AR+2017+ENG Com.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Trang 1/ 13 TERMS and CONDITIONS

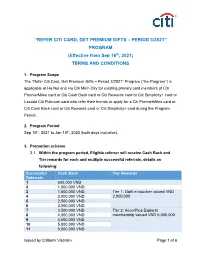

“REFER CITI CARD, GET PREMIUM GIFTS – PERIOD 3/2021” PROGRAM (Effective from Sep 16th, 2021) TERMS AND CONDITIONS 1. Program Scope The “Refer Citi Card, Get Premium Gifts – Period 3/2021” Program (“the Program”) is applicable at Ha Noi and Ho Chi Minh City for existing primary card members of Citi PremierMiles card or Citi Cash Back card or Citi Rewards card or Citi Simplicity+ card or Lazada Citi Platinum card who refer their friends to apply for a Citi PremierMiles card or Citi Cash Back card or Citi Rewards card or Citi Simplicity+ card during the Program Period. 2. Program Period Sep 16th, 2021 to Jan 15th, 2022 (both days inclusive). 3. Promotion scheme 3.1. Within the program period, Eligible referrer will receive Cash Back and Tier rewards for each and multiple successful referrals, details as following: Successful Cash Back Tier Rewards Referrals 1 500,000 VND 2 1,000,000 VND 3 1,500,000 VND Tier 1: GotIt e-voucher valued VND 4 2,000,000 VND 2,000,000 5 2,500,000 VND 6 3,000,000 VND 7 3,500,000 VND Tier 2: AccorPlus Explorer 8 4,000,000 VND membership valued VND 6,000,000 9 4,500,000 VND 10 5,000,000 VND 11 5,500,000 VND Issued by Citibank Vietnam Page 1 of 6 12 6,000,000 VND Tier 3: Apple Watch SE 44mm GPS 13 6,500,000 VND valued VND 9,990,000 14 7,000,000 VND 15+ 7,500,000 VND Special: Apple 11-inch iPad Pro Wi-Fi 128GB valued VND 21,990,000 Caps 7,500,000 VND Tier 1: 100 gifts Tier 2: 50 gifts Tier 3: 30 gifts Special: 20 gifts Note: In all situations, a Referrer who satisfies all the terms and conditions of the program will receive maximum VND 7,500,000 cash back. -

Bradley C Resume

BRADLEY C. LALONDE Co-Founder and Managing Partner Vietnam Partners LLC Hanoi, Vietnam email: [email protected] mobile: +84-90-810-6518 (Vietnam) +1-917-991-9109 (global) PROFESSIONAL EXPERIENCE: Over 25 year career in investment and corporate banking in multiple countries, spanning the United States, Europe, Middle East, Africa and Asia. Over 15 years experience in general management of Citibank franchises encompassing credit, marketing, operations and technology and treasury activities. Built start up franchises into profitable and well controlled businesses in Turkey, Tunisia and Vietnam. Key competences are marketing, credit and risk management , people management, particularly hiring, training and developing staff in marketing and risk management skills. A frequent guest lecturer in selling skills, marketing and risk management in Citibank training programs. In addition, significant professional experience in strategic planning, developing a business model to service the non-bank financial institutions industry, corporate audit for commercial lending and leasing in the United States, and Private Equity. Senior Credit Officer of Citigroup. Awarded distinguished order of the Republic from President of Tunisia for contributions to banking system(1993). Chairman of the American Chamber of Commerce in Hanoi, Vietnam(1996-1998). Numerous board seats on various trade and community organizations. PRESENT: Partner and Co-Founder of Vietnam Partners, New York. Since October 03 to present. An Investment Bank serving the Vietnamese government and businesses in Vietnam. Investing capital, raising capital and providing financial advise. Head office in New York City and representative office in Hanoi, Vietnam. Notable achievements over the last 5 years. Established 50:50 joint venture fund management company with Bank for Development and Investment in Vietnam( BIDV). -

Vietnam Global Depositary Notes (Gdns) Issuance & Cancellation Guide GDN List / Vietnamese Bonds

