Carly Fiorina, HP Chairman and Chief Executive Officer

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

New CSC Computing Resources

New CSC computing resources Atte Sillanpää, Nino Runeberg CSC – IT Center for Science Ltd. Outline CSC at a glance New Kajaani Data Centre Finland’s new supercomputers – Sisu (Cray XC30) – Taito (HP cluster) CSC resources available for researchers CSC presentation 2 CSC’s Services Funet Services Computing Services Universities Application Services Polytechnics Ministries Data Services for Science and Culture Public sector Information Research centers Management Services Companies FUNET FUNET and Data services – Connections to all higher education institutions in Finland and for 37 state research institutes and other organizations – Network Services and Light paths – Network Security – Funet CERT – eduroam – wireless network roaming – Haka-identity Management – Campus Support – The NORDUnet network Data services – Digital Preservation and Data for Research Data for Research (TTA), National Digital Library (KDK) International collaboration via EU projects (EUDAT, APARSEN, ODE, SIM4RDM) – Database and information services Paituli: GIS service Nic.funet.fi – freely distributable files with FTP since 1990 CSC Stream Database administration services – Memory organizations (Finnish university and polytechnics libraries, Finnish National Audiovisual Archive, Finnish National Archives, Finnish National Gallery) 4 Current HPC System Environment Name Louhi Vuori Type Cray XT4/5 HP Cluster DOB 2007 2010 Nodes 1864 304 CPU Cores 10864 3648 Performance ~110 TFlop/s 34 TF Total memory ~11 TB 5 TB Interconnect Cray QDR IB SeaStar Fat tree 3D Torus CSC -

Quickspecs HP Integrity Bl870c Server Blade Overview

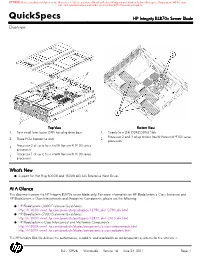

RETIRED: Retired products sold prior to the November 1, 2015 separation of Hewlett-Packard Company into Hewlett Packard Enterprise Company and HP Inc. may have older product names and model numbers that differ from current models. QuickSpecs HP Integrity BL870c Server Blade Overview Top View Bottom View 1. Four small form factor (SFF) hot-plug drive bays 1. Twenty-four (24) DDR2 DIMM Slots Processor 2 and 3 of up to four Intel® Itanium® 9100 series 2. Three PCIe Mezzanine slots 2. processors Processor 0 of up to four Intel® Itanium® 9100 series 3. processors Processor 1 of up to four Intel® Itanium® 9100 series 4. processors What's New Support for Hot Plug 600GB and 450GB 6G SAS Enterprise Hard Drives At A Glance This document covers the HP Integrity BL870c server blade only. For more information on HP BladeSystem c-Class Enclosure and HP BladeSystem c-Class Interconnects and Mezzanine Components, please see the following: HP BladeSystem c3000 Enclosure QuickSpecs: http://h18000.www1.hp.com/products/quickspecs/12790_div/12790_div.html HP BladeSystem c7000 Enclosure QuickSpecs: http://h18000.www1.hp.com/products/quickspecs/12810_div/12810_div.html HP BladeSystem c-Class Interconnect and Mezzanine Components: http://h18004.www1.hp.com/products/blades/components/c-class-interconnects.html http://h18004.www1.hp.com/products/blades/components/c-class-adapters.html The HP Integrity BL870c delivers the performance, reliability, and availability on 64-bit operating systems for the ultimate in DA - 12926 Worldwide — Version 16 — June 24, 2011 Page 1 RETIRED: Retired products sold prior to the November 1, 2015 separation of Hewlett-Packard Company into Hewlett Packard Enterprise Company and HP Inc. -

