From Benjamin Graham to Warren Buffett

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

29:390:470:01 & 02 COURSE TITLE: Security Analysis

Department of Finance and Economics COURSE NUMBER: 29:390:470:01 & 02 COURSE TITLE: Security Analysis COURSE MATERIALS Lecture notes and assignments will be distributed via Blackboard. Required Textbooks: 1) “Value Investing – from Graham to Buffett and Beyond”, Bruce Greenwald, Judd Kahn, Paul Sonkin and Michael Biema. Wiley Finance. ISBN 0-471-46339-6 2) “The Warren Buffett Way”, 3rd Edition, Robert Hagstrom, Wiley Other readings (buy used copies): 3) “The Intelligent Investor”, Benjamin Graham. Revised Edition 2006 by Harper Collins Publishers. ISBN-10 0-06-055566-1 4) “Security Analysis”, 1951 Edition”, Benjamin Graham & David L. Dodd by McGraw Hill. ISBN 0-07-144820-9 5) “The Essays of Warren Buffett: Lessons for Corporate America”, First Revised Edition, by Lawrence A. Cunningham, ISBN-10: 0-9664461-1-9 6) “Investment Banking: Valuation, Leveraged Buyouts, and Mergers and Acquisitions”, Joshua Rosenbaum, Joshua Pearl and Joseph R. Perella (Wiley Finance) 2009. ISBN 978-0-470-44220-3 FINAL GRADE ASSIGMENT Grades Mid-Term: 40% Equity Challenge competition: 60% (team work) Teams: Each student must be part of a team of 4 members. Please take advantage of student diversity in your class. Your team is expected to work on class assignments and the equity challenge competition. 1 Department of Finance and Economics (29:390:470) COURSE SCHEDULE Course Outline Week 1: Principles of Security Analysis Lectures 1A & 1B Buying a business Lecture 1C Read Accounting Clinic 1 Appendix 1 Week 2: Balance Sheet, Income Statement Lectures 2A & 2B Appendix -

The Mecca of Value Investing

The mecca of Value Investing Subject: The mecca of Value Invesng From: CSH Investments <[email protected]> Date: 6/18/2019, 1:44 PM To: Randy <[email protected]> View this email in your browser Some of you know I'm a big believer in lifetime learning. It wasn't always the case. My early academic years were less than stellar. But I caught on fairly quickly and made do. By my late 20's I knew I wanted to be in finance. I had studied finance and economics in college but it didn't really grab me. Looking back partly it was me but also it was the way it was taught. Stodgy old theories that really didn't make any sense to me. The Efficient Market Theory for instance. EMT says basically that the markets are fully efficient. That stocks are perfectly priced therefore there aren't any bargains. You have absolutely nothing to gain from fundamental analysis and if you do it you are wasting your time. Yeah I thought but I knew there were guys who did exactly that. They did 1 of 5 6/18/2019, 4:48 PM The mecca of Value Investing their own research and found things that were mispriced. Most of them were quite wealthy. If the market is perfectly efficient as you say then how can they do it? And almost every theory had a list of assumptions you had to make. Here's one I love, every investor has the same information. Well, let's just be logical every investor doesn't have the same information and even if they did they would interpret differently. -

Value Investing” Has Had a Rough Go of It in Recent Years

True Value “Value investing” has had a rough go of it in recent years. In this quarter’s commentary, we would like to share our thoughts about value investing and its future by answering a few questions: 1) What is “value investing”? 2) How has value performed? 3) When will it catch up? In the 1992 Berkshire Hathaway annual letter, Warren Buffett offers a characteristically concise explanation of investment, speculation, and value investing. The letter’s section on this topic is filled with so many terrific nuggets that we include it at the end of this commentary. Directly below are Warren’s most salient points related to value investing. • All investing is value investing. WB: “…we think the very term ‘value investing’ is redundant. What is ‘investing’ if it is not the act of seeking value at least sufficient to justify the amount paid?” • Price speculation is the opposite of value investing. WB: “Consciously paying more for a stock than its calculated value - in the hope that it can soon be sold for a still-higher price - should be labeled speculation (which is neither illegal, immoral nor - in our view - financially fattening).” • Value is defined as the net future cash flows produced by an asset. WB: “In The Theory of Investment Value, written over 50 years ago, John Burr Williams set forth the equation for value, which we condense here: The value of any stock, bond or business today is determined by the cash inflows and outflows - discounted at an appropriate interest rate - that can be expected to occur during the remaining life of the asset.” • The margin-of-safety principle – buying at a low price-to-value – defines the “Graham & Dodd” school of value investing. -

