Of Reasons by Topic

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2005 Washington H. Soul Pattinson and Company Limited and Controlled Entities A.B.N

WASHINGTON H. SOUL PATTINSON AND COMPANY LIMITED A.B.N. 49 000 002 728 DIRECTORS’ ANNUAL REPORT and FINANCIAL STATEMENTS 2005 WASHINGTON H. SOUL PATTINSON AND COMPANY LIMITED AND CONTROLLED ENTITIES A.B.N. 49 000 002 728 FINANCIAL SUMMARY 2001 2002 2003 2004 2005 $000 $000 $000 $000 $000 Before non regular items Total sales revenue 906,448 334,307 340,624 392,854 597,104 Operating profit after taxation and excluding outside equity............................ 45,756 65,987 78,706 81,508 105,109 Total assets employed................................ 1,381,008 1,092,348 1,115,282 1,414,693 2,220,042 Shareholders’ funds.................................. 643,017 668,436 729,926 867,509 1,260,448 Operating profit after taxation and excluding outside equity as a percentage of shareholders’ funds... 7.1% 9.9% 10.8% 9.4% 8.3% Earnings per share on adjusted issued capital (cents)..... 19.17 27.65 32.98 34.16 44.04 Ordinary Dividends per share (cents)................... 11.5 14.0 17.0 20.0 25.0 Special Dividends per share (cents).................... 4.0 5.0 5.0 10.0 15.0 After non regular items Operating profit after taxation and excluding outside equity ........................... 56,751 72,741 88,307 155,925 421,455 Earnings per share on adjusted issued capital (cents) .. 23.78 30.48 37.00 65.34 176.61 WASHINGTON H. SOUL PATTINSON AND COMPANY LIMITED A.B.N. 49 000 002 728 DIRECTORS: ROBERT D. MILLNER Chairman of Directors Director since 1984 MICHAEL J. MILLNER Non-Executive Director - Deputy Chairman Director since 1997 PETER R. -

Westpac Online Investment Loan Acceptable Securities List - Effective 3 September2021

Westpac Online Investment Loan Acceptable Securities List - Effective 3 September2021 ASX listed securities ASX Code Security Name LVR ASX Code Security Name LVR A2M The a2 Milk Company Limited 50% CIN Carlton Investments Limited 60% ABC Adelaide Brighton Limited 60% CIP Centuria Industrial REIT 50% ABP Abacus Property Group 60% CKF Collins Foods Limited 50% ADI APN Industria REIT 40% CL1 Class Limited 45% AEF Australian Ethical Investment Limited 40% CLW Charter Hall Long Wale Reit 60% AFG Australian Finance Group Limited 40% CMW Cromwell Group 60% AFI Australian Foundation Investment Co. Ltd 75% CNI Centuria Capital Group 50% AGG AngloGold Ashanti Limited 50% CNU Chorus Limited 60% AGL AGL Energy Limited 75% COF Centuria Office REIT 50% AIA Auckland International Airport Limited 60% COH Cochlear Limited 65% ALD Ampol Limited 70% COL Coles Group Limited 75% ALI Argo Global Listed Infrastructure Limited 60% CPU Computershare Limited 70% ALL Aristocrat Leisure Limited 60% CQE Charter Hall Education Trust 50% ALQ Als Limited 65% CQR Charter Hall Retail Reit 60% ALU Altium Limited 50% CSL CSL Limited 75% ALX Atlas Arteria 60% CSR CSR Limited 60% AMC Amcor Limited 75% CTD Corporate Travel Management Limited ** 40% AMH Amcil Limited 50% CUV Clinuvel Pharmaceuticals Limited 40% AMI Aurelia Metals Limited 35% CWN Crown Limited 60% AMP AMP Limited 60% CWNHB Crown Resorts Ltd Subordinated Notes II 60% AMPPA AMP Limited Cap Note Deferred Settlement 60% CWP Cedar Woods Properties Limited 45% AMPPB AMP Limited Capital Notes 2 60% CWY Cleanaway Waste -

