Moody's Credit Opinion Update, June 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

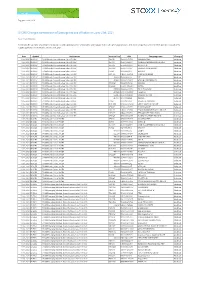

STOXX Changes Composition of Strategy Indices Effective on June 21St, 2021

Zug, June 11th, 2021 STOXX Changes composition of Strategy Indices effective on June 21st, 2021 Dear Sir and Madam, STOXX Ltd., the operator of Qontigo’s index business and a global provider of innovative and tradable index concepts, today announced the new composition of STOXX Strategy Indices as part of the regular quarterly review effective on June 21st, 2021 Date Symbol Index name Internal Key ISIN Company name Changes 11.06.2021 BDXDSX STOXX Nordic Diversification Select 30 SEK SE502D SE0006593927 KLOVERN PREF. Addition 11.06.2021 BDXDSX STOXX Nordic Diversification Select 30 SEK SE0039 SE0011844091 SAMHALLSBYGGNADSBOL AGET Addition 11.06.2021 BDXDSX STOXX Nordic Diversification Select 30 SEK SE50HS SE0002626861 CLOETTA 'B' Addition 11.06.2021 BDXDSX STOXX Nordic Diversification Select 30 SEK SE50MX SE0007100607 SVENSKA HANDBKN.'B' Addition 11.06.2021 BDXDSX STOXX Nordic Diversification Select 30 SEK FI5024 FI4000058870 AKTIA 'A' Addition 11.06.2021 BDXDSX STOXX Nordic Diversification Select 30 SEK DK1064 DK0060036564 SPAR NORD BANK Addition 11.06.2021 BDXDSX STOXX Nordic Diversification Select 30 SEK 498539 FI0009800643 YIT Addition 11.06.2021 BDXDSX STOXX Nordic Diversification Select 30 SEK 453890 SE0000191827 ATRIUM LJUNGBERG 'B' Addition 11.06.2021 BDXDSX STOXX Nordic Diversification Select 30 SEK SE50BM SE0007185418 NOBINA Addition 11.06.2021 BDXDSX STOXX Nordic Diversification Select 30 SEK NO40AP NO0010716418 ENTRA Addition 11.06.2021 BDXDSX STOXX Nordic Diversification Select 30 SEK 597838 SE0000667925 TELIA COMPANY Deletion -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

MFS Meridian® Funds

Shareholder Semiannual Report 31 July 2021 MFS Meridian® Funds Luxembourg-Registered SICAV RCS: B0039346 SICAV-UK-SEM-7/21 MFS Meridian® Funds CONTENTS General information .................................................................... 3 Shareholder complaints or inquiries .......................................................... 3 Schedules of investments ................................................................. 4 Statements of assets and liabilities ........................................................... 130 Statements of operations and changes in net assets ............................................... 135 Statistical information ................................................................... 140 Notes to financial statements .............................................................. 179 Addendum .......................................................................... 217 Directors and administration ............................................................... 223 Primary local agents ................................................................ back cover MFS Meridian® Funds listing The following sub-funds comprise the MFS Meridian Funds family. Each sub-fund name is preceded with “MFS Meridian Funds –” which may not be stated throughout this report. Asia Ex-Japan Fund ® Blended Research European Equity Fund Continental European Equity Fund Contrarian Value Fund Diversified Income Fund Emerging Markets Debt Fund Emerging Markets Debt Local Currency Fund Emerging Markets Equity Fund Emerging Markets -

Company Presentation

H1 2019 FINANCIAL RESULTS PRESENTATION AUG 2019 Cologne TABLE OF CONTENTS 1 Financial Highlights 2 Financial and Portfolio performance 3 ESG 4 Guidance 5 Appendix 2 1 FINANCIAL HIGHLIGHTS H1 2019 Net profit Rental and Consistent top-line & Net rental income Adjusted EBITDA € 250 million operating income bottom-line growth € 189 million € 146 million EPS (Basic) € 278 million € 1.28 FFO I per share FFO I per share 65% of FFO I Robust operational FFO I after perpetual notes Dividend yield over performance € 0.64 attribution € 106 million 1) (FFO I yield: 6.3 %1) € 0.54 2019 guidance: 4.0 % 1) based on a share price of €20.4 EPRA NAV EPRA NAV incl. perpetuals Secure financial structure Total Assets LTV enabling consistent € 3.9 billion, € 4.9 billion, € 9.3 billion 34 % shareholder value creation per share € 23.1 per share € 29.2 *Dividend adjusted 3 2 OPERATIONAL RESULTS Selected Income Statement Data H1 2019 H1 2018 NET RENTAL INCOME (IN € MILLION) ADJUSTED EBITDA (IN € MILLION) in € ‘000 unless otherwise indicated Rental and operating income 278,195 268,275 146 Net rental income 189,320 181,682 182 189 137 Property revaluations and capital gains 210,877 249,985 Property operating expenses (128,581) (127,076) Administrative & other expenses (6,015) (6,062) EBITDA 356,386 387,544 Adjusted EBITDA 146,253 136,749 H1 2018 H1 2019 H1 2018 H1 2019 Finance expenses (22,807) (23,322) Other financial results (19,731) (24,061) Current tax expenses (15,429) (13,600) Deferred tax expenses (47,264) (54,088) ADJUSTED EBITDA (IN € MILLIONS) Profit for -

