ABS-CBN Broadcasting Corporation Sgt

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2017-2018 Course Catalog Rose-Hulman Institute of Technology Course Catalog Programs of Study

2017-2018 Course Catalog Rose-Hulman Institute of Technology Course Catalog Programs of Study: Biochemistry Biochemistry & Molecular Biology (SMO) Biology Biomathematics Biomedical Engineering Chemical Engineering Chemistry Civil Engineering Computational Science Major (SMO) Computer Engineering Computer Science Economics Electrical Engineering Engineering Physics International Computer Science International Studies Major (SMO) Mathematics Mechanical Engineering Optical Engineering Physics Software Engineering ROTC: Air Force ROTC: Army Pre-Professional Programs Special Programs *(SMO) = Second Major Only 1 Rose-Hulman Institute of Technology Course Catalog Minors: Anthropology Software Engineering Art Solid State Physics / Material Astronomy Science Biochemical Engineering Statistics Biochemistry and Molecular Biology Sustainability Biomedical Engineering Theater Chemical Engineering Thermal Fluids Chemistry Cognitive Science Data Science East Asian Studies Economics Electrical and Computer Engineering Electrical Engineering Entrepreneurial Studies Environmental Chemistry Environmental Engineering European Studies Geography History Imaging Language and Literature Latin American Studies Mathematics Medical Physics and Nanomedicine Modern Languages o German o Japanese o Spanish Music Optical Engineering Philosophy Physics Political Science Psychology Robotics 2 Rose-Hulman Institute of Technology Course Catalog Biochemistry Graduates with a degree in biochemistry will be well -

A Celebration of 'Wow at Saya'

JUNE 2015 www.lopezlink.ph Sa ika-12 ng Hunyo, gunitain ang kanilang ipinaglaban. http://www.facebook.com/lopezlinkonline www.twitter.com/lopezlinkph Maligayang Araw ng Kalayaan, Pilipinas! #SKYat25: A celebration of ‘wow at saya’ AS a teen, Alex’s family had four channels on their TV, five on a good day. Residential landline phones were objects of wonder found in only a few homes, even in the 1990s. Comput- ers and cellphones were like extraterrestrials—one heard about them but didn’t actually see them. Turn to page 6 Samontes vs. Lopez Group 1Q financial Elizondos in Dad’s Day@Power results …page 2 …page 12 ‘Pasion’ …page 4 Plant Mall Lopezlink June 2015 Lopezlink June 2015 Biz News Biz News JANUARY TO MARCH 2015 FINANCIAL RESULTS (UNAUDITED) NET INCOME ATTRIBUTABLE TO Dispatch from Japan TOTAL CONSOLIDATED REVENUES EQUITY HOLDERS OF THE PARENT First Gen reports attributable COMPANY Embassy briefs vice mayors on PH-Japan relations 2014 2015 % change 2014 2015 % change net income up 18% at $50.5M FIRST Gen Corporation re- higher recurring net income The combined earnings of the P569.2M ABS-CBN P8.191B P8.391B +2 P538.1M +6 ported net income attributable contribution of the geothermal plants were $29.6M versus Lopez Holdings P23.535B P25.942B +10 P877M P1.095B +25 to equity holders of the parent and natural gas businesses. $27.6M in comparison to the EDC P7.138B P8.498B +19 P2.376B P2.493B +5 of $50.5 million for the first First Gen’s consolidated same quarter last year. -