Asx Clear – Acceptable Collateral List 28

et6 ASX CLEAR – ACCEPTABLE COLLATERAL LIST Effective from 20 September 2021 APPROVED SECURITIES AND COVER Subject to approval and on such conditions as ASX Clear may determine from time to time, the following may be provided in respect of margin: Cover provided in Instrument Approved Cover Valuation Haircut respect of Initial Margin Cash Cover AUD Cash N/A Additional Initial Margin Specific Cover N/A Cash S&P/ASX 200 Securities Tiered Initial Margin Equities ETFs Tiered Notes to the table . All securities in the table are classified as Unrestricted (accepted as general Collateral and specific cover); . Specific cover only securities are not included in the table. Any securities is acceptable as specific cover, with the exception of ASX securities as well as Participant issued or Parent/associated entity issued securities lodged against a House Account; . Haircut refers to the percentage discount applied to the market value of securities during collateral valuation. ASX Code Security Name Haircut A2M The A2 Milk Company Limited 30% AAA Betashares Australian High Interest Cash ETF 15% ABC Adelaide Brighton Ltd 30% ABP Abacus Property Group 30% AGL AGL Energy Limited 20% AIA Auckland International Airport Limited 30% ALD Ampol Limited 30% ALL Aristocrat Leisure Ltd 30% ALQ ALS Limited 30% ALU Altium Limited 30% ALX Atlas Arteria Limited 30% AMC Amcor Ltd 15% AMP AMP Ltd 20% ANN Ansell Ltd 30% ANZ Australia & New Zealand Banking Group Ltd 20% © 2021 ASX Limited ABN 98 008 624 691 1/7 ASX Code Security Name Haircut APA APA Group 15% APE AP -

Australian Listed Equities: Weekly Share Market Wrap

Australian Listed Equities: Weekly Share Market Wrap Total Shareholder Returns as at 02 March 2018 Price 1 week 1 month 6 months 1 year 2 years 3 years 5 years 10 years 10 years Ticker Stock Name $ % % % % % p.a. % p.a. % p.a. % p.a. ranking A2M The A2 Milk Company 12.11 2.89 41.31 136.99 450.45 172.57 - - - - ABC Adelaide Brighton 6.71 -3.17 0.90 17.51 25.64 19.93 19.93 16.49 9.33 47 ABP Abacus Property Grp. 3.44 0.00 -5.49 -2.22 14.48 13.15 8.30 14.82 -1.94 113 AFI Australian Foundat. 6.06 -0.66 -2.53 4.58 9.57 8.95 2.86 5.97 4.48 77 AGL AGL Energy Limited. 21.47 -0.42 -5.41 -9.87 -8.38 12.64 16.55 10.72 10.44 40 AIA Auckland Internation 5.92 -0.50 -2.95 -0.08 -9.11 3.61 14.22 23.94 12.61 30 AIZ Air New Zealand 3.02 5.96 4.86 -3.73 43.40 18.90 12.05 30.24 12.15 32 ALL Aristocrat Leisure 23.98 -1.96 -1.96 14.54 43.91 55.66 48.93 46.20 9.54 43 ALQ ALS Limited 7.10 1.28 0.85 -9.80 19.41 34.61 11.55 -5.15 6.78 63 ALU Altium Limited 19.96 0.10 28.13 97.93 179.50 91.94 72.34 82.96 44.32 3 AMC Amcor Limited 14.03 0.93 -1.57 -9.77 1.89 3.52 4.09 14.96 11.64 34 AMP AMP Limited 5.27 0.38 2.56 7.23 10.10 5.17 -2.02 4.40 0.41 103 ANN Ansell Limited 25.74 2.14 2.36 19.76 20.64 24.17 2.56 12.52 8.89 52 ANZ ANZ Banking Grp Ltd 28.57 0.46 -1.86 -0.74 -3.76 14.82 -2.02 5.27 7.05 60 APA APA Group 7.82 -4.97 -5.31 -8.52 -4.27 1.28 -1.92 10.97 14.13 23 ARG Argo Investments 8.06 -0.25 -1.73 4.92 10.05 9.57 3.86 7.74 3.78 82 AST AusNet Services Ltd 1.635 -1.80 -4.11 -3.65 5.85 12.17 8.25 11.72 7.71 56 ASX ASX Limited 57.85 -0.43 3.69 7.47 14.89 20.40 12.70 -