Eurex Circular 043/14

eurex circular 043/14 Date: 6 March 2014 Recipients: All Trading Participants of Eurex Deutschland and Eurex Zürich and Vendors Authorized by: Thomas Book Action required A. Single Stock Futures: Introduction of SSFs on Belgian, French, German, Italian, Spanish and Swiss underlyings; B. Equity options: Introduction of equity options on CompuGroup Medical AG, Flughafen Wien AG Inhaber-Aktien o.N. and Nemetschek AG Inhaber-Aktien o.N. Contact: Derivatives Trading Operations, T +49-69-211-1 12 10, Michael Durica, T +49-69-211-1 59 23 Content may be most important for: Attachments: Ü All departments 1. Updated Annexes A and B of the Contract Specifications for Futures Contracts and Options Contracts at Eurex Deutschland and Eurex Zürich 2. Market Maker Obligations (excerpt) Summary: The Management Board of Eurex Deutschland and the Executive Board of Eurex Zürich AG took the following decisions with effect from 10 March 2014: 1. Introduction of Single Stock Futures on Beneteau S.A. Actions Port. EO -,10, Société Foncière Lyonnaise SA Actions Port. EO 2, Carl Zeiss Meditec AG, Dt. Annington Immobilien SE Namens-Aktien o.N., CompuGroup Medical AG, CANCOM SE, Almirall S.A. Acciones Port. EO -,12, GameLoft SE Actions Port. EO 0,05, Helvetia Holding AG, KBC Ancora Actions au Port. o.N, LEG Immobilien AG, LPKF Laser & Electronics AG, C.M.B. (Cie Maritime Belge) SA Actions Nouvelles au Port.o.N., Nemetschek AG Inhaber-Aktien o.N., Norma Group SE, Telefonica Deutschland Holding, Swiss Prime Site AG, Sartorius AG, Temenos Group AG and Yoox S.p.A. Azioni nom. -

LEG Immobilien AG (Incorporated in Germany As a Stock Corporation)

Not for distribution in the United States of America LEG Immobilien AG (incorporated in Germany as a stock corporation) €500,000,000 1.250% Fixed Rate Standalone Notes due 2024 ISIN XS1554456613, Common Code 155445661 and German Securities Code (WKN) A2E4W8 Issue Price: 99.409% LEG Immobilien AG, with its registered office at Hans-Böckler-Straße 38, 40476 Düsseldorf, Germany, and registered in the commercial register of the Local Court of Düsseldorf, Germany, under HRB 69386 (the “Issuer” or the “Company”, and together with its fully consolidated subsidiaries, the “Group”, “LEG” or “LEG Group”) will issue on January 23, 2017 Notes in the aggregate principal amount of €500,000,000 due 2024 (the “Notes”). The Notes will bear interest at a rate of 1.250% per year. The Issuer will pay interest on the Notes annually in arrears on January 23, commencing on January 23, 2018. The Notes, which are governed by the laws of the Federal Republic of Germany (“Germany”), will be issued in a denomination of €100,000 each. The Notes will constitute direct, unconditional, unsecured and unsubordinated obligations of the Issuer, ranking pari passu among themselves and pari passu with all other unsecured and unsubordinated obligations of the Issuer, unless such obligations are accorded priority under mandatory provisions of statutory law. Unless previously redeemed or purchased and cancelled in accordance with the terms and conditions of the Notes (“Terms and Conditions”), the Notes will be redeemed at par on January 23, 2024 (the “Maturity Date”). The Notes may be redeemed before the Maturity Date, in whole but not in part, at their principal amount, together with, if applicable, accrued interest, notably in the event of any change in taxation or in an event of default, see “Terms and Conditions of the Notes—§6 Redemption—(2) Early Redemption for Reasons of Taxation” and “Terms and Conditions of the Notes—§10 Events of Default”. -

