Solid Foundations Crowdfunding Finance Adding Social Value

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Private Equity Firms Fueling the Growth of Electronic Trading June

Private Equity Firms Fueling the Growth of Electronic Trading June 23, 2007 Article Excepts: Steve McLaughlin, managing partner in Financial Technology Partners, the only investment banking firm focused exclusively on financial technology deals, insists the trend is going to continue because there's always innovation in the space, but maybe not at the current pace. "It's going to slow because so much attention has been brought to this space recently," he says. "A lot of the better later-stage companies [already] have done their transactions." McLaughlin — who gave Liquidnet its eye-popping $1.8 billion valuation in 2005, which resulted in a $250 million investment from TCV and Summit Equity Investors — points to Liquidnet as an example. "Liquidnet is a very simple idea — the business plan and the idea you could write on the back of a postage stamp," he contends. "It was very elegant in the way that [the company] put it together and marketed itself as the Napster of electronic trading. ... Financial technology is more about using existing technologies to solve complex problems." FT Partner's McLaughlin, however, says, "There are still plenty of deals out there. A lot of the companies getting finance were created five or six years ago. There are plenty of firms being created now that in five or six years will be looking for capital. But a lot of the really good companies have been pursued by these private equity firms" Full Article: It's good to be in the financial technology industry these days — especially if your company is getting calls from private equity firms looking to invest in one of the economy's hottest growth sectors. -

Avetta and BROWZ Combine to Form One of the World's Leading

Avetta and BROWZ Combine to Form One of the World’s Leading Providers of Supply Chain Risk Management Transaction expands global network to 85,000 customers in over 100 countries with a configurable SaaS platform and industry leading customer service Feb. 14, 2019—OREM, Utah—Avetta and BROWZ, two leading providers of SaaS based supply chain risk management software, today announced they have combined to form a new, market leading organization focused on delivering the best in supply chain risk management services to companies world-wide. The transaction further solidifies Avetta’s position as a world-class organization, innovator and thought leader, expanding the company’s global network to 85,000 customers in over 100 countries in the fast growing $14 billion global marketplace for supply chain risk management solutions. Avetta and BROWZ combine more than three decades of experience in making industries safer, more sustainable and compliant by vetting and qualifying the suppliers that support their global clients. Avetta and BROWZ’s 450 combined clients include blue chip companies in industry verticals such as energy, chemicals, manufacturing, utilities, construction materials, facilities management, communications, transportation, logistics & retail, mining, aerospace & defense and food & beverage. These industry leaders require better visibility into supply chain risks, such as workplace health & safety, sustainability, modern slavery, data privacy, anti-bribery & corruption, regulatory and insurance compliance. Together, the companies’ market-leading technology platform and products strengthen sustainable connections between clients and suppliers, while streamlining and simplifying the engagement process for both parties. Avetta and BROWZ share a common vision of putting customers first and a belief that the solutions offered to their clients should be configurable to address the specific needs and requirements of their client base across industries and geographies. -

Hosted Fundraising Event: How to Secure Your Funds Vol

PM World Journal Hosted Fundraising Event: How to secure your funds Vol. VII, Issue I – January 2018 by Christelle Leonetti www.pmworldjournal.net Student Paper Hosted Fundraising Event: How to secure your funds1 Christelle Leonetti ABSTRACT Nonprofit organizations and non-governmental organizations (NGOs) represent more than 10 million organizations throughout the world and most of them use fundraising to collect money for their programs. However, they do not use the same methods or have the same results. Fundraising can fail and let the organization without fund and with a negative cashflow depending of the method used and the event planned. Therefore, this paper is developed to analyze the different methods used to raise funds using Multi-Attribute Decision making and determine which one is the best and most effective to use to create a fundraising contract. Based on the analysis, only using one method ensures a low rate of success therefore organizations must be creative when creating their fundraising strategy and aimed at organizations as well as individuals. Key Words: fundraising, event planning, termination, funds, contract, relative weighting INTRODUCTION The American Association of Fundraising Professionals’ 2016 “the Fundraising Effectiveness Survey” report states that the amount raised between 2014 and 2015 by 9,922 nonprofit organizations in the United States is $8,628,240,699. How do those organizations raise so much money? They use online fundraising (Causes, Crowdrise), grants, financial endowment or they use their network to communicate directly with potential donors by organizing events that combine a just cause with a moment of sharing. Those events can be categorized in 3 different types: self- managed events that the organization manages by itself to raise money, one of the most famous being the “Monaco Red Cross Ball” organized yearly since 1948 by the Red Cross. -