HP/NVIDIA Solutions for HPC Compute and Visualization

HP Update Bill Mannel VP/GM HPC & Big Data Business Unit Apollo Servers © Copyright 2015 Hewlett-Packard Development Company, L.P. The information contained herein is subject to change without notice. The most exciting shifts of our time are underway Security Mobility Cloud Big Data Time to revenue is critical Decisions Making IT critical Business needs must be rapid to business success happen anywhere Change is constant …for billion By 2020 billion 30 devices 8 people trillion GB million 40 data 10 mobile apps 2 © Copyright 2015 Hewlett-Packard Development Company, L.P. The information contained herein is subject to change without notice. HP’s compute portfolio for better IT service delivery Software-defined and cloud-ready API HP OneView HP Helion OpenStack RESTful APIs WorkloadWorkload-optimized Optimized Mission-critical Virtualized &cloud Core business Big Data, HPC, SP environments workloads applications & web scalability Workloads HP HP HP Apollo HP HP ProLiant HP Integrity HP Integrity HP BladeSystem HP HP HP ProLiant SL Moonshot Family Cloudline scale-up blades & Superdome NonStop MicroServer ProLiant ML ProLiant DL Density and efficiency Lowest Cost Convergence Intelligence Availability to scale rapidly built to Scale for continuous business to accelerate IT service delivery to increase productivity Converged Converged network Converged management Converged storage Common modular HP Networking HP OneView HP StoreVirtual VSA architecture Global support and services | Best-in-class partnerships | ConvergedSystem 3 © Copyright 2015 Hewlett-Packard Development Company, L.P. The information contained herein is subject to change without notice. Hyperscale compute grows 10X faster than the total market HPC is a strategic growth market for HP Traditional Private Cloud HPC Service Provider $50 $40 36% $30 50+% $B $20 $10 $0 2013 2014 2015 2016 2017 4 © Copyright 2015 Hewlett-Packard Development Company, L.P. -

HP Pavilion Ze4100 Notebook PC / Compaq Evo Notebook N1010v

HP Pavilion ze4100 Notebook PC Compaq Evo Notebook N1010v Series Compaq Presario 1100 Series Mobile PC Technology Code KE Service Manual © 2002 Hewlett-Packard Company Microsoft and Windows are trademarks of Microsoft Corporation in the U.S. and/or other countries. Intel, Celeron, and Pentium are trademarks of Intel Corporation in the U.S. and/or other countries. All other product names mentioned herein may be trademarks of their respective companies. HP shall not be liable for technical or editorial errors or omissions contained herein or for incidental or consequential damages in connection with the furnishing, performance, or use of this material. The information in this document is provided “as is” without warranty of any kind, including, but not limited to, the implied warranties of merchantability and fitness for a particular purpose, and is subject to change without notice. The warranties for HP products are set forth in the express limited warranty statements accompanying such products. Nothing herein should be construed as constituting an additional warranty. This document contains proprietary information that is protected by copyright. No part of this document may be photocopied, reproduced, or translated to another language without the prior written consent of Hewlett-Packard Company. Service Manual First Edition October 2002 Reference Number: N1010v/1100/ze4100 Document Part Number: F5761-90006 ii Service Manual Contents Product Information..................................................................................................... -

Compaq Insight Manager 7 Technical Reference Guide

Compaq Insight Manager 7 Technical Reference Guide Part Number 175757-003 April 2002 (Seventh Edition) Product Version: Version 3.1 Compaq Insight Manager 7 helps maximize system uptime and performance and reduces the cost of maintaining the IT infrastructure by providing proactive notification of problems before those problems result in costly downtme and reduced worker productivity. COMPAQ CONFIDENTIAL Codename: Puff Part Number: 175757-003 Last Saved On: 4/4/02 3:20 PM © 2002 Compaq Information Technologies Group, L.P. Compaq, the Compaq logo, Compaq Insight Manager, DeskPro, ProLiant, SmartStart, ActiveUpdate, AlphaServer, Tru64, NonStop, OpenVMS, SoftPaq, and ProSignia are trademarks of Compaq Information Technologies Group, L.P. in the U.S. and/or other countries. Microsoft, MS-DOS, Windows, and Windows NT are trademarks of Microsoft Corporation in the U.S. and/or other countries. All othe product names mentioned herein may be trademarks of their respective companies. Compaq shall not be liable for technical or editorial errors or omissions contained herein. The information in this document is provided “as is” without warranty of any kind and is subject to change without notice. The warranties for Compaq products are set forth in the express limited warranty statements accompanying such products. Nothing herein should be construed as constituting an additional warranty. Compaq Insight Manager 7 Technical Reference Guide April 2002 (Seventh Edition) Part Number 175757-003 COMPAQ CONFIDENTIAL Codename: Puff Part Number: 175757-003 -