Saksi December 16 2020 Pinoy TV Channel

Saksi December 16, 2020 | Pinoy TV Channel Saksi December 16, 2020 | Pinoy TV Channel 1 / 2 Share the best GIFs now >>> Kapamilya Teleserye GIFs Jun 12, 2020 · MANILA—Already ... HD Pinoy Teleserye Jun 17, 2021 · Watch ABS CBN Kapamilya Channel Teleserye It's ... List of programs broadcast by Kapamilya Channel Mar 16, 2021 · Ang Sayo Ay Akin Kapamilya Teleserye. ... Pinoy Tv. Saksi March 17 2021 .. Dec 15, 2020 — Watch Online Pinoy TV Drama Love in Sadness December 16, 2020, TodayFull Episode in Hd. Pinoy Channel Love in Sadness December 16, ... May 14, 2021 — Pinoy Tambayan: Pinoy Tv Jul 02, 2021 · 24 Oras July 1 2021 Today . ... PINOY TV May 14, 2021 · Pinoy TV Replay | Pinoy TV Channel | Pinoy Tambayan ... Teleserye Dec 16, 2020 · Watch Pinoy TV, Pinoy Lambingan, Pinoy .... Jun 11, 2021 - Pinoy Tambayan - Watch 24 Oras June 12 2021 Replay. ... Pinoy Tv Has a Lot of Pinoy Tambayan List That on Air in The Philipines Tv Shows.. Jun 18, 2020 — news channels, with only 10% using email news in Finland. • The proportion ... Notable changes over the last 12 months include a 16-percentage point fall in ... GMA Network (24 Oras, Saksi, GMA News TV). ABS-CBN (TV .... Bible-based videos for families, teenagers, and children. Documentaries about Jehovah's Witnesses. Watch or download. This is the official DEclips channel of GMA Pinoy TV, the flagship international ... Meteor Garden September 17 2020 in By Pinoy TV September 16, 2020.. Pinoy Channel has a Lot of TV Drama Like Go Back Couple December 16 2020 Online. Stay tuned with us .... OFWteleserye.su - Watch your favorite Pinoy TV Channel, Pinoy Tambayan, Pinoy Teleserye Replay, Pinoy TV Series and Pinoy TV Shows online for free! Download the official mobile app of GMA Network and get instant access to the latest news and entertainment updates delivered by the most awarded and most ... -

Diliman (Report 07.2016)

UNITED ARCHITECTS OF THE PHILIPPINES ______________DILIMAN________________ (Name of Chapter) Address: Blk 1 Lot 10 Celery St., Phase 6F Greenwoods, Executive Village, Cainta Contact and Email: [email protected] ACTIVITY REPORT NO. 001 JULY 10, 2016 UAP INAUGURAL RITES & STRATEGIC PLANNING CONFERENCE Photo Credits: Florencio Sebastian III District A-4 Director Florencio Sebastian III, UAP Diliman F.Y. 2016-2017 President Karen Kaye Ang, UAP Diliman IPP Rebecca Vanessa Rellosa and Ms. Steph Gilles participated at the recently held UAP Inaugural Rites & Strategic Planning Conference in Ilo-Ilo City last June 30-July 1, 2016. More information www.united-architects.org 5-Time PRC’s Most Outstanding Accredited Professional Organization of the Year (2002, 2007, 2008, 2011 & 2014) Photo Credits: Florencio Sebastian III More information www.united-architects.org 5-Time PRC’s Most Outstanding Accredited Professional Organization of the Year (2002, 2007, 2008, 2011 & 2014) UNITED ARCHITECTS OF THE PHILIPPINES ______________DILIMAN________________ (Name of Chapter) Address: Blk 1 Lot 10 Celery St., Phase 6F Greenwoods, Executive Village, Cainta Contact and Email: [email protected] ACTIVITY REPORT NO. 002 JULY 10, 2016 DILIMANER AS EMCEE DURING UAP INAUGURALS Photo Credits: Florencio Sebastian III UAP Diliman IPP Rebecca Vanessa Rellosa as the Master of the Ceremony during the Opening event, Officer’s Orientation Seminar and Inaugural Dinner for the new set of National Officers, Chapter Presidents and Committee Heads at the UAP Inaugural Rites -

First Philippine Holdings Corporation

A lopez Group Company April 4, 2013 SECURITIES AND EXCHANGE COMMISSION SEC Building, EDSA Greenhills Mandaluyong City, Metro Manila The management of First Philippine Holdings Corporation (the Company) is responsible for the preparation and fair presentation of the consolidated financial statements as of December 31, 2012 and 2011, and for each of the three years in the period ended December 31, 2012, in accordance with the Philippine Financial Reporting Standards, including the additional components attached therein. This responsibility includes designing and implementing internal controls relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error, selecting and applying appropriate accounting policies, and making accounting estimates that are reasonable in the circumstances. The Board of Directors reviews and approves the consolidated financial statements and submits the same to the stockholders of the Company. SyCip Gorres Velayo & Co., the independent auditors, appointed by the stockholders, has examined the consolidated financial statements of the Company in accordance with Philippine Standards on Auditing, and in its report to the stockholders, has expressed its opinion on the fairness of presentation upon completion of such examination. Signed under oath by the following: ~~n ~ ~J FEDERICO R. LOPEZ / ELPIDIO L. m~~ FRANCIS GILES B. PUNO Chairman of the Board President & -rw Executive Vice President, Treasurer & Chief Executive Officer Chief Operating Officer & Chief Finance Officer l\PR ':G,~~ SUBSCRlBED AND SWORN to before me this,lth ayof Ap~il, 2013, affiants exhibited to me their Competent Evidence of Identity (CEI) and Community Tax Certificate (CTC) Nos. as follows: Name Details of CEI/CTC Issued On/Issued At Federico R. -

