Dear Chairman

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Spooky Trades/Corporate Fraud an Introduction to Corporate Scandals Brainteaser Problem

Spooky Trades/Corporate Fraud An introduction to corporate scandals Brainteaser Problem: You and I are to play a competitive game. We shall take it in turns to call out integers. The first person to call out '50' wins. The rules are as follows: –The player who starts must call out an integer between 1 and 10, inclusive; –A new number called out must exceed the most recent number called by at least one and by no more than 10. (if first number is 5, the next number can be anything 6 to 15) Do you want to go first, and if so, what is your strategy? Brainteaser Solution: • Winning number must be just out of reach of other player • 50 -> 39 -> 28 -> 17 -> 6 Market Update • Eurozone - draghi came out with a more dovish tilt on the announcement regarding their QE program • Fed – Chairman still up in the air, but Powell is expected as of now • 19th party congress – People looking at to see what will happen with China going forward Fraud What is fraud? Death Arbitrage • Initially designed as an estate planning tool • If one joint-owner dies, the other is able to redeem the bond at par • Death put option on bonds + terminally ill patients = arbitrage • Banks would get mad and refuse to redeem to a hedge fund • “Fair exploit of a wall street loophole” Ponzi Scheme • Old investors are (falsely) told about great returns, while new investors’ capital is used to fulfill old investors’ capital withdrawals as needed • Essentially robbing Friend A to pay Friend B • Works until the money runs out Original Ponzi Scheme • Named after Charles Ponzi for his postal stamp arbitrage • Buy stamps cheap in Italy and exchange them for a higher value in the U.S. -

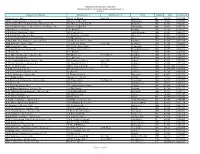

Agencie Name Address 1 Address 2 City State Zip License

Massachusettes Division of Insurance Massachusetts Licensed Property and Casualty Agencies 9/1/2011 Agencie Name Address 1 Address 2 City State Zip License 12 Interactive, LLC 224 West Huron Suite 6E Chicago IL 60654 1880124 20th Century Insurance Services,Inc 3 Beaver Valley Rd Wilmington DE 19803 1846952 21st Century Benefit & Insurance Brokerage, Inc. 888 Worcester St Ste 80 Wellesley MA 02482 1782664 21st Century Insurance And Financial Services, Inc. 3 Beaver Valley Rd Wilmington DE 19803 1805771 21st Insurance Agency P.O. Box 477 Knoxville TN 37901 1878897 A & K Fowler Insurance,LLC 200 Park Street North Reading MA 01864 1805577 A & P Insurance Agency,Inc. 273 Southwest Cutoff Worcester MA 01604 1780999 A .James Lynch Insurance Agency,Inc. 297 Broadway Lynn MA 019041857 1781698 A Plus Blue Lion Insurance Agency, LLC. 1324 Belmont Street Suite Brockton MA 02301 1887320 A&B Insurance Group, LLC 239 Littleton Road Suite 4B Westford MA 01886 1856659 A&R Associates, Ltd. 6379 Little River Tnpk Alexandria VA 22312 1847232 A. Action Insurance Agency Inc 173 West Center Street West Bridgewater MA 02379 1898416 A. B. Gile, Inc. P.O. Box 66 Hanover NH 03755 1842909 A. F. Macedo Insurance Agency, Inc. 646 Broadway P. O. Box C Raynham MA 02767 1781769 A. Gange & Sons, Inc. P.O. Box 301 Medford MA 02155 1780731 A. M. Franklin Insurance Agency, Inc. 300 Congress Street Ste. 308 Quincy MA 02169 1878527 A. Regan Insurance Agency, Inc. 213 Broadway Street (Rear) Methuen MA 01844 1872103 A. W. G. Dewar, Inc. 4 Batterymarch Park Ste 320 Quincy MA 021697468 1780211 A.A.Dority Company, Inc. -

