Ex Ante Assessment

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Ministero Della Salute Direzione Generale Per L'igiene E La Sicurezza Degli Alimenti E La Nutrizione Ufficio 2 Via Giorgio Ribotta 5- 00144Roma

arsl_ge.alisa.REGISTRO UFFICIALE.I.0012225.25-06-2018 0026792-25/06/2018-DGISAN-MDS-P Trasmissione elettronica N. prot. DGISAN in Docsa/PEC Ministero della Salute Direzione generale per l'igiene e la sicurezza degli alimenti e la nutrizione Ufficio 2 Via Giorgio Ribotta 5- 00144Roma ASSESSORATI ALLA SANITA’ REGIONI E PROVINCIA AUTONOMA DI TRENTO SERVIZI VETERINARI LORO SEDI ASSESSORATO ALL’AGRICOLTURA PROVINCIA AUTONOMA DI BOLZANO SEDE E p.c. ASSICA Pec: [email protected] UNICEB [email protected] [email protected] ASSOCARNI [email protected] FEDERCARNI [email protected] CONSORZIO DEL PROSCIUTTO DI PARMA [email protected]; [email protected] [email protected] CONSORZIO DEL PROSCIUTTO SAN DANIELE [email protected] CARPEGNA PROSCIUTTI S.p.A. [email protected] CONSORZIO DEL PROSCIUTTO DI MODENA [email protected] C.I.A. organizzazione @cia.it CNA [email protected] UNIONALIMENTARI [email protected] A.I.I.P.A. [email protected] CIM –CONSORZIO ITALIANO MACELLATORI Pec: [email protected] DGSAF Ufficio 1 SEDE OGETTO: Aggiornamenti sull’esportazioni di carne fresca suina, prodotti a base di carne suina e prodotti finiti contenti suino dall’ Italia verso la Federazione russa. Si fa seguito alle lettere di questo ufficio n° prot. 15196 del 12 aprile 2018 e N° prot. 10609 del 19 marzo 2018 concernenti l’oggetto per fornire ulteriori aggiornamenti giunti dalla Parte russa con le ultime linee guida Versione del 14/6/2018 e pervenuti per il tramite della Commissione europea, al fine di consentire una esatta compilazione della certificazione veterinaria che deve accompagnare le carni ed i prodotti del settore suino che sono esportati dall’Italia verso la Federazione Russa. -

LLU TF Studentu Un Maģistrantu Zinātniskā Conference 2020

Latvijas Lauksaimniec ības universit āte Tehnisk ā fakult āte LLU TF studentu un ma ģistrantu zin ātnisk ā conference 2020 Inženierzin ātņu sekcija 2020. gada 17. apr īlī Jelgava 2020 Programmas komiteja Dainis Berjoza Ilm ārs Dukulis Vit ālijs Osad čuks Att ālin ātas konferences vad ītāji Vad ītājs: Ilm ārs Dukulis Vad ītāja vietnieks: Dainis Berjoza Tehniskais redaktors: Vit ālijs Osad čuks Recenzenti Ilm ārs Dukulis; Aldis Pecka; Dainis Berjoza; Vilnis P īrs; M ārti ņš Ziemelis; Aivars Birkavs; Ain ārs Gali ņš; Liene Kancevi ča; Gints Birzietis; J ānis L āceklis-Bertmanis TF studentu un ma ģistrantu zin ātnisk ā konference Jelgava, 17.04.2020. SATURS - CONTENT Art ūrs Za ķis, Ruslans Šmigins DIETIL ĒTERA IETEKME UZ AUGU E ĻĻ AS FIZIK ĀLI – ĶĪ MISKAJ ĀM ĪPAŠ ĪBĀM EFFECT OF DIETHYL ETHER ON VEGETABLE OIL PHYSICAL – CHEMICAL PROPERTIES........................................................................................................................................... 4 Dainis Bergšpics, Dainis Berjoza TR ĪSRITE ŅU ELEKTROVELOSIP ĒDA R ĀMJA KONSTRUKCIJAS ANAL ĪZE ANALYSIS OF THREE – WHEEL ELECTRIC BICYCLE FRAME DESIGN........................................ 10 Jānis Saule, Dainis Berjoza UZ ŅĒ MUMA AUTOPARKA IZMAKSU ANAL ĪZE P ĀREJAI UZ ELEKTROTRANSPORTU ANALYSIS OF CAR FLEET CHARGES FOR THE COMPANY’S TRANSITION TO ELECTRIC TRANSPORT....................................................................................................................... 16 Aivis Jaškovskis, Aivars Birkavs RŪPNIECISKI KONSTRU ĒTIE P ĀRVIETOJAMIE RU ĻĻ -

