For Personal Use Only Use Personal For

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Socially Conscious Australian Equity Holdings

Socially Conscious Australian Equity Holdings As at 30 June 2021 Country of Company domicile Weight COMMONWEALTH BANK OF AUSTRALIA AUSTRALIA 10.56% CSL LTD AUSTRALIA 8.46% AUST AND NZ BANKING GROUP AUSTRALIA 5.68% NATIONAL AUSTRALIA BANK LTD AUSTRALIA 5.32% WESTPAC BANKING CORP AUSTRALIA 5.08% TELSTRA CORP LTD AUSTRALIA 3.31% WOOLWORTHS GROUP LTD AUSTRALIA 2.93% FORTESCUE METALS GROUP LTD AUSTRALIA 2.80% TRANSURBAN GROUP AUSTRALIA 2.55% GOODMAN GROUP AUSTRALIA 2.34% WESFARMERS LTD AUSTRALIA 2.29% BRAMBLES LTD AUSTRALIA 1.85% COLES GROUP LTD AUSTRALIA 1.80% SUNCORP GROUP LTD AUSTRALIA 1.62% MACQUARIE GROUP LTD AUSTRALIA 1.54% JAMES HARDIE INDUSTRIES IRELAND 1.51% NEWCREST MINING LTD AUSTRALIA 1.45% SONIC HEALTHCARE LTD AUSTRALIA 1.44% MIRVAC GROUP AUSTRALIA 1.43% MAGELLAN FINANCIAL GROUP LTD AUSTRALIA 1.13% STOCKLAND AUSTRALIA 1.11% DEXUS AUSTRALIA 1.11% COMPUTERSHARE LTD AUSTRALIA 1.09% AMCOR PLC AUSTRALIA 1.02% ILUKA RESOURCES LTD AUSTRALIA 1.01% XERO LTD NEW ZEALAND 0.97% WISETECH GLOBAL LTD AUSTRALIA 0.92% SEEK LTD AUSTRALIA 0.88% SYDNEY AIRPORT AUSTRALIA 0.83% NINE ENTERTAINMENT CO HOLDINGS LIMITED AUSTRALIA 0.82% EAGERS AUTOMOTIVE LTD AUSTRALIA 0.82% RELIANCE WORLDWIDE CORP LTD UNITED STATES 0.80% SANDFIRE RESOURCES LTD AUSTRALIA 0.79% AFTERPAY LTD AUSTRALIA 0.79% CHARTER HALL GROUP AUSTRALIA 0.79% SCENTRE GROUP AUSTRALIA 0.79% ORORA LTD AUSTRALIA 0.75% ANSELL LTD AUSTRALIA 0.75% OZ MINERALS LTD AUSTRALIA 0.74% IGO LTD AUSTRALIA 0.71% GPT GROUP AUSTRALIA 0.69% Issued by Aware Super Pty Ltd (ABN 11 118 202 672, AFSL 293340) the trustee of Aware Super (ABN 53 226 460 365). -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

(ASX100) Women on Boards Analysis

Australia/NZ | Australia Thematic Investing (Citi) Equities 18 August 2011 │ 32 pages ESG: ASX100 Women on Board Analysis Increasing Focus on Board Diversity Women on Boards of ASX100 Companies — The ASX Corporate Governance Council’s new principles and recommendations on diversity commenced on 1 January Elaine Prior 2011. This is likely to lead to increasing focus on companies’ approaches to diversity +61-2-8225-4891 issues, including female representation on company boards. This report looks at data [email protected] on women directors on ASX100 company boards. The number of women directors has Felipe Faria increased, particularly in recent months (Figure 5 to Figure 8). Board diversity may [email protected] enhance effectiveness, by providing a wider range of perspectives and knowledge. Women on Boards Data — We collected and analysed data on female board directors of S&P/ASX100 companies from FY08 to 8 August 2011 (Figure 5 to Figure 9). At 8 August 2011 there were 134 women on ASX100 boards, a 46% increase from FY08. ASX100 companies with no female board directors were AQP, CQO, EGP, FMG, IPL, JHX, LEI, LYC, OSH, PDN, PRY, RHC, RMD, SGM and SWM. Companies with three female directors (the highest number identified) are AMP, BEN, CBA, MQG, QAN, QBE and WBC. Seven female directors each currently hold three ASX100 directorships. Business Case for Gender Diversity — Reibey Institute research found that those ASX500 companies with women directors on 30 June 2010 had a 3-year return on equity (ROE) 10.7% higher than those without any women directors. The 5-year ROE was 11.1% higher. -

