Analysing the Heavy Goods Vehicle “Écotaxe” in France: Why Did a Promising Idea Fail in Implementation? T

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Implementing Pricing Schemes to Meet a Variety of Transportation Goals 09/26/2019 6

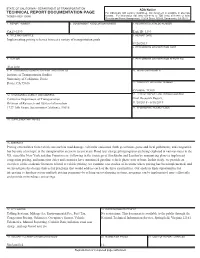

STATE OF CALIFORNIA • DEPARTMENT OF TRANSPORTATION ADA Notice TECHNICAL REPORT DOCUMENTATION PAGE For individuals with sensory disabilities, this document is available in alternate TR0003 (REV 10/98) formats. For information call (916) 654-6410 or TDD (916) 654-3880 or write Records and Forms Management, 1120 N Street, MS-89, Sacramento, CA 95814. 1. REPORT NUMBER 2. GOVERNMENT ASSOCIATION NUMBER 3. RECIPIENT'S CATALOG NUMBER CA19-3399 Task ID: 3399 4. TITLE AND SUBTITLE 5. REPORT DATE Implementing pricing schemes to meet a variety of transportation goals 09/26/2019 6. PERFORMING ORGANIZATION CODE 7. AUTHOR 8. PERFORMING ORGANIZATION REPORT NO. Alan Jenn 9. PERFORMING ORGANIZATION NAME AND ADDRESS 10. WORK UNIT NUMBER Institute of Transportation Studies University of California, Davis 11. CONTRACT OR GRANT NUMBER Davis, CA 95616 65A0686, TO 09 12. SPONSORING AGENCY AND ADDRESS 13. TYPE OF REPORT AND PERIOD COVERED California Department of Transportation Final Research Report, Division of Research and System Information 11/20/2018 - 6/30/2019 1727 30th Street, Sacramento California, 95618 14. SPONSORING AGENCY CODE 15. SUPPLEMENTARY NOTES 16. ABSTRACT Pricing externalities from vehicle use such as road damage, vehicular emissions (both greenhouse gases and local pollutants), and congestion has become a hot topic in the transportation sector in recent years. Road user charge pilot programs are being explored in various states in the US, cities like New York and San Francisco are following in the footsteps of Stockholm and London by announcing plans to implement congestion pricing, and numerous cities and countries have announced gasoline vehicle phase-outs or bans. In this study, we provide an overview of the academic literature related to vehicle pricing, we examine case studies of locations where pricing has been implemented, and we investigate the design choices for programs that would address each of the three externalities. -

Gunpowder Empires

Gunpowder Empires James Gelvin “Modern Middle East” Part 1 - Chapter 2 expanded lecture notes by Denis Bašić Gunpowder Empires • These empires established strong centralized control through employing the military potential of gunpowder (naval and land-based siege cannons were particularly important). • The major states of the Western Hemisphere were destroyed by European gunpowder empires while throughout the Eastern Hemisphere, regional empires developed on the basis of military power and new centralized administrations. • The world gunpowder empires were : the Ottoman, Safavid, Moghul, Habsburg, Russian, Chinese, and Japanese. • Emperor vs. King Military Patronage State • brought to the Middle East by Turkic and Mongolian rulers • Their three main characteristics are : • they were essentially military • all economic resources belonged to the chief military family or families • their laws combined dynastic laws, local laws, and Islamic law (shari’a) Ottoman Empire - 1st Islamic gunpowder empire • The Ottoman Empire was the first of the three Islamic empires to harness gunpowder. • Most probably the Ottomans learned of gunpowder weapons from renegade Christians and used it to devastating effects in the Battle of Kosovo in 1389. • The Ottomans used the largest cannons of the time to destroy the walls and conquer Constantinople in 1453. They conquered Constantinople the same year when the Hundred Years’ (116-year) War in Europe ended. The Siege of Constantinople (painted 1499) Sultan Mehmed II (1432-1481) on the road to the siege of Constantinople painter : Fausto Zonaro (1854-1929) The Great Ottoman Bombard Prior to the siege of Constantinople it is known that the Ottomans held the ability to cast medium-sized cannon, yet nothing near the range of some pieces they were able to put to field. -

