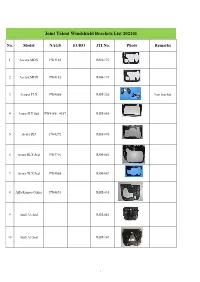

Joint Talent Windshield Brackets List 202101

Joint Talent Windshield Brackets List 202101 No. Model NAGS EURO JTI No. Photo Remarks 1 Accura MDX FW4183 RSH-172 2 Accura MDX FW4182 RSH-173 3 Accura TLX FW4068 RSH-326 Iron bracket 4 Acura ILX Sed FW4186 / 4187 RSH-095 5 Acura RD FW4272 RSH-096 6 Acura RLX Sed FW3716 RSH-086 7 Acura TLX Sed FW4068 RSH-067 8 Alfa Romeo Giulia FW4651 RSH-431 9 Audi A3 Sed RSH-082 10 Audi A3 Sed RSH-167 1 11 Audi A4 RSH-353 12 Audi A5 RSH-381 13 Audi A6 RSH-453 14 Audi A7 RSH-445 with heating pad 15 Audi A7 5D RSH-444 with heating pad 16 Audi A8 FW3350 RSH-156 17 Audi A8L FW3085 RSH-384 18 Audi B8 Sed RSH-032 Audi E-Tron 5D 19 RSH-531 Suv 20 Audi Q2 RSH-215 21 Audi Q3 5D Suv RSH-539 22 Audi Q3 5D Suv RSH-530 Audi Q3 5D SUV 23 8648 RSH-315 2018- 2 Audi Q3 Sensor 24 FW3870 RSH-174 holder 25 Audi Q5 FW4688 RSH-350 26 Audi Q5 FW4688 RSH-417 27 Audi Q7 RSH-104 28 Audi TT 2D Cpe RSH-080 29 BMW 3 Series G20 RSH-498 with connector BMW 3 Series 30 G20/G21 4D Sed RSH-499 /5D Wgn BMW 4 Series Coupe 2014- / 31 BMW Mini FW3609 RSH-031 Clubman 2015- / BMW 3 Series Sed 32 BMW 5 Series RSH-380 33 BMW 5 Series FW4674 RSH-361 34 BMW 7 Series FW4391 RSH-223 BMW 8 2D Cpe 35 RSH-513 2018- 3 BMW 8 Series 36 RSH-500 G14/G15 BMW X4 2014 / BMW X1 2015 / 37 BMW X3 2012 / FW03953 RSH-325 RSH031 BMW X6/BMW X5 2015-2018 38 BMW X5 (G05) RSH-436 BMW X7 5D Suv 39 RSH-550 G05/G07 40 BMW Z4 G29 RSH-514 BMW Z4 sensor 41 FW3112/3113 RSH-155 Bkt 42 Buick RSH134 43 Buick Encore RSH-076 44 Buick Regal- RHD RSH-063 45 Chevrolet 200 Sed DW2151 RSH-081 46 Chevrolet 300 DW2177 RSH-106 Chevrolet -

Daihatsu Mira Cocoa Mini Passenger Car Undergoes Minor Changes

August 26, 2014 (1/4) Daihatsu Mira Cocoa Mini Passenger Car Undergoes Minor Changes The fun of finding a favorite vehicle by selecting from 160 different styles and plus α Mira Cocoa Plus X Interior color (Ivory x Brown) Daihatsu Motor Co., Ltd. is pleased to announce minor changes to the Mira Cocoa mini passenger car, which will be released nationwide on August 26. The Mira Cocoa, under the concept of “My perfect, smart and happy partner,” has been gaining the support of a large number of female customers due to its design, which makes outings enjoyable, and its compact style, offering ease of handling. With the latest minor changes, under the keywords, “Creating vehicles that suit customers’ tastes,” in addition to improvements in the attractiveness of the exterior design, the Mira Cocoa has become a vehicle that achieves the fun of selection and enables customers to express their personalities and individuality by offering 160 variations, the largest number available for a mini passenger car*1, including the selection of a total of 15 body colors*2 and 9 different interior colors*3, and by offering the plus α (special models limited to each region). Moreover, in addition to achieving a fuel efficiency of 29.0 km/L*4 through the application of e:S technology, the fundamental performance of the Mira Cocoa has been improved, including the achievement of a more comfortable ride and high driving tranquility. *1: As of August 2014; based on research undertaken by Daihatsu *2: Excluding the Cocoa L *3: Standard features of the Cocoa Plus X (including Smart Selection SN) *4: 2WD vehicles; JC08 mode fuel efficiency (2/4) Outline Creating vehicles that suit customers’ tastes ◆ In planning and development, the basic specifications were determined based on thorough research into the opinions of female customers. -