ESG Reporting by the ASX200

Australian Council of Superannuation Investors ESG Reporting by the ASX200 August 2019 ABOUT ACSI Established in 2001, the Australian Council of Superannuation Investors (ACSI) provides a strong, collective voice on environmental, social and governance (ESG) issues on behalf of our members. Our members include 38 Australian and international We undertake a year-round program of research, asset owners and institutional investors. Collectively, they engagement, advocacy and voting advice. These activities manage over $2.2 trillion in assets and own on average 10 provide a solid basis for our members to exercise their per cent of every ASX200 company. ownership rights. Our members believe that ESG risks and opportunities have We also offer additional consulting services a material impact on investment outcomes. As fiduciary including: ESG and related policy development; analysis investors, they have a responsibility to act to enhance the of service providers, fund managers and ESG data; and long-term value of the savings entrusted to them. disclosure advice. Through ACSI, our members collaborate to achieve genuine, measurable and permanent improvements in the ESG practices and performance of the companies they invest in. 6 INTERNATIONAL MEMBERS 32 AUSTRALIAN MEMBERS MANAGING $2.2 TRILLION IN ASSETS 2 ESG REPORTING BY THE ASX200: AUGUST 2019 FOREWORD We are currently operating in a low-trust environment Yet, safety data is material to our members. In 2018, 22 – for organisations generally but especially businesses. people from 13 ASX200 companies died in their workplaces. Transparency and accountability are crucial to rebuilding A majority of these involved contractors, suggesting that this trust deficit. workplace health and safety standards are not uniformly applied. -

2017-2018 Annual Investment Report Retirement System Investment Commission Table of Contents Chair Report

South Carolina Retirement System Investment Commission 2017-2018 Annual Investment Report South Carolina Retirement System Investment Commission Annual Investment Report Fiscal Year Ended June 30, 2018 Capitol Center 1201 Main Street, Suite 1510 Columbia, SC 29201 Rebecca Gunnlaugsson, Ph.D. Chair for the period July 1, 2016 - June 30, 2018 Ronald Wilder, Ph.D. Chair for the period July 1, 2018 - Present 2017-2018 ANNUAL INVESTMENT REPORT RETIREMENT SYSTEM INVESTMENT COMMISSION TABLE OF CONTENTS CHAIR REPORT Chair Report ............................................................................................................................... 1 Consultant Letter ........................................................................................................................ 3 Overview ................................................................................................................................... 7 Commission ............................................................................................................................... 9 Policy Allocation ........................................................................................................................13 Manager Returns (Net of Fees) ..................................................................................................14 Securities Lending .....................................................................................................................18 Expenses ...................................................................................................................................19 -

