2021-2022 National Budget Statement

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

An Inclusively Wealthy and Self-Reliant Nation

An Inclusively Wealthy and Self-reliant Nation Malawi 2063 - Transforming Our Nation Malawi 2063 - Kusintha Dziko Lathu Mokomera Aliyense An Inclusively Wealthy and Self-reliant Nation Malawi 2063 - Transforming Our Nation ©National Planning Commission (NPC), Private Bag B316, Capital City, Lilongwe 3, Malawi. First Published in 2020 (Launch version) All rights reserved. This publication can be cited or quoted with due referencing to the National Planning Commission. Cover Photo: Artistic Piece by Ms. Shameemah Morta, Winner of the 2020 'My Future, Our Future Youth Art Com petition Designed by Peter Gwazayani, Lyph Outlet Malawi 2063 - Kusintha Dziko Lathu Mokomera Aliyense OUR VISION ‘An inclusively wealthy and self-reliant nation’ OUR RESOLUTION ‘We as Malawians desire and resolve to be an inclusively wealthy and self-reliant industrialized upper-middle-income country by the year 2063, so we can fund our development needs primarily by ourselves. Our manufacturing industry shall have strong forward and backward linkages with the sectors that will drive it. We shall achieve this Vision through collective effort and shall not allow any state or non-state actor to derail us.’ Malawi 2063 - Transforming Our Nation TABLE OF CONTENTS THE MALAWI WE WANT BY 2063 i ACKNOWLEDGEMENTS iii ACRONYMS v FOREWORD BY THE HEAD OF STATE vii PREFACE BY THE VICE-PRESIDENT viii PREFACE BY THE YOUTH REPRESENTATIVES ivx COMMITMENT STATEMENT BY THE SPEAKER OF THE NATIONAL ASSEMBLY x COMMITMENT STATEMENT BY THE LEADER OF OPPOSITION IN PARLIAMENT xi COMMITMENT STATEMENT -

2012 Annual Report

MISSION, VISION AND VALUES STATEMENT Mission Statement To create value for stakeholders Vision To be the preferred financial service provider Our Values Integrity, care, ethical values, quality services, health and safety, transparency, accountability, corporate governance, environmental awareness FIVE YEAR HIGHLIGHTS 2008 2009 2010 2011 2012 GROSS REVENUE (MK’ million) 14,132 17,916 21,757 26,437 41,895 PROFIT BEFORE TAX (MK’ million) 2,667 3,237 3,819 4,211 2,373 EARNINGS PER SHARE (tambala) 175 187 222 163 42 NET DIVIDEND PAID (MK’ million) * 407 407 1,095 417 250 NET DIVIDEND PER SHARE (tambala) 39 39 105 40 24 TOTAL ASSETS (MK’ million) 44,293 57,764 75,766 99,413 124,350 NET ASSETS (MK’ million) 4,725 6,237 8,793 9,315 10,152 SHARE PRICE (tambala) 950 900 920 1,100 1,430 NET ASSET VALUE PER SHARE (tambala) 453 598 843 893 973 PRICE TO BOOK VALUE (times) 2.1 1.5 1.1 1.2 1.5 PRICE EARNINGS RATIO (times) 5.4 4.8 4.1 6.7 34 MARKET CAPITALISATION (MK million) 9,909 9,387 9,596 11,473 14,915 * Dividend paid out of the year’s profits GROSS REVENUE ProFIT BEFORE TAX (Million Kwacha) (Million Kwacha) 45,000 4,500 40,000 4,000 35,000 3,500 30,000 3,000 25,000 2,500 20,000 2,000 15,000 1,500 10,000 1,000 5,000 500 0 0 2008 2009 2010 2011 2012 2008 2009 2010 2011 2012 14,132 17,916 21,757 26,437 41,895 2,667 3,237 3,819 4,211 2,373 2 SHARE PRICE (Tambala) 1600 1400 1200 1000 800 600 400 200 2008 2009 2010 2011 2012 950 900 920 1,100 1,430 NET DIVIDEND EARNINGS PER SHARE PER SHARE (Tambala) (Tambala) 250 110 225 100 90 200 80 175 70 150 60 125 50 40 100 30 50 20 25 10 0 0 2008 2009 2010 2011 2012 2008 2009 2010 2011 2012 175 187 222 163 42 39 39 105 40 24 ToTAL AsseTS NET AsseTS (Million Kwacha) (Million Kwacha) 130,000 12,000 120,000 11,000 110,000 10,000 100,000 9,000 90,000 8,000 80,000 7,000 70,000 6,000 60,000 5,000 50,000 4,000 40,000 30,000 3,000 20,000 2,000 10,000 1,000 0 0 2008 2009 2010 2011 2012 2008 2009 2010 2011 2012 44,293 57,764 75,766 99,413 124,350 4,725 6,237 8,793 9,315 10,152 3 SUMMARISED LIST OF SHAREHOLDERS GENERAL PUBLIC C/O NICO P.O. -