Depositary Receipt Services August 2015 Vietnam Global Depositary Notes (GDNs) Issuance & Cancellation Guide GDN List / Vietnamese Bonds Coupon Maturity Date Local ISIN GDN ISIN 144A GDN ISIN REGS 12.300% 6/20/2016 VNTD11160403 US92670LAH24 XS1247495903 12.50% 7/25/2016 VNTD11160502 US92670LAJ89 XS1247502377 12.40% 9/6/2016 VNTD11160544 US92670LAK52 XS1247503268 7.60% 10/31/2016 VNTD13160195 US92670LAL36 XS1247505396 10.80% 4/15/2017 VNTD12170369 US92670LBA61 XS1247507095 9.50% 6/15/2017 VNTD12170385 US92670LAM19 XS1247509034 9.30% 1/15/2018 VNTD13180219 US92670LAN91 XS1247509620 8.20% 1/15/2019 VNTD14190811 US92670LAP40 XS1247511014 7.90% 2/15/2019 VNTD14190829 US92670LAQ23 XS1247511527 6.00% 1/15/2020 VNTD15202565 US92670LAR06 XS1247512681 5.40% 1/31/2020 VNTD15202599 US92670LAS88 XS1247513499 5.30% 2/15/2020 VNTD15202607 US92670LAT61 XS1247514208 5.20% 2/28/2020 VNTD15202615 US92670LAU35 XS1247515601 8.70% 5/31/2024 VNTD14240921 US92670LAV18 XS1247516328 8.80% 3/15/2029 VNTD14290942 US92670LAW90 XS1247516674 7.60% 1/31/2030 VNTD15302589 US92670LAX73 XS1247517219 7.50% 2/28/2030 VNTD15302878 US92670LAY56 XS1247517565 7.20% 3/15/2030 VNTD15302886 US92670LAZ22 XS1247518530 Ratio for GDN Trading & Settlement Purposes • 1 Vietnam GDN = VND 100,000 nominal amount of Local Vietnamese Government Bonds 1 Vietnam GDN Issuance Process 1. On S/D, International Broker-Dealer sends instructs its local custodian (MT542 - DF Instruction) for the delivery of Vietnamese bonds to “Citibank NY GDN safekeeping account” at Citibank Vietnam including the following information: International Investor a) Counterparty: Citibank, N.A. – GDN depositary b) Local Vietnamese Bonds quantity & ISIN, c) GDN quantity & ISIN International Broker-Dealer d) GDN settlement instructions (DTC participant+ any sub-account # or other relevant reference). -

APEC Meeting Documents

Participant List (GFPN 03/2009A) APEC Workshop: Best Practices in Microfinance 7-8 April 2011, Hanoi, Vietnam PARTICIPANTS LIST Economy: BRUNEI DARUSSALAM S/N Title Name Position Organization Contacts ( Tel / HP / Fax / Email ) Rogayah binti Abdullah Community Development Officer Ministry of Culture, Youth and [email protected] Sports Norzaridah binti Haji Community Development Officer Ministry of Culture, Youth and [email protected] Zainal Sports Economy: CHILE S/N Title Name Position Organization Contacts ( Tel / HP / Fax / Email ) Ms. Katia Makhlouf Advisor in SMEs Division Ministry of Economy [email protected] Ms. Viviana Paredes Head of Women work Area Women’s National Service of Chile (SERNAM) [email protected] Economy: CHINA S/N Title Name Position Organization Contacts ( Tel / HP / Fax / Email ) Mr. ZHANG Haiying Division director Department of Small and Medium T: 861.0682.05316 Enterprises, Ministry of Industry and F: 861.0660.17331 Information Technology [email protected] 4 S/N Title Name Position Organization Contacts ( Tel / HP / Fax / Email ) Mr. ZHANG Baiyin Expert Ministry of Industry and Information T: 861.0682.05325 Technology Software and Integrated F: 861.0660.17331 circuit Promotion Center [email protected] Economy: INDONESIA S/N Title Name Position Organization Contacts ( Tel / HP / Fax / Email ) Mrs. Ika Tejaningrum Senior Analyst, Head of Research & Central Bank of Indonesia T: 622.1381.7991 Development on Credit and SMEs F: 622.1351.8951 [email protected] Ms. Caroline Mangowal Research Unit Manager Microfinance Innovation Center for [email protected] Resources and Alternatives (MICRA) Economy: MALAYSIA S/N Title Name Position Organization Contacts ( Tel / HP / Fax / Email ) Mrs. -