SKI 2020 Full Year Investor Presentation

31 DECEMBER 2020 FULL YEAR RESULTS TUESDAY, 23 FEBRUARY 2021 INFRASTRUCTURE FOR THE FUTURE SPARK INFRASTRUCTURE – AT A GLANCE ASX-listed owner of leading essential energy infrastructure MARKET Distribution Transmission Renewables $ CAPITALISATION(1) 3.6bn S&P/ASX 100 Victoria Power Networks TransGrid Bomen Solar Farm and SA Power Networks (NSW) (NSW) REGULATED AND CONTRACTED ASSET 49% 15% 100% $ BASE (PROPORTIONAL) SPARK INFRASTRUCTURE SPARK INFRASTRUCTURE SPARK INFRASTRUCTURE 6.7bn OWNERSHIP OWNERSHIP OWNERSHIP $18.7bn $ $ $ TOTAL ELECTRICITY NETWORK 11.03bn 7.52bn 0.17bn AND GENERATION ASSETS(2) REGULATED ASSET BASE REGULATED AND CONTRACTED ASSET BASE CONTRACTED ASSET BASE SUPPLYING 5.0m+ WAGGA HOMES AND BUSINESSES WAGGA, 80% 17% 3% NSW 5,400 SKI PROPORTIONAL SKI PROPORTIONAL SKI PROPORTIONAL EMPLOYEES ASSET BASE(3) ASSET BASE(3) ASSET BASE(3) (1) As at 19 February 2021. Balance sheet and other information as at 31 December 2020 (2) Spark Infrastructure has proportional interests in $18.7bn of total electricity network and contracted generation assets (3) Pro forma Spark Infrastructure I Investor Presentation I February 2021 2 INFRASTRUCTURE FOR THE FUTURE FINANCIAL HIGHLIGHTS Solid earnings and growth delivered by high quality energy network businesses Underlying Look- FY2020 Regulated Contracted through EBITDA(1) Distribution asset base(1) asset base(2) $ 13.5cps $6.4bn $294m 862m +2.1cps franking Up 3.3% Up 13.4% Up 2.4% FY2021 Growth FFO/ Distribution capital Net debt(5) (3) guidance expenditure(4) 12.5cps $231m 12.4% + ~25% franking -

Morningstar Equity Research Coverage

December 2019 Equity Research Coverage Morningstar covers more than 200 companies in We use the following guidelines to Contact Details Australia and New Zealand as part of our global determine our Australian equity coverage: Australia stock coverage of about 1,500 companies. We are × Nearly all companies in the S&P/ASX 100 Index. Helpdesk: +61 2 9276 4446 Email: [email protected] one of the largest research teams globally with × Companies in the S&P/ASX 200 Index which more than 100 analysts, associates, and have an economic moat and/or have cash flow New Zealand strategists, including 17 in Australia. Local analysts which is at least mildly predictable. Helpdesk: +64 9 915 6770 regularly glean insights from our global sector teams × In total, Morningstar will cover about 80% of Email: [email protected] in China, Europe, and the United States, enriching S&P/ASX 200 companies (which typically the process and enhancing outcomes for investors. equates to about 95% of S&P/ASX 200 by Our research philosophy focuses on bottom-up market capitalisation). Companies we choose analysis, developing differentiated and deep not to cover in this index are usually unattractive opinions on competitive forces, growth prospects, for most portfolios, in our opinion. and valuations for every company we cover. We × About 30 ex-S&P/ASX 200 stocks are selected publish on each company under coverage at least on Morningstar’s judgement of each security's quarterly, and as events demand, to ensure investment merit − which includes a very investment ideas are always relevant. strong lean towards high-quality companies We are an independent research house, and with sustainable competitive advantages, or therefore determine our coverage universe based economic moats. -

Antares June 2020 Dividend Builder Fund Quarterly Investment Update

Quarterly Investment Update Antares Dividend Builder– June 2020 For adviser use only Highlights for the quarter Performance: The Fund’s twin objectives are to provide a yield above that of the S&P/ASX 200 All Industrials Total Return index, as well as moderate capital growth over the medium term. Yield: The annual income yield to 30 June 2020 was 4.38% versus the benchmark’s yield of 3.21%. Many companies have announced changes to their dividend payments due to the coronavirus pandemic. We emphasize the importance of not using past performance as a guide to future performance. However, it is our objective to deliver income in excess of our benchmark. During the June quarter, dividends were paid by Boral, Nine Entertainment, Treasury Wine Estates, Viva Energy, Amcor and Harvey Norman. Contributors to capital returns: Positive contributors – CSL (underweight), Boral, Viva Energy; Negative contributors – Metcash, Afterpay (not owned), Macquarie Group (not owned). Stock Activity: Buys- Boral, CocaCola Amatil, GPT, Iress, Metcash, NAB; Sells – Treasury Wine Estates, Bank of Queensland, Harvey Norman, Tabcorp, Star Entertainment, Spark Infrastructure, Sydney Airport, Nine Entertainment Stock activity: Buys/additions – ; Sells/reductions – Fund snapshot Inception date 6 September 2005 Benchmark S&P/ASX 200 Industrials Total Return Index Deliver higher levels of tax effective dividend income than Investment objective the S&P/ASX 200 Industrials Total Return Index, and moderate capital growth Investment returns as at 30 June 20201 Since Period 3 months 1 year 3 years pa 5 years pa 10 years pa inception pa Portfolio3,4 income - 4.38 5.05 4.80 4.45 4.13 yield % Benchmark5,6 inc yield % - 3.21 3.90 3.99 3.94 - Net return2 % 14.7 -15.7 -2.3 0.7 7.5 5.8 1 Past performance is not a reliable indicator of future performance. -