2021 Annual Report About the Seed Co Annual Report

Seed Co International 2021 Annual Report About the Seed Co Annual Report Seed Co International Limited, which is listed on Welcome to the home the Botswana Stock Exchange (BSE) and Zimbabwe Stock Exchange (ZSE), is the leading of bumper harvests producer and marketer of certified crop seeds in Africa. We believe that our annual report can help our stakeholders make better informed Our Vision decisions about our business. To dominate the Agro industry in Africa. This report, which is our primary report to stakeholders, covers the period 1 April 2020 to Our Mission 31 March 2021. The scope of this report includes the Seed Co group’s operations, We breed seed, feed and lead in Africa. projects and the key functions over which we exercise control. Our Brands For ease of reference we have used Seed Co or Specially bred for Africa hence assuring farmers the group to represent the company and its group entities. All our subsidiaries, business highest yield. divisions and products are referred to by their branded names. With respect to comparability, all items are reported on a like-for-like basis with Core Values no major restatements. Any restatements are Farmer Centricity: Putting customers at the centre noted and explained. People Our Pride: Results through people with passion Reporting frameworks Knowledge: Information advantage Our report conforms to the requirements of local Teamwork: Work and win together and international reporting frameworks, including those of the Victoria Falls Stock Exchange Quality Focused: Drive for quality and value Listings Requirements. We have used the Innovation: Learning and applying International Integrated Reporting Framework to guide us in structuring our report to show the connectivity between material information on our strategy, governance, performance and prospects and how our strategy affects and is affected by environmental, social and financial matters. -

NBS Bank Was Incorporated As a Limited Company on 14Th March 2003 and Was Registered Under the Banking Act 1989 on 1St March 2004

www.nbsmw.com Pg 2 Chitipa Kayelekela Karonga Northern Region La ke Malaw i Expect Rumphi Mzuzu more Raiply Nkhata Bay ease and convenience Mzuzu Mzimba Mzuzu Branch Luwawa from a bank that’s Mzuni - Bank @ Campus in your area. Dwangwa Nkhota Kota Branch Network ua Kasungu B Central Region “We seek to add new Mchinji Mponela Ntchisi delivery channels to meet an Salima increasing customer base.” Lilongwe Monkey Bay Lilongwe Capital City Branch Kanengo Agency Dedza Mangochi Lilongwe Branch Southern Region Bunda College Balaka Bank @ Campus Ntcheu Crossroads Agency Liwonde KIA Agency Riverside Agency Neno Zomba Zomba Zomba Branch ire Sh Bank @ Campus - Catholic University - Chancellor College Bank @ Campus Blantyre Blantyre Limbe Branch Nchalo Chichiri Mall Agency Thyolo Ginnery Corner Mulanje Branch Blantyre Branch Halie Selassie Road Branch Chiwembe Turn-off Agency Expect more ease and convenience Contents from a bank that’s 6 Corporate Profile in your area. 7 NBS Directors 8 Chairman’s Report 10 Chief Executive Officer’s Report 11 NBS Senior Management 12 Corporate Social Responsibility 15 Annual Financial Statements 72 Shareholding Statistics “We seek to add new products and services to our range to meet a broadening array of our customer needs.” Pg 3 Pg 4 Vision To be the Bank of choice in Malawi. Mission We undertake to add value to all our stakeholders by offering an innovative range of banking products through efficient business processes and empowered and caring staff. Values Integrity, Care, Quality Service, Health and Safety, Ethical -