The Global Market for Compact Cars

a look at The global market for compact cars The search for fuel-saving solutions has led to a trend for acquiring smaller and lighter cars. Small compact cars, whether powered by internal combustion or electric engines, have gained and are continuing to gain market share, in both mature automobile markets such as Europe or Japan and emerging markets such as India. In Europe and in France, automotive A and B segments These cars have the highest market share in Europe, and categorize: this share has been increasing since the 1990s. Today, 4 cars out of 10 sold in Europe are in the A and B segments, I mini cars for the A segment, such as the Fiat 500, compared with 3 out of 10 in the early 1990s (Fig. 1). No Peugeot 108, Renault Twingo and Citroën C-Zero. other range has seen such growth over this period. Very compact, their length varies between 3.1 m and 3.6 m in Europe; The C segment is small family cars, the D segment large family cars, and the H segment luxury saloon cars I supermini cars or “subcompacts” for the B segment, and tourers. such as the Toyota Yaris, Citroën DS3, Renault Clio and Peugeot 208. Slightly bigger than A segment cars, they are still very easy to handle due to their Fig. 2 – Sub-A segment cars length, often under 4 meters, but their 5 seats make Tata Nano Renault Twizy them more versatile. Fig. 1 – Breakdown of the European automobile market by range of vehicles % 9 . 45% 0 4 40% Kia Pop Lumeneo Neoma % % 2 9 . -

Vehicle Initial Quality in Japan Has Steadily Improved, but Satisfaction Remains Stagnant, J.D

Vehicle Initial Quality in Japan Has Steadily Improved, but Satisfaction Remains Stagnant, J.D. Power Finds Honda Ranks Highest for Initial Quality for First Time TOKYO: 19 Aug. 2020 — While new-vehicle owners report fewer problems overall with their new vehicle this year and initial vehicle quality has further improved, more problems are reported in two areas than in previous years, according to the J.D. Power 2020 Japan Initial Quality StudySM (IQS), released today. “Initial vehicle quality in Japan has clearly improved due to efforts by every automobile manufacturer,” said Koichi Urayama, senior director of the automotive division at J.D. Power. “Despite those efforts, however, there’s still work to be done because customer satisfaction has not increased since 2014. It is critical that manufacturers find ways to decrease the number of reported problems with safety features and the advanced technology-related functions. Both of these areas represent emerging quality issues, and such improvements will not only increase initial quality satisfaction among current owners but also among those who switch from other brands. Presenting the market with solutions to these challenges will be the first step toward a competitive advantage strategy.” The study, now in its 10th year, examines problems experienced by owners of new 2020 model-year vehicles during the first 90 days of ownership. Initial quality is determined by the number of problems experienced per 100 vehicles (PP100), with a lower score reflecting higher quality. Following are some key findings of the 2020 study: The fewest number of problems are reported since the study’s redesign in 2014: Initial quality in 2020 averages 60 PP100. -