Ellerston Australian Market Neutral Fund Performance Report | November 19

Ellerston Australian Market Neutral Fund Performance Report | November 19 PERFORMANCE SUMMARY Investment Objective The Fund targets Absolute Returns Since 3 Year 5 Year with an annualised return objective of Performance 1 Month 3 Months 6 Months 1 Year Inception (p.a.) (p.a.) 5% above the RBA Cash Rate over (p.a.) rolling five year periods. Net^ 1.52% 8.47% 18.03% 12.36% 2.33% 4.10% 7.38% Investment Strategy Benchmark* 0.06% 0.21% 0.48% 1.23% 1.41% 1.63% 1.84% The Fund will seek to provide investors Alpha 1.46% 8.26% 17.55% 11.13% 0.92% 2.47% 5.54% with a return profile that has low correlation with traditional asset Source: Ellerston Capital classes. The Fund aims to generate ^Net return figure is calculated after fees & expenses. Past performance is not a reliable indication of future performance positive returns in all market *RBA Cash Rate environment by reducing the majority of market risk and focusing on capital PORTFOLIO CHARACTERISTICS preservation and alpha generation. The Fund will utilise a Relative Value KEY PORTFOLIO METRICS and a Special Situations strategy. Positive months 67% Net Equity Exposure 19.6% Key Information No. Relative Value positions 52 Gross Portfolio Exposure 227.0% Correlation Coefficient (vs ASX 200 Strategy Inception 3 June 2013 No. Special Situations 28 5.79% Accum) Portfolio Manager Paul Drzewucki Beta Adjusted 4.6% Net Sharpe Ratio ( RFR = RBA Cash) 1.01 Application Price $1.0874 SECTOR ALLOCATION Net Asset Value $1.0847 Sector Long Equity Short Equity Net Equity Financials 41.8% -38.2% 3.6% Redemption Price $1.0820 Industrials 47.8% -18.5% 29.3% Liquidity Daily Resources 29.9% -26.6% 3.2% Management Fee 1.20% Index 3.8% -20.3% -16.5% 20% of Total 123.3% -103.7% 19.6% Performance Fee outperformance COMMENTARY Buy/Sell Spread 0.25%/0.25% The Fund produced a net return of +1.5% in November, outperforming the benchmark return of +0.1%. -

Australia & New Zealand Report 2018

DISCLOSURE INSIGHT ACTION Australia & New Zealand Report 2018 On behalf of over 650 investors with US$87 trillion in assets. CDP Report 2018 | Published February 2019 Contents 3 CEO foreword 14 Appendix I List of disclosing companies in Australia & 4 Disclosure in 2018 New Zealand 5 Climate Change: Australia & New 18 Appendix II Zealand insights Responding companies in Australia & New Zealand – supply chain program 9 Water Security: Driving water stewardship 19 Appendix III Non-responding companies in Australia & 10 Forests: Building sustainable New Zealand supply chains 12 CDP Australia & New Zealand Awards 2018 13 Investor Signatories & Members in Australia & New Zealand Important Notice The contents of this report may be used by anyone providing acknowledgement is given to CDP. This does not represent a license to repackage or resell any of the data reported to CDP or the contributing authors and presented in this report. If you intend to repackage or resell any of the contents of this report, you need to obtain express permission from CDP before doing so. CDP has prepared the data and analysis in this report based on responses to the CDP 2018 information request. No representation or warranty (express or implied) is given by CDP as to the accuracy or completeness of the information and opinions contained in this report. You should not act upon the information contained in this publication without obtaining specific professional advice. To the extent permitted by law, CDP does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this report or for any decision based on it. -

