For Personal Use Only Use Personal for Vanguard Total Stock Market Index Fund

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Market Cap Close ADV 1598 67Th Pctl 745,214,477.91 $ 23.96

Market Cap Close ADV 1598 67th Pctl $ 745,214,477.91 $ 23.96 225,966.94 801 33rd Pctl $ 199,581,478.89 $ 10.09 53,054.83 2399 Ticker_ Listing_ Effective_ Revised Symbol Security_Name Exchange Date Mkt Cap Close ADV Stratum Stratum AAC AAC Holdings, Inc. N 20160906 M M M M-M-M M-M-M AAMC Altisource Asset Management Corp A 20160906 L M L L-M-L L-M-L AAN Aarons Inc N 20160906 H H H H-H-H H-H-H AAV Advantage Oil & Gas Ltd N 20160906 H L M H-L-M H-M-M AB Alliance Bernstein Holding L P N 20160906 H M M H-M-M H-M-M ABG Asbury Automotive Group Inc N 20160906 H H H H-H-H H-H-H ABM ABM Industries Inc. N 20160906 H H H H-H-H H-H-H AC Associated Capital Group, Inc. N 20160906 H H L H-H-L H-H-L ACCO ACCO Brand Corp. N 20160906 H L H H-L-H H-L-H ACU Acme United A 20160906 L M L L-M-L L-M-L ACY AeroCentury Corp A 20160906 L L L L-L-L L-L-L ADK Adcare Health System A 20160906 L L L L-L-L L-L-L ADPT Adeptus Health Inc. N 20160906 M H H M-H-H M-H-H AE Adams Res Energy Inc A 20160906 L H L L-H-L L-H-L AEL American Equity Inv Life Hldg Co N 20160906 H M H H-M-H H-M-H AF Astoria Financial Corporation N 20160906 H M H H-M-H H-M-H AGM Fed Agricul Mtg Clc Non Voting N 20160906 M H M M-H-M M-H-M AGM A Fed Agricultural Mtg Cla Voting N 20160906 L H L L-H-L L-H-L AGRO Adecoagro S A N 20160906 H L H H-L-H H-L-H AGX Argan Inc N 20160906 M H M M-H-M M-H-M AHC A H Belo Corp N 20160906 L L L L-L-L L-L-L AHL ASPEN Insurance Holding Limited N 20160906 H H H H-H-H H-H-H AHS AMN Healthcare Services Inc. -

28521 Folder

5445 NE Dawson Creek Drive Hillsboro, OR 97124 Toll-Free: 1-800-950-0044 Phone: 1-503-615-1100 FAX: 1-503-615-1121 Balance is All Internet E-Mail: [email protected] World Wide Web: http://www.radisys.com/ customer focused market diversity technology partner financial foundation RADISYS 2002 ANNUAL REPORT ANNUAL 2002 RADISYS Financial Overview To our shareholders 2002 (In thousands, except per share data) Years Ended December 31, 2002 was an important year for RadiSys. Our team did an exceptional job diversifying our revenue base, winning new business and driving our financial model to break-even. This was accomplished while making Consolidated Statement of Operations Data 2002 2001 2000 1999 1998 significant investments in research and development and introducing compelling new products for our customers. Our investments in new products enabled the Company to achieve 46 new design wins. These Revenues $200,139 $227,752 $340,676 $251,090 $186,548 design wins are with large customers in a diverse set of end markets. I believe this strong customer position Gross profit $ 59,272 $ 35,172 $116,897 $ 92,297 $ 62,684 will be the foundation for our long-term success. We also strengthened our balance sheet by generating $18 million of operating cash flow and exiting the year with $119 million in cash and investments. I believe (Loss) income from operations $ (7,676) $(60,332) $ 34,005 $ 16,604 $ 8,569 our accomplishments, coupled with our deep customer relationships and increased market diversification, position us well as a leading embedded solutions provider in our industry. Net (loss) income $ (3,305) $(34,486) $ 32,646 $ 18,997 $ 7,818 Net (loss) income per share (diluted)* $ (0.19) $ (2.00) $ 1.80 $ 1.11 $ 0.48 Customer focused Weighted average shares outstanding (diluted)* 17,495 17,249 18,161 17,110 16,129 We have an impressive list of customers in each of our addressable markets. -

RY-6 0MB Numbar7100.0297 Approval Expires November 30, 2019 Page 1 Of2 Board of Governors of the Federal Reserve System

