Company Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

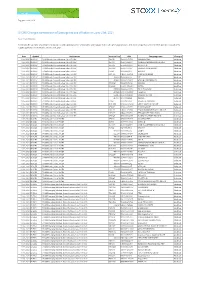

STOXX Changes Composition of Strategy Indices Effective on June 21St, 2021

Zug, June 11th, 2021 STOXX Changes composition of Strategy Indices effective on June 21st, 2021 Dear Sir and Madam, STOXX Ltd., the operator of Qontigo’s index business and a global provider of innovative and tradable index concepts, today announced the new composition of STOXX Strategy Indices as part of the regular quarterly review effective on June 21st, 2021 Date Symbol Index name Internal Key ISIN Company name Changes 11.06.2021 BDXDSX STOXX Nordic Diversification Select 30 SEK SE502D SE0006593927 KLOVERN PREF. Addition 11.06.2021 BDXDSX STOXX Nordic Diversification Select 30 SEK SE0039 SE0011844091 SAMHALLSBYGGNADSBOL AGET Addition 11.06.2021 BDXDSX STOXX Nordic Diversification Select 30 SEK SE50HS SE0002626861 CLOETTA 'B' Addition 11.06.2021 BDXDSX STOXX Nordic Diversification Select 30 SEK SE50MX SE0007100607 SVENSKA HANDBKN.'B' Addition 11.06.2021 BDXDSX STOXX Nordic Diversification Select 30 SEK FI5024 FI4000058870 AKTIA 'A' Addition 11.06.2021 BDXDSX STOXX Nordic Diversification Select 30 SEK DK1064 DK0060036564 SPAR NORD BANK Addition 11.06.2021 BDXDSX STOXX Nordic Diversification Select 30 SEK 498539 FI0009800643 YIT Addition 11.06.2021 BDXDSX STOXX Nordic Diversification Select 30 SEK 453890 SE0000191827 ATRIUM LJUNGBERG 'B' Addition 11.06.2021 BDXDSX STOXX Nordic Diversification Select 30 SEK SE50BM SE0007185418 NOBINA Addition 11.06.2021 BDXDSX STOXX Nordic Diversification Select 30 SEK NO40AP NO0010716418 ENTRA Addition 11.06.2021 BDXDSX STOXX Nordic Diversification Select 30 SEK 597838 SE0000667925 TELIA COMPANY Deletion -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

MFS Meridian® Funds

Shareholder Semiannual Report 31 July 2021 MFS Meridian® Funds Luxembourg-Registered SICAV RCS: B0039346 SICAV-UK-SEM-7/21 MFS Meridian® Funds CONTENTS General information .................................................................... 3 Shareholder complaints or inquiries .......................................................... 3 Schedules of investments ................................................................. 4 Statements of assets and liabilities ........................................................... 130 Statements of operations and changes in net assets ............................................... 135 Statistical information ................................................................... 140 Notes to financial statements .............................................................. 179 Addendum .......................................................................... 217 Directors and administration ............................................................... 223 Primary local agents ................................................................ back cover MFS Meridian® Funds listing The following sub-funds comprise the MFS Meridian Funds family. Each sub-fund name is preceded with “MFS Meridian Funds –” which may not be stated throughout this report. Asia Ex-Japan Fund ® Blended Research European Equity Fund Continental European Equity Fund Contrarian Value Fund Diversified Income Fund Emerging Markets Debt Fund Emerging Markets Debt Local Currency Fund Emerging Markets Equity Fund Emerging Markets -

Consolidated Financial Statements for the Year Ended December 31, 2019

CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2019 NUREMBERG / FÜRTH LEIPZIG CONTENTS Board of Directors’ report 2 EPRA Performance Measures 60 Report of the Rèviseur d’Enterprises Agréé (Independent Auditor) 72 Consolidated statement of profit or loss 76 Consolidated statement of comprehensive income 77 Consolidated statement of financial position 78 Consolidated statement of changes in equity 80 Consolidated statement of cash flows 82 Notes to the consolidated financial statements 84 IMPRINT Publisher: Grand City Properties S.A. | 1, Avenue du Bois | L-1251 Luxembourg phone: +352 28 77 87 86 | e-mail: [email protected] | www.grandcityproperties.com Board of Directors’ Report | 1 KEY FINANCIALS BALANCE SHEET HIGHLIGHTS in €’000 unless otherwise indicated Dec 2019 Dec 2018 Dec 2017 Total Assets 9,851,428 8,860,526 7,508,292 Total Equity 4,966,599 4,666,987 3,849,662 Loan-to-Value 33% 34% 36% Equity Ratio 50% 53% 51% P&L HIGHLIGHTS in €’000 unless otherwise indicated 1–12/2019 Change 1–12/2018 Rental and operating income 560,303 3% 544,977 Net rental income 382,605 5% 364,365 EBITDA 696,741 -11% 782,313 Adjusted EBITDA 297,662 8% 275,530 FFO I 211,966 7% 197,854 FFO I per share (in €) 1.27 7% 1.19 FFO I per share after perpetual notes attribution (in €) 1.07 6% 1.01 FFO II 381,387 14% 334,456 Profit for the year 493,360 -15% 583,034 EPS (basic) (in €) 2.43 -18% 2.95 EPS (diluted) (in €) 2.30 -17% 2.76 2019* Change 2018 Dividend per share (in €) 0.8238 7 % 0.7735 *2019 dividend is subject to the next AGM approval and -

