Discussion Materials and Market Overview

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Private Equity Firms Fueling the Growth of Electronic Trading June

Private Equity Firms Fueling the Growth of Electronic Trading June 23, 2007 Article Excepts: Steve McLaughlin, managing partner in Financial Technology Partners, the only investment banking firm focused exclusively on financial technology deals, insists the trend is going to continue because there's always innovation in the space, but maybe not at the current pace. "It's going to slow because so much attention has been brought to this space recently," he says. "A lot of the better later-stage companies [already] have done their transactions." McLaughlin — who gave Liquidnet its eye-popping $1.8 billion valuation in 2005, which resulted in a $250 million investment from TCV and Summit Equity Investors — points to Liquidnet as an example. "Liquidnet is a very simple idea — the business plan and the idea you could write on the back of a postage stamp," he contends. "It was very elegant in the way that [the company] put it together and marketed itself as the Napster of electronic trading. ... Financial technology is more about using existing technologies to solve complex problems." FT Partner's McLaughlin, however, says, "There are still plenty of deals out there. A lot of the companies getting finance were created five or six years ago. There are plenty of firms being created now that in five or six years will be looking for capital. But a lot of the really good companies have been pursued by these private equity firms" Full Article: It's good to be in the financial technology industry these days — especially if your company is getting calls from private equity firms looking to invest in one of the economy's hottest growth sectors. -

Avetta and BROWZ Combine to Form One of the World's Leading

Avetta and BROWZ Combine to Form One of the World’s Leading Providers of Supply Chain Risk Management Transaction expands global network to 85,000 customers in over 100 countries with a configurable SaaS platform and industry leading customer service Feb. 14, 2019—OREM, Utah—Avetta and BROWZ, two leading providers of SaaS based supply chain risk management software, today announced they have combined to form a new, market leading organization focused on delivering the best in supply chain risk management services to companies world-wide. The transaction further solidifies Avetta’s position as a world-class organization, innovator and thought leader, expanding the company’s global network to 85,000 customers in over 100 countries in the fast growing $14 billion global marketplace for supply chain risk management solutions. Avetta and BROWZ combine more than three decades of experience in making industries safer, more sustainable and compliant by vetting and qualifying the suppliers that support their global clients. Avetta and BROWZ’s 450 combined clients include blue chip companies in industry verticals such as energy, chemicals, manufacturing, utilities, construction materials, facilities management, communications, transportation, logistics & retail, mining, aerospace & defense and food & beverage. These industry leaders require better visibility into supply chain risks, such as workplace health & safety, sustainability, modern slavery, data privacy, anti-bribery & corruption, regulatory and insurance compliance. Together, the companies’ market-leading technology platform and products strengthen sustainable connections between clients and suppliers, while streamlining and simplifying the engagement process for both parties. Avetta and BROWZ share a common vision of putting customers first and a belief that the solutions offered to their clients should be configurable to address the specific needs and requirements of their client base across industries and geographies. -

Want to Crush Competitors? Forget Softbank, Blackstone Suggests; It Can Write $500 Million Checks, Too

September 20, 2019 Extra Crunch Want to crush competitors? Forget SoftBank, Blackstone suggests; it can write $500 million checks, too Connie Loizos @cookie JK: There are 2,600 altogether across 24 offices. an investing giant is the better gig? ack in January, Blackstone — the TC: Is your group investing a discreet pool of JK: If you’re an intellectually curious individ- investment firm whose assets un- capital? ual, there are so many signals [coming through der management surpassed a jaw- Blackstone] that it’s almost a proxy for the dropping half a trillion dollars earlier JK: At some point, we’ll have a dedicated pool world. It’s like manna from heaven. It’s not like Bthis year — quietly began piecing together a of capital, but as a firm, we’ve been investing in they’re doing a single-threaded approach. The new, growth equity platform called Blackstone growth equity for some time [so have relied on nature of the challenges across our companies Growth, or BXG. Step one was hiring away Jon other funds within Blackstone to date]. is so vast and so varying that whether you’re Korngold from General Atlantic, where looking at a fast-growing retailer or a cell phone he’d spent the previous 18 years, including TC: There’s no shortage of growth equity tower in another country, the nature of the tasks as a managing director and a member of its in the world right now. What is Blackstone is always changing. management committee. building that’s so different? Step two has been for Korngold, who is re- TC: SoftBank seems to have shaken things sponsible for running the new program, to build JK: The sheer scale of the operation is different. -

