Ea Reports Fourth Quarter and Fiscal Year 2008 Results

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

UPC Platform Publisher Title Price Available 730865001347

UPC Platform Publisher Title Price Available 730865001347 PlayStation 3 Atlus 3D Dot Game Heroes PS3 $16.00 52 722674110402 PlayStation 3 Namco Bandai Ace Combat: Assault Horizon PS3 $21.00 2 Other 853490002678 PlayStation 3 Air Conflicts: Secret Wars PS3 $14.00 37 Publishers 014633098587 PlayStation 3 Electronic Arts Alice: Madness Returns PS3 $16.50 60 Aliens Colonial Marines 010086690682 PlayStation 3 Sega $47.50 100+ (Portuguese) PS3 Aliens Colonial Marines (Spanish) 010086690675 PlayStation 3 Sega $47.50 100+ PS3 Aliens Colonial Marines Collector's 010086690637 PlayStation 3 Sega $76.00 9 Edition PS3 010086690170 PlayStation 3 Sega Aliens Colonial Marines PS3 $50.00 92 010086690194 PlayStation 3 Sega Alpha Protocol PS3 $14.00 14 047875843479 PlayStation 3 Activision Amazing Spider-Man PS3 $39.00 100+ 010086690545 PlayStation 3 Sega Anarchy Reigns PS3 $24.00 100+ 722674110525 PlayStation 3 Namco Bandai Armored Core V PS3 $23.00 100+ 014633157147 PlayStation 3 Electronic Arts Army of Two: The 40th Day PS3 $16.00 61 008888345343 PlayStation 3 Ubisoft Assassin's Creed II PS3 $15.00 100+ Assassin's Creed III Limited Edition 008888397717 PlayStation 3 Ubisoft $116.00 4 PS3 008888347231 PlayStation 3 Ubisoft Assassin's Creed III PS3 $47.50 100+ 008888343394 PlayStation 3 Ubisoft Assassin's Creed PS3 $14.00 100+ 008888346258 PlayStation 3 Ubisoft Assassin's Creed: Brotherhood PS3 $16.00 100+ 008888356844 PlayStation 3 Ubisoft Assassin's Creed: Revelations PS3 $22.50 100+ 013388340446 PlayStation 3 Capcom Asura's Wrath PS3 $16.00 55 008888345435 -

Printmgr File

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K Í ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended March 31, 2019 OR ‘ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File No. 000-17948 ELECTRONIC ARTS INC. (Exact name of registrant as specified in its charter) Delaware 94-2838567 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 209 Redwood Shores Parkway 94065 Redwood City, California (Zip Code) (Address of principal executive offices) Registrant’s telephone number, including area code: (650) 628-1500 Securities registered pursuant to Section 12(b) of the Act: Name of Each Exchange on Title of Each Class Trading Symbol Which Registered Annual Report Common Stock, $0.01 par value EA NASDAQ Global Select Market Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes Í No ‘ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ‘ No Í Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

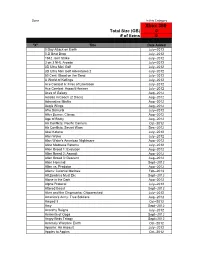

Xbox 360 Total Size (GB) 0 # of Items 0

Done In this Category Xbox 360 Total Size (GB) 0 # of items 0 "X" Title Date Added 0 Day Attack on Earth July--2012 0-D Beat Drop July--2012 1942 Joint Strike July--2012 3 on 3 NHL Arcade July--2012 3D Ultra Mini Golf July--2012 3D Ultra Mini Golf Adventures 2 July--2012 50 Cent: Blood on the Sand July--2012 A World of Keflings July--2012 Ace Combat 6: Fires of Liberation July--2012 Ace Combat: Assault Horizon July--2012 Aces of Galaxy Aug--2012 Adidas miCoach (2 Discs) Aug--2012 Adrenaline Misfits Aug--2012 Aegis Wings Aug--2012 Afro Samurai July--2012 After Burner: Climax Aug--2012 Age of Booty Aug--2012 Air Conflicts: Pacific Carriers Oct--2012 Air Conflicts: Secret Wars Dec--2012 Akai Katana July--2012 Alan Wake July--2012 Alan Wake's American Nightmare Aug--2012 Alice Madness Returns July--2012 Alien Breed 1: Evolution Aug--2012 Alien Breed 2: Assault Aug--2012 Alien Breed 3: Descent Aug--2012 Alien Hominid Sept--2012 Alien vs. Predator Aug--2012 Aliens: Colonial Marines Feb--2013 All Zombies Must Die Sept--2012 Alone in the Dark Aug--2012 Alpha Protocol July--2012 Altered Beast Sept--2012 Alvin and the Chipmunks: Chipwrecked July--2012 America's Army: True Soldiers Aug--2012 Amped 3 Oct--2012 Amy Sept--2012 Anarchy Reigns July--2012 Ancients of Ooga Sept--2012 Angry Birds Trilogy Sept--2012 Anomaly Warzone Earth Oct--2012 Apache: Air Assault July--2012 Apples to Apples Oct--2012 Aqua Oct--2012 Arcana Heart 3 July--2012 Arcania Gothica July--2012 Are You Smarter that a 5th Grader July--2012 Arkadian Warriors Oct--2012 Arkanoid Live -