Corporate Fraud 9.26.16

Corporate Fraud An introduction to corporate scandals Brainteaser Problem: Brainteaser Solution: • Monty Hall Problem (Wikipedia it for more info) Result if staying at Result if switching Behind door 1 Behind door 2 Behind door 3 door #1 to the door offered Car Goat Goat Wins Car Wins Goat Goat Car Goat Wins Goat Wins Car Goat Goat Car Wins Goat Wins Car QFS Mentorship Applications • Application Due October 6th at 11:59PM • Application will go live before Wednesday September 28th • What is Mentorship Program? • Who is it targeted towards? • Any Other Q’s? Fraud What is fraud? Ponzi Scheme • Old investors are (falsely) told about great returns, while new investors’ capital is used to fulfill old investors’ capital withdrawals as needed • Essentially robbing Friend A to pay Friend B • Works until the money runs out Original Ponzi Scheme • Named after Charles Ponzi for his postal stamp arbitrage • Buy stamps cheap in Italy and eXchange them for a higher value in the U.S. • Promised 50% profit in 45 days or 100% profit in 90 days • Would not work today… Bernie Madoff • Most famous Ponzi scheme • Madoff exhibited unrealistically steady returns of ~10% for decades • It all came crashing down when the SEC acted on tips from suspicious wealth managers • Ended up stealing $20 billion from clients, that he claimed was worth $65 billion Enron Accounting Fraud, Lies, Assholes Accounting Issues / Earnings Manipulation • Revenue Recognition Fraud • Downfall of Arthur Andersen • Earnings Targeting Rather than Operations Targeting Aggressive Culture but a Market Darling • Accusations / Critics all ignored • Debt paydown to reassure everyone (but nobody noticed that they used more debt to do it) • Dynegy intervention? Salad Oil Scandal The Culprit Behind the Scandal Anthony “Tino” De Angelis • Con-man at young age – as a teenager he worked in meat market managing 200 employees. -

Salad Oil Swindle’

THE ASTONISHING STORY OF THE ‘SALAD OIL SWINDLE’ Originally published in Accountancy © Emile Woolf | emilewoolfwrites.co.uk THE ASTONISHING STORY OF THE ‘SALAD OIL SWINDLE’ The great US salad oil swindle was first brought to light publicly, by a strange coincidence, on Friday 22 November 1963: the day President Kennedy was assassinated. From the publicity angle, its full dimensions were overshadowed by that momentous event, but there is no doubt that its impact, which lasted several years, was comparable with the great Wall Street crash 35 years earlier. An extravagant claim? The eventual losses were beyond precise computation, but must be placed conservatively at around $200m, spread over some 51 major banking and brokerage concerns in the USA and Europe, a number of which were bankrupted in the process. So analogous was the 1963 collapse to that of 1929 that one thing is clear: whatever lessons were learnt in the 20s and 30s were forgotten by the 60s. It is this fascinating question of whether there is in fact any benefit in hindsight, whether lessons of this order are ever really learnt, that makes it worthwhile reconsidering the salad oil swindle from our present vantage point; we may then discover whether it is merely the appearances that alter from generation to generation – the essential and causal ingredients remaining unchanged. Ingredients of what? Let me quote from the last few lines of Norman Miller’s penetrating analysis of the case: ‘Viewed in a broad context, Tino’s success as a master swindler was another indictment of the ethics of a vast segment of business. -

Primer on Commodity Frauds Final

UNCTAD/DITC/COM/39 7 March 2003 ENGLISH ONLY A PRIMER ON NEW TECHNIQUES USED BY THE SOPHISTICATED FINANCIAL FRAUDSTER WITH SPECIAL REFERENCE TO COMMODITY MARKET INSTRUMENTS Report prepared by the UNCTAD secretariat Executive summary Financial instruments such as documentary credit, structured finance and derivatives have proved their value in commodity trade. However, the sophisti cation of these instruments can also make them a tool for financial fraud. This report discusses how, using commodity market instruments such as letters of credit, warehouse receipts, Special Purpose Vehicles, futures and swaps, the sophisticated financia l fraudster may try to trick bankers, commercial counterparties, Government regulatory or tax offices, and shareholders. Various techniques that have been used in the past are described, and illustrated with case studies (e.g. the salad oil swindle, Solo Industries and Enron). Ways in which Governments, banks and commodity firms can reduce the potential for such frauds are summarized in the report’s conclusion. GE.03-50736 The designations employed and the presentation of the material in this document do not imply the expression of any opinion whatsoever on the part of the secretariat of UNCTAD concerning the legal status of any country, territory, city or area, or of its authorities, or concerning the definition of its frontiers or boundaries. This report was drafted by Lamon Rutten of the UNCTAD secretariat. The author thanks Anthony Belchambers (Futures and Options Association), Bogdan Rascanu (Caterpillar World Trading), Julian Roche, Jan de Sterke (Steinweg), Amos Taporaie (UNCTAD), and Jan Willem Termijtelen (Control Union World Group) for their useful comments, suggestions and contributions. -