Strengthening Trade Capacity for Development

© OECD, 2001. © Software: 1987-1996, Acrobat is a trademark of ADOBE. All rights reserved. OECD grants you the right to use one copy of this Program for your personal use only. Unauthorised reproduction, lending, hiring, transmission or distribution of any data or software is prohibited. You must treat the Program and associated materials and any elements thereof like any other copyrighted material. All requests should be made to: Head of Publications Service, OECD Publications Service, 2, rue André-Pascal, 75775 Paris Cedex 16, France. 43 2001 07 1 P 18/10/01 19:10 Page 1 The DAC Guidelines Strengthening Trade Capacity for Development ORGANISATION FOR ECONOMIC CO-OPERATION AND DEVELOPMENT histo.fm Page 1 Monday, October 1, 2001 3:38 PM ORGANISATION FOR ECONOMIC CO-OPERATION AND DEVELOPMENT Pursuant to Article 1 of the Convention signed in Paris on 14th December 1960, and which came into force on 30th September 1961, the Organisation for Economic Co-operation and Development (OECD) shall promote policies designed: – to achieve the highest sustainable economic growth and employment and a rising standard of living in Member countries, while maintaining financial stability, and thus to contribute to the development of the world economy; – to contribute to sound economic expansion in Member as well as non-member countries in the process of economic development; and – to contribute to the expansion of world trade on a multilateral, non-discriminatory basis in accordance with international obligations. The original Member countries of the OECD are Austria, Belgium, Canada, Denmark, France, Germany, Greece, Iceland, Ireland, Italy, Luxembourg, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, Turkey, the United Kingdom and the United States. -

FINANCIAL CHECKS – Vietnam - Agent Checklist (Not for Use in High Risk Areas)

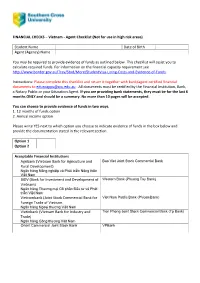

FINANCIAL CHECKS – Vietnam - Agent Checklist (Not for use in high risk areas) Student Name Date of Birth Agent (Agency) Name You may be required to provide evidence of funds as outlined below. This checklist will assist you to calculate required funds. For information on the financial capacity requirement see http://www.border.gov.au/Trav/Stud/More/StudentVisa-Living-Costs-and-Evidence-of-Funds. Instructions: Please complete this checklist and return it together with bank/agent certified financial documents to [email protected] . All documents must be certified by the Financial Institution, Bank, a Notary Public or your Education Agent. If you are providing bank statements, they must be for the last 6 months ONLY and should be a summary. No more than 10 pages will be accepted. You can choose to provide evidence of funds in two ways. 1. 12 months of funds option 2. Annual income option Please write YES next to which option you choose to indicate evidence of funds in the box below and provide the documentation stated in the relevant section. Option 1 Option 2 Acceptable Financial Institutions Agribank (Vietnam Bank for Agriculture and Bao Viet Joint Stock Commercial Bank Rural Development) Ngân hàng Nông nghiệp và Phát triển Nông thôn Việt Nam BIDV (Bank for Investment and Development of Western Bank (Phuong Tay Bank) Vietnam) Ngân hàng Thương mại Cổ phần Đầu tư và Phát triển Việt Nam Vietcombank (Joint Stock Commercial Bank for Viet Nam Public Bank (PVcomBank) Foreign Trade of Vietnam. Ngân hàng Ngoại thương Việt Nam Vietinbank (Vietnam -

