Electronic Arts Reports Q1 Fy11 Financial Results

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Electronic Arts Reports Q2 Fy11 Financial Results

ELECTRONIC ARTS REPORTS Q2 FY11 FINANCIAL RESULTS Reports Q2 Non-GAAP Revenue and EPS Ahead of Expectations Reaffirms Full-Year Non-GAAP EPS and Net Revenue Guidance FIFA 11 Scores With 8.0 Million Units Sold In Need For Speed Hot Pursuit with Autolog, Ships November 16 REDWOOD CITY, CA – November 2, 2010 – Electronic Arts Inc. (NASDAQ: ERTS) today announced preliminary financial results for its second fiscal quarter ended September 30, 2010. “We had another strong quarter, beating expectations both top and bottom line,” said John Riccitiello, Chief Executive Officer. “We credit our results to blockbusters like FIFA 11 and to innovative digital offerings like The Sims 3 Ambitions and Madden NFL 11 on the iPad.” “EA reaffirms its FY11 non-GAAP guidance,” said Eric Brown, Chief Financial Officer. “EA is the world’s #1 publisher calendar year-to-date and our portfolio is focused on high- growth platforms -- high definition consoles, PC, and mobile.” Selected Quarterly Operating Highlights and Metrics: EA is the #1 publisher on high-definition consoles with 25% segment share calendar year-to date, two points higher than the same period a year ago. In North America and Europe, the high-definition console software market is growing strongly with the combined PlayStation®3 and Xbox 360® segments up 23% calendar year-to-date. The PlayStation 3 software market is up 36% calendar year-to-date. EA is the #1 PC publisher with 27% segment share at retail calendar year-to-date and strong growth in digital downloads of full-game software. For the quarter, EA had six of the top 20 selling games in Western markets with FIFA 11, Madden NFL 11, NCAA® Football 11, NHL®11, Battlefield: Bad Company™ 2 and FIFA 10. -

Nintendo Co., Ltd

Nintendo Co., Ltd. Financial Results Briefing for the Nine-Month Period Ended December 2008 (Briefing Date: 2009/1/30) Supplementary Information [Note] Forecasts announced by Nintendo Co., Ltd. herein are prepared based on management's assumptions with information available at this time and therefore involve known and unknown risks and uncertainties. Please note such risks and uncertainties may cause the actual results to be materially different from the forecasts (earnings forecast, dividend forecast and other forecasts). Nintendo Co., Ltd. Consolidated Statements of Income Transition million yen FY3/2005 FY3/2006 FY3/2007 FY3/2008 FY3/2009 Apr.-Dec.'04 Apr.-Dec.'05 Apr.-Dec.'06 Apr.-Dec.'07 Apr.-Dec.'08 Net sales 419,373 412,339 712,589 1,316,434 1,536,348 Cost of sales 232,495 237,322 411,862 761,944 851,283 Gross margin 186,877 175,017 300,727 554,489 685,065 (Gross margin ratio) (44.6%) (42.4%) (42.2%) (42.1%) (44.6%) Selling, general, and administrative expenses 83,771 92,233 133,093 160,453 183,734 Operating income 103,106 82,783 167,633 394,036 501,330 (Operating income ratio) (24.6%) (20.1%) (23.5%) (29.9%) (32.6%) Other income 15,229 64,268 53,793 37,789 28,295 (of which foreign exchange gains) (4,778) (45,226) (26,069) (143) ( - ) Other expenses 2,976 357 714 995 177,137 (of which foreign exchange losses) ( - ) ( - ) ( - ) ( - ) (174,233) Income before income taxes and extraordinary items 115,359 146,694 220,713 430,830 352,488 (Income before income taxes and extraordinary items ratio) (27.5%) (35.6%) (31.0%) (32.7%) (22.9%) Extraordinary gains 1,433 6,888 1,047 3,830 98 Extraordinary losses 1,865 255 27 2,135 6,171 Income before income taxes and minority interests 114,927 153,327 221,734 432,525 346,415 Income taxes 47,260 61,176 89,847 173,679 133,856 Minority interests -91 -34 -29 -83 35 Net income 67,757 92,185 131,916 258,929 212,524 (Net income ratio) (16.2%) (22.4%) (18.5%) (19.7%) (13.8%) - 1 - Nintendo Co., Ltd. -