Harnessing Rural Radio for Climate Change Mitigation and Adaptation in the Philippines

Harnessing Rural Radio for Climate Change Mitigation and Adaptation in the Philippines Working Paper No. 275 CGIAR Research Program on Climate Change, Agriculture and Food Security (CCAFS) Rex L. Navarro Renz Louie V. Celeridad Rogelio P. Matalang Hector U. Tabbun Leocadio S. Sebastian 1 Harnessing Rural Radio for Climate Change Mitigation and Adaptation in the Philippines Working Paper No. 275 CGIAR Research Program on Climate Change, Agriculture and Food Security (CCAFS) Rex L. Navarro Renz Louie V. Celeridad Rogelio P. Matalang Hector U. Tabbun Leocadio S. Sebastian 2 Correct citation: Navarro RL, Celeridad RLV, Matalang RP, Tabbun HU, Sebastian LS. 2019. Harnessing Rural Radio for Climate Change Mitigation and Adaptation in the Philippines. CCAFS Working Paper no. 275. Wageningen, the Netherlands: CGIAR Research Program on Climate Change, Agriculture and Food Security (CCAFS). Available online at: www.ccafs.cgiar.org Titles in this Working Paper series aim to disseminate interim climate change, agriculture and food security research and practices and stimulate feedback from the scientific community. The CGIAR Research Program on Climate Change, Agriculture and Food Security (CCAFS) is a strategic partnership of CGIAR and Future Earth, led by the International Center for Tropical Agriculture (CIAT). The Program is carried out with funding by CGIAR Fund Donors, Australia (ACIAR), Ireland (Irish Aid), Netherlands (Ministry of Foreign Affairs), New Zealand Ministry of Foreign Affairs & Trade; Switzerland (SDC); Thailand; The UK Government (UK Aid); USA (USAID); The European Union (EU); and with technical support from The International Fund for Agricultural Development (IFAD). For more information, please visit https://ccafs.cgiar.org/donors. Contact: CCAFS Program Management Unit, Wageningen University & Research, Lumen building, Droevendaalsesteeg 3a, 6708 PB Wageningen, the Netherlands. -

Philippine Humanities Review, Vol. 13, No

The Politics of Naming a Movement: Independent Cinema According to the Cinemalaya Congress (2005-2010) PATRICK F. CAMPOS Philippine Humanities Review, Vol. 13, No. 2, December 2011, pp. 76- 110 ISSN 0031-7802 © 2011 University of the Philippines 76 THE POLITICS OF NAMING A MOVEMENT: INDEPENDENT CINEMA ACCORDING TO THE CINEMALAYA CONGRESS (2005-2010) PATRICK F. CAMPOS Much has been said and written about contemporary “indie” cinema in the Philippines. But what/who is “indie”? The catchphrase has been so frequently used to mean many and sometimes disparate ideas that it has become a confusing and, arguably, useless term. The paper attempts to problematize how the term “indie” has been used and defined by critics and commentators in the context of the Cinemalaya Film Congress, which is one of the important venues for articulating and evaluating the notion of “independence” in Philippine cinema. The congress is one of the components of the Cinemalaya Independent Film Festival, whose founding coincides with and is partly responsible for the increase in production of full-length digital films since 2005. This paper examines the politics of naming the contemporary indie movement which I will discuss based on the transcripts of the congress proceedings and my firsthand experience as a rapporteur (2007- 2009) and panelist (2010) in the congress. Panel reports and final recommendations from 2005 to 2010 will be assessed vis-a-vis the indie films selected for the Cinemalaya competition and exhibition during the same period and the different critical frameworks which panelists have espoused and written about outside the congress proper. Ultimately, by following a number PHILIPPINE HUMANITIES REVIEW 77 of key and recurring ideas, the paper looks at the key conceptions of independent cinema proffered by panelists and participants. -

