Larry Smith &Associates Ltd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Walmart Canada's

Walmart Canada’s Corporate Social Responsibility Report Environment People Ethical Sourcing Community Published September 2011 Introduction Corporate Social Responsibility Report Published September 2011 Message from the President and CEO Welcome to our latest CSR Report. This year’s theme is collaboration – it’s about working with our corporate peers, stakeholders, and even retail competitors to pursue the solutions to challenges which concern us all. We see this report as a powerful tool for corporate good. Our size gives us considerable influence and with it comes considerable responsibility – a role we embrace in order to help Canadians save money and live better. Our goal is to present an open look into the impact of our operations in Canada over the past year. This latest report frames our diverse activities into four broad categories of CSR: Environment, People, Ethical Sourcing and Community. In each area, we highlight our efforts and actions, both large and small – and summarize our current programs and challenges while outlining plans to keep improving in the future. Now ready to share this report with stakeholders, we are tremendously proud of the progress to date but equally aware of how much is still left to do. In the spirit of collaboration that permeates this report, I welcome your feedback to help us better pursue and attain our goals. David Cheesewright President and CEO, Walmart Canada What to look for in our 2011 CSR Report: Key Performance Indicators (KPIs) .........................................................................................................................3 -

NRDC ACQUISITION CORP. (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2008 or o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from ____ to ____ Commission file number: NRDC ACQUISITION CORP. (Exact name of registrant as specified in its charter) Delaware 26-0500600 (State or other jurisdiction (I.R.S. Employer of incorporation or organization) Identification No.) 3 Manhattanville Road, Purchase, NY 10577 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (914) 272-8067 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Units, each consisting of one share of Common Stock NYSE Alternext U.S. and one Warrant Common Stock, par value $0.0001 per share NYSE Alternext U.S. Common Stock Purchase Warrants NYSE Alternext U.S. Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(a) of the Act. Yes o No x Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

24Th Annual Report to the Hudson's Bay Company History Foundation

2018 24th Annual Report to the Hudson’s Bay Company History Foundation COVER PICTURE: PEGUIS SELKIRK 200 EVENT, 18 JULY 2017 HUDSON’S BAY COMPANY ARCHIVES | Archives of Manitoba Cover photo courtesy of the Peguis Selkirk 200 planning committee (https://peguisselkirk200.ca) Contents Transmittal ................................................................................................................. 3 Financial Expenditures, 2017-2018 ........................................................................... 4 Actual to Projected 2016-2017 and 2017-2018 Financial Expenditures, 2017-2020 ........................................................................... 5 Actual to Projected 2017-2019 and Requested 2019-2020 Program Report, 2017-2018 ....................................................................................... 6 Acquisition Client Service Description Digitization Promotion and Outreach Indigenous Peoples and Remote Communities Initiatives Preservation Appendix A ..............................................................................................................12 Staff, October 2018 Appendix B ..............................................................................................................13 HBCA 3-Year Operating Expenditures, 2015-2018 Appendix C ..............................................................................................................14 Non-Capital 5-Year Expenditures Appendix D ..............................................................................................................15 -

Canadian Multinationals

Canadian Multinationals A multinational corporation (MNC) is a corporation/enterprise that manages production establishments or delivers services in at least two countries Also called multinational enterprise (MNE) Or transnational enterprise (TNC) Very large MNC have budgets that exceed that of some countries Are divided into three types: Horizontal Vertical Diversified Multinational Companies Powerful influence Individually Societal International Competition for spots Multinational Companies Emerging issues Transfer pricing Transparency Quick Facts 6 of the largest 15 Canadian MNEs are resource companies Two-thirds of the top Canadian financial enterprises have international operations Brief History Chartered Banks were the first Canadian MNEs and remain among the largest. Bank of Montreal: Created in 1817 by a group of Montreal merchants Used the best organizational and financial methods of the time 1818 – Opened a branch in New York 1870 – Established a branch in London After world war II, Canada become one of the largest exporters of direct investment First significant outflow to Canadian utility enterprises in Latin American and the Caribbean 1971: 6th largest capital exporter in the world Most successful: Brazilian Traction, Light & Power -Eventually nationalized by the Brazilian government Reasons Canadian firms had to reach outside for capital Canadian Pacific Railway - Financed itself by selling shares and bonds through the London financial market Canadian banks were pioneers in the combination of domestic retail -