Not All Value Is True Value: the Case for Quality-Value Investing

For professional use only Not all value is true value: the case for quality-value investing • A rise in inflation could prompt a long-awaited resurgence for value stocks • Investors looking to add a value tilt can benefit from a quality-value approach with a focus on dividend sustainability • Stringent ESG integration and an adaptive approach can help value investors navigate turbulence and beat the market www.nnip.com Not all value is true value: the case for quality-value investing Inflation-related speculation has reached fever pitch in recent weeks. Signs of rising consumer prices are leading equity investors to abandon the growth stocks that have outperformed for more than a decade, and to look instead to the long-unloved value sectors that would benefit from rising inflation. How can investors interested in incorporating a value tilt in their portfolios best take advantage of this opportunity? We explain why we believe a quality-value approach, with a focus on long-term stability, adaptiveness and ESG integration, is the way to go. Value sectors have by and large underperformed since the continue delivering hefty fiscal support. In particular, 10-year Great Financial Crisis. There are several reasons for this. bond yields – a common market indicator that inflation might be Central banks have taken to using unconventional tools that about to increase – have been steadily climbing over the past distorted the yield curve, such as quantitative easing, which few months (see Figure 1). has led many investors to pay significant premiums for growth stocks. All-time-low interest rates and the absence of inflation- ary pressures have exacerbated this trend. -

Gwen Weiss BB.Indd

EXTRAORDINARY CENTENARIANS IN AMERICA Their secrets to living a long vibrant life R GWEN WEISSNUMEROFF PUBLISHING HOUSE 151 Howe Street, PUBLISHING HOUSE Victoria BC Canada V8V 4K5 COPYRIGHT© 2013, Gwen Weiss-Numeroff. PAGE All rights reserved. Without limiting the rights under copyright reserved above, no part of this publication may be reproduced, stored in or introduced into a retrieval system, or } transmitted, in any form or by any means (electronic, mechanical, photocopying, } recording or otherwise), without the prior A portion of the written permission of both the copyright author’s royalties owner and the publisher of this book. will be donated to the Ovarian Cancer For rights information and bulk \Research Fund. orders, please contact us through agiopublishing.com Extraordinary Centenarians in America is based on the recollections of the people commemorated in this book as well as their closest family members. Due to the possibility of human error, the author cannot guarantee the complete accuracy of the information. It should also be noted that since the time the interviews were conducted, some of these individuals have passed away. The author expresses her condolences to their loved ones and hopes this book will serve as a reminder of their incredible legacy. Although nutrition and lifestyle data has been collected and reported, the author is not dispensing medical advice or calling Extraordinary Centenarians in America this a scientifi c study. The intent of the ISBN 978-1-897435-86-1 (paperback) author is to provide information for ISBN 978-1-897435-87-8 (hardcover) readers to consider in consultation with ISBN 978-1-897435-88-5 (ebook) their health practitioners. -

Spooky Trades/Corporate Fraud an Introduction to Corporate Scandals Brainteaser Problem

