An Empirical Conjectural Variation Model of Oligopoly

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Endogenous Market Power"

Endogenous Market Power Marek Weretkay August 5, 2010 Abstract In this paper we develop a framework to study thin markets, in which all traders, buyers, and sellers are large, in the sense that they all have market power (also known as bilateral oligopoly). Unlike many IO models, our framework does not assume a priori that some traders have or do not have market power because “they are large or small.” Here, market power arises endogenously for each trader from market clearing and optimization by all agents. This framework allows for multiple goods and heterogeneous traders. We de…ne an equilibrium and show that such equilibrium exists in economies with smooth utility and cost functions and is determinate. The model suggests that price impact depends positively on the convexity of preferences or cost functions of the trading partners. In addition, the market power of di¤erent traders reinforces that of others. We also characterize an equilibrium outcome: Compared to the competitive model, the volume of trade is reduced and hence is Pareto ine¢ cient. JEL classification: D43, D52, L13, L14 Keywords: Thin Markets, Bilateral Oligopoly, Walrasian Auction The problem of the exchange of goods among rational traders is at the heart of economics. The study of this problem, originating with the work of Walras and re…ned by Fisher, Hicks, Samuelson, Arrow, and Debreu, provides a well-established methodology for analyzing market interactions in an exchange economy. The central concept of this approach is competitive equilibrium, wherein it is assumed that individual traders cannot a¤ect prices. Price taking behavior is justi…ed by the informal argument that the economy is so large that each individual trader is negligible and hence has no impact on price. -

Anaheim Showcases the Magic OF

BY MARY ELLEN KUHN AN AHEIM SHOWCS A ES THE MAGIC OF IFT pg 24 08.09 • www.ift.org Photos of the 2009 IFT Annual Meeting & Food Expo were taken by Lagniappe Studio. I F T 2009 Annual Me eting & Food E x p o ANAHEIM 2 3 ear round, Anaheim/Orange year. With members representing County, Calif., is home to beauti- 63 countries on hand in Anaheim, Yful beaches, a vacation-friendly the Annual Meeting & Food Expo climate, and, of course, the magical was very much a global gathering. realm of Disneyland. For three days in The event drew about 1,400 inter- June this year, it was also home to the national attendees, and the roster of magic of IFT as a fascinating world of exhibitors included 164 companies food-focused exploration and inven- based outside the United States. MAGIC OF IFT tion unfolded at the Anaheim Conven- International programming The 2009 Annual Meeting & tion Center. kicked off before the official start of The 2009 IFT Annual Meet- the Annual Meeting & Food Expo Food Expo delivered substantive ing & Food Expo® drew more than with the fourth IFT International 14,500 food industry professionals Food Nanoscience Conference spon- science, a multi-faceted from around the world to Southern sored by the Netherlands Foreign California (1). Attendee registration Investment Agency and Canada’s exposition, and countless this year increased by 10% com- Advanced Foods & Materials Net- pared with last year’s event in New work. Global outreach continued on opportunities to celebrate and Orleans. With average convention Wednesday after the Annual Meet- support the best of food thinking. -

