Consolidated Financial Statements for the Year Ended December 31, 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Commerzbank German Investment Seminar Christian Bruch, President and CEO Siemens Energy January 13, 2021

Commerzbank German Investment Seminar Christian Bruch, President and CEO Siemens Energy January 13, 2021 Siemens Energy is a registered trademark licensed by Siemens AG. © Siemens Energy, 2021 Disclaimer INFORMATION AND FORWARD-LOOKING STATEMENTS This document contains statements related to our future business and financial performance, and future events or developments involving Siemens Energy that may constitute forward-looking statements. These statements may be identified by words such as “expect,” “look forward to,” “anticipate” “intend,” “plan,” “believe,” “seek,” “estimate,” “will,” “project,” or words of similar meaning. We may also make forward-looking statements in other reports, prospectuses, in presentations, in material delivered to shareholders, and in press releases. In addition, our representatives may from time to time make oral forward-looking statements. Such statements are based on the current expectations and certain assumptions of Siemens Energy´s management, of which many are beyond Siemens Energy´s control. These are subject to a number of risks, uncertainties, and other factors, including, but not limited to, those described in disclosures, in particular in the chapter “Report on expected developments and associated material opportunities and risks” in the Annual Report. Should one or more of these risks or uncertainties materialize, should acts of force majeure, such as pandemics, occur, or should underlying expectations including future events occur at a later date or not at all, or should assumptions prove incorrect, Siemens Energy´s actual results, performance, or achievements may (negatively or positively) vary materially from those described explicitly or implicitly in the relevant forward-looking statement. Siemens Energy neither intends, nor assumes any obligation, to update or revise these forward-looking statements in light of developments which differ from those anticipated. -

Women-On-Board-Index

WOMENONBOARDINDEX III Aufsichtsräte (Stand 14.01.2012) powered by FidAR Zahl Anteil WoB-Index Posit Zahl AR- Unternehmen Notierung Frauen Frauen nur ion Mitgl. AR AR Aufsichtsräte 1 Douglas Holding AG MDAX 16 8 50% 50,00% 2 Kabel Deutschland Holding AG MDAX 12 5 42% 41,67% 3 Deutsche Bank AG DAX 20 8 40% 40,00% 4 Amadeus Fire AG SDAX 11 4 36% 36,36% 5 Bechtle AG TecDAX 12 4 33% 33,33% 5 Beiersdorf AG DAX 12 4 33% 33,33% 5 Bertrandt AG SDAX 6 2 33% 33,33% 5 Biotest AG SDAX 6 2 33% 33,33% 5 centrotherm photovoltaics AG TecDAX 3 1 33% 33,33% 5 comdirect bank AG SDAX 6 2 33% 33,33% 5 HAMBORNER REIT SDAX 9 3 33% 33,33% 5 TAG Immobilien AG SDAX 6 2 33% 33,33% 13 Deutsche Post AG DAX 20 6 30% 30,00% 13 GfK SE SDAX 10 3 30% 30,00% 15 Sky Deutschland AG MDAX 7 2 29% 28,57% 16 Commerzbank AG DAX 20 5 25% 25,00% 16 Fielmann AG MDAX 16 4 25% 25,00% 16 Fraport AG MDAX 20 5 25% 25,00% 16 Henkel AG & Co. KGaA DAX 16 4 25% 25,00% 16 Merck KGaA DAX 16 4 25% 25,00% 16 Q-CELLS SE TecDAX 8 2 25% 25,00% 16 Software AG TecDAX 12 3 25% 25,00% 16 Symrise AG MDAX 12 3 25% 25,00% 24 Axel Springer AG MDAX 9 2 22% 22,22% 24 STADA Arzneimittel AG MDAX 9 2 22% 22,22% 26 ADVA AG Optical Networking TecDAX 5 1 20% 20,00% 26 Deutsche Telekom AG DAX 20 4 20% 20,00% 26 Hawesko Holding AG SDAX 5 1 20% 20,00% 26 Münchener Rück AG DAX 20 4 20% 20,00% 26 RHÖN-KLINIKUM AG MDAX 20 4 20% 20,00% 26 Siemens AG DAX 20 4 20% 20,00% 26 ThyssenKrupp AG DAX 20 4 20% 20,00% 33 Praktiker Bau- und Heimwerkermärkte SDAX 16 3 19% 18,75% 33 TUI AG MDAX 16 3 19% 18,75% 35 adidas AG DAX 12 -