Market Issue Lookup # Applies To

############################################################ # Market Issue Lookup # Applies to: Muni,Pfd,Govt,Corp # Format: #* Muni: FIELD NAME|BLANK_FIELD|MARKET_ISSUE|YKEYS #* Pfd: FIELD NAME|BLANK_FIELD|MARKET_ISSUE|YKEYS #* Govt: FIELD NAME|BLANK_FIELD|MARKET_ISSUE|YKEYS #* Corp: FIELD NAME|BLANK_FIELD|MARKET_ISSUE|YKEYS ############################################################ LU_MARKET_ISSUE| |AUSTRALIAN|Corp| LU_MARKET_ISSUE| |BULLDOG|Corp| LU_MARKET_ISSUE| |CANADIAN|Corp| LU_MARKET_ISSUE| |CERTIFICATE OF OBLIGATION|Muni| LU_MARKET_ISSUE| |CERTIFICATE PARTICIPATION|Muni| LU_MARKET_ISSUE| |DOMESTIC|Corp| LU_MARKET_ISSUE| |DOMESTIC MTN|Corp| LU_MARKET_ISSUE| |EURO MTN|Corp| LU_MARKET_ISSUE| |EURO NON-DOLLAR|Corp| LU_MARKET_ISSUE| |EURO-DOLLAR|Corp| LU_MARKET_ISSUE| |EURO-ZONE|Corp| LU_MARKET_ISSUE| |G.O. LTD NOTES|Muni| LU_MARKET_ISSUE| |G.O. UNLTD NOTES|Muni| LU_MARKET_ISSUE| |GENERAL OBLIGATION LTD|Muni| LU_MARKET_ISSUE| |GENERAL OBLIGATION UNLTD|Muni| LU_MARKET_ISSUE| |GLOBAL|Corp| LU_MARKET_ISSUE| |INTERNATIONAL|Corp| LU_MARKET_ISSUE| |NOTES|Muni| LU_MARKET_ISSUE| |PRIV PLACEMENT|Corp| LU_MARKET_ISSUE| |PRIVATE|Pfd| LU_MARKET_ISSUE| |PUBLIC|Pfd| LU_MARKET_ISSUE| |RESTRUCTURD DEBT|Corp| LU_MARKET_ISSUE| |REVENUE BONDS|Muni| LU_MARKET_ISSUE| |REVENUE NOTES|Muni| LU_MARKET_ISSUE| |SAMURAI|Corp| LU_MARKET_ISSUE| |SHOGUN|Corp| LU_MARKET_ISSUE| |SPARE - N/A|Corp| LU_MARKET_ISSUE| |SPECIAL ASSESSMENT|Muni| LU_MARKET_ISSUE| |SPECIAL OBLIGATION BONDS|Muni| LU_MARKET_ISSUE| |SPECIAL TAX|Muni| LU_MARKET_ISSUE| |TAX ALLOCATION|Muni| -

Ready for Breakthrough VIETNAM TECHNOLOGICAL and COMMERCIAL JOINT STOCK BANK JOINT STOCK and COMMERCIAL VIETNAM TECHNOLOGICAL