Bonus Card Infernus 6 2 16Cdcapc002 30 Day

Lot of games for PC and Console Law Court of Bolzano Bankruptcy N. 57/2014 Total Value: 35.698 EUR Prog. Article Description Quantity 1 16CDACDS117 DS GTA CHINATOWN WARS - BONUS CARD INFERNUS 6 2 16CDCAPC002 30 DAY GAME TIME CARD 6 3 16CDCAPC003 60 DAY GAME TIME CARD 2 4 16CDDS169 DS PROFESSOR LAYTON COUNTRY D.MIST *** 3 5 16CDP3083 PS3 NBA 2K9 1 6 16CDP3101 PS3 BLITZ THE LEAGUE II 2 7 16CDPC497 MySims PC 6 8 16CDPP101 PSP FIFA 09 1 9 16CDSW3D004 3DS Nintendogs + Cats And POODLES 3 10 16CDSW3D005 3DS Pilotwings Resort 1 11 16CDSW3D006 3DS SUPER STREET FIGHTER 4 3D EDIT 2 12 16CDSW3D010 3DS RESIDENT EVIL: THE MERCENARIES 8 13 16CDSW3D023 3DS TETRIS 1 14 16CDSW3D024 3DS SUPER POKEMON RUMBLE 2 15 16CDSWDS185 DS DON KING BOXING 3 16 16CDSWDS192 DS RHYTHM PARADISE 1 17 16CDSWDS198 DS MySims Agents 2 18 16CDSWDS273 DS Pokemon SoulSilver + ACCESSORY POKEWAL 8 19 16CDSWDS282 FIFA 10 SPECIAL PRICE 1 20 16CDSWDS302 DS FACE TRAINING DSI 2 21 16CDSWDS311 DS Professor Layton and the Unwound Future 7 22 16CDSWDS320 DS POKEMON BLACK VERSION 6 23 16CDSWDS321 DS POKEMON WHITE VERSION 5 24 16CDSWDS331 DS DRAGON QUEST MONSTERS - JOKER 3 25 16CDSWP2224 BOOGIE 1 26 16CDSWP2340 ROCK BAND 5 27 16CDSWP3040 PS3 TOP SPIN 3 1 28 16CDSWP3118 PS3 F.E.A.R. 2 PROJECT ORIGIN 1 29 16CDSWP3127 PS3 WANTED WEAPONS OF FATE 1 30 16CDSWP3136 PS3 FIGHT NIGHT ROUND 4 1 31 16CDSWP3138 PS3 RED FACTION: GUERRILLA 2 32 16CDSWP3151 PS3 THE BEATLES ROCK BAND 6 33 16CDSWP3152 PS3 WATCHMEN 1 34 16CDSWP3162 PS3 LEGO ROCK BAND 4 35 16CDSWP3163 PS3 Where the Wild Things Are 2 36 16CDSWP3187 BIOSHOCK 2 4 37 16CDSWP3188 BIOSHOCK 2 SPECIAL EDITION 1 38 16CDSWP3194 PS3 SCENE IT? TAKE! TURNS! 2 39 16CDSWP3195 FIFA WORLD CUP SOUTH AFRICA 2010 4 40 16CDSWP3206 GREEN DAY ROCK BAND 4 41 16CDSWP3209 PS3 LEGO HARRY POTTER YEARS 1-4 1 42 16CDSWP3216 PS3 Mafia II 2 43 16CDSWP3223 PS3 L.A. -

TITLES = (Language: EN Version: 20101018083045

TITLES = http://wiitdb.com (language: EN version: 20101018083045) 010E01 = Wii Backup Disc DCHJAF = We Cheer: Ohasta Produce ! Gentei Collabo Game Disc DHHJ8J = Hirano Aya Premium Movie Disc from Suzumiya Haruhi no Gekidou DHKE18 = Help Wanted: 50 Wacky Jobs (DEMO) DMHE08 = Monster Hunter Tri Demo DMHJ08 = Monster Hunter Tri (Demo) DQAJK2 = Aquarius Baseball DSFE7U = Muramasa: The Demon Blade (Demo) DZDE01 = The Legend of Zelda: Twilight Princess (E3 2006 Demo) R23E52 = Barbie and the Three Musketeers R23P52 = Barbie and the Three Musketeers R24J01 = ChibiRobo! R25EWR = LEGO Harry Potter: Years 14 R25PWR = LEGO Harry Potter: Years 14 R26E5G = Data East Arcade Classics R27E54 = Dora Saves the Crystal Kingdom R27X54 = Dora Saves The Crystal Kingdom R29E52 = NPPL Championship Paintball 2009 R29P52 = Millennium Series Championship Paintball 2009 R2AE7D = Ice Age 2: The Meltdown R2AP7D = Ice Age 2: The Meltdown R2AX7D = Ice Age 2: The Meltdown R2DEEB = Dokapon Kingdom R2DJEP = Dokapon Kingdom For Wii R2DPAP = Dokapon Kingdom R2DPJW = Dokapon Kingdom R2EJ99 = Fish Eyes Wii R2FE5G = Freddi Fish: Kelp Seed Mystery R2FP70 = Freddi Fish: Kelp Seed Mystery R2GEXJ = Fragile Dreams: Farewell Ruins of the Moon R2GJAF = Fragile: Sayonara Tsuki no Haikyo R2GP99 = Fragile Dreams: Farewell Ruins of the Moon R2HE41 = Petz Horse Club R2IE69 = Madden NFL 10 R2IP69 = Madden NFL 10 R2JJAF = Taiko no Tatsujin Wii R2KE54 = Don King Boxing R2KP54 = Don King Boxing R2LJMS = Hula Wii: Hura de Hajimeru Bi to Kenkou!! R2ME20 = M&M's Adventure R2NE69 = NASCAR Kart Racing -

