Ready for Boarding 3

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Magisterarbeit / Master's Thesis

MAGISTERARBEIT / MASTER’S THESIS Titel der Magisterarbeit / Title of the Master‘s Thesis Wahrnehmung und Bewertung von Krisenkommunikation Eine Untersuchung am Beispiel des Flugzeugunglücks der Lufthansa-Tochter Germanwings am 24. März 2015 verfasst von / submitted by Raffaela ECKEL, Bakk. phil. angestrebter akademischer Grad / in partial fulfilment of the requirements for the degree of Magistra der Philosophie (Mag. phil.) Wien, 2016 / Vienna, 2016 Studienkennzahl lt. Studienblatt / degree programme code as it appears on the student record sheet: A 066 841 Studienrichtung lt. Studienblatt / degree programme as it appears on the student record sheet: Publizistik- und Kommunikationswissenschaft Betreut von / Supervisor: Univ.-Prof. Dr. Sabine Einwiller Eidesstattliche Erklärung Ich erkläre hiermit an Eides statt, dass ich die vorliegende Arbeit selbstständig und ohne Benutzung anderer als der angegebenen Hilfsmittel angefertigt habe. Die aus fremden Quellen direkt oder indirekt übernommenen Gedanken sind als solche kenntlich ge- macht. Die Arbeit wurde bisher in gleicher oder ähnlicher Form keiner anderen Prü- fungsbehörde vorgelegt und auch noch nicht veröffentlicht. Wien, August 2016 Raffaela Eckel Inhaltsverzeichnis 1 Einführung und Problemstellung ......................................................................................... 1 1.1 Theoretische Hinführung: Beitrag der Wissenschaft zu einer gelungenen Krisenkommunikation.................................................................................................... 2 1.2 -

246429 Master S Thesis___Ro

Link to Microsoft Excel-Model In order to gain a better understanding of the following analysis and valuation, it is recommended to consider the original excel model, which has been built in a self-explanatory manner and can be found via the following link: https://www.dropbox.com/s/csj7ii75mvzcng7/Valuation of LHA - Master Thesis.xlsx?dl=0 While the main findings and explanations can be found in the text, you are welcome to contact me via e-mail with any questions or if problems with opening the file occur: [email protected] _______________________________________________________________________________________ Abstract The ultimate goal of this report is to provide the marginal investor with a thorough strategic as well as financial analysis of Deutsche Lufthansa AG leading towards a recommendation whether to buy, sell or hold the company's stock on 30.12.2016. Included in this analysis is an assessment of the credibility of current rumors about Lufthansa's potential engagement in M&A activity with Air Berlin. As consolidation is generally anticipated within the European airline industry, an informed assessment of the rumors' credibility is of relevance for the marginal investor. The applied DCF-valuation model derives at an estimate of 18,41€ for Deutsche Lufthansa AG's fair share price. As the stock is trading for 12,27€ on the valuation date, this report suggests that the market undervalues Lufthansa's stock. The additional constructions of a best and worst case scenario provide a potential range of share prices resembling possible deviations in estimated future growth rates of ASKs, load factors, unit yields, fuel and staff costs. -

THE AIRPORT COMMERCIAL SALES BENCHMARKING REPORT (Sample Document)

THE AIRPORT COMMERCIAL SALES BENCHMARKING REPORT (sample document) by 1 TABLE OF CONTENTS Introduction Disclaimer Methodology and Assumptions Summary of Findings : Duty-Free Summary of Findings : Duty-Free and Duty-Paid Summary of Findings : Food & Beverage Summary Tables: Duty-Free Summary Tables: Duty-Free and Duty-Paid Summary Tables: Food & Beverage Airport Profiles : Argentina – Aeropuertos Argentina 2000 Airport Profiles : Australia – Sydney Airport Airport Profiles : Australia – Melbourne Airport Airport Profiles : Australia – Selected Australian Airports Airport Profiles : Austria – Vienna International Airport Airport Profiles : Bahrain – Bahrain International Airport Airport Profiles : Belgium – Brussels Airport Airport Profiles : Bulgaria – Sofia Airport Airport Profiles : Canada – Airports of Canada Airport Profiles : Canada – Ottawa International Airport The Airport Commercial Sales Benchmarking Report 2 TABLE OF CONTENTS Airport Profiles : Canada – Toronto Pearson International Airport Airport Profiles : Chile – Arturo Benitez International Airport Airport Profiles : China – Beijing Capital International Airport Airport Profiles : China – Guangzhou Baiyun International Airport Airport Profiles : China – Shenzhen Bao’an International Airport Airport Profiles : China – Shanghai Airports Airport Profiles : Costa Rica – Airports of Costa Rica Airport Profiles : Croatia – Dubrovnik Airport Airport Profiles : Croatia – Franjo Tuđman Airport Zagreb Airport Profiles : Czech Republic - Václav Havel Airport Prague Airport Profiles -