Euro Stoxx® Multi Premia Index

EURO STOXX® MULTI PREMIA INDEX Components1 Company Supersector Country Weight (%) SARTORIUS STEDIM BIOTECH Health Care France 1.59 IMCD Chemicals Netherlands 1.25 VOPAK Industrial Goods & Services Netherlands 1.15 BIOMERIEUX Health Care France 1.04 REMY COINTREAU Food, Beverage & Tobacco France 1.03 EURONEXT Financial Services France 1.00 HERMES INTERNATIONAL Consumer Products & Services France 0.94 SUEZ ENVIRONNEMENT Utilities France 0.94 BRENNTAG Chemicals Germany 0.93 ENAGAS Energy Spain 0.90 ILIAD Telecommunications France 0.89 DEUTSCHE POST Industrial Goods & Services Germany 0.88 FUCHS PETROLUB PREF Chemicals Germany 0.88 SEB Consumer Products & Services France 0.87 SIGNIFY Construction & Materials Netherlands 0.86 CARL ZEISS MEDITEC Health Care Germany 0.80 SOFINA Financial Services Belgium 0.80 EUROFINS SCIENTIFIC Health Care France 0.80 RATIONAL Industrial Goods & Services Germany 0.80 AALBERTS Industrial Goods & Services Netherlands 0.74 KINGSPAN GRP Construction & Materials Ireland 0.73 GERRESHEIMER Health Care Germany 0.72 GLANBIA Food, Beverage & Tobacco Ireland 0.71 PUBLICIS GRP Media France 0.70 UNITED INTERNET Technology Germany 0.70 L'OREAL Consumer Products & Services France 0.70 KPN Telecommunications Netherlands 0.68 SARTORIUS PREF. Health Care Germany 0.68 BMW Automobiles & Parts Germany 0.68 VISCOFAN Food, Beverage & Tobacco Spain 0.67 SAINT GOBAIN Construction & Materials France 0.67 CORBION Food, Beverage & Tobacco Netherlands 0.66 DAIMLER Automobiles & Parts Germany 0.66 PROSIEBENSAT.1 MEDIA Media Germany 0.65 -

Consolidated Financial Statements for the Year Ended December 31, 2019

CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEAR ENDED DECEMBER 31, 2019 NUREMBERG / FÜRTH LEIPZIG CONTENTS Board of Directors’ report 2 EPRA Performance Measures 60 Report of the Rèviseur d’Enterprises Agréé (Independent Auditor) 72 Consolidated statement of profit or loss 76 Consolidated statement of comprehensive income 77 Consolidated statement of financial position 78 Consolidated statement of changes in equity 80 Consolidated statement of cash flows 82 Notes to the consolidated financial statements 84 IMPRINT Publisher: Grand City Properties S.A. | 1, Avenue du Bois | L-1251 Luxembourg phone: +352 28 77 87 86 | e-mail: [email protected] | www.grandcityproperties.com Board of Directors’ Report | 1 KEY FINANCIALS BALANCE SHEET HIGHLIGHTS in €’000 unless otherwise indicated Dec 2019 Dec 2018 Dec 2017 Total Assets 9,851,428 8,860,526 7,508,292 Total Equity 4,966,599 4,666,987 3,849,662 Loan-to-Value 33% 34% 36% Equity Ratio 50% 53% 51% P&L HIGHLIGHTS in €’000 unless otherwise indicated 1–12/2019 Change 1–12/2018 Rental and operating income 560,303 3% 544,977 Net rental income 382,605 5% 364,365 EBITDA 696,741 -11% 782,313 Adjusted EBITDA 297,662 8% 275,530 FFO I 211,966 7% 197,854 FFO I per share (in €) 1.27 7% 1.19 FFO I per share after perpetual notes attribution (in €) 1.07 6% 1.01 FFO II 381,387 14% 334,456 Profit for the year 493,360 -15% 583,034 EPS (basic) (in €) 2.43 -18% 2.95 EPS (diluted) (in €) 2.30 -17% 2.76 2019* Change 2018 Dividend per share (in €) 0.8238 7 % 0.7735 *2019 dividend is subject to the next AGM approval and -

FACTSHEET - AS of 28-Sep-2021 Solactive Mittelstand & Midcap Deutschland Index (TRN)