IML's Portfolios Well-Placed to Benefit from Corporate Activity

IML’s portfolios well-placed to benefit from corporate activity by IML Investment Team 26 July 2021 Over the past six months, there has been a significant increase in the level of corporate activity in the Australian sharemarket. This has included takeover approaches for Spark Infrastructure, Crown Resorts, Tabcorp’s wagering division, Sydney Airports, Vitalharvest, Australian Pharmaceutical Industries and a number of others. Companies have also been able to divest assets at much better than expected prices. Telstra, for instance, recently announced the sale of 49% of its mobile tower network ‘InfraCo Towers’ to a consortium for A$2.8 billion or 28 times earnings before interest, taxes, depreciation, and amortisation. This article seeks to explain why this is happening, what it means for a number of companies in IML’s portfolios, IML’s approach to corporate activity, and why IML’s portfolios are well-placed to benefit from these trends. Favourable environment for corporate activity Government and central bank responses to the COVID-19 pandemic have created a window of opportunity for many corporates and strategic buyers to execute on their long-held M&A ambitions, or to realise significantly higher proceeds from divesting assets. A well-executed acquisition can bring scale, integration benefits, and new capabilities which can strengthen a company’s future earnings and improve its competitive position in its industry. Ultra-low interest rates also make the economics of using debt to partially or fully fund an acquisition more potentially favourable. With the return on risk-free assets essentially zero, and the cost of borrowing long-term debt so low, the incentive for many corporates and private equity players to acquire high cash-generating businesses using high amounts of low-cost debt is very strong. -

Praemium Super Single Assets List.Pdf

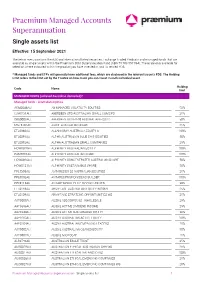

Praemium Managed Accounts Superannuation Single assets list Effective: 15 September 2021 The below menu contains the ASX and international listed securities, Exchange Traded Products and managed funds that are available as single assets within the Praemium SMA Superannuation Fund (ABN 75 703 857 864). These are only available for selection where indicated within the product you have invested in, and its related PDS. * Managed funds and ETPs will generally have additional fees, which are disclosed in the relevant issuer’s PDS. The Holding Limit refers to the limit set by the Trustee on how much you can invest in each individual asset. Holding Code Name limit MANAGED FUNDS (unlisted Australian domiciled)* Managed funds - Australian equities ACM0006AU AB MANAGED VOLATILITY EQUITIES 50% CSA0131AU ABERDEEN STD AUSTRALIAN SMALL COMS FD 25% CRS0003AU ABERDEEN STD EX-20 AUSTRALIAN EQS FD 50% MGE9705AU AIRLIE AUSTRALIAN SHARE 25% ETL0060AU ALLAN GRAY AUSTRALIA EQUITY A 100% ETL0091AU ALPHA AUSTRALIAN BLUE CHIP EQUITIES 50% ETL0092AU ALPHA AUSTRALIAN SMALL COMPANIES 25% HOW0019AU ALPHINITY AUSTRALIAN EQUITY 100% PAM0001AU ALPHINITY AUSTRALIAN SHARE 100% HOW0026AU ALPHINITY CONCENTRATED AUSTRALIAN SHARE 50% HOW0121AU ALPHINITY SUSTAINABLE SHARE 50% PPL5308AU ANTARES EX-20 AUSTRALIAN EQUITIES 25% PPL0002AU ANTARES PROF DIVIDEND BUILDER 100% PPL0115AU ANTARES PROF ELITE OPPORTUNITIES 50% ETL0148AU ARMYTAGE AUSTRALIAN EQUITY INCOME 25% ETL0139AU ARMYTAGE STRATEGIC OPPORTUNITIES WS 25% AAP0008AU AUSBIL 130/30 FOCUS - WHOLESALE 25% AAP3656AU AUSBIL ACTIVE