Submission to the Senate Ctte. on Charity Fundraising in the 21St Century

Submission to the Senate Ctte. on Charity Fundraising in the 21st Century Background to the PFRA The Public Fundraising Regulatory Association (PFRA) is the self-regulatory body for face to face fundraising in Australia. Face to face fundraising is one of a number of methods used by charities across Australia to generate funding. It provides significant funding that allows charities to provide vital services for local communities and to help solve some of the greatest global issues. Established in February 2015, the role of the PFRA is to make sure that the right balance is maintained between the duty of charities to ask for donations and the right of the public to experience high standards of behaviour from our members’ fundraisers. The PFRA is a charity-led, membership-based association. Members include those charities that benefit from face to face fundraising and the professional fundraising suppliers that support charities in this work. A complete list of PFRA charity members is available as Annex B. The PFRA is governed by a Board of Directors elected PFRA members. The current members of the PFRA Board include senior fundraisers from Plan International, Australian Red Cross, and Peter MacCallum Cancer Foundation. The PFRA is unique in the fundraising sector in that it is the only organisation that has been established specifically to regulate one type of fundraising and ensure compliance with a Standard. In addition to setting standards for face to face fundraisers, the PFRA rigorously checks that fundraisers comply with its Standard through a quality assurance program, as well as enforcing the Standard through a penalty, sanctions and remediation regime. -

Want to Crush Competitors? Forget Softbank, Blackstone Suggests; It Can Write $500 Million Checks, Too

September 20, 2019 Extra Crunch Want to crush competitors? Forget SoftBank, Blackstone suggests; it can write $500 million checks, too Connie Loizos @cookie JK: There are 2,600 altogether across 24 offices. an investing giant is the better gig? ack in January, Blackstone — the TC: Is your group investing a discreet pool of JK: If you’re an intellectually curious individ- investment firm whose assets un- capital? ual, there are so many signals [coming through der management surpassed a jaw- Blackstone] that it’s almost a proxy for the dropping half a trillion dollars earlier JK: At some point, we’ll have a dedicated pool world. It’s like manna from heaven. It’s not like Bthis year — quietly began piecing together a of capital, but as a firm, we’ve been investing in they’re doing a single-threaded approach. The new, growth equity platform called Blackstone growth equity for some time [so have relied on nature of the challenges across our companies Growth, or BXG. Step one was hiring away Jon other funds within Blackstone to date]. is so vast and so varying that whether you’re Korngold from General Atlantic, where looking at a fast-growing retailer or a cell phone he’d spent the previous 18 years, including TC: There’s no shortage of growth equity tower in another country, the nature of the tasks as a managing director and a member of its in the world right now. What is Blackstone is always changing. management committee. building that’s so different? Step two has been for Korngold, who is re- TC: SoftBank seems to have shaken things sponsible for running the new program, to build JK: The sheer scale of the operation is different. -

Corporate Philanthropy in Asia: Innovations That Unlock the Resources of Business for the Common Good

