SEGA SAMMY HOLDINGS Discussion Points

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Esports – Who Are the Big Players and the Likely

Esports – Who are the big players and the likely winners Millennial driven esports continues to grow rapidly. The number of esports enthusiasts worldwide was estimated to be ~165 million in 2018, and for total global viewers, the forecast is ~453 million in 2019. Esports global revenue is forecast to pass US$1b in 2019 and by 2022 the global eSports market revenue is forecast to reach US$1.79 billion growing at a CAGR of 22.3%. The big players in esports Activision Blizzard Inc. (NASDAQ: ATVI) Activision Blizzard owns the popular Overwatch League as well as World of Warcraft, StarCraft, Diablo, and Hearthstone. In 2018 Activision Blizzard signed a multiyear deal with Walt Disney to broadcast the Overwatch League. As of March 2018, it was the largest game company in the Americas and Europe in terms of revenue and market capitalization. Activision Blizzard has several business units: Activision Publishing, Blizzard Entertainment, King, Major League Gaming,and Activision Blizzard Studios. Alphabet Inc. (NASDAQ: GOOGL) Alphabet (Google) has a new cloud gaming platform called Stadia. It operates games hosted on remote servers and then streams video content to connected devices, including smartphones, tablets, computers and TVs. Other competitors in the streaming space include Amazon (Twitch), Facebook, Twitter, Microsoft, Tencent, and Alibaba. Amazon (NASDAQ: AMZN) Amazon’s Twitch leads the online USA streaming market. Amazon acquired Twitch for nearly $1 billion in 2014. Twitch is only a very small percentage of Amazon’s massive revenue. Electronic Arts Inc. (NASDAQ: EA) Electronic Arts is an American video game company headquartered in California. It is the second-largest gaming company in the Americas and Europe by revenue and market capitalization. -

Sega Sammy Holdings Integrated Report 2019

SEGA SAMMY HOLDINGS INTEGRATED REPORT 2019 Challenges & Initiatives Since fiscal year ended March 2018 (fiscal year 2018), the SEGA SAMMY Group has been advancing measures in accordance with the Road to 2020 medium-term management strategy. In fiscal year ended March 2019 (fiscal year 2019), the second year of the strategy, the Group recorded results below initial targets for the second consecutive fiscal year. As for fiscal year ending March 2020 (fiscal year 2020), the strategy’s final fiscal year, we do not expect to reach performance targets, which were an operating income margin of at least 15% and ROA of at least 5%. The aim of INTEGRATED REPORT 2019 is to explain to stakeholders the challenges that emerged while pursuing Road to 2020 and the initiatives we are taking in response. Rapidly and unwaveringly, we will implement initiatives to overcome challenges identified in light of feedback from shareholders, investors, and other stakeholders. INTEGRATED REPORT 2019 1 Introduction Cultural Inheritance Innovative DNA The headquarters of SEGA shortly after its foundation This was the birthplace of milestone innovations. Company credo: “Creation is Life” SEGA A Host of World and Industry Firsts Consistently Innovative In 1960, we brought to market the first made-in-Japan jukebox, SEGA 1000. After entering the home video game console market in the 1980s, The product name was based on an abbreviation of the company’s SEGA remained an innovator. Representative examples of this innova- name at the time: Service Games Japan. Moreover, this is the origin of tiveness include the first domestically produced handheld game the company name “SEGA.” terminal with a color liquid crystal display (LCD) and Dreamcast, which In 1966, the periscope game Periscope became a worldwide hit. -