Vaihtoehtoja Valtavirtaan!!!

maaliskuu 2008 menot sivulta 25 vahava ja sitkas • klamydia • con gusto • iiskon ajokoulu • sannan viinit • duudsonit • kekelooks erilaista talavivaihtoehtoja puuhaa valtavirtaan!!! lapin ihmisten lehti www.roihulehti.com 2 maaliskuu 2008 Oikeaa tietoa Huippunaiset vuonna 2008 askmen.com Ei ole mitään mitä en tekisi -sivuston tekemän listauksen mukaan. saadakseen takaisin nuoruuteni, Kiiskinen kuvitus: Toni Suluissa viime vuoden sijoitus. paitsi harjoittaa liikuntaa, nousta ylös aikaisin tai olla säädyllinen. 1. Katherine Heigl, näyttelijä (39) -Oscar Wilde 2. Alessandra Ambrosio, malli (6) 3. Kate Beckinsale, näyttelijä (16) 4. Eva Mendes, malli/näyttelijä (45) 5. Jessica Alba, näyttelijä (3) checklist 6. Scarlett Johansson, näyttelijä/laulaja (2) lämmittää puistattaa 7. Jessica Biel, näyttelijä (5) Pitkästä aikaa kunnon toimintamättö k-18 ikära- Joka tapauksessa täysin tarpeeton pätkä. Tuli, John Rambo jalla. Verellinen vaihtelu virkistää meni eikä sanonu mitään. Ja tiemmä tulee vielä 8. Rihanna, laulaja (20) viidennen kerranki, tämä ei enää niin nuori herra. 9. Marisa Miller, malli (12) Omaperäinen hieno kokemus. Katastrofi -elokuvien Juoni on kuitenkin aika huttua. Lopun kokosuh- uusi aikakausi voisi olla tässä suunnassa. Käännä teet menevät reisille. Ne pikkumänkit on turhia ja Cloverfield 10. Adriana Lima, malli (4) nyt sitä kameraa -tunne on ainutlaatuinen. Koke- liian epäloogisia. Elokuvana kaksi ja puoli tähteä. muksena täydet viisi tähteä. Viime vuoden ykkönen, liikaa parrasvaloissa pyörinyt Tim Burton iskee musikaalien kantaan ja pistää Ei iskeny. Musikaaleja on mahdoton suomentaa ja Beyonce tipahti sijalle 14. Sweeney Todd Johnny Deppin laulamaan. Toiset tykkää toiset ei. muutenkin, jostakin syystä näitä tehdään nykyään hyvin harvoin; “Its evolution, baby!” Oscarit Coenin Menetetty maa on varmasti uskomaton Eipä tullu kumpikaan näille leveyksille. Käykää ja Daniel Day Lewis P.T Andersonin ohjastamana ihmiset leffassa nii saadaan taas huippu setit tän- luultavasti parhaimmillaan ikinä. -