Firmenhistorien Zur Rechentechnik

Biographien von Herstellern zur Rechentechnik in der rechentechnischen Sammlung des Geodätischen Instituts der Leibniz Universität Hannover In alphabetischer Reihenfolge Inhalte ohne Anspruch auf Vollständigkeit von Rainer Heer 1 Ascota (Astra) VEB 1919 Mechaniker-Werkstatt von John E. Greve in Chemnitz, Schlossstraße 2, 1921 Gründung der Astra-Werke AG in Chemnitz, Herbertstraße 9, Eintragung in HR Blatt 8209, dann HRB 23, Vorstand: John Greve, erste Mustermaschine des Modells A mit Einfachtastatur, erste deutsche und eu- ropäische Zehnertastatur. 1922 Fertigungsverlagerung in die Reitbahnstraße 40 1923 Beginn der Serienfertigung Modell A, (produziert bis 1939 mit 1 451 Stück) 1924 Modell B (Addier- und Subtrahiermaschine), Weiterent wicklung Modell A - D mit elektrischem Antrieb, Stellenan- zeiger und Sprungwagen 1928 Steigerung der Belegschaft von 175 im Jahr 1923 auf 407 Mitarbeiter. Jahresprodukti- on: Modell A: 446 Stück, Modell B: 1 183 Stück, Modell C: 810 Stück, Modell D: 313 Stück. 1928 Duplexmaschine in verschiedener Ausstattung, ab 1938 als Klasse 3/Modell 320 bis 340 (Buchungsmaschine mit 1 Saldierwerk und 1 Duplexwerk) Bild 1: Fertigungsstätte Astra-Werke 1929 1928 Triplexmaschine in verschiedener Ausstattung: ab 1938 als Klasse 4/Modell 420 und 430 (3 Zählwerke) 1929 Inbetriebnahme der neuen Fertigungsstätte im Bauhausstil auf der Altchemnitzer Straße 41 (siehe Bild 1); neue Modelle der Pultmaschinen und der Symbol-Buchungsmaschine: (Modelle J, K, L) 1930 Multiplex - Buchungsautomat mit bis zu 16 Registern, 1938-41 Produktion -

HP Integrity Nonstop Operations Guide for H-Series and J-Series Rvus

HP Integrity NonStop Operations Guide for H-Series and J-Series RVUs HP Part Number: 529869-023 Published: February 2014 Edition: J06.03 and subsequent J-series RVUs and H06.13 and subsequent H-series RVUs © Copyright 2014 Hewlett-Packard Development Company, L.P. Legal Notice Confidential computer software. Valid license from HP required for possession, use or copying. Consistent with FAR 12.211 and 12.212, Commercial Computer Software, Computer Software Documentation, and Technical Data for Commercial Items are licensed to the U.S. Government under vendor’s standard commercial license. The information contained herein is subject to change without notice. The only warranties for HP products and services are set forth in the express warranty statements accompanying such products and services. Nothing herein should be construed as constituting an additional warranty. HP shall not be liable for technical or editorial errors or omissions contained herein. Export of the information contained in this publication may require authorization from the U.S. Department of Commerce. Microsoft, Windows, and Windows NT are U.S. registered trademarks of Microsoft Corporation. Intel, Pentium, and Celeron are trademarks or registered trademarks of Intel Corporation or its subsidiaries in the United States and other countries. Java® is a registered trademark of Oracle and/or its affiliates. Motif, OSF/1, Motif, OSF/1, UNIX, X/Open, and the "X" device are registered trademarks, and IT DialTone and The Open Group are trademarks of The Open Group in the U.S. and other countries. Open Software Foundation, OSF, the OSF logo, OSF/1, OSF/Motif, and Motif are trademarks of the Open Software Foundation, Inc. -

Memorandum in Opposition to Hewlett-Packard Company's Motion to Quash Intel's Subpoena Duces Tecum