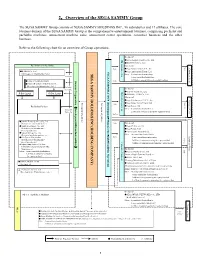

2.Overview of the SEGA SAMMY Group

2.Overview of the SEGA SAMMY Group The SEGA SAMMY Group consists of SEGA SAMMY HOLDINGS INC., 96 subsidiaries and 17 affiliates. The core business domain of the SEGA SAMMY Group is the comprehensive entertainment business, comprising pachislot and pachinko machines, amusement machine sales, amusement center operations, consumer business and the other business. Refer to the following chart for an overview of Group operations. 《In Japan》 AM machine sales machine AM ●SEGA Logistics Service Co., Ltd. ●DARTSLIVE Co., Ltd. Pachislot and Pachinko 《Overseas》 Sale Customers (DevelopmentCORPORATION SEGA Sale ●Sega Amusements U.S.A., Inc. ●RODEO Co., Ltd. ●Sega Amusements Europe Ltd. (Development・Manufacture・Sale ) SEGA SAMMY HOLDINGS INC.(HOLDING COMPANY) Other : 2 consolidated subusidiary Pachislot ・ 1 non-consolidatd subsidiary Users Sammy CorporationSammy 1 affiliated company using the equity method ●GINZA CORPORATION Sale ●GINZAHANBAI CORPORATION ・ ・ (Development Manufacture Sale ) Pachislot 《In Japan》 Pachinko center operationAM ●OASYS PARK Co., Ltd. Sales Agent Sales Agent ●SEGA Bee LINK Co., Ltd. 《Overseas》 ●Sega Entertainment U.S.A., Inc. Customers Service Management guidanceManagement guidanceManagement ●Sega Amusements Taiwan Ltd. ( Sale Pachinko Parlors ●Sega Korea, Ltd. Development ・ Pachislot Other : 6 consolidated subsidiaries Users Pachinko 2 affiliated companies using the equity method Service ・ Manufacture ●Sammy Rental Services Co., Ltd. (Rental lease and maintenance) ・ Sale 《Overseas》 Manufacture ●Shuko Electronics Co., Ltd. ●Sega of America, Inc. (Development・Manufacture・ ●Sega Europe Ltd. Sale of peripherals) ●The Creative Assembly Ltd. ●Sammy Design Co., Ltd. ・ Other : 16 consolidated subsidiaries (Design of pachinko parlors, etc.) Customers Sale ● Sale 2 non-consolidatd subsidiaries H-I System Corporation Service (Development・Manufacture・ ・ ・ 2 affiliated companies using the equity method Sale Consumer businessConsumer Operation) Facilities Sale of peripherals) 4 affiliated companies non-using the equity method △Japan Setup Service Co., Ltd. -

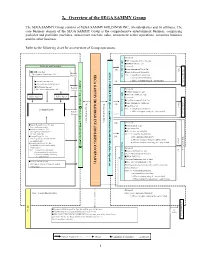

2.Overview of the SEGA SAMMY Group

2.Overview of the SEGA SAMMY Group The SEGA SAMMY Group consists of SEGA SAMMY HOLDINGS INC., 86 subsidiaries and 16 affiliates. The core business domain of the SEGA SAMMY Group is the comprehensive entertainment business, comprising pachislot and pachinko machines, amusement machine sales, amusement center operations, consumer business and the other business. Refer to the following chart for an overview of Group operations. 《In Japan》 AM machine sales ●SEGA Logistics Service Co., Ltd. ● DARTSLIVE Co., Ltd. Pachislot and Pachinko 《Overseas》 Sale Customers SEGA CORPORATION (Development CORPORATION SEGA Sale ●Sega Amusements U.S.A., Inc. ●RODEO Co., Ltd. ●Sega Amusements Europe Ltd. (Development・Manufacture・Sale ) SEGA SAMMY HOLDINGS INC.(HOLDINGCOMPANY) Pachislot Other : 2 consolidated subusidiary ・ 1 non-consolidatd subsidiary Users Sammy Corporation 1 affiliated company using the equity method ●GINZA CORPORATION Sale ●GINZAHANBAI CORPORATION ●TAIYO ELEC Co.,Ltd. Pachislot (Development・Manufacture・Sale ) 《In Japan》 Pachinko operation AM center ●OASYS PARK Co., Ltd. ●SEGA Bee LINK Co., Ltd. Sales Agent Sales Agent 《Overseas》 ●Sega Entertainment U.S.A., Inc. Customers Service Management guidance Management guidance ●Sega Amusements Taiwan Ltd. ( Sale ●Sega Korea Ltd. Development ・ Pachinko Parlors Other : 5 consolidated subsidiaries Users Pachislot 2 affiliated companies using the equity method Pachinko Service ・ Manufacture ・ Sale 《Overseas》 Manufacture ●Sammy Rental Services Co., Ltd. ●Sega of America, Inc. (Lease and maintenance) ●Sega Europe Ltd. ●Sammy Systems Co., Ltd. (Development・Manufacture・ ●The Creative Assembly Ltd. Sale of peripherals) ・ Other : 18 consolidated subsidiaries Customers Sale ●Sammy Design Co., Ltd. Sale 2 non-consolidatd subsidiaries (Planning, design, construction of) Service ・ ・ 2 affiliated companies using the equity method pachinko parlors.) Sale Consumer business Facilities Operation) △Japan Setup Service Co., Ltd. -