World Bank Document

29-Nov-2020 _____________________________ Public Disclosure Authorized Honourable Felix Mlusu Minister of Finance Ministry of Finance P.O. Box 30049 Capital City Lilongwe 3 Malawi Re: Republic of Malawi: Advance Agreement for the Preparation of the Proposed Southern African Trade and Connectivity Project Public Disclosure Authorized Project Preparation Advance No. V352 Dear Honourable Minister: In response to the request for financial assistance made on behalf of Republic of Malawi (“Recipient”), I am pleased to inform you that the International Development Association (“World Bank”) proposes to extend to the Recipient an advance out of the World Bank’s Project Preparation Facility in an amount not to exceed one million four hundred thousand Dollars ($1,400,000) (“Advance”) on the terms and conditions set forth or referred to in this letter agreement (“Agreement”), which includes the attached Annex, to assist in financing the activities described in the Annex (“Activities”). The objective of the Activities is to facilitate the preparation of a proposed project designed to reduce trade and transport costs and increase private investment along targeted Public Disclosure Authorized corridors in the Participating Countries (“Project”), for the carrying out of which the Recipient has requested the World Bank’s financial assistance. The Recipient represents, by confirming its agreement below, that: (a) it understands that the provision of the Advance does not constitute or imply any commitment on the part of IBRD or IDA to assist in financing the Project; and (b) it is authorized to enter into this Agreement and to carry out the Activities, repay the Advance and perform its other obligations under this Agreement, all in accordance with the provisions of this Agreement. -

BLANTYRE HOTELS LIMITED Company Registration Number: 178

BLANTYRE HOTELS LIMITED Company Registration number: 178 NOTICE OF ANNUAL GENERAL MEETING NOTICE IS HEREBY GIVEN that the 70th Annual General Meeting of Blantyre Hotels Limited is scheduled to be held at Ryalls Hotel in Blantyre on 9th March 2017 from 2:30 pm at which the following ordinary business will be transacted: 1. Minutes of Previous Annual General Meeting To approve the minutes of the 69th Annual General Meeting held on 21st April 2016. 2. Chairman’s Report To receive the Chairman’s report for the year ended 30th September 2016. 3. Financial Statements To consider and approve the audited financial statements for the year ended 30th September 2016. 4. Dividend To declare a final dividend of K25.80 million representing 20 tambala per share (2015: K25.80 million representing 20 tambala per share) for the year ended 30 September 2016 as recommended by the Directors. A first interim dividend of K64.6 million (or 50 tambala per share) was paid in July 2016 followed by a second interim dividend of K38.80 million (or 30 tambala per share) which was paid in November 2016. Once the final dividend is approved, the total dividend for the year will be K129.20 million or K1.00 per share (2015: K103.4 million or 80 tambala per share). The share register will be closed from 17th March 2017 to 20th March 2017, both dates inclusive. Members whose names will appear in the register at the close of business on 17th March 2017 will be eligible for this dividend payable on 24th March 2017. -

(0) 1 875 298. Email: [email protected] Website: We Continue to Ensure That Our Customers Receive Services of the Highest Standards

Tel +265 (0) 1 876 222 / 231. Fax +265 (0) 1 875 298. Email: [email protected] Website: www.nbsmw.com We continue to ensure that our customers receive services of the highest standards. NBS Bank Annual Report 2006 Our vision: To be the Bank of choice in Malawi. Our mission: We undertake to add value to our stakeholders by offering an innovative range of banking products through efficient business processes and empowered and caring staff. Our values: Integrity, Care, Quality Service, Health and Safety, Ethical Standards, Transparency and Good Corporate Governance. Contents: 1 Background 3 Chairmans report 6 Board of Directors 7 Chief Executive Officer’s report 9 Senior Management 10 Corporate Governance 11 Branch Network 12 Social responsibility 13 Financial highlights 15 Financial statements Contact details: NBS Bank, Head Office, NBS House, Cnr. Chipembere Highway/ Johnstone Road, P.O. Box 32251, Chichiri, Blantyre 3, Malawi. Telephone: +265 (0) 1 876 222. Fax: +265 (0) 1 876 041. Email: [email protected]. Web: www.nbsmw.com 1 Banking together. Growing together. Stronger everyday. background NBS Bank was incorporated as Commonwealth Century Building mortgage business to financial a Limited Liability company on Society and First Building Society. institutions registered under the 14th March 2003 and registered It got incorporated under the Banking Act. under the Banking Act on the 1st Building Societies Act on 7th March 2004. It started its February 1964. Since then the The Society however, could not commercial banking operations Society continued to operate under offer products traditionally on 1st July 2004, when the New the Act and raised funds from the marketed by banks. -