Kellogg Company 2012 Annual Report

® Kellogg Company 2012 Annual Report ™ Pringles Rice Krispies Kashi Cheez-It Club Frosted Mini Wheats Mother’s Krave Keebler Corn Pops Pop Tarts Special K Town House Eggo Carr’s Frosted Flakes All-Bran Fudge Stripes Crunchy Nut Chips Deluxe Fiber Plus Be Natural Mini Max Zucaritas Froot Loops Tresor MorningStar Farms Sultana Bran Pop Tarts Corn Flakes Raisin Bran Apple Jacks Gardenburger Famous Amos Pringles Rice Krispies Kashi Cheez-It Club Frosted Mini Wheats Mother’s Krave Keebler Corn Pops Pop Tarts Special K Town House Eggo Carr’s Frosted Flakes All-Bran Fudge Stripes Crunchy Nut Chips Deluxe Fiber Plus Be Natural Mini Max Zucaritas Froot Loops Tresor MorningStar Farms Sultana Bran Pop Tarts Corn Flakes Raisin Bran Apple JacksCONTENTS Gardenburger Famous Amos Pringles Rice Letter to Shareowners 01 KrispiesOur Strategy Kashi Cheez-It03 Club Frosted Mini Wheats Pringles 04 Our People 06 Mother’sOur Innovations Krave Keebler11 Corn Pops Pop Tarts Financial Highlights 12 Our Brands 14 SpecialLeadership K Town House15 Eggo Carr’s Frosted Flakes Financials/Form 10-K All-BranBrands and Trademarks Fudge Stripes01 Crunchy Nut Chips Deluxe Selected Financial Data 14 FiberManagement’s Plus Discussion Be & Analysis Natural 15 Mini Max Zucaritas Froot Financial Statements 30 Notes to Financial Statements 35 LoopsShareowner Tresor Information MorningStar Farms Sultana Bran Pop Tarts Corn Flakes Raisin Bran Apple Jacks Gardenburger Famous Amos Pringles Rice Krispies Kashi Cheez-It Club Frosted Mini Wheats Mother’s Krave Keebler Corn Pops Pop Tarts Special K Town House Eggo Carr’s Frosted Flakes All-Bran Fudge Stripes Crunchy Nut Chips Deluxe Fiber Plus2 Be NaturalKellogg Company 2012 Annual Mini Report MaxMOVING FORWARD. -

Markets and Hierarchies: Analysis and Antitrust Implications

Markets and Hierarchies: Analysis and Antitrust Implications A Study in the Economics of Internal Organization Oliver E. Williamson University of Pennsylvania THE FREE PRESS A Division of Macmillan Publishing Co., Inc. ~ NEW YORK Collier Macmillan Publishers LONDON ...... 1. Toward a New Institutional Economics A broadly based interest among economists in what might be referred to as the "new institutional economics" has developed in recent years. Aspects of mainline microtheory, economic history, the economics of property rights, comparative systems, labor economics, and industrial organization• have each had a bearing on this renaissance. The common threads that tie these various studies together are: (1) an evolving consensus that received microtheory, as useful and powerful as it is for many purposes, operates at too high a level of abstraction to permit many important microeconomic phenomena to be addressed in an uncontrived way; and (2) a sense that the study of "transactions," which concerned the institutionalists in the profes sion some forty years ago, is really a core matter and deserves renewed attention. Unlike the earlier institutionalists, however, the current group is inclined to be eclectic. The new institutional economists both draw on microtheory and, for the most part, regard what they are doing as comple mentary to, rather than a substitute for, conventional analysis. The spirit in which this present book is written very much follows the ~hinking of these new institutionalists. I hope, by exploring microeconomic Issues of markets and hierarchies in greater detail than conventional analysis commonly employs, to achieve a better understanding of the origins and functions of various firm and market structures- stretching from ele ~entary work groups to complex modern corporations. -

Dynamic Duopoly with Output Adjustment Costs in International Markets: Taking the Conjecture out of Conjectural Variations

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Research Papers in Economics This PDF is a selection from an out-of-print volume from the National Bureau of Economic Research Volume Title: Trade Policies for International Competitiveness Volume Author/Editor: Robert C. Feenstra, editor Volume Publisher: University of Chicago Press Volume ISBN: 0-226-23949-7 Volume URL: http://www.nber.org/books/feen89-1 Conference Date: April 29-30, 1988 Publication Date: 1989 Chapter Title: Dynamic Duopoly with Output Adjustment Costs in International Markets: Taking the Conjecture out of Conjectural Variations Chapter Author: Robert Driskill, Stephen McCafferty Chapter URL: http://www.nber.org/chapters/c6178 Chapter pages in book: (p. 125 - 144) 4 Dynamic Duopoly with Output Adjustment Costs in International Markets: Taking the Conjecture out of Conjectural Variations Robert Driskill and Stephen McCafferty Microeconomics in general and trade economists in particular have made wide use of the conjectural variations approach to modeling oligopolistic behavior. Most users of this approach acknowledge its well-known shortcomings but defend its use as a “poor man’s’’ dynamics, capable of capturing dynamic considerations in a static framework. As one example, Eaton and Grossman ( 1986) organize discussion about optimal trade policy in international oligopolistic markets around the question of whether conjectural variations are Nash-Coumot, Bertrand, or consistent in the sense of Bresnahan (1981). Their primary finding is that the optimal policy might be a tax, a subsidy, or free trade, depending on whether the exogenous conjectural variation is Nash-Coumot, Bertrand, or consistent. -