Sega Sammy Holdings Integrated Report 2019

SEGA SAMMY HOLDINGS INTEGRATED REPORT 2019 Challenges & Initiatives Since fiscal year ended March 2018 (fiscal year 2018), the SEGA SAMMY Group has been advancing measures in accordance with the Road to 2020 medium-term management strategy. In fiscal year ended March 2019 (fiscal year 2019), the second year of the strategy, the Group recorded results below initial targets for the second consecutive fiscal year. As for fiscal year ending March 2020 (fiscal year 2020), the strategy’s final fiscal year, we do not expect to reach performance targets, which were an operating income margin of at least 15% and ROA of at least 5%. The aim of INTEGRATED REPORT 2019 is to explain to stakeholders the challenges that emerged while pursuing Road to 2020 and the initiatives we are taking in response. Rapidly and unwaveringly, we will implement initiatives to overcome challenges identified in light of feedback from shareholders, investors, and other stakeholders. INTEGRATED REPORT 2019 1 Introduction Cultural Inheritance Innovative DNA The headquarters of SEGA shortly after its foundation This was the birthplace of milestone innovations. Company credo: “Creation is Life” SEGA A Host of World and Industry Firsts Consistently Innovative In 1960, we brought to market the first made-in-Japan jukebox, SEGA 1000. After entering the home video game console market in the 1980s, The product name was based on an abbreviation of the company’s SEGA remained an innovator. Representative examples of this innova- name at the time: Service Games Japan. Moreover, this is the origin of tiveness include the first domestically produced handheld game the company name “SEGA.” terminal with a color liquid crystal display (LCD) and Dreamcast, which In 1966, the periscope game Periscope became a worldwide hit. -

Sega Sammy Holdings Inc

Feature Article: Start of the New SEGA Group Start of the New SEGA Group In accordance with the Group structure reform, the new SEGA Group was launched in April 2015. Through Continuing to Create Moving Experiences for our customers and the construction of new business models, the new the the SEGA Group will transform into a “Game Changer” that redefines games, industries, and lifestyles in the world, and realize Group Value sustainable growth in the earnings of theBE Group. A GAMECreation is Life On April 1, 2015, upon the launch of the new SEGA Group, the SEGA Group formu- lated a Group Value we must cherish, a Mission we must accomplish, and a Vision that the SEGA Group should strive for. The SEGA Group was once a group that had a significant impact on lifestyles of CHANGERMission Vision people around the world. Each and every employee of the SEGA Group shall once Continuing to again become a Game Changer, or a revolutionary who creates products that would Be a Game move people’s hearts, and provide all kinds of entertainment. Create Moving Changer. To mark this occasion, we have presented the resolution of the SEGA Group in a Experiences video and published it on our website. Please watch it when you have the chance. http://mission-vtr.sega.jp/ Digital Game Area In the digital game area, we are rapidly heightening our market presence, through the Growth expected in our core business, the digital game area! combination of the SEGA Group’s abundant development resources and group of experts on business model construction. -

Sega Sammy Holdings Inc

Review of Activities Looking back with a “Key Person” Review of Activities up to the Second Quarter Tomo, latest title in the Pachislot Hokuto No Ken series, This year’s newly released titles start strong! began operations on September 7! Keep an eye on Hortensia SAGA, Operations began on September 7, 2015 for Pa- MONSTER GEAR and Sen-no-kaizoku! chislot Hokuto No Ken Tomo, the latest title in the SEGA Games SEGA Networks Company’s product line is Pachislot Hokuto No Ken series, which recorded growing ever more plentiful, with a collection of games in the highest number of unit sales in pachislot history genres and worlds that meet the needs of diversifying player Hortensia SAGA with the launch of its first generation title in 2003. base. ©SEGA / f4samurai This machine was developed as the culmination of Released in April 2015, Hortensia SAGA surpassed 3 mil- the series with “inheritance of the classic” and lion downloads in October. This RPG is an epic tale of war, “evolution of the classic” as its concepts. In addi- in which players learn about the history woven by myriad tion to inheriting the most beloved gameplay in pa- knights at the mercy of fates in the war. chislot history from the first generation Pachislot MONSTER GEAR (released in May) also surpassed 3 mil- Hokuto No Ken, and expanding upon the game- lion downloads in August. Anyone can enjoy the authentic MONSTER GEAR play of the previous title Pachislot Hokuto No Ken hunting action immediately, with the easy controls of this ©SEGA Chapter of Resurrection, its unique housing livens new era hunting action RPG from SEGA. -