Spooky Trades/Corporate Fraud An introduction to corporate scandals Brainteaser Problem: You and I are to play a competitive game. We shall take it in turns to call out integers. The first person to call out '50' wins. The rules are as follows: –The player who starts must call out an integer between 1 and 10, inclusive; –A new number called out must exceed the most recent number called by at least one and by no more than 10. (if first number is 5, the next number can be anything 6 to 15) Do you want to go first, and if so, what is your strategy? Brainteaser Solution: • Winning number must be just out of reach of other player • 50 -> 39 -> 28 -> 17 -> 6 Market Update • Eurozone - draghi came out with a more dovish tilt on the announcement regarding their QE program • Fed – Chairman still up in the air, but Powell is expected as of now • 19th party congress – People looking at to see what will happen with China going forward Fraud What is fraud? Death Arbitrage • Initially designed as an estate planning tool • If one joint-owner dies, the other is able to redeem the bond at par • Death put option on bonds + terminally ill patients = arbitrage • Banks would get mad and refuse to redeem to a hedge fund • “Fair exploit of a wall street loophole” Ponzi Scheme • Old investors are (falsely) told about great returns, while new investors’ capital is used to fulfill old investors’ capital withdrawals as needed • Essentially robbing Friend A to pay Friend B • Works until the money runs out Original Ponzi Scheme • Named after Charles Ponzi for his postal stamp arbitrage • Buy stamps cheap in Italy and exchange them for a higher value in the U.S. -

Value Investing Iii: Requiem, Rebirth Or Reincarnation!

VALUE INVESTING III: REQUIEM, REBIRTH OR REINCARNATION! The Lead In Value Investing has lost its way! ¨ It has become rigid: In the decades since Ben Graham published Security Analysis, value investing has developed rules for investing that have no give to them. Some of these rules reflect value investing history (screens for current and quick ratios), some are a throwback in time and some just seem curmudgeonly. For instance, ¤ Value investing has been steadfast in its view that companies that do not have significant tangible assets, relative to their market value, and that view has kept many value investors out of technology stocks for most of the last three decades. ¤ Value investing's focus on dividends has caused adherents to concentrate their holdings in utilities, financial service companies and older consumer product companies, as younger companies have shifted away to returning cash in buybacks. ¨ It is ritualistic: The rituals of value investing are well established, from the annual trek to Omaha, to the claim that your investment education is incomplete unless you have read Ben Graham's Intelligent Investor and Security Analysis to an almost unquestioning belief that anything said by Warren Buffett or Charlie Munger has to be right. ¨ And righteous: While investors of all stripes believe that their "investing ways" will yield payoffs, some value investors seem to feel entitled to high returns because they have followed all of the rules and rituals. In fact, they view investors who deviate from the script as shallow speculators, but are convinced that they will fail in the "long term". 2 1. -

The Intelligent Investor

THE INTELLIGENT INVESTOR A BOOK OF PRACTICAL COUNSEL REVISED EDITION BENJAMIN GRAHAM Updated with New Commentary by Jason Zweig An e-book excerpt from To E.M.G. Through chances various, through all vicissitudes, we make our way.... Aeneid Contents Epigraph iii Preface to the Fourth Edition, by Warren E. Buffett viii ANote About Benjamin Graham, by Jason Zweigx Introduction: What This Book Expects to Accomplish 1 COMMENTARY ON THE INTRODUCTION 12 1. Investment versus Speculation: Results to Be Expected by the Intelligent Investor 18 COMMENTARY ON CHAPTER 1 35 2. The Investor and Inflation 47 COMMENTARY ON CHAPTER 2 58 3. A Century of Stock-Market History: The Level of Stock Prices in Early 1972 65 COMMENTARY ON CHAPTER 3 80 4. General Portfolio Policy: The Defensive Investor 88 COMMENTARY ON CHAPTER 4 101 5. The Defensive Investor and Common Stocks 112 COMMENTARY ON CHAPTER 5 124 6. Portfolio Policy for the Enterprising Investor: Negative Approach 133 COMMENTARY ON CHAPTER 6 145 7. Portfolio Policy for the Enterprising Investor: The Positive Side 155 COMMENTARY ON CHAPTER 7 179 8. The Investor and Market Fluctuations 188 iv v Contents COMMENTARY ON CHAPTER 8 213 9. Investing in Investment Funds 226 COMMENTARY ON CHAPTER 9 242 10. The Investor and His Advisers 257 COMMENTARY ON CHAPTER 10 272 11. Security Analysis for the Lay Investor: General Approach 280 COMMENTARY ON CHAPTER 11 302 12. Things to Consider About Per-Share Earnings 310 COMMENTARY ON CHAPTER 12 322 13. A Comparison of Four Listed Companies 330 COMMENTARY ON CHAPTER 13 339 14. -