ORIGINAL UNITED STATES OF AMERICA BEFORE THE FEDERAL TRADE COMMISSION ) In the Matter of ) ) DOCKET NO. 9341 INTEL. CORPORATION, ) a corporation ) PUBLIC ) .' ) MEMORANDUM IN OPPOSITION TO HEWLETT -PACKARD COMPANY'S MOTION TO QUASH INTEL'S SUBPOENA DUCES TECUM Intel Corporation ("Intel") submits this memorandum in opposition to Hewlett-Packard Company's ("HP") motion to quash Intel's subpoena duces tecum issued on March 11,2010 ("Subpoena"). HP's motion should be denied, and it should be ordered to comply with Intel's Subpoena, as narrowed by Intel's April 19,2010 letter. Intel's Subpoena seeks documents necessary to defend against Complaint Counsel's broad allegations and claimed relief. The Complaint alleges that Intel engaged in unfair business practices that maintained its monopoly over central processing units ("CPUs") and threatened to give it a monopoly over graphics processing units ("GPUs"). See CompI. iiii 2-28. Complaint Counsel's Interrogatory Answers state that it views HP, the world's largest manufacturer of personal computers, as a centerpiece of its case. See, e.g., Complaint Counsel's Resp. and Obj. to Respondent's First Set ofInterrogatories Nos. 7-8 (attached as Exhibit A). Complaint Counsel intends to call eight HP witnesses at trial on topics crossing virtually all of HP' s business lines, including its purchases ofCPUs for its commercial desktop, commercial notebook, and server businesses. See Complaint Counsel's May 5, 2010 Revised Preliminary Witness List (attached as Exhibit B). Complaint Counsel may also call HP witnesses on other topics, including its PUBLIC FTC Docket No. 9341 Memorandum in Opposition to Hewlett-Packard Company's Motion to Quash Intel's Subpoena Duces Tecum USIDOCS 7544743\'1 assessment and purchases of GPUs and chipsets and evaluation of compilers, benchmarks, interface standards, and standard-setting bodies. -

Compaq Evo D310 Microtower Compaq, the Compaq Logo, Evo, HP and the HP Logo Are Trademarks of Hewlett-Packard Development Company, Illustrated Parts Map L.P

© 2002, 2005 Hewlett-Packard Development Company, L.P Compaq Evo D310 Microtower Compaq, the Compaq logo, Evo, HP and the HP logo are trademarks of Hewlett-Packard Development Company, Illustrated Parts Map L.P. Compaq Evo Family of Personal Computers Intel, Celeron, and Pentium are trademarks of Intel Corporation in the United States and other countries. Microtower Models All other product names mentioned herein may be trademarks of their respective companies. HP shall not be liable for technical or editorial errors or omissions contained herein. The information in this document is provided “as is” without warranty of any kind and is subject to change without notice. The warranties for HP products are set forth in the express limited warranty statements accompanying such products. Nothing herein should be construed as constituting an additional warranty. Standard and Optional Boards December 2005 1 System board for Intel processor, with thermal 283983-001 grease June 2002 Memory Modules 2 128 MB RAM, DDR 285648-001 Document Part Number 292400-002 * 256 MB RAM, DDR 285649-001 s * 512 MB RAM, DDR 285650-001 Miscellaneous Boards b 3 Front audio/USB I/O board 284247-001 * Lucent PCI Modem 239411-001 * 3COM NIC 253951-001 Intel Celeron Processors with thermal grease 4 1.7 GHz 288691-001 * 1.8 GHz 288692-001 * 2.0 GHz 309578-001 Intel Pentium P4 Processors with thermal grease 4 2.26 GHz\512K cache 288688-001 * 2.4 GHz\512K cache 288689-001 * 2.0 GHz\512K cache 273051-001 * 1.9 GHz\256K cache 255436-001 * 1.8 GHz\256K cache 255435-001 1.7 GHz\256K -

Microsoft® Dynamics CRM: HP Solution Brief for Midsize

Microsoft® Dynamics CRM HP Solution brief for midsize businesses To compete effectively and drive a profitable business, You can count on HP, Microsoft, and local technology midsize companies such as yours require a tangible partners, together on the frontline, to deliver optimized return on their technology investments. With limited IT solutions that are reliable and ready to meet your resources, you must take a pragmatic, project-oriented unique business needs. You can have the confidence approach. In short, you need a fast payback, solutions that HP, Microsoft, and our partners will continue to that are easy to deploy and manage, and ones that support your business each and every step of the way. are both affordable and reliable. We deliver uniquely valuable technology experiences for your business through impressive technologies, a As you invest in customer relationship management complete portfolio of total care services, and award- (CRM) solutions, HP makes sure that you get the most winning support. out of them with an application infrastructure you can count on. With our approach, you know what to expect—configurations on HP servers, storage, and software designed for midsize companies, optimized to meet your need for higher levels of business continuity, security, and operational efficiency. Microsoft Dynamics CRM delivers a fast, flexible, and affordable solution that helps you create consistent and measurable improvements in your customer relationships. By helping midsize businesses reduce risk, cut costs, Microsoft Dynamics CRM application and generate growth, HP and Microsoft—together with our partners—provide you with outstanding technology architecture for better business outcomes. Microsoft Dynamics CRM has a multi-tier architecture consisting of a Web-based client, a highly Solution description configurable business logic layer, and a back-end Microsoft Dynamics CRM provides all the tools and database. -