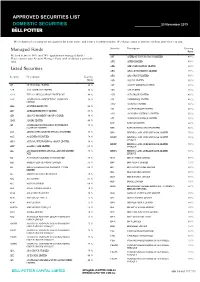

Approved Securities List

APPROVED SECURITIES LIST DOMESTIC SECURITIES 23 November 2019 The inclusion of a security on our approval list is not advice and is not a recommendation. We change ratios at any time without prior notice to you. Security Description Gearing Managed Funds Ratio We lend between 50% and 70% against most managed funds. APT AFTERPAY TOUCH GROUP LIMITED 40 % Please contact your Account Manager if you wish to discuss a particular fund. APX APPEN LIMITED 40 % Listed Securities ARB ARB CORPORATION LIMITED. 60 % ARG ARGO INVESTMENTS LIMITED 75 % Security Description Gearing ARQ ARQ GROUP LIMITED 50 % Ratio ASB AUSTAL LIMITED 50 % 3PL 3P LEARNING LIMITED.. 40 % AST AUSNET SERVICES LIMITED 65 % A2B A2B AUSTRALIA LIMITED 50 % ASX ASX LIMITED 70 % A2M THE A2 MILK COMPANY LIMITED NZ 40 % AUB AUB GROUP LIMITED 40 % AAC AUSTRALIAN AGRICULTURAL COMPANY 50 % AVJ AVJENNINGS LIMITED 40 % LIMITED. AWC ALUMINA LIMITED 70 % ABA AUSWIDE BANK LTD 40 % AX1 ACCENT GROUP LIMITED 50 % ABC ADELAIDE BRIGHTON LIMITED 65 % AYS AMAYSIM AUSTRALIA LIMITED 50 % ABP ABACUS PROPERTY GROUP STAPLED 50 % AZJ AURIZON HOLDINGS LIMITED 70 % ADH ADAIRS LIMITED 40 % BAP BAPCOR LIMITED 60 % AFI AUSTRALIAN FOUNDATION INVESTMENT 75 % COMPANY LIMITED BBN BABY BUNTING GROUP LIMITED 50 % AGI AINSWORTH GAME TECHNOLOGY LIMITED 55 % BEN BENDIGO AND ADELAIDE BANK LIMITED 70 % AGL AGL ENERGY LIMITED. 70 % BENPE BENDIGO AND ADELAIDE BANK LIMITED 70 % LPYR6UT AHG AUTOMOTIVE HOLDINGS GROUP LIMITED. 50 % BENPF BENDIGO AND ADELAIDE BANK LIMITED 70 % AHY ASALEO CARE LIMITED 65 % LPYR6UT AIA AUCKLAND INTERNATIONAL AIRPORT LIMITED 70 % BENPG BENDIGO AND ADELAIDE BANK LIMITED 70 % NZX LPYR3UT ALF AUSTRALIAN LEADERS FUND LIMITED 50 % BGA BEGA CHEESE LIMITED 60 % ALG ARDENT LEISURE GROUP LIMITED 55 % BHP BHP GROUP LIMITED 75 % ALI ARGO GLOBAL LISTED INFRASTRUCTURE 60 % BIN BINGO INDUSTRIES LIMITED 50 % LIMITED BKL BLACKMORES LIMITED 60 % ALL ARISTOCRAT LEISURE LIMITED 70 % BKW BRICKWORKS LIMITED 60 % ALQ ALS LIMITED 65 % BLD BORAL LIMITED. -