FACTSHEET - AS OF 28-Sep-2021 Solactive Mittelstand & MidCap Deutschland Index (TRN) DESCRIPTION The Index reflects the net total return performance of 70 medium/smaller capitalisation companies incorporated in Germany. Weights are based on free float market capitalisation and are increased if significant holdings in a company can be attributed to currentmgmtor company founders. HISTORICAL PERFORMANCE 350 300 250 200 150 100 50 Jan-2010 Jan-2012 Jan-2014 Jan-2016 Jan-2018 Jan-2020 Jan-2022 Solactive Mittelstand & MidCap Deutschland Index (TRN) CHARACTERISTICS ISIN / WKN DE000SLA1MN9 / SLA1MN Base Value / Base Date 100 Points / 19.09.2008 Bloomberg / Reuters MTTLSTRN Index / .MTTLSTRN Last Price 342.52 Index Calculator Solactive AG Dividends Included (Performance Index) Index Type Equity Calculation 08:00am to 06:00pm (CET), every 15 seconds Index Currency EUR History Available daily back to 19.09.2008 Index Members 70 FACTSHEET - AS OF 28-Sep-2021 Solactive Mittelstand & MidCap Deutschland Index (TRN) STATISTICS 30D 90D 180D 360D YTD Since Inception Performance -3.69% 3.12% 7.26% 27.72% 12.73% 242.52% Performance (p.a.) - - - - - 9.91% Volatility (p.a.) 13.05% 12.12% 12.48% 13.60% 12.90% 21.43% High 357.49 357.49 357.49 357.49 357.49 357.49 Low 342.52 329.86 315.93 251.01 305.77 52.12 Sharpe Ratio -2.77 1.14 1.27 2.11 1.40 0.49 Max. Drawdown -4.19% -4.19% -4.19% -9.62% -5.56% -47.88% VaR 95 \ 99 -21.5% \ -35.8% -34.5% \ -64.0% CVaR 95 \ 99 -31.5% \ -46.8% -53.5% \ -89.0% COMPOSITION BY CURRENCIES COMPOSITION BY COUNTRIES EUR 100.0% DE -

Stoxx® Global 3000 Esg-X Index

STOXX® GLOBAL 3000 ESG-X INDEX Components1 Company Supersector Country Weight (%) Apple Inc. Technology United States 3.19 Microsoft Corp. Technology United States 2.88 Amazon.com Inc. Retail United States 2.17 FACEBOOK CLASS A Technology United States 1.15 ALPHABET CLASS C Technology United States 1.05 TESLA Automobiles & Parts United States 0.84 TSMC Technology Taiwan 0.83 JPMorgan Chase & Co. Banks United States 0.78 Samsung Electronics Co Ltd Technology South Korea 0.62 VISA Inc. Cl A Industrial Goods & Services United States 0.58 UnitedHealth Group Inc. Health Care United States 0.57 Walt Disney Co. Media United States 0.57 NESTLE Food, Beverage & Tobacco Switzerland 0.53 NVIDIA Corp. Technology United States 0.52 Procter & Gamble Co. Personal Care, Drug & Grocery Stores United States 0.52 MasterCard Inc. Cl A Industrial Goods & Services United States 0.52 Home Depot Inc. Retail United States 0.51 Bank of America Corp. Banks United States 0.49 PayPal Holdings Industrial Goods & Services United States 0.47 Intel Corp. Technology United States 0.43 Comcast Corp. Cl A Telecommunications United States 0.42 Exxon Mobil Corp. Energy United States 0.40 ASML HLDG Technology Netherlands 0.39 ROCHE HLDG P Health Care Switzerland 0.39 Verizon Communications Inc. Telecommunications United States 0.39 Netflix Inc. Media United States 0.37 Abbott Laboratories Health Care United States 0.35 AT&T Inc. Telecommunications United States 0.35 NOVARTIS Health Care Switzerland 0.35 ADOBE Technology United States 0.35 Cisco Systems Inc. Telecommunications United States 0.34 Toyota Motor Corp. -