The Concept of Infamy in Roman

The International Journal ENTREPRENEURSHIP AND SUSTAINABILITY ISSUES ISSN 2345-0282 (online) http://jssidoi.org/jesi/ 2017 Volume 5 Number 2 (December) http://doi.org/10.9770/jesi.2017.5.2(9) Publisher http://jssidoi.org/esc/home --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- THROUGH ECONOMIC GROWTH TO THE VIABILITY OF RURAL SPACE* Baiba Rivza¹, Maiga Kruzmetra² 1,2 Latvia University of Agriculture, Svetes street 18, Jelgava, LV-3001, Latvia E-mails:1 [email protected]; 2 [email protected] Received 15 August 2017; accepted 19 November; published 29 December 2017 Abstract. Rural areas as a necessary component of living space for the population is an increasing focus both in official documents of various EU institutions and in research investigations. Both the documents and the research papers stress the necessity to enhance and maintain the viability of rural areas. The viability of rural areas is ensured by employment opportunities and the readiness of residents for active and innovative economic activity. The authors’ research focuses on an analysis of vertical and horizontal changes in entrepreneurship in the period 2009-2015 and their effects on changes in the living space in the territories analysed, which primarily involves the country’s regions, but a special focus is placed on the mentioned processes in territorial units of the regions – municipalities –, as the life of residents is influenced not only by national policies but also by on-going processes in the administrative territories of local governments. Zemgale region was chosen for an in-depth analysis of these processes. LURSOFT data for the period 2009-2015 and Central Statistical Bureau data for the period 2013-2015 were used as information sources. -

Cooperating Neighbours Showcasesh Brochureb H Volume 3

Cooperating neighbours ShowcaseSh BrochureB h Volume 3 Latvia–Lithuania Cross Border Cooperation Programme under the European Territorial Cooperation Objective 2007-2013 www.latlit.eu Content Introduction 6 Project Descriptions 12 I Priority - Encouragement of Socio-Economic Development and Competitiveness of the Region Business, Labour Market and Research and Technology Development LTLVMARINE 12 eBig3 33 ENTERBANK 13 Creative industries 34 FruitTechCentre 14 HipiLatLit 35 Cross boarder JRTC 15 Cross-border DISCOS 36 Business Promotion 16 I CAN WORK 37 REDBURDEN 17 FARA 38 Natural Sciences 18 MODPART 39 F.A.R. RESEARCH 19 BUILDER TRAINING 40 COPQUALITY 20 Business library 41 5L 21 ENECO 42 VILLAGE HERITAGE 22 VocEdu 43 Step into Craft 23 LTLV-MARINE-ENGINEER 44 JOINT RT UNIT 24 THEME VILLAGES 45 REGION INVEST 25 Smart 46 MatNet 26 TRUFFLE 47 Be-Able 27 EDUCATE FOR BUSINESS 48 MFORBusinessgrowth 28 Local products 49 Science ft. Industry 29 INTERACTIVE TV 50 Mission:to create 30 Start ups promotion 51 COOP EDU-SHIP 31 Invest to grow 52 Without Borders 32 Improvement of Internal and External Accessibility of the Border Region LATLIT TRAFFIC 53 Trans-Port 56 Active Tour LV-LT 54 Roadside rest areas 57 ROTLBSARM 55 II Priority - Attractive Living Environment and Development of Sustainable Community Enhancing Joint Management of Public Services and Natural Resources LatLitCBC 58 Renewable energy 70 Fire Fighting 59 GERME 71 Water quality 60 Flood 72 1FIRETEAM 61 EAE 73 CBRM II 62 INISS 74 First Aid 63 Urban Green 75 Green Environment 64 Lielupe -