Key Data on Sustainability Within the Lufthansa Group Issue 2012 Www

Issue 2012 Balance Key data on sustainability within the Lufthansa Group www.lufthansa.com/responsibility You will fi nd further information on sustainability within the Lufthansa Group at: www.lufthansa.com/responsibility Order your copy of our Annual Report 2011 at: www.lufthansa.com/investor-relations The new Boeing 747-8 Intercontinental The new Boeing 747-8 Intercontinental is the advanced version of one of the world’s most successful commercial aircraft. In close cooperation with Lufthansa, Boeing has developed an aircraft that is optimized not only in terms of com- fort but also in all dimensions of climate and environmental responsibility. The fully redesigned wings, extensive use of weight-reducing materials and innova- tive engine technology ensure that this aircraft’s eco-effi ciency has again been improved signifi cantly in comparison with its predecessor: greater fuel effi - ciency, lower emissions and signifi cant noise reductions (also see page 27). The “Queen of the Skies,” as many Jumbo enthusiasts call the “Dash Eight,” offers an exceptional travel experience in all classes of service, especially in the exclusive First Class and the entirely new Business Class. In this way, environmental effi ciency and the highest levels of travel comfort are brought into harmony. Lufthansa has ordered 20 aircraft of this type. Editorial information Published by Deutsche Lufthansa AG Lufthansa Group Communications, FRA CI Senior Vice President: Klaus Walther Concept, text and editors Media Relations Lufthansa Group, FRA CI/G Director: Christoph Meier Bernhard Jung Claudia Walther in cooperation with various departments and Petra Menke Redaktionsbüro Design and production organic Marken-Kommunikation GmbH Copy deadline 18 May 2012 Photo credits Jens Görlich/MO CGI (cover, page 5, 7, 35, 85) SWISS (page 12) Brussels Airlines (page 13) Reto Hoffmann (page 24) AeroLogic (page 29) Fraport AG/Stefan Rebscher (page 43) Werner Hennies (page 44) Ulf Büschleb (page 68 top) Dr. -

Annual Report 2015

Consistently safeguarding the future Annual Report 2015 Lufthansa Group The Lufthansa Group is the world’s leading aviation group. Its portfolio of companies consists of hub airlines, point-to-point airlines and aviation service companies. Its combination of business segments makes the Lufthansa Group a globally unique aviation group whose integrated value chain not only offers financial synergies but also puts it in a superior position over its competitors in terms of know-how. Key figures Lufthansa Group 2015 2014 Change in % Revenue and result Total revenue €m 32,056 30,011 6.8 of which traffic revenue €m 25,322 24,388 3.8 EBIT1) €m 1,676 1,000 67.6 Adjusted EBIT €m 1,817 1,171 55.2 EBITDA1) €m 3,395 2,530 34.2 Net profit / loss €m 1,698 55 2,987.3 Key balance sheet and cash flow statement figures Total assets €m 32,462 30,474 6.5 Equity ratio % 18.0 13.2 4.8 pts Net indebtedness €m 3,347 3,418 – 2.1 Cash flow from operating activities €m 3,393 1,977 71.6 Capital expenditure (gross) €m 2,569 2,777 – 7.5 Key profitability and value creation figures EBIT margin % 5.2 3.3 1.9 pts Adjusted EBIT margin % 5.7 3.9 1.8 pts EBITDA margin 1) % 10.6 8.4 2.2 pts EACC €m 323 – 223 ROCE % 7.7 4.6 3.1 pts Lufthansa share Share price at year-end € 14.57 13.83 5.3 Earnings per share € 3.67 0.12 2,958.3 Proposed dividend per share € 0.50 – Traffic figures 2) Passengers thousands 107,679 105,991 1.6 Freight and mail thousand tonnes 1,864 1,924 – 3.1 Passenger load factor % 80.4 80.1 0.3 pts Cargo load factor % 66.3 69.9 – 3.6 pts Flights number 1,003,660 1,001,961 0.2 Employees Average number of employees number 119,559 118,973 0.5 Employees as of 31.12. -