Global Equity Fund Description Plan 3S DCP & JRA MICROSOFT CORP

Global Equity Fund June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA MICROSOFT CORP 2.5289% 2.5289% APPLE INC 2.4756% 2.4756% AMAZON COM INC 1.9411% 1.9411% FACEBOOK CLASS A INC 0.9048% 0.9048% ALPHABET INC CLASS A 0.7033% 0.7033% ALPHABET INC CLASS C 0.6978% 0.6978% ALIBABA GROUP HOLDING ADR REPRESEN 0.6724% 0.6724% JOHNSON & JOHNSON 0.6151% 0.6151% TENCENT HOLDINGS LTD 0.6124% 0.6124% BERKSHIRE HATHAWAY INC CLASS B 0.5765% 0.5765% NESTLE SA 0.5428% 0.5428% VISA INC CLASS A 0.5408% 0.5408% PROCTER & GAMBLE 0.4838% 0.4838% JPMORGAN CHASE & CO 0.4730% 0.4730% UNITEDHEALTH GROUP INC 0.4619% 0.4619% ISHARES RUSSELL 3000 ETF 0.4525% 0.4525% HOME DEPOT INC 0.4463% 0.4463% TAIWAN SEMICONDUCTOR MANUFACTURING 0.4337% 0.4337% MASTERCARD INC CLASS A 0.4325% 0.4325% INTEL CORPORATION CORP 0.4207% 0.4207% SHORT-TERM INVESTMENT FUND 0.4158% 0.4158% ROCHE HOLDING PAR AG 0.4017% 0.4017% VERIZON COMMUNICATIONS INC 0.3792% 0.3792% NVIDIA CORP 0.3721% 0.3721% AT&T INC 0.3583% 0.3583% SAMSUNG ELECTRONICS LTD 0.3483% 0.3483% ADOBE INC 0.3473% 0.3473% PAYPAL HOLDINGS INC 0.3395% 0.3395% WALT DISNEY 0.3342% 0.3342% CISCO SYSTEMS INC 0.3283% 0.3283% MERCK & CO INC 0.3242% 0.3242% NETFLIX INC 0.3213% 0.3213% EXXON MOBIL CORP 0.3138% 0.3138% NOVARTIS AG 0.3084% 0.3084% BANK OF AMERICA CORP 0.3046% 0.3046% PEPSICO INC 0.3036% 0.3036% PFIZER INC 0.3020% 0.3020% COMCAST CORP CLASS A 0.2929% 0.2929% COCA-COLA 0.2872% 0.2872% ABBVIE INC 0.2870% 0.2870% CHEVRON CORP 0.2767% 0.2767% WALMART INC 0.2767% -

FACTSHEET - AS of 27-Sep-2021 Deutschland Ethik 30 Aktienindex

FACTSHEET - AS OF 27-Sep-2021 Deutschland Ethik 30 Aktienindex HISTORICAL PERFORMANCE 300 250 200 150 100 Jan-2010 Jan-2012 Jan-2014 Jan-2016 Jan-2018 Jan-2020 Deutschland Ethik 30 Aktienindex CHARACTERISTICS ISIN / WKN DE000SLA8ET8 / SLA8ET Base Value / Base Date 100 Points / 31.12.2013 Bloomberg / Reuters DETHIP30 Index / .DETHIP30 Last Price 290.19 Index Calculator Solactive AG Dividends Not included (Price index) Index Type Equity Calculation 08:00am to 06:00pm (CET), every 15 seconds Index Currency EUR History Available daily back to 31.12.2013 Index Members 30 FACTSHEET - AS OF 27-Sep-2021 Deutschland Ethik 30 Aktienindex STATISTICS 30D 90D 180D 360D YTD Since Inception Performance -2.05% -0.50% 4.31% 18.22% 8.80% 54.20% Performance (p.a.) - - - - - 5.75% Volatility (p.a.) 12.00% 11.76% 11.67% 14.61% 12.36% 18.47% High 296.27 298.82 298.82 298.82 298.82 298.82 Low 282.92 282.92 278.19 225.13 261.73 158.75 Sharpe Ratio -1.81 -0.12 0.81 1.30 1.02 0.34 Max. Drawdown -4.51% -5.32% -5.32% -11.56% -5.32% -41.72% VaR 95 \ 99 -23.1% \ -40.4% -28.6% \ -53.0% CVaR 95 \ 99 -36.1% \ -61.6% -45.3% \ -74.2% COMPOSITION BY CURRENCIES COMPOSITION BY COUNTRIES EUR 100.0% DE 100.0% TOP COMPONENTS AS OF 27-Sep-2021 Company Ticker Country Currency Index Weight (%) SAP SE SAP GY Equity DE EUR 9.88% SIEMENS AG SIE GY Equity DE EUR 9.79% ALLIANZ SE ALV GY Equity DE EUR 8.98% DEUTSCHE POST AG DPW GY Equity DE EUR 7.74% ADIDAS AG ADS GY Equity DE EUR 6.21% LEG IMMOBILIEN SE LEG GY Equity DE EUR 6.03% TELEFONICA DEUTSCHLAND HOLDING AG O2D GY Equity DE EUR