Nutribalance-5000 Nutritional Scale

NutriBalance-5000 Nutritional Scale Carb. Guide Contains over 7000 additional food codes for carbohydrates! oz Max: 11lb d: 0.1oz MR M+ WT 9 Prot 7 8 Cal Sal 0 Tare 6 Fat Carb Col 4 5 Fibr 3 g/oz CLR 2 WT MC 1 How To Use This Manual: This manual provides a cross-reference of carbohydrate codes for the NutriBalance nutritional scale, based on the USDA National Nutrient Database Release 18. When using this manual, only the Carb function of the Nutribalance should be used. All other nutritional buttons such as Fiber, Prot, etc will not display accurate information. 1. To find the Carb Code for a food item, simply use the Acrobat Search function (Ctrl+F or Ctrl+Shift+F). Enter the name of the food item in the Search Field and hit Enter. Give the search time to complete. 2. Once you find your food item in the manual, select your code from the “Code to use” column, or the Code (Fiber Method) column. 3. Place the food item onto the weighing platform and enter the code using the keypad. Now press the Carb button. NOTE: The NutriBalance requires 3-digit input for the code to be accepted. Therefore, if the “Code to use” is 3, you should enter 003, etc. Code to use Code Carbo- Fiber_ Refuse_ Modified ( Fiber hydrt TD Pct Carbs (- Method) fiber) MILK SUBSTITUTES,FLUID,W/ 41 41 6.16 0 0 6.16 LAURIC ACID OIL MILK,WHL,3.25% MILKFAT 85 85 4.52 0 0 4.52 MILK,PRODUCER,FLUID,3.7% 819 819 4.65 0 0 4.65 MILKFAT MILK,RED 819 819 4.68 0 0 4.68 FAT,FLUID,2%MILKFAT,W/ADDED VIT A MILK,RED FAT,FLUID,2% 696 696 4.97 0 0 4.97 MILKFAT,W/ NONFAT MILK SOL&VIT A MILK,RED -

Conjectural Variation’ in Cournot Duopoly, Evaluate Its Impacts and Discuss the Policy Implication

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Munich Personal RePEc Archive MPRA Munich Personal RePEc Archive Explain `conjectural variation' in Cournot duopoly, evaluate its impacts and discuss the policy implication Niall Edward Douglas University of St. Andrews December 2006 Online at http://mpra.ub.uni-muenchen.de/13652/ MPRA Paper No. 13652, posted 27. February 2009 18:59 UTC Explain ‘conjectural variation’ in Cournot duopoly, evaluate its impacts and discuss the policy implication To fully understand the impacts and policy implications of conjectural variation, one must first understand the part it played in the great indeterminacy debate within marginal economics during the first half of the 20th century. Therefore, this paper shall begin with a short description and history of conjectural variation, followed by how the debates surrounding it led to the final resolution of the indeterminacy issue. The policy implications of that resolution for imperfect markets are then briefly discussed. Definition & History At the beginning of the 20th century, political economics, as it was still known then, was wrestling with the indeterminacy issue i.e.; whether an economy tended towards an equilibrium or not1. The prevailing mood of the time felt a strong need that an economy should be determinate as it was not understood then how otherwise an economy should not fall apart2. The problem was that empirical evidence strongly suggested indeterminacy, as did some of the most notable Economists of the time. F. Y. Edgeworth (1897) was considered to have given the authoritative judgement on the indeterminacy of Cournot duopoly by showing that the imposition of a quantity constraint caused the market price to oscillate inside an interval3. -