Benjamin Graham: the Father of Financial Analysis

BENJAMIN GRAHAM THE FATHER OF FINANCIAL ANALYSIS Irving Kahn, C.F.A. and Robert D. M£lne, G.F.A. Occasional Paper Number 5 THE FINANCIAL ANALYSTS RESEARCH FOUNDATION Copyright © 1977 by The Financial Analysts Research Foundation Charlottesville, Virginia 10-digit ISBN: 1-934667-05-6 13-digit ISBN: 978-1-934667-05-7 CONTENTS Dedication • VIlI About the Authors • IX 1. Biographical Sketch of Benjamin Graham, Financial Analyst 1 II. Some Reflections on Ben Graham's Personality 31 III. An Hour with Mr. Graham, March 1976 33 IV. Benjamin Graham as a Portfolio Manager 42 V. Quotations from Benjamin Graham 47 VI. Selected Bibliography 49 ******* The authors wish to thank The Institute of Chartered Financial Analysts staff, including Mary Davis Shelton and Ralph F. MacDonald, III, in preparing this manuscript for publication. v THE FINANCIAL ANALYSTS RESEARCH FOUNDATION AND ITS PUBLICATIONS 1. The Financial Analysts Research Foundation is an autonomous charitable foundation, as defined by Section 501 (c)(3) of the Internal Revenue Code. The Foundation seeks to improve the professional performance of financial analysts by fostering education, by stimulating the development of financial analysis through high quality research, and by facilitating the dissemination of such research to users and to the public. More specifically, the purposes and obligations of the Foundation are to commission basic studies (1) with respect to investment securities analysis, investment management, financial analysis, securities markets and closely related areas that are not presently or adequately covered by the available literature, (2) that are directed toward the practical needs of the financial analyst and the portfolio manager, and (3) that are of some enduring value. -

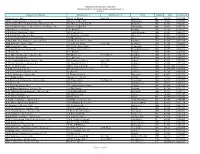

Agencie Name Address 1 Address 2 City State Zip License

Massachusettes Division of Insurance Massachusetts Licensed Property and Casualty Agencies 9/1/2011 Agencie Name Address 1 Address 2 City State Zip License 12 Interactive, LLC 224 West Huron Suite 6E Chicago IL 60654 1880124 20th Century Insurance Services,Inc 3 Beaver Valley Rd Wilmington DE 19803 1846952 21st Century Benefit & Insurance Brokerage, Inc. 888 Worcester St Ste 80 Wellesley MA 02482 1782664 21st Century Insurance And Financial Services, Inc. 3 Beaver Valley Rd Wilmington DE 19803 1805771 21st Insurance Agency P.O. Box 477 Knoxville TN 37901 1878897 A & K Fowler Insurance,LLC 200 Park Street North Reading MA 01864 1805577 A & P Insurance Agency,Inc. 273 Southwest Cutoff Worcester MA 01604 1780999 A .James Lynch Insurance Agency,Inc. 297 Broadway Lynn MA 019041857 1781698 A Plus Blue Lion Insurance Agency, LLC. 1324 Belmont Street Suite Brockton MA 02301 1887320 A&B Insurance Group, LLC 239 Littleton Road Suite 4B Westford MA 01886 1856659 A&R Associates, Ltd. 6379 Little River Tnpk Alexandria VA 22312 1847232 A. Action Insurance Agency Inc 173 West Center Street West Bridgewater MA 02379 1898416 A. B. Gile, Inc. P.O. Box 66 Hanover NH 03755 1842909 A. F. Macedo Insurance Agency, Inc. 646 Broadway P. O. Box C Raynham MA 02767 1781769 A. Gange & Sons, Inc. P.O. Box 301 Medford MA 02155 1780731 A. M. Franklin Insurance Agency, Inc. 300 Congress Street Ste. 308 Quincy MA 02169 1878527 A. Regan Insurance Agency, Inc. 213 Broadway Street (Rear) Methuen MA 01844 1872103 A. W. G. Dewar, Inc. 4 Batterymarch Park Ste 320 Quincy MA 021697468 1780211 A.A.Dority Company, Inc. -