102413435.Pdf

NO 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 143 144 145 146 147 148 149 150 151 152 153 154 155 157 158 159 160 161 162 163 164 165 166 167 168 169 170 171 172 173 174 175 176 177 178 179 180 181 182 183 184 185 186 187 188 189 190 191 192 193 194 195 196 197 198 199 200 201 202 203 204 205 206 207 208 209 210 211 212 213 214 215 216 217 218 219 220 221 222 223 224 225 226 227 228 229 230 231 232 233 234 235 236 237 238 239 240 241 242 243 244 245 246 247 248 249 250 251 252 253 254 255 256 257 258 259 260 261 262 263 264 265 266 267 268 269 270 271 272 273 274 275 276 277 278 279 280 281 282 283 284 285 286 287 288 289 290 291 292 293 294 295 296 297 298 299 300 301 302 303 304 305 306 307 308 309 310 311 312 313 314 315 316 317 318 319 320 321 322 323 324 325 326 327 328 329 330 331 332 333 334 335 336 337 338 339 340 341 342 343 344 345 346 347 348 349 350 351 352 353 354 355 356 357 358 359 360 361 362 363 364 365 366 367 368 369 370 371 372 373 374 375 376 377 378 379 380 381 382 383 384 385 386 387 388 389 390 391 392 393 394 395 396 397 398 399 400 401 402 403 404 405 406 407 408 409 410 411 412 413 414 415 416 417 418 -

Reality Is Broken a Why Games Make Us Better and How They Can Change the World E JANE Mcgonigal

Reality Is Broken a Why Games Make Us Better and How They Can Change the World E JANE McGONIGAL THE PENGUIN PRESS New York 2011 ADVANCE PRAISE FOR Reality Is Broken “Forget everything you know, or think you know, about online gaming. Like a blast of fresh air, Reality Is Broken blows away the tired stereotypes and reminds us that the human instinct to play can be harnessed for the greater good. With a stirring blend of energy, wisdom, and idealism, Jane McGonigal shows us how to start saving the world one game at a time.” —Carl Honoré, author of In Praise of Slowness and Under Pressure “Reality Is Broken is the most eye-opening book I read this year. With awe-inspiring ex pertise, clarity of thought, and engrossing writing style, Jane McGonigal cleanly exploded every misconception I’ve ever had about games and gaming. If you thought that games are for kids, that games are squandered time, or that games are dangerously isolating, addictive, unproductive, and escapist, you are in for a giant surprise!” —Sonja Lyubomirsky, Ph.D., professor of psychology at the University of California, Riverside, and author of The How of Happiness: A Scientific Approach to Getting the Life You Want “Reality Is Broken will both stimulate your brain and stir your soul. Once you read this remarkable book, you’ll never look at games—or yourself—quite the same way.” —Daniel H. Pink, author of Drive and A Whole New Mind “The path to becoming happier, improving your business, and saving the world might be one and the same: understanding how the world’s best games work. -

EA Supercharges Its Partner Program with New Titles from Independent Mobile and Social Game Developers

EA Supercharges Its Partner Program with New Titles from Independent Mobile and Social Game Developers EA Partners Expands to Chillingo and Playfish to Help Independent Developers Publish on Fast-Growing Digital Platforms REDWOOD SHORES, Calif.--(BUSINESS WIRE)-- Electronic Arts Inc. (NASDAQ:ERTS) today announced that Chillingo and Playfish™ will offer publishing services to the fast-growing mobile and social gaming platforms to the independent development community. Following the successful and award-winning EA Partners program, EA will be expanding its partnership programs for Chillingo and Playfish furthering the delivery of fresh content to platforms such as the Apple App StoreSM, Google Android™ and Facebook®. Since its establishment in 2003, EA Partners has built a reputation for working with top-notch independent game developers, promoting both creativity and innovation amongst its global partners. Current partner titles include Epic Games and People Can Fly (Bulletstorm™), Crytek (Crysis®2), Valve (Portal 2), 38 Studios (Kingdoms of Amalur: Reckoning), Spicy Horse (Alice: Madness Returns™), Grasshopper Manufacture (Shadows of the Damned™), Paramount Digital Entertainment (Rango The Video Game), Trap Door (Warp), Funcom (Secret World) and Vanguard Games (Gatling Gears). EA partner studios also include Insomniac Games, Starbreeze Studios and Respawn Entertainment with forthcoming titles. "The EA Partners program has proven to be a phenomenally successful model. It is an all around win-win situation. The program allows EA to partner with some of the world's best console, PC and digital developers while providing those independent developers with a global distribution/publishing partner," said Bryan Neider, EA Games Label COO and General Manager of EA Partners. -

Die Entwicklung Des Sportspielgenres Am Beispiel Der FIFA-Spieleserie BACHELORARBEIT