The Definitive Review of the US Venture Capital Ecosystem Credits & Contact

Q4 2019 In partnership with Angel & seed deal value remains Value of VC deals with 2019 marks record year for elevated in 2019 at $9.1B nontraditional investor VC exit value despite tepid exit Page 7 participation approaches $100B for activity in Q4 second consecutive year Page 32 Page 27 The definitive review of the US venture capital ecosystem Credits & contact PitchBook Data, Inc. JOHN GABBERT Founder, CEO ADLEY BOWDEN Vice President, Research & Analysis Content NIZAR TARHUNI Director, Research JAMES GELFER Senior Strategist & Lead Analyst, VC ALEX FREDERICK Senior Analyst, VC CAMERON STANFILL, CFA Analyst II, VC KYLE STANFORD Analyst, VC VAN LE Senior Data Analyst RESEARCH Contents [email protected] Report & cover design by CONOR HAMILL Executive summary 3 National Venture Capital Association (NVCA) BOBBY FRANKLIN President & CEO NVCA policy highlights 4 MARYAM HAQUE Senior Vice President of Industry Advancement Overview 5-6 CASSIE HODGES Director of Communications DEVIN MILLER Manager of Communications & Digital Angel, seed & first financings 7-8 Strategy Early-stage VC 9-10 Contact NVCA nvca.org Late-stage VC 11-12 [email protected] SVB: Resilience is the theme for 2020 14-15 Silicon Valley Bank Deals by region 17 GREG BECKER Chief Executive Officer MICHAEL DESCHENEAUX President Deals by sector 18-21 BEN STASIUK Vice President SVB: Global trade tensions create stress—and opportunity 22-23 Contact Silicon Valley Bank svb.com Female founders 24-25 [email protected] Nontraditional investors 27-28 Carta: How dual-class and single-class companies Carta 29-30 MISCHA VAUGHN Head of Editorial compare JEFF PERRY Vice President of Revenue D’ARCY DOYLE Senior Vice President of Investor Exits 32-33 Services Sales VINCENT TIMONEY Director of Channel Strategy Fundraising 34-35 Contact Carta Methodology 37 carta.com 2 Q4 2019 PITCHBOOK-NVCA VENTURE MONITOR Executive summary The big question mark at the start of 2019 was how VC deal value would fare after a historic showing in the year prior. -

Santa Barbara County Employees' Retirement System

Santa Barbara County Employees’ Retirement System 2021 Private Equity Strategic Plan Agenda • Program Review 3 • Portfolio Snapshot and Performance Summary 9 • Strategic Plan 13 • Appendix 20 Program Review PE Portfolio Highlights - September 30, 2020 Hamilton Lane (“HL”) is entering our 15th year of building the Santa Barbara County Employees’ Retirement System (“SBCERS”) PE Program Performance • Since inception IRR of 12.67% outperforms the benchmark (Russell 3000 + 300 bps) by 28 bps • Double-digit performance for the one-year period, with a point-to-point IRR of 14.96% Strategic Objectives • Fulfilled all objectives outlined in the 2020 Strategic Plan • PE target of 10% established in 2016; Portfolio at 11.45% as of September 30, 2020 • Established a strong foundation of top tier managers Additional Highlights • Accessed highly sought, oversubscribed funds • Received preferred legal terms for one fund in 2020 as a result of the HL platform • Presented Private Equity 101 to new Board Members Hamilton Lane | Global Leader in the Private Markets Proprietary and Confidential | 4 SBCERS’ Private Equity Investment Milestones Hamilton Lane was hired by SBCERS in 2006 to select new investments, monitor, and provide advice for the private equity portfolio 2005 - Lexington Capital Partners VI • First private equity investment (made by SBCERS) 2006 - HL hired to build long-term PE allocation to 5% • Original contract allowed HL to invest $80M on behalf of SBCERS 2008 - Amendment to contract giving HL full discretion • Recommended annual commitment -

