Results for the Third Quarter and First Nine Months 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A1 Group Structure.Pdf

Telekom Austria AG, Austria 100% mobilkom 100% mobilkom 100% mobilkom 100% mobilkom Belarus 100% Mobilkom 100% Telekom Fi- 100% Kroatien Be- 100% A1 Telekom Austria AG, CEE Beteiligungs- Bulgarien Beteili- Mazedonien Beteili- Beteiligungs- Beteiligungsgesellschaft nanzmanagement (TFG) teiligungsverwal- Austria verwaltung GmbH, gungsverwaltung GmbH, gungsverwaltung. GmbH, verwaltung GmbH, mbH, GmbH, Austria tung GmbH, Austria Austria Austria Austria Austria Austria 100% JetStream RO SRL, 1,5037% Wiener Börse Romania 100% A1 Towers 100% A1 TOWER 100% A1 Towers 100% SB Telecom 100% A1 Slovenija d.d., AG, Austria 100% A1now TV Bulgaria EOOD, DOOEL Skopje, d.o.o., Croatia Ltd. Cyprus, Slovenia 100% JetStream TR GmbH, Austria Bulgaria Macedonia Ticaret Ltd., Sirketi, Turkey 100% JetStream 100% Telekom 100% A1 Makedonija 100% A1 Towers Holding 100% A1 Srbija 100% A1 Bulgaria EAD, Germany GmbH, Germany Austria Personalma- DOOEL, 100% A1 Hrvatska 100% Unitary enterprise GmbH, Austria d.o.o., Serbia Bulgaria d.o.o., Croatia 90,46% TS RPL d.d., nagement GmbH, Macedonia A1, Belarus Slovenia Austria 100% JetStream Hungary Kft., Hungary 100% A1 TOWERS 100% Telemedia 100% DOSTOP 100%Jet Stream Slovakia 100% wedify GmbH 51% CABLETEL- INFRASTRUCTURE DOOEL Skopje, 100% A1 Content, KOMUNIKACIJE s.r.o., Slovakia Austria PRIMA AD Bulgaria d.o.o., Serbia Macedonia Belarus d.o.o., Slovenia 100% JetStream Switzerland mbH, CH 100% World-Direct eBusiness solutions 100% A1 Towers 100% JetStream Poland, 100% Aprimis EOOD, 100% A1 ICT 100% STUDIO GmbH, Austria Austria GmbH, Austria Poland Bulgaria services, Belarus PROTEUS d.o.o., Slovenia 100% JetStream BH d.o.o., Bosnia- Herzegovina 3,00% Eurescom GmbH, Germany 100% Unitary 100% TA CZ site Enterprise Solar 100% A1 Digital s.r.o., Czech Republic Invest, Belarus International GmbH, Austria 100% JetStream Italy S.r.l., Italy 100% MK Logistik GmbH, Austria 100% Unitary 100% A1 Digital 100% JetStream enterprise TA- Deutschland GmbH, England Ltd., England Engineering, Belarus Germany 76% CableRunner GmbH, Austria 88,83% Akenes S.A. -