Saeima Ir Pieņēmusi Un Valsts

The Saeima1 has adopted and the President has proclaimed the following Law: Law On Administrative Territories and Populated Areas Chapter I General Provisions Section 1. Administrative Territory An administrative territory is a territorial divisional unit of Latvia, in which the local government performs administration within the competence thereof. Section 2. Populated Area A populated area is a territory inhabited by people, the material pre-conditions have been established for residence therein and to which the relevant status of populated area has been granted according to the procedures specified by regulatory enactments. Section 3. Scope of Application of this Law (1) The Law prescribes the conditions for the creation, registration, modification of boundaries and establishing of the administrative centre of administrative territories and the territorial divisional units of a municipality, and the definition of the status of a populated area, the procedures for registration thereof and the competence of institutions in these matters. (2) The activities of State administrative institutions in administrative territories shall be regulated by other regulatory enactments. Chapter II Administrative Territories Section 4. Administrative Territories The Republic of Latvia shall be divided into the following administrative territories: 1) regions; 2) cities; and, 3) municipalities. Section 5. Region (1) The territorially amalgamated administrative territories of local governments shall be included in a region. (2) The municipalities and cities to be included in a region, as well as the administrative centre of the region shall be determined by the Saeima. 1 The Parliament of the Republic of Latvia Translation © 2010 Valsts valodas centrs (State Language Centre) (3) When creating or eliminating a region, establishing the administrative centre of a region, and modifying the boundaries of a region, the interests of the inhabitants of the State and local government, the Cabinet opinion and the decisions of interested local governments shall be evaluated. -

Ombudsman of the Republic of Latvia Annual Report 2015

Ombudsman of the Republic of Latvia Annual Report 2015 Riga, 2016 2 Contents Contents .................................................................................................................................... 2 Introductory Words of the Ombudsman .................................................................................... 6 I. Area of the Rights of Children ............................................................................................... 8 1. Division of the Rights of Children: Developments ........................................................... 8 1.1. Statistics ..................................................................................................................... 8 1.2. Recommendations of the Ombudsman ...................................................................... 9 1.3. Most Essential Opinions .......................................................................................... 11 1.4. International Cooperation in the Area of the Rights of Children ............................. 13 1.5. Research ................................................................................................................... 16 1.6. Educational Activities for Children and Subjects of Children's Rights ................... 19 2. Promoting the Rights of the Children to Grow Up in the Family ................................... 20 2.1. Issues Regarding Guardians and Foster Families .................................................... 20 2.2. Problems of Service Procurement and Settlement of -

Integrated Development Plan to Support Business Activity in Jelgava Local Municipality 2018-2028

INTEGRATED DEVELOPMENT PLAN TO SUPPORT BUSINESS ACTIVITY IN JELGAVA LOCAL MUNICIPALITY 2018-2028 EUROPEAN UNION European Regional Development Fund CONTENT WHAT DO WE HOPE TO ACHIEVE WITH THE INTEGRATED DEVELOPMENT PLAN TO SUPPORT BUSINESS ACTIVITY IN THE JELGAVA LOCAL MUNICIPALITY? 02 ANNOTATION 03 IN BRIEF ABOUT JELGAVA LOCAL MUNICIPALITY 04 SWOT 06 VISION, EXPECTED RESULTS, CHANGES 07 ACTION PLAN /SUMMARY/ 08 INTEGRATED DEVELOPMENT PLAN CREATION PROCESS LEARNING AND SHARING AT THE EU LEVEL 09 METHOD 11 RURAL – CITY INTERACTION STRATEGY 12 INTEGRATED APPROACH 13 COMMUNICATION AND COMMUNITY INVOLVEMENT IN THE PLAN’S IMPLEMENTATION FUNDING 14 THE FUTURE MONITORING AND CONTROL APPENDIX 16 WHAT DO WE HOPE TO ACHIEVE WITH THE INTEGRATED DEVELOPMENT PLAN TO SUPPORT 2 BUSINESS ACTIVITY IN THE JELGAVA LOCAL MUNICIPALITY? In its long-term development strategy, the Jelgava Local Municipality is positioning itself as a local municipality with a sustainable future. With the creation of the Integrated Development Plan to Support Business Activity in the Jelgava 02 Local Municipality 2018-2028, the council of the local municipality is highlighting the important role of business activity in the stable development of the municipality and 03 defines the tasks which must be undertaken to ensure stability in developing business activity. 04 The quality of the environment for business activity is one of the most important elements in increasing the local municipality’s competitiveness. The better the conditions the 06 local municipality can create for businesses, the greater the investment that can be expected in the economy, in turn The long-range availability of resources, academic potential 07 meaning the creation of new employment and prosperity for and the local municipality’s support can facilitate the Jelgava its residents. -