Ea Reports Fourth Quarter and Fiscal Year 2008 Results

EA REPORTS FOURTH QUARTER AND FISCAL YEAR 2008 RESULTS Record GAAP Net Revenue of $3.665 Billion and Non-GAAP Net Revenue of $4.020 Billion in Fiscal 2008 More Than Fifteen New Games Scheduled for Release in Fiscal 2009 REDWOOD CITY, CA – May 13, 2008 – Electronic Arts (NASDAQ: ERTS) today announced preliminary financial results for its fiscal fourth quarter and fiscal year ended March 31, 2008. Full Year Results Net revenue for the fiscal year ended March 31, 2008 was $3.665 billion, up 19 percent as compared with $3.091 billion for the prior year. Beginning in fiscal 2008, EA no longer charges for its service related to certain online-enabled packaged goods games. As a result, the Company recognizes revenue from the sale of these games over the estimated service period. The Company ended the year with $387 million in deferred net revenue related to its service for certain online-enabled packaged goods games, which will be recognized in future periods. Non-GAAP net revenue* was $4.020 billion, up 30 percent as compared with $3.091 billion for the prior year. EA had 27 titles that sold more than one million copies in the year as compared with 24 titles in the prior year. Net loss for the year was $454 million as compared with net income of $76 million for the prior year. Diluted loss per share was $1.45 as compared with diluted earnings per share of $0.24 for the prior year. Non-GAAP net income* was $339 million as compared with $247 million a year ago, up 37 percent year-over-year. -

John Riccitiello Chief Executive Officer

John Riccitiello Chief Executive Officer 1 Safe Harbor Statement Some statements contained in this presentation contain forward-looking statements that involve risks and uncertainties. Statements including words such as "anticipate", "believe" or "expect" and statements in the future tense are forward-looking statements. These forward- looking statements are subject to business and economic risks and actual events or actual future results could differ materially from those set forth in the forward-looking statements due to such risks and uncertainties. Some of the factors which could cause our results to differ materially from our expectations include the following: competition in the interactive entertainment industry; the timely release and availability of an adequate supply of hardware units; our ability to predict consumer preferences among competing hardware platforms; consumer spending trends; the seasonal and cyclical nature of the interactive game segment; timely development and release of our products; our ability to manage expenses during fiscal year 2008; our ability to secure licenses to valuable entertainment properties on favorable terms; our ability to attract and retain key personnel; changes in our effective tax rates; adoption of new accounting regulations and standards; potential regulation of our products in key territories; developments in the law regarding protection of our products; fluctuations in foreign exchange rates; and other factors described in our annual report on Form 10-K for the year ended March 31, 2007 -