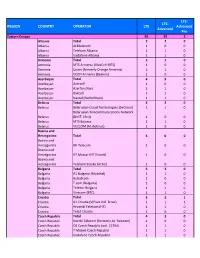

Prepared for Upload GCD Wls Networks

LTE‐ LTE‐ Region Country Operator LTE Advanced 5G Advanced Pro Eastern Europe 92 57 4 3 Albania Total 32 0 0 Albania ALBtelecom 10 0 0 Albania Telekom Albania 11 0 0 Albania Vodafone Albania 11 0 0 Armenia Total 31 0 0 Armenia MTS Armenia (VivaCell‐MTS) 10 0 0 Armenia Ucom (formerly Orange Armenia) 11 0 0 Armenia VEON Armenia (Beeline) 10 0 0 Azerbaijan Total 43 0 0 Azerbaijan Azercell 10 0 0 Azerbaijan Azerfon (Nar) 11 0 0 Azerbaijan Bakcell 11 0 0 Azerbaijan Naxtel (Nakhchivan) 11 0 0 Belarus Total 42 0 0 Belarus A1 Belarus (formerly VELCOM) 10 0 0 Belarus Belarusian Cloud Technologies (beCloud) 11 0 0 Belarus Belarusian Telecommunications Network (BeST, life:)) 10 0 0 Belarus MTS Belarus 11 0 0 Bosnia and Total Herzegovina 31 0 0 Bosnia and Herzegovina BH Telecom 11 0 0 Bosnia and Herzegovina HT Mostar (HT Eronet) 10 0 0 Bosnia and Herzegovina Telekom Srpske (m:tel) 10 0 0 Bulgaria Total 53 0 0 Bulgaria A1 Bulgaria (Mobiltel) 11 0 0 Bulgaria Bulsatcom 10 0 0 Bulgaria T.com (Bulgaria) 10 0 0 Bulgaria Telenor Bulgaria 11 0 0 Bulgaria Vivacom (BTC) 11 0 0 Croatia Total 33 1 0 Croatia A1 Hrvatska (formerly VIPnet/B.net) 11 1 0 Croatia Hrvatski Telekom (HT) 11 0 0 Croatia Tele2 Croatia 11 0 0 Czechia Total 43 0 0 Czechia Nordic Telecom (formerly Air Telecom) 10 0 0 Czechia O2 Czech Republic (incl. CETIN) 11 0 0 Czechia T‐Mobile Czech Republic 11 0 0 Czechia Vodafone Czech Republic 11 0 0 Estonia Total 33 2 0 Estonia Elisa Eesti (incl. -

Single Wholesale Networks Lessons from Existing and Earlier Projects

Single Wholesale Networks Lessons From Existing and Earlier Projects December 2019 Copyright © 2019 GSMA SINGLE WHOLESALE NETWORKS – LESSONS FROM EXISTING AND EARLIER PROJECTS The GSMA represents the interests of mobile operators worldwide, uniting more than 750 operators with over 350 companies in the broader mobile ecosystem, including handset and device makers, software companies, equipment providers and internet companies, as well as organisations in adjacent industry sectors. The GSMA also produces the industry-leading MWC events held annually in Barcelona, Los Angeles and Shanghai, as well as the Mobile 360 Series of regional conferences. For more information, please visit the GSMA corporate website at www.gsma.com. Follow the GSMA on Twitter: @GSMA. SINGLE WHOLESALE NETWORKS – LESSONS FROM EXISTING AND EARLIER PROJECTS Contents What is an SWN? 2 Why do countries want to do it/What issues are they hoping to solve? 3 What is the status of existing deployments? 3 What are the disadvantages? 4 What are the alternatives? 5 What is the GSMA’s position? 5 1 SINGLE WHOLESALE NETWORKS – LESSONS FROM EXISTING AND EARLIER PROJECTS What is an SWN? Policymakers in some countries are considering establishing single While there are variations in the SWN proposals discussed and wholesale networks (SWNs) or wholesale open access networks implemented by different governments, SWNs can be generally (WOAN) instead of relying on competing mobile networks to defined as government-initiated network monopolies that compel deliver mobile broadband services in their country. Most of these mobile operators and others to rely on wholesale services provided proposals specify at least partial network ownership and financing by the SWN as they serve and compete for retail customers. -

Ready for Upload GCD Wls Networks

LTE‐ LTE‐ REGION COUNTRY OPERATOR LTE Advanced Advanced Pro Eastern Europe 92 55 2 Albania Total 320 Albania ALBtelecom 100 Albania Telekom Albania 110 Albania Vodafone Albania 110 Armenia Total 310 Armenia MTS Armenia (VivaCell‐MTS) 100 Armenia Ucom (formerly Orange Armenia) 110 Armenia VEON Armenia (Beeline) 100 Azerbaijan Total 430 Azerbaijan Azercell 100 Azerbaijan Azerfon (Nar) 110 Azerbaijan Bakcell 110 Azerbaijan Naxtel (Nakhchivan) 110 Belarus Total 420 Belarus Belarusian Cloud Technologies (beCloud) 110 Belarusian Telecommunications Network Belarus (BeST, life:)) 100 Belarus MTS Belarus 110 Belarus VELCOM (A1 Belarus) 100 Bosnia and Herzegovina Total 300 Bosnia and Herzegovina BH Telecom 100 Bosnia and Herzegovina HT Mostar (HT Eronet) 100 Bosnia and Herzegovina Telekom Srpske (m:tel) 100 Bulgaria Total 530 Bulgaria A1 Bulgaria (Mobiltel) 110 Bulgaria Bulsatcom 100 Bulgaria T.com (Bulgaria) 100 Bulgaria Telenor Bulgaria 110 Bulgaria Vivacom (BTC) 110 Croatia Total 321 Croatia A1 Croatia (VIPnet incl. B.net) 111 Croatia Hrvatski Telekom (HT) 110 Croatia Tele2 Croatia 100 Czech Republic Total 430 Czech Republic Nordic Telecom (formerly Air Telecom) 100 Czech Republic O2 Czech Republic (incl. CETIN) 110 Czech Republic T‐Mobile Czech Republic 110 Czech Republic Vodafone Czech Republic 110 Estonia Total 330 Estonia Elisa Eesti (incl. Starman) 110 Estonia Tele2 Eesti 110 Telia Eesti (formerly Eesti Telekom, EMT, Estonia Elion) 110 Georgia Total 630 Georgia A‐Mobile (Abkhazia) 100 Georgia Aquafon GSM (Abkhazia) 110 Georgia MagtiCom -