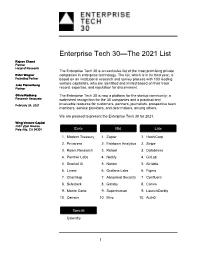

Enterprise Tech 30—The 2021 List

Enterprise Tech 30—The 2021 List Rajeev Chand Partner Head of Research The Enterprise Tech 30 is an exclusive list of the most promising private Peter Wagner companies in enterprise technology. The list, which is in its third year, is Founding Partner based on an institutional research and survey process with 103 leading venture capitalists, who are identified and invited based on their track Jake Flomenberg Partner record, expertise, and reputation for discernment. Olivia Rodberg The Enterprise Tech 30 is now a platform for the startup community: a Research Associate watershed recognition for the 30 companies and a practical and February 24, 2021 invaluable resource for customers, partners, journalists, prospective team members, service providers, and deal makers, among others. We are pleased to present the Enterprise Tech 30 for 2021. Wing Venture Capital 480 Lytton Avenue Palo Alto, CA 94301 Early Mid Late 1. Modern Treasury 1. Zapier 1. HashiCorp 2. Privacera 2. Fishtown Analytics 2. Stripe 3. Roam Research 3. Retool 3. Databricks 4. Panther Labs 4. Netlify 4. GitLab 5. Snorkel AI 5. Notion 5. Airtable 6. Linear 6. Grafana Labs 6. Figma 7. ChartHop 7. Abnormal Security 7. Confluent 8. Substack 8. Gatsby 8. Canva 9. Monte Carlo 9. Superhuman 9. LaunchDarkly 10. Census 10. Miro 10. Auth0 Special Calendly 1 2021 The Curious Case of Calendly This year’s Enterprise Tech 30 has 31 companies rather than 30 due to the “curious case” of Calendly. Calendly, a meeting scheduling company, was categorized as Early-Stage when the ET30 voting process started on January 11 as the company had raised $550,000. -

Solid Foundations Crowdfunding Finance Adding Social Value

Solid foundations Crowdfunding finance Adding social value Positive returns offered by Crowdfunding for charities as The social economy is on the commercial property investment a test bed for fundraising skills march to build a stronger society August/September 2014 l www.charitytimes.com EDITORIAL COMMENT Editor Andrew Holt [email protected] Positive mergers 020 7562 2411 Contributing Writers Dawn Austwick, Rachael Badger, Anna Bloch, One interesting but little focused on trend, is the Dan Corry, Nicola Davies, Harry de Ferry Foster, one that highlighted charities involved in mergers Peter Holbrook, Julie Howell, Tris Lumley, transferred over £225m to form new organisations Paul Palmer, Jayne Phenton, Antony Savvas, last year. This is considerable. Asheem Singh, Sam Simmons Together, the 189 organisations undertaking mergers Design & Production turned over almost £1bn, or some 2.4 per cent of Matleena Lilja total voluntary sector income. This was according to [email protected] The Good Merger Index, the first overview of charity 020 7562 2400 sector mergers, produced by management consultancy Commercial Manager Eastside Primetimers. Cerys Brafield There was significant activity amongst health and social care organisations, [email protected] which accounted for more than 50 per cent of mergers, with a disproportionate 07766 662 610 bias towards mental health and disability charities, reflecting commissioners’ Advertising Manager preoccupation with lower costs and pan-disability provision. Sam Ridley The Good Merger Index also revealed comparatively high levels of merger [email protected] 020 7562 4386 activity in supported housing, community development, minorities, intermediary and religious charities. Subscriptions Broken down into approaches: mergers represented: 23 per cent, takeovers: Joel Whitefoot 43 per cent, subsidiaries: 23 per cent; group structures 7 per cent and asset [email protected] 020 8950 9117 exchanges 5 per cent. -