Corporate Philanthropy in Asia: Innovations that Unlock the Resources of Business for the Common Good Entrepreneurial Social Finance in Asia: Working Paper No. 5 asia centre for ocial Our Entrepreneurial Social Finance working papers explore the role of philanthropy in s supporting entrepreneurial social ventures in Asia. We previously reported on the social entrepreneurship & fnance ecosystem, innovative models of philanthropy including collective giving, and how hilanthropy angel investing for impact can beneft social enterprise. This paper examines the particular p role of corporate business as provider of philanthropic capital – fnancial, human and intellectual. In addition to using traditional grant funding, we found that some corporations invest in early stage ventures that reach the poorest with afordable goods and services, or outsource their business processes to social enterprise vendors. Businesses increasingly see skilled volunteering and giving circles as new approaches to community engagement that Corporate Philanthropy in Asia motivate and retain employees. Innovations that Unlock the Resources of Business By way of 23 case studies drawn from Australia, China, Hong Kong, India, Japan, the Philippines for the Common Good and Singapore, we illustrate in this report the various ways these businesses engage with high-potential social organisations and ofer recommendations on ways the corporation can Entrepreneurial Social Finance in Asia: Working Paper No. 5 creatively deploy its resources for public good in Asia. Rob John Audrey Chia Ken Ito ISBN 978-981-11-2708-3 May 2017 acsep: knowledge for good acsep: knowledge for good ACSEP The Asia Centre for Social Entrepreneurship and Philanthropy (ACSEP) is an academic research centre at the National University of Singapore (NUS) Business School, stafed by an international multi-disciplinary research team. -

The Definitive Review of the US Venture Capital Ecosystem Credits & Contact

Q4 2019 In partnership with Angel & seed deal value remains Value of VC deals with 2019 marks record year for elevated in 2019 at $9.1B nontraditional investor VC exit value despite tepid exit Page 7 participation approaches $100B for activity in Q4 second consecutive year Page 32 Page 27 The definitive review of the US venture capital ecosystem Credits & contact PitchBook Data, Inc. JOHN GABBERT Founder, CEO ADLEY BOWDEN Vice President, Research & Analysis Content NIZAR TARHUNI Director, Research JAMES GELFER Senior Strategist & Lead Analyst, VC ALEX FREDERICK Senior Analyst, VC CAMERON STANFILL, CFA Analyst II, VC KYLE STANFORD Analyst, VC VAN LE Senior Data Analyst RESEARCH Contents [email protected] Report & cover design by CONOR HAMILL Executive summary 3 National Venture Capital Association (NVCA) BOBBY FRANKLIN President & CEO NVCA policy highlights 4 MARYAM HAQUE Senior Vice President of Industry Advancement Overview 5-6 CASSIE HODGES Director of Communications DEVIN MILLER Manager of Communications & Digital Angel, seed & first financings 7-8 Strategy Early-stage VC 9-10 Contact NVCA nvca.org Late-stage VC 11-12 [email protected] SVB: Resilience is the theme for 2020 14-15 Silicon Valley Bank Deals by region 17 GREG BECKER Chief Executive Officer MICHAEL DESCHENEAUX President Deals by sector 18-21 BEN STASIUK Vice President SVB: Global trade tensions create stress—and opportunity 22-23 Contact Silicon Valley Bank svb.com Female founders 24-25 [email protected] Nontraditional investors 27-28 Carta: How dual-class and single-class companies Carta 29-30 MISCHA VAUGHN Head of Editorial compare JEFF PERRY Vice President of Revenue D’ARCY DOYLE Senior Vice President of Investor Exits 32-33 Services Sales VINCENT TIMONEY Director of Channel Strategy Fundraising 34-35 Contact Carta Methodology 37 carta.com 2 Q4 2019 PITCHBOOK-NVCA VENTURE MONITOR Executive summary The big question mark at the start of 2019 was how VC deal value would fare after a historic showing in the year prior. -