FRY-6 0MB Numbar7100.0297 Approval expires November 30, 2019 Page 1 of2 Board of Governors of the Federal Reserve System Annual Report of Holding Companies-FR Y-6 Report at the close of business as of the end of fiscal year This Report is required by law: Section 5(c)(1 )(A) of the Bank This report form is to be filed by all top-tier bank holding compa Holding Company Act (12 U.S.C. § 1844(c)(1 )(A)): sections 8(a) nies, top-tier savings and loan holding companies, and U.S. inter and 13(a) of the International Banking Act (12 U.S.C. §§ 3106(a) mediate holding companies organized under U.S. law, and by and 3108(a)); sections 11(a)(1), 25, and 25A of the Federal any foreign banking organization that does not meet the require Reserve Act (12 U.S.C. §§ 248(a)(1), 602, and 611a); and sec ments of and is not treated as a qualifying foreign banking orga tions 113, 165, 312, 618, and 809 of the Dodd-Frank Act(12 U.S.C. nization under Section 211.23 of Regulation K (12 C.F.R. § §§ 5361, 5365, 5412, 1850a(c)(1), and 5468(b)(1)). Return to the 211.23). (See page one of the general instructions for more detail appropriate Federal Reserve Bank the original and the number of of who must file.) The Federal Reserve may not conduct or spon copies specified. sor, and an organization (or a person) is not required to respond to, an information collection unless it displays a currently valid 0MB control number. -

Mount Allison University Endowment Fund Holdings As of December 31, 2017

Mount Allison University Endowment Fund Holdings As of December 31, 2017 Security Name Market Value ($Can) EQUITY HOLDINGS Canadian Holdings 5N PLUS INC $ 155 ABSOLUTE SOFTWARE CORP $ 851 ACADIAN TIMBER CORP $ 302 ADVANTAGE OIL & GAS LTD $ 283,788 AECON GROUP INC $ 1,728 AFRICA OIL CORP $ 684 AG GROWTH INTERNATIONAL INC $ 1,163 AGELLAN COMMERCIAL REAL ESTATE $ 349 AGF MANAGEMENT LTD $ 990 AGNICO-EAGLE MINES LTD $ 427,207 AGT FOOD AND INGREDIENTS INC $ 653 AIMIA INC $ 832 AIR CANADA INC $ 325,411 AIRBOSS OF AMERICA CORP $ 315 ALACER GOLD CORP $ 1,289 ALAMOS GOLD INC $ 2,216 ALAMOS GOLD INC NEW COM CLASS A $ 4,877 ALARIS ROYALTY CORP $ 1,107 ALGOMA CENTRAL CORP $ 330 ALIMENTATION COUCHE-TARD INC $ 98,854 ALIO GOLD INC $ 472 ALLIED PROPERTIES REAL ESTATE INVESTMENT TRUST $ 2,575 ALTIUS MINERALS CORP $ 1,233 ALTUS GROUP LTD/CANADA $ 1,916 ANDREW PELLER LTD $ 1,448 ARGONAUT GOLD INC $ 656 ARTIS REAL ESTATE INVESTMENT TRUST $ 1,539 ASANKO GOLD INC $ 209 ATCO LTD $ 119,947 ATHABASCA OIL COP $ 703 ATS AUTOMATION TOOLING SYSTEMS INC $ 1,769 AURICO METALS INC $ 311 AUTOCANADA INC $ 1,128 AVIGILON CORP $ 1,258 B2GOLD CORP $ 29,898 BADGER DAYLIGHTING LTD $ 1,525 BANK OF MONTREAL $ 725,449 BANK OF NOVA SCOTIA $ 2,019,757 BARRICK GOLD CORP $ 459,749 BAYTEX ENERGY CORP $ 1,213 BCE INC $ 791,441 BELLATRIX EXPLORATION LTD $ 94 BIRCHCLIFF ENERGY LTD $ 1,479 BIRD CONSTRUCTION INC $ 731 1 Mount Allison University Endowment Fund Holdings As of December 31, 2017 Security Name Market Value ($Can) BLACK DIAMOND GROUP LTD $ 95 BLACKBERRY LIMITED $ 151,777 BLACKPEARL RESOURCES INC $ 672 BOARDWALK REAL ESTATE INVESTMENT TRUST $ 1,610 BONAVISTA ENERGY CORP $ 686 BONTERRA ENERGY CORP $ 806 BORALEX INC $ 2,276 BROOKFIELD ASSET MANAGEMENT INCORPORATED $ 672,870 BROOKFIELD INFRASTRUCTURE PARTNERS L.P. -