ENG COV 4SEDAR.Qxd

here for you Hudson’s Bay Company 2003 Annual Report Hbc is a shopping solution that offers Canadians superior products, assortments, service and ease of shopping. Supported by 70,000 associates and a retail network that is unparalleled, Hbc’s management team is guided by a single aligned vision. We are “one Hbc”. The Bay is the department store Zellers is the mass merchandise divi- Home Outfitters is Hbc’s specialty division of Hbc, with locations from sion of Hbc, with Zellers and Zellers kitchen, bed and bath decor super- coast to coast and a dominant Select locations in communities store chain with unbeatable selection position in the downtown cores of nationwide. Offering customers value, and service. With locations across Canada’s major cities. The Bay service and price competitiveness on Canada, Home Outfitters offers cus- offers a full line of quality fashion national and private-brand merchandise tomers more choices, more brands merchandise in apparel, appliances, is Zellers’ top priority. There are more and great ideas. Home Outfitters is accessories and home categories at than 300 Zellers stores. Canada’s fastest-growing specialty mid-to-upper price points, accompa- store chain. There are 45 Home nied by traditional department store Outfitters stores. services. There are 99 Bay stores. In 2003, after a thorough analysis of the Canadian retail market and Hbc’s opportunities to achieve growth, the Company outlined a plan for $1.5 billion in incremental sales growth from existing oper- ations by 2008. Six growth objectives, which are managed within our organization, were identified. These initiatives are targeted to deliver comparable store sales increases throughout Hbc’s family of stores: the Bay, Zellers and Home Outfitters. -

Community, Technical, and Junior College Statistical Yearbook, 1988 Edition, INSTITUTION American Association of Community and Junior Colleges, Washington, D.C

DOCUMENT RESUME ED 307 907 JC 890 262 AUTHOR Palmer, Jim, Ed. TITLE Community, Technical, and Junior College Statistical Yearbook, 1988 Edition, INSTITUTION American Association of Community and Junior Colleges, Washington, D.C. PUB DATE 88 NOTE 74p.; For an appendix to the yearbook, see JC 890 263. PUB TYPE Reports Research/Technical (143) Statistical Data (110) EDPS PRICE MF01/PC03 Plus Postage. DESCRIPTORS Administrators; *College Faculty; Community Colleges; Community Education; Degrees (Academic); *Enrollment; Fees; Full Time Students; Institutional Characteristics; Minority Groups; National Surveys; cart Time Students; Private Colleges; Public Colleges; Statistical Data; Statistical Surveys; Tuition; *Two Year Colleges; *Two Year College Students ABSTRACT Drawing primarily from a survey conducted by the American Association of Community and Junior Colleges in f.11 1987, this report provides a statistical portrait of the country's community, junior, and technical colleges on a state-by-state and institution-by-institution basis. Part 1 presents data for individual colleges listed by state. For each college, it provides the following information: the name, city, and zip code of the institution; the name of the chief executive officer; type of control (i.e., public or private); fall 1986 and 1987 headcount enrollment in credit classes of full-time, part-time, and minority students; noncredit enrollment for 1986-87; number of full- and part-time faculty teaching credit classes in fall 1987; number of administrators employed in fall 1987; and annual tuition and required fees for the 1987-88 academic year. Part 2 presents statewide data on both public and private two-year colleges. Tha state summaries include the number of colleges; fall 1986 and 1987 full- and part-time and total headcount enrollment in credit classes; fall 1987 minority enrollment in public institutions; and the numbers of faculty employed full- and part-time in fall 1987. -

1 • MAY 2, 2011 DRUGSTORENEWS.COM MAY 2, 2011 • 2 Fast, Nimble Walgreens Aims to Own ‘Well’ by JIM FREDERICK

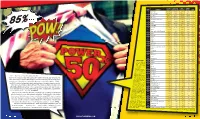

2010 Rx 2010 TOTAL TOTAL STORES RANK COMPANY SALES* CORP. SALES* STORES WITH Rx PAGE 1 Walgreens1 $44,400 $67,420 7,561 7,561 3 2 CVS Caremark 40,000 96,4132 7,182 7,123 4 3 Rite Aid 17,100 25,200 4,714 4,714 5 4 Walmart3,4 15,600 260,261 3,804 3,732 6 5 Good Neighbor Pharmacy 10,200 11,300 3,700 3,700 7 6 Cardinal5 9,000 10,300 4,300 4,300 8 7 Kroger 7,200 82,189 2,458 1,950 9 8 Health Mart 5,600 6,920 2,800 2,800 10 9 Safeway 3,700 41,050 1,694 1,320 11 10 Target 3,200 67,3906 1,755 1,565 12 11 American Associated Pharmacies 2,800 3,100 2,000 2,000 13 12 Kmart† 2,370 15,593 1,307 981 13 13 Supervalu7 2,300 28,911 2,394 805 14 14 Ahold† 2,100 23,523 751 555 14 15 Costco† 1,500 59,600 424 419 15 16 Publix 1,500 25,134 1,033 841 15 17 Sam’s Club 1,340 49,459 609 537 16 18 BioScrip 1,327 1,639 31 31 22 19 Medicine Shoppe International† 1,250 1,320 658 658 17 20 H-E-B 1,200 16,000 330 210 16 21 Giant Eagle 1,120 8,600 228 213 17 22 Hy-Vee 942 6,900 232 229 18 23 Albertsons 787 3,283 216 205 18 24 Fred’s 628 1,842 677 313 19 25 Kinney Drugs 602 789 90 90 20 FOOTNOTES 26 Shopko 592 2,010 136 135 20 1 Store count as 27 ShopRite 590 11,800 232 191 21 of end of fiscal 2010 — Aug. -