C NTENTASIA #Thejobsspace Pages 14, 15, 16

Bumper jobs issue C NTENTASIA #TheJobsSpace pages 14, 15, 16 www.contentasia.tv l https://www.facebook.com/contentasia?fref=ts facebook.com/contentasia l @contentasia l www.asiacontentwatch.com New Warner TV debuts on 15 March iZombie leads launch schedule Turner unveils the new version of regional entertainment channel Warner TV on 15 March, three days ahead of the express premiere in Asia of iZombie, the brain-eat- ing zombie show inspired by DC Comics. The new Warner TV debuts with a re- worked logo and the tagline “Get Into It”. The new schedule is divided into three clear pillars – drama, action and comedy. More on page 3 Hong Kong preps for Filmart 2015 800 exhibitors, 30 countries expected Digital entertainment companies are ex- pected to turn out in force for this year’s 19th annual Hong Kong Filmart, which runs from 23-26 March. Organisers said in the run up to the market that about 170 digital companies would participate. About 18% of these are from Hong Kong. The welcome mat is also being rolled More on page 16 Facing facts in China Docu bosses head for Asian Side of the Doc About 600 delegates are expected in the Chinese city of Xiamen for this year’s Asian Side of the Doc (ASD), including the event’s first delegation from Brazil and more indie producers than ever. This year’s event (17-20 March) takes place against sweeping changes in Chi- More on page 18 9-22 March 2015 page 1. C NTENTASIA 9-22 March 2015 Page 2. -

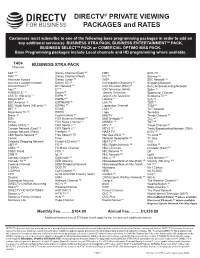

DIRECTV® PRIVATE VIEWING PACKAGES and RATES

DIRECTV® PRIVATE VIEWING PACKAGES and RATES Customers must subscribe to one of the following base programming packages in order to add on any additional service(s): BUSINESS XTRA PACK, BUSINESS ENTERTAINMENTTM PACK, BUSINESS SELECTTM PACK or COMERCIAL ÓPTIMO MÁS PACK. Base Programming packages include Local channels and HD programming where available. 140+ BUSINESS XTRA PACK Channels A&E HD Disney Channel (East) HD HSN RFD-TV AMC HD Disney Channel (West) IFC HD Science HD American Heroes Disney Junior HD INSP SEC Network HD America’s Auction Network Disney XD HD Investigation Discovery HD Shopping Network Animal Planet HD DIY Network HD ION Television (East) HD Son Life Broadcasting Network Aqui †† E! HD ION Television (West) Spike HD AUDIENCE® HD Enlace†† Jewelry Television Sportsman Channel AXS TV (HD only) HD ESPN HD Jewish Life Television SundanceTV HD BabyFirstTV ESPN2 HD Lifetime HD Syfy HD BBC America HD ESPNEWS HD Link TV TBS HD BBC World News (HD only) HD ESPNU HD Liquidation Channel TCM HD BET HD EVINE LMN HD TCT Network Bloomberg TV HD EWTN Logo TeenNick Bravo HD Food Network HD MAVTV Tennis Channel HD BTN FOX Business Network HD MLB Network HD TLC HD BYUtv FOX News Channel HD MSNBC HD TNT HD CANAL ONCE †† FOX Sports 1 HD MTV HD Travel Channel HD Cartoon Network (East) HD FOX Sports 2 HD MTV2 HD Trinity Broadcasting Network (TBN) Cartoon Network (West) Freeform HD NASA TV truTV HD CBS Sports Network HD Free Speech TV Nat Geo WILD HD TV Land HD Centric Fuse National Geographic HD TV One Celebrity Shopping Network Fusion (HD only) HD NBA TV HD TVG CMT HD FX HD NBC Sports Network HD UniMás HD CNBC HD FX Movie Channel NBC Universo Univision (East) HD CNBC World FXX HD NFL Network HD UP CNN HD fyi, HD NHL Network HD Uplift Comedy Central HD Galavisión HD Nick Jr. -

USBC Approved Bowling Balls

USBC Approved Bowling Balls (See rulebook, Chapter VII, "USBC Equipment Specifications" for any balls manufactured prior to January 1991.) ** Bowling balls manufactured only under 13 pounds. 5/17/2011 Brand Ball Name Date Approved 900 Global Awakening Jul-08 900 Global BAM Aug-07 900 Global Bank Jun-10 900 Global Bank Pearl Jan-11 900 Global Bounty Oct-08 900 Global Bounty Hunter Jun-09 900 Global Bounty Hunter Black Jan-10 900 Global Bounty Hunter Black/Purple Feb-10 900 Global Bounty Hunter Pearl Oct-09 900 Global Break Out Dec-09 900 Global Break Pearl Jan-08 900 Global Break Point Feb-09 900 Global Break Point Pearl Jun-09 900 Global Creature Aug-07 900 Global Creature Pearl Feb-08 900 Global Day Break Jun-09 900 Global DVA Open Aug-07 900 Global Earth Ball Aug-07 900 Global Favorite May-10 900 Global Head Hunter Jul-09 900 Global Hook Dark Blue/Light Blue Feb-11 900 Global Hook Purple/Orange Pearl Feb-11 900 Global Hook Red/Yellow Solid Feb-11 900 Global Integral Break Black Nov-10 900 Global Integral Break Rose/Orange Nov-10 900 Global Integral Break Rose/Silver Nov-10 900 Global Link Jul-08 900 Global Link Black/Red Feb-09 900 Global Link Purple/Blue Pearl Dec-08 900 Global Link Rose/White Feb-09 900 Global Longshot Jul-10 900 Global Lunatic Jun-09 900 Global Mach One Blackberry Pearl Sep-10 900 Global Mach One Rose/Purple Pearl Sep-10 900 Global Maniac Oct-08 900 Global Mark Roth Ball Jan-10 900 Global Missing Link Black/Red Jul-10 900 Global Missing Link Blackberry/Silver Jul-10 900 Global Missing Link Blue/White Jul-10 900 Global -