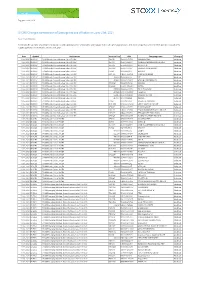

STOXX Changes Composition of Strategy Indices Effective on June 21St, 2021

Zug, June 11th, 2021 STOXX Changes composition of Strategy Indices effective on June 21st, 2021 Dear Sir and Madam, STOXX Ltd., the operator of Qontigo’s index business and a global provider of innovative and tradable index concepts, today announced the new composition of STOXX Strategy Indices as part of the regular quarterly review effective on June 21st, 2021 Date Symbol Index name Internal Key ISIN Company name Changes 11.06.2021 BDXDSX STOXX Nordic Diversification Select 30 SEK SE502D SE0006593927 KLOVERN PREF. Addition 11.06.2021 BDXDSX STOXX Nordic Diversification Select 30 SEK SE0039 SE0011844091 SAMHALLSBYGGNADSBOL AGET Addition 11.06.2021 BDXDSX STOXX Nordic Diversification Select 30 SEK SE50HS SE0002626861 CLOETTA 'B' Addition 11.06.2021 BDXDSX STOXX Nordic Diversification Select 30 SEK SE50MX SE0007100607 SVENSKA HANDBKN.'B' Addition 11.06.2021 BDXDSX STOXX Nordic Diversification Select 30 SEK FI5024 FI4000058870 AKTIA 'A' Addition 11.06.2021 BDXDSX STOXX Nordic Diversification Select 30 SEK DK1064 DK0060036564 SPAR NORD BANK Addition 11.06.2021 BDXDSX STOXX Nordic Diversification Select 30 SEK 498539 FI0009800643 YIT Addition 11.06.2021 BDXDSX STOXX Nordic Diversification Select 30 SEK 453890 SE0000191827 ATRIUM LJUNGBERG 'B' Addition 11.06.2021 BDXDSX STOXX Nordic Diversification Select 30 SEK SE50BM SE0007185418 NOBINA Addition 11.06.2021 BDXDSX STOXX Nordic Diversification Select 30 SEK NO40AP NO0010716418 ENTRA Addition 11.06.2021 BDXDSX STOXX Nordic Diversification Select 30 SEK 597838 SE0000667925 TELIA COMPANY Deletion -

Lyxor German Mid-Cap MDAX UCITS ETF - Dist

LYXOR ETF MONTHLY REPORT 31st August 2021 Lyxor German Mid-Cap MDAX UCITS ETF - Dist 1. FUND INFORMATION Ticker: MD4X GY Description Ticker MD4X GY Lyxor Asset Management Group ("Lyxor") was founded in 1998 and comprises two subsidiaries (1) (2) of Société Générale group. Lyxor benefits from the Fund Type SICAV expertise of 600 professionals across the wealth management world, advising EUR 117.6 billion* in assets. Lyxor offers bespoke asset management services, UCITS compliant Yes capitalising on its know-how in ETFs and indexing, Alternative and Multi Management, and Absolute Performance and Solutions. As one of the most ISIN FR0011857234 experienced players on the market, Lyxor ETF is Europe's number three provider of ETFs (number two in terms of liquidity (3)), with AuM of more than EUR UKFRS Yes 49.8 billion*. With 220 ETFs listed on 13 financial marketplaces, Lyxor ETF provides investors with varied investment solutions enabling them to diversify their allocation across the entire spectrum of asset classes (equities, bonds, money market instruments and commodities via forward financial instruments). Replication method Indirect (Swap Based) Demonstrating its commitment to high-quality ETFs, in 2011, Lyxor ETF implemented an ETF quality charter with the aim of ensuring that each ETF it offers Full ownership of fund assets Yes complies with the strictest requirements in terms of replication quality, risk monitoring, liquidity and transparency. www.lyxoretf.com Share Class Currency EUR Investment objective Inception Date 15/05/2014 Nav per share at inception (EUR) 100 The Lyxor German Mid-Cap MDAX UCITS ETF - Dist is a UCITS compliant exchange traded fund that aims to track the benchmark index MDAX PERF INDEX. -