IFC Deal Query Based on IFC Investment Services Projects

IFC Deal Query Based on IFC Investment Services Projects Date Disclosed Project Name Project Number Product Line 07/23/2021 DCM UBP Social Bond 44900 Loan 07/07/2021 RATCH Loan 43901 Loan 07/01/2021 HDFC II 44139 Loan 06/30/2021 Erste_CRO_MREL 44745 Loan 06/30/2021 OCB green loan 43733 Loan 06/30/2021 Aspen Pharmacare 45174 Loan 06/29/2021 PSL - Ultratech 45146 Loan 06/28/2021 Banco BV SEF Credit Line 43661 Loan 06/24/2021 CTP Bond 44887 Loan 06/23/2021 WCS COVID NMBTZ 44080 Loan 06/22/2021 NSG RSE FACILITY 45366 Loan 06/15/2021 Axian Togo 44666 Loan Page 1 of 1315 09/29/2021 IFC Deal Query Based on IFC Investment Services Projects Company Name Country Sector UNION BANK OF THE Philippines Financial Institutions PHILIPPINES RH INTERNATIONAL Thailand Infrastructure (SINGAPORE) CORPORATION PTE. LTD. HOUSING DEVELOPMENT India Financial Institutions FINANCE CORPORATION LIMITED ERSTE & Croatia Financial Institutions STEIERMARKISCHE BANK D. D. ORIENT COMMERCIAL Vietnam Financial Institutions JOINT STOCK BANK ASPEN FINANCE South Africa other PROPRIETARY LIMITED PRECIOUS SHIPPING Thailand Infrastructure PUBLIC COMPANY LIMITED BANCO VOTORANTIM S.A. Brazil Financial Institutions CTP N.V. Central Europe Region other NMB BANK PLC Tanzania Financial Institutions NSG UK ENTERPRISES Argentina Manufacturing LIMITED LA SOCIETE HOLDING Togo Telecommunications, Media, and Technology Page 2 of 1315 09/29/2021 IFC Deal Query Based on IFC Investment Services Projects Environmental Category Department Status FI-2 Regional Industry - FIG Asia & Pac Active B Regional -

Prepared for Upload GCD Wls Networks

Region Country Operator LTE LTE‐Advanced 5G Europe 171 123 77 Albania Total 32 0 Albania ALBtelecom 10 0 ONE Telecommunications (formerly Albania Telekom Albania) 11 0 Albania Vodafone Albania (incl. ABCom) 11 0 Andorra Total 11 0 Andorra Andorra Telecom 11 0 Austria Total 33 3 Austria A1 Telekom Austria 11 1 Austria Hutchison Drei Austria 11 1 Austria T‐Mobile Austria (Magenta Telekom) 11 1 Belarus Total 43 1 Belarus A1 Belarus 10 1 Belarus Belarusian Cloud Technologies (beCloud) 11 0 Belarusian Telecommunications Network Belarus (BeST, life:)) 11 0 Belarus MTS Belarus 11 0 Belgium Total 33 1 Belgium Orange Belgium 11 0 Belgium Proximus 11 1 Belgium Telenet (incl. BASE) 11 0 Bosnia‐ Herzegovina Total 31 0 Bosnia‐Herzegovina BH Telecom 11 0 Bosnia‐Herzegovina HT Mostar (HT Eronet) 10 0 Bosnia‐Herzegovina Telekom Srpske (m:tel) 10 0 Bulgaria Total 53 2 Bulgaria A1 Bulgaria (Mobiltel) 11 1 Bulgaria Bulsatcom 10 0 Bulgaria T.com (Bulgaria) 10 0 Bulgaria Telenor Bulgaria 11 0 Bulgaria Vivacom (BTC) 11 1 Croatia Total 33 1 Croatia A1 Hrvatska (formerly VIPnet/B.net) 11 0 Croatia Hrvatski Telekom (HT) 11 1 Croatia Telemach Hrvatska (formerly Tele2) 11 0 Cyprus Total 32 1 Cyprus Cytamobile‐Vodafone 11 1 Cyprus Epic (previously MTN Cyprus) 11 0 Cyprus PrimeTel (Cyprus) 10 0 Czech Republic Total 43 3 Czech Republic Nordic Telecom 10 0 Czech Republic O2 Czech Republic (incl. CETIN) 11 1 Czech Republic T‐Mobile Czech Republic 11 1 Czech Republic Vodafone Czech Republic 11 1 Denmark Total 54 4 Denmark Hi3G Access (3) 11 1 Denmark Net 1 Denmark 10 0 Denmark TDC (incl. -