BACHELORARBEIT Die Entwicklung des Sportspielgenres am Beispiel der FIFA-Spieleserie ausgeführt von Bernd Steinberger A-2524 Teesdorf, Kirchfeldstr. 28b Begutachter: FH-Prof. Dipl.-Ing. Alexander Nimmervoll Teesdorf, 10.01.2010 Ausgeführt an der FH Technikum Wien Studiengang Informatik Eidesstattliche Erklärung „Ich erkläre hiermit an Eides Statt, dass ich die vorliegende Arbeit selbständig angefertigt habe. Die aus fremden Quellen direkt oder indirekt übernommenen Gedanken sind als solche kenntlich gemacht. Die Arbeit wurde bisher weder in gleicher noch in ähnlicher Form einer anderen Prüfungsbehörde vorgelegt und auch noch nicht veröffentlicht.“ ____________________ _________________________ Ort, Datum Unterschrift Kurzfassung Diese Arbeit behandelt Videospiele des Sportgenres und verwendet zur Veranschaulichung die Fußballspielserie FIFA . Dabei soll die Definition der Sportspiele vermittelt und ein Überblick über die Vertreter des Genres gegeben werden. Das Videospiel FIFA , welches von Electronic Arts entwickelt wurde, startete seine Laufbahn im Jahr 1994 und ist bis heute präsent, wodurch an diesem Beispiel eine lange Zeitspanne der Computerspielindustrie verfolgt werden kann. Dieses Spiel wird in seiner technischen Entwicklung auf Gameplay, Grafik und Sound analysiert und beschrieben und auch die Geschichte des Herstellers wird genauer unter die Lupe genommen. Um das Beispiel noch besser zu veranschaulichen, werden einige der bekanntesten Konkurrenten von FIFA zum Vergleich herangezogen. Schlagwörter: Videospiele, Sportgenre, Electronic Arts, FIFA, Konkurrenz Abstract This paper deals with the sports genre of videogames and uses the FIFA soccer series as an example. The definition of sports games will be given and an overview of the representatives of the genre will be shown. The videogame FIFA was developed by Electronic Arts and started its career in 1994. -

NIBC First Round Case NIBC Ele Ctro N Ic Arts Contents

NIBC First Round Case NIBC Ele ctro n ic Arts Contents 1. The Scenario 2. Background Information 3. Tasks & Deliverables A. Discounted Cash Flow Analysis B. Trading Comparables Analysis C. Precedent Transactions Analysis D. LBO Analysis E. Presentation 4. Valuation & Technical Guidance A. Discounted Cash Flow Analysis B. Trading Comparables Analysis C. Precedent Transactions Analysis D. LBO Analysis 5. Rules & Regulations 6. Appendix A: Industry Overview 7. Appendix B: Precedent Transactions Legal Disclaimer: The Case and all relevant materials such as spreadsheets and presentations are a copyright of the members of the NIBC Case Committee of the National Investment Banking Competition & Conference (NIBC), and intended only to be used by competitors or signed up members of the NIBC Competitor Portal. No one may copy, republish, reproduce or redistribute in any form, including electronic reproduction by “uploading” or “downloading”, without the prior written consent of the NIBC Case Committee. Any such use or violation of copyright will be prosecuted to the full extent of the law. Need for Speed Madden NFL Electronic Arts Electronic Arts Welcome Letter Dear Competitors, Thank you for choosing to compete in the National Investment Banking Competition. This year NIBC has continued to expand globally, attracting top talent from 100 leading universities across North America, Asia, and Europe. The scale of the Competition creates a unique opportunity for students to receive recognition and measure their skills against peers on an international level. To offer a realistic investment banking experience, NIBC has gained support from a growing number of former organizing team members now on the NIBC Board, who have pursued investment banking careers in New York, Hong Kong, Toronto, and Vancouver. -

Fifa 10 Free Download for Pc Full Version FIFA 21 Download

fifa 10 free download for pc full version FIFA 21 Download. Download FIFA 21 for free – learn how to enjoy the latest instalment of FIFA cycle! F IFA 21 is yet another part of very successful series that allowed us to delve into the virtual world of football. It is a discipline that brings almost everyone behind TV screens or stadiums. No wonder that most of us would like to play the game and feel the incredible emotions all the professional footballers feel. For this reason, we decided to create a very simple access to FIFA 21 download links . It is a great opportunity to test out recently released FIFA game. There are plenty of novelties and features that the authors decided to include, so it is definitely not the same game with another number. If you don’t believe, here is your chance to test it out! What makes FIFA 21 so interesting? Before we tell you more about our installing device and FIFA 21 download links, we should certainly take a closer look at the authors of this game as well as the basics. As we all know, FIFA 21 is yet another instalment that was created by Electronic Arts Sports (known as EA Sports). It is one of the most popular and the most profitable cycles that up to this moment sold in millions of copies. Another part of the game once again allows us to control our favorite club or a footballer . The game introduces several novelties. The most important changes regard the artificial intelligence as well as career game mode. -