In This Issue

FI.News June 2019 In this issue: Island stopping: The importance of digital standards Supply chain finance: Making it more inclusive The Belt and Road Initiative: Bridging east and west Post-trade services: Delivering on new expectations Clearing the decks 10 Bridging east and west Making supply chain finance more inclusive 12 08 Contents Editorial welcome 03 Eye on the industry: Delivering on new 14 expectations in post-trade Big Interview: Island stopping 05 Regional spotlight: Are trade opportunities 16 in Africa shifting south? Innovation focus: Making supply chain 08 Regional focus: Seizing opportunities in 18 finance more inclusive central America Eye on the industry: Clearing the 10 News & awards 20 decks Expert view: Bridging east and west 12 Commerzbank in the press 22 2 Editorial welcome Never standing still Nikolaus Giesbert Divisional Board Member, Trade Finance & Cash Management While Commerzbank takes pride in its history, • Moving towards end-to-end, front-to-back, we are not a bank content to stand still. Having digital solutions; financed trade since 1870, we are accustomed to change. And today, technology, regulation • Being at the forefront of exploring how and changing client preferences stand to emerging technologies can transform fundamentally alter transaction banking, the landscape for trade finance and cash bringing new services, business models and management, and; competition. It’s a dynamic we are embracing. • Recognising permanent changes in the banking So rather than take a short-sighted view and sector and understanding the possibilities. focus simply on the automation of processes, we have invested resources and energy into Of course, extensive transformation must be digital transformation. -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

MFS Meridian® Funds

Shareholder Semiannual Report 31 July 2021 MFS Meridian® Funds Luxembourg-Registered SICAV RCS: B0039346 SICAV-UK-SEM-7/21 MFS Meridian® Funds CONTENTS General information .................................................................... 3 Shareholder complaints or inquiries .......................................................... 3 Schedules of investments ................................................................. 4 Statements of assets and liabilities ........................................................... 130 Statements of operations and changes in net assets ............................................... 135 Statistical information ................................................................... 140 Notes to financial statements .............................................................. 179 Addendum .......................................................................... 217 Directors and administration ............................................................... 223 Primary local agents ................................................................ back cover MFS Meridian® Funds listing The following sub-funds comprise the MFS Meridian Funds family. Each sub-fund name is preceded with “MFS Meridian Funds –” which may not be stated throughout this report. Asia Ex-Japan Fund ® Blended Research European Equity Fund Continental European Equity Fund Contrarian Value Fund Diversified Income Fund Emerging Markets Debt Fund Emerging Markets Debt Local Currency Fund Emerging Markets Equity Fund Emerging Markets -

MDAX—2019 Supervisory Board Study Key Insights from This Year’S Analysis by Russell Reynolds Associates

MDAX—2019 Supervisory Board Study Key insights from this year’s analysis by Russell Reynolds Associates Summary Over the past year, Germany's MDAX companies have experienced significant change. The number of companies in the index increased by 10, bringing the overall total to 60. Moreover, 11 "old economy" firms, including Jungheinrich, Krones, Leoni, Salzgitter and Schaeffler, were ousted by pharma, med and biotech risers, such as Evotec, Morphosys, Qiagen, Sartorius and Siemens Healthineers, as well as "new economy" powerhouses like Dialog, Nemetschek, Software AG, Telefonica D, and United Internet. This was also an exceptional election year, with 106 shareholder representative positions expiring. All positions were filled. A total of 67 board members were re-elected, while 36 were replaced. The three remaining roles were absorbed by changes to board sizes. Female shareholder representation surpasses 30 percent For the first time, the share of female shareholder representatives surpassed the required quota, reaching 30.6 percent. Including employee representatives, women now make up 32 percent of supervisory board members. A total of three boards are now chaired by women. However, there is still a major gender discrepancy concerning positions of power when comparing chairpersonships and especially executive board positions. Only four companies can boast more than 30 percent of female executives, while 40 MDAX companies do not have a single woman in a leadership role. Accelerated increase in digital directors The number of digital directors on MDAX supervisory boards showed a significant 30 percent year- on-year increase. However, digital expertise is still unevenly spread in the MDAX. Seven companies have three or more digital directors, while 57 percent of boards completely lack digital expertise. -