PROVINCIA DE MENDOZA Ing

BOLETIN OFICIAL - Mendoza, jueves 2 de enero de 2014 PODER EJECUTIVO 1 GOBERNADOR Dr. Francisco Humberto Pérez VICEGOBERNADOR Sr. Carlos Germán Ciurca MINISTRO DE TRABAJO, JUSTICIA Y GOBIERNO Lic. Félix Rodolfo González MINISTRO DE DESARROLLO SOCIAL Y DERECHOS HUMANOS Prof. Cristian Pablo Bassin MINISTRO DE SEGURIDAD Dr. Leonardo Fabián Comperatore MINISTRO DE HACIENDA Y FINANZAS Cdor. Marcelo Fabián Costa MINISTRO DE AGROINDUSTRIA Y TECNOLOGIA Lic. Marcelo Daniel Barg MINISTRO DE SALUD Dr. Carlos Washington Díaz MINISTRO DE INFRAESTRUCTURA Y ENERGIA PROVINCIA DE MENDOZA Ing. Rolando Daniel Baldasso MINISTRO DE TURISMO Lic. Javier Roberto Espina FUNDADO EL 7 DE ABRIL DE 1899 MINISTRO DE CULTURA Aparece todos los días hábiles Prof. Marizul Beatriz Lilia Ibáñez AÑO CXIV MENDOZA, JUEVES 2 DE ENERO DE 2014 N° 29.540 Que entre las operatorias in- Deuda y su Addenda, respectivamen- Registro Nacional de la DECRETOS cluidas en el Programa, se en- te, en fechas 07 de diciembre de 2011 Propiedad Intelectual N° 94397 cuentran las que asumió la Pro- y 13 de marzo de 2012, los que fue- vincia con el Fondo Fiduciario de ron ratificados por Decreto N° 1146/ MINISTERIO Desarrollo Provincial y con origen 12, cuya copia se adjunta a fs. 1/8 del Sumario DE HACIENDA Y FINANZAS en operatorias de préstamo entre expediente N° 00821-M-12-01027. DECRETOS Págs. _____ entidades financieras y las Muni- Que el Poder Ejecutivo elevó Mrio. de Hacienda cipalidades de Godoy Cruz, Luján proyecto de ley a la Honorable Le- y Finanzas 1 DECRETO N° 2.286 de Cuyo y Tunuyán, cuyos Conve- gislatura Provincial, trasladando el Mrio. -

Plug-In Hybrid and Electric Vehicles Increasingly Appeal to New-Vehicle Owners, J.D

Plug-in Hybrid and Electric Vehicles Increasingly Appeal to New-Vehicle Owners, J.D. Power Finds Overall Vehicle Appeal Remains the Same Level as in 2017, While Satisfaction with Fuel Economy Decreases TOKYO: 20 Sept. 2018 — While overall new-vehicle appeal in Japan remains the same as in 2017, according to the J.D. Power 2018 Japan Automotive Performance, Execution and Layout (APEAL) StudySM released today, APEAL scores for motor-driven vehicles such as plug-in hybrids and electrical vehicles have increased, compared to scores for fuel-powered vehicles. The study finds that “electric powertrain vehicles1” have a greater appeal for new-vehicle owners than do “internal combustion engine (ICE) vehicles” such as gasoline or diesel-fueled vehicles and hybrids. The overall APEAL score averages 676 points for electric powertrain vehicles, while the score averages 636 points for ICE vehicles, representing a 40-point gap in score between vehicle types. Additionally, electric powertrain vehicles outperform ICE vehicles in engine/ transmission (a 107-point gap); fuel economy (an 85-point gap); and driving dynamics (a 44-point gap), which are typical advantages for electric powertrain vehicles. Those who owned a hybrid but purchased a plug-in hybrid or electric vehicle as a replacement are less satisfied with fuel economy than are owners of gasoline- or diesel-fueled vehicles, a 42-point gap in score. The study also finds that the proportion of those who owned a hybrid when they purchased a plug-in hybrid or electric vehicle as a replacement to the household has increased to 10% in 2018 from 6% last year. -

Battery Application Guide

BATTERY APPLICATION GUIDE VERSION 6 Used batteries are recycled ACDelco delivers new into new lead-acid batteries batteries to distributors ACDelco® supports responsible, sustainable battery recycling & environmental protection Distributors & other third Customers receive new batteries party recyclers collect used from distributors batteries from customers New batteries are sold and installed, used batteries are returned ABOUT ACDELCO ACDelco® Batteries are available for a comprehensive range of automotive, commercial, transport, marine & other industrial applications. Our commitment to high quality products and excellent customer service has led to ACDelco being one of the most trusted battery brands in the world. To us, standing tall is standing by you. ACDelco has been associated with premium electrical automotive products for over 100 years. Starting its journey as the Remy Electric Company in 1901, our history and expertise in automotive technology puts ACDelco at the leading edge of the after-market. With over 90,000 parts across 37 product lines worldwide, our products can be found right around the globe. That’s strength in numbers that we continue to grow. If you’re interested in making ACDelco your first point of call for all automotive maintenance needs, visit our website www.acdelco.com.au 2 CONTENTS ACDelco AGM Battery Key Features ___________________________ 4 Jaguar _________________________________________________ 42 ACDelco Battery Range _____________________________________ 5 Jeep ___________________________________________________