Taxation and Voting Rights in Medieval England and France

TAXATION AND VOTING RIGHTS IN MEDIEVAL ENGLAND AND FRANCE Yoram Barzel and Edgar Kiser ABSTRACT We explore the relationship between voting rights and taxation in medieval England and France. We hypothesize that voting was a wealth-enhancing institution formed by the ruler in order to facili- tate pro®table joint projects with subjects. We predict when voting rightsand tax paymentswill be linked to each other, as well asto the projectsinducing them, and when they will become separated. We classify taxes into three types: customary, consensual and arbitrary. Customary taxes that did not require voting were dominant in both countriesin the early medieval period. Thesepay- ments, ®xed for speci®c purposes, were not well suited for funding new, large-scale projects. Consensual taxation, in which voting rightsand tax paymentswere tightly linked, wasusedto ®nance new, large-scale collective projects in both England and France. Strong rule-of-law institutions are necessary to produce such taxes. In England, where security of rule remained high, the rela- tionship between tax payments and voting rights was maintained. In France, an increase in the insecurity of rule, and the accompany- ing weakening of voting institutions, produced a shift to arbitrary taxation and a disjunction between tax payments and voting rights. These observations, as well as many of the details we con- sider, are substantially in conformity with the predictions of our model. KEY WORDS . medieval history . taxation . voting Introduction The relationship between taxation and voting rights has been a central issue in political philosophy and the cause of signi®cant poli- tical disputes, as `no taxation without representation' exempli®es. -

The Inward Investment and International Taxation Review

The Inward Investment and International Taxation Review Third Edition Editor Tim Sanders Law Business Research The Inward Investment and International Taxation Review THIRD EDITION Reproduced with permission from Law Business Research Ltd. This article was first published in The Inward Investment and International Taxation Review, 3rd edition (published in January 2013 – editor Tim Sanders). For further information please email [email protected] The Inward Investment and International Taxation Review THIRD EDITION Editor Tim Sanders Law Business Research Ltd The Law Reviews THE MERGERS AND ACQUISITIONS REVIEW THE RESTRUCTURING REVIEW THE PRIVatE COMPETITION ENFORCEMENT REVIEW THE DISPUTE RESOLUTION REVIEW THE EMPLOYMENT LAW REVIEW THE PUBLIC COMPETITION ENFORCEMENT REVIEW THE BANKING REGUlatION REVIEW THE INTERNatIONAL ARBITRatION REVIEW THE MERGER CONTROL REVIEW THE TECHNOLOGY, MEDIA AND TELECOMMUNICatIONS REVIEW THE INWARD INVESTMENT AND INTERNatIONAL TAXatION REVIEW THE CORPORatE GOVERNANCE REVIEW THE CORPORatE IMMIGRatION REVIEW THE INTERNatIONAL INVESTIGatIONS REVIEW THE PROJECts AND CONSTRUCTION REVIEW THE INTERNatIONAL CAPItal MARKEts REVIEW THE REAL EstatE LAW REVIEW THE PRIVatE EQUITY REVIEW THE ENERGY REGUlatION AND MARKEts REVIEW THE INTELLECTUAL PROPERTY REVIEW THE ASSET MANAGEMENT REVIEW THE PRIVATE WEALTH AND PRIVATE CLIENT REVIEW THE MINING laW REVIEW THE ANTi-BriBERY AND ANTi-CORRUPTION REVIEW THE EXECUTIVE REMUNERatION REVIEW www.TheLawReviews.co.uk Contents PUBLISHER Gideon Roberton BUSINESS DEVELOPMENT MANAGERS Adam Sargent, Nick Barette MARKETING MANAGER Katherine Jablonowska PUBLISHING ASSISTANT Lucy Brewer PRODUCTION CO-ORDINatOR Lydia Gerges HEAD OF EDITORIAL PRODUCTION Adam Myers PRODUCTION EDITOR Anne Borthwick SUBEDITOR Caroline Rawson EDITor-in-CHIEF Callum Campbell MANAGING DIRECTOR Richard Davey Published in the United Kingdom by Law Business Research Ltd, London 87 Lancaster Road, London, W11 1QQ, UK © 2013 Law Business Research Ltd No photocopying: copyright licences do not apply. -