Company Presentation

H1 2019 FINANCIAL RESULTS PRESENTATION AUG 2019 Cologne TABLE OF CONTENTS 1 Financial Highlights 2 Financial and Portfolio performance 3 ESG 4 Guidance 5 Appendix 2 1 FINANCIAL HIGHLIGHTS H1 2019 Net profit Rental and Consistent top-line & Net rental income Adjusted EBITDA € 250 million operating income bottom-line growth € 189 million € 146 million EPS (Basic) € 278 million € 1.28 FFO I per share FFO I per share 65% of FFO I Robust operational FFO I after perpetual notes Dividend yield over performance € 0.64 attribution € 106 million 1) (FFO I yield: 6.3 %1) € 0.54 2019 guidance: 4.0 % 1) based on a share price of €20.4 EPRA NAV EPRA NAV incl. perpetuals Secure financial structure Total Assets LTV enabling consistent € 3.9 billion, € 4.9 billion, € 9.3 billion 34 % shareholder value creation per share € 23.1 per share € 29.2 *Dividend adjusted 3 2 OPERATIONAL RESULTS Selected Income Statement Data H1 2019 H1 2018 NET RENTAL INCOME (IN € MILLION) ADJUSTED EBITDA (IN € MILLION) in € ‘000 unless otherwise indicated Rental and operating income 278,195 268,275 146 Net rental income 189,320 181,682 182 189 137 Property revaluations and capital gains 210,877 249,985 Property operating expenses (128,581) (127,076) Administrative & other expenses (6,015) (6,062) EBITDA 356,386 387,544 Adjusted EBITDA 146,253 136,749 H1 2018 H1 2019 H1 2018 H1 2019 Finance expenses (22,807) (23,322) Other financial results (19,731) (24,061) Current tax expenses (15,429) (13,600) Deferred tax expenses (47,264) (54,088) ADJUSTED EBITDA (IN € MILLIONS) Profit for -

Media R Elease

Frankfurt/Main, 5 December 2018 Carl Zeiss Meditec AG to be included in MDAX Three changes in SDAX/ Changes to be effective as of 27 December 2018 On Wednesday, Deutsche Börse announced changes to its selection indices, which will become effective on 27 December 2018. The shares of Carl Zeiss Meditec AG will be included in the MDAX index and will replace the shares of CTS Eventim AG & CO. KGaA, which will be included in the SDAX index. The exclusion of CTS Eventim AG & CO. KGaA is based on the fast exit rule; Carl Zeiss Meditec AG is eligible for the index inclusion due to its market capitalisation and order book turnover. MDAX tracks the 60 largest and most liquid companies below DAX. The following changes will apply to SDAX: CTS Eventim AG & CO. KGaA, Knorr- Bremse AG and VARTA AG will be included. The shares of BayWa AG and DMG Mori AG will be deleted from the index, according to the fast exit rule. SDAX tracks the 70 next biggest and most actively traded companies after the MDAX. The constituents of the indices DAX and TecDAX remain unchanged. The next scheduled index review is 5 March 2019. DAX®, MDAX®, SDAX® and TecDAX® are registered trademarks of Deutsche Börse AG. Media Release About Deutsche Börse – Market Data + Services In the area of data, Deutsche Börse Group is one of the world’s leading service providers for the securities industry with products and services for issuers, investors, intermediaries, and data vendors. The Group’s portfolio covers the entire value chain in the financial business. -