Ficha País De Malawi

OFICINA DE INFORMACIÓN DIPLOMÁTICA FICHA PAÍS Malawi República de Malawi La Oficina de Información Diplomática del Ministerio de Asuntos Exteriores, Unión Europea y Cooperación pone a disposición de los profesionales de los medios de comunicación y del público en general la presente ficha país. La información contenida en esta ficha país es pública y se ha extraído de diversos medios, no defendiendo posición política alguna ni de este Ministerio ni del Gobierno de España respecto del país sobre el que versa. ABRIL 2021 Malawi 1. DATOS BÁSICOS 1.1. Características generales Nombre oficial: República de Malaui Superficie: 118,484 km² Chitipa Límites: Limita con Zambia al noroeste, Tanzania al noreste y Mozambique Karonga al sur, sureste y suroeste no tiene salida al mar. El país cuenta con un impor- TANZANIA tante lago, el Lago Malaui. Población: 17.563.749 habitantes (enero 2019), 49% hombres y 51% mu- jeres (2019). 51% de la población tiene menos de 18 años. Capital: Lilongüe, 989.318 habitantes, 5,6% del total de la población ZAMBIA Rumphi (2019). Otras ciudades: Blantyre (800.264 hab., 5,1% del total), es la capital eco- Mzuzu nómica del país. Otras ciudades son: Mzuzu (221.272 hab., 1% del total) y Zomba (105.013 hab., 0,6% del total) (datos de enero 2019). Lago Malawi Idioma: El inglés es la lengua oficial del país. El chichewa es el idioma Mzimba nacional en todo el territorio, aunque el chitumbuka es la lengua franca del norte del país. Moneda: 1 $ EEUU=783,61 Kwacha malauí (Reserve Bank of Malawi, 15.03.2021) MOZAMBIQUE Religión: Aproximadamente el 80% de la población es cristiana, siendo la Nkhotakota Kasungu Iglesia Católica y la Protestante Presbiteriana las más seguidas. -

Mission Statement Vision Our Values

1 NICO Holdings Limited MISSION STATEMENT To create value for stakeholders VISION To be the preferred financial service provider OUR VALUES Integrity, care, ethical values, quality services, health and safety, transparency, accountability, corporate governance, environmental awareness 2 NICO HOLDINGS LIMITED Annual Report 2013 3 SHARE PRICE (Tambala) 1800 1600 FIVE YEAR HIGHLIGHTS 1400 1200 2009 2010 2011 2012 2013 1000 GROSS REVENUE (MK’ Million) 17,916 21,757 26,441 41,695 65,139 800 600 PROFIT BEFORE TAX (MK’ Million) 3,237 3,819 4,211 2,372 11,642 400 EARNINGS PER SHARE (tambala) 187 222 163 42 548 200 NET DIVIDEND PAID (MK’ Million)* 407 1,095 417 250 1,043 0 2009 2010 2011 2012 2013 NET DIVIDEND PER SHARE (tambala) 39 105 40 24 100 900 920 1,100 1,430 1,780 TOTAL ASSETS (MK’ Million) 57,764 75,766 99,413 125,157 168,581 NET DIVIDEND EARNINGS PER SHARE PER SHARE NET ASSETS (MK’ Million) 6,237 8,793 9,315 10,152 14,205 (Tambala) (Tambala) 600 110 SHARE PRICE (tambala) 900 920 1,100 1,430 1,780 550 100 NET ASSET VALUE PER SHARE (tambala) 598 843 893 973 1,362 500 90 450 80 PRICE TO BOOK VALUE (times) 1.5 1.1 1.2 1.5 1.3 400 70 350 PRICE EARNINGS RATIO (times) 4.8 4.1 6.7 34.0 3.2 60 300 50 MARKET CAPITALISATION (MK’ Million) 9,387 9,596 11,473 14,915 18,566 250 40 200 * Dividend paid out of the year’s profits 150 30 100 20 50 10 0 0 2009 2010 2011 2012 2013 2009 2010 2011 2012 2013 187 222 163 42 548 39 105 40 24 100 GROSS REVENUE PROFIT BEFORE TAX (Million Kwacha) (Million Kwacha) NET ASSETS 70,000 TOTAL ASSETS (Million Kwacha) (Million -