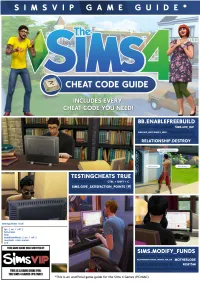

Simsvip Game Guide*

SIMSVIP GAME GUIDE* testlngcheats truel fps { on I off } full screen help headlineeffects { on I off } resetsim <sim name> *This is an unofficial game guide for the Sims 4 Games (PC/MAC) ~ CHEAT CODE GUIDE SIMSVIP CHEAT CODE GUIDE SIMSVIP HAS MADE EVERY EFFORT TO ENSURE THE INFORMATION IN THIS GUIDE IS ACCURATE AND MAKES NO WARRANTY AS TO THE ACCURACY OR COMPLETENESS OF THE MATERIAL WITHIN THE GUIDE. COPYRIGHT© 2015 CONTRIBUTORS ALEXIS EDITOR-IN-CHIEF Hey everyone! My name is Alexis and I am the Editor-in-Chief for SimsVIP.com! I am a long-time simmer and community member, and am one of the writers for The Sims Cheat Code Guide. If you're reading my author bio, that means you're checking out the PDF version of our guide! I hope this guide helps you with mixing up your game with cheats, and thank you for your continued support! KERR I DESIGNER Hello! My name is Kerri and I am a designer here for the SimsVIP. My job is to essentially make things look good. I do info graphics for the site and now these game guides! So I really hope you enjoy it. I have been a fan of the sims since the first game my favorite thing to do in the Sims 4 is build stuff and customize sims. Thank you for the support on this game guide and I hope to provide you with high quality PDF's like this one in the future :) TWISTEDMEXICAN CODE GURU I'm TwistedMexican, or TwistedMexi depending on who you ask. -

RENAUD TERNYNCK Mobile Game Exploration & Prototyping Simcity – Cities of Tomorrow Simcity PROFILE EXPERIENCE

RENAUD TERNYNCK Piedmont, CA 415.297.2185 [email protected] PROFILE 15 years of game and interactive design experience with focus on UI/UX. Strong skills in creating, producing and managing team projects as well as creative problem solving, meeting tight deadlines and taking projects from concept to completion. Strong design process, from interfacing with the design and engineering teams to flow diagramming, concept iterations, prototyping, icon design and in-game implementation. Expertise in key production software for interactive design, image manipulation, 2D and 3D motion graphics, 3D modeling, flow diagrams and wireframing. EXPERIENCE EA/Maxis Over 11 years of user experience work for several AAA PC titles. Includes: User flow diagramming, Interactive prototyping, UI Tech research and evaluation. UI tool design, Artist management, Presentation. Mobile Game Exploration & Prototyping [2014 to Present] Director/Senior UI Designer Worked on several UX/UI game prototypes for unreleased mobile title. SimCity – Cities of Tomorrow [2009 to 2013] Lead Senior UI Designer In charge of the SimCity expansion pack user interface. Game Intro Animation. SimCity [2009 to 2013] Co-Lead Senior UI Designer Prototyping, Icon design, Interfacing with Engineering team for in-game implementation. Game Intro Animation. !1 of !3 ”MUiLE” Internal UI Tool [2009 to 2014] Feature and UI Designer Main customer and UX/UI designer for the SimCity home brewed UI tool, developed in EA Webkit. Darkspore [2010 to 2011] Senior UI Designer Co-led the design and implementation of the Darkspore user interface in Scaleform. Spore Galactic Adventures [2008 to 2009] Lead UI Designer Led the design and implementation of the Spore user interface. -

Our Fourth Quarter Fiscal 2008 Earnings Call. Today on The

Tricia: Welcome to our fourth quarter fiscal 2008 earnings call. Today on the call we have John Riccitiello – Chief Executive Officer; Eric Brown – Chief Financial Officer, John Pleasants – Chief Operating Officer; and Frank Gibeau – President of EA Games. Before we begin, I’d like to remind you that you may find copies of our SEC filings, our earnings release and a replay of the webcast on our web site at investor.ea.com. Shortly after the call we will post a copy of our prepared remarks on our website. Throughout this call we will present both GAAP and non-GAAP financial measures. Non-GAAP measures exclude charges and related income tax effects associated with: • acquired in-process technology, • amortization of intangibles, • certain litigation expenses, • losses on strategic investments, • restructuring charges, • stock-based compensation and • the impact of the change in deferred net revenue related to packaged goods and digital content. In addition, the Company’s non-GAAP results exclude the impact of certain one- time income tax adjustments. Our earnings release provides a reconciliation of our GAAP to non-GAAP measures. In addition, we include a detailed GAAP to non-GAAP reconciliation on our website. These non-GAAP measures are not intended to be considered in isolation from – a substitute for – or superior to – our GAAP results – and we encourage investors to consider all measures before making an investment decision. All comparisons made in the course of this call are against the same period for the prior year – unless otherwise stated. All references to “current generation systems” include the Xbox 360, the PS3 and the Wii. -