Stoxx® Global 3000 Esg-X Index

STOXX® GLOBAL 3000 ESG-X INDEX Components1 Company Supersector Country Weight (%) Apple Inc. Technology United States 3.19 Microsoft Corp. Technology United States 2.88 Amazon.com Inc. Retail United States 2.17 FACEBOOK CLASS A Technology United States 1.15 ALPHABET CLASS C Technology United States 1.05 TESLA Automobiles & Parts United States 0.84 TSMC Technology Taiwan 0.83 JPMorgan Chase & Co. Banks United States 0.78 Samsung Electronics Co Ltd Technology South Korea 0.62 VISA Inc. Cl A Industrial Goods & Services United States 0.58 UnitedHealth Group Inc. Health Care United States 0.57 Walt Disney Co. Media United States 0.57 NESTLE Food, Beverage & Tobacco Switzerland 0.53 NVIDIA Corp. Technology United States 0.52 Procter & Gamble Co. Personal Care, Drug & Grocery Stores United States 0.52 MasterCard Inc. Cl A Industrial Goods & Services United States 0.52 Home Depot Inc. Retail United States 0.51 Bank of America Corp. Banks United States 0.49 PayPal Holdings Industrial Goods & Services United States 0.47 Intel Corp. Technology United States 0.43 Comcast Corp. Cl A Telecommunications United States 0.42 Exxon Mobil Corp. Energy United States 0.40 ASML HLDG Technology Netherlands 0.39 ROCHE HLDG P Health Care Switzerland 0.39 Verizon Communications Inc. Telecommunications United States 0.39 Netflix Inc. Media United States 0.37 Abbott Laboratories Health Care United States 0.35 AT&T Inc. Telecommunications United States 0.35 NOVARTIS Health Care Switzerland 0.35 ADOBE Technology United States 0.35 Cisco Systems Inc. Telecommunications United States 0.34 Toyota Motor Corp. -

Women-On-Board-Index

WOMEN‐ON‐BOARD‐INDEX III Aufsichtsräte (Stand 30.06.2011) powered by FidAR Zahl Anteil WoB-Index Posit Zahl AR- Unternehmen Notierung Frauen Frauen nur ion Mitgl. AR AR Aufsichtsräte 1 Biotest AG SDAX 6 3 50% 50,00% 1 Douglas Holding AG MDAX 16 8 50% 50,00% 3 HAMBORNER REIT SDAX 10 4 40% 40,00% 4 Deutsche Bank AG DAX 20 7 35% 35,00% 5 Amadeus Fire AG SDAX 6 2 33% 33,33% 5 Bechtle AG TecDAX 12 4 33% 33,33% 5 Beiersdorf AG DAX 12 4 33% 33,33% 5 centrotherm photovoltaics AG TecDAX 3 1 33% 33,33% 5 TAG Immobilien AG SDAX 6 2 33% 33,33% 10 Deutsche Post AG DAX 20 6 30% 30,00% 10 GfK SE SDAX 10 3 30% 30,00% 12 Commerzbank AG DAX 20 5 25% 25,00% 12 Fielmann AG MDAX 16 4 25% 25,00% 12 Fraport AG MDAX 20 5 25% 25,00% 12 Henkel AG & Co. KGaA DAX 16 4 25% 25,00% 12 Kabel Deutschland Holding AG MDAX 12 3 25% 25,00% 12 Merck KGaA DAX 16 4 25% 25,00% 12 Software AG TecDAX 12 3 25% 25,00% 12 Symrise AG MDAX 12 3 25% 25,00% 20 Axel Springer AG MDAX 9 2 22% 22,22% 20 Q-CELLS SE TecDAX 9 2 22% 22,22% 20 Sky Deutschland AG MDAX 9 2 22% 22,22% 20 STADA Arzneimittel AG MDAX 9 2 22% 22,22% 24 comdirect bank AG SDAX 5 1 20% 20,00% 24 Deutsche Telekom AG DAX 20 4 20% 20,00% 24 Hawesko Holding AG SDAX 5 1 20% 20,00% 24 Münchener Rück AG DAX 20 4 20% 20,00% 24 RHÖN-KLINIKUM AG MDAX 20 4 20% 20,00% 24 Siemens AG DAX 20 4 20% 20,00% 30 Praktiker Bau- und Heimwerkermärkte MDAX 16 3 19% 18,75% 30 TUI AG MDAX 16 3 19% 18,75% 32 adidas AG DAX 12 2 17% 16,67% 32 ADVA AG Optical Networking TecDAX 6 1 17% 16,67% 32 AIXTRON SE TecDAX 6 1 17% 16,67% 32 BASF SE DAX 12 2 17%