ANNUAL REPORT BLANTYRE HOTELS PLC BLANTYRE HOTELS PLC Annual Report 2017 2

1 2017 ANNUAL REPORT BLANTYRE HOTELS PLC BLANTYRE HOTELS PLC Annual Report 2017 2 FIVE YEAR PERFORMANCE HIGHLIGHTS 2013 2014 2015 2016 2017 Gross Revenue (MK’ Million) 1 574 2 163 2 705 3 524 4 118 Profit Before Tax (MK’ Million) 154 231 254 576 743 Earnings per Share (Tambala) 84 124 141 321 392 Gross Dividend Paid (MK’ Million) 32 78 106 129 129 Gross Dividend per Share (Tambala) 25 60 82 100 100 Total Assets (MK’ Million) 3 044 5 629 5 671 7 255 7 669 Net Assets (MK’ Million) 1 760 3 547 3 700 4 765 5 147 Share Price (Tambala) 800 800 960 1290 2500 Net Asset Value per Share (Tambala) 1363 2745 2864 3688 3984 Price to Book Value (times) 0,59 0,29 0,34 0,35 0,63 Price Earnings Ratio (times) 9,52 6,45 6,81 4,02 6,38 Market Capitalisation (MK’ Million) 1 034 1 034 1 240 1 667 3 230 GROSS REVENUE PROFIT BEFORE TAX 4,500 900 4,000 800 3,500 700 3,000 600 2,500 500 2,000 400 MK’ Million 1,500 MK’ Million 300 1,000 200 500 100 - - 2013 2014 2015 2016 2017 2013 2014 2015 2016 2017 1,574 2,163 2,705 3,524 4,118 154 231 254 576 743 Annual Report 2017 BLANTYRE HOTELS PLC 3 TOTAL ASSETS NET ASSETS 9,000 6,000 8,000 5,000 7,000 6,000 4,000 5,000 3,000 4,000 MK’ Million 3,000 MK’ Million 2,000 2,000 1,000 1,000 - - 2013 2014 2015 2016 2017 2013 2014 2015 2016 2017 3,044 5,629 5,671 7,255 7,669 1,760 3,547 3,700 4,765 5,147 DIVIDEND PER SHARE EARNINGS PER SHARE 140 450.00 120 400.00 350.00 100 300.00 80 250.00 60 200.00 Tambala Tambala 150.00 40 100.00 20 50.00 0 0.00 2013 2014 2015 2016 2017 2013 2014 2015 2016 2017 25 60 82 100 100 84 124 141 321 392 SHARE PRICE MARKET CAPITALISATION 3,000 3,500 2,500 3,000 2,500 2,000 2,000 1,500 1,500 Tambala 1,000 MK’ Million 1,000 500 500 - - 2013 2014 2015 2016 2017 2013 2014 2015 2016 2017 800 800 960 1290 2500 1,034 1,034 1,240 1,667 3,230 BLANTYRE HOTELS PLC Annual Report 2017 4 Mr. -