NASDAQ Stock Market LLC (“Nasdaq Exchange”), a Subsidiary of the Nasdaq Stock Market, Inc

July 31, 2006 Nancy M. Morris, Esq. Secretary US Securities and Exchange Commission 100 F Street, NE Washington, DC 20549 RE: Request for Relief from § 12 of the Securities Exchange Act of 1934 Dear Ms. Morris: On January 13, 2006, the Securities and Exchange Commission (“SEC” or “Commission”) approved the application of The NASDAQ Stock Market LLC (“Nasdaq Exchange”), a subsidiary of The Nasdaq Stock Market, Inc. (“Nasdaq”), to register under Section 6 of the Securities Exchange Act of 1934 (“Act” or “Exchange Act”) as a national securities exchange.1 Nasdaq’s transition of its listing and trading activities to the Nasdaq Exchange will further Congress’s instruction to promote “fair competition . between exchange markets.”2 Absent the relief requested herein, however, Nasdaq’s transition to a national securities exchange would require approximately 3,200 Nasdaq Global Market3 and Capital Market issuers with securities registered pursuant to the Act, or exempt from registration under Section 12(g) of the Act,4 to file registration statements5 to register those securities under Section 12(b) of the Act.6 1 Securities Exchange Act Release No. 53128 (January 13, 2006), 71 FR 3550 (January 23, 2006) (the “Exchange Approval Order”). 2 Exchange Act Section 11A(a)(1)(C)(ii). 3 Effective July 1, 2006, Nasdaq renamed the Nasdaq National Market as the Nasdaq Global Market and created a new segment within the Global Market called the Global Select Market. References to the Nasdaq Global Market include those securities listed on the Nasdaq Global Market and the Nasdaq Global Select Market. See Securities Exchange Act Release No. -

Ameris Bancorp Annual Report 2018

Ameris Bancorp Annual Report 2018 Form 10-K (NASDAQ:ABCB) Published: March 1st, 2018 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-K x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2017, or ¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to . Commission File Number 001-13901 AMERIS BANCORP (Exact name of registrant as specified in its charter) GEORGIA 58-1456434 (State of incorporation) (IRS Employer ID No.) 310 FIRST ST., SE, MOULTRIE, GA 31768 (Address of principal executive offices) (229) 890-1111 (Registrant’s telephone number) Securities registered pursuant to Section 12(b) of the Act: Common Stock, Par Value $1 Per Share Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act. Yes ¨ No x Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

PLANAR SYSTEMS INC Exact Name of Registrant As Specified in Its Charter

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington D.C 20549 Amendment No Form 10-K/A Mark One 12025225 ANNUAL REPORT PURSUANT TO SECTION 13 OR 15d OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended September 30 2011 or fl TRANSITION REPORT PURSUANT TO SECTION 13 OR 15d OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File No 0-23018 00 PLANAR SYSTEMS INC Exact name of Registrant as specified in its charter Oregon 93-0835396 State or other jurisdiction IRS Employer of incorporation Identification No 1195 NW Compton Drive Beaverton Oregon 97006 503 748-1100 Address of principal executive offices Zip Code Registrants Telephone Number Including Area Code Securities registered pursuant to Section 12b of the Act Common Stock Preferred Stock Purchase Rights NASDAQ Global Market Title of Each Class Name of Each Exchange on Which Registered Securities registered pursuant to Section 12g of the Act None Indicate by check mark if the registrant is well-known seasoned issuer as defined in Rule 405 of the Securities Act Yes No IEJ Indicate check if the by mark registrant is not required to file reports pursuant to Section 13 or Section 15d of the Act Yes No Indicate check whether the by mark registrant has filed all reports required to be filed by Section 13 or 15d of the Securities Exchange Act of 1934 during the preceding 12 months or for such shorter period that the registrant was required to file such reports and has been subject to such filing requirements for the past 90 days Yes No Indicate -