Ed 303 318 Author Title Institution Report No Pub

DOCUMENT RESUME ED 303 318 SE 050 265 AUTHOR Druger, Marvin, Ed. TITLE Science for the Fun of It. A Guide to Informal Science Education. INSTITUTION National Science Teachers Association, Washington, D.C. REPORT NO ISBN-0-87355-074-9 PUB DATE 88 NOTE 137p.; Photographs may not reproduce well. AVAILABLE FROMNational Science Teachers Association, 1742 Connecticut Avenue, NW, Washington, DC 20009 ($15.00, 10% discount on 10 or more). PUB TYPE Collected Works - General (020) -- Books (010) -- Guides - Non-Classroom Use (055) EDRS PRICE MF01 Plus Postage. PC Not Available from EDRS. DESCRIPTORS Educational Facilities; Educational Innovation; Educational Media; Educational Opportunities; Educational Television; *Elementary School Science; Elementary Secondary Education; *Mass Media; *Museums; *Nonformal Education; Periodicals; Program Descriptions; Science Education; *Secondary School Science; *Zoos ABSTRACT School provides only a small part of a child's total education. This book focuses on science learning outside of the classroom. It consists of a collection of articles written by people who are involved with sevaral types of informal science education. The value of informal science education extends beyond the mere acquisition of knowledge. Attitudes toward science can be greatly influenced by science experiences outside of the classroom. The intent of this book is to highlight some of the many out-of-school opportunities which exist including zoos, museums, television, magazines and books, and a variety of creative programs and projects. The 19 articles in this volume are organized into four major sections entitled: (1) "Strategies"; (2) "The Media"; (3) "Museums and Zoos"; and (4) "Projects, Coop2titions, and Family Activities." A bibliography of 32 references on these topies is included. -

DIRECTV® PUBLIC VIEWING PACKAGES and RATES

DIRECTV® PUBLIC VIEWING PACKAGES and RATES Customers must subscribe to one of the following base programming packages in order to add on any additional service(s): COMMERCIAL XTRA PACK, COMMERCIAL CHOICE PLUS, COMMERCIAL CHOICE, COMMERCIAL ENTER- TAINMENT PACK, BUSINESS SELECT PACK, COMERCIAL MÁS ULTRA PACK or COMERCIAL ÓPTIMO MÁS PACK. To receive DIRECTV HD programming, HD Access and equipment are required. COMMERCIAL XTRATM PACK — $139.99/month* 180+ The best in sports, news, entertainment and more! Includes locals & regional sports networks from across the country. Channels Service automatically renews**. *COMMERCIAL XTRA PACK (regularly $133.99/mo.) includes local channels, COMMERCIAL XTRA ($79.49/mo.), SPORTS PACK ($13.99/mo.) and Outlet Fee ($46.51/mo.). A&E HD Disney Channel (West) Hope Channel† QVC Plus ABC Family HD Disney Junior HD HSN ReelzChannel HD Al Jazeera America Disney XD HD IFC HD RFD-TV AMC HD DIY Network HD INSP Science HD American Heroes E! HD Investigation Discovery HD Spike HD Animal Planet HD El Rey ION Television (East) HD Sportsman Channel AUDIENCE® HD Enlace †† ION Television (West) Sprout AXS TV (HD only) HD ESPN HD Jewelry Television Syfy HD BabyFirstTV† ESPN2 HD Jewish Life Television† TBS HD BBC America HD ESPNEWS HD Lifetime HD TCM HD BET HD ESPNU HD Link TV TCT Network Bloomberg TV HD Esquire Network LMN HD TeenNick Boomerang EVINE Logo Tennis Channel HD Bravo HD EWTN MAVTV TLC HD BYUtv Food Network HD MLB Network HD TNT HD CANAL ONCE †† FOX Business Network HD MSNBC HD Travel Channel HD Cartoon Network