United and American Airlines

UC Berkeley Working Paper Series Title Estimating a Mixed Strategy: United and American Airlines Permalink https://escholarship.org/uc/item/2f36z7n1 Authors Golan, Amos Karp, Larry S. Perloff, Jeffrey M. Publication Date 1998-06-01 eScholarship.org Powered by the California Digital Library University of California Estimating a Mixed Strategy: United and American Airlines Amos Golan Larry S. Karp Jeffrey M. Perloff June 1998 Abstract We develop a generalized maximum entropy estimator that can estimate pure and mixed strategies subject to restrictions from game theory. This method avoids distributional assumptions and is consistent and efficient. We demonstrate this method by estimating the mixed strategies of duopolistic airlines. KEYWORDS: Mixed strategies, noncooperative games, oligopoly, maximum entropy, airlines JEL: C13, C35, C72, L13, L93 George Judge was involved in every stage of this paper and was a major contributor, but is too modest to agree to be a coauthor. He should be. We are very grateful to Jim Brander and Anming Zhang for generously providing us with the data used in this study. Contact: Jeffrey M. Perloff (510/642-9574; 510/643-8911 fax) Department of Agricultural and Resource Economics 207 Giannini Hall University of California Berkeley, California 94720 [email protected] Revised: June 25, 1998 Printed: July 23, 1999 Table of Contents 1. INTRODUCTION 1 2. OLIGOPOLY GAME 3 2.1 Strategies 4 2.2 Econometric Implications 5 3. GENERALIZED-MAXIMUM-ENTROPY ESTIMATION APPROACH 8 3.1 Background: Classical Maximum Entropy Formulation 8 3.2 The Basic Generalized Maximum Entropy Formulation 10 3.3 Generalized Maximum Entropy Formulation of the Nash Model 12 3.4 Properties of the Estimators and Normalized Entropy 13 4. -

[email protected]

A CONJECTURAL VARIATION COMPUTABLE GENERAL EQUILIBRIUM MODEL WITH FREE ENTRY by Roberto A. De Santis* The Kiel Institute of World Economics Düsternbrooker Weg 120, 24105, Kiel, Germany E-mail: [email protected] ABSTRACT: This paper proposes a procedure to incorporate the conjectural variation approach in Computable General Equilibrium (CGE) analysis such that the strategic interaction among rival firms in international markets can be modelled. It shows how to calibrate the conjectured reactions of rival domestic and foreign firms. It also shows that the approach suggested by Harrison, Rutherford and Tarr (henceforth, HRT) is valid if Cournot competition prevails among domestic firms, among foreign firms, and between domestic and foreign firms. A conjectural variation CGE model applied to Turkey indicates that, if Cournot competition prevails between domestic and foreign firms, the results obtained under the HRT approach are very similar to those obtained under the conjectural variation approach. However, if foreign firms expect that rival domestic firms would react to their own action, then the results change dramatically. In a more competitive context, a large welfare gain from trade liberalisation can be generated. KEYWORDS: Price cost margin, Conjectural variation, CGE analysis. JEL classification: D43, D58. * I am indebted to Glenn Harrison, Thomas Rutherford, Frank Stähler and John Whalley for their valuable comments on an early stage of this paper. All errors are my responsibility. 1. Introduction The CGE modelling literature has developed quite markedly in the last two decades. Initially, these models were constructed under the assumption of perfect competition and constant returns to scale (CRS). In the middle eighties, under the wave of the ‘new trade theory’,1 models with industrial organisation features were used to study the impact of trade policy actions when industries are characterised by endogenous market structure, and the economies to scale are exploited at firm level. -

World Nutrition Volume 5, Number 3, March 2014

World Nutrition Volume 5, Number 3, March 2014 World Nutrition Volume 5, Number 3, March 2014 Journal of the World Public Health Nutrition Association Published monthly at www.wphna.org Processing. Breakfast food Amazing tales of ready-to-eat breakfast cereals Melanie Warner Boulder, Colorado, US Emails: [email protected] Introduction There are products we all know or should know are bad for us, such as chips (crisps), sodas (soft drinks), hot dogs, cookies (biscuits), and a lot of fast food. Nobody has ever put these items on a healthy list, except perhaps industry people. Loaded up with sugar, salt and white flour, they offer about as much nutritional value as the packages they’re sold in. But that’s just the tip of the iceberg, the obvious stuff. The reach of the processed food industry goes a lot deeper than we think, extending to products designed to look as if they’re not really processed at all. Take, for instance, chains that sell what many people hope and believe are ‘fresh’ sandwiches. But since when does fresh food have a brew of preservatives like sodium benzoate and calcium disodium EDTA, meat fillers like soy protein, and manufactured flavourings like yeast extract and hydrolysed vegetable protein? Counting up the large number of ingredients in just one sandwich can make you cross-eyed. I first became aware of the enormity of the complex field known as food science back in 2006 when I attended an industry trade show. That year IFT, which is for the Institute of Food Technologists, and is one of the food industry’s biggest gatherings, was held in New Warner M. -