The Monthly Survey of Large Retailers / L'enquête Mensuelle Des Grands

The Monthly Survey of Large Retailers / L’Enquête mensuelle des grands détaillants Legal Name / Raison sociale Operating Name / Nom commercial The Food Retailers / Magasins d’alimentations 1. Canada Safeway Limited Canada Safeway Retail Division, Canada Safeway Liquor Stores 2. Great Pacific Industries Inc Buy Low Foods, Overwaitea Foods, Overwaitea Foods Gas, Price$mart 3. Loblaw Companies Limited Real Canadian Superstore Division, Loblaws Supermarket Division, Zehrmart Division, Ontario Gas Bars, Supermarches/Banniere Provigo, Supermarches/Banniere Maxi, Supermarches/Banniere Maxi & CIE, Loblaws Quebec, Quebec Gas Bars, The Real Canadian Superstore, Extra Foods, Western Gas Bars, Real Atlantic Superstore, Atlantic Dominions, Atlantic Gas Bars, Real Canadian Liquor Store Division, Western Grocers, National Grocers, Supervalue 4. Métro-Richelieu Inc Loeb, Métro-Richelieu, Division Super C, A & P Drug Mart, Food Basic$, The Great Atlantic & Pacific Company of Canada, Dominion, A & P Superfresh., The Barn Market 5. Sobeys Group Inc TRA Maritimes, Needs Convenience Stores, Price Chopper, Sobeys, Ontario Corporate Stores, Quebec, Corporate Stores, Sobeys West Corporate Stores, Sobeys Atlantic Corporate Stores, Sobeys Western Cellars, IGA, Foodland 1 The Department Stores (including concessions) / Les grands magasins (incluant leurs Concessions) 1. Hudson’s Bay Company The Bay/La Baie, The Bay Furniture Outlet, Designer Depot, Fields Store, Home Outfitters, Zellers 2. Sears Canada Inc Sears Canada Full Line Stores, Sears Whole Home Furniture Stores, Sears Off- Mall Stores, Sears Clearance Centres 3. Wal-Mart Canada Corp Sam’s Club, Wal-Mart Canada The Other Non-Food Retailers / Les détaillants autres qu’alimentaires 1. 668824 Alberta Ltd Visions : The Big Name in Electronics 2. A & B Sound Inc A & B Sound 3. -

Hudson's Bay Company 2004 Annual Financial Report

HBC04_Book2E_sedar 4/20/05 3:50 PM Page FC1 Hudson’s Bay Company 2004 Annual Financial Report HBC04_Book2E_sedar 4/20/05 3:50 PM Page FC2 01 Letter to Shareholders 03 Financial Highlights 04 Annual Management’s Discussion and Analysis 34 Consolidated Financial Statements 37 Notes to Consolidated Financial Statements 58 Five-Year Financial Summary 59 Board of Directors 60 Senior Officers IBC Corporate Information HBC04_Book2E_sedar 4/20/05 3:50 PM Page 1 To Our Shareholders Left George J. Heller 01 President and Chief Executive Officer Right L. Yves Fortier, C.C., Q.C. Governor Retailing in Canada continues to evolve and change, and growing the business and profits is frustratingly slow in this climate of rapid change. However, success will go to those who are most responsive to the customer and marketplace while respecting the fundamentals of the business. Although we are disappointed with the year’s results, we remain confident and committed to the strategy of an integrated Hbc delivering increasingly better and targeted assortments through distinct yet integrated banners, backed by a solid balance sheet, great real estate and a robust “back-of-house” capability. The consumer continues to be ever more price conscious and selective, for the past decade we have experienced a low level general deflation that is forcing more units at lower prices into the marketplace as retailers look for sales growth. At Hbc, we are accelerating the pace of offering our customers ever better value through consolidating our purchases and finding or engineering great values internationally. Our programs such as Power Buys, Style Outlets and our newest entry, Designer Depot, are meant to ensure we remain in the forefront of delivering value to Canadians. -