Airport Development

Page 1 of 12 25 July 2010 No. 885 DEV Published biweekly – available by annual subscription only – www.mombergerairport.info Editorial office / Subscriptions; Phone: +1 519 833 4642, e-mail: [email protected] Managing Editor / Publisher: Martin Lamprecht [email protected] News Editor: Paul Ellis [email protected] – Founding Editor: Manfred Momberger Copyright © 2010 – Momberger Airport Information by Air Trans Source Inc. – published since 1973 AIRPORT DEVELOPMENT (Southern Europe) ITALY Fondi Italiani per le Infrastrutture SGR SpA (F2i) has initiated discussions with Ferrovial SA regarding acquiring a controlling stake in GE.S.A.C. S.p.A., the operator of Naples- Capodichino Airport (#883.OPS1). Reuters reported that F2i’s Board has asked CEO Vito Gamberale to discuss the airport deal, valued at EUR 150 to 200 million, with Ferrovial. The Spanish company holds a 65% stake in Capodichino Airport through BAA Airports Ltd. It intends to sell non-core assets such as Naples Airport to repay its massive debt, reported to be GBP 1.54 billion. “There are various interested parties in the airport and we are studying their proposals,” a source close to BAA’s parent company Ferrovial said. #885.1 Officials at Bologna Airport have begun a call of bids for the remodelling of the passenger terminal. An announcement was made in the European Union’s official gazette in order to determine which company will care for hub requalification, construction supervision, and security co-ordination during the project’s execution phase. A starting amount of EUR 21.5 million was mentioned. Work must be completed within 720 days from the assigned date. -

Diapositiva 1

Numbers Italian Airport Industry Association - ATI SHORT PROFILES OF AIR TECH ITALY COMPANIES Welcome to the Italian Airport Industry Association Air Tech Italy (ATI) is the leading Trade Association representing Italian companies specialized in supplying products, technologies and services for airports and air-traffic control. We are the first hub for international clients looking for top-quality Italian companies. We have divided the companies into six main segments AIR TRAFFIC MANAGEMENT AIRFIELD CONSTRUCTION & SERVICES ENGINEERING & CONSULTANCY IT TERMINAL Main Segment: IT Numbers 17+ 14 YEARS OF EXPERIENCE PRODUCT PORTFOLIO 46 8 AIRPORTS SERVED SALES AND TECHNICAL WORLDWIDE SUPPORT CENTRES Products & Services Top Airports served • A-DCS Departure control system • Milan Malpensa MXP • A-WBS Weight and balance system • Milan Linate LIN • A-CUBE Multi CUTE Client • Gaborone GBE • A-MDS Message Distribution System • Teheran IKA • A-ODB Airport Operational Database • Istanbul IST • A-SCHED Flight Schedule • Verona Catullo VRN IT Solutions Provider for Airports, Airlines and Ground • A-FIDS Flight information display system • Rome Fiumicino FCO Handlers A-ICE provides value-added IT solutions and • A-MIS Multimedia information system • Tel Aviv TLV integrated applications to Airport, Airlines and Ground • A-SCP Security check point • A-HDB Handling database • Bangkok BKK Handlers, with specific experience in the implementa- • A-CAB Contract and billing • Bari BRI tion and support of mission critical systems. • BRS Baggage Reconciliation System A-ICE relies on its strong relationship with the Air • A-VMS Vehicles Maintenance System Transport community, addressing and anticipating the • CLOS Cooperative Logistics Optimization System needs as they evolve. Company associated with Via dei Castelli Romani, 59, 00071 – Pomezia (RM) ITALY Tel. -