Pricing out Congestion

RESEARCH NOTE PRICING OUT CONGESTION Experiences from abroad Patrick Carvalho*† 28 January 2020 I will begin with the proposition that in no other major area are pricing practices so irrational, so out of date, and so conducive to waste as in urban transportation. — William S. Vickrey (1963)1 Summary As part of The New Zealand Initiative’s transport research series, this study focuses on the international experiences around congestion pricing, i.e. the use of road charges encouraging motorists to avoid traveling at peak times in busy routes. More than just a driving nuisance, congestion constitutes a serious global economic problem. By some estimates, congestion costs the world as much as a trillion dollars every year. In response, cities across the globe are turning to decades of scientific research and empirical support in the use of congestion charges to manage road overuse. From the first congestion charging implementation in Singapore in 1975 to London, Stockholm and Dubai in the 2000s to the expected 2021 New York City launch, myriad road pricing schemes are successfully harnessing the power of markets to fix road overcrowding – and providing valuable lessons along the way. In short, congestion charging works. The experiences of these international cities can be an excellent blueprint for New Zealand to learn from and tailor a road pricing scheme that is just right for us. By analysing the international experience on congestion pricing, this research note provides further insights towards a more rational, updated and un-wasteful urban transport system. When the price is right, a proven solution to chronic road congestion is ours for the taking. -

Zbwleibniz-Informationszentrum

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Herlin-Giret, Camille Article Avoiding and protesting taxes: Wealthy people and tax consent economic sociology_the european electronic newsletter Provided in Cooperation with: Max Planck Institute for the Study of Societies (MPIfG), Cologne Suggested Citation: Herlin-Giret, Camille (2017) : Avoiding and protesting taxes: Wealthy people and tax consent, economic sociology_the european electronic newsletter, ISSN 1871-3351, Max Planck Institute for the Study of Societies (MPIfG), Cologne, Vol. 19, Iss. 1, pp. 29-37 This Version is available at: http://hdl.handle.net/10419/175569 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte. may exercise further usage rights as specified in the indicated licence. www.econstor.eu 29 wealthy people, little is known about it except for what we find in a few book-length studies. -

How Taxation Can Increase Inequality

11. FRANCE: HOW TAXATION CAN INCREASE INEQUALITY Nicolas Frémeaux and Thomas Piketty Abstract The evolution of inequality in France is specific compared with most OECD countries. Inequality only started to rise at the end of the 1990s after a period of decline during the 1970s and the 1980. This late increase partly explains the limited effects of inequality on social, political and cultural outcomes. However, social gradients like income or education play a considerable role for fields such as health, housing, political participation or trust in institutions. France is also particular with regard to the role of taxation. This chapter provides evidence about the absence of progressivity in the tax system. We conclude that the reforms implemented during the past decade have contributed to the increase in income inequality. 1 Introduction In this chapter, we describe the evolution of inequality in France and its impact on social, political and cultural outcomes. Three points make France distinctive with respect to other rich countries. First, the increase in inequalities in France occurred later than in many countries. More specifically, income inequality declined during the 1980s. Then, inequality started to rise at the end of the 1990s and this offset the decrease observed at the beginning of the period. Second, this difference in terms of timing also influences the study of its effects since it may take time for changing inequalities to lead to social, political or cultural impacts. Third, the role of taxation is rather specific in France. The absence of progressivity in the tax system has contributed to the recent increase in income inequality. -