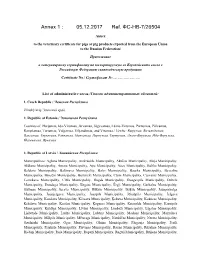

05.12.2017 Ref. ФС-НВ-7/26504

Annex 1 : 05.12.2017 Ref. ФС-НВ-7/26504 Annex to the veterinary certificate for pigs or pig products exported from the European Union to the Russian Federation/ Приложение к ветеринарному сертификату на зкспортируемую из Европейското союза в Российскую Федерацию свиноводческую продукцию Certificate No./ Сертификат №:………………….. List of administrative areas /Список административных областей: 1. Czech Republic / Чешская Республика Zlínský kraj/ Злинский край. 2. Republic of Estonia / Эстонская Республика Counties of: Harjumaa, Ida-Virumaa, Järvamaa, Jõgevamaa, Lääne-Virumaa, Pärnumaa, Põlvamaa, Ramplamaa, Tartumaa, Valgamaa, Viljandimaa, and Virumaa./ Уезды: Вырумаа, Вильяндимаа, Валгамаа, Харьюмаа, Рапламаа, Пылвамаа, Пярнумаа, Тартумаа, Ляэне-Внрумаа, Ида-Внру.маа, Йыгевамаа, Ярвамаа. 3. Republic of Latvia / Латвийская Республика Municipalities: Aglona Municipality, Aizkraukle Municipality, Aknīste Municipality, Aloja Municipality, Alūksne Municipality, Amata Municipality, Ape Municipality, Auce Municipality, Babīte Municipality, Baldone Municipality, Baltinava Municipality, Balvi Municipality, Bauska Municipality, Beverīna Municipality, Brocēni Municipality, Burtnieki Municipality, Cēsis Municipality, Cesvaine Municipality, Carnikava Municipality, Cibla Municipality, Dagda Municipality, Daugavpils Municipality, Dobele Municipality, Dundaga Municipality, Engure Municipality, Ērgļi Municipality, Garkalne Municipality, Gulbene Municipality, Iecava Municipality, Ilūkste Municipality, Ikšķile Municipality, Jaunpiebalga Municipality, Jaunjelgava -

2019 Quality Report on Electronic Communications Services

APPROVED at the Public Utilities Commission’s Board meeting of 23 April 2020 (minutes No. 19, p. 9) 2019 Quality Report on Electronic Communications Services 45 Unijas Street Riga, LV-1039 Latvia T: +371 67097200 E: [email protected] www.sprk.gov.lv TABLE OF CONTENTS LIST OF ABBREVIATIONS ................................................................................................ 3 LIST OF ABBREVIATIONS OF LAWS AND REGULATIONS ................................................ 4 INTRODUCTION ............................................................................................................... 5 I INTERNET SERVICE ....................................................................................................... 7 1.1. How Internet service measurements are performed .................................................... 7 1.2. Measurement results ................................................................................................. 8 1.2.1. Connection speed ............................................................................................. 8 1.2.2. Latency .......................................................................................................... 14 1.2.3. Jitter .............................................................................................................. 15 1.2.4. Packet loss ratio ............................................................................................. 16 1.3. Summary .............................................................................................................. -

Diversity Unites – Heading Towards an Inclusive European Citizenship Imprint

Diversity Unites – heading towards an inclusive European citizenship Imprint District of Recklinghausen Head of the district authority ImprintDepartment for growth, the county council and the head of district Ansgar Lewe District of Recklinghausen HeadDivision for of theservices for elderly and disabled district authority , integration aid and The Municipal Integration Centre DepartmentSabine Fischer for growth, the county council and the head of district Ansgar Lewe Realised within the framework of the European project Division for services for elderly and disabled, integration aid and The Municipal Integration Centre Sabine Fischer Realised within the framework of the European project between between In Germany In Germany InIn Poland In SwedenIn Sweden In Latvia In Latvia With financial support from the European Commission´s programme: With financial support from the European Commission´s programme: This project has been funded with support from the European Commission. This publication reflects the views only of the author, and the Commission cannot be held responsible forThis project has been funded with any use which may be madesupport from the European Commission. of the information contained therein. This publication reflects the views only of the author, and the Commission cannot be held responsible for any use which may be made of the information contained therein. Dear reader, keeping Europe ever closer together and making it possible for every citizen to participate and contribute their ideas to our inte- grated communities are the leading goals of our recently founded network between the District of Wodzisław in Poland, the County of Sörmland in Sweden, Jelgava Local Municipality in Latvia and the District of Recklinghausen in Germany. -