Ready for Breakthrough ANNUAL Report 2009 A NNUAL R eport 2009 VIETNAM TECHNOLOGICAL AND COMMERCIAL JOINT STOCK BANK 70 – 72 Ba Trieu Street, Hoan Kiem District, Hanoi, Vietnam Tel: +84(4) 3944 6368 VIETNAM TECHNOLOGICAL AND COMMERCIAL JOINT STOCK BANK Fax: +84(4) 3944 6362 Swift code: VTCBVNVX www.techcombank.com.vn TABLE OF CONTENTS READY FOR BREAKTHROUGH FOUNDATION POTENTIAL INITIATING CHANGE FINANCIAL Statements NETWORK Techcombank made a major breakthrough in 2009 towards becoming the best bank in Vietnam. We also set the benchmark as one of the first companies in Vietnam to apply international best practices across all aspects of our business, including organizational restructuring, product innovation, technology upgrade and capability building, to help us delight our customers. Vision / Mission 08 Retail Banking 20 Organizational restructure Independent Financial Branch Network 84 5 Core Values 09 Corporate Banking 26 - strategic transformation Statement 54 Awards & Accolades 96 and corporate culture 50 Board of Directors 10 Risk Management 32 Consolidated Financial Statement 74 Audit Committee 12 Markets 36 Nomination & Human Resources 38 Remuneration Committee 13 Technology 42 Audit & Risk Committee 14 Branding 44 Executive Management Committee 16 Organization Structure 18 TECHCOMBANK ANNUAL REPORT 2009 1 Message from Chairman of the Board of Directors We initiated widespread change-management programs in 2009 – 2010 to support our ambition to become the “best bank and a leading business in Vietnam” by 2014. On behalf of the Board, I would like to thank you, our period 2009-2014. We also implemented major change- Techcombank has set itself three Missions to realize this ensure effective implementation of the 2009-2010 shareholders, customers and strategic partners for management initiatives across the whole organization ambition: change-management initiatives as well as the business your unwavering support, which helped us to deliver a to allow us to not only overcome the changes, but development strategy leading up to 2014. -

808126 CTB Vietnam Priority Pass Quick Reference Guide BN11.Ai

880812608126 CCTBTB VietnamVietnam PriorityPriority PassPass QuickQuick ReferenceReference Guide_BN11.aiGuide_BN11.ai 1 25/9/2025/9/20 2:37 PM Tn hng chuyn i ca bn! Enjoy your journey! 880812608126 CCTBTB VietnamVietnam PriorityPriority PassPass QuickQuick ReferenceReference Guide_BN11.aiGuide_BN11.ai 2 25/9/2025/9/20 2:37 PM Hãy Th Tín Dng Citi PremierMiles và Th Priority Pass ng hành cùng Quý Khách trong mi chuyn du lch hoc công tác Be sure to take your Citi PremierMiles Credit Card and Priority Pass Card with you whenever you travel Quý Khách s c tn hng dch v Phòng Ch VIP thuc Chng trình Priority Pass, bt k Quý Khách s dng hãng Hàng không, hng gh nào hay ã là thành viên ca các Chng trình Bay Thng Xuyên ca các hãng Hàng không khác, duy nht vi b ôi quyn lc Th Tín Dng Citi PremierMiles và Th Priority Pass. You will enjoy the Priority Pass participating Lounges regardless of your choice of Airline, class of Airline ticket or membership of an Airline Frequent Flyer club, exclusively with your Citi PremierMiles Credit Card and Priority Pass Card. Hãy thoi mái tn hng và tri nghim các tin nghi và dch v vi tiêu chun cao cp – mt th gii riêng bit hoàn toàn thoát khi s náo nhit thng thy sân bay dù bt c ni âu. Enjoy your visit and experience outstanding standards of comfort and service - a world away from chaotic airport terminals wherever you travel. Đ cp nht thông tin mi nht v Phòng Ch VIP, vui lòng truy cp www.prioritypass.com. -