Chakwera Clears Rubble in Fight Against Covid-19 Pandemic

Insight Bulletin ForFor PeoplePeople WhoWho WantWant toto KnowKnow Y REGISTERED AT THE G.P.O. AS A NEWSPAPER • FIFTIETH EDITION • APRIL 2021 FREE COP CHAKWERA CLEARS RUBBLE IN FIGHT AGAINST COVID-19 PANDEMIC resident Dr. Lazarus Chakwera fired the Co-chairperson of Presidential Task Force on Covid-19, a group Pthat was established to lead in the fight against Coronavirus pandemic. Chakwera has also suspended the cluster heads following the Covid Gate amounting to 6.2 Billion Kwacha meant to combat the pandemic. Speaking during the sixth national address at Kamuzu Palace on 14th February 2021, President Chakwera said he has fired Dr John Phuka as Co-Chairperson for Presidential Task Force on Covid-19 and replaced him with Dr Wilfred Chalamira Nkhoma. Chakwera also removed the Department of Disaster Management Affairs (DODMA) Commissioner James Chiusiwa. “Last week, I expressed my outrage over the alleged abuse of funds and lack of financial accountability by certain clusters entrusted with 6.2 billion Kwacha for tackling the pandemic. This has been done due to the clusters failure to maintain proper records of how such critical funds were used and others for defying my directive to submit reports weekly to my office,” he said. A report on the abuse of the funds was released by the Office of the Ombudsman in November 2020 after investigating the matter. The President later gave the heads of the clusters and controlling officers 48 TO PAGE 6>> FIFTIETH EDITION APRIL 2021 FOR PEOPLE WHO WANT TO KNOW 1 2 FOR PEOPLE WHO WANT TO KNOW FIFTIETH EDITION APRIL 2021 ContentsIs Government Not Failing on Inquiries 4 Government Partially Bows Down to TUM 5 US to Restore Aid to UN Palestinian Refugee Agency Cut by Trump 8 Planting Underaged Tree Seedlings Affecting Afforestation 10 Football Partners Health 12 Islamic Insurance (Takaful) Part Three 14 8 10 12 Insight Bulletin, is a monthly views of the editorial staff. -

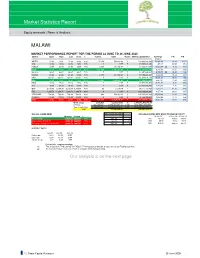

Market Statistics Report MALAWI

Market Statistics Report Equity research | News & Analysis MALAWI MARKET PERFORMANCE REPORT FOR THE PERIOD 22 JUNE TO 26 JUNE 2020 Symbol Open High Low Close % Volume Value Trades Market Capitalization Earnings P/E P/B K'million AIRTEL 20.00 20.01 20.00 20.00 0.0% 25,400 508,100.00 2 220,000,000,000 15,908.00 13.83 12.22 BHL 12.94 12.94 12.94 12.94 0.0% 0 0.00 0 10,866,374,123 466.70 23.28 1.67 FMBCH 29.99 29.99 29.99 29.99 0.0% 5,500 164,945.00 1 73,722,917,500 12,053.97 $$ 6.12 1.44 ICON 10.40 11.50 10.40 11.40 9.6% ↑ 2,761,587 31,481,014.80 9 76,152,000,000 7,248.62 10.51 1.03 ILLOVO 94.50 94.50 94.50 94.50 0.0% 0 0.00 0 67,420,494,950 4,009.00 ## 16.82 0.94 MPICO 24.98 24.98 24.98 24.98 0.0% 8,470 211,580.60 2 57,405,225,551 5,532.02 10.38 1.47 NBM 550.01 550.01 550.01 550.01 0.0% 0 0.00 0 256,817,125,217 17,106.00 15.01 2.55 NBS 17.50 17.51 17.50 17.51 0.1% ↑ 198,883 3,482,441.83 6 50,964,139,464 4,457.61 11.43 3.32 NICO 48.42 48.42 48.42 48.42 0.0% 0 0.00 0 50,504,049,868 8,011.00 6.30 1.59 NITL 94.99 94.99 94.99 94.99 0.0% 0 0.00 0 12,823,650,000 1,779.69 7.21 1.11 OMU 2,199.99 2,199.99 2,199.99 2,199.99 0.0% 26 57,199.74 1 28,571,795,928 1,313.71 21.75 3.10 PCL 1,399.76 1,399.76 1,399.76 1,399.76 0.0% 0 0.00 0 168,329,286,603 8,157.00 20.64 1.07 STANDARD 790.00 790.00 790.00 790.00 0.0% 684 540,360.00 3 185,387,847,980 15,879.00 11.68 2.04 SUNBIRD 120.00 120.00 120.00 120.00 0.0% 0 0.00 0 31,389,909,600 2,594.55 12.10 1.34 TNM 24.93 24.93 23.00 24.92 0.0% ↓ 648,275 15,926,895.84 7 250,208,014,000 15,063.00 16.61 4.81 Week totals