Stoxx® Global 3000 Esg-X Index

STOXX® GLOBAL 3000 ESG-X INDEX Components1 Company Supersector Country Weight (%) Apple Inc. Technology United States 3.19 Microsoft Corp. Technology United States 2.88 Amazon.com Inc. Retail United States 2.17 FACEBOOK CLASS A Technology United States 1.15 ALPHABET CLASS C Technology United States 1.05 TESLA Automobiles & Parts United States 0.84 TSMC Technology Taiwan 0.83 JPMorgan Chase & Co. Banks United States 0.78 Samsung Electronics Co Ltd Technology South Korea 0.62 VISA Inc. Cl A Industrial Goods & Services United States 0.58 UnitedHealth Group Inc. Health Care United States 0.57 Walt Disney Co. Media United States 0.57 NESTLE Food, Beverage & Tobacco Switzerland 0.53 NVIDIA Corp. Technology United States 0.52 Procter & Gamble Co. Personal Care, Drug & Grocery Stores United States 0.52 MasterCard Inc. Cl A Industrial Goods & Services United States 0.52 Home Depot Inc. Retail United States 0.51 Bank of America Corp. Banks United States 0.49 PayPal Holdings Industrial Goods & Services United States 0.47 Intel Corp. Technology United States 0.43 Comcast Corp. Cl A Telecommunications United States 0.42 Exxon Mobil Corp. Energy United States 0.40 ASML HLDG Technology Netherlands 0.39 ROCHE HLDG P Health Care Switzerland 0.39 Verizon Communications Inc. Telecommunications United States 0.39 Netflix Inc. Media United States 0.37 Abbott Laboratories Health Care United States 0.35 AT&T Inc. Telecommunications United States 0.35 NOVARTIS Health Care Switzerland 0.35 ADOBE Technology United States 0.35 Cisco Systems Inc. Telecommunications United States 0.34 Toyota Motor Corp. -

Global Equity Fund Description Plan 3S DCP & JRA MICROSOFT CORP

Global Equity Fund June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA MICROSOFT CORP 2.5289% 2.5289% APPLE INC 2.4756% 2.4756% AMAZON COM INC 1.9411% 1.9411% FACEBOOK CLASS A INC 0.9048% 0.9048% ALPHABET INC CLASS A 0.7033% 0.7033% ALPHABET INC CLASS C 0.6978% 0.6978% ALIBABA GROUP HOLDING ADR REPRESEN 0.6724% 0.6724% JOHNSON & JOHNSON 0.6151% 0.6151% TENCENT HOLDINGS LTD 0.6124% 0.6124% BERKSHIRE HATHAWAY INC CLASS B 0.5765% 0.5765% NESTLE SA 0.5428% 0.5428% VISA INC CLASS A 0.5408% 0.5408% PROCTER & GAMBLE 0.4838% 0.4838% JPMORGAN CHASE & CO 0.4730% 0.4730% UNITEDHEALTH GROUP INC 0.4619% 0.4619% ISHARES RUSSELL 3000 ETF 0.4525% 0.4525% HOME DEPOT INC 0.4463% 0.4463% TAIWAN SEMICONDUCTOR MANUFACTURING 0.4337% 0.4337% MASTERCARD INC CLASS A 0.4325% 0.4325% INTEL CORPORATION CORP 0.4207% 0.4207% SHORT-TERM INVESTMENT FUND 0.4158% 0.4158% ROCHE HOLDING PAR AG 0.4017% 0.4017% VERIZON COMMUNICATIONS INC 0.3792% 0.3792% NVIDIA CORP 0.3721% 0.3721% AT&T INC 0.3583% 0.3583% SAMSUNG ELECTRONICS LTD 0.3483% 0.3483% ADOBE INC 0.3473% 0.3473% PAYPAL HOLDINGS INC 0.3395% 0.3395% WALT DISNEY 0.3342% 0.3342% CISCO SYSTEMS INC 0.3283% 0.3283% MERCK & CO INC 0.3242% 0.3242% NETFLIX INC 0.3213% 0.3213% EXXON MOBIL CORP 0.3138% 0.3138% NOVARTIS AG 0.3084% 0.3084% BANK OF AMERICA CORP 0.3046% 0.3046% PEPSICO INC 0.3036% 0.3036% PFIZER INC 0.3020% 0.3020% COMCAST CORP CLASS A 0.2929% 0.2929% COCA-COLA 0.2872% 0.2872% ABBVIE INC 0.2870% 0.2870% CHEVRON CORP 0.2767% 0.2767% WALMART INC 0.2767% -