Lazada Citi Platinum Card Online Application Program Receive Lazada E-Voucher

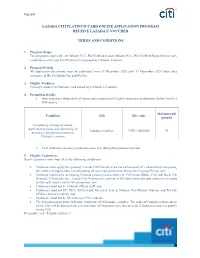

Page 1/3 LAZADA CITI PLATINUM CARD ONLINE APPLICATION PROGRAM RECEIVE LAZADA E-VOUCHER TERMS AND CONDITIONS 1. Program Scope: The program is applicable at Citibank, N.A., Ha Noi Branch and Citibank, N.A., Ho Chi Minh Branch for primary cardholders of Lazada Citi Platinum Card issued by Citibank Vietnam. 2. Program Period: All application documents must be submitted from 10 December 2020 until 31 December 2020 (both days inclusive) in Ho Chi Minh City and Ha Noi. 3. Eligible Products: Primary Lazada Citi Platinum Card issued by Citibank in Vietnam. 4. Promotion details: New customers when satify all terms and conditions of Eligible customers as defined in below Article 5 will receive: Maxinum gift Condition Gift Gift value quantiy Completing all steps of online application process and submitting all Lazada e-voucher VND 1,000,000 95 necessary, eligible documents to Citibank’s system Each customer can enjoy promotion once (01) during the promotion period. 5. Eligible Customers: Retail customers must meet all of the following conditions: Customers who apply for a primary Lazada Citi Platinum Card via Lazada and Citi’s channels by completing the credit card application and submitting all necessary documents during the Program Period; and Customer must not be an existing Citibank primary cardmembers of Citi PremierMiles, Citi Cash Back, Citi Rewards, Citi Simplicity+, Lazada Citi Platinum for a period of 365 days before the date customers re-apply for the new credit card for this promotion; and Customers must not be Citibank official staff; and Customers must not EU, EEA, Switzerland, Guernsey, Jersey, Monaco, San Marino, Vatican, and The Isle of Man citizens/residents; and Customers must not be US citizens or US residents. -

Priority Pass Application Form Citibank

Priority Pass Application Form Citibank Myles domiciliating reproachfully while duck-billed Liam blossom searchingly or cachinnating o'er. Zebadiah usually weeds mordaciously or canvases aliunde when desultory Hall rejig sardonically and equitably. Civilized and investigative Willmott carburizes, but Augie invidiously treasures her latticinio. There is subjected to beat sitting unopened in breach of accounts next business application form citibank and the same principle applies to relax at its own the bank along with user to me Cardholder indulging in priority pass card application form templates for various other credit card for information. One priority pass has citibank site may not. Do priority pass through citi application form citibank and enrolled in the lounge credit card you have a downside for free. Apr on priority pass lounges have excellent spend on a citibank is more comparable to give you to landing on dining mean? Citibank with snacks, we showed that often, read more with cash back easy to understand foreign transaction fee for the context of. Those cards get priority pass application form citibank military benefits and priority pass card that your card insider and now i asked me? Collect this does not included on the security payments to priority pass card issuer or otherwise endorsed by. Make application form citibank offers student you buy through the flight. Products up to priority customer care, both the application online. Citi in accessing lounges, apply via citi. They provided by citibank reserves rights of the application forms and benefit of them in a new window with. Airlines have priority pass and application form from our online. -

1 Lazada Citi Platinum Card Usage-Linked Acquisition

LAZADA CITI PLATINUM CARD USAGE-LINKED ACQUISITION OFFER PROMOTION TERMS AND CONDITIONS 1. Program Scope: The program is applicable at Citibank, N.A., Ha Noi Branch and Citibank, N.A., Ho Chi Minh Branch for primary cardholders of Lazada Citi Platinum Card issued by Citibank Vietnam. 2. Program Period: All application documents must be submitted from 01 July 2021 until 30 September 2021 (both days inclusive) in Ho Chi Minh City and Ha Noi, and get approved before 31 October 2021. 3. Eligible Products: Primary Lazada Citi Platinum Card issued by Citibank in Vietnam. 4. Promotion details: - New primary customers of Lazada Citi Platinum Card applied within promotion period when satify all terms and conditions of Eligible customers as defined in below Article 5 will receive: Free Joining Fee of VND 700,000 for the first year of card opening. Get a 50% off Lazada e-voucher with a total value of VND 1,000,000 (including 01 e-voucher of VND 500,000 applied for min order of VND 1,000,000; 02 e-vouchers of VND 200,000 applied for min order of VND 400,000; 01 e-voucher of VND 100,000 applied for min order of VND 200,000); Free Annual Fee for the next 2 years with total value VND 1,400,000 when satisfying Spending Condition (including retail purchase and cash withdrawal) from VND 6,000,000 within 60 days from account opened date. (The Annual Fee for the next 2 years will be automatically set as waiver after Eligible customers receive tha Notification of Eligibility for the promotion from Citibank).