Christopher S. Connell

FOCUS Christopher S. Connell Banking Corporate & Securities Co-Chair, Corporate, Mergers & Acquisitions Mergers & Acquisitions and Securities Regulation & Compliance Philadelphia, PA Financial Services 215.564.8138 Real Estate White-Collar Defense, Internal [email protected] Investigations & Corporate Compliance Common & Collective Trust Funds Special Situations Investment Management Mergers & Acquisitions Christopher Connell is the co-chair of Stradley Ronon’s corporate, mergers and BAR ADMISSIONS acquisitions and securities practice group. He focuses his practice on the representation of financial institutions, financial services businesses and other New Jersey corporate clients in various industries in numerous transactional matters, Pennsylvania including mergers and acquisitions, offerings of debt and equity securities (both public and private), initial public offerings and securities matters for public EDUCATION companies. Chris also regularly advises corporate clients of all sizes in an outside J.D., Villanova University School of Law general counsel role, supporting the clients’ general corporate law, contracting B.S., cum laude, Villanova University and governance needs. RESULTS Chris’ experience includes the representation of: Banking and Financial Institutions . DNB Financial Corp. (NASDAQ: DNBF), the holding company for community bank DNB First, in its $206 million acquisition by S&T Bancorp, Inc. that will expand S&T’s footprint into Chester, Delaware and Philadelphia, Pennsylvania counties . Bryn Mawr Bank Corporation in its: . definitive agreement and plan of merger to acquire Continental Bank Holdings Inc., and related joint proxy statement/prospectus on Form S-4, in a transaction valued at $109 million . multimillion-dollar acquisition of the private wealth management group of Hershey Trust Company . agreement to acquire certain assets of First Bank of Delaware . -

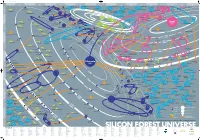

Silicon Forest Universe

15239 Poster 9/16/02 1:03 PM Page 1 AB CDE FGH I JKL M N O P Q R S Pearlsoft COMSAT General Integrated Systems Ashwood Group '85 Qualis Design fka CPU International Nel-Tech Development '98 Qsent '01 Briefsmart.com '00 Relyent TrueDisk Trivium Systems '80 '74 '99 '90 Gearbeat '81 Relational Systems Galois 3DLand Teradyne in 2001 '85 '00 '98 Solution Logic SwiftView Imagenation '89 Metro One IronSpire '84 Smart Mediary Systems Connections 13 Telecommunications WireX GenRad in 1996 '00 CyberOptics E-Core Salu Logiplex '79 MyHealthBank Semiconductor Cotelligent Technologies Fujitsu America Barco Metheus '77 '99 Group Knowledge fka United Data Biotronik Timlick & Associates in 1999 Gadget Labs Adaptive Solutions Wave International Processing Cascade Laser '98 Webridge Axis Clinical Software Mitron Basicon '91 GemStone fka Servio Logic Source Services '83 Integra Telecom Accredo FaxBack Polyserve Metheus Intersolv Babcock & Jenkins Electro '79 Informedics Scientific Sliceware Graphic Software Systems Industries IBM 12 in 1999 Atlas Telecom 1944 Sequent Computer ProSight Credence in 2001 19 ADC Kentrox '78 Oracle '69 Merant Datricon 60s Informix Systems FEI Sage Software fka Polytron MKTX 197 Mikros Nike 0s Etec Systems '63 19 Sentrol in 1995 Intel 80s SEH America Teseda Oregon Graduate Institute Flight Dynamics 1976 '97 1990 Purchasing Solutions Fluence ~ Relcom Vidco Mushroom Resources Cunningham & Cunningham '99 Myteam.com Praegitzer Industries Integrated Measurement Systems Zicon Digital World Lucy.Com Nonbox in 2001 ATEQ 11 Software Access -

C. P1-56.Indd

PARTICIPANT DIRECTORY Data from a total of 312 Northwest companies are included in this survey. The following list includes 140 publicly traded & 172 privately held/other companies. BANKING / FINANCIAL - PRIVATELY HELD Pacifi c NW Federal Credit Union Heritage Bank Rentrak Corporation* Advantis Credit Union Peoples Bank HomeStreet Bank Starbucks Corporation* Alaska USA Federal Credit Union Pioneer Trust Bank, N.A. MBank URM Stores, Inc. ALPS Federal Credit Union Point West Credit Union Northrim Bank Willamette Valley Vineyards, Inc.* Bank of Eastern Oregon Riverbank Oregon Pacifi c Bank zulily, inc.* bankcda SaviBank Pacifi c Continental Bank Zumiez, Inc.* Cascade Federal Credit Union Security State Bank People's Bank of Commerce ELECTRONICS / TECHNOLOGY Cashmere Valley Bank SELCO Community Credit Union Plaza Bank Coastal Community Bank Skagit Bank Premier Community Bank Array Health Commencement Bank Solarity Credit Union Puget Sound Bank Base2 Solutions Community Bank Sound Credit Union Riverview Bancorp, Inc. BlackPoint IT Services Community First Bank - Kennewick Spirit of Alaska Federal Credit Union Sound Financial Bancorp, Inc.* Blucora Inc.* Craft3 St. Helens Community Credit Union Summit Bank - Oregon BSQUARE Corporation* Credit Union 1 State Bank Northwest Timberland Bank Cascade Microtech, Inc. * D.L. Evans Bank The Bank of Oswego Umpqua Holdings Corporation Chef Software, Inc. Denali Alaskan Federal Credit Union True North Federal Credit Union Washington Federal Clearsign Combustion Corp* Evergreen Federal Bank Unitus Community -

UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, D.C

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 13F FORM 13F COVER PAGE Report for the Calendar Year or Quarter Ended: September 30, 2004 Check here if Amendment [ ]; Amendment Number: This Amendment (Check only one.): [ ] is a restatement [ ] adds new holdings entries. Institutional Investment Manager Filing this Report: Name: Principal Financial Group, Inc. Address: 711 High Street Des Moines, IA 50392 13F File Number: 28-10106 The institutional investment manager filing this report and the person by whom it is signed hereby represent that the person signing the report is authorized to submit it, that all information contained herein is true, correct and complete, and that it is understood that all required items, statements, schedules, lists, and tables, are considered integral parts of this form. Person Signing this Report on Behalf of Reporting Manager: Name: Michael Roughton Title: Vice-President Phone: 515-248-3842 Signature, Place, and Date of Signing: Michael Roughton Des Moines, Iowa November 12, 2004 Report Type (Check only one.): [X] 13F HOLDINGS REPORT. [ ] 13F NOTICE. [ ] 13F COMBINATION REPORT. I AM SIGNING THIS REPORT AS REQUIRED BY THE SECURITIES EXCHANGE ACT OF 1934. FORM 13F SUMMARY PAGE Report Summary: Number of Other Included Managers: 4 Form 13F Information Table Entry Total: 1993 Form 13F Information Table Value Total: $17518865 (X$1000) List of Other Included Managers: No. 13F File Number Name 01 28-1549 Principal Global Investors, LLC 02 28-10400 Principal Real Estate Investors, LLC 03 28-793 Principal Life Insurance Co 04 28-10107 Principal Financial Services, Inc FORM 13F INFORMATION TABLE TITLE OF VALU SHARES/ S PUT/ INVSTMT OTH VOTING AUTHOR NAME OF ISSUER CLAS CUSIP (X$10 PRN AMT P CALL DSCRETN MANAG SOLE SHARED NONE ---------------------------------------------------- ------ ------- --------------- -------- -------- AAR CORP. -

Early Career and Career Change Full-Time MBA

Early Career and Career Change Full-Time MBA PREPARE FOR SUCCESS IN BUSINESS, GOVERNMENT AND NOT-FOR-PROFIT MANAGEMENT Salem, Oregon, USA • willamette.edu/mba YOUR FUTURE is WAITING. BE READY. EQUIP YOURSELF TO ANALYZE, STRATEGIZE AND SUCCEED. • 2 YOUR FUTURE is WAITING. While you are reading this, the world is changing. The economy is changing. It’s getting better, getting tougher and getting faster. And right now someone is responding with a new business model or an entire new industry. Someone else is reinventing a governmental service or agency or reshaping a not-for-profit organization. You need to be ready. The Willamette Early Career and Career Change MBA at the Atkinson Graduate School of Management goes beyond the traditional ideas of management education. Here you will learn in an innovative program that effectively blends the development of knowledge with real-world experience. You will build friendships and a network that will last a lifetime. BE READY. EQUIP YOURSELF TO ANALYZE, STRATEGIZE AND SUCCEED. “Your Willamette MBA education will be a career-building and life-changing experience. Our faculty and staff provide a rigorous, collaborative and caring learning environment that helps you acquire the tools to become a world-class manager. In two years you will be pushed to learn, do and experience more than you might imagine.” Debra J. Ringold Dean and JELD-WEN Professor of Free Enterprise • 3 DEVELOP your KNOWLEDGE and EXPERIENCE. Set Your Direction – Choose From One or More Career Areas of Interest: Accounting Entrepreneurship Finance Human Resources General Management Global Management Marketing Operations, Analysis & Systems Organizational Analysis Public & Not-for-Profit Management Sustainability Management • 4 DEVELOP your KNOWLEDGE and EXPERIENCE.