VALIC Co I Form NPORT-P Filed 2021-04-29

SECURITIES AND EXCHANGE COMMISSION FORM NPORT-P Filing Date: 2021-04-29 | Period of Report: 2021-02-28 SEC Accession No. 0001752724-21-088119 (HTML Version on secdatabase.com) FILER VALIC Co I Mailing Address Business Address HARBORSIDE 5 HARBORSIDE 5 CIK:719423| IRS No.: 720029692 | State of Incorp.:MD | Fiscal Year End: 0531 185 HUDSON STREET, 185 HUDSON STREET, Type: NPORT-P | Act: 40 | File No.: 811-03738 | Film No.: 21866428 SUITE 3300 SUITE 3300 JERSEY CITY NJ 07311 JERSEY CITY NJ 07311 201-324-6378 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document VALIC Company I Asset Allocation Fund PORTFOLIO OF INVESTMENTS - February 28, 2021 - (unaudited) Shares/ Principal Value Security Description Amount(7) (Note 1) COMMON STOCKS - 59.1% Aerospace/Defense - 0.8% Northrop Grumman Corp. 4,087 $1,192,014 Applications Software - 4.0% Microsoft Corp. 25,318 5,883,397 Auto-Cars/Light Trucks - 1.1% Tesla, Inc. 2,379 1,607,015 Banks-Commercial - 2.2% Regions Financial Corp. 23,650 487,900 Truist Financial Corp. 48,414 2,757,661 3,245,561 Banks-Super Regional - 1.9% Huntington Bancshares, Inc. 32,372 496,587 KeyCorp 42,139 848,679 Wells Fargo & Co. 41,330 1,494,906 2,840,172 Beverages-Non-alcoholic - 1.5% Coca-Cola Co. 46,376 2,271,960 Brewery - 0.8% Constellation Brands, Inc., Class A 5,352 1,146,077 Cable/Satellite TV - 0.4% Charter Communications, Inc., Class A 951 583,362 Chemicals-Diversified - 0.3% Eastman Chemical Co. -

Sega Sammy Holdings Inc

Contents Key Points of Financial Results by the Numbers P1 SEGA SAMMY in 2015 Interim A Message from P 3 Management Segment P 5 Information Feature Article P7 Start of the New Sega Group Looking back with a “Key Person” P 9 Review of Activities up to the Second Quarter Tomo, latest title in the Pachislot Hokuto No Ken series, began opera- tions on September 7! This year’s newly released titles start strong! Keep an eye on Hortensia SAGA, MONSTER GEAR and Sen-no-kaizoku! P12 Latest News P13 Group Information Winter Business Report for the six months ended September 30, 2015 Edition From April 1, 2015 to September 30, 2015 SEGA SAMMY HOLDINGS INC. Stock Code 6460 Key Points of Financial Results by the Numbers First Half of FY2016 (Fiscal year ending March 31, 2016) SEGA SAMMY in 2015Interim Net Sales (billions of yen) Operating Income (billions of yen) Profit Attributable to Net sales Operating income First Half First Half Owners of Parent (billions of yen) Full Year Full Year First Half 420.0 Full Year 19.0 First half First half (Forecast) 25.0 (Forecast) 366.8 (Forecast) 17.4 0.9 billion billion 158.1 154.3 5.7 (2.8) ¥154.3 ¥ 5.7 2.7 (down 2% year on year) (up 111% year on year) (11.3) 2015/3 2016/3 2015/3 2016/3 2015/3 2016/3 In the Pachislot and Pachinko Machines Business, although we launched main- * From the fiscal year ending March 31, 2016, we have changed our accounting standards for net sales from shipment basis to delivery basis. -