Principles for Statutory Regulation and Self-Regulation of Fundraising

PRINCIPLES FOR STATUTORY REGULATION AND SELF-REGULATION OF FUNDRAISING Authors: Eszter Hartay, European Center for Not-for-Profit Law Stichting Francesca Fanucci, European Center for Not-for-Profit Law Stichting Kristen McGeeney, International Center for Not-for-Profit Law Core group of experts: Eva E. Aldrich, CFRE International Oonagh B. Breen, Sutherland School of Law, University College Dublin Pia Tornikoski, Finnish Fundraising Association Usha Menon, Usha Menon Management Consultancy (Asia) Editor: Alexander Carter Published in April 2020 This document was developed as part of the Sustainable Frameworks for Public Fundraising, managed by the European Center for Not-for-Profit Law Stichting (ECNL). The project is made possible by the International Center for Not-for-Profit Law (ICNL) through the Civic Space Initiative, financed by the Government of Sweden. The Government of Sweden does not necessarily share the opinions here within expressed. The author bears the sole responsibility for the content. This publication was produced partially with the financial support of the European Union. Its contents are the sole responsibility of ECNL and ICNL and do not necessarily reflect the views of the European Union. Co-funded by the European Union Copyright © 2020 by the European Center for Not-for-Profit Law Stichting and the International Center for Not-for-Profit Law. All rights reserved. Table of Contents ACRONYMS _______________________________________________ 4 I. INTRODUCTION __________________________________________ 5 II. RELATIONSHIP BETWEEN STATUTORY REGULATION AND SELF- REGULATION ______________________________________________ 11 III. PRINCIPLES FOR STATUTORY REGULATION AND SELF-REGULATION OF FUNDRAISING _____________________________________________ 14 III.1. FUNDAMENTAL GUARANTEES ______________________________________ 14 III.2. FUNDRAISING METHODS __________________________________________ 18 III.3. -

Oxfam Accountability Report 2015/16

2015 - 2016 HOME / CONTACT CONTACT We value your feedback on the information contained in this annual Accountability Report. Please contact Ali Henderson ([email protected]) with any comments or suggestions you may have. Oxfam is an international confederation of 17 organizations or ‘affiliates’ networked together in 90 countries. The Oxfam International Secretariat provides co-ordination and support to the confederation. This report has been prepared on behalf of the Oxfam confederation by the Oxfam International Secretariat, the registered office of which is Oxfam House, John Smith Drive. Contact details for individual affiliates can be found at www.oxfam.org OXFAM ACCOUNTABILITY REPORT 2015 - 2016 2 HOME / CONTENTS CONTENTS MESSAGE FROM THE CHIEF EXECUTIVE (INGO CHARTER PROFILE DISCLOSURE REF: 1.1) 6 1 SCOPE OF THIS REPORT (INGO CHARTER PROFILE DISCLOSURE REF: 2.4, 2.6, 2.9, 3.1-3.12) 8 2 ABOUT OXFAM 10 WHO WE ARE & WHAT WE DO (INGO CHARTER PROFILE DISCLOSURE REF: 2.1-2.3) 10 HOW WE WORK - ONE OXFAM (INGO CHARTER PROFILE DISCLOSURE REF: 2.5) 11 WHERE WE WORK (INGO CHARTER PROFILE DISCLOSURE REF: 2.7) 12 OXFAM STRATEGIC PLAN AND GOALS (INGO CHARTER PROFILE DISCLOSURE REF: 2.2) 14 INCOME & EXPENDITURE (INGO CHARTER PROFILE DISCLOSURE REF: 2.8, NGO8) 15 STAFF & VOLUNTEERS (INGO CHARTER PROFILE DISCLOSURE REF: 2.8) 17 3 GOVERNANCE 18 STRUCTURES (INGO CHARTER PROFILE DISCLOSURE REF: 4.1, 4.2, 4.3, 4.4, 4.5) 18 ENSURING EFFECTIVE DECISION-MAKING (INGO CHARTER PROFILE DISCLOSURE REF: 4.1, 4.2, 4.4, 4.6, 4.10) 19 MEMBERSHIP OF EXTERNAL -