Hellman Warren 2014.Pdf

Regional Oral History Office University of California The Bancroft Library Berkeley, California Warren Hellman: Financier, Philanthropist, Civic Patron, Mensch including supplemental interviews with: Philip Hammarskjold and Susan Hirsch Interviews conducted by Lisa Rubens in 2011 Copyright © 2014 by The Regents of the University of California ii Since 1954 the Regional Oral History Office has been interviewing leading participants in or well-placed witnesses to major events in the development of Northern California, the West, and the nation. Oral History is a method of collecting historical information through tape-recorded interviews between a narrator with firsthand knowledge of historically significant events and a well-informed interviewer, with the goal of preserving substantive additions to the historical record. The tape recording is transcribed, lightly edited for continuity and clarity, and reviewed by the interviewee. The corrected manuscript is bound with photographs and illustrative materials and placed in The Bancroft Library at the University of California, Berkeley, and in other research collections for scholarly use. Because it is primary material, oral history is not intended to present the final, verified, or complete narrative of events. It is a spoken account, offered by the interviewee in response to questioning, and as such it is reflective, partisan, deeply involved, and irreplaceable. ********************************* All uses of this manuscript are covered by a legal agreement between The Regents of the University of California and Warren Hellman dated October 1, 2012; Philip Hammarskjold dated August 22, 2014; and Susan Hirsch dated September 6, 2014. The manuscript is thereby made available for research purposes. All literary rights in the manuscript, including the right to publish, are reserved to The Bancroft Library of the University of California, Berkeley. -

| Book Reviews |

| Book Reviews | Resurgence of the Warfare State: ernment. Certainly, these statutes and the Washington Post on Nov. 4, 2001, The Crisis Since 9/11 the supporting court decisions created advocating reinstating the draft in order the dangerous notion prevalent today: to fight the war on terror. Higgs op- By Robert Higgs that civil liberties may be sacrificed in a poses the draft on libertarian grounds. The Independent Institute, Oakland, CA, 2005. time of war (whether the war is real or These two essays are so limited in their 252 pages, $12.95. imagined). If you need any further per- focus that, unless you have read the suading on this point, Higgs painfully underlying article, you can safely skip reminds us that approximately 160,000 these two short pieces. REVIEWED BY CA R OL A. SIGMOND Japanese-Americans were interned dur- The fourth section discusses the ing World War II, none of whom were way in which the unhealthy relation- “Cry ‘Havoc,’ and let slip the dogs guilty of anything except being of Japa- ship of the military-industrial complex of war”—a line from Shakespeare’s Ju- nese extraction. That these acts were with the Department of Defense results lius Caesar—sums up the disturbing approved of by contemporary society in powerful imperatives favoring war premise of Resurgence of the Warfare and sustained by the courts at that time (real or imagined). The title of one es- State, which is that the so-called war demonstrates the value of war to any say says it all: “Suppose You Wanted on terror is less about battling terror- government that seeks to restrain pub- to Have a Permanent War.” In this sec- ism than about government augment- lic discourse, individual freedom, and tion, Higgs makes three basic points. -

“Identifying Great Capital Allocators” Presented by Tom Gayner 11Th Annual Value Investor Conference—May 1 & 2, 2014

“Identifying Great Capital Allocators” presented by Tom Gayner 11th Annual Value Investor Conference—May 1 & 2, 2014 Markel CIO Tom Gayner's Transcript Below is the transcript including questions and answers of Tom Gayner's sold out talk at the 11th Annual Value Investor Conference held on May 1 and 2, 2014 in Omaha, just prior to Warren Buffett’s Berkshire Hathaway [NYSE:BRK.A] annual meeting. Miles: It takes a great investment manager to know one, so we asked our next presenter to help with “Identifying Great Capital Allocators.” Tom Gayner is President and Chief Investment Officer of Markel Corporation [NYSE:MKL]. He currently has approximately $18 billion in assets under management. Please welcome Tom Gayner. Gayner: Thanks very much for having me here today. I’m always humbled to be asked to speak. At the same time I appreciate the invitation very much, even though it means that I have to do a bit of homework. I also recognize that I’m the guy who is standing between you and drinks right now. It’s always an uncomfortable place to be, so I’ll try not to dawdle. As I said, I’m grateful for these periodic but not too frequent homework assignments, because they cause me to spend some time reflecting and considering what I’m going to say. I start with the basic proposition that if I’m going to say something, I’ve got to actually believe it. The good news is the process of getting ready for a talk helps me to examine my beliefs. -

From Benjamin Graham to Warren Buffett

THE EVOLUTION OF THE IDEA OF “VALUE INVESTING”: FROM BENJAMIN GRAHAM TO WARREN BUFFETT Robert F. Bierig1 Duke University Durham, North Carolina April 2000 1 Robert F. Bierig graduated summa cum laude and Phi Beta Kappa in 2000 from Duke University, where he studied economics and art history. During summer 1999, he worked for the investment firm of Ruane, Cunniff & Co. in New York City. He is currently employed as an investment banking analyst at Morgan Stanley Dean Witter in New York. Mr. Bierig grew up in Highland Park, Illinois. Acknowledgments From his freshman seminar on the life of John Maynard Keynes and in his many subsequent courses over the following four years, Professor E. Roy Weintraub instilled in me and many others an interest in the substance and history of economics. That interest led to my research on the evolution of the idea of “value investing” that is reflected in this paper. I would like to thank Professor Weintraub for his criticism and his insights that helped shape both this thesis and my development as a student of economics. 2 A Note on Sources This paper draws on the writings, speeches, and lectures of Benjamin Graham, Warren Buffett, their associates, and fellow practitioners; many biographies, interviews, and business histories; and relevant articles in newspapers, magazines, and professional journals. On the life and career of Benjamin Graham, the most balanced and thoroughly researched source is without question Janet Lowe’s Benjamin Graham on Value Investing. Lowe portrays Graham and his ideas through the eyes of several of his most devoted students, and her effort stands as the definitive biography on Graham. -