Merkle Lands $75M Private- Equity Investment

Merkle lands $75M private-equity investment | Baltimore Business Journal Page 1 of 3 This Was Printed From Baltimore Business Journal Merkle lands $75M private- equity investment Premium content from Baltimore Business Journal - by Gary Haber Date: Monday, October 18, 2010, 12:00am EDT - Last Modified: Thursday, October 14, 2010, 3:40pm EDT Merkle has snagged a $75 million investment from a Silicon Valley private equity firm known for backing high-tech high flyers like Netflix, Expedia and the online dating site, eHarmony. Technology Crossover Ventures’ cash infusion in the Columbia marketing firm is likely the biggest stake a private equity firm has taken in a Baltimore-area company this year and a healthy sign for Greater Baltimore’s economy. “That’s a good size deal for Baltimore,” said George Nemphos, who runs the corporate practice at law firm Duane Morris, which was not involved in the deal. “The fact that they took a minority stake for that much money shows there are companies in the Baltimore area that can attract this type of investment.” The size of the deal is noteworthy, said Andrew Clark, managing principal of the mergers and acquisitions practice at Evergreen Advisors in Columbia. Most private equity deals in the region are in the range of $10 million to $20 million or less. Hovde Private Equity Partners’ recent investment in Lutherville’s Bay Bank was $24 million, for example. In August, Harbinger Capital Partners, a New York private equity fund, said it would pay $350 million to buy Old Mutual Plc’s Baltimore-based U.S. life insurance business. -

Sportradar Announces Canada Pension Plan Investment Board and TCV As New Strategic Partners

Sportradar Announces Canada Pension Plan Investment Board and TCV as New Strategic Partners TORONTO, CANADA / MENLO PARK, USA / ST. GALLEN, SWITZERLAND -- (July 9, 2018): Sportradar, the global leader in analysing and leveraging the power of sports data, today announced two new strategic partners: Canada Pension Plan Investment Board (CPPIB) and Silicon Valley-based growth equity firm TCV. CPPIB, through its wholly owned subsidiary, CPP Investment Board Europe S.à r.l., and TCV will together acquire a stake in Sportradar at an enterprise value of EUR 2.1Bn (~USD 2.4Bn.) from private equity firm EQT and certain minority shareholders. Carsten Koerl, Founder and CEO, will retain his entire ownership position in Sportradar and will continue to drive its future development and growth. EQT will also reinvest a portion of its sale proceeds into Sportradar. Additional existing shareholders include Revolution Growth, Ted Leonsis, Michael Jordan, and Mark Cuban. “CPPIB and TCV are both known for extensive global tech experience and a track record for working alongside innovative management teams to help achieve their long-term vision,” said Carsten Koerl, CEO of Sportradar. “Having two new investors with a strong North American footprint is ideal given our increasing focus and expanding operations in the U.S., as the sports industry evolves to meet the expectations of today’s sports fans. Sportradar will continue to develop best-in-class, integrity and technology- driven services as we expand into new market segments, and we’re excited to have such a strong team behind us.” Sportradar is the nexus between sports and entertainment, serving leagues, news media, consumer platforms and sports betting operators with deep insights and a suite of strategic solutions to help grow their businesses. -

Fundraising Report Q1 2021

FUNDRAISING REPORT Q1 2021 Buyouts' interactive and downloadable review of Q1 2021's fundraising environment Download data Kirk Falconer Daniel Humphrey Rodriguez Senior Writer Head of Fund Manager Research [email protected] [email protected] Fundraising overview Year-on-year fundraising 500 900 Fundraising by North American private equity 450 810 firms in Q1 2021 represented the biggest 400 720 haul ever, as the market anticipates a post- 350 630 pandemic recovery. ) d n e b 300 540 s $ ( o l c d In all, more than $122 billion was secured e 250 450 s s d i n across 175 buyout, growth equity and other a r u l f 200 360 a f PE vehicles between January and March, t i o p o according to Buyouts’ data. This is up 5 a 150 270 N percent from the $117 billion collected by C 100 180 171 funds a year earlier. 50 90 Q1’s strong results follow a rebound in 0 0 fundraising in last year’s final months. In all, 2016 2017 2018 2019 2020 Q1 2021 more than $380 billion flowed into 719 vehicles in 2020, revised Buyouts’ data show. Q1 Q2-Q4 Number of funds closed FUNDRAISING REPORT Q1 2021 Download data Fundraising overview Q1 year-on-year fundraising 180 180 PE fundraising in Q1 2021 was the all-time 160 160 highest for a first quarter. This was the case 140 140 for both volume of capital raised and funds 120 120 closed. ) d n e b s $ ( o 100 100 l c d The second-most-active first quarter on e s s d i n record was last year’s. -