How Effective Are Employer-Subsidized Commute

Can Employer-Subsidized Commute Assistance Programs be Effective in a Free Parking Environment? The City of San José and the Eco-Pass Program By Ray Salvano June 2009 A Thesis Quality Research Project Submitted in Partial Fulfillment of the Requirements for the Masters of Science in Transportation Management Mineta Transportation Institute San Jose State University San José, California Can Employer-Subsidized Commute Assistance Programs be Effective in a Free Parking Environment? The City of San José and the Eco-Pass Program ________________________________________________________________________ Table of Contents Executive Summary ............................................................................................................ 3 CHAPTER 1 - INTRODUCTION 1.1 Overview of the Issue ....................................................................................... 5 1.2 What is an Eco-Pass? ........................................................................................ 6 1.3 The City of San José at a Glance ...................................................................... 6 1.4 Research Objective and Report Organization ................................................... 9 CHAPTER 2 - LITERATURE REVIEW 2.1 Introduction ..................................................................................................... 11 2.2 Focused Literature Review ............................................................................. 11 2.3 Broad-based Literature Review ..................................................................... -

NEWSLETTER June 2008 N°1 Summary

NEWSLETTER June 2008 N°1 Summary REAL ESTATE TRANSACTIONS-TAX PLANNING REAL ESTATE TRANSACTIONS Individual income tax- Purchase of the principal residence TAX PLANNING Purchase of a secondary home in France by foreign citizens settled in Monaco Individual income tax - Purchase of the principal residence Sale of a French real estate property indirectly held through a foreign vehicle Loan interest paid by a taxpayer to finance the purchase of his French 3% tax reform and its impact on offshore trust principal residence will have the benefit of a tax credit, whether French trust (Fiducie) and real estate transactions the purchase is direct or indirect through an SCI, subject to the following conditions: FAMILIES New French inheritance and gift tax provisions - the provision only applies to contracts signed after May 6, 2007; - applicable to both direct and indirect (namely via an SCI) CITIZENS OF THE WORLD investment; Stock options or the best manner to compensate - the loan must be granted by a EU Bank subject to fixed or executives and employees variable rate interest ; French Wealth tax new incentives - an indefinite loan, a “ prêt in fine”, is also allowed ; French tax cap amended - the loan must follow the special French legal provisions relating to loans under the French Consumer Code. «The purchase of the MONEGASQUE CORPORATE ISSUES principal residence now Disadvantages of branches against subsidiaries : garnishee The benefits of this provi- gives rise to a tax credit...» proceedings out in France on assets held in a foreign country sion will also apply if the Contract of employment in Monaco at a glance loan is to refinance an existing loan. -

Taxation in France Deloitte, Haskins & Sells

University of Mississippi eGrove Deloitte, Haskins and Sells Publications Deloitte Collection 1980 Taxation in France Deloitte, Haskins & Sells Follow this and additional works at: https://egrove.olemiss.edu/dl_dhs Part of the Accounting Commons, and the Taxation Commons Recommended Citation Deloitte, Haskins & Sells, "Taxation in France" (1980). Deloitte, Haskins and Sells Publications. 11. https://egrove.olemiss.edu/dl_dhs/11 This Book is brought to you for free and open access by the Deloitte Collection at eGrove. It has been accepted for inclusion in Deloitte, Haskins and Sells Publications by an authorized administrator of eGrove. For more information, please contact [email protected]. Deloitte Haskins+Sells Taxation in France International Tax and Business Service Deloitte Haskins+Sells Taxation in France International Tax and Business Service France MAY 1980 This book is based on the latest information available to Deloitte Haskins & Sells as of the above date. The office of Deloitte Haskins & Sells in France is located at the following address: PARIS 96, Avenue d'léna 75116 Paris Telephone: 723.53.21 Copyright © 1980 Deloitte Haskins & Sells New York, N.Y. All rights reserved Printed in the U.S.A. Introduction France Taxation in France is part of a series that presents information on taxation in various countries of the world. The book is intended to supply informa- tion of a general character regarding taxation in France for use as back- ground when considering the conduct of business in that country. Specific questions should be answered by reference to the laws and regulations of the country and by consultation with professional advisors in the light of the particular circumstances. -