BRICKWORKS LIMITED 21 October 2011 Australian Securities

21 October 2011 Australian Securities Exchange Attention: Companies Department BY ELECTRONIC LODGEMENT Dear Sir/Madam, Please find attached the Brickworks Ltd 2011 Annual Report which will be distributed to shareholders today. Yours faithfully, BRICKWORKS LIMITED IAIN THOMPSON COMPANY SECRETARY BRICKWORKS LIMITED ABN 17 000 028 526 738 – 780 Wallgrove Road, Horsley Park NSW 2175; PO Box 6550, Wetherill Park NSW 1851 Telephone: 61 2 9830 7800 Fax: 61 2 9620 1328 Internet Address: http://www.brickworks.com.au E.Mail Address: [email protected] ABN 17 000 028 526 ANNUAL REPORT 2011 BRICKWORKS LIMITED AND CONTROLLED ENTITIES A.B.N. 17 000 028 526 FIVE YEAR SUMMARY 2007 2008 2009 2010 2011 % $000 $000 $000 $000 $000 Growth Total revenue 558,936 553,716 593,511 656,538 635,615 (3%) Building Products revenue 516,851 519,986 489,253 580,283 604,915 4% Earnings before interest tax and amortisation Building products 65,919 53,610 37,026 53,379 42,017 (21%) Property 58,168 91,867 38,798 26,638 26,662 0% Waste management 2,115 1,792 1,841 1,755 2,573 47% Investments 655 681 1,268 2,434 1,713 (30%) Associates 31,837 36,247 94,157 74,047 66,182 (11%) Head office and other expenses (5,807) (6,135) (7,271) (7,729) (7,148) 8% Total EBITA 152,887 178,062 165,819 150,524 131,999 (12%) Borrowing costs (27,305) (37,286) (33,314) (24,491) (21,155) 14% Income tax (23,385) (32,603) (18,825) (15,851) (10,061) 37% Net profit after income tax - normal 102,197 108,173 113,680 110,182 100,783 (9%) Significant items Washington H Soul Pattinson & Co. -

ESG Reporting by the ASX200

Australian Council of Superannuation Investors ESG Reporting by the ASX200 August 2019 ABOUT ACSI Established in 2001, the Australian Council of Superannuation Investors (ACSI) provides a strong, collective voice on environmental, social and governance (ESG) issues on behalf of our members. Our members include 38 Australian and international We undertake a year-round program of research, asset owners and institutional investors. Collectively, they engagement, advocacy and voting advice. These activities manage over $2.2 trillion in assets and own on average 10 provide a solid basis for our members to exercise their per cent of every ASX200 company. ownership rights. Our members believe that ESG risks and opportunities have We also offer additional consulting services a material impact on investment outcomes. As fiduciary including: ESG and related policy development; analysis investors, they have a responsibility to act to enhance the of service providers, fund managers and ESG data; and long-term value of the savings entrusted to them. disclosure advice. Through ACSI, our members collaborate to achieve genuine, measurable and permanent improvements in the ESG practices and performance of the companies they invest in. 6 INTERNATIONAL MEMBERS 32 AUSTRALIAN MEMBERS MANAGING $2.2 TRILLION IN ASSETS 2 ESG REPORTING BY THE ASX200: AUGUST 2019 FOREWORD We are currently operating in a low-trust environment Yet, safety data is material to our members. In 2018, 22 – for organisations generally but especially businesses. people from 13 ASX200 companies died in their workplaces. Transparency and accountability are crucial to rebuilding A majority of these involved contractors, suggesting that this trust deficit. workplace health and safety standards are not uniformly applied. -

View Annual Report

ANNUAL REPORT 2 019 Table of CONTENTS 02 Five Year Summary 05 Chairman’s Letter 09 Managing Director’s 61 Board of Directors Overview 63 Executive Management 15 Financial Overview 65 Corporate Governance 19 Group Structure 69 Directors’ Report 20 Building Products Australia 73 Remuneration Report 34 Building Products North America 91 Auditor’s Independence Declaration 38 Property 92 Consolidated Financial Statements 42 Investments 93 Consolidated Income Statement 45 Health and Safety 94 Consolidated Statement of 47 Overview of Sustainability Other Comprehensive Income 52 Environmental Sustainability 95 Consolidated Balance Sheet 57 Our People 96 Consolidated Statement of Changes in Equity Brickworks Limited / Annual Report 2019 97 Consolidated Statement of Cash Flows 98 Notes to the Consolidated Financial Statements 143 Directors’ Declaration 145 Independent Auditor’s Report 149 Statement of Shareholders 150 Corporate Information and Important dates Urbanstone Commercial Engineered Stone Milsons Point NSW Brickworks Limited / Annual Report 2019 / 01 / Total revenue Total / unlessotherwisestated significantitemsanddiscontinuedoperations andearnings exclude All revenue measures SUMMARY Five Year 2015 $679m 02 / 2016 $708m Brickworks Limited 2017 $803m 2018 $785m 2019 $919m / Annual Report2019 Total EBITDA Total 2015 $192m 2016 $225m 2017 $278m 2018 $311m 2019 $346m profit after tax Underlying net 2015 $121m 2016 $148m 2017 $200m 2018 $226m 1 2019 $234m Dividends 2015 45.0¢ 2016 48.0¢ 2017 51.0¢ 2018 54.0¢ 2019 57.0¢ 2015 2016 2017 2018 -