The Heilbrunn Center's First Annual Letter 2012 – 2013

The Heilbrunn Center’s First Annual Letter 2012 – 2013 Greetings from the Heilbrunn Center! As we embark on another academic year, we are excited to announce the courses and events the Heilbrunn Center is supporting in conjunction with our two major themes for 2012 – 2013: highlighting women investors and celebrating 85 years of Benjamin Graham. Faculty We welcome back from sabbatical center co-director Professor Bruce Greenwald. Bruce taught Globalization with Joseph Stiglitz in July and will teach Economics Fall Semester Spring Semester of Strategic Behavior and Course Name Professor Course Name Professor Value Investing in Spring Applied Value Investing Artie Williams/ Advanced Investment Ken Shubin-Stein/Cheryl 2013. T. Charlie Quinn Research Einhorn Applied Value Investing Avi Berg/ We are very pleased to Applied Security Analysis Jon Salinas/Naveen Michelle Borre 1&2 Bhatia welcome new faculty Applied Security Analysis Ciara Burnham members: Rishi Renjen Applied Value Investing Jeff Gramm/ (EMBA) Terry Kontos (Maverick Capital), Lauren Applied Value Investing Tom Tryforos (EMBA) Applied Value Investing Mark Cooper Krueger ’02 (Esopus Creek Applied Value Investing Arnaud Ajdler Advisors), Yen Liow (Ziff (EMBA) Applied Value Investing Mike Blitzer/ Applied Value Investing Eric Almeraz/David Horn Brothers), Patrick Sullivan Guy Shanon ’11 (Ziff Brothers), Ellen Applied Value Investing Neal Nathani Carr (Capital Group), Eric Applied Value Investing Rishi Renjen/ Credit Markets and Margaret Cannella Kevin Oro-Hahn Leveraged Buy-Outs Almeraz ’02 (Apis Capital), Distressed Value Investing Dan Krueger and David Horn ’02 (Kiron Credit Markets and Margaret Cannella Economics of Strategic Bruce Greenwald Advisors), and Ciara Leveraged Buy-Outs Behavior (EMBA) Burnham ’93 (Evercore (EMBA) From Feast to Famine Margaret Cannella/Ellen (And Back Again) Carr Partners). -

The Intelligent Investor: the Definitive Book on Value Investing. a Book of Practical Counsel by Benjamin Graham and Jason Zweig

The Intelligent Investor: The Definitive Book on Value Investing. A Book of Practical Counsel by Benjamin Graham and Jason Zweig Security Analysis: Sixth Edition, Foreword by Warren Buffett by Benjamin Graham and David Dodd Contrarian Investment Strategies: The Psychological Edge by David Dreman Margin of Safety: Risk-Averse Value Investing Strategies for the Thoughtful Investor by Seth A. Klarman What Has Worked In Investing: Studies of Investment Approaches and Characteristics Associated with Exceptional Returns by Tweedy, Browne Company LLC Value Investing: From Graham to Buffett and Beyond by Bruce C. N. Greenwald and Judd Kahn The Little Book That Builds Wealth: The Knockout Formula for Finding Great Investments by Pat Dorsey The Five Rules for Successful Stock Investing: Morningstar's Guide to Building Wealth and Winning in the Market by Pat Dorsey Common Stocks and Uncommon Profits and Other Writings by Philip A. Fisher The Investment Checklist: The Art of In-Depth Research by Michael Shearn Financial Statements: A Step-by-Step Guide to Understanding and Creating Financial Reports by Thomas R. Ittelson Active Value Investing: Making Money in Range-Bound Markets by Vitaliy N. Katsenelson The Little Book of Sideways Markets: How to Make Money in Markets that Go Nowhere by Vitaliy N. Katsenelson The Art of Value Investing: How the World's Best Investors Beat the Market by John Heins and Whitney Tilson The Art of Short Selling Hardcover by Kathryn F. Staley The Most Important Thing Illuminated: Uncommon Sense for the Thoughtful Investor by Howard Marks and Paul Johnson Financial Shenanigans: How to Detect Accounting Gimmicks & Fraud in Financial Reports, 3rd Edition by Howard Schilit and Jeremy Perler Quality of Earnings by Thornton L.