Telecom Security During a Pandemic

Telecom Security During A Pandemic Telecom security good practices and lessons learned from the COVID-19 outbreak NOVEMBER 2020 0 TELECOM SECURITY DURING A PANDEMIC November 2020 ABOUT ENISA The European Union Agency for Cybersecurity (ENISA) is the Union’s agency dedicated to achieving a high common level of cybersecurity across Europe. Established in 2004 and strengthened by the EU Cybersecurity Act, the European Union Agency for Cybersecurity contributes to EU cyber policy, enhances the trustworthiness of ICT products, services and processes with cybersecurity certification schemes, cooperates with Member States and EU bodies and helps Europe prepare for the cyber challenges of tomorrow. Through knowledge sharing, capacity building and awareness raising, the Agency works together with its key stakeholders to strengthen trust in the connected economy, to boost resilience of the Union’s infrastructure, and, ultimately, to keep Europe’s society and citizens digitally secure. For more information, visit www.enisa.europa.eu. CONTACT To contact the authors please email [email protected]. For media enquiries about this paper, please email [email protected]. AUTHORS Georgia Bafoutsou (ENISA) and Marnix Dekker (ENISA). ACKNOWLEDGEMENTS To support the stocktaking and the analysis, ENISA contracted Mojca Volk, Ph.D., University of Ljubljana via the ENISA call for expressions of interest framework. We are grateful for the useful early input on this project from Oscar Koeroo, Paul Slootmaker (KPN), Alejandro Becerra and Edi Fernando (Telefónica). This ENISA paper has been reviewed by the Article 13a group and the document contains input from this group. LEGAL NOTICE Notice must be taken that this publication represents the views and interpretations of ENISA, unless stated otherwise. -

October 1, 2020 CEO Helmut Duhs, A1 Belarus CEO Thomas Arnoldner

October 1, 2020 CEO Helmut Duhs, A1 Belarus CEO Thomas Arnoldner, A1 Telekom Austria Group CEO Daniel Hajj Aboumrad, América Móvil Group Re: Joint letter to A1 Belarus calling on telecom service providers in Belarus to be transparent and resist internet shutdowns Dear Helmut Duhs, Thomas Arnoldner, and Daniel Hajj Aboumrad: We, the undersigned organizations and members of the #KeepItOn coalition — a global network that unites over 220 organizations from 99 countries working to end internet shutdowns1 globally — write to urgently request that you publicly pledge your support to maintain free and open internet access in Belarus, and resist and denounce any and all orders by the Alyaksandr Lukashenka government to shut down the internet. Telecommunications companies have a duty to respect human rights and provide access to remedy. It is crucial that you exercise all possible methods to resist future internet shutdown orders in Belarus, and denounce the August and September 2020 internet shutdowns, provide information to the public about how and why they were implemented, contribute to reporting on their impact, and challenge their legality in courts. Election-related repression in Belarus has occurred online and offline. According to various reliable reports, Belarus has shut down and throttled mobile and fixed-line internet on numerous occasions since August 8, 2020. Depending on who the government was targeting, the extent and geographical coverage of these arbitrary shutdowns changed. The most widespread throttling of fixed-line and mobile internet access took place the day of the 1 An internet shutdown is defined as an intentional disruption of internet or electronic communications, rendering them inaccessible or effectively unusable, for a specific population or within a location, often to exert control over the flow of information. -