BRICKWORKS LIMITED 22 October 2010 Australian Stock Exchange

22 October 2010 Australian Stock Exchange (Sydney) Limited Attention: Companies Department BY ELECTRONIC LODGEMENT Dear Sir/Madam, Please find attached the Brickworks Ltd 2010 Annual Report which will be distributed to shareholders today. Yours faithfully, BRICKWORKS LIMITED IAIN THOMPSON COMPANY SECRETARY BRICKWORKS LIMITED ABN 17 000 028 526 738 – 780 Wallgrove Road, Horsley Park NSW 2175; PO Box 6550, Wetherill Park NSW 1851 Telephone: 61 2 9830 7800 Fax: 61 2 9620 1328 Internet Address: http://www.brickworks.com.au E.Mail Address: [email protected] ABN 17 000 028 526 ANNUAL REPORT 2010 BRICKWORKS LIMITED AND CONTROLLED ENTITIES A.B.N. 17 000 028 526 FIVE YEAR SUMMARY 2006 2007 2008 2009 2010 % $000 $000 $000 $000 $000 Growth Total revenue 532,068 558,936 553,716 593,511 656,538 11% Building Products revenue 483,083 516,851 519,986 489,253 580,283 19% Earnings before interest tax and amortisation Building products 65,529 65,919 53,610 37,026 53,379 44% Property 53,269 58,168 91,867 38,798 26,638 (31%) Waste management 1,936 2,115 1,792 1,841 1,755 (5%) Investments 1,206 655 681 1,268 2,434 92% Associates 32,110 31,837 36,247 94,157 74,047 (21%) Head office and other expenses (4,817) (5,807) (6,135) (7,271) (7,729) (6%) Total EBITA 149,233 152,887 178,062 165,819 150,524 (9%) Borrowing costs (25,398) (27,305) (37,286) (33,314) (24,491) 26% Income tax (21,914) (23,385) (32,603) (18,825) (15,851) 16% Net profit after income tax - normal 101,921 102,197 108,173 113,680 110,182 (3%) Non-regular items Washington H Soul Pattinson & Co. -

Longwave Capital Partners Invests with a Philosophy Informed by the Belief That for Small Caps, Quality Is a Key Driver of Long-Term Investment Outperformance

// Longwave Capital Partners invests with a philosophy informed by the belief that for small caps, quality is a key driver of long-term investment outperformance. When we assess companies considering Environmental, Social and Governance (ESG) characteristics, we see them as markers of quality. // Historically, we have considered ESG as a component in the The first stage uses systematic fundamental assessments to fundamental assessment that determines the quality of a identify companies that exhibit characteristics which have business – factored into the quality score that we use to drive historically been high probability markers of failure or our valuation. This is calculated by applying a discount rate to underperformance. These are low-quality companies we look to our sustainable, mid-cycle earnings estimate in forecast year ensure are not present in our portfolio. Based upon our current five. We believe the equity risk premium required of higher- criteria across the different models we employ, around 85% of quality companies is lower than average companies, and lower- the small caps we assess have a reasonable probability of failure quality companies require a higher equity risk premium than or long-term underperformance. We construct a systematic average. portfolio of the remaining 15%, built from the ensemble of our While cognisant of the impact ESG factors have on the quality of different quality models. a business (and thereby its value), our previous approach did not It would appear at first glance that using available ESG data and have the same objective level of data capture or comparability testing for performance would be an appropriate measure to as the investment process that we now employ, driven by enhance our existing systematic process. -