Airline Alliances

AIRLINE ALLIANCES by Paul Stephen Dempsey Director, Institute of Air & Space Law McGill University Copyright © 2011 by Paul Stephen Dempsey Open Skies • 1992 - the United States concluded the first second generation “open skies” agreement with the Netherlands. It allowed KLM and any other Dutch carrier to fly to any point in the United States, and allowed U.S. carriers to fly to any point in the Netherlands, a country about the size of West Virginia. The U.S. was ideologically wedded to open markets, so the imbalance in traffic rights was of no concern. Moreover, opening up the Netherlands would allow KLM to drain traffic from surrounding airline networks, which would eventually encourage the surrounding airlines to ask their governments to sign “open skies” bilateral with the United States. • 1993 - the U.S. conferred antitrust immunity on the Wings Alliance between Northwest Airlines and KLM. The encirclement policy began to corrode resistance to liberalization as the sixth freedom traffic drain began to grow; soon Lufthansa, then Air France, were asking their governments to sign liberal bilaterals. • 1996 - Germany fell, followed by the Czech Republic, Italy, Portugal, the Slovak Republic, Malta, Poland. • 2001- the United States had concluded bilateral open skies agreements with 52 nations and concluded its first multilateral open skies agreement with Brunei, Chile, New Zealand and Singapore. • 2002 – France fell. • 2007 - The U.S. and E.U. concluded a multilateral “open skies” traffic agreement that liberalized everything but foreign ownership and cabotage. • 2011 – cumulatively, the U.S. had signed “open skies” bilaterals with more than100 States. Multilateral and Bilateral Air Transport Agreements • Section 5 of the Transit Agreement, and Section 6 of the Transport Agreement, provide: “Each contracting State reserves the right to withhold or revoke a certificate or permit to an air transport enterprise of another State in any case where it is not satisfied that substantial ownership and effective control are vested in nationals of a contracting State . -

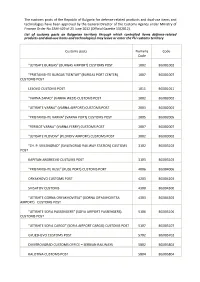

The Customs Posts of the Republic of Bulgaria for Defence-Related

The customs posts of the Republic of Bulgaria for defence-related products and dual-use items and technologies have been approved by the General Director of the Customs Agency under Ministry of Finance Order No ZAM-429 of 25 June 2012 (Official Gazette 53/2012). List of customs posts on Bulgarian territory through which controlled items defence-related products and dual-use items and technologies) may leave or enter the EU customs territory Customs posts Numeric Code Code “LETISHTE BURGAS” (BURGAS AIRPORT) CUSTOMS POST 1002 BG001002 “PRISTANISHTE BURGAS TSENTAR” (BURGAS PORT CENTER) 1007 BG001007 CUSTOMS POST LESOVO CUSTOMS POST 1011 BG001011 “VARNA ZAPAD” (VARNA WEST) CUSTOMS POST 2002 BG002002 “LETISHTE VARNA” (VARNA AIRPORT) CUSTOMS POST 2003 BG002003 “PRISTANISHTE VARNA” (VARNA PORT) CUSTOMS POST 2005 BG002005 “FERIBOT VARNA” (VARNA FERRY) CUSTOMS POST 2007 BG002007 “LETISHTE PLOVDIV” (PLOVDIV AIRPORT) CUSTOMS POST 3002 BG003002 “ZH. P. SVILENGRAD” (SVILENGRAD RAILWAY STATION) CUSTOMS 3102 BG003102 POST KAPITAN ANDREEVO CUSTUMS POST 3103 BG003103 “PRISTANISHTE RUSE” (RUSE PORT) CUSTOMS PORT 4006 BG004006 ORYAKHOVO CUSTOMS POST 4203 BG004203 SVISHTOV CUSTOMS 4300 BG004300 “LETISHTE GORNA ORYAKHOVITSA” (GORNA ORYAKHOVITSA 4303 BG004303 AIRPORT) CUSTOMS POST “LETISHTE SOFIA PASSENGERS” (SOFIA AIRPORT PASSENGERS) 5106 BG005106 CUSTOMS POST “LETISHTE SOFIA CARGO” (SOFIA AIRPORT CARGO) CUSTOMS POST 5107 BG005107 GYUESHEVO CUSTOMS POST 5702 BG005702 DIMITROVGRAD CUSTOMS OFFICE – SERBIAN RAILWAYS 5802 BG005802 KALOTINA CUSTOMS POST 5804 BG005804 -