The Measurement of Conjectural Variations in an Oligopoly Industry

EG & EA WORKING PAPERS THE MEASUREMENT OF CONJECTURAL VARIATIONS IN AN OLIGOPOLY INDUSTRY Robert P. Rogers WORKING PAPER NO. 102 November 1983 FI'CBureau of Ec onomics working papers arepreliminary materials circulated to stimulate discussion and critical comment All data contained in themare in the public domain. This includesinfo rmation obtained by the Commissionwhich has become part of public record. The analyses and conclusions set forth are those of the authors and do not necessarily reflect the views of othermemb ers of the Bureauof Economics, other Commission staff, or the Commission itself. Upon request, single copies of the paper will be provided. Referencesin publications to FTCBureau of Economics working papers by FTC economists (other than acknowledgement by a writer that he has accessto such unpublhed mat erial s) should be cleared with the author to protect the tentative character of these papers. BUREAUOF ECONOMICS FEDERALTRADE COMMISSION WASHINGTON,DC 20580 DRAF T (Please do not quote for re ference without permission) The Measurement of Conjectural Vari ations in an Oligopoly Industry by Ro bert P. Rogers Federal Trade Commission Washington, D.C. 20580 Novem ber 1983 The views expressed in this paper are those of the aut hor and therefore do not necessarily reflect the position of the Federal Trade Commission or any individual Commissioner. I. Introduction Oligopolistic markets are common if not ubiquitous, but econo mists have only put forth a num ber of competing hypotheses on how firms behave in these situations. The outstanding characteristic of these markets is that any one firm can significantly influence industry output and price. -

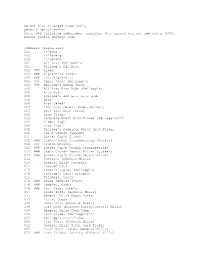

Cereal List Arranged Numerically Generic Default=***** Note: ### Following Codenumber Signifies That Cereal Was Not Updated in 2001, Please Choose Another Code

Cereal List arranged numerically generic default=***** Note: ### following codenumber signifies that cereal was not updated in 2001, please choose another code COMPLETE CEREAL LIST 000 ***None 000 ***Rarely 000 ***Seldom 001 All Bran (Kellogg's) 001 Kellogg's All Bran 002 ### Alpen 003 ### Alpha-Bits (Post) 003 ### Post Alpha-Bits 004 ### Apple Jacks (Kellogg's) 004 ### Kellogg's Apple Jacks 005 All Bran Bran Buds (Kellogg's) 005 Bran Buds 005 Kellogg's All Bran Bran Buds 006 Bran 006 Bran Cereal 007 100% Bran Cereal (Nabisco/Post) 007 Post 100% Bran Cereal 009 Bran Flakes 009 Complete Wheat Bran Flakes (Kellogg's)*** 009 Fiber, High 009 High Fiber 009 Kellogg's Complete Wheat Bran Flakes 011 Cap'n Crunch (Quaker) 011 Quaker Cap'n Crunch 012 ### Cap'n Crunch Crunchberries (Quaker) 012 ### Crunch Berries 012 ### Quaker Cap'n Crunch Crunchberries 013 ### Cap'n Crunch Peanut Butter (Quaker) 013 ### Quaker Cap'n Crunch Peanut Butter 014 Cheerios (General Mills) 014 General Mills Cheerios 014 Toasted Oats 015 Cocoa Krispies (Kellogg's) 015 Kellogg's Cocoa Krispies 015 Krispies, Cocoa 016 ### Cocoa Pebbles (Post) 016 ### Pebbles, Cocoa 016 ### Post Cocoa Pebbles 017 Cocoa Puffs (General Mills) 017 General Mills Cocoa Puffs 017 Puffs, Cocoa 019 Chex, Corn (General Mills) 019 Corn Chex (Ralston Purina/General Mills) 019 General Mills Corn Chex 020 Corn Flakes (Kellogg's)*** 020 Kellogg's Corn Flakes 022 Corn Total (General Mills) 022 General Mills Total Corn Flakes 022 Total Corn Flakes (General Mills) 023 ### Corn Flakes, Country (General Mills)