The Effects of Road Pricing on Driver Behavior and Air Pollution

The effects of road pricing on driver behavior andair pollution Matthew Gibson, Maria Carnovale To cite this version: Matthew Gibson, Maria Carnovale. The effects of road pricing on driver behavior and air pollution. Journal of Urban Economics, Elsevier, 2015, 89, pp.62-73. 10.1016/j.jue.2015.06.005. hal-01589743 HAL Id: hal-01589743 https://hal.archives-ouvertes.fr/hal-01589743 Submitted on 19 Sep 2017 HAL is a multi-disciplinary open access L’archive ouverte pluridisciplinaire HAL, est archive for the deposit and dissemination of sci- destinée au dépôt et à la diffusion de documents entific research documents, whether they are pub- scientifiques de niveau recherche, publiés ou non, lished or not. The documents may come from émanant des établissements d’enseignement et de teaching and research institutions in France or recherche français ou étrangers, des laboratoires abroad, or from public or private research centers. publics ou privés. The eects of road pricing on driver behavior and air pollution Matthew Gibsona,∗, Maria Carnovaleb aDepartment of Economics, Williams College, Schapiro Hall, 24 Hopkins Hall Dr., Williamstown MA 01267 bCERTeT, Università Bocconi and Duke University, Duke Box 90239, Durham, NC 27708 Abstract Exploiting the natural experiment created by an unanticipated court injunction, we evaluate driver responses to road pricing. We nd evidence of intertemporal substitution toward unpriced times and spatial substitution toward unpriced roads. The eect on trac volume varies with public transit availability. Net of these responses, Milan's pricing policy reduces air pollution substantially, generating large welfare gains. In addition, we use long-run policy changes to estimate price elasticities. -

Taxes, Efficiency, and Redistribution: Discriminatory Taxation of Villages in Ottoman Palestine, Southern Syria and Transjordan in the Sixteenth Century Metin M

University of Connecticut OpenCommons@UConn Economics Working Papers Department of Economics July 2004 Taxes, Efficiency, and Redistribution: Discriminatory Taxation of Villages in Ottoman Palestine, Southern Syria and Transjordan in the Sixteenth Century metin M. Cosgel University of Connecticut Follow this and additional works at: https://opencommons.uconn.edu/econ_wpapers Recommended Citation Cosgel, metin M., "Taxes, Efficiency, and Redistribution: Discriminatory Taxation of Villages in Ottoman Palestine, Southern Syria and Transjordan in the Sixteenth Century" (2004). Economics Working Papers. 200222. https://opencommons.uconn.edu/econ_wpapers/200222 Department of Economics Working Paper Series Taxes, Efficiency, and Redistribution: Discriminatory Taxation of Villages in Ottoman Palestine, Southern Syria and Transjor- dan in the Sixteenth Century Metin Cos¸gel University of Connecticut Working Paper 2002-22R October 2002, revised July 2004 341 Mansfield Road, Unit 1063 Storrs, CT 06269–1063 Phone: (860) 486–3022 Fax: (860) 486–4463 http://www.econ.uconn.edu/ Abstract Governments can tax productive activities with either uniform or discrimina- tory rates among taxpayers. Although discriminatory rates can cause productive inefficiency and require high cost of administration, they can be preferred because of their advantage in distributional flexibility. This paper studies the discrimina- tory taxation of production in the Fertile Crescent. Using information from the Ottoman tax registers, it examines the basis, distortionary effects, and distribu- tional consequences of discriminatory rates quantitatively. The results challenge widely held beliefs about the basis for discriminatory rates in this region and the Ottoman government’s motivation in adapting systems of taxation in newly con- quered lands. Keywords: taxes, efficiency, redistribution, discriminatory rates, Ottoman Empire, Palestine, Syria, Transjordan Forthcoming in Explorations in Economic History.