Travel Info, Bulgaria

Info and travel hints for BBCAC-4 participants • Please kindly arrange your visa, travel schedule and report it to us now. • Please check the number of your lecture or poster and its scheduled time. • Poster size 80 cm (width) x 100 cm (height). • Plenary lectures 40 min, Power Point presentation. • Oral presentations 20 min, Power Point presentation. • Please bring a copy of your fee transfer document. • Students please bring a copy of your student status proof document. • Participants who have not made their bank transfer until now may pay cash during registration (preferably in BGN but Euro will be acceptable as well; no credit cards for registration payment). You will obtain a receipt for your payment (signed and stamped original). • You will obtain during registration a receipt for your bank transfer (signed and stamped original). • Changes in program due to late cancellations will be announced on 19 th September, Wednesday afternoon In Bulgarian Sunny Beach is "Slanchev Bryag". The conference site is just at the South part of SB, around a small river shown on map, not far from the road Burgas-Varna or Nessebar-Varna, ca. 15 km from Burgas airport Sarafovo. There are many busses Varna-SB and Varna-Burgas. http://sunnybeach-bg.com http://www.map-guide.bg/more_SunnyBeach.htm http://www.bulgariandreams.com/maps/map_sunnybeacharea.gif Airways www.hemusair.bg www.air.bg Sofia Airport www.sofia-airport.bg Burgas Airport http://www.bourgas- airport.com/l_en/index.php?PHPSESSID=3006f402c960f81f981346a516e755f8 http://www.bourgas-airport.com/l_bg/map.php -

Atmosfair Airline Index 2011

atmosfair Airline Index 2011 Copyright © atmosfair, Berlin 2011 How is the Airline Index used? - Even efficient flights can quickly exceed a single person’s climate appropriate CO budget 1. Avoidance 2 (see graphic). Is my flight necessary? - Have I chosen the most direct flight? (Rule of thumb: a direct flight in Efficiency Class E is better for the climate than a transfer flight in Class C) 2. Optimization - The airline index shows you the efficiency points of an airline broken down by short, medium and long distance flights. First, ascertain your flight distance and then, in the appropriate distance class, the most efficient airline. - The airline with the most efficiency points will generally also be the most efficient on your specific flight from point A to point B. Deviations are possible, but generally do not exceed one efficiency class. - atmosfair can offset the CO quantity that you generate with your flight by building up and 3. Compensation 2 expanding the generation of renewable energies. Make your contribution to fighting global warming online with the multiple test winner www.atmosfair.de Food, habitation, energy mobility C G C G C G Climate impact*: 100 kg CO2 210 kg CO2 360 kg CO2 1.600 kg CO2 2.000 kg CO2 850 kg CO2 1.450 kg CO2 1.600 kg CO2 2.600 kg CO2 1 year 1 passenger 1 year Personal 1 passenger 1 passenger operation of Distance 700 km car usage climate Distance 3.300 km Distance 6.550 km a fridge (e.g. Düsseldorf - Mailand) budget** (e.g. -

Annual Report 2016-2017 HELPLINE: +44 845 868 2708 [email protected] Amsterdam Schiphol Airport Table of Contents

Annual Report 2016-2017 HELPLINE: +44 845 868 2708 [email protected] Amsterdam Schiphol Airport Table of Contents 4 Highlights 8 1 Programme Overview 18 2 Participation Trends 42 3 Case Studies 62 4 Key Developments In Year 8 69 5 Looking Ahead To Year 9 72 6 Carbon Performance Of Accredited Airports 90 7 Participation List 3 Annual Report 2016-2017 Airport Carbon Accreditation Highlights This Annual Report of Airport Carbon Accreditation covers Year 8 of the programme: 16th May 2016 - 15th May 2017. This has been another positive year for the programme, with participation continuing to build year-on-year. At the beginning of this reporting year there were 156 airports in the programme. Since then, a further 36 airports have joined and 3 have withdrawn, bringing the total number of airports at the end of this reporting year to 189. The following developments should be highlighted: 1. Sustained programme growth in all world regions – including at Level 3+ In programme Year 8, for the first time airports outside Europe achieved the highest accreditation status: 1 airport in North America, 5 in Asia-Pacific and 1 in Africa have been recognised as carbon neutral. Carbon neutrality in Airport Carbon Accreditation means that all the emissions under direct control of these airports have been offset, on top of the reductions that have been made. This milestone shows that carbon neutrality is an objective shared by airports worldwide, and that Airport Carbon Accreditation effectively supports airports in working towards it, and reaching it. In total, 34 airports worldwide have achieved carbon neutrality in Year 8.