Prepared for Upload GCD Wls Networks

LTE‐ Region Country Operator LTE 5G Advanced Eastern Europe 93 60 21 Albania Total 32 0 Albania ALBtelecom 10 0 ONE Telecommunications (formerly Albania Telekom Albania) 11 0 Albania Vodafone Albania (incl. ABCom) 11 0 Armenia Total 33 0 Armenia MTS Armenia (Viva‐MTS) 11 0 Telecom Armenia (formerly VEON, Armenia trading as Beeline) 11 0 Armenia Ucom 11 0 Azerbaijan Total 43 0 Azerbaijan Azercell 10 0 Azerbaijan Azerfon (Nar) 11 0 Azerbaijan Bakcell 11 0 Azerbaijan Naxtel (Nakhchivan) 11 0 Belarus Total 43 1 Belarus A1 Belarus 10 1 Belarus Belarusian Cloud Technologies (beCloud) 11 0 Belarusian Telecommunications Network Belarus (BeST, life:)) 11 0 Belarus MTS Belarus 11 0 Bosnia‐Herzegovina Total 31 0 Bosnia‐Herzegovina BH Telecom 11 0 Bosnia‐Herzegovina HT Mostar (HT Eronet) 10 0 Bosnia‐Herzegovina Telekom Srpske (m:tel) 10 0 Bulgaria Total 53 2 Bulgaria A1 Bulgaria (Mobiltel) 11 1 Bulgaria Bulsatcom 10 0 Bulgaria T.com (Bulgaria) 10 0 Bulgaria Telenor Bulgaria 11 0 Bulgaria Vivacom (BTC) 11 1 Croatia Total 33 1 Croatia A1 Hrvatska (formerly VIPnet/B.net) 11 0 Croatia Hrvatski Telekom (HT) 11 1 Croatia Tele2 Croatia 11 0 Czech Republic Total 43 3 Czech Republic Nordic Telecom 10 0 Czech Republic O2 Czech Republic (incl. CETIN) 11 1 Czech Republic T‐Mobile Czech Republic 11 1 Czech Republic Vodafone Czech Republic 11 1 Estonia Total 33 1 Estonia Elisa Eesti (incl. Starman) 11 0 Estonia Tele2 Eesti 11 0 Telia Eesti (formerly Eesti Telekom, EMT, Estonia Elion) 11 1 Georgia Total 63 0 Georgia A‐Mobile (Abkhazia) 10 0 Georgia Aquafon GSM (Abkhazia) 11 0 Georgia MagtiCom 11 0 Georgia Ostelecom (MegaFon) (South Ossetia) 10 0 Georgia SilkNet (incl. -

Annual Financial Report 2020

Annual Financial Report 2020 The following documents are translations from the original German versions, which are solely valid. Table of Contents A1 Telekom Austria Group Group Management Report 3 Consolidated Financial Statements 34 Auditor’s Report 97 Declaration of the Management Board 101 Financial Statements Of Telekom Austria AG Financial Statements 102 Management Report 117 Auditor’s Report 130 Declaration of the Management Board 134 Consolidated Non-Financial Report According to § 267a UGB 135 A1 TELEKOM AUSTRIA GROUP — ANNUAL FINANCIAL REPORT 2020 2 Group Management Report General economic environment such as mobile WiFi routers and VPN connections. Mobile network providers offered their customers additional offerings As a result of the COVID-19 pandemic and the accompanying at reduced cost or free of charge. The market environment political measures to curb the spread of the virus, there was remained intensively competitive in both fixed-line and mobile a recession on all the A1 Telekom Austria Group’s markets in communications throughout this period. One example of this 2020. Clearly negative growth rates are expected in gross can be seen in the no-frills 2) segment in Austria, where there domestic product. In a forecast published in November 2020, was sustained pressure on prices due to the aggressive pricing the European Commission estimated the decline in economic policy of mobile virtual network operators (MVNOs). growth in the European Union for 2020 at 7.4 %. A recovery with growth of 4.1 % is assumed for 2021. The latest market report issued by the regulatory authority, which tracked the most recent market data in Austria up to the The ECB kept its key interest rate unchanged at 0.00 % and its end of the second quarter of 2020, describes the following deposit rate at –0.50 % in the year under review. -