Manias, Panics, and Crashes: a History of Financial Crises

FM JWBK120/Kindleberger February 13, 2008 14:53 Char Count= Manias, Panics, and Crashes A History of Financial Crises Fifth Edition Charles P. Kindleberger and Robert Z. Aliber John Wiley & Sons, Inc. iii FM JWBK120/Kindleberger February 13, 2008 14:53 Char Count= ii FM JWBK120/Kindleberger February 13, 2008 14:53 Char Count= Manias, Panics, and Crashes Fifth Edition i FM JWBK120/Kindleberger February 13, 2008 14:53 Char Count= ii FM JWBK120/Kindleberger February 13, 2008 14:53 Char Count= Manias, Panics, and Crashes A History of Financial Crises Fifth Edition Charles P. Kindleberger and Robert Z. Aliber John Wiley & Sons, Inc. iii FM JWBK120/Kindleberger February 13, 2008 14:53 Char Count= C 2005 by Charles P. Kindleberger and Robert Z. Aliber; 1978, 1989, 1996, 2000 by Charles P. Kindleberger. All rights reserved. Foreword copyright by Robert M. Solow Published by John Wiley & Sons, Inc., Hoboken, New Jersey Published simultaneously in Canada No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, 222 Rosewood Drive, Danvers, MA 01923, 978-750-8400, fax 978-646-8600, or on the web at www.copyright.com. Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, 201-748-6011, fax 201-748-6008. -

FRAUD and ERROR – WHY, WHAT and HOW? 1. How Would You

FRAUD AND ERROR – WHY, WHAT AND HOW? 1. How would you define fraud? Fraud refers to an intentional act by one or more individuals among management, those charged with governance, employees, or third parties, involving the use of deception to obtain an unjust or illegal advantage. 2. What is the difference between fraud and error? The distinguishing factor between fraud and error is whether the underlying action that results in the misstatement in the financial statements is intentional or unintentional. Unlike error, fraud is intentional and usually involves deliberate concealment of the facts. Error refers to an unintentional misstatement in the financial statements, including the omission of an amount or disclosure. 3. Why is fraud important to us? Misstatements in the financial statements can arise from fraud or error. Although fraud is a broad legal concept, the auditor is concerned with fraudulent acts that cause a material misstatement in the financial statements. We should consider the risk of misstatement from fraud or error of each significant account balance, recognizing the material classes of transactions included therein, in order to identify specific risk. In addition, if a material misstatement is found due to the possibility of fraud, it may cause us to question management’s integrity and the reliability of evidence obtained from management in other areas of the audit. 4. What is the difference between management and employee fraud? Management fraud involves one or more members of management or those charged with governance. Those charged with governance - "Governance" is the term used to describe the role of persons entrusted with the supervision, control, and direction of an entity. -

Don't Be Fooled by the Blocks That It Got

Don’t be fooled by the blocks that it got. Blockchain, a revolution or not? W.R. van Nes 321311 ERASMUS UNIVERSITY ROTTERDAM Supervisor Erasmus School of Economics Dr. B. Kuipers Urban, Port & Transport Economics Second assessor Master thesis written at CARU containers O. de Jong MSc Preface Well, here I am. Sitting at CARU containers Rotterdam at the Seattleweg, working on the final pieces of my thesis. This was all quite unexpected to say the least. I would like to thank Siebren Hoekstra for putting me in the spotlight at CARU containers and Merijn Zondag for inviting me for a talk at the company. Because I definitely wanted to know the company better but I could not do a full-time internship, I got offered every kind of flexibility that was possible. I would like to thank Rob Tromp and Rob Feenstra for this fantastic opportunity. I have learnt a lot during this internship about CARU containers and the people that work here. The atmosphere is very pleasant and generous. I could ask anyone about anything. What I noticed later on is that some of the employees were also honestly interested in my thesis subject. My topic arose during a brainstorm session with both Merijn Zondag and my supervisor from the Erasmus University Bart Kuipers, who I would both like to thank for the guidance that was offered during the entire thesis process but also for some tips that might be useful for the rest of my life. During my research I got into contact with several blockchain experts in the field.