“Multi Stage Payout-Ratio” to Pachinko Machines

FY Ended March 2018 Appendix May 11th, 2018 [Disclaimer] The contents of this material and comments made during the questions and answers etc of this briefing session are the judgment and projections of the Company’s management based on currently available information. These contents involve risk and uncertainty and the actual results may differ materially from these contents/comments. © SEGA SAMMY HOLDINGS INC. All Rights Reserved. Consolidated Income Statements (Summary) (JPY Billion) 2017/3 2018/3 2019/3 Through Through Through Through Through Through Forecast 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q Sales 70.6 169.5 285.7 366.9 107.2 194.7 260.8 323.6 390.0 Pachislot and Pachinko Machines 21.2 64.9 119.7 148.2 54.9 88.3 95.4 105.6 122.0 Entertainment Contents 46.7 97.8 155.4 205.7 50.2 101.5 157.9 208.0 258.0 Resort 2.6 6.7 10.5 13.0 2.0 4.7 7.3 9.9 10.0 Operating Income 3.0 15.3 35.0 29.5 16.6 26.8 25.6 17.7 21.0 Pachislot and Pachinko Machines 0.3 10.6 25.8 26.3 15.1 21.4 15.1 11.9 18.5 Entertainment Contents 4.9 9.1 15.3 11.1 3.7 10.1 17.2 14.8 13.5 Resort -0.8 -1.3 -1.8 -2.2 -0.7 -1.2 -1.8 -2.5 -3.0 Other / Elimination -1.4 -3.1 -4.3 -5.7 -1.5 -3.4 -4.9 -6.5 -8.0 Operating Income Margin 4.2% 9.0% 12.3% 8.0% 15.5% 13.8% 9.8% 5.5% 5.4% Ordinary Income 2.9 15.4 35.3 28.5 16.2 25.2 24.3 14.5 16.0 Extraordinary Gain 1.5 11.9 12.8 13.3 0.5 0.8 0.8 0.9 1.0 Extraordinary Loss 0.1 0.3 5.2 8.1 0.3 0.4 0.7 3.1 - Income before income taxes 4.3 27.1 43.0 33.7 16.4 25.6 24.4 12.4 17.0 Profit attributable to owners of parent 4.1 24.2 36.5 27.6 11.5 17.7 13.7 8.9 12.0 Dividends per share (JPY) - 20.00 20.00 40.00 - 20.00 20.00 40.00 40.00 Earnings per share (JPY) 17.54 103.47 155.84 117.79 49.22 75.78 58.68 38.10 51.20 Net Assets per share (JPY) 1,215.03 1,292.06 1,356.30 1,313.06 1,353.20 1,380.42 1,339.46 1,313.90 - - 2 - © SEGA SAMMY HOLDINGS INC. -

2020/08/05 Fiscal Year Ending March 2021 1Q Results Appendix

Fiscal Year Ending March 2021 1Q Results Appendix August 5, 2020 [Disclaimer] Market forecasts, operating results forecast, and other information contained in this materials are based on judgements and projections of the Company’s managements based on currently available information. Therefore, please understand that the contents herein involve risks and uncertainties and that actual results could differ materially depending on various factors. © SEGA SAMMY HOLDINGS INC. All Rights Reserved. Results Highlights 1Q Results Forecast ◆ Significant decline in sales YoY and recording of ◆ Expected to record losses for the full year assuming losses. the impact of COVID-19 will remain. Consolidated ✓ Pachislot and Pachinko Machines Business, ◆ Undertake structural reforms. Business Amusement Machine Sales & Amusement Center ◆ Dividend plan is not yet determined. Operations and Resort Business are heavily influenced by COVID-19. ◆ Sales decreased YoY and recorded losses as no ◆ Sales decrease YoY and recording losses due to Pachislot and new title launched. the decrease of unit sales. Pachinko ✓ Delayed the release of new titles considering the ✓ Unit sales decrease YoY for both pachislot and Machines impact of COVID-19 on Pachinko halls. pachinko. Business ✓ Sales were mainly attributable to Sammy Networks ✓ Launch titles to coincide with the demand for and etc. replacement at the end of 2020. ◆ Sales decreased but profit increased YoY due to ◆ Despite the contribution of Consumer area, profit strong performance in Consumer area. decreased significantly YoY due to spread losses in Amusement Machine Sales and Amusement Center ✓ Consumer area performed strong centered on Operation area. Entertainment repeat sales overseas. ✓ Recorded losses in Amusement Machine Sales ✓ The profit of Consumer area is expected to be Contents and Amusement Center Operation due to the increased significantly Business temporary closure and a decline in utilization of ✓ Proceed the optimization of business and shift of R&D facilities.