Nonstop Product Offerings and Roadmap

NonStop Product Offerings and Roadmap Iain Liston-Brown (EMEA NED Presales Consulting) 8th May, 2013 © Copyright 2013 Hewlett-Packard Development Company, L.P. The information contained herein is subject to change without notice. Forward-looking statements This is a rolling (up to three year) Roadmap and is subject to change without notice. This document contains forward looking statements regarding future operations, product development, product capabilities and availability dates. This information is subject to substantial uncertainties and is subject to change at any time without prior notification. Statements contained in this document concerning these matters only reflect Hewlett Packard's predictions and / or expectations as of the date of this document and actual results and future plans of Hewlett-Packard may differ significantly as a result of, among other things, changes in product strategy resulting from technological, internal corporate, market and other changes. This is not a commitment to deliver any material, code or functionality and should not be relied upon in making purchasing decisions. 2 © Copyright 2013 Hewlett-Packard Development Company, L.P. The information contained herein is subject to change without notice. HP confidential information This is a rolling (up to three year) Roadmap and is subject to change without notice. This Roadmap contains HP Confidential Information. If you have a valid Confidential Disclosure Agreement with HP, disclosure of the Roadmap is subject to that CDA. If not, it is subject to the following terms: for a period of 3 years after the date of disclosure, you may use the Roadmap solely for the purpose of evaluating purchase decisions from HP and use a reasonable standard of care to prevent disclosures. -

Zerohack Zer0pwn Youranonnews Yevgeniy Anikin Yes Men

Zerohack Zer0Pwn YourAnonNews Yevgeniy Anikin Yes Men YamaTough Xtreme x-Leader xenu xen0nymous www.oem.com.mx www.nytimes.com/pages/world/asia/index.html www.informador.com.mx www.futuregov.asia www.cronica.com.mx www.asiapacificsecuritymagazine.com Worm Wolfy Withdrawal* WillyFoReal Wikileaks IRC 88.80.16.13/9999 IRC Channel WikiLeaks WiiSpellWhy whitekidney Wells Fargo weed WallRoad w0rmware Vulnerability Vladislav Khorokhorin Visa Inc. Virus Virgin Islands "Viewpointe Archive Services, LLC" Versability Verizon Venezuela Vegas Vatican City USB US Trust US Bankcorp Uruguay Uran0n unusedcrayon United Kingdom UnicormCr3w unfittoprint unelected.org UndisclosedAnon Ukraine UGNazi ua_musti_1905 U.S. Bankcorp TYLER Turkey trosec113 Trojan Horse Trojan Trivette TriCk Tribalzer0 Transnistria transaction Traitor traffic court Tradecraft Trade Secrets "Total System Services, Inc." Topiary Top Secret Tom Stracener TibitXimer Thumb Drive Thomson Reuters TheWikiBoat thepeoplescause the_infecti0n The Unknowns The UnderTaker The Syrian electronic army The Jokerhack Thailand ThaCosmo th3j35t3r testeux1 TEST Telecomix TehWongZ Teddy Bigglesworth TeaMp0isoN TeamHav0k Team Ghost Shell Team Digi7al tdl4 taxes TARP tango down Tampa Tammy Shapiro Taiwan Tabu T0x1c t0wN T.A.R.P. Syrian Electronic Army syndiv Symantec Corporation Switzerland Swingers Club SWIFT Sweden Swan SwaggSec Swagg Security "SunGard Data Systems, Inc." Stuxnet Stringer Streamroller Stole* Sterlok SteelAnne st0rm SQLi Spyware Spying Spydevilz Spy Camera Sposed Spook Spoofing Splendide