Tion Thomas EA Graphics Lunch Presentation

Tion Thomas EA Graphics Lunch Presentation Software Engineering Intern Central Technology Group – Apt Purdue University – MS ‘09 Mentor: Anand Kelkar Manager: Fazeel Gareeboo EA Company Overview Founded in 1982 Largest 3rd party game publisher in the world Net revenue of $3.67 billion in FY 2008 #1 mobile game publisher (acquired JAMDAT) Multi-Platform philosophy Has/owns development studios all over the globe: Bioware/Pandemic (Bioshock, Mercenaries) Criterion (Burnout, Black) Digital Illusions (Battlefield series) Tiburon (Madden) Valve (Half-Life) Crytek (Crysis) EA Company Overview cont… 4 Major Brands/Divisions: EA Sports (FIFA, Madden, NBA, NFL, Tiger Woods, NASCAR) EA Sports Freestyle (NBA Street, NFL Street, FIFA Street, SSX) EA (Medal of Honor, C&C, Need For Speed, SIMS, Spore, Dead Space) POGO (Casual web based games) Currently has 4 entries on the top selling franchises of all time list: #3 - Sims (100 million) #5 - Need For Speed (80 million) #7 – Madden (70 million) #9 - FIFA (65 million) EA Is Unique Sheer size breaks the traditional game developer paradigm Bound by multi-platform technology Long history with titles on almost every console that ever existed Most studios have annual cycles that cannot be broken Both developer and publisher with ownership in many huge studios Origin Of Tiburon Founded by 3 programmers in Longwood, FL First title was MechWarrior for SNES First Madden title was Madden 96 for Genesis, SNES Acquired by EA in 1998 How Tiburon Got Madden Originally, EA contracted Visual -

09062299296 Omnislashv5

09062299296 omnislashv5 1,800php all in DVDs 1,000php HD to HD 500php 100 titles PSP GAMES Title Region Size (MB) 1 Ace Combat X: Skies of Deception USA 1121 2 Aces of War EUR 488 3 Activision Hits Remixed USA 278 4 Aedis Eclipse Generation of Chaos USA 622 5 After Burner Black Falcon USA 427 6 Alien Syndrome USA 453 7 Ape Academy 2 EUR 1032 8 Ape Escape Academy USA 389 9 Ape Escape on the Loose USA 749 10 Armored Core: Formula Front – Extreme Battle USA 815 11 Arthur and the Minimoys EUR 1796 12 Asphalt Urban GT2 EUR 884 13 Asterix And Obelix XXL 2 EUR 1112 14 Astonishia Story USA 116 15 ATV Offroad Fury USA 882 16 ATV Offroad Fury Pro USA 550 17 Avatar The Last Airbender USA 135 18 Battlezone USA 906 19 B-Boy EUR 1776 20 Bigs, The USA 499 21 Blade Dancer Lineage of Light USA 389 22 Bleach: Heat the Soul JAP 301 23 Bleach: Heat the Soul 2 JAP 651 24 Bleach: Heat the Soul 3 JAP 799 25 Bleach: Heat the Soul 4 JAP 825 26 Bliss Island USA 193 27 Blitz Overtime USA 1379 28 Bomberman USA 110 29 Bomberman: Panic Bomber JAP 61 30 Bounty Hounds USA 1147 31 Brave Story: New Traveler USA 193 32 Breath of Fire III EUR 403 33 Brooktown High USA 1292 34 Brothers in Arms D-Day USA 1455 35 Brunswick Bowling USA 120 36 Bubble Bobble Evolution USA 625 37 Burnout Dominator USA 691 38 Burnout Legends USA 489 39 Bust a Move DeLuxe USA 70 40 Cabela's African Safari USA 905 41 Cabela's Dangerous Hunts USA 426 42 Call of Duty Roads to Victory USA 641 43 Capcom Classics Collection Remixed USA 572 44 Capcom Classics Collection Reloaded USA 633 45 Capcom Puzzle