H1 2017 Financial Results Presentation 7.99 MB

Berlin Nuremberg Dortmund Leipzig Frankfurt H1 2017 FINANCIAL RESULTS PRESENTATION Amsterdam Munich TABLE OF CONTENTS CORPORATE ACHIEVEMENTS HIGHLIGHTS FINANCIAL RESULTS & CAPITAL MARKET ACTIVITY OPERATIONS AND PORTFOLIO APPENDIX 2 CORPORATE ACHIEVEMENTS Listing upgrade to Migration to Frankfurt Luxembourg Prime Standard Aroundtown is in the final stages of redomiciling to Trading symbol On June 2, 2017, Luxembourg, subject to Aroundtown was listed on the EGM on September AT1 the Prime Standard of the 13th 2017 Frankfurt Stock Exchange, allowing for inclusion in EPRA indices as well as the DAX index family. ESG Development - Sustainalytics Score AT is highly ranked amongst the international real estate sector and is an outperformer in all sub-factors RAPID PORTFOLIO GROWTH (INVESTMENT PROPERTY IN € BN) Overall score CAGR 2015 - Oct 2017 August 2017 90% 7.4 7.8 88th Percentile 5.0 AT is ranked #35 among 280 real estate peers 2.4 Environment 83rd percentile Outperformer 2015 2016 Jun 2017 Oct 2017 Social 93rd percentile Outperformer Governance 79th percentile Outperformer 3 CORPORATE ACHIEVEMENTS EQUITY - OVER €1.3 BILLION ISSUANCE OF NEW EQUITY IN 2017 €426 million issuance of equity capital in USD 500 million perpetual notes issuance in May 2017 June 2017 Conversion of Series B 3% convertible bonds. €387 million has been converted and €56 million has been repurchased Tap issuance of €100 million perpetual notes in January 2017 DEBT - €1.5 BILLION EMTN PROGRAMME ESTABLISHED MARCH 2017 USD 450 million straight bonds issued in Q1 2017 and placed with anchor investors in Asia €500 million Series I straight bonds issued in July 2017 A- Long-Term Unencumbered Target LTV ICR Ratio BBB 36% 5.7x 56% S&P June 2016 4 FINANCIAL HIGHLIGHTS – H1 2017 Net Rental Adjusted Net Profit FFO I income EBITDA €777m €204m €195m €130m FFO I FFO yield1) per share €0.18 6.7% Annualized 1) Dividend Div yield per share 4.3% €0.23 Investment EPRA NAV Total assets LTV EPRA NAV incl. -

Investment Holdings As of June 30, 2019

Investment Holdings As of June 30, 2019 Montana Board of Investments | Portfolio as of June 30, 2019 Transparency of the Montana Investment Holdings The Montana Board of Investment’s holdings file is a comprehensive listing of all manager funds, separately managed and commingled, and aggregated security positions. Securities are organized across common categories: Pension Pool, Asset Class, Manager Fund, Aggregated Individual Holdings, and Non-Pension Pools. Market values shown are in U.S. dollars. The market values shown in this document are for the individual investment holdings only and do not include any information on accounts for receivables or payables. Aggregated Individual Holdings represent securities held at our custodian bank and individual commingled accounts. The Investment Holdings Report is unaudited and may be subject to change. The audited Unified Investment Program Financial Statements, prepared on a June 30th fiscal year-end basis, will be made available once the Legislative Audit Division issues the Audit Opinion. Once issued, the Legislative Audit Division will have the Audit Opinion available online at https://www.leg.mt.gov/publications/audit/agency-search-report and the complete audited financial statements will also be available on the Board’s website http://investmentmt.com/AnnualReportsAudits. Additional information can be found at www.investmentmt.com Montana Board of Investments | Portfolio as of June 30, 2019 2 Table of Contents Consolidated Asset Pension Pool (CAPP) 4 CAPP - Domestic Equities 5 CAPP - International -