Prepared for 5G Americas

Region Country Operator LTE 5G Europe 173 84 Albania Total 30 Albania ALBtelecom 10 ONE Telecommunications (formerly Telekom Albania Albania) 10 Albania Vodafone Albania (incl. ABCom) 10 Andorra Total 10 Andorra Andorra Telecom 10 Austria Total 33 Austria A1 Telekom Austria 11 Austria Hutchison Drei Austria 11 Austria T‐Mobile Austria (Magenta Telekom) 11 Belarus Total 41 Belarus A1 Belarus 11 Belarus Belarusian Cloud Technologies (beCloud) 10 Belarusian Telecommunications Network (BeST, Belarus life:)) 10 Belarus MTS Belarus 10 Belgium Total 31 Belgium Orange Belgium 10 Belgium Proximus 11 Belgium Telenet (incl. BASE) 10 Bosnia‐Herzegovina Total 30 Bosnia‐Herzegovina BH Telecom 10 Bosnia‐Herzegovina HT Mostar (HT Eronet) 10 Bosnia‐Herzegovina Telekom Srpske (m:tel) 10 Bulgaria Total 53 Bulgaria A1 Bulgaria (Mobiltel) 11 Bulgaria Bulsatcom 10 Bulgaria T.com (Bulgaria) 10 Bulgaria Telenor Bulgaria 11 Bulgaria Vivacom (BTC) 11 Croatia Total 31 Croatia A1 Hrvatska (formerly VIPnet/B.net) 10 Croatia Hrvatski Telekom (HT) 11 Croatia Telemach Hrvatska (formerly Tele2) 10 Cyprus Total 31 Cyprus Cytamobile‐Vodafone 11 Cyprus Epic (previously MTN Cyprus) 10 Cyprus PrimeTel (Cyprus) 10 Czech Republic Total 43 Czech Republic Nordic Telecom 10 Czech Republic O2 Czech Republic (incl. CETIN) 11 Czech Republic T‐Mobile Czech Republic 11 Czech Republic Vodafone Czech Republic 11 Denmark Total 54 Denmark Hi3G Access (3) 11 Denmark Net 1 Denmark 10 Denmark TDC (incl. Nuuday, TDC Net) 11 Denmark Telenor Denmark 11 Denmark Telia Denmark 11 Estonia Total 31 -

Europe 173 84 Albania Total 30 Albania Albtelecom 10 ONE Telecommunications (Formerly Albania Telekom Albania) 10 Albania Vodafone Albania (Incl

Region Country Operator LTE 5G Europe 173 84 Albania Total 30 Albania ALBtelecom 10 ONE Telecommunications (formerly Albania Telekom Albania) 10 Albania Vodafone Albania (incl. ABCom) 10 Andorra Total 10 Andorra Andorra Telecom 10 Austria Total 33 Austria A1 Telekom Austria 11 Austria Hutchison Drei Austria 11 Austria T‐Mobile Austria (Magenta Telekom) 11 Belarus Total 41 Belarus A1 Belarus 11 Belarus Belarusian Cloud Technologies (beCloud) 10 Belarusian Telecommunications Network Belarus (BeST, life:)) 10 Belarus MTS Belarus 10 Belgium Total 31 Belgium Orange Belgium 10 Belgium Proximus 11 Belgium Telenet (incl. BASE) 10 Bosnia‐Herzegovina Total 30 Bosnia‐Herzegovina BH Telecom 10 Bosnia‐Herzegovina HT Mostar (HT Eronet) 10 Bosnia‐Herzegovina Telekom Srpske (m:tel) 10 Bulgaria Total 53 Bulgaria A1 Bulgaria (Mobiltel) 11 Bulgaria Bulsatcom 10 Bulgaria T.com (Bulgaria) 10 Bulgaria Telenor Bulgaria 11 Bulgaria Vivacom (BTC) 11 Croatia Total 31 Croatia A1 Hrvatska (formerly VIPnet/B.net) 10 Croatia Hrvatski Telekom (HT) 11 Croatia Telemach Hrvatska (formerly Tele2) 10 Cyprus Total 31 Cyprus Cytamobile‐Vodafone 11 Cyprus Epic (previously MTN Cyprus) 10 Cyprus PrimeTel (Cyprus) 10 Czech Republic Total 43 Czech Republic Nordic Telecom 10 Czech Republic O2 Czech Republic (incl. CETIN) 11 Czech Republic T‐Mobile Czech Republic 11 Czech Republic Vodafone Czech Republic 11 Denmark Total 54 Denmark Hi3G Access (3) 11 Denmark Net 1 Denmark 10 Denmark TDC (incl. Nuuday, TDC Net) 11 Denmark Telenor Denmark 11 Denmark Telia Denmark 11 Estonia Total 31