Private Equity Update 9/24/2014 Alternatives Allocation

Private Equity Update 9/24/2014 Alternatives Allocation As of June 30, 2014 o Alternatives represented 6.30% of the Total NCRS Plan o Private Equity represented 4.44%, below the Policy Target of 6% 2 Private Equity Allocation Policy Relative to Actual Portfolio Weights* Policy Range Actual Strategy MIN TARGET MAX (FMV) Buyout 35% 50% 65% 49.83% Growth/Venture 10% 20% 30% 32.01% Special Situations 15% 30% 45% 18.16% *Data includes Fund of Funds’ underlying exposure to given strategy as of June 30, 2014. GICS Industry Allocation** Geographic Allocation** **Data includes Fund of Funds’ underlying exposure to industry or geography, based on latest available FMV. 3 Future Portfolio Weighting Strategy Allocation including Fund-of-Funds Commitment Pace = $1.2 billion / year Declining Increasing Fund-of-Funds Special Situations VC / Growth Equity Buyout 4 Private Equity Cash Flow Detail In 2011, 2012, and 2013, Distributions have exceeded Contributions. 1H 2014 – Contributions outweighed Distributions. 5 Prior & Current Activities Fund commitments by calendar year in which commitment was made. FUND COMMITMENTS COMPLETED IN 2012 FUND COMMITMENTS COMPLETED IN 2013 FUND COMMITMENTS FOR 2014 COMMITMENT VINTAGE COMMITMENT VINTAGE COMMITMENT VINTAGE FUND AMOUNT YEAR RELATIONSHIP FUND AMOUNT YEAR RELATIONSHIP FUND AMOUNT YEAR RELATIONSHIP ($ millions) ($ millions) ($ millions) BUYOUT BUYOUT BUYOUT Avista Capital Partners III 150 2011 existing Accel-KKR Capital Partners IV 10 2013 NEW Crestview Capital Partners III 150 2013 existing Apollo Investment -

Department of Defense Emerging Technology Strategy: a Venture Capital Perspective

Department of Defense Emerging Technology Strategy: A Venture Capital Perspective Silicon Valley Defense Working Group April 2019 ABSTRACT The purpose of this paper is to assess the DOD’s efforts to access new sources of innovation through engagement with venture-backed emerging technology companies. The intended audience is threefold: DOD innovation policy makers, members of innovation units deployed to emerging tech ecosystems, and their overseers and financial backers in Congress. The paper starts by offering an overview of venture funding trends in areas of DOD interest both generally, and then in the Artificial Intelligence category. The encouraging conclusion is that at least on the surface, DOD efforts have been a stunning success. Based on publicly available data, venture funding to dual use companies the last five years has tripled from around $5B to nearly $15B. However, a deeper look as shown in the AI study reveals that the DOD overly focuses on the Early Stage. The corresponding geographic analysis of venture flows in 2018 compared to DOD innovation units shows an incomprehensible lack of engagement in Silicon Valley. The Valley sees nearly 55% of dual use funding but only 2.7% of DOD innovation budgets. The Defense Innovation Unit (DIU) based in Mountain View, California is the most important element of DOD’s emerging technology strategy. It’s resources should be sharply increased, and its mandate greatly expanded to reflect Silicon Valley’s importance as the leading emerging technology ecosystem. The second section lays out a multi-stage throughput model for dual use venture activity. The goal is to establish a common understanding by all three intended audiences of the VC market’s structure and inner workings.