Euro Stoxx® Small Index

EURO STOXX® SMALL INDEX Components1 Company Supersector Country Weight (%) METSO OUTOTEC Industrial Goods & Services Finland 2.34 SIEMENS GAMESA Oil & Gas Spain 2.19 KION GROUP Industrial Goods & Services Germany 2.13 WDP Real Estate Belgium 1.77 SIGNIFY Industrial Goods & Services Netherlands 1.76 HUHTAMAKI Industrial Goods & Services Finland 1.71 LA FRANCAISE DES JEUX Travel & Leisure France 1.69 MORPHOSYS Health Care Germany 1.67 TAG IMMOBILIEN AG Real Estate Germany 1.66 AMPLIFON Health Care Italy 1.64 CARL ZEISS MEDITEC Health Care Germany 1.62 KOJAMO OYJ Real Estate Finland 1.62 SOFINA Financial Services Belgium 1.61 JERONIMO MARTINS Retail Portugal 1.51 SEB Personal & Household Goods France 1.48 IPSEN Health Care France 1.48 COFINIMMO Real Estate Belgium 1.46 VOPAK Industrial Goods & Services Netherlands 1.42 REMY COINTREAU Food & Beverage France 1.40 COVIVIO Real Estate France 1.38 NOKIAN RENKAAT Automobiles & Parts Finland 1.37 Valmet Industrial Goods & Services Finland 1.36 RATIONAL Industrial Goods & Services Germany 1.36 AALBERTS Industrial Goods & Services Netherlands 1.34 VERBUND Utilities Austria 1.33 ETS COLRUYT Retail Belgium 1.27 BOLLORE Industrial Goods & Services France 1.25 FUCHS PETROLUB PREF Chemicals Germany 1.25 HERA Utilities Italy 1.25 AEDIFICA Real Estate Belgium 1.25 ELIA GROUP Utilities Belgium 1.24 CNP ASSURANCES Insurance France 1.23 EVOTEC Health Care Germany 1.23 GERRESHEIMER Health Care Germany 1.21 BANKINTER Banks Spain 1.20 BE SEMICONDUCTOR Technology Netherlands 1.19 WIENERBERGER Construction & Materials -

Dimensional International Core Equity Market ETF SCHEDULE of INVESTMENTS April 30, 2021 (Unaudited)

Dimensional International Core Equity Market ETF SCHEDULE OF INVESTMENTS April 30, 2021 (Unaudited) Security Description Shares Fair Value ($) COMMON STOCKS (98.4%) AUSTRALIA (6.7%) 5G Networks, Ltd. 40 37 *A2B Australia, Ltd. 92 91 Accent Group, Ltd. 272 618 Adairs, Ltd. 92 330 Adbri, Ltd. 288 716 *Advance NanoTek, Ltd. 16 48 *Aeris Resources, Ltd. 1,048 81 *Afterpay, Ltd. 1,438 130,684 AGL Energy, Ltd. 14,736 101,649 #*»Alkane Resources, Ltd. 276 157 *Alliance Aviation Services, Ltd. 368 1,194 ALS, Ltd. 11,346 92,375 Altium, Ltd. 1,925 44,089 Alumina, Ltd. 4,497 6,009 *AMA Group, Ltd. 1,351 579 Ampol, Ltd. 3,655 72,249 Ansell, Ltd. 2,657 86,735 APA Group 19,887 154,078 Appen, Ltd. 1,204 14,564 ARB Corp., Ltd. 40 1,209 *Ardent Leisure Group, Ltd. 420 281 Aristocrat Leisure, Ltd. 8,793 252,465 *Artemis Resources, Ltd. 496 44 Asaleo Care, Ltd. 260 283 ASX, Ltd. 2,886 162,694 Atlas Arteria, Ltd. 18,915 88,250 AUB Group, Ltd. 109 1,718 Aurelia Metals, Ltd. 8,745 2,837 Aurizon Holdings, Ltd. 41,513 120,250 AusNet services 1,164 1,704 Austal, Ltd. 264 492 Austin Engineering, Ltd. 396 44 Australia & New Zealand Banking Group, Ltd. 35,542 789,041 *Australian Agricultural Co., Ltd. 990 879 Australian Ethical Investment, Ltd. 56 378 Australian Finance Group, Ltd. 965 2,102 Australian Pharmaceutical Industries, Ltd. 1,902 1,741 Australian Vintage, Ltd. 136 78 Auswide Bank, Ltd. 45 223 #Ava Risk Group, Ltd. -