Simcity 4 Manual

GAME TABLE OF CONTENTS INTRODUCTION 2 WHAT'S NEW 4 CITYS MARTS 4 LOOK CLOSELY: LOOK LOCALLY 5 REGIONS: PLAYING THE BIG PICTURE 6 GOD MODE: ZEUS HAS NOTHING ON YOU .6 MYSIMS: A SIM'S EYE VIEW OF LIFE IN YOUR CITY 7 GETTING STARTED 8 REGION VIEW 8 IN-GAME TUTORIALS 10 PLAY A DEVELOPED CITY ..11 ESTABLISHING A NEW CITY 12 RESOURCES FOR MAYORS: WHERE TO GET HELP ..13 EXPANDED TOOLTIPS 13 OTHER RESOURCES 13 SHAPING WORLDS: GOD MODE 14 LANDSCAPING ON A REALLY BIG SCALE 14 GOD MODE IN CITY PLAY 14 SUCCESSFUL MAYORING: MAYOR MODE 17 DEMAND. DESIRABILITY AND DEMOGRAPHICS 18 INVESTING IN INFRASTRUCTURE 18 JUST THE FACTS, MAYOR: WHERE TO FIND CITY DATA 29 THE BUCK STOPS HERE: BUDGETING YOUR SIMOLEONS 33 REALIZING YOUR VISION: EXPANDING CITIES 36 ITS ALL PERSONAL: MYSIM MODE . .38 SIMCITYSCAPE.COM: INTERNET PLAY 40 CREDITS 41 INTRODUCTION Welcome 1o a world you create-S/m% '4? Whether you are an experienced Mayor, or are just entering the world of city planning and politics, S/m% 4 offers unparalleled opportunities to creole the metropolis of your dreams. Or, if yon prefer, you can destroy thal visionary city with a fiery meteor shower. The possibilities are endless. Are you a Mayor who yearns to be loved by your citizenry, or one whose name instills fear in Sims's hearts? Does your vision include building an industrial empire, a sleepy agrarian community, or o cutting edge eco-friendly metropolis? With SintCity 4, your power extends from the gad-like creation of mountainscapes to the adjustment of funding levels al a local elementary school. -

1 Tricia Gugler

Tricia Gugler: Welcome to our first quarter fiscal 2009 earnings call. Today on the call we have John Riccitiello, our Chief Executive Officer; Eric Brown, our Chief Financial Officer; John Pleasants, our Chief Operating Officer; and Peter Moore, our President of EA SPORTS. Before we begin, I’d like to remind you that you may find copies of our SEC filings, our earnings release and a replay of this webcast on our web site at investor.ea.com. Shortly after the call we will post a copy of our prepared remarks on our website. Throughout this call we will present both GAAP and non-GAAP financial measures. Non-GAAP measures exclude the following items: • amortization of intangibles, • stock-based compensation, • acquired in-process technology, • restructuring charges, • certain litigation expenses, • losses on strategic investments, • the impact of the change in deferred net revenue related to certain packaged goods and digital content. In addition, starting with its fiscal 2009 results, the Company began to apply a fixed, long-term projected tax rate of 28% to determine its non-GAAP results. Prior to fiscal 2009, the Company’s non-GAAP financial results were determined by excluding the specific income tax effects associated with the non-GAAP items and the impact of certain one-time income tax adjustments. Our earnings release provides a reconciliation of our GAAP to non-GAAP measures. These non-GAAP measures are not intended to be considered in isolation from – a substitute for – or superior to – our GAAP results – and we encourage investors to consider all measures before making an investment decision. -

Frequently Asked Questions

Frequently Asked Questions +Collect Windows log files Windows log files can be used to troubleshoot and diagnose issues you may encounter while playing games and watching videos. You may be asked by technical support to provide various log files so they can further help you to solve the problem. Here's how to obtain some of the most commonly used files: DirectX Diagnostic files System Information files Windows System and Application Event log files Installation log files DirectX Diagnostic files DirectX is a programming interface that handles Windows tasks related to multimedia, especially game programming and video. The DirectX Diagnostic file contains information about this interface and its current status. Here’s how to generate a DirectX Diagnostic file: 1. Hold down the Windows key and press R. 2. In the Run dialog box, type DXDIAG and then click OK. This opens the DirectX diagnostic tool. 3. On the bottom of the DirectX Diagnostic Tool window, click Save All Information. 4. When prompted, save the file to your Desktop with the file name DXDIAG. 5. Click Save. 6. Attach the file when you reply to Support. System Information files The Microsoft System Information tool collects system information, such as devices installed on your computer and any associated device drivers. To generate a System Information file: 1. Hold down the Windows key and press R. 2. In the Run dialog box, type MSINFO32 and then click OK. This opens the System Information diagnostic panel. 3. In the menu bar on the left, click File, and then click Save. This will prompt you to choose a location to save the file.