Santa Barbara County Employees' Retirement System

Santa Barbara County Employees’ Retirement System 2021 Private Equity Strategic Plan Agenda • Program Review 3 • Portfolio Snapshot and Performance Summary 9 • Strategic Plan 13 • Appendix 20 Program Review PE Portfolio Highlights - September 30, 2020 Hamilton Lane (“HL”) is entering our 15th year of building the Santa Barbara County Employees’ Retirement System (“SBCERS”) PE Program Performance • Since inception IRR of 12.67% outperforms the benchmark (Russell 3000 + 300 bps) by 28 bps • Double-digit performance for the one-year period, with a point-to-point IRR of 14.96% Strategic Objectives • Fulfilled all objectives outlined in the 2020 Strategic Plan • PE target of 10% established in 2016; Portfolio at 11.45% as of September 30, 2020 • Established a strong foundation of top tier managers Additional Highlights • Accessed highly sought, oversubscribed funds • Received preferred legal terms for one fund in 2020 as a result of the HL platform • Presented Private Equity 101 to new Board Members Hamilton Lane | Global Leader in the Private Markets Proprietary and Confidential | 4 SBCERS’ Private Equity Investment Milestones Hamilton Lane was hired by SBCERS in 2006 to select new investments, monitor, and provide advice for the private equity portfolio 2005 - Lexington Capital Partners VI • First private equity investment (made by SBCERS) 2006 - HL hired to build long-term PE allocation to 5% • Original contract allowed HL to invest $80M on behalf of SBCERS 2008 - Amendment to contract giving HL full discretion • Recommended annual commitment -

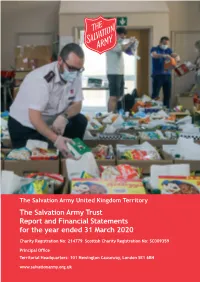

The Salvation Army Trust Report and Financial Statements for the Year Ended 31 March 2020

The Salvation Army United Kingdom Territory The Salvation Army Trust Report and Financial Statements for the year ended 31 March 2020 Charity Registration No: 214779 Scottish Charity Registration No: SC009359 Principal Office Territorial Headquarters: 101 Newington Causeway, London SE1 6BN www.salvationarmy.org.uk CONTENTS Trustees’ Report .......................................................................................... 3 What We Do ............................................................................................ 4 Introduction from the Territorial Commander ..................................................... 5 Explaining our Strategy, Structure and Operation ................................................. 6 2019/2020: A year in Review – Highlights, Achievements and Impact .......................... 9 Energising Church life ................................................................................. 9 Homelessness – our church-based response ........................................................ 10 Engaging Community action .......................................................................... 14 Fighting Poverty ....................................................................................... 15 Combatting Modern Slavery ......................................................................... 18 Overcoming Disability ................................................................................ 19 Celebrating Children and Young People ........................................................... -

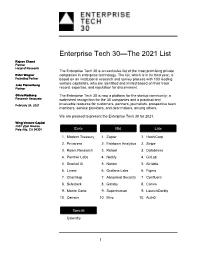

Enterprise Tech 30—The 2021 List

Enterprise Tech 30—The 2021 List Rajeev Chand Partner Head of Research The Enterprise Tech 30 is an exclusive list of the most promising private Peter Wagner companies in enterprise technology. The list, which is in its third year, is Founding Partner based on an institutional research and survey process with 103 leading venture capitalists, who are identified and invited based on their track Jake Flomenberg Partner record, expertise, and reputation for discernment. Olivia Rodberg The Enterprise Tech 30 is now a platform for the startup community: a Research Associate watershed recognition for the 30 companies and a practical and February 24, 2021 invaluable resource for customers, partners, journalists, prospective team members, service providers, and deal makers, among others. We are pleased to present the Enterprise Tech 30 for 2021. Wing Venture Capital 480 Lytton Avenue Palo Alto, CA 94301 Early Mid Late 1. Modern Treasury 1. Zapier 1. HashiCorp 2. Privacera 2. Fishtown Analytics 2. Stripe 3. Roam Research 3. Retool 3. Databricks 4. Panther Labs 4. Netlify 4. GitLab 5. Snorkel AI 5. Notion 5. Airtable 6. Linear 6. Grafana Labs 6. Figma 7. ChartHop 7. Abnormal Security 7. Confluent 8. Substack 8. Gatsby 8. Canva 9. Monte Carlo 9. Superhuman 9. LaunchDarkly 10. Census 10. Miro 10. Auth0 Special Calendly 1 2021 The Curious Case of Calendly This year’s Enterprise Tech 30 has 31 companies rather than 30 due to the “curious case” of Calendly. Calendly, a meeting scheduling company, was categorized as Early-Stage when the ET30 voting process started on January 11 as the company had raised $550,000.