Vidzemes Augstskolas 5. Studentu Pētniecisko Darbu Konferences Rakstu Krājums

Vidzemes Augstskolas 5. Studentu pētniecisko darbu konferences rakstu krājums 2012 VIDZEMES AUGSTSKOLAS 5.Studentu pētnieciSko darbu konferenceS rakStu krājumS 2012 - 1 - Satura rādītājs Sekcijas „Sabiedrība. Vide. Procesi” galvenais redaktors Dr.sc.pol. Visvaldis Valtenbergs, Vidzemes Augstskola Sekcijas „Uzņēmumu, organizāciju un sabiedrības vadība” galvenā redaktore Dr.oec. Maira Leščevica, Vidzemes Augstskola Priekšvārds 4 Sekcijas „Tūrisms un reģionālā politika” galvenā redaktore Mg.sc.soc. Inese Ebele, Vidzemes Augstskola SABIEDRĪBA. VIDE. PROCESI Anna Zemblicka. Politiskās polarizācijas iezīmes Latvijas Republikas likumdevējā: 5 Redkolēģija argumentācijas kļūdu analīze Mg.oec. Aigars Andersons, Mg.geogr. Ilgvars Ābols, MBA Iluta Bērziņa, Mg.sc.soc. Renāte Cāne, Mg.sc.soc. Dace Signija Eglīte. Sabiedrisko attiecību modeļu pielietojums un analīze krīzes eskalācijas procesā. 12 Jansone, Dr.art. Jānis Kalnačs, Mg.geogr. Andris Klepers, Bc.sc.soc. Kristīne Liepiņa, Mg.paed. Vija Melbārde, Valsts ieņēmumu dienesta gadījums Dr.phil. Baiba Pētersone, Dr.oec. Sarmīte Rozentāle, Mg.biol. Juris Smaļinskis, Dr.phil. Jurģis Šķilters, Dipl.econ. Anda Ziemele Kārlis Nīlanders. Vietējās pārvaldes līmeņa koruptīvo prakšu vērtējums sabiedrībā 18 Latviešu valodas tekstu literārā redaktore Mg.paed. Zane Bērziņa Baiba Strause. Nevalstisko organizāciju veiktās komunikācijas loma krievvalodīgo jauniešu 25 iesaistīšanā to darbā Angļu valodas tekstu literārā redaktore Mg.philol. Daina Lārmane Lelde Gavare. Latvijas augstākās izglītības internacionalizācija 35 Tehniskā redaktore Mg.sc.soc. Zane Kalniņa Vāka dizaina un teksta maketa autors Māris Bičkovs Vākam izmantota Artūra Kaurova fotogrāfija UZŅĒMUMU, ORGANIZĀCIJU UN SABIEDRĪBAS VADĪBA Egita Kamarute. Jauniešu bezdarba izvērtējums Gulbenes novadā 42 Dace Ločmele. Jauniešu uzņēmējdarbības iespējas un šķēršļi Valmierā un Kocēnu novadā 51 Krājumā apkopoti Vidzemes Augstskolas 5.Studentu pētniecisko darbu konferences raksti. Konference norisinājās Jānis Cercins. -

How Politics Influence the Amount of Government Transfers Received by Latvian Municipalities

SSE Riga Student Research Papers 2020 : 5 (227) FINANCIAL SUPPORT FOR PARTY SUPPORTERS? HOW POLITICS INFLUENCE THE AMOUNT OF GOVERNMENT TRANSFERS RECEIVED BY LATVIAN MUNICIPALITIES Authors: Daria Orz Oļegs Skripņiks ISSN 1691-4643 ISBN 978-9984-822-49-5 September 2020 Riga Financial Support for Party Supporters? How Politics Influence the Amount of Government Transfers Received by Latvian Municipalities Daria Orz and Oļegs Skrip ņiks Supervisor: Oļegs Tka čevs September 2020 Riga Table of contents 1. Introduction .................................................................................................................. 6 2. Literature review........................................................................................................... 8 2.1. The normative approach to transfer allocation .................................................................. 8 2.2. Public choice literature .................................................................................................... 10 2.3. Positive approach to transfer allocation ........................................................................... 11 2.3.1. Link between transfers and elections ........................................................................ 11 2.3.2. Partisan alignment as a predictor of increased transfers ........................................... 12 2.3.3. Transfers misallocation............................................................................................. 14 2.4. Choice of research design ...............................................................................................