Morningstar Equity Research Coverage

December 2019 Equity Research Coverage Morningstar covers more than 200 companies in We use the following guidelines to Contact Details Australia and New Zealand as part of our global determine our Australian equity coverage: Australia stock coverage of about 1,500 companies. We are × Nearly all companies in the S&P/ASX 100 Index. Helpdesk: +61 2 9276 4446 Email: [email protected] one of the largest research teams globally with × Companies in the S&P/ASX 200 Index which more than 100 analysts, associates, and have an economic moat and/or have cash flow New Zealand strategists, including 17 in Australia. Local analysts which is at least mildly predictable. Helpdesk: +64 9 915 6770 regularly glean insights from our global sector teams × In total, Morningstar will cover about 80% of Email: [email protected] in China, Europe, and the United States, enriching S&P/ASX 200 companies (which typically the process and enhancing outcomes for investors. equates to about 95% of S&P/ASX 200 by Our research philosophy focuses on bottom-up market capitalisation). Companies we choose analysis, developing differentiated and deep not to cover in this index are usually unattractive opinions on competitive forces, growth prospects, for most portfolios, in our opinion. and valuations for every company we cover. We × About 30 ex-S&P/ASX 200 stocks are selected publish on each company under coverage at least on Morningstar’s judgement of each security's quarterly, and as events demand, to ensure investment merit − which includes a very investment ideas are always relevant. strong lean towards high-quality companies We are an independent research house, and with sustainable competitive advantages, or therefore determine our coverage universe based economic moats. -

Australian Listed Equities: Weekly Share Market Wrap

Australian Listed Equities: Weekly Share Market Wrap Total Shareholder Returns as at 19 May 2017 Price 1 week 1 month 6 months 1 year 2 years 3 years 5 years 10 years 10 years Ticker Stock Name $ % % % % % p.a. % p.a. % p.a. % p.a. ranking A2M The A2 Milk Company 3.27 0.31 9.36 62.69 125.52 158.33 - - - - ABC Adelaide Brighton 5.61 -2.94 0.54 10.95 8.19 16.12 18.37 17.52 7.59 37 ABP Abacus Property Group 3.42 0.89 0.29 27.08 11.22 14.30 17.39 17.37 -4.79 111 AFI Australian Foundation 5.80 -1.53 0.52 2.97 7.09 0.40 3.45 10.62 3.45 67 AGL AGL Energy Limited 26.57 -2.06 -3.14 34.43 48.18 37.31 23.60 16.71 8.17 34 AIA Auckland Internation 6.37 -0.62 0.00 8.07 9.13 24.60 22.20 28.64 11.99 20 AIZ Air New Zealand 2.66 2.70 13.68 46.06 51.17 11.77 23.93 40.03 5.16 53 ALL Aristocrat Leisure 20.20 2.28 6.32 38.91 64.79 63.22 61.32 48.77 3.74 63 ALQ ALS Limited 5.81 -8.36 -7.78 -6.46 40.74 4.10 -3.39 -7.38 6.12 49 AMC Amcor Limited 15.00 -1.77 -1.32 6.91 -4.77 7.76 16.88 20.78 11.42 23 AMP AMP Limited 5.08 -3.61 -2.31 10.36 -2.37 -5.31 4.30 10.46 -2.30 103 ANN Ansell Limited 24.18 -0.45 4.13 10.86 33.44 -0.94 12.31 12.86 8.78 33 ANZ ANZ Banking Grp Ltd 28.50 -2.46 -5.97 4.72 20.84 -0.23 1.01 12.12 3.80 62 AOG Aveo Group 3.30 0.00 5.43 6.11 2.11 12.92 19.57 8.48 -13.15 122 APA APA Group 9.35 -0.85 3.09 27.40 8.91 7.53 17.29 18.72 12.16 18 APE AP Eagers Limited 7.95 1.92 -8.20 -11.20 -19.96 -3.78 18.44 25.11 14.35 13 ARG Argo Investments 7.61 -1.42 0.13 6.16 9.93 1.56 5.27 12.21 2.40 76 AST AusNet Services Ltd 1.75 0.86 4.48 21.63 14.27 14.32 13.81