A Potted History of Woolworths Stores

A potted history of Woolworths stores F.W. Woolworth was the retail phenomenon of the twentieth century - a shop for masses that sold factory made goods at rock bottom prices. It was the first brand to go global, building to more than 3,000 near identical stores across the world. At its height it generated such fabulous riches that its founder was able to build the world's tallest building and pay for it in cash. It shares were the gold standard of the exchanges in New York and London, paying dividends that others could only dream of. To become a Woolworth supplier was considered a licence to print money. Part of its magic was an ability to adapt to fit into different local communities and to 'go native', without sacrificing its uniqueness. Shoppers in the UK considered 'Woolies' as British as fish and chips, while Americans continued to call the chain 'the five and ten' more than sixty years after it dropped its fixed price formula. But, having risen like a meteor, all the way to the top, it faded in the 1990s into a peaceful retirement in the USA and Canada before falling like a stone in the UK in 2008. Woolworths UK went from normal trading in 800 stores to complete shutdown in just 41 days. In Germany the chain faced a similar fate a few months later. In both Countries the brand was soon revived on-line. There can be little doubt that if Frank Woolworth was starting out today it would be on the Internet, with its low costs and mass reach. -

Downes, Prentice G., 1909-1978 80-004 TITLE Prentice G

Selected Trent University Archives Resources Related to Northern Studies Which are Linked to Publications in the Special Collections Downes, Prentice G., 1909-1978 80-004 TITLE Prentice G. Downes fonds. -- 1930-1954. -- 3 items. -- 1 photograph. BIOGRAPHY / HISTORY Prentice Gilbert Downes, born in 1909, was a school teacher from Concord, Massachusetts. He often travelled to the north during the summer and one such visit is chronicled in his book "Sleeping Island: the Story of One Man's Travels in the Great Barren Lands of the Canandian North" (1943). He died in approximately 1978. CUSTODIAL HISTORY The fonds was created by P.G. Downes, and remained in the custody of his wife E.G. Downes. She donated it to the Trent University Archives. SCOPE AND CONTENT This fonds consists of three notebooks of typewritten notes entitled "Reference Notes on the Cree", and one photograph of P.G. Downes with Richard Finnie. The notebooks contain bibliographic sources, alphabetically arranged, their contents briefly analyzed and evaluated in terms of their usefulness to the study of various facets of Cree society. The notebooks also contain a number of Prentice G. Downes' writings. Related book: Downes, P.G. Sleeping island: the story of one man’s travels in the great Barren Lands of the Canadian North. New York: Coward- McCann, Inc., c1943. F 5905 .D745 SpC • Prentice G. Downes was an American school teacher with a love of the north and the Arctic who made a numerous trips to these areas – in 1936, 1937, 1939, 1947 and 1951. This book related to his 1939 canoe trip was north of Reindeer Lake up to Nueltin Lake – the Lake of the Sleeping Island - in the Barren lands off the coast of Hudson’s Bay. -

2003 Annual Report

FOOT LOCKER, INC. Successful Growth...Worldwide 2003 Annual Report $4,779,000,000 2003 $4,509,000,000 2002 $4,379,000,000 2001 FOOT LOCKER, INC. About the Company Foot Locker, Inc. (NYSE: FL) is the world's leading Additionally, the Company's Footlocker.com/Eastbay retailer of athletic footwear and apparel. Headquartered business operates a rapidly growing direct-to-customers in New York City, it operates approximately 3,600 athlet- business offering athletic footwear, apparel and equip- ic retail stores in 16 countries in North America, Europe ment through its Internet and catalog channels. and Australia under the brand names Foot Locker, Lady Foot Locker, Kids Foot Locker and Champs Sports. Athletic Stores Sales Per Average Gross Square Foot (dollars) 2003 $335 2002 $316 2001 $306 2000 $301 1999 $282 Operating Profit Margin (percent) 2003 7.2% 2002 6.0% 2001 4.5% 2000 4.2% 1999 -1.8% Income from Continuing Operations (millions) 2003 $209 2002 $162 2001 $111 2000 $107 1999 $59 ROE (percent) 2003 16.8% 2002 15.4% 2001 11.1% 2000 10.0% 1999 5.4% Table of Contents Shareholders’ Letter 1 Business Overview 4 Foot Locker 5 Champs Sports 6 Lady Foot Locker/Kids Foot Locker 7 Footlocker.com/Eastbay 8 Form 10-K 9 Board of Directors, Corporate Management, Division Management, Corporate Information IBC Cover image illustrates sales growth. SHAREHOLDERS’LETTER The successful implementation of strategic initiatives has contributed to our significantly improved profitability, strong cash flow and solid balance sheet. Since the commencement of the new 2003 Financial Highlights dence and a highly promotional retail millennium, our financial results have 2003 was a significant year for us.