Digitales Archiv ZBW – Leibniz-Informationszentrum Wirtschaft ZBW – Leibniz Information Centre for Economics

digitales archiv ZBW – Leibniz-Informationszentrum Wirtschaft ZBW – Leibniz Information Centre for Economics Trautvetter, Christoph Book Profitmaximierer oder verantwortungsvolle Vermieter? Provided in Cooperation with: Rosa-Luxemburg-Stiftung, Berlin und Brüssel This Version is available at: http://hdl.handle.net/11159/4510 Kontakt/Contact ZBW – Leibniz-Informationszentrum Wirtschaft/Leibniz Information Centre for Economics Düsternbrooker Weg 120 24105 Kiel (Germany) E-Mail: [email protected] https://www.zbw.eu/econis-archiv/ Standard-Nutzungsbedingungen: Terms of use: Dieses Dokument darf zu eigenen wissenschaftlichen Zwecken This document may be saved and copied for your personal und zum Privatgebrauch gespeichert und kopiert werden. Sie and scholarly purposes. You are not to copy it for public or dürfen dieses Dokument nicht für öffentliche oder kommerzielle commercial purposes, to exhibit the document in public, to Zwecke vervielfältigen, öffentlich ausstellen, aufführen, vertreiben perform, distribute or otherwise use the document in public. If oder anderweitig nutzen. Sofern für das Dokument eine Open- the document is made available under a Creative Commons Content-Lizenz verwendet wurde, so gelten abweichend von diesen Licence you may exercise further usage rights as specified in Nutzungsbedingungen die in der Lizenz gewährten Nutzungsrechte. the licence. Leibniz-Informationszentrum Wirtschaft zbw Leibniz Information Centre for Economics STUDIEN CHRISTOPH TRAUTVETTER UND SOPHIE BONCZYK PROFITMAXIMIERER ODER VERANTWORTUNGSVOLLE VERMIETER? GROSSE IMMOBILIENUNTERNEHMEN MIT MEHR ALS 3.000 WOHNUNGEN IN BERLIN IM PROFIL CHRISTOPH TRAUTVETTER UND SOPHIE BONCZYK PROFITMAXIMIERER ODER VERANTWORTUNGSVOLLE VERMIETER? GROSSE IMMOBILIENUNTERNEHMEN MIT MEHR ALS 3.000 WOHNUNGEN IN BERLIN IM PROFIL Studie im Auftrag der Rosa-Luxemburg-Stiftung und in Kooperation mit der Fraktion DIE LINKE. im Abgeordnetenhaus von Berlin SOPHIE BONCZYK ist Masterstudentin der Wirtschaftsinformatik an der Humboldt-Universität zu Berlin mit Schwerpunkt «Data Analytics». -

Berenberg Equity Research

BERENBERG EQUITY RESEARCH Grand City Properties SA Buy Realising potential in German residential real estate Kai Klose, CIIA Analyst +44 20 3207 7888 [email protected] Estelle Weingrod Analyst +44 20 3207 7931 [email protected] 7 November 2013 Real Estate For our disclosures in respect of section 34b of the German Securities Trading Act (Wertpapierhandelsgesetz – WpHG) and our disclaimer please see the end of this document. Please note that the use of this research report is subject to the conditions and restrictions set forth in the disclosures and the disclaimer at the end of this document. Table of contents Realising potential in German residential real estate 4 Grand City Properties – strong organic and external growth 5 Business model and strategy 6 Management and shareholder structure 12 Portfolio and earnings forecasts 14 Valuation 23 Key risks 31 Residential property markets – a snapshot 32 Financials 41 Disclosures in respect of section 34b of the German Securities Trading Act (Wertpapierhandelsgesetz – WpHG) 44 Contacts: Investment Banking 47 Grand City Properties SA Small/Mid-Cap: Real Estate Realising potential in German residential real estate ● Special focus: Grand City Properties (GCP) creates value by upgrading undermanaged and distressed German residential Buy (initiation) Current price Price target properties. The company has been in the market for nine years and EUR 6.01 EUR 7.50 has demonstrated a strong track record in deal sourcing, with a current 06/11/2013 Luxembourg Stock portfolio of c22,000 units (up from 12,000 units in 2012). The assets Exchange Close